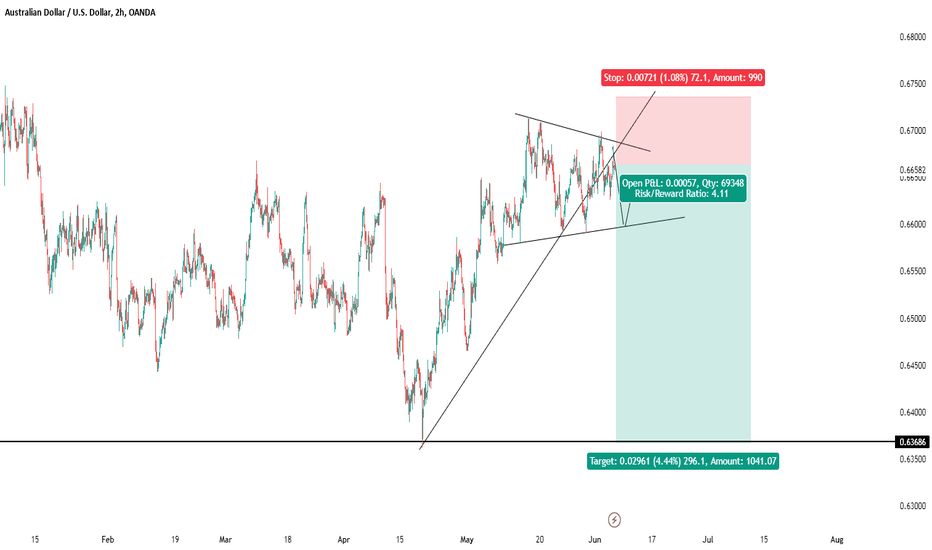

Audusdshort

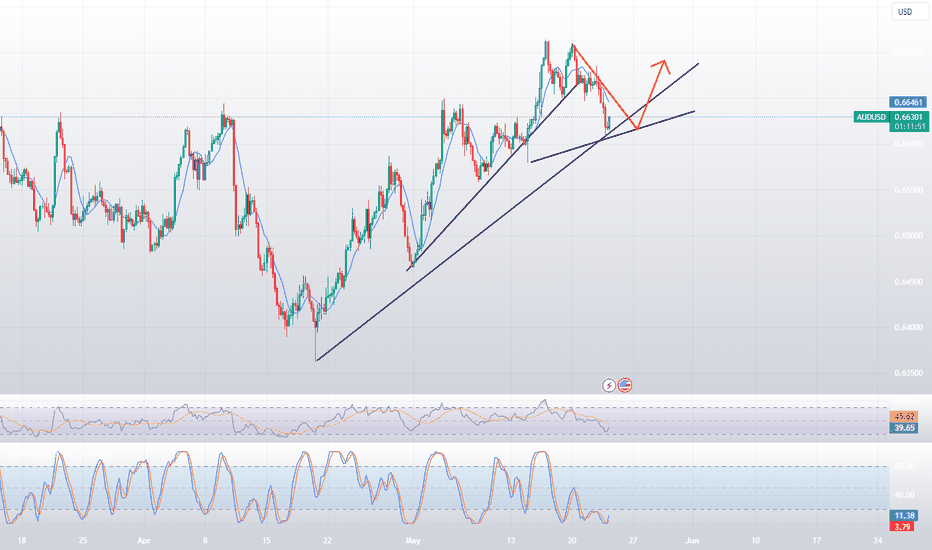

AUDUSD - Bearish price action !!Hello traders!

‼️ This is my perspective on AUDUSD.

