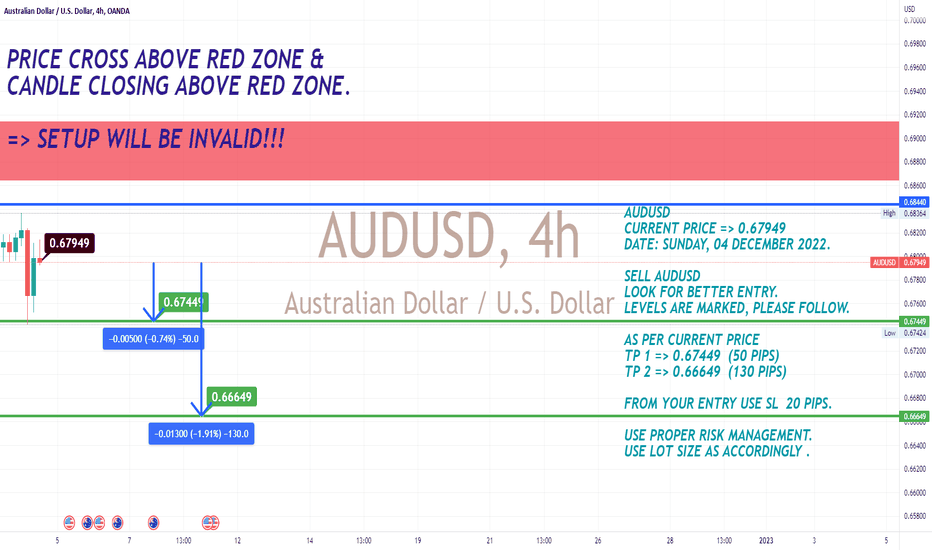

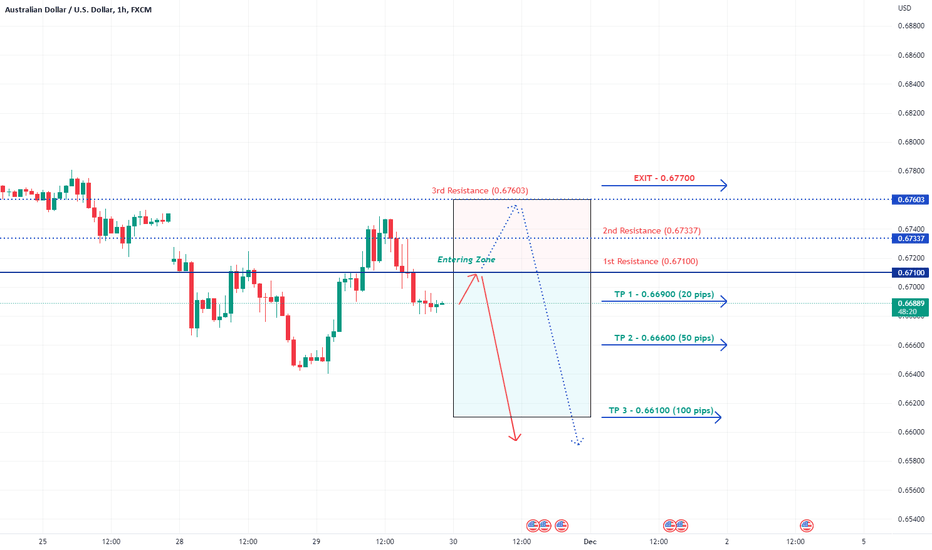

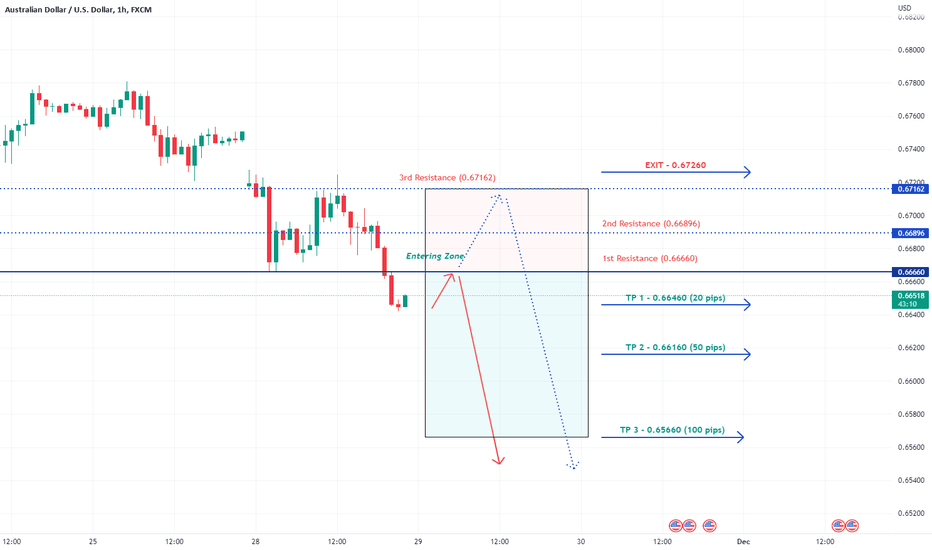

AUDUSD - Daily Trade Idea - 6-Dec-22AUDUSD (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

