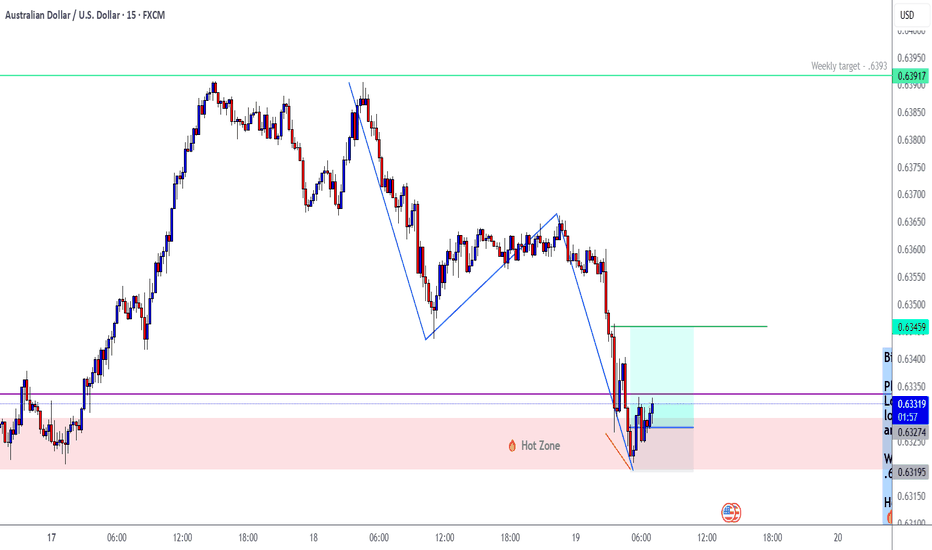

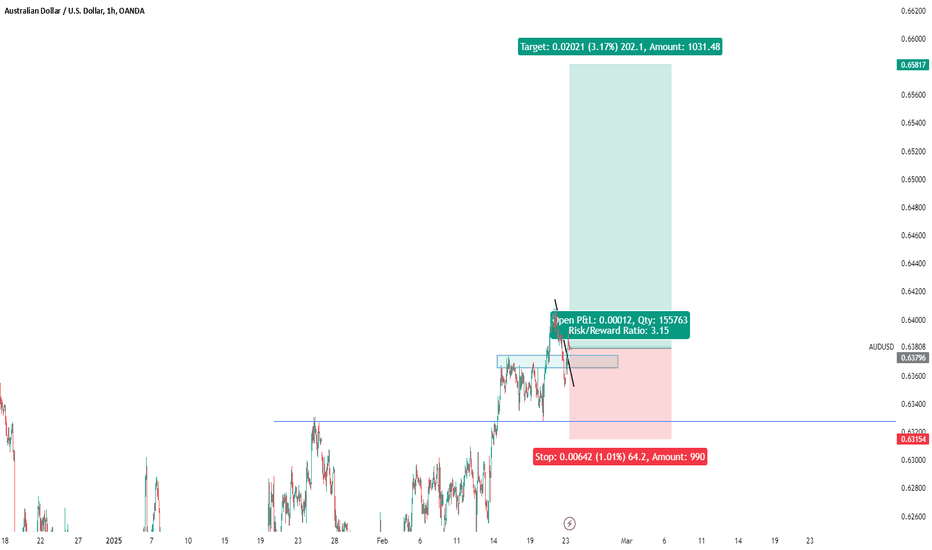

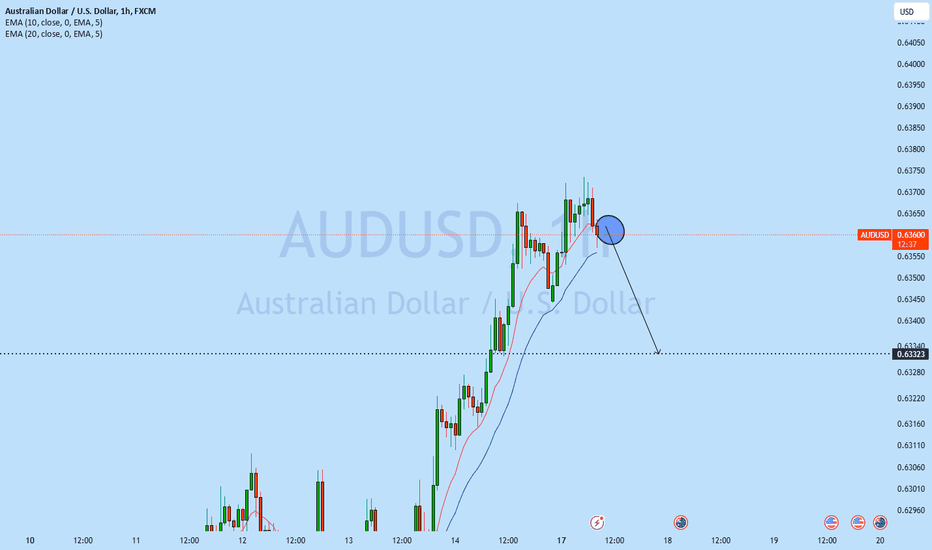

Setup #006 - AUDUSD - Long (Not the cleanest)Trade entered. I used the 5 min for entry but Tradingview doesn't let me post it on a small time frame.

We should find out if this is a winner or loser during the rest of US/UK overlap. I personally think price wants to drop more, but my strategy says to buy, so I'm listening to the strategy, plus there is a nice risk to reward for this trade.

