Audusdshort

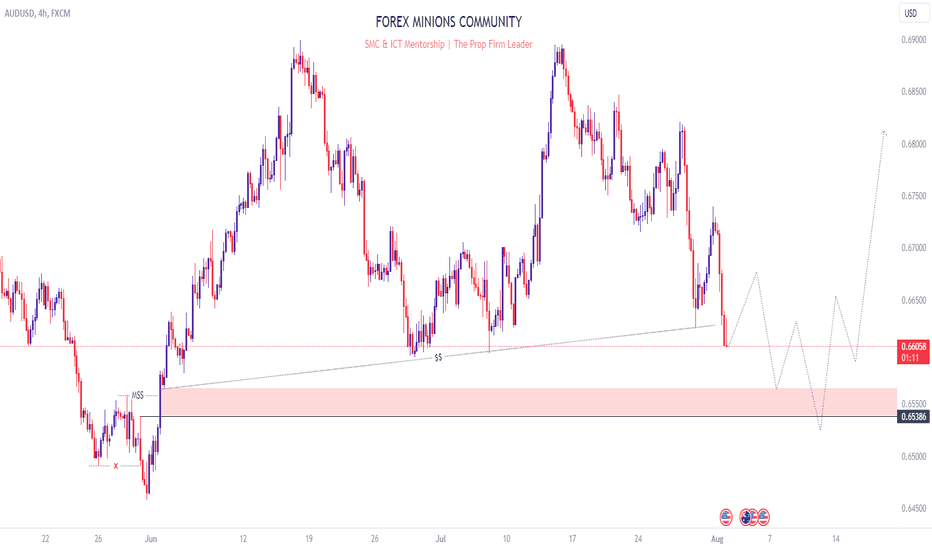

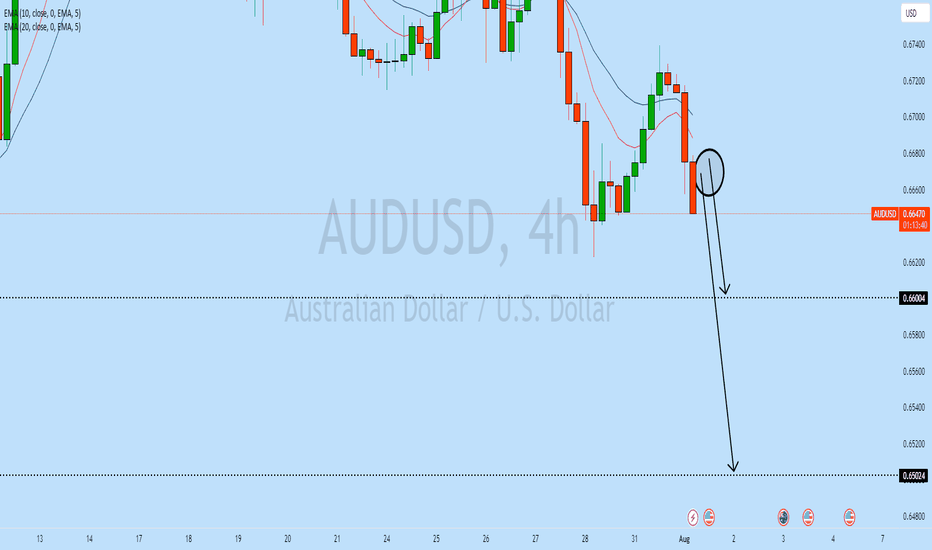

AUDUSD the condition is closing 4h candle under 0.6606 AUDUSD

stabilizing above 0.6606 will support rising to touch 0.6640 then 0.6694 then 0.6724