Audusdshort

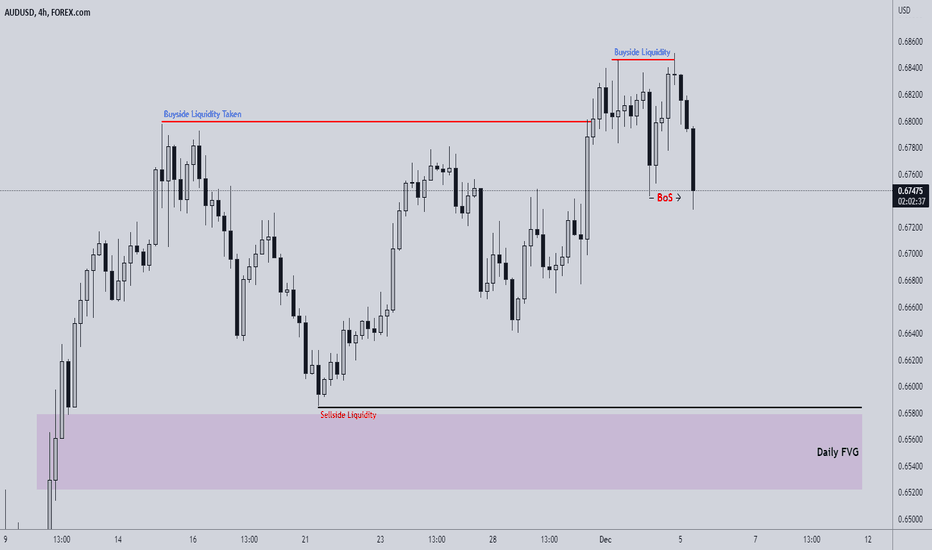

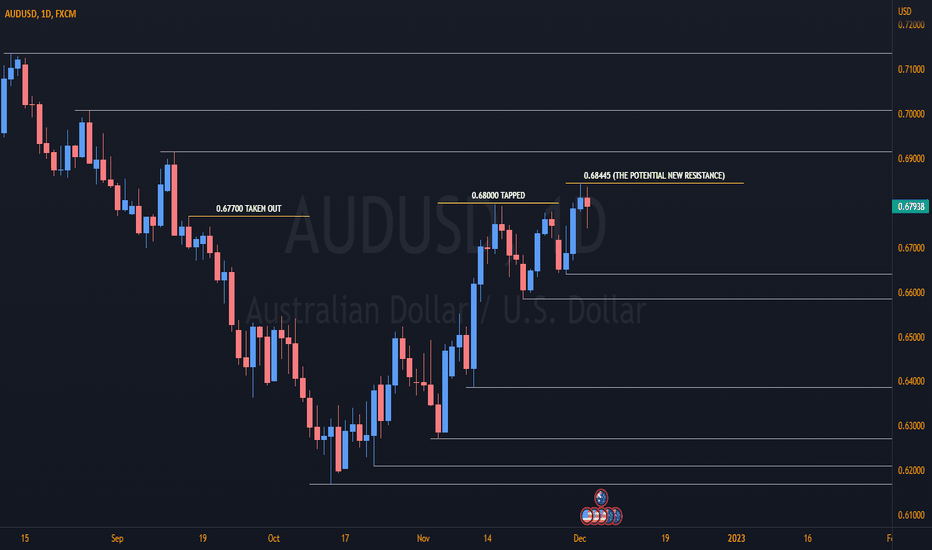

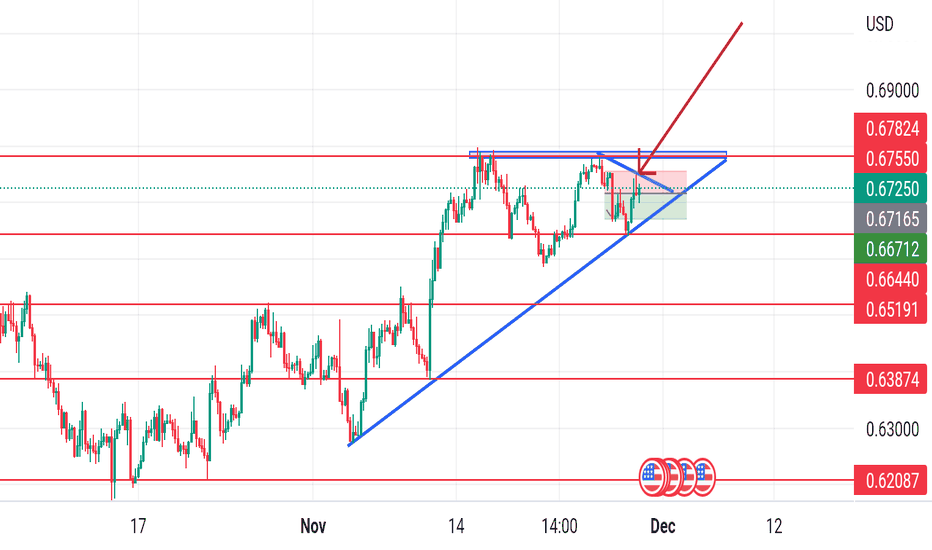

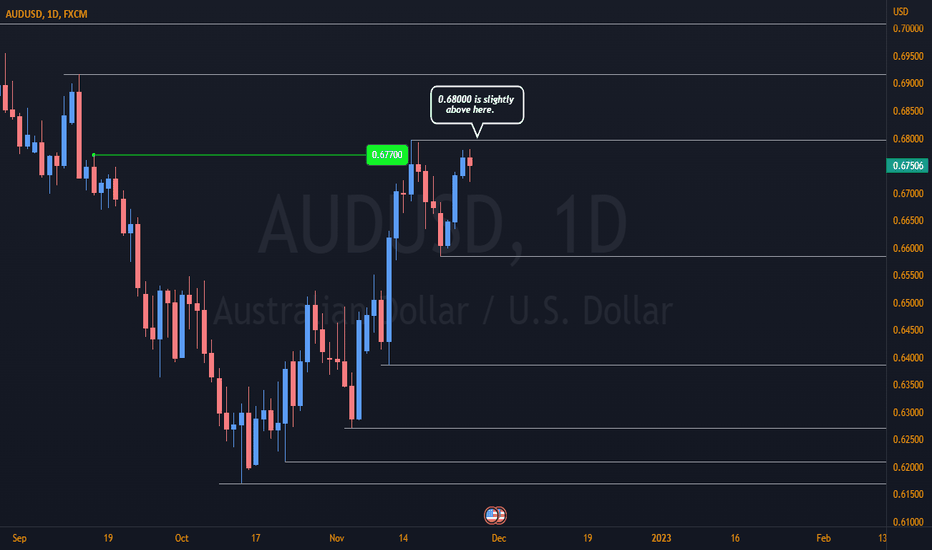

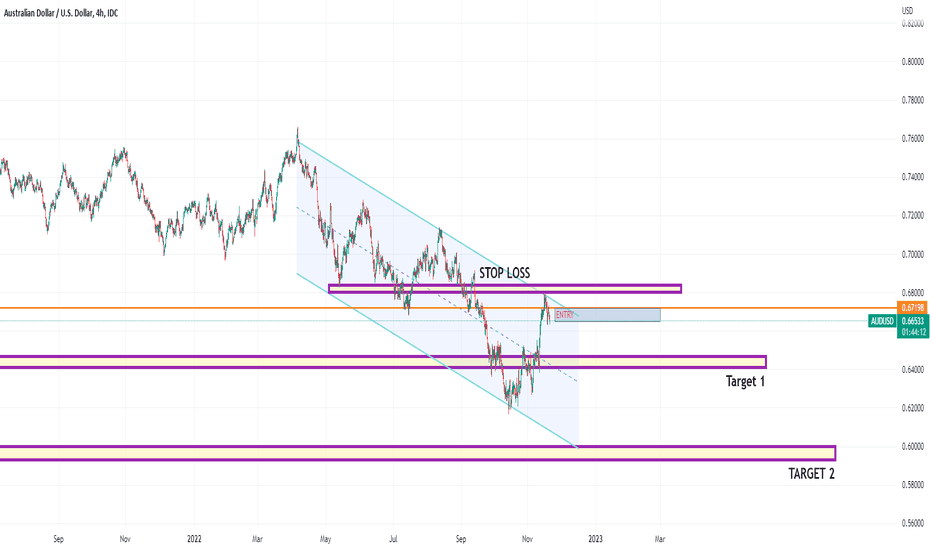