Confluences:

✅ Bullish overall bias

✅ Bulllish demand zone

✅ Bullish ABCD on 15 min chart, bullish impulse crab on H4

✅ Bullish divergence in price reversal zone

✅ Buillish break of structure

✅ Entering NY open

✅ Break of structure confirmed

✅ Required risk:reward met

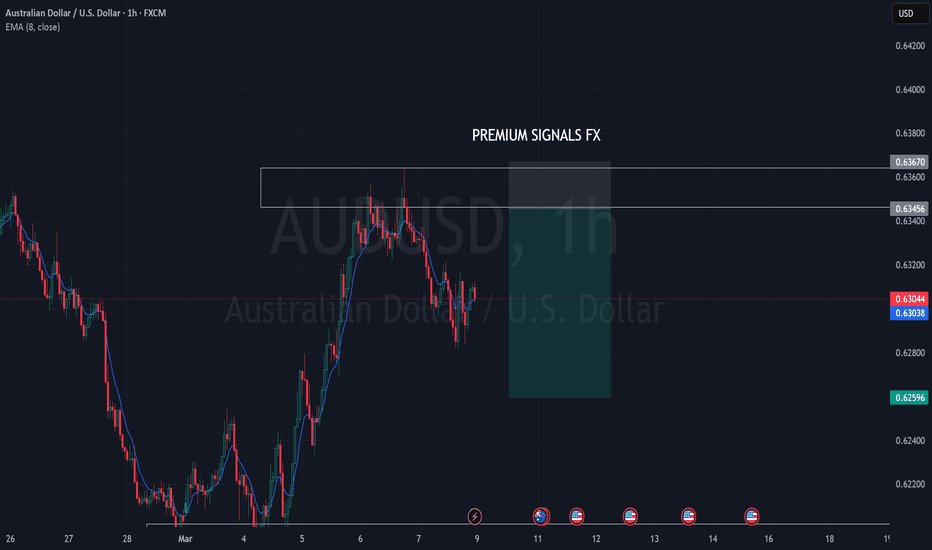

Audusdshort

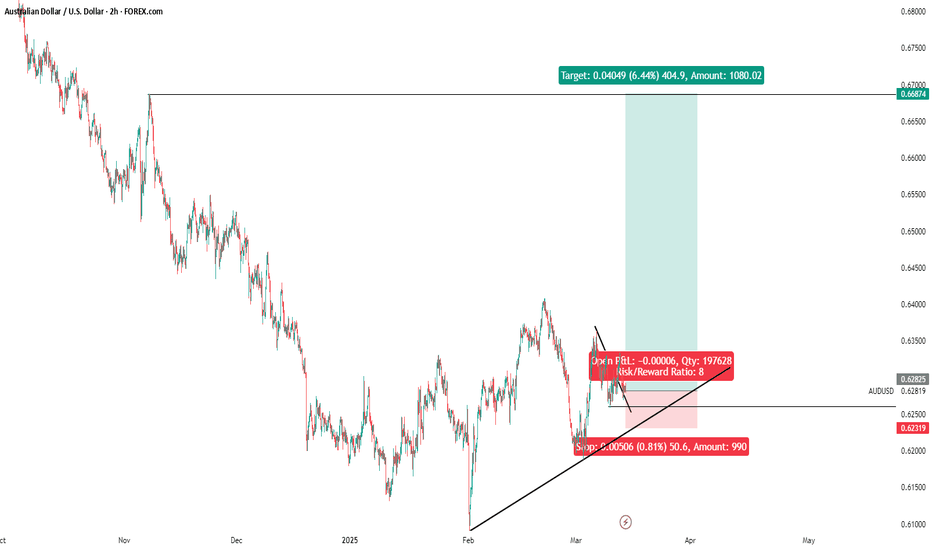

audusd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUDUSD BUY signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUCTION Is Breaking Down—More Pain Ahead?Yello, Paradisers! #AUCTION has been under heavy selling pressure, just like the broader crypto market. The price action remains weak, and the recent break below its ascending trendline support confirms that buyers are losing control. This breakdown is a crucial signal that the bullish structure has been invalidated, and unless something changes, the probability of further downside remains high.

💎#AUCTIONUSDT is trading just below this broken trendline, which has now flipped into a resistance zone, making it difficult for buyers to reclaim lost ground.Adding to the bearish momentum, the previous support level has now turned into a strong resistance, creating another obstacle for any potential recovery. The more a level gets tested as resistance after a breakdown, the stronger it becomes.

💎On top of that, there is an additional trendline resistance, meaning that even if AUCTION attempts a push upward, it will face multiple rejection points before any significant breakout can occur. This kind of price action suggests that sellers are still in control, and buying pressure is not strong enough to force a reversal.

💎Further reinforcing this bearish outlook is the 1D 12EMA, which is now acting as a dynamic resistance. Moving averages like this often act as barriers in downtrends, preventing price recoveries and leading to further declines. Additionally, the Multi-Timeframe VWAP (Quarterly) is also aligning with these resistance areas, making it even more challenging for AUCTION to break above these levels. When multiple technical indicators confirm the same resistance zones, it significantly increases the probability of the market rejecting any bullish attempts and continuing lower.

💎Another critical factor supporting the bearish thesis is the Fibonacci retracement level, which is also acting as resistance. This means that even from a retracement perspective, the price is struggling to move higher and remains capped under key technical levels. With all these resistances stacked against AUCTION, it is no surprise that the probability of a further downward move is increasing.

💎If the selling pressure persists, the next major downside target lies between $10.20 - $9.60, a key support area that could provide temporary relief. However, if bearish momentum continues, we must be prepared for a deeper correction, with the next significant support zone sitting between $8.85 - $8.30. These levels are crucial to monitor because they represent areas where buyers might step in to slow down the decline.

💎That said, there is one key level that could invalidate this bearish outlook—a 4H candle closing above $14.48. If AUCTION manages to break and hold above this level, it would indicate that buyers are regaining strength, and we could start reconsidering a shift in market structure. Until then, the trend remains bearish, and the higher probability play is to the downside.