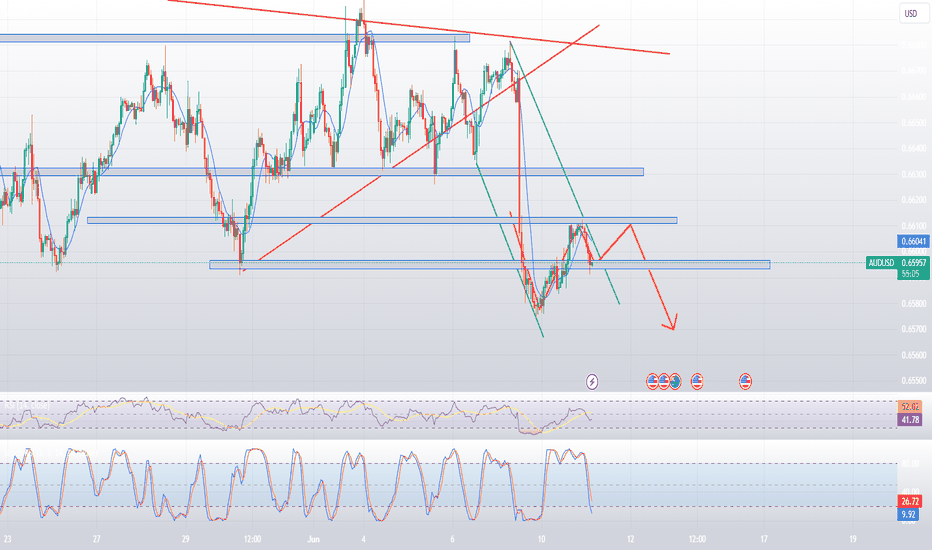

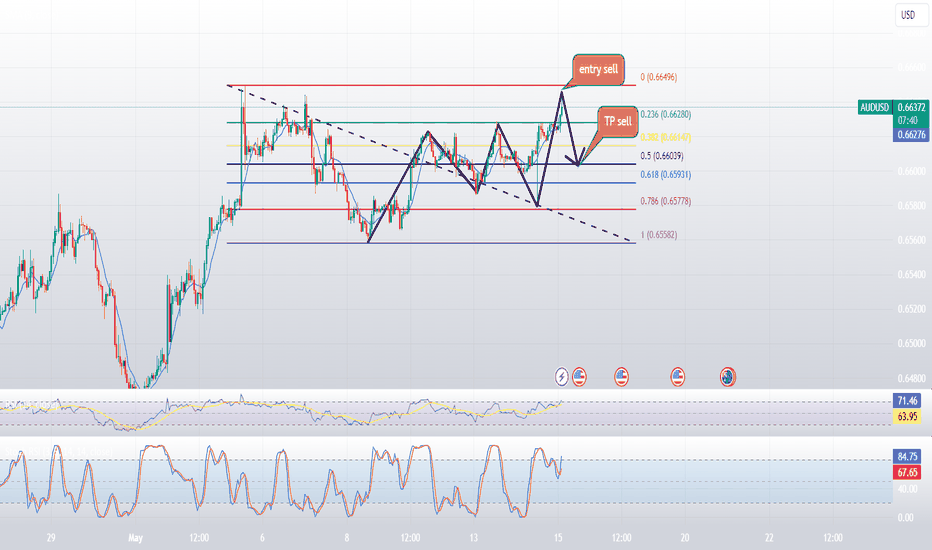

Technical analysis: Here I expect bearish price action as price took buy side liquidity and rejected from bearish order block + institutional big figure 0.67000. My target is imbalance lower.

Fundamental news: Tomorrow (GMT+3) we will see results of Unemployment Rate on AUD, news with high impact on currency.

Like, comment and subscribe to be in touch with my content!

AUDUSD: AUD outlook adjusted upward in the short termAUDUSD: The AUD also has the prospect of an upward adjustment in the short term. Therefore, it is expected that ace can continue to maintain the buying trend with AUDUSD in the short term to the 0.6640 area and sell above this price range. In the context that the USD is adjusting to fill the gap