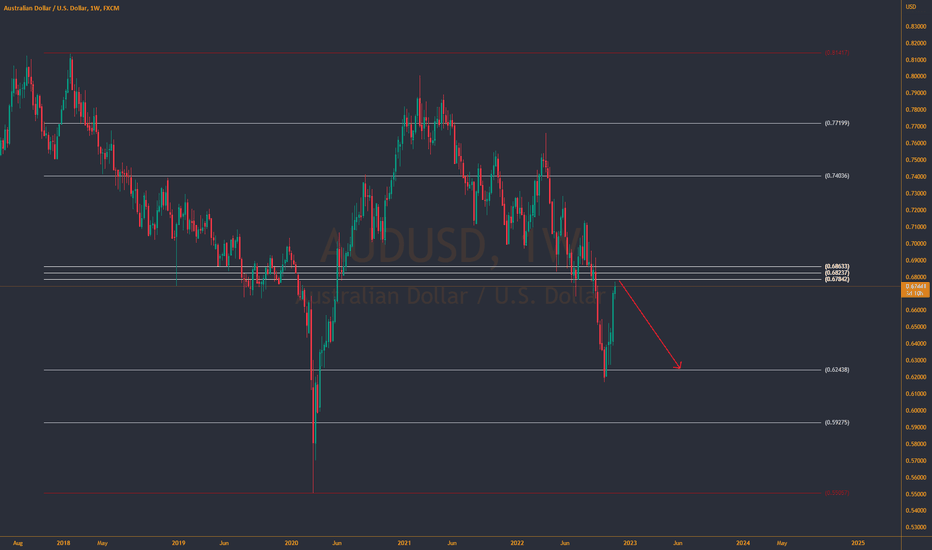

Is 0.68445 the New Resistance?What an eventful week we've just had. The AUDUSD pair did the three things we were expecting (anticipating) in the previous ideas.