The market is ruthless right now, and only traders who stick to disciplined strategies will come out on top. If you want to be among the winners, don’t let emotions dictate your trades—wait for the highest probability setups and execute with precision. Stay patient, stay smart, and make sure you’re on the right side of the trade, Paradisers!

MyCryptoParadise

iFeel the success🌴

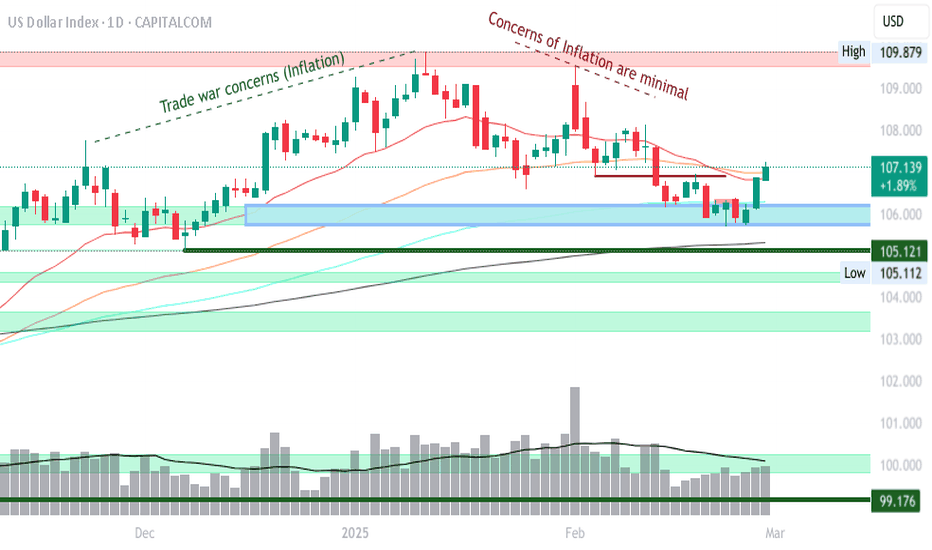

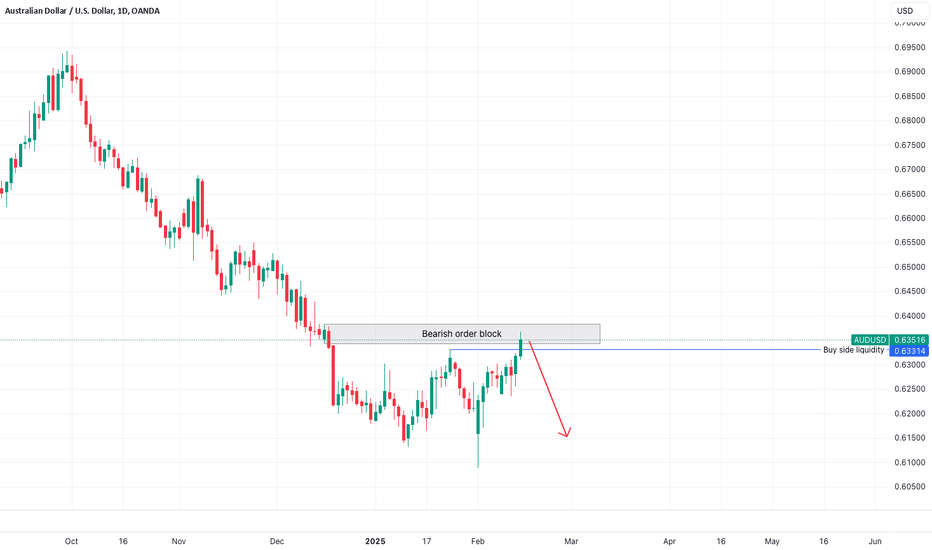

Short AUDUSD The Perfect Storm: Stagflation, GeopoliticsIn a world increasingly defined by geopolitical volatility and economic uncertainty, a perfect storm is brewing, casting a long shadow over the Australian dollar. The confluence of persistent stagflationary pressures, escalating trade tensions, and a resurgent U.S. dollar is creating a formidable headwind for the AUDUSD pair. This article delves into the intricate web of factors driving this bearish sentiment, offering a comprehensive analysis for macro traders and financial viewers seeking clarity amidst market turbulence.

The Stagflationary Grip: A Global Economic Quagmire

The global economic landscape is ensnared in a precarious dance between "sticky" inflation and a palpable slowdown. Core Personal Consumption Expenditures (PCE) remains stubbornly elevated, while Producer Price Index (PPI) figures signal continued upward pressure on consumer prices. This persistent inflation, coupled with a weakening housing market, declining consumer confidence, and a sharp contraction in global trade activity (as evidenced by the plummeting Shanghai and China Containerized Freight Indices), paints a stark picture of a "Stagflationary Weakness."

www.census.gov

The Federal Reserve finds itself trapped between a rock and a hard place, grappling with the unenviable task of taming inflation while averting a looming recession. Policy missteps are increasingly probable, further amplifying market anxieties.

Geopolitical Fault Lines and Trade Wars: Fueling the Fire

Adding to the economic woes are escalating geopolitical tensions and trade disputes. The contentious US-Ukraine situation, heightened US-China strategic competition (including technology decoupling and potential military tensions in the South China Sea), and the ever-present threat of cyberattacks are creating an environment of heightened risk aversion.

President Trump's aggressive tariff policies, targeting Canada, Mexico, and China, have ignited fears of retaliatory measures and further disruptions to global trade flows. The market's reaction has been swift and decisive, with the S&P 500 experiencing consecutive weekly declines, reflecting growing investor unease.

The AUDUSD Under Siege: A Technical and Fundamental Breakdown

Against this backdrop, the AUDUSD pair is experiencing a decisive bearish breakdown. The U.S. dollar (DXY), fueled by its safe-haven appeal and the prevailing risk-off sentiment, is exhibiting robust strength, targeting 109.900. This dollar resurgence is exerting significant downward pressure on the risk-sensitive Australian dollar.