stabilizing under 0.6606 will support falling to touch 0.6542 and then 0.6501

the condition is closing 4h candle under 0.6606

Pivot Price: 0.6606

Resistance prices: 0.6640 & 0.6694 & 0.6724

Support prices: 0.6542 & 0.6501 & 0.6469

tendency: bearish

timeframe:4H

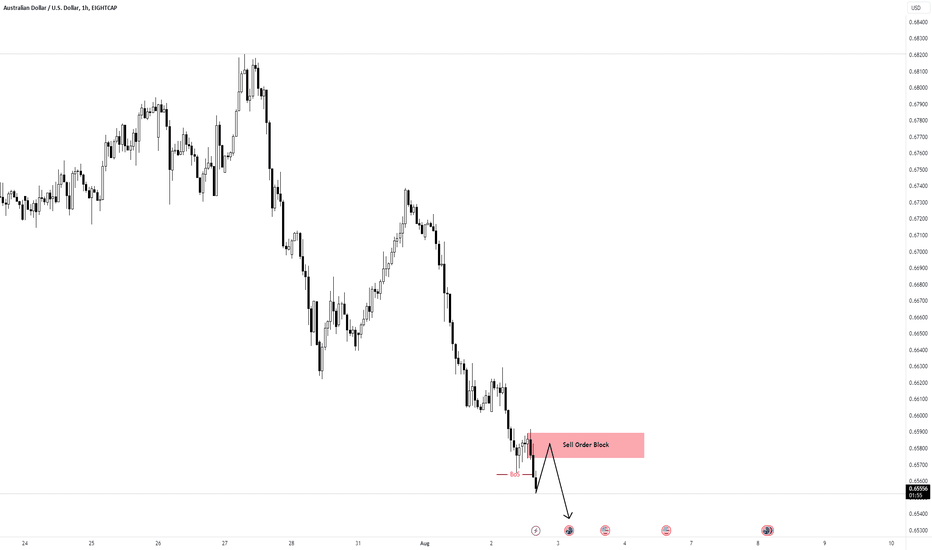

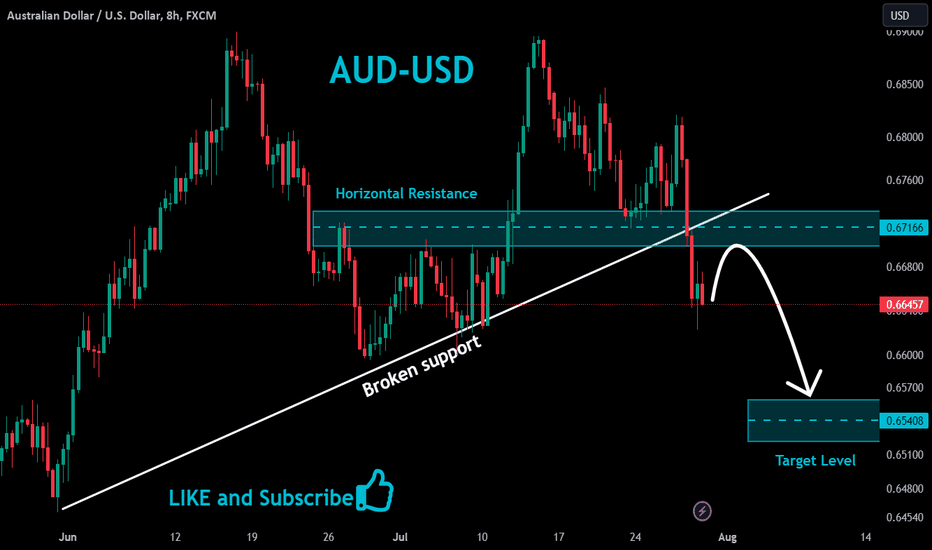

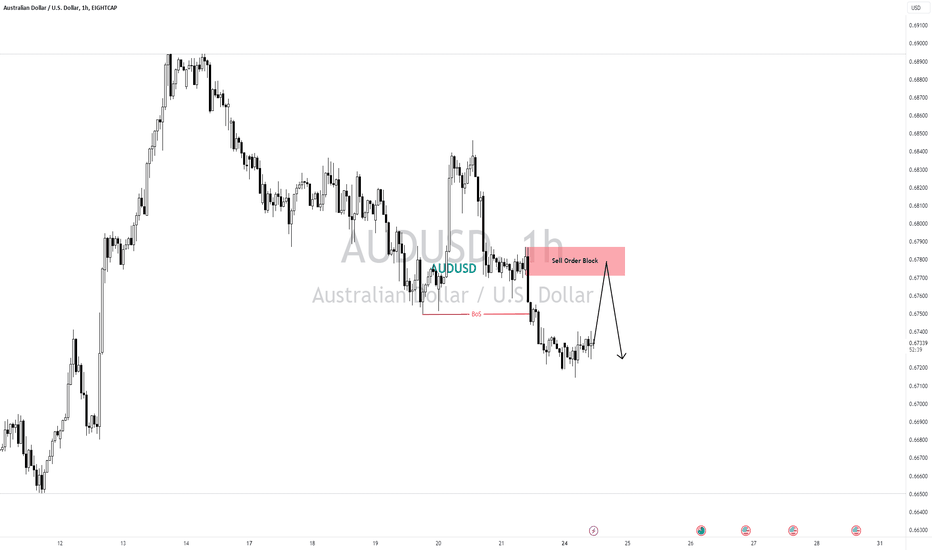

AUDUSD - SELL - Inflation and Interest rate forecastThere seems to be a movement in the opposite direction from the original bearish movement. My prediction is the Buyers are making a prediction forecast in the event of lower inflation for AUSSIE and a no-interest rate hike for USD.