1. Price closed above the 0.67700 level, finally.

2. Price tapped into that 0.68000 level and barely closed above it.

3. Price dropped massively on the second daily tap on that 0.68000 level and that can be seen on the hourly time-frame. We can thank the USD Non-Farm Employment Change and Unemployment Rate news release for that.

Now, with these three points, what can we expect this coming week? Well, as the title of the idea entails - is 0.68445 the new resistance? I mean that being the case would be a great start.

We already have enough evidence (confluences) that clearly show that price wants to drop lower. However, we need to get a resistance (supply level) for that to happen. By that I mean we want to see price continuing below the 0.68445 level; And when that happens, we will look for more setups to go short on the hourly time-frame.

We still have to wait for the market to tell us when it wants to go and so, for now, we will just enjoy the weekend. Until next time, let me hear your thoughts and views below.

AUDUSD - Daily Trade Idea - 30-Nov-22AUDUSD (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

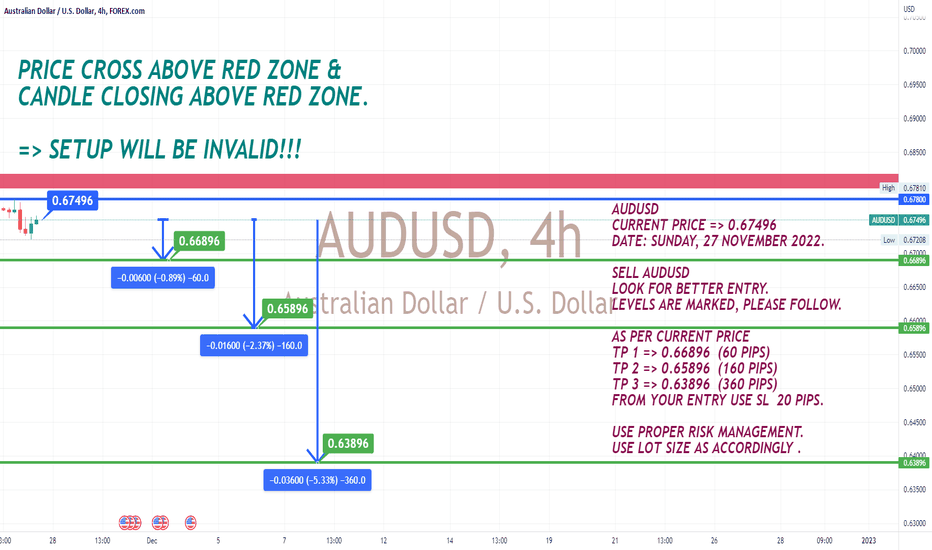

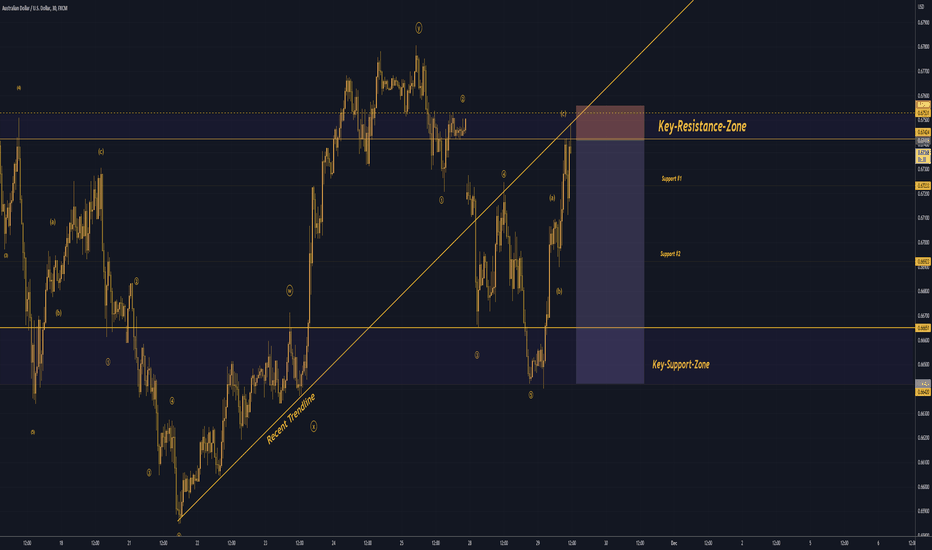

AU BIAS: SHORT; ANALYSIS CHART: H4ZOOM THE CHART TO SEE CLEARLY . Currently, AU is inside the triangle but losing momentum to break the resistance level of 1.67687. It's clearly showing failure to make a new high by the appearance of the bearish pin bar that formed below 1.6787.

Now, what's up? We need to sell this to make just 41pips out of the market.