Gaining Traction Amidst Global Uncertainty

The AUDUSD has decisively breached the critical 0.64000 level, signaling a clear shift in market sentiment. While rising commodity prices, particularly in energy, have historically provided support for the AUD, the current environment is unique. Geopolitical risks and global economic uncertainties are overshadowing the positive impact of rising commodity prices.

Technical indicators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), confirm the bearish momentum. The 20-day, 50-day, and 200-day moving averages are all trending downwards, reinforcing the bearish outlook.

Key Support Zone and Outlook:

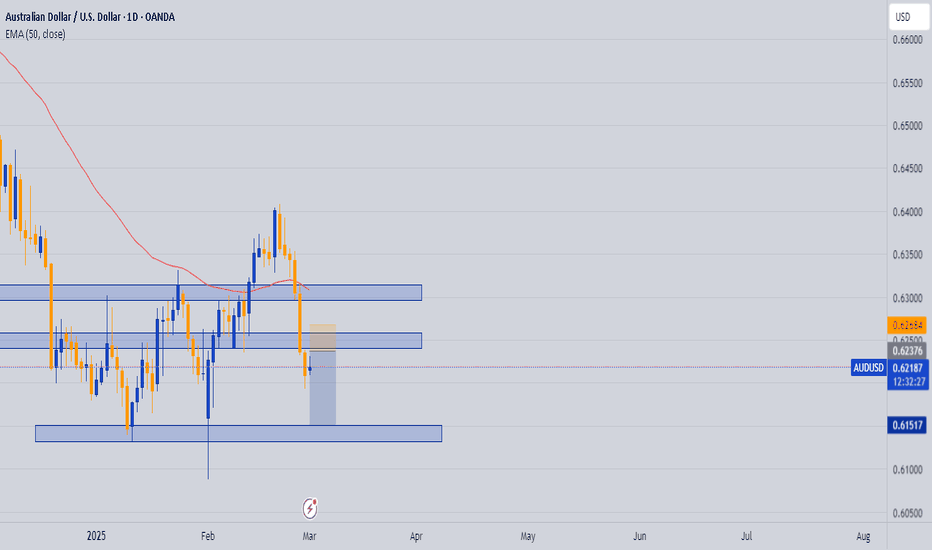

We have identified a key support zone between 0.61435 and 0.60838. This zone represents a potential area of consolidation or a temporary pause in the downtrend. However, given the strong bearish momentum and the prevailing fundamental factors, we anticipate a continued downward trajectory.

Impact of Strong Dollar and Risk Aversion"

Traders should closely monitor the DXY and global risk sentiment for further confirmation of the bearish trend. Any sustained break of the 0.64000 level would confirm the current outlook.

The AUDUSD pair is currently navigating a perfect storm of stagflationary pressures, geopolitical risks, and a resurgent U.S. dollar. This confluence of factors has created a compelling bearish outlook, with technical indicators and fundamental analysis aligning to support continued downward momentum.

In this environment, vigilance and a deep understanding of the global macroeconomic landscape are paramount. Traders must remain attuned to the evolving geopolitical and economic narratives, adapting their strategies to navigate the turbulent waters of the current market. FX:AUDUSD CAPITALCOM:DXY