However, according to my pattern analysis, the price has not completed its full reversal on price yet. Therefore, there is still a potential for a downside bearish movement.

Please note that the information presented on TradingView is sourced from a third-party provider. It is important to remember that you are solely responsible for making trading decisions for your account. Trading involves a very high level of risk. Any information or content provided is strictly for research, educational, and informational purposes and should not be considered as investment advice, consultation advice, or an investment strategy. The information provided is not customized to meet the investment requirements of any specific individual, and it does not take into account the investment objectives, financial situation, or needs of any recipient who may access it. This is not financial advice and we are not responsible for your losses that may occur following our analysis!!!

If you find this analysis of AUD/USD helpful, please give me a boost, or like to show your support. My first public Idea post

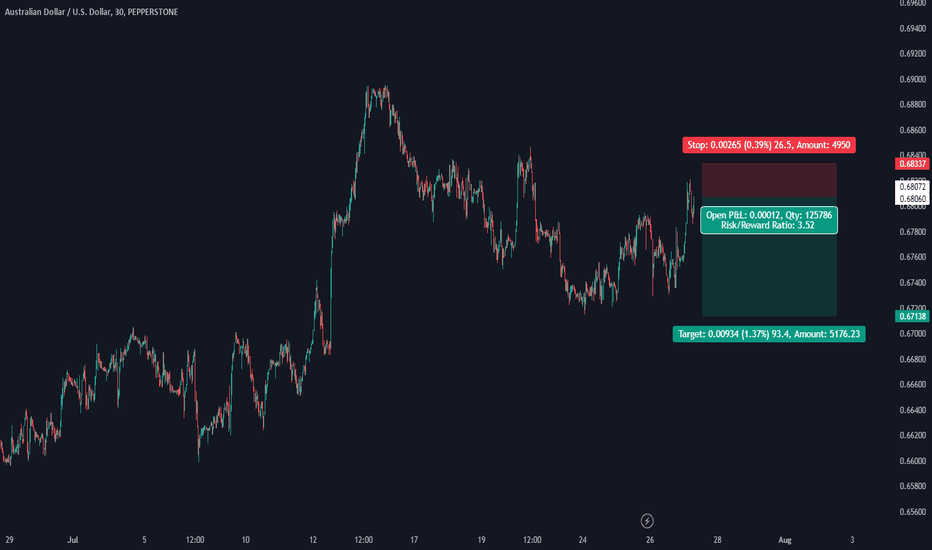

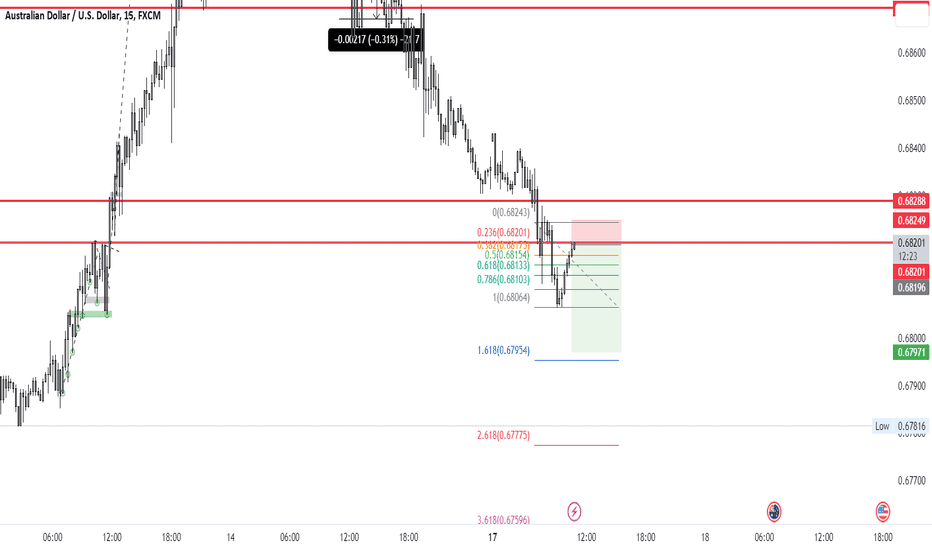

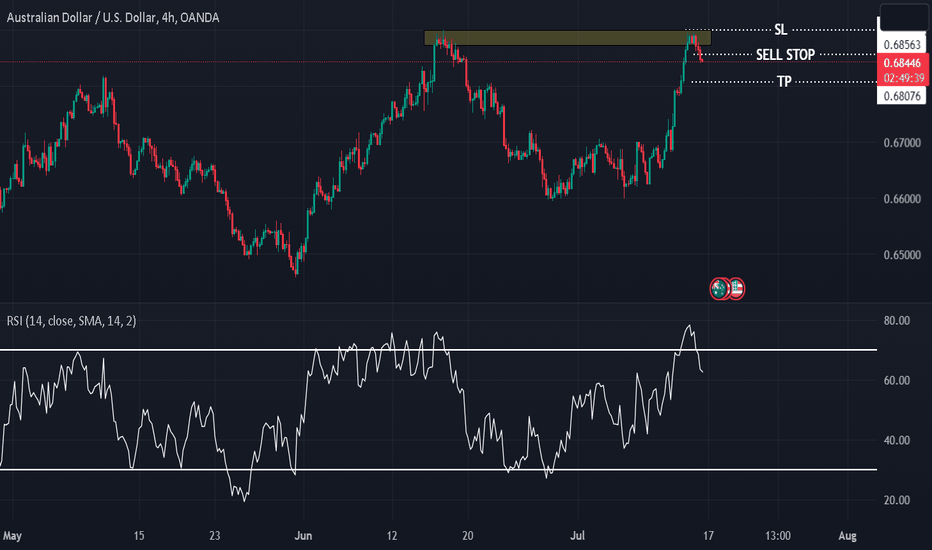

AUDUSD - SHORT SETUP - SELL

The Stochastic Oscillator %K value is 84.92% and the %D value is 91.64%. Both values are above 80, indicating an overbought condition. This suggests that the price has reached a relatively high level and a pullback or reversal may be likely. The price is likely to retrace back to around .66300.

From the Daily time frame, it is evident that the price is nearing a significant supply area. This suggests the possibility of a downward correction. We should observe whether the market will present us with a suitable trading setup.

Please note that the information presented on TradingView is sourced from a third-party provider. It is important to remember that you are solely responsible for making trading decisions for your account. Trading involves a very high level of risk. Any information or content provided is strictly for research, educational, and informational purposes and should not be considered as investment advice, consultation advice, or an investment strategy. The information provided is not customized to meet the investment requirements of any specific individual, and it does not take into account the investment objectives, financial situation, or needs of any recipient who may access it. This is not financial advice and we are not responsible for your losses that may occur following our analysis!!!

If you find this analysis of AUD/USD helpful, please give me a boost, or like to show your support. My first public Idea post