Entry:Market: Exit: 1.66712; stop lose: 67507

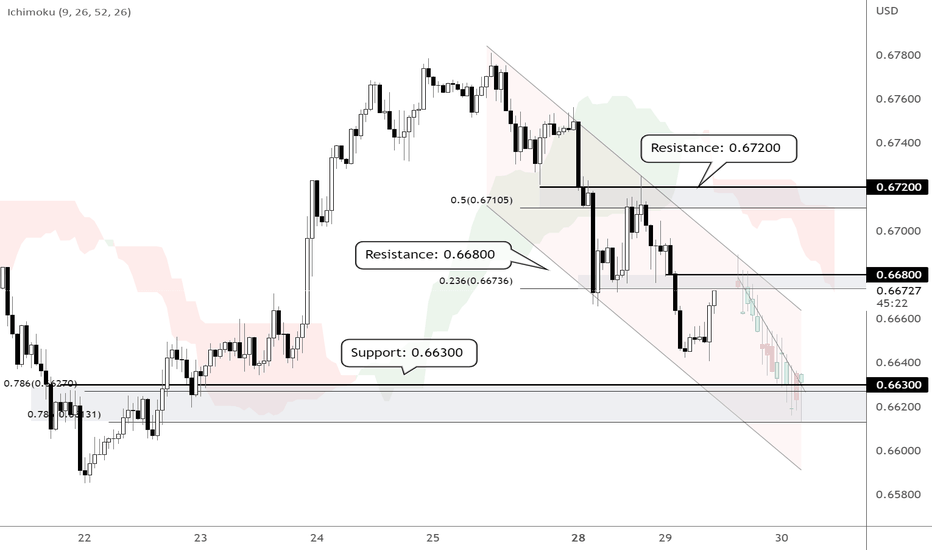

AUD/USD lkely to fall!Hey tradomaniacs,

looks like AUD/USD is rdy to fall after creating a double-top.

Market-Depth showing DELTA-DIV by FP in the previous upmove, means a move down is getting prepared.

Still cautious due to upcoming CPI-Data from germany, so be carefull!

Technically a great chance!

What do you think?

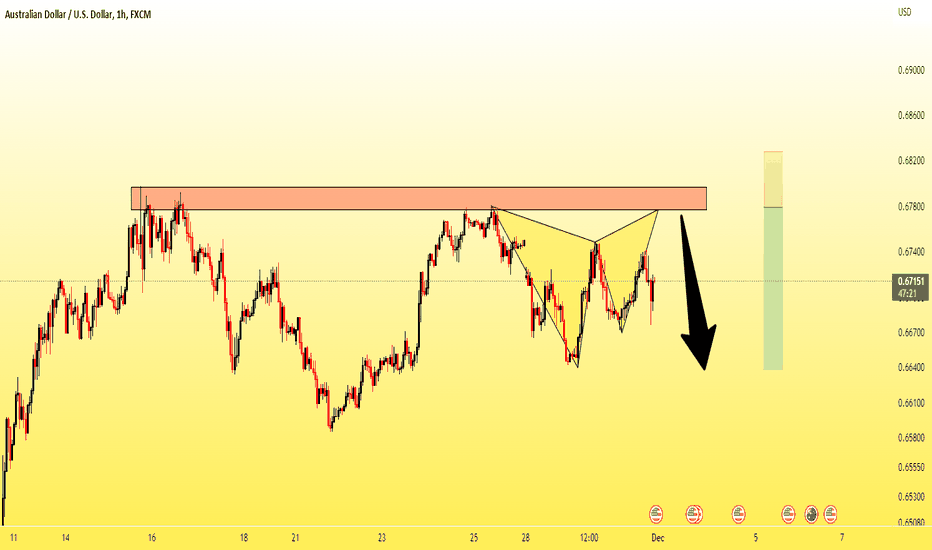

AUDUSD H1: Bearish outlook seen, further downside below 0.6680On the H1 time frame, prices are facing bearish pressure from the resistance at 0.6680, in line with the descending channel, 23.6% Fibonacci retracement and M15 supply zone. A pullback to the resistance zone at 0.6680 presents an opportunity to play the drop to the next support target at 0.6630, which coincides with the graphical resistance-turned-support level and Fibonacci confluence levels. Ichimoku cloud is showing signs of bearish pressure as well, supporting the bearish bias.