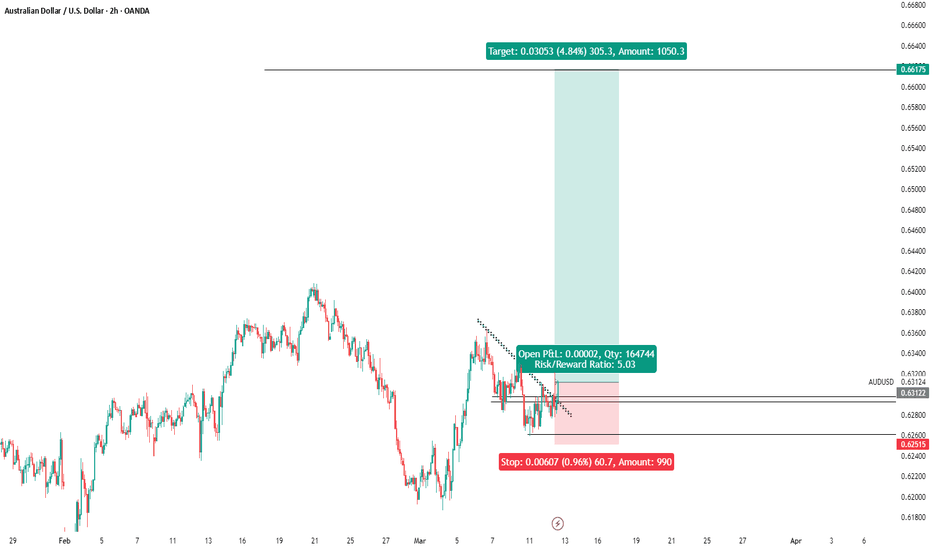

audusd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

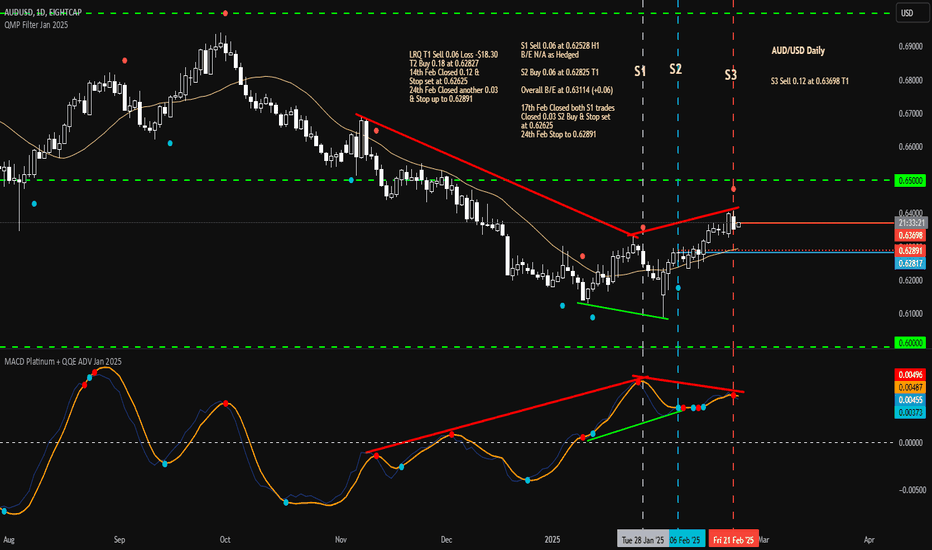

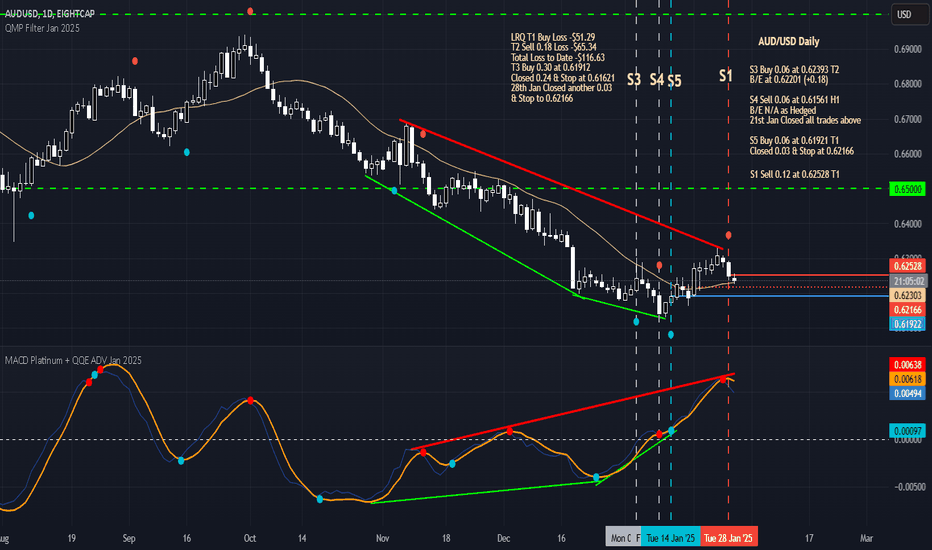

Mon 24th Feb 2025 AUD/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a AUD/USD Sell. Enjoy the day all. Cheers. Jim

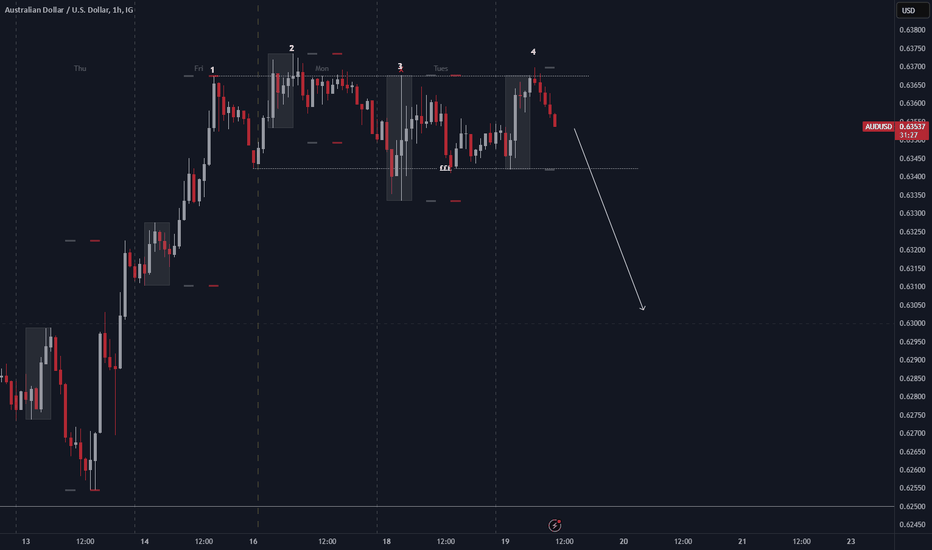

AUD/USD Bearish Breakout PotentialThe chart shows AUD/USD on a 1-hour timeframe, highlighting a consolidation phase with multiple rejections at resistance (labelled 1-4). The price has recently rejected the upper boundary and is breaking down from the range, suggesting bearish momentum. A significant liquidity grab appears to have occurred near the highs, followed by a strong rejection. The projected move suggests a further decline toward the next support level around 0.6300. Traders might look for confirmation via increased selling pressure and volume before entering short positions.

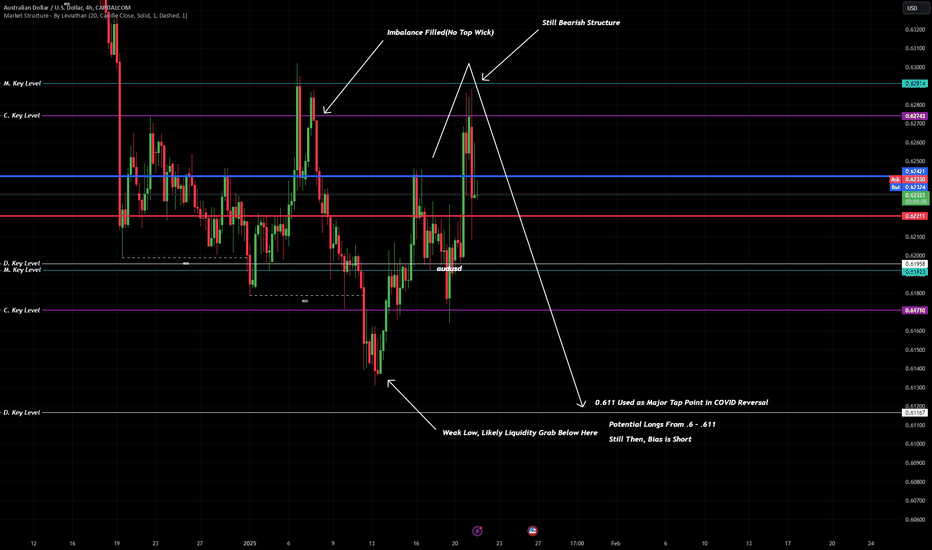

AUDUSD - Look for a short !!Hello traders!