EURUSD and AUDUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

audusd sell. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

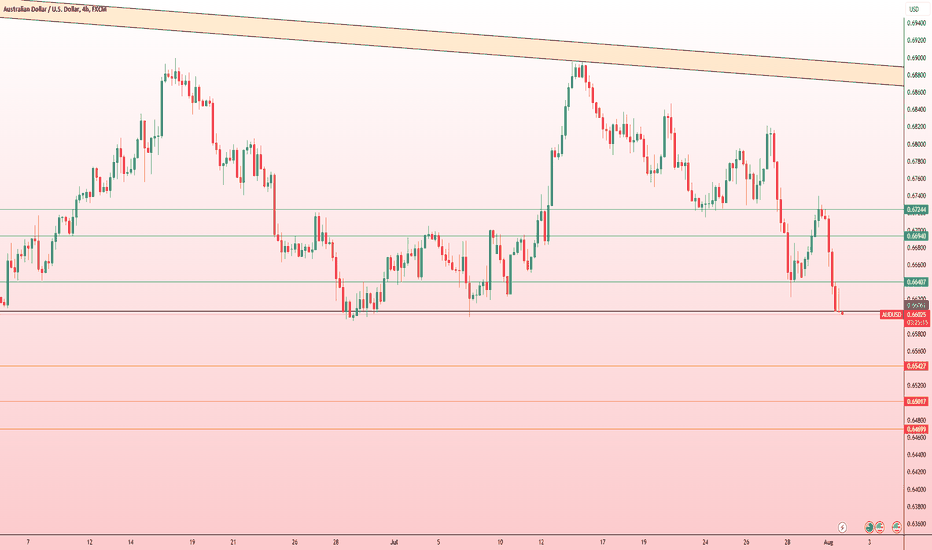

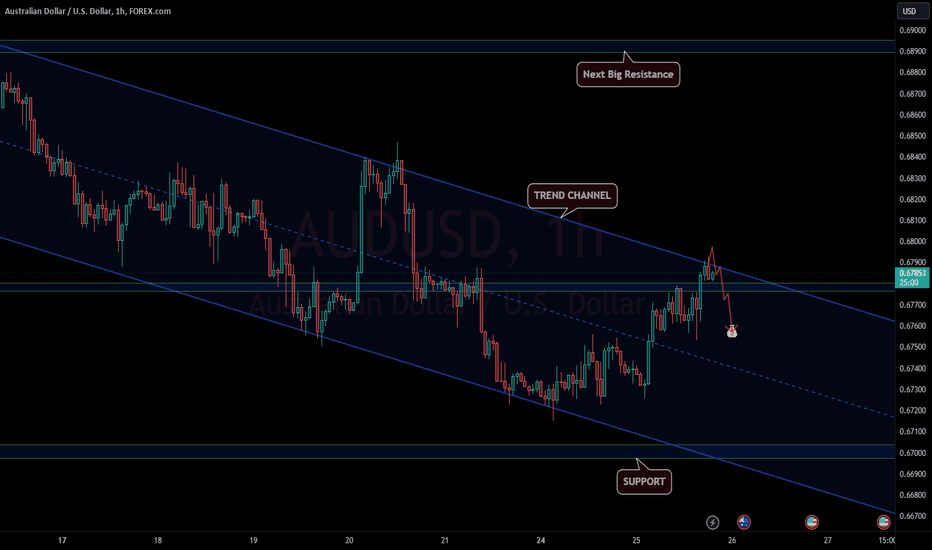

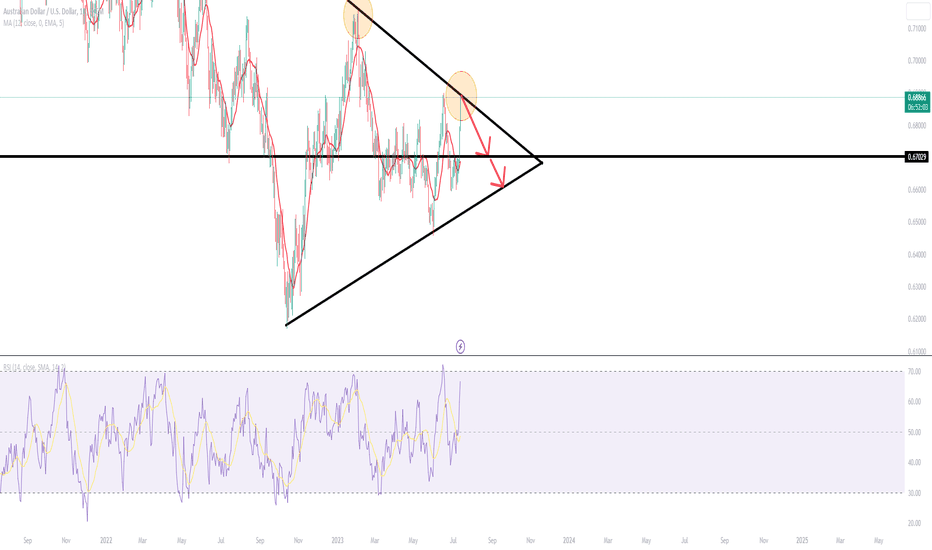

AUDUSD Correction inside Trend ChannelAfter my last AUDUSD idea was a success, I now think of a correction in the downtrend channel.

Still, AUDUSD would need to break above the vital hurdle at the June and July highs of around 0.6900 to confirm that the trend had reversed to up from down. Until then, the path of least resistance remains sideways, within the recently well-established range of 0.6500-0.6900

Data due on Wednesday is expected to show that Australia CPI eased to 1.0% on-quarter in the April-June quarter from 1.4% in the January-March quarter, and 6.2% on-year in Q2-2023 from 7.0% in the previous quarter. On a monthly basis, CPI is expected to have eased to 5.4% on-year in June from 5.6% in May.

Therefore, the bearish trend will remain suggested until now.