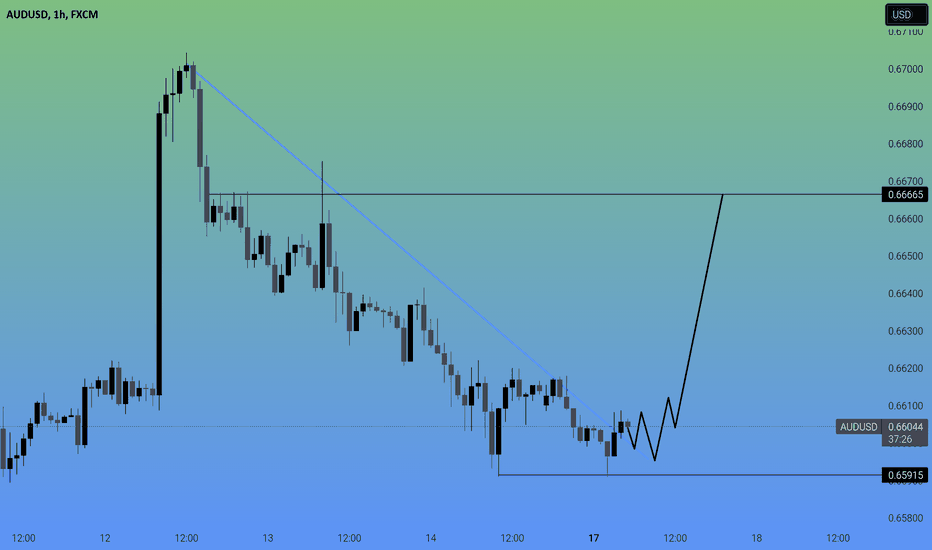

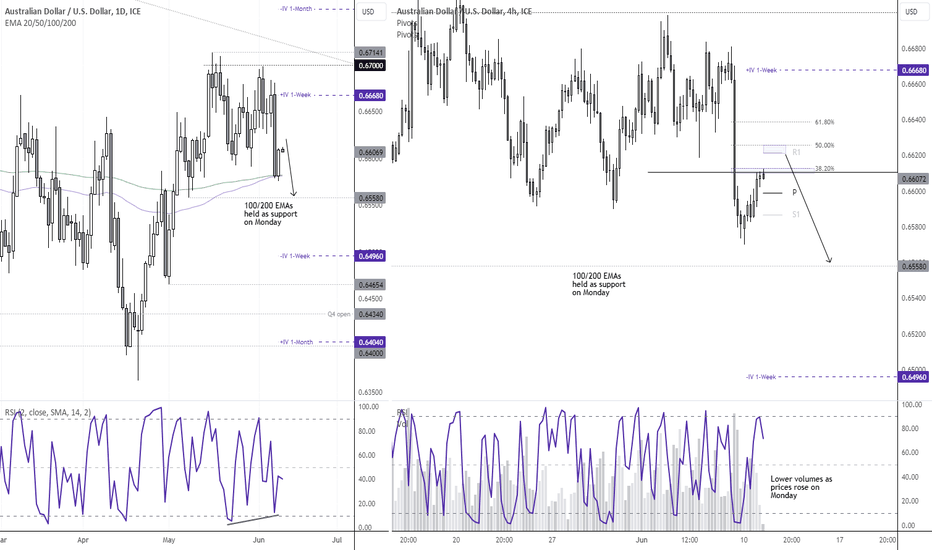

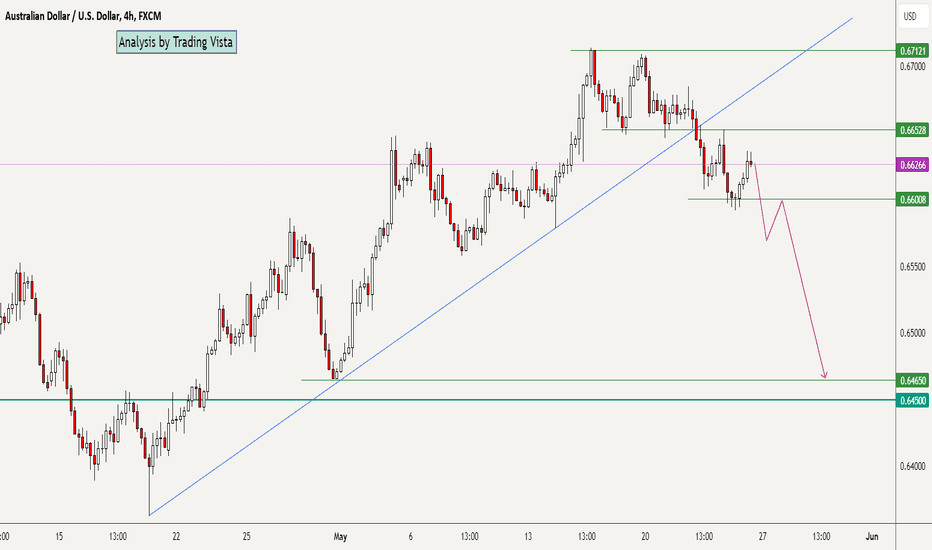

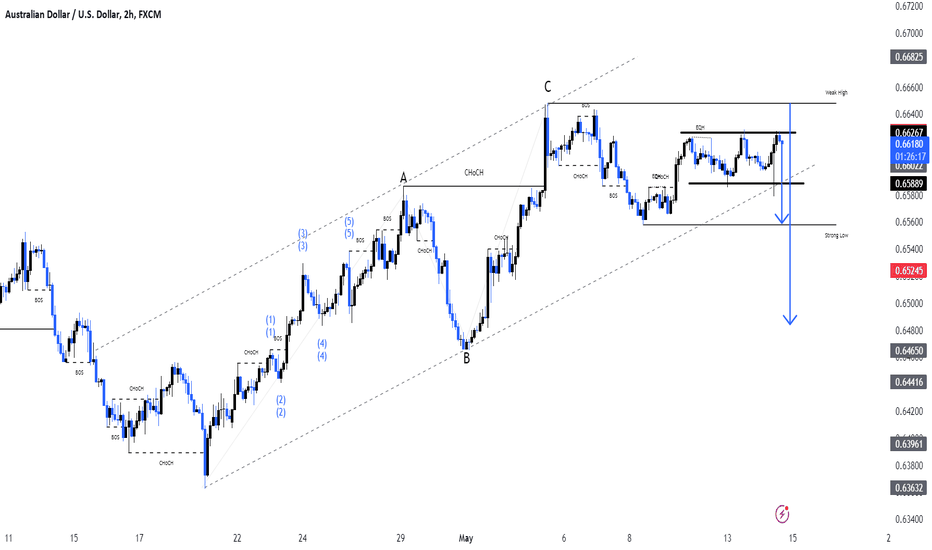

A cautious bounce for AUD/USD ahead of US CPI, FOMCFriday's nonfarm payroll report took many by surprise to send the USD dollar sharply higher against all of its major peers. And that clearly took it toll on the Aussie, which suffered its worst day in five weeks. A bearish outside week formed, all thanks to an elongated bearish engulfing candle on Friday.

AUD/USD managed a minor rebound from its 100 and 200-day EMAs on Monday, but it was a public holiday in Australia and China so the move is assume to corrective.

The 1-hour chart shows prices are sitting around the monthly pivot point and 38.2% Fibonacci level, so we're looking for a swing trade short whilst prices remain beneath 0.6630 and for a move down to 0.6560.

