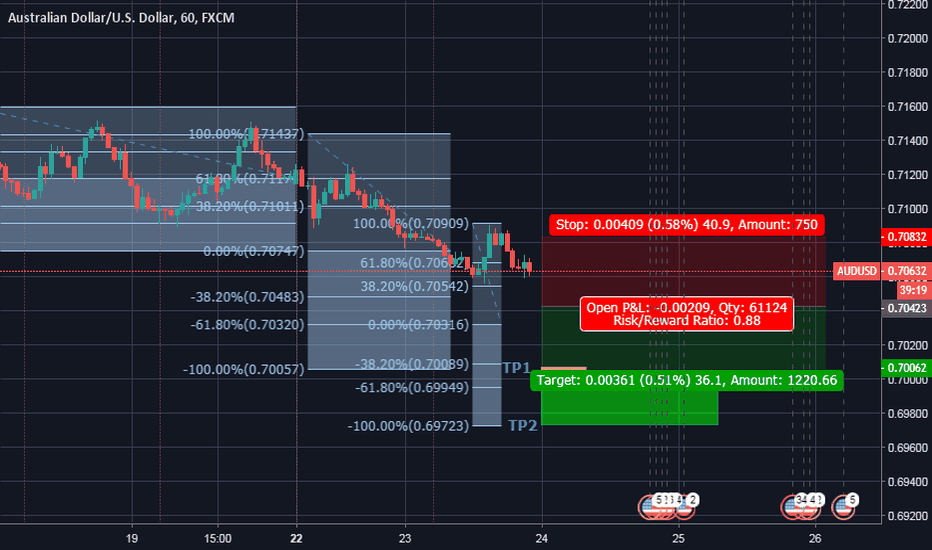

AUDUSD Short (Short-term)Though it seems like it's now forming a double bottom in the hourly chart (and I also have bullish bias in AUD overall, especially since it has been oversold for some time now), AUDUSD already broke the 2017 low (0.70500) and if this pair breaks past 0.70468 (-38.2 fib level in the weekly chart), I'm expecting it to go down further near 2016 low at 0.68489 (-61.8 fib level in the weekly chart). The possible escalation of the US-China trade war will also have an effect on AUD. Setting up a sell stop order few pips below 0.70468, with 1st TP at 0.70 psychological support, and 2nd TP at -100 fib level in hourly chart (some pips above 2016 low, to have buffer and avoid getting whipsawed in case this pair finally start going bullish). SL is gonna be between 61.8 - 100 fib level in the hourly chart (might adjust past 100 in case of more volatility, but not beyond the 38.2 level in the previous fibonacci).

www.reuters.com

www.cnbc.com

Daily:

Weekly:

Confidence: B (need to manually close this position before USD news by Thu; any upcoming geopolitical news between US and China will have an impact on this pair)

Audusdshortsetup

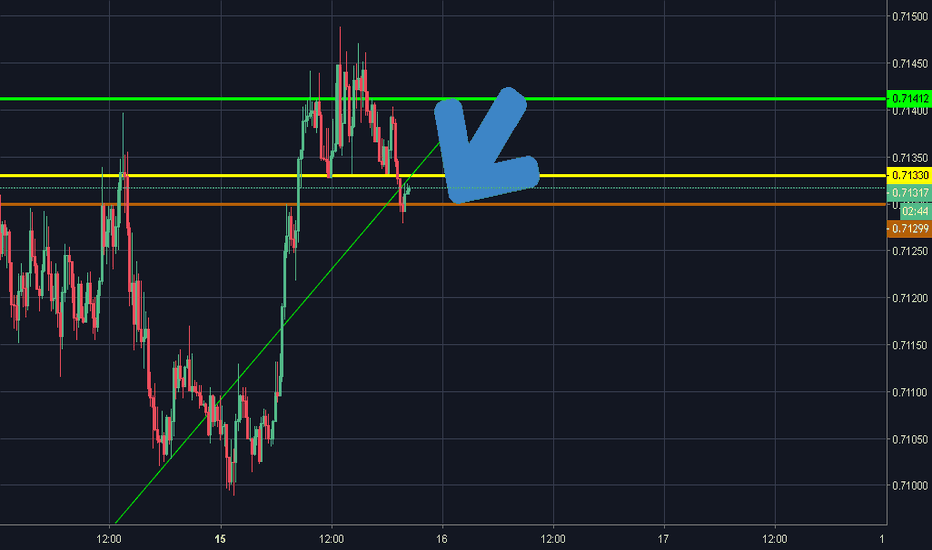

AUDUSD Short Position (4Hr Timeframe)-4Hr: Retest of support line with bullish momentum towards resistance which I feel will retest and gain bearish momentum upon the interest rate decision

-Daily: retest of support line

- RBA governor Philip Lowe indicated in July that interest rates were likely to remain on hold for a while as Australians grappled with rising household debt, stubbornly weak inflation, and slow wage growth.

- If the RBA is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the AUD. Likewise, if the RBA has a dovish view on the Australian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

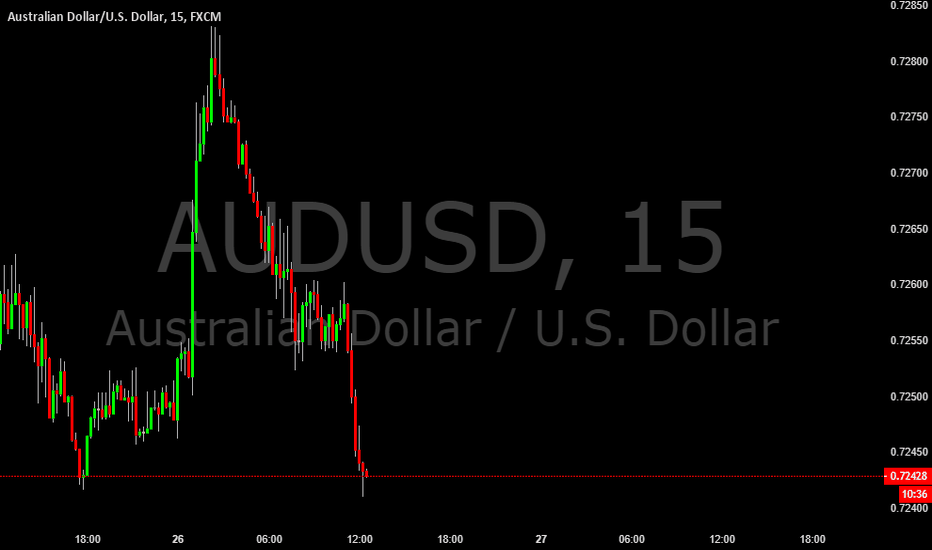

AUDUSD Short Setup @ 0.7590I'm expecting a short-term correction on USD, which may pull AU back to areas of previous support. AU has been ranging within an ascending wedge for quite some time, so I'm targeting the bottom of this wedge as a tp. The target sell zone is between 0.7550 and 0.7590. These are my entry, sl, and tp targets:

Entry Sell: 0.75900

Stop Loss: 0.77550

Take Profit: 0.73025

Regarding the poor risk/reward ratio- I'm planning on opening a small position at 0.75900, then averaging out with more shorts if the price continues to climb toward the upper trendline. I'd think 0.7680 would be a safe SL, but you never know what can happen in terms of fundamentals. My take profit is above the trendline and 0.786 fib.

I may enter at a position earlier than my stated target, depending on the status of RSI and EMAs. If so, I'll update this accordingly.

Thanks for checking out my idea!