My target is 0.67580

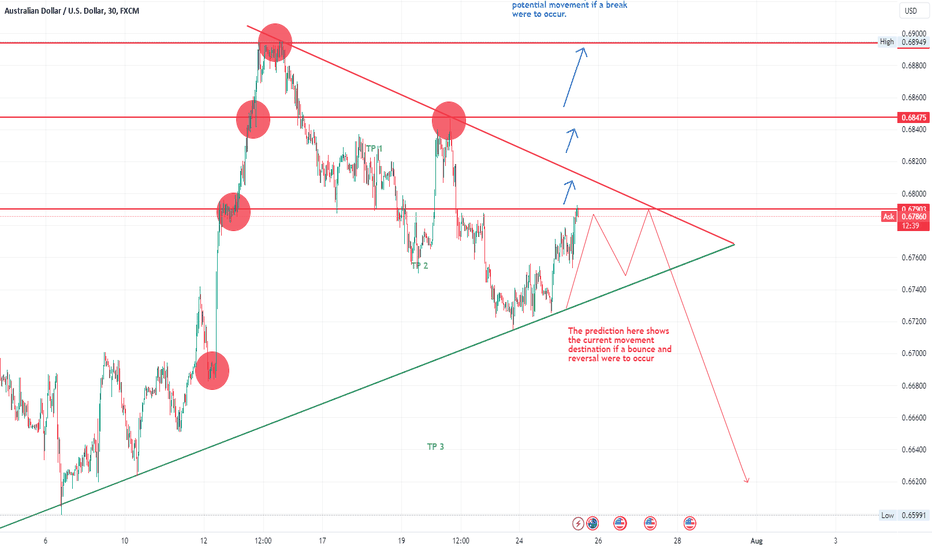

AUDUSD to see a temporary move higher?AUDUSD - 24h expiry

We are trading at oversold extremes.

A Doji style candle has been posted from the base.

A higher correction is expected.

Short term bias has turned negative.

We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

We look to Sell at 0.6790 (stop at 0.6830)

Our profit targets will be 0.6690 and 0.6620

Resistance: 0.6810 / 0.6890 / 0.7010

Support: 0.6620 / 0.6460 / 0.6380

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

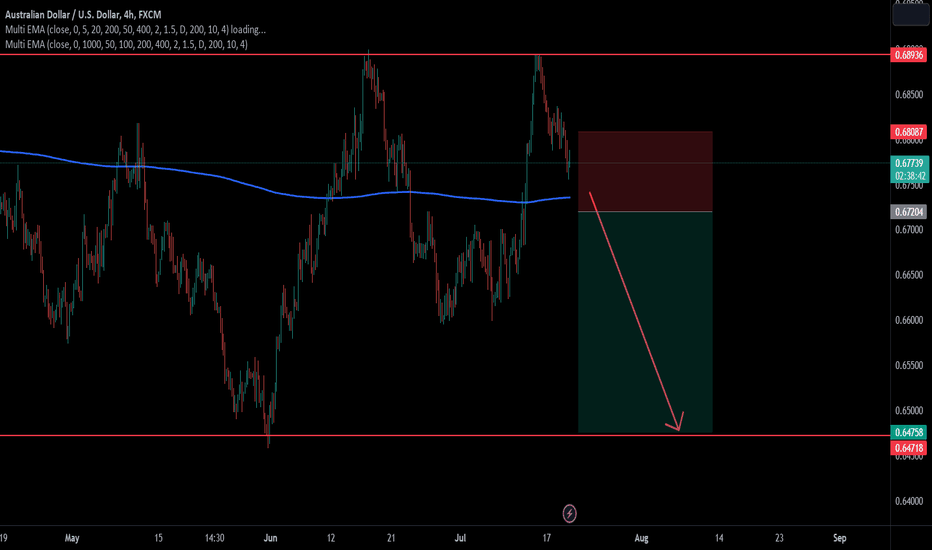

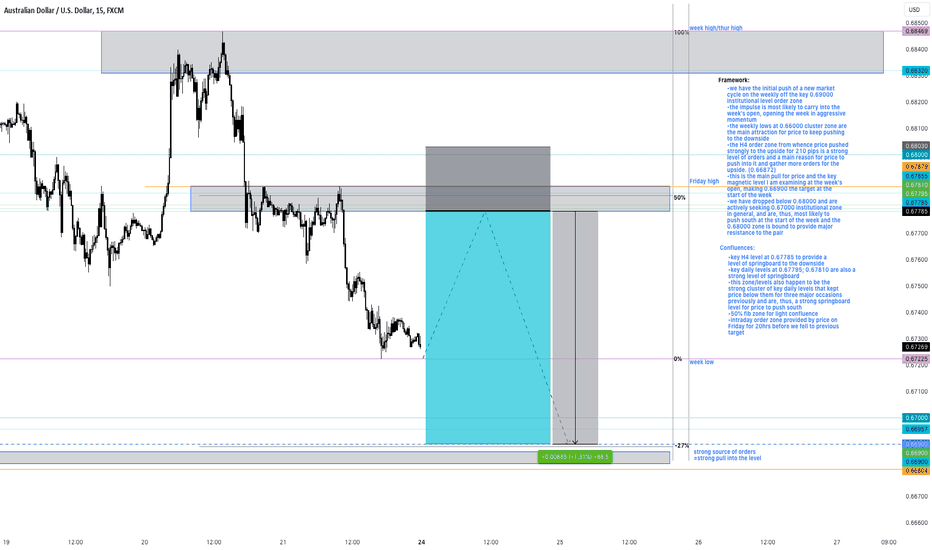

AUDUSD Sell SetupHere is the reason why I am anticipating this sell:

Weekly:

-we have an initial push to the downside off the key institutional level at 0.69000 which

provided a level of sell orders at the close of June

-we are in a new sell cycle and have initiated sells in a strong manner, establishing momentum

to the downside at the onset

-this momentum is the key reason for the sell outlook

-the weekly lows, clustering around 0.66000 institutional level are providing incentive for

price to push further to the downside

H4:

-we are officially bearish on H4

-we had a strong drop at the close of the week, culminating at around 0.67300 round level

-the next phase on H4 is most likely a bullish push to retrace the closed selloff impulse last week

-after that I anticipate a sell into the next target, the -27% extension of the recent swing, making

the target around 0.66890. This translates to my target of 0.66900 to be perfect for the setup

Midrange/H1

-I anticipate a push into the mid-level order zone clear on H4 around 0.67800

-the key daily levels thereon portend a strong area of resistance and had been used before by

price to keep the pair below this specific level (check daily chart)

-since we formed an order zone hereon recently, I expect price to reach to these levels around

0.67800 then push to the downside, aiming for the strong order level from which the most

recent highs came from, which is around 0.67782 and very much in the vicinity of the -27%

extension

This is the overall trade

NOTE: this is just an opinion of mine and should not be construed as financial advice. Use your own analysis to come up with your own decisions.

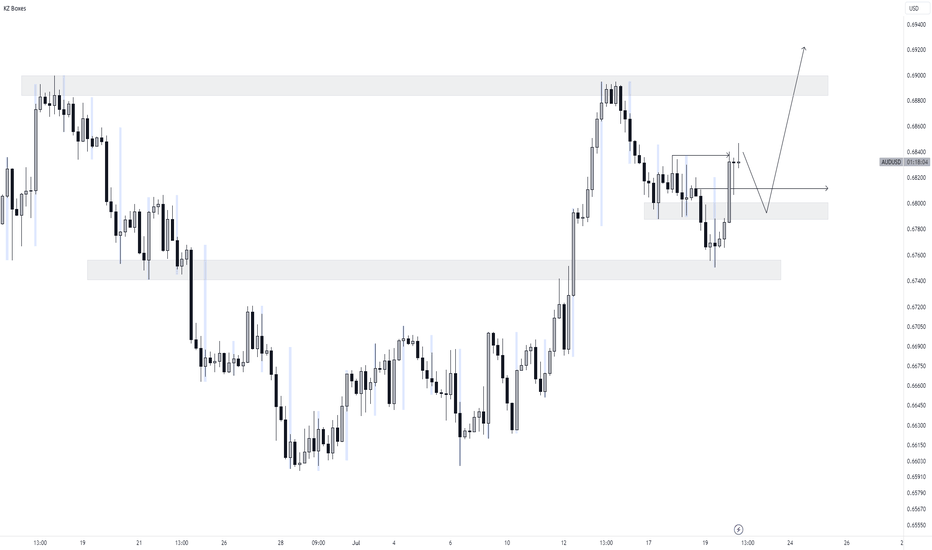

AUDUSD long term forecastAUDUSD, in the long run, is going to be one hell of a ride

Why? You may ask, while things look pretty straightforward at the moment, price doesn't always go as planned. Especially when trading on the lower time frame. However, for those who utilize the H1, H4, and even daily timeframe, this should be a good wave to ride.

First post here, will be offering more as time goes on.