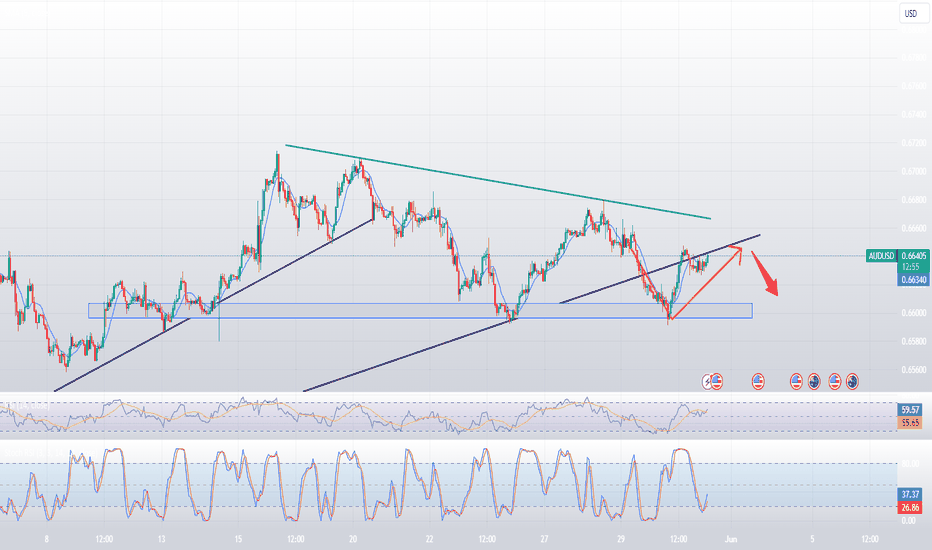

audusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

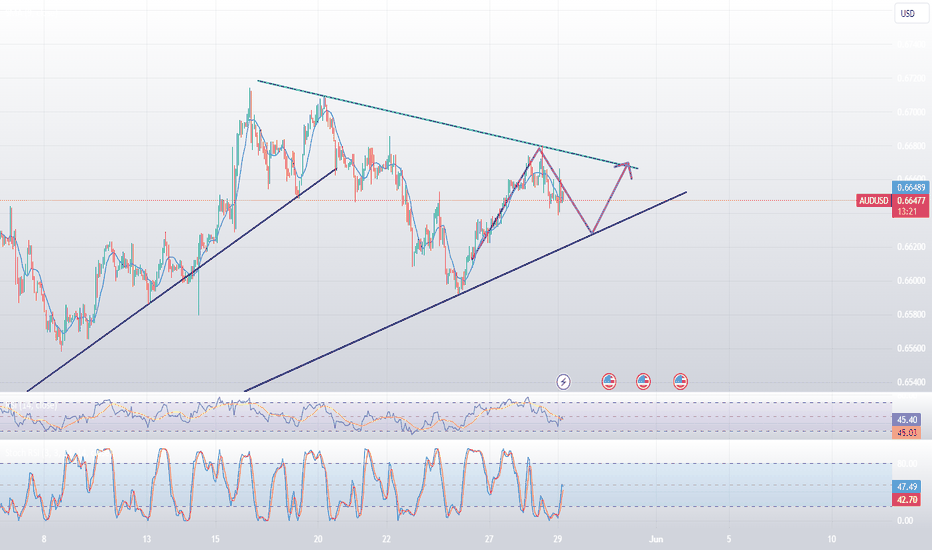

AUD/USD Made A Reversal Pattern ,H&S Will Change The Direction ?This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

AUDUSD: slight correction from the peak areaAUDUSD: The AUD in the short term has also had a slight correction from the peak of 0.6680. It is expected that in the short term, AUDUSD will fluctuate and accumulate with the support area around the 0.6600 threshold. In today's session, it is possible that AUD will test this price range again. Ace can consider waiting to buy up AUDUSD today.

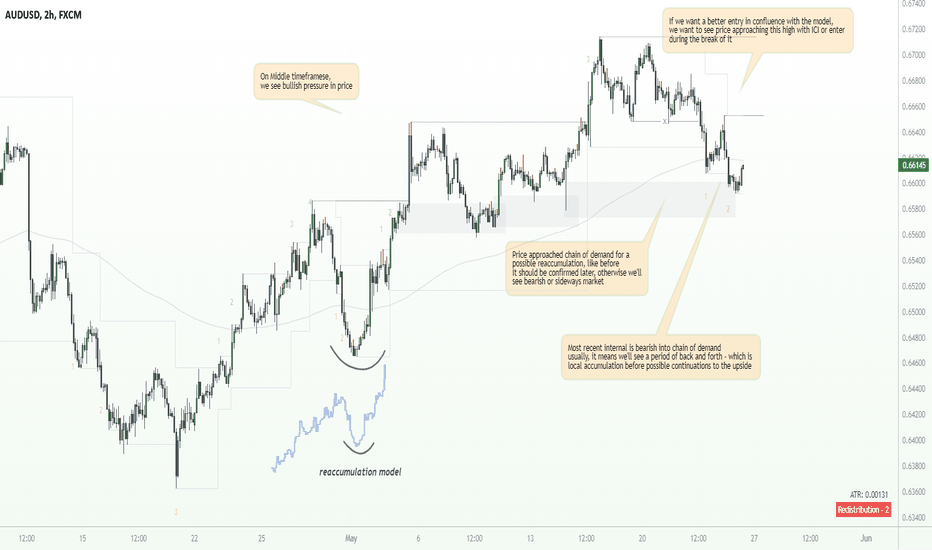

🤔AUDUSD: example of an unclear market🤔☝️Do not act based on my analysis, do your own research!!