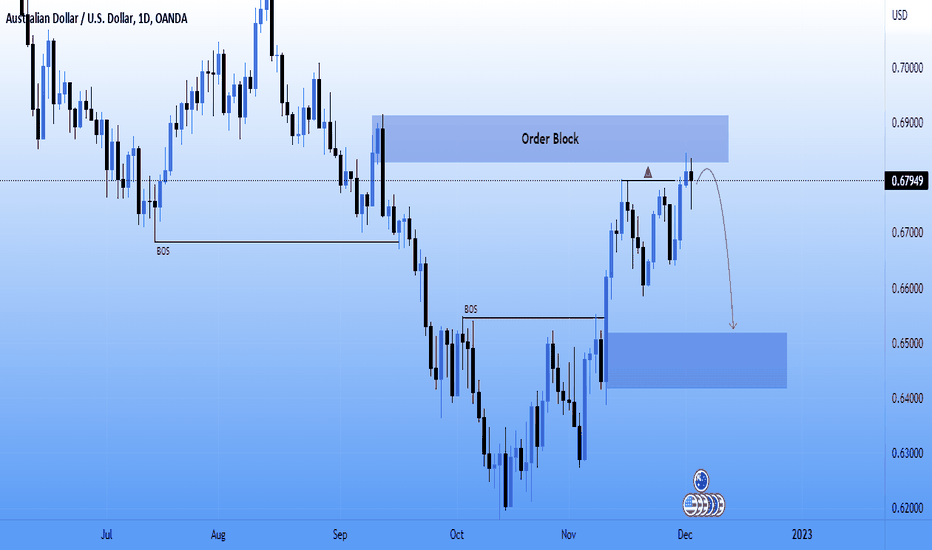

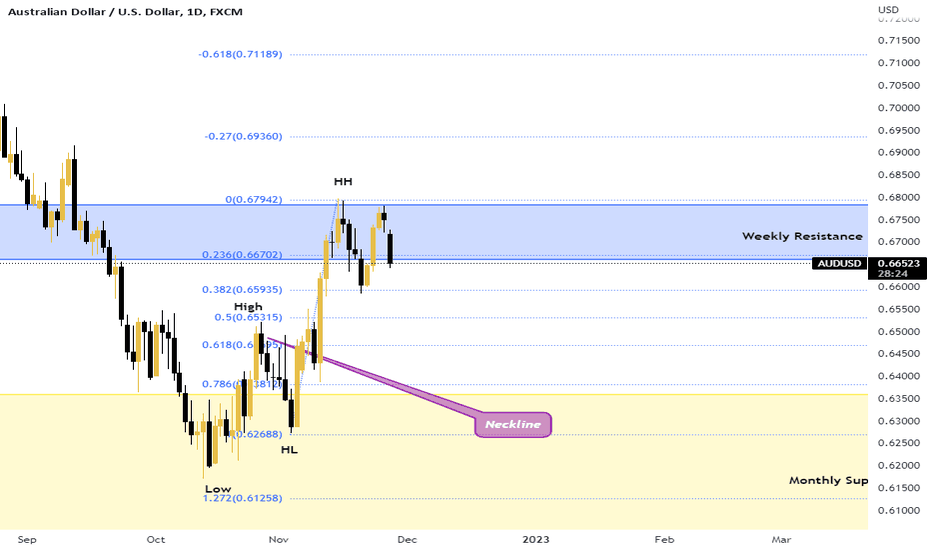

AUDUSD Analysis Bearish Opportunity-Price found support at the monthly demand zone and formed a double bottom.

-Price then made a series of Highs and Lows as it began it's bullish push

-Price then met resistance and closed Friday candle as a doji, hinting at bullish exhaustion.

-The large bearish candle of today closing further confirm that price is ready to make a move to the downside.

-Price also formed a double top pattern, which is a bearish reversal candlestick pattern.

-I am expecting price to make a retracement to the 50.0 Fib level, which also will test the previous high.

-A test of this previous high is also a test of the neckline of the previous double bottom.

-A retest and respect of the previous high 50.0-61.8 fib level will serve as a higher low.

AUDUSD - Daily Trade Idea - 29-Nov-22AUDUSD (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