‼️ This is my perspective on AUDUSD.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. As we can see price took buy side liquidity and now it's in bearish OB, I expect to see BOS on lower timeframe to open the trade.

Fundamental news: Upcoming week on Tuesday (GMT+2) we will see results of Cash Rate on AUD and on Thursday (GMT+2) we have Unemployment Rate. News with high impact on currency.

Like, comment and subscribe to be in touch with my content!

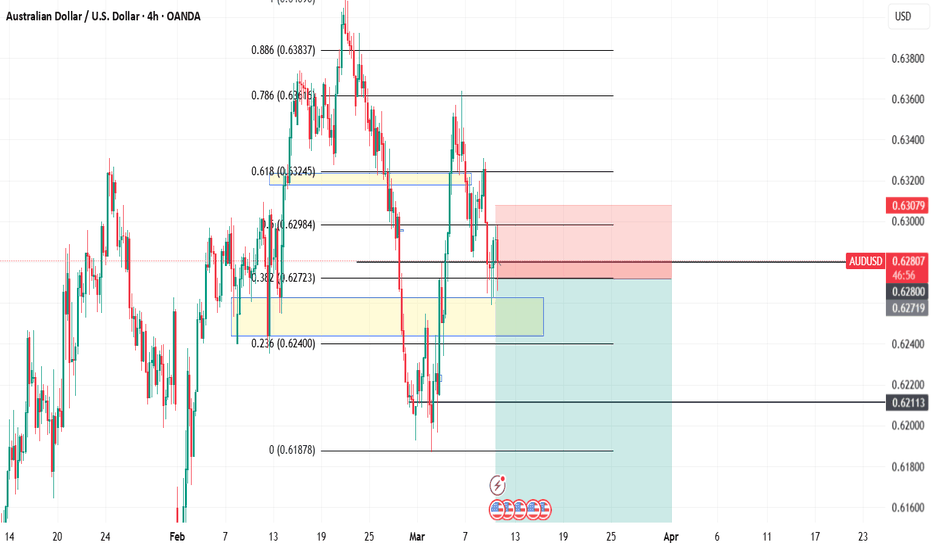

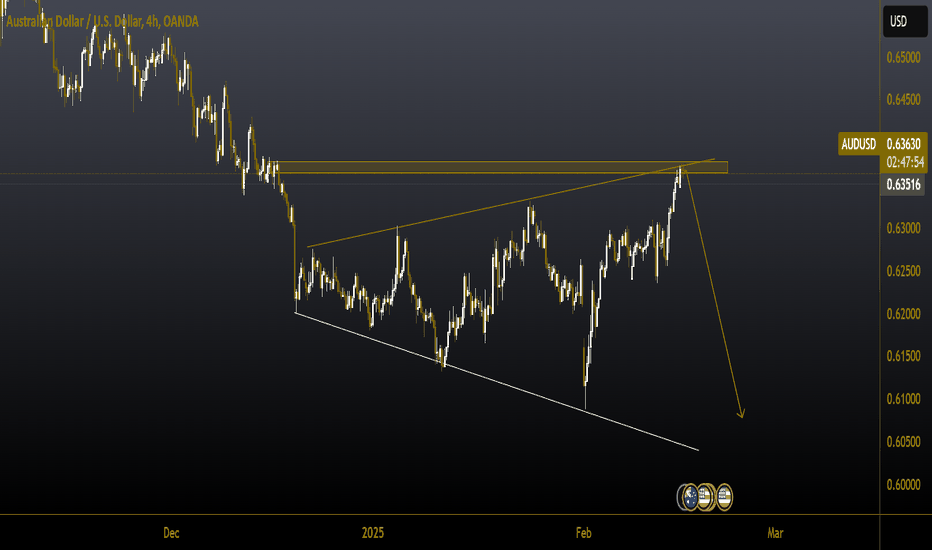

#AUDUSD 4HAUDUSD (4H Timeframe) Analysis

Market Structure:

The price is forming an expanding pattern, indicating increased volatility and uncertainty in market direction. Additionally, a sell engulfing candlestick has appeared, suggesting strong bearish momentum and potential downside movement.

Forecast:

A sell opportunity is anticipated as the expanding pattern, combined with the sell engulfing area, signals increased selling pressure.

Key Levels to Watch:

- Entry Zone: A sell position can be considered near the recent resistance area where the sell engulfing pattern has formed.

- Risk Management:

- Stop Loss: Placed above the recent swing high to manage risk.

- Take Profit: Target lower support levels for potential downside movement.

Market Sentiment:

The formation of an expanding pattern with a sell engulfing candlestick suggests that bearish pressure is increasing. Monitoring price action and confirmation signals before entry will help align with the prevailing trend.