Learn from my experience, with all the mistakes and pain shared on the way to the main goal - consistency. I'm always glad to discuss and answer questions.

⚠️ ALL videos and ideas here are for sharing my experience purposes only, not financial advice, NOT A SIGNAL. YOUR TRADES ARE YOUR COMPLETE RESPONSIBILITY. Everything here should be treated as a simulated, educational environment. DO NOT act based on my analysis, do your own research!!

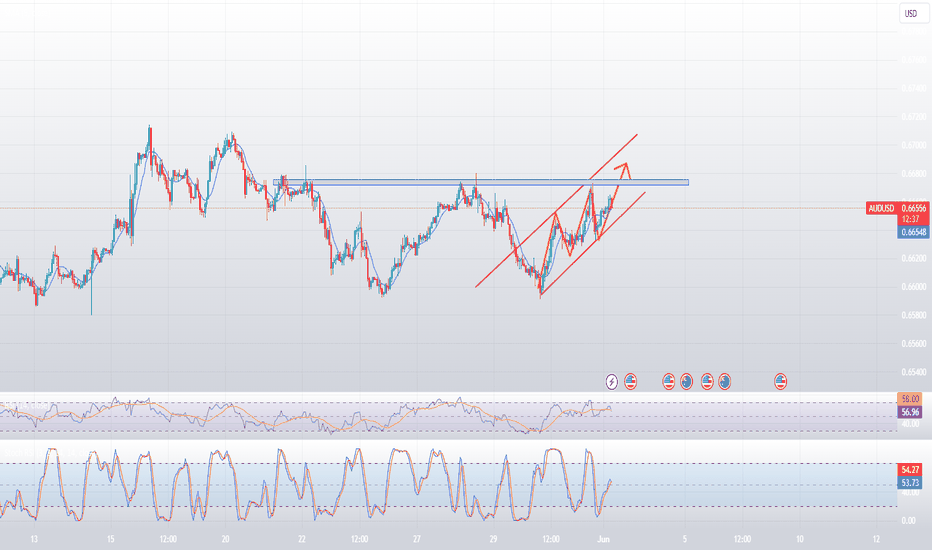

AUDUSD: The AUD has also returned to rising momentumAUDUSD: The AUD has also returned to its upward momentum, especially surpassing the 0.6660 zone, showing that the flag pattern has broken to maintain the previous upward trend, so AUDUSD has a high risk of continuing to rise above it. resistance zone 0.67 to move to higher price area. The target is expected to be above the 0.68 threshold. Therefore, in the short term, you can consider buying up AUDUSD today. Recommended to buy around the current price range

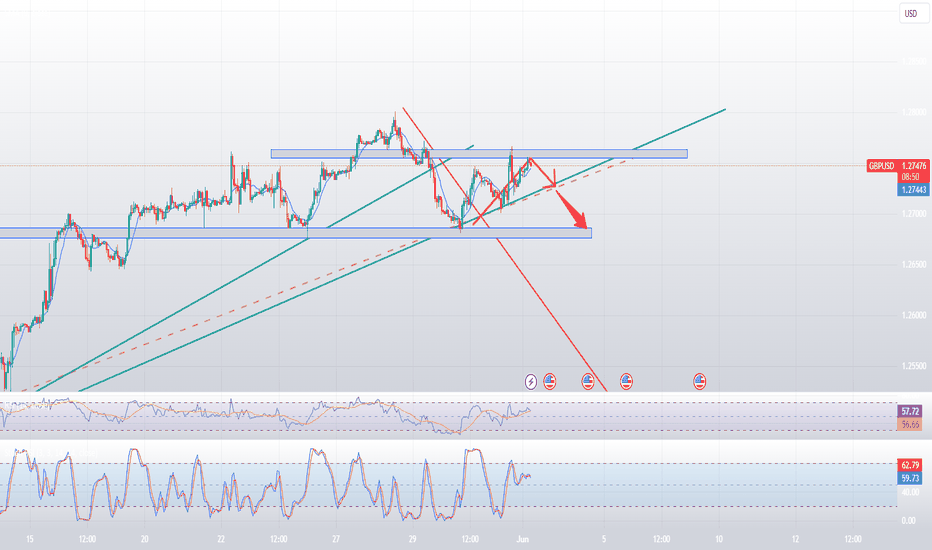

GBPUSD: in the short term there is also a recoveryGBPUSD: In the quick time period, the British Pound is likewise recuperating to check the resistance round 1.2770. On the H1 frame, it could be visible that this resistance region has promoting stress acting on GU, so withinside the quick time period and with high-quality records which could come to the USD tonight, it's far anticipated that GU will even flip down whilst tested. Check this resistance zone. Ace considers promoting down with GU round 1.2770, quick-time period goal returns to 1.2700

AUDUSD: In the short term, the AUD is recoveringAUDUSD: In the quick term, the AUD is recuperating from the aid vicinity round 0.6600. And in today`s context, it's miles predicted that AUDUSD will now no longer have many fluctuations. Most will acquire strain from the 0.66-0.sixty seven vicinity, so that you can take into account ready to promote across the 0.sixty seven resistance vicinity.