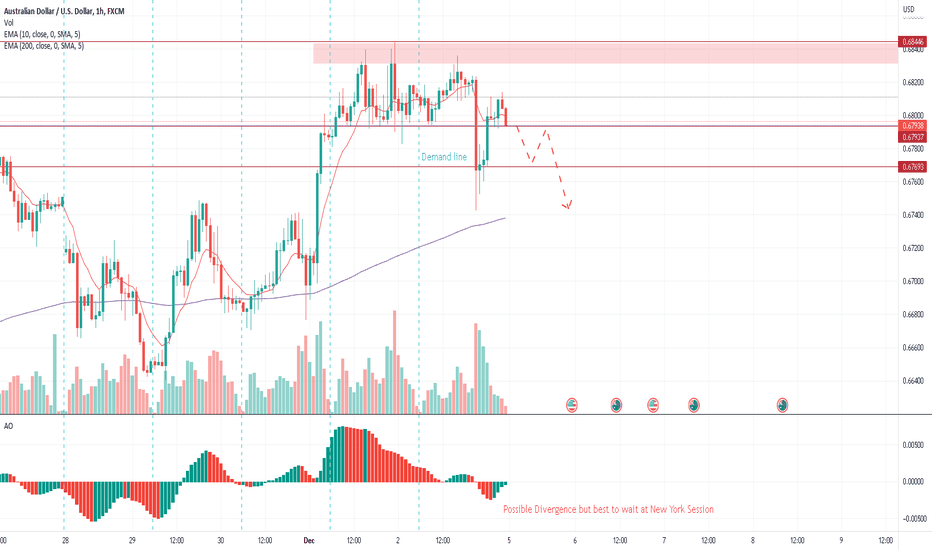

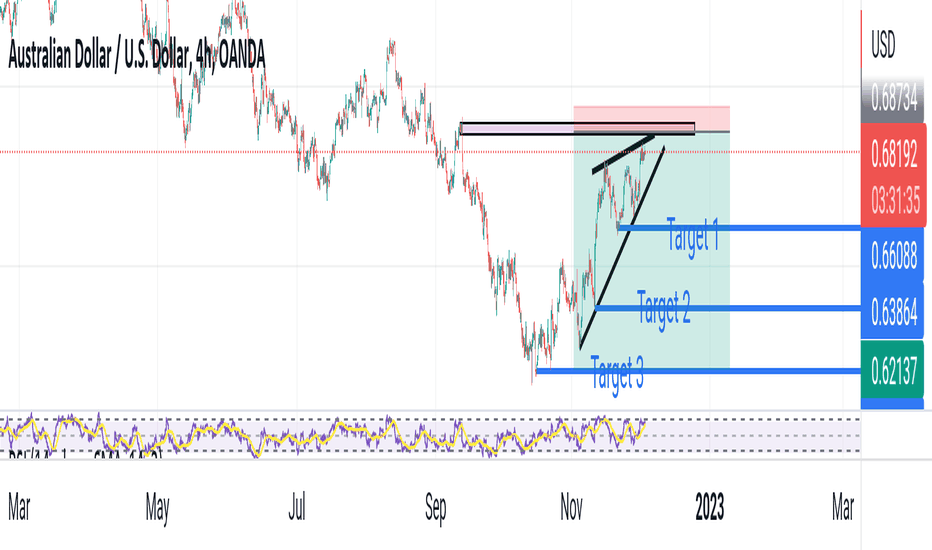

AUDUSD to Distribute Shorts?Howdy, howdy!

Moving on from this week’s price action, we can clearly see that price has found support at 0.65848 and not the 0.65777 level we anticipated earlier this week (pretty close 😊).

Anyway, what can we expect this coming week?

1. Well, for one, we still haven’t closed above the 0.67700 level on the daily time-frame (we have retested it again though) and honestly, I don’t think we have to close above it this coming week.

For the coming week a touch at the 0.68000 level is enough for us to see some reversal signs.

2. Price looks to be creating some Wyckoff Distribution Schematics on the hourly time-frame and we are currently expecting the UT of Phase B.

3. Some short-term buys at the current SOW level can be expected.

And yeah, that's pretty much it.