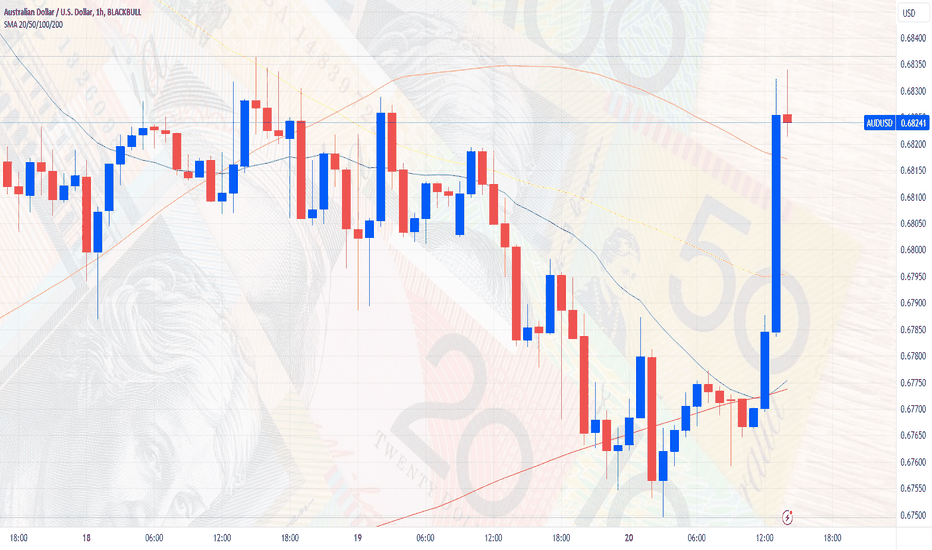

32,600 Jobs Added! Aussie Dollar Skyrockets!The Australian dollar has surged, driven by an impressive employment report that far exceeded expectations. In the month of June, Australia's net employment rose by a staggering 32,600 compared to the previous month, surpassing estimates by more than double.

This development propelled the Aussie currency up by over 0.9%, reaching an intra-day high of $0.6834. The New Zealand dollar also rode the wave, gaining 0.57% to reach $0.6299. Both Antipodean currencies are now poised to reverse the losses incurred over four consecutive trading sessions.

The current market sentiment favors the bulls, with both short and long-term momentum in their favor. Price action is trading above the 50 and 200-day moving averages, reinforcing the positive outlook for the Australian dollar.

Elsewhere in the currency market, the sterling is doing its best to counter deep losses following a sharp fall in the previous session. The decline was prompted by Britain's inflation data, which fell short of market expectations.

The British pound managed a modest recovery, trading 0.15% higher at $1.2958 in the latest session.

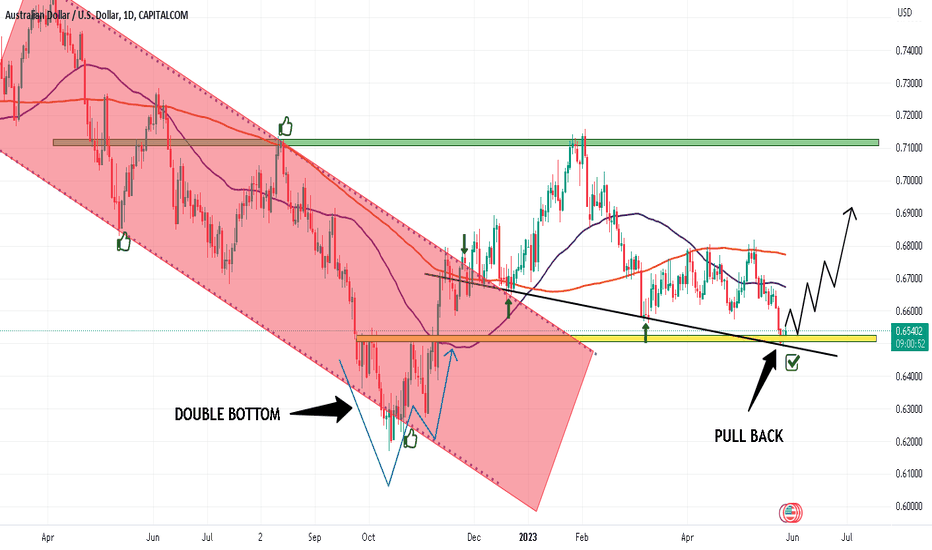

AUDUSD BUYHi, according to my analysis of the AUDUSD pair. There is a possibility of an uptrend with a retest of the price. Double button model. There is strong support in this area 0.65000. And this is just a corrective wave. to return to height. Good luck everyone .Note: If you like this analysis, please give your opinion on it. in the comments. I will be happy to share ideas. Like and click to get free content. Thank you

AUDUSD continues to hold back the bulls.AUDUSD - 24h expiry

0.6900 has been pivotal.

0.6895 has been pivotal.

0.6900 continues to hold back the bulls.

Preferred trade is to sell into rallies.

We look for a temporary move higher.

We look to Sell at 0.6889 (stop at 0.6921)

Our profit targets will be 0.6809 and 0.6785

Resistance: 0.6837 / 0.6850 / 0.6890

Support: 0.6807 / 0.6787 / 0.6770

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.