EURUSD and AUDUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

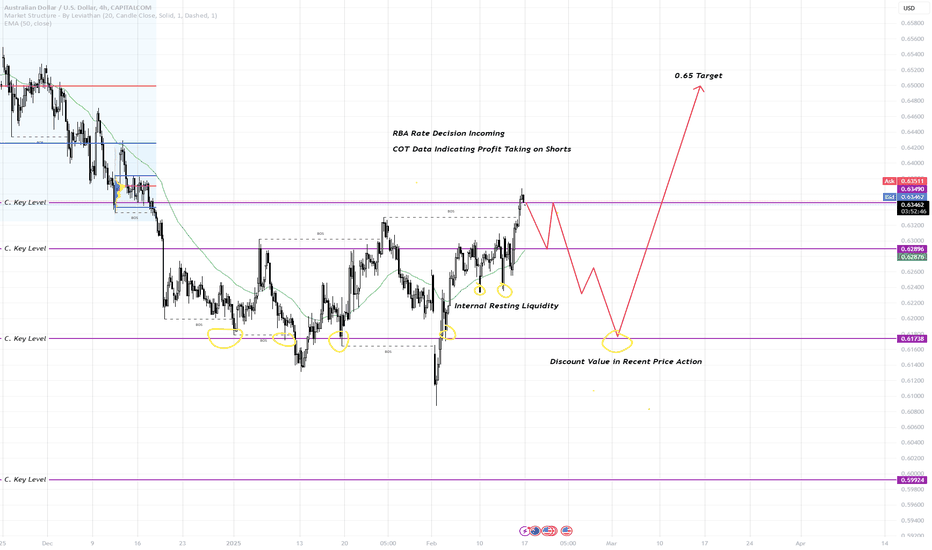

Ghost's AUD/USD Setup [LONG/SHORT]I believe at the moment shorts and longs are valid, shorts on the short-term, longs for the long-term no pun intended.

We have an equal low created leaving behind internal liquidity I am expecting to be swept before price can continue higher, 0.617 to me seems to be a strong & critical area of price for the current environment and as such, could be tapped before price continues to .65+.

RBA interest rate decision is around the corner & COT positioning is indicating profit take so be careful gang.

As it stands right now GTFX is on a 22 win streak, almost 300 pips acquired for 2025 already and a lot more to come.

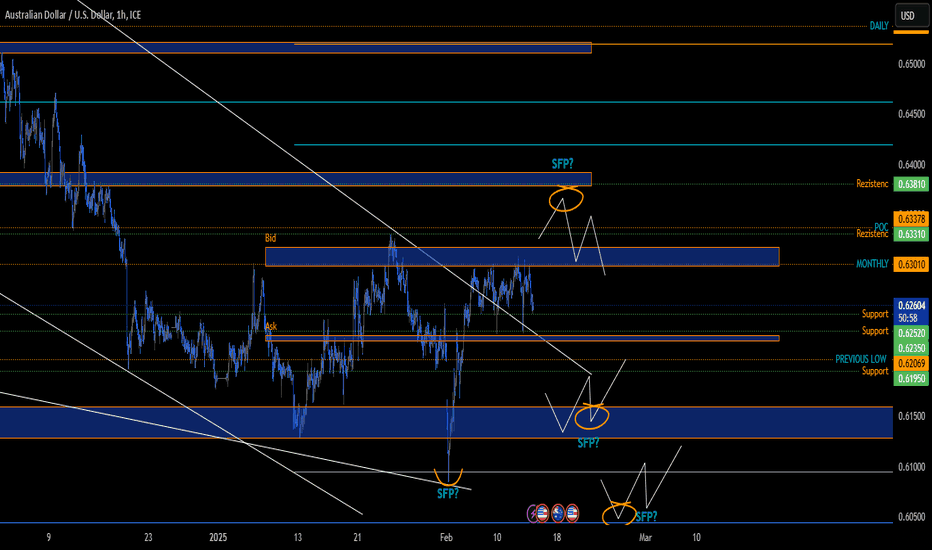

Scenario on AUDUSD 13.2.2025I would see AUDUSD like this, if it were to be a short, then the first place I would be willing to enter is the sfp above the high around poc 0.63378 long positions are the first acceptable until the sfp around the support at the level of 0.616-0.613 and then only after the building sfp

Wed 29th Jan 2025 AUD/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being an AUD/USD Sell. Enjoy the day all. Cheers. Jim

AUDUSD - Long from bullish OB !!Hello traders!

‼️ This is my perspective on AUDUSD.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is imbalance filled + rejection from bullish OB.

Like, comment and subscribe to be in touch with my content!

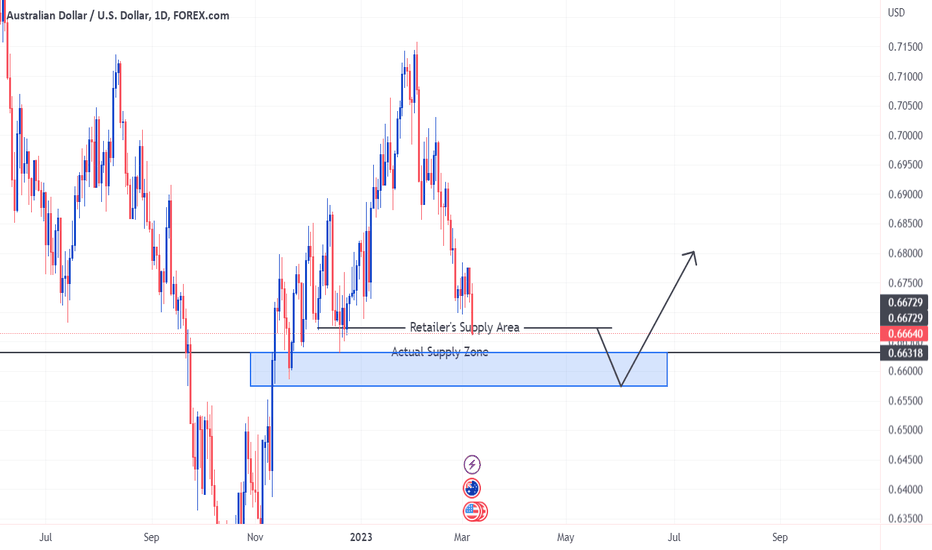

AUDUSD Potential 1:3 up to 1:11 RR | POSITION | LONGAs seen in the chart, it was expected that the ideal "supply" zone was swept. As a retailer, your normal reaction is to buy on that support area; however, looking at the bigger picture, due to the momentum of the bears, there was no clear indication for us to buy in that area, hence using SMC, we should be buying at our actual discount/supply zone. By buying in this area, we can potentially reach 1:11 RR with a minimum RR of 1:3, a reward I am sure that most of us would like, especially for those trading with big lots.