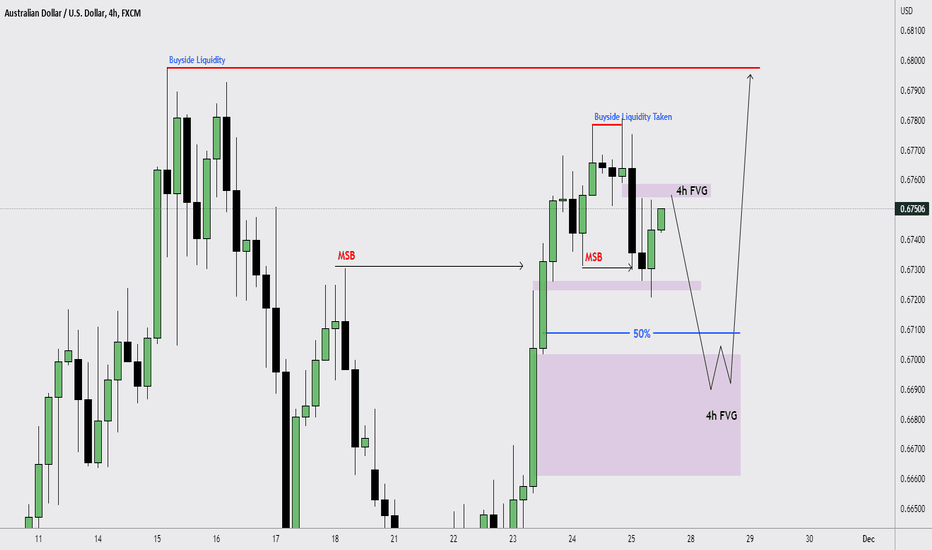

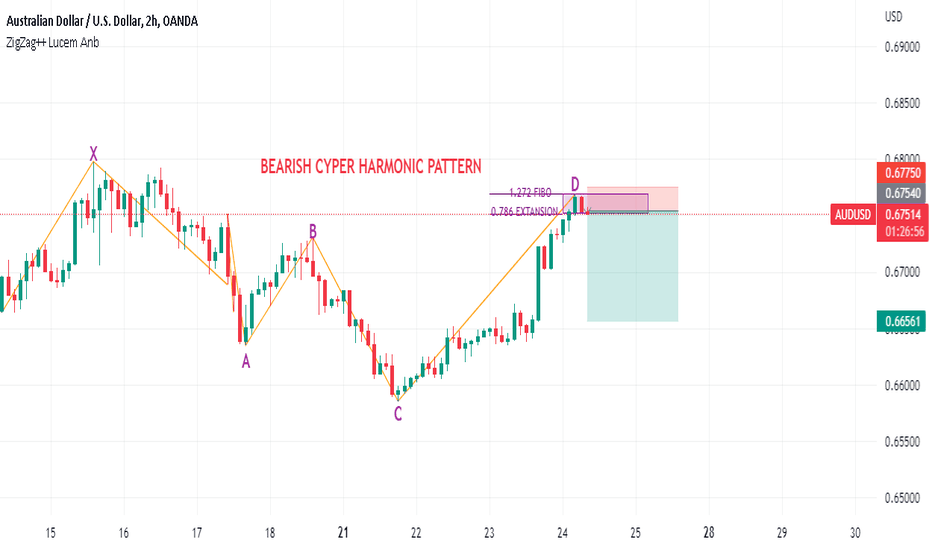

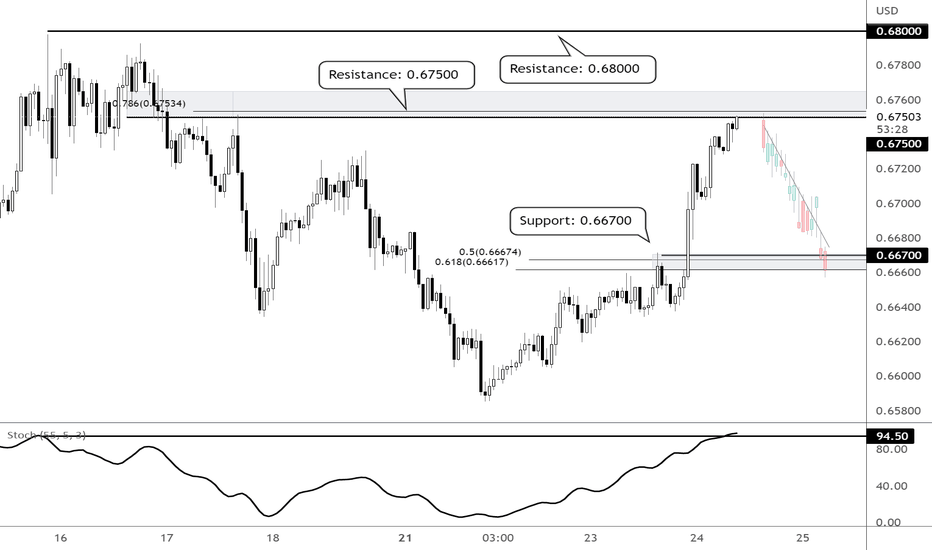

Bearish outlook on AUDUSD: 24th November 2022On the H4 timeframe, prices are facing bearish pressure from its resistance area at 0.67500, in line with the 78.6% Fibonacci retracement. The pullback to this zone presented an opportunity to play further drop to the next support target at 0.65000, in line with the 141.4% Fibonacci retracement. Stochastic is in the overbought region, supporting our bearish bias.

AUDUSD H1: Bearish outlook seen, further downside below 0.6750On the H1 time frame, prices are facing bearish pressure from the resistance at 0.6750, in line with the H4 supply zone, graphical resistance zone and 78.6% Fibonacci retracement. A pullback to the resistance zone at 0.6750 presents an opportunity to play the drop to the next support target at 0.6670, which coincides with the graphical resistance-turned-support level and Fibonacci confluence levels. Stochastic is testing resistance at 94.50 as well where we could see a reversal below this level.

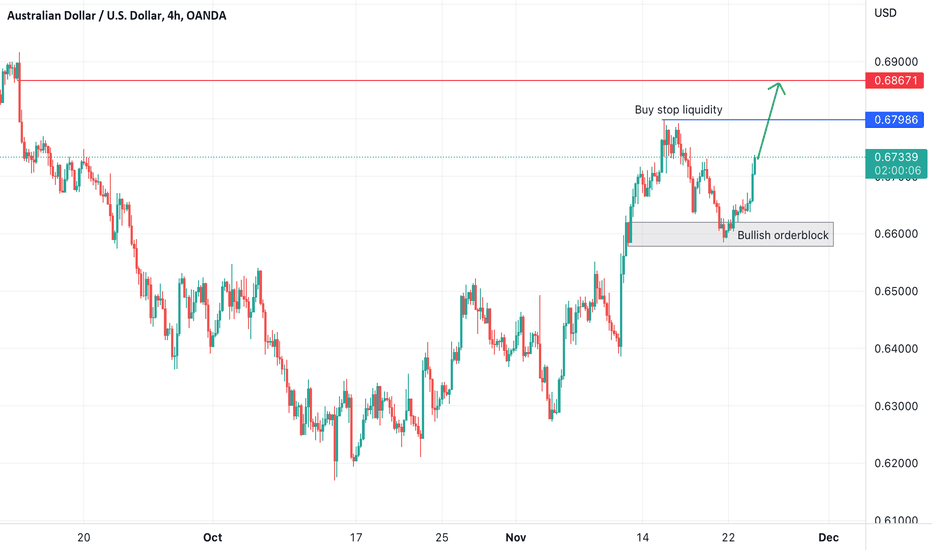

AUDUSD - Bullish price action ✅Hello traders!

‼️ This is my analysis on AUDUSD.

Here we are bullish from H4 timeframe perspective, so I am looking for longs. I expect price to continue bullish price action after rejecting from bullish orderblock. My target is buy stop liquidity and imbalance higher.

Like, comment and subscribe to be in touch with my content!