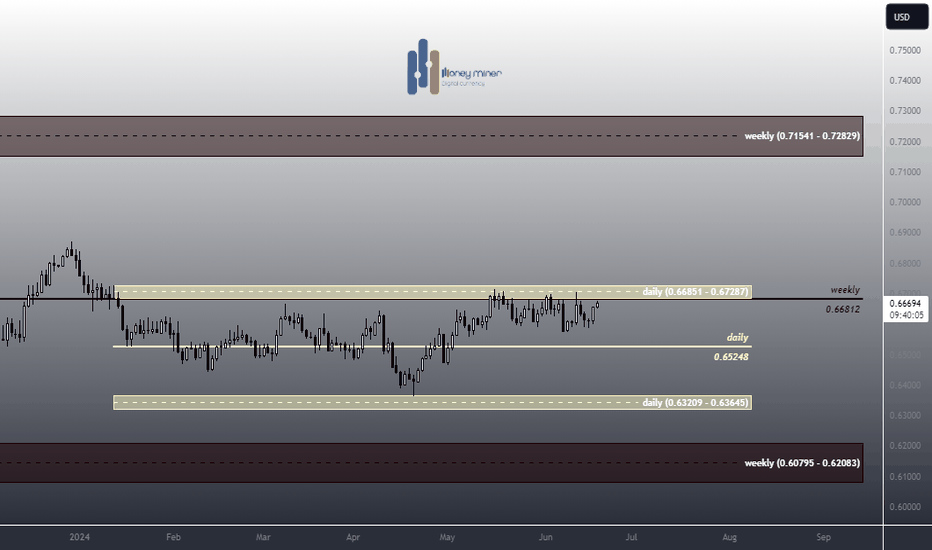

AUDUSD: maintaining narrow range accumulationAUDUSD: The AUD withinside the quick time period is likewise preserving a slender accumulation variety with a corrective downtrend wherein the aid place of 0.6590 is likewise touching the EMA200 withinside the H4 frame. The predicted situation is that AUDUSD may also lower from the modern-day rate variety. If AUDUSD falls beneath 0.6590, it'll verify a longer-time period downtrend. It is usually recommended to promote with this forex pair.

AUDUSD: The AUD in the short term turned downAUDUSD: In the short term, the AUD has also turned down. Currently located around the 0.6600 support zone. Because this is an important neckline support area as well as touching the EMA 200 H4 frame, we need to observe the price reaction around this area. If AUDUSD continues to penetrate the current price range, it will create a double peak pattern confirming a deep downtrend. Ace may explore selling down on AUDUSD in the context that the USD is currently rising strongly, reinforcing this short position.