Reminder: Do not risk more than 1-3% of your port so you can make up your losses.

Disclaimer: I am not a guru or a professional trader, I am simply sharing my insight based on my understanding of the market.

SHORT AUDUSDI'm looking for further movement to the downside on AUDUSD, targeting a price level of 0.59784. Price has been bearish since October of last year. There is still a key level residing below 0.59815 that would be of interest to seek out if downside momentum continues. Volume has been decreasing as price started its retracement from 0.61311, price traded back into a fair value gap and proceeded to close below it. I'm currently in a short position, this is a swing trade. Patience is all is takes, let's see if price continues to trend bearish. Let me know your thoughts if it differs from my perspective.

Ghost Traders FX AUD/USD Trend Continuation [SHORT]The Ghost Traders FX gang has been taking shorts pretty much off every pump for very easy wins, as per last idea for Short, price is still yet to take the weak low which I would attribute to just manipulation & speculation in the market during Trump's Inauguration week.

My bias is still short until 0.613 is taken and 0.6 - 0.611 is tapped into.

Trade Record for GTFX stands at 126 wins, 17 breakevens, 7 losses with a 94%+ W/R & +2670 pips gained.

Best of luck to everyone.

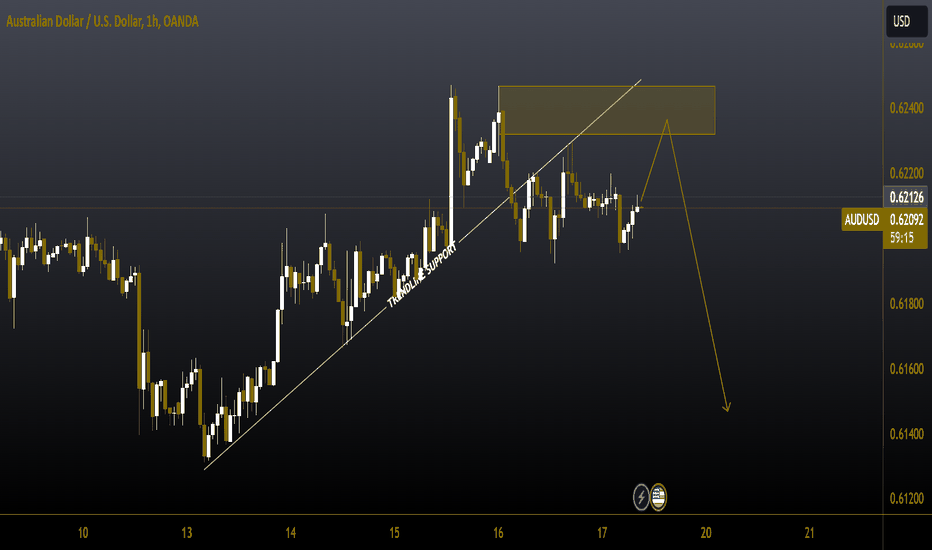

#AUDUSD 1HAUDUSD (1H Timeframe) Analysis

Market Structure:

The price has broken below a key trendline support, indicating a potential shift in market momentum toward the downside. The breakdown suggests that buyers could not maintain control, and selling pressure has begun to dominate.

Forecast:

A sell opportunity may arise if the price retests the broken trendline as resistance and confirms rejection, signaling further bearish movement.

Key Levels to Watch:

- Entry Zone: After the price retests the broken trendline and shows signs of rejection.

- Risk Management:

- Stop Loss: Placed above the retest level or the recent swing high to manage risk.

- Take Profit: Target the next support levels or significant price zones below for potential downside objectives.

Market Sentiment:

The breakdown of the trendline support highlights a bearish sentiment in the short term. Waiting for a retest provides a more strategic entry point, minimizing risk and aligning with market confirmation. Proper risk management is essential.

AUDUSD Retest of Key breakout area at 0.62060-Fakeout or Retest.Following US CPI coming out as expected, (showing a slight uptick in inflation for December) TVC:DXY pushed back to 108.6-108.4 area:

-> A rising wedge was identified on AUD/USD with an exit on the upside following CPI release.

-> Aussie is trading at a key area around 0.6260, whether it will be a retest of the top of the wedge or a reclaim of this resistance and become a fakeout is still to be determined.

Bulls narrative:

-> Bulls see the current set up as a breakout from a wedge followed by a three leg pullback (5 min the time frame), they want a retest of 0.6260 followed by a follow through buying around 0.6260 and a reclaim of the 5 min EMA. bulls need to see follow through buying and consecutive bull bars. Previous 4H close above 0.62070 shows the market is willing to go above.

Bears narrative

-> After breakout there was no significant follow through buying followed by 5 consecutive bear bars on the 30 min. >A reclaim of the 0.62025 on the 4H timeframe would open the door to downside targets for at least a test of the bottom of the wedge at 0.61700. W

-> Bears want weak buying around the 0.6260 and trap bulls for follow through selling and put them in a loosing trade

For now, trade favors bulls with potential for upside targets around the daily 20EMA and a retest of the 0.62800 and 0.63000 area. If none of these scenarios play out in the coming hours, market will go sideways to down.