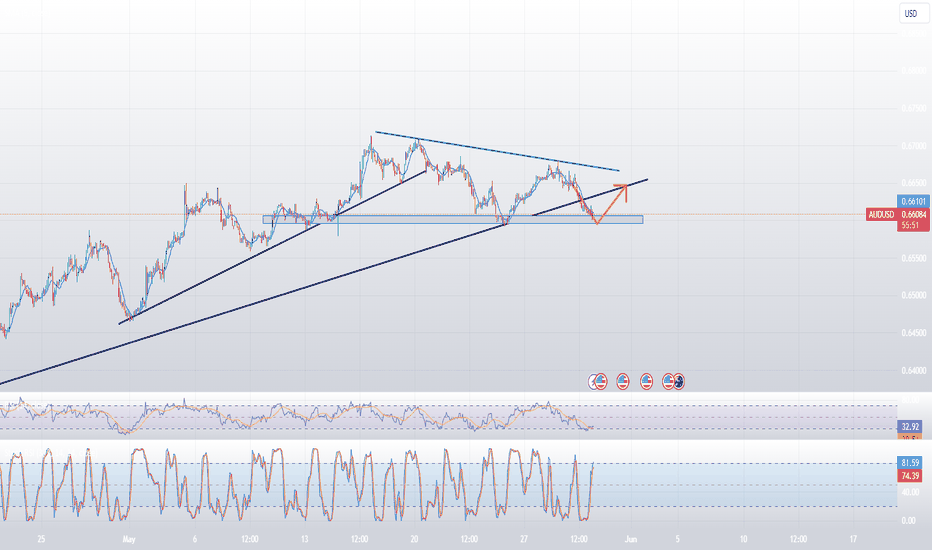

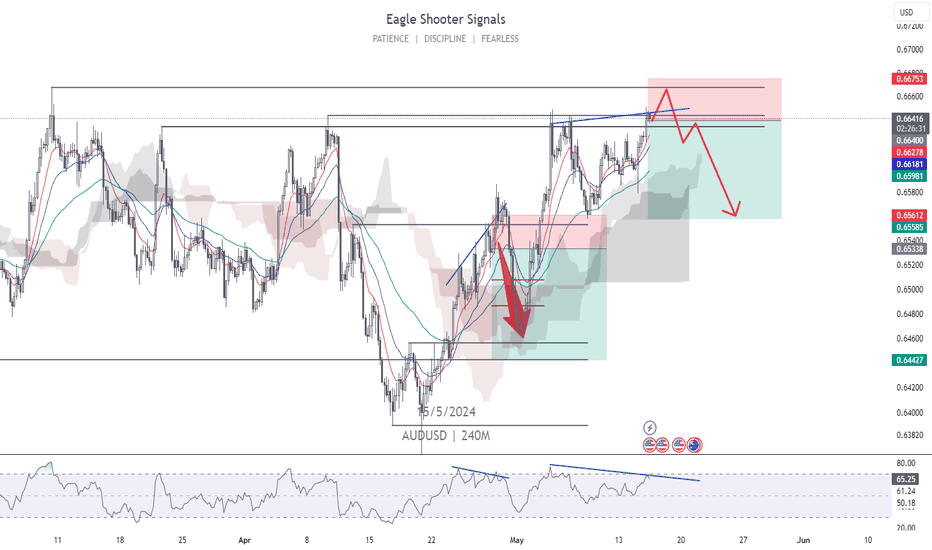

Possible short AUDUSD ... the week of 27 MayThe uptrend of this pair has been broken as evidenced by the double top and then, price crossing below the uptrend line. Now we can see a nice structure forming as the pair makes its way to the downside. My arrowed line indicates what I would like to see happen, but it is rare to see an ideal formation.

I will be watching this pair next week for further indication that bearish trend will continue and take action at the appropriate time. An initial target in the area between 0.6465 and 0.6450 seems logical with the possibility of lower levels too.

This is not a trade recommendation.

Trading carries a high level of risk, so only trade with money you can afford to lose.

Please use sound money and risk management in all your trades.

If you like my idea, please give a “boost” and follow me to get even more.

Please comment and share your thoughts too!!

AUDUSD: The AUD is also having downward adjustmentsAUDUSD: The AUD is also having downward adjustments in the context of the USD index recovering. Therefore, in today's session, it is expected that AUD will still maintain short-term correction momentum to retest around the 0.6600 area. It is recommended to briefly sell AUD and then monitor the price reaction when AUDUSD tests 0.6600.

AUDUSD: The AUD has also had significant correctionsAUDUSD: The AUD additionally had large corrections the previous day whilst the strain from the growing USD brought on this pair to weaken. Short-term, it's miles predicted that AUDUSD will nevertheless keep its decline today. Returning to the assist place round 0.6580. Consider promoting with AUDUSD round 0.6640 tp 0.6580

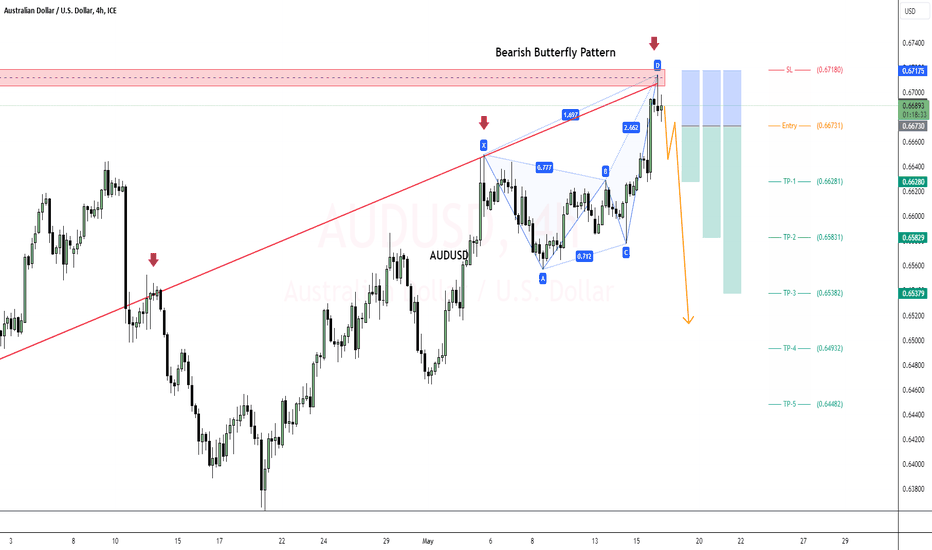

AUDUSD Bearish Butterfly Pattern Signals ReversalThe AUDUSD pair is currently forming a Bearish Butterfly Harmonic Pattern (XABCD), a classical harmonic formation that signals potential trend reversals. The critical Point D, known as the Potential Reversal Zone (PRZ), is where the pattern completes, indicating a high probability of a bearish reversal.

Confluence Factors:

Key Resistance Area: Point D aligns precisely with a significant resistance level, suggesting strong selling pressure at this zone.

4-Hour Trend Line: The PRZ also coincides with a descending trend line on the 4-hour chart, reinforcing the bearish outlook.

RSI Bearish Divergence: The Relative Strength Index (RSI) is exhibiting bearish divergence, where the price is making higher highs while the RSI is making lower highs, indicating weakening bullish momentum.

Entry and Risk Management:

Entry: Based on the confluence factors, an entry is recommended at 0.66730.

Stop Loss: To manage risk, place the stop loss at 0.67180, just above the resistance and PRZ, providing a buffer against potential volatility.

Take Profit Levels:

TP-1: 0.66280

TP-2: 0.65830

TP-3: 0.65380

These profit levels are strategically placed at key support zones and Fibonacci retracement levels, offering a structured exit plan as the market potentially moves in our favor.

Conclusion:

Given the alignment of the Bearish Butterfly Harmonic Pattern, key resistance, trend line, and RSI divergence, a bearish reversal is anticipated from Point D. This setup presents a high-probability trading opportunity, supported by multiple technical factors. The proposed trade setup provides a favorable risk-reward ratio, making it a prudent entry for traders looking to capitalize on a potential trend reversal in the AUDUSD pair.

ICT Short Setup AUDUSD👋Hello Traders,

Our 🖥️ AI system detected that there is an ICT Short setup in AUDUSD for scalping.

Please refer to the details Stop loss, FVG(Supply Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

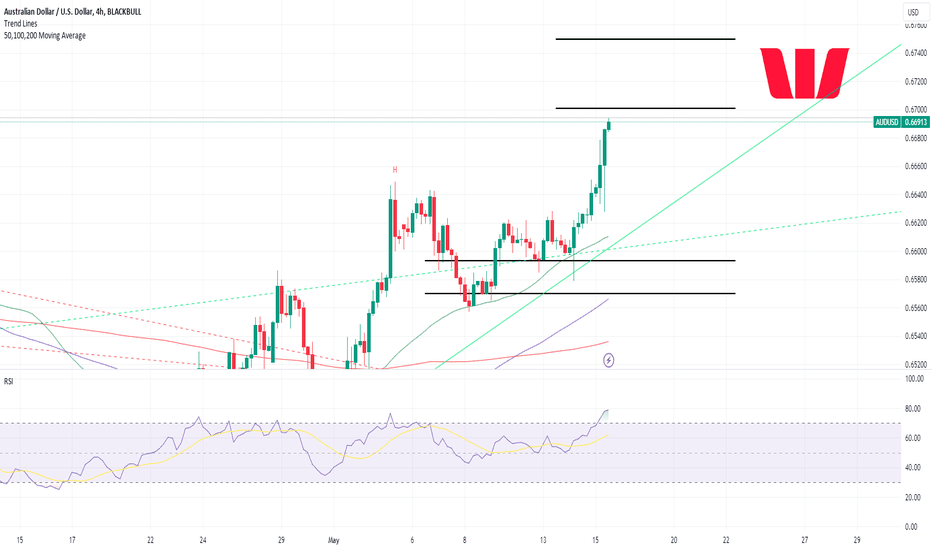

AUD/USD: Westpac's Bullish Perspective The AUD/USD and NZD/USD are trending higher due to risk-on flows boosting these currency pairs.

For AUD/USD, on the downside, immediate support could lie at 0.6594, just above the 100 Daily Moving Average. The RSI is almost levelling off at around 80.

Westpac recently highlighted a bullish stance on AUD/USD:

“...there is no clear path to significantly higher US yields at the moment, especially with Powell reiterating that persistent inflation trends prolong restrictive policies rather than suggesting imminent rate hikes. Additionally, there are increasing risks of a weakening job market, as indicated by softer April payrolls and last week's rise in jobless claims.”

In essence, Powell has tentatively ruled out rate hikes, while Nonfarm Payrolls and other job data have started to soften.

Furthermore, recent US CPI data revealed that the annual inflation rate eased to 3.4% in April 2024 from 3.5% in March. Although inflation remains stubbornly high, the downward trend may not support USD bulls.

Extra gains might push the AUD/USD to test 0.6700, before approaching the key 0.6750 level.

I have no choice but to get "AUDUSD" resistanceHello, Friends!

I hope you have a good day today.

AUDUSD arrives at resistance strong zone.

RSI bearish divergence has emerged and will be making adjustments soon.

The adjustments will be made in my view like this, but I hope you'll be CAREFUL because chart can raise and lower again with a small wave.

If it dosen't adjust from the current position, It'll raise to 0.67000 and make retracement to 0.66800

Let's do it!!

AUDUSD: AUDUSD analysis todayUBS, a Swiss bank, stated in a May thirteen report: "Historically, May has been a superb month for the greenback. Our seasonal indicator indicates that call for for USD normally will increase in overdue April and peaking in mid-May, with the Euro (EUR), Australian Dollar (AUD) and New Zealand Dollar (NZD) normally maximum affected."

UBS added: "More mainly to the overseas exchange (FX) marketplace, that is additionally a signal that the marketplace can also additionally were preserving the USD lengthy for superb costs and as a shielding hedge. This prevents chance sell-offs in desire of the greenback as visible in preceding periods, while the greenback acted as extra of a supply of chance."