Audusdsignal

Possible opportunity in Aussie vs USD this week?US dollar

Attention will be paid to key economic indicators that roll out over the course of the week such as the Non-farm Payrolls jobs report, JOLTs job openings, and the ISM Services PMI survey.

Moody's analysis suggests a cooling down of various labor market measures. The uptick in November jobs growth is attributed to the impact of the United Auto Workers strikes in October rather than a substantial resurgence in the labor market.

Aussie Dollar

The Reserve Bank of Australia (RBA) is anticipated to maintain its interest rate in its upcoming meeting on Wednesday, with a 97% probability for the rate to stay at 4.35%. There is only a 3% chance of a 25bps hike to 4.60%. This expectation follows the RBA's decision to raise the Cash Rate by 25bps in the last November meeting.

A surprise decision by the RBA (or even a change in outlook) could see the Aussie dollar spike like the NZ dollar did last week. Look for weak preliminary job numbers coming from the US for extra confirmation of a bullish Aussie outlook.

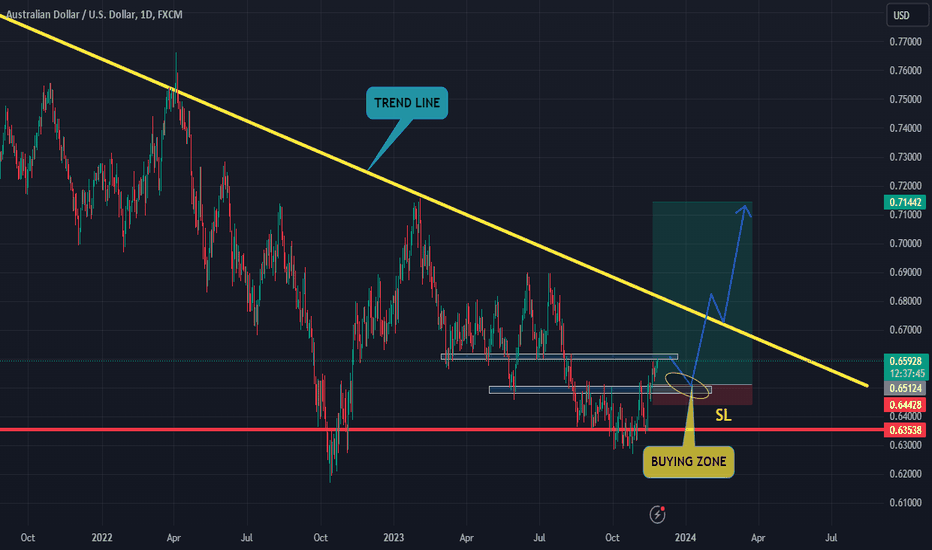

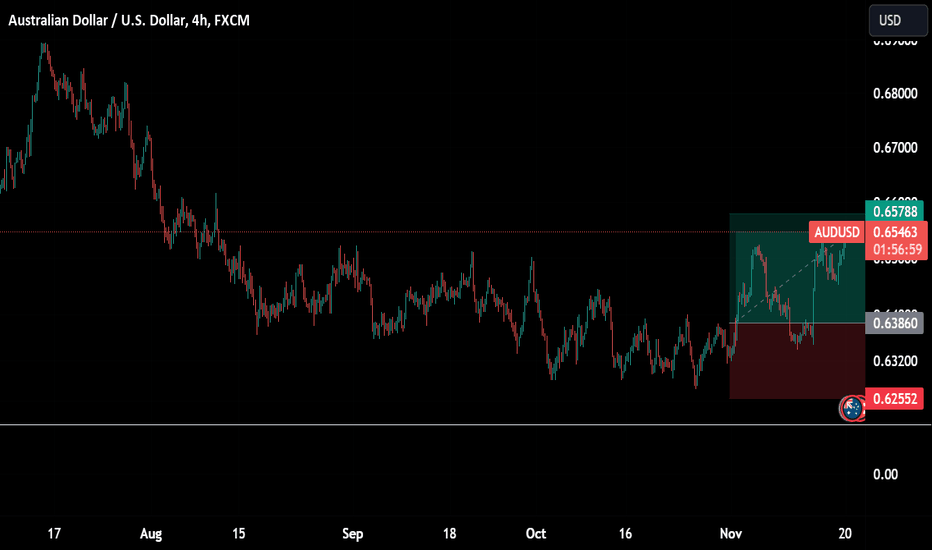

AUDUSD BUYING ZONE !!!HELLO TRADERS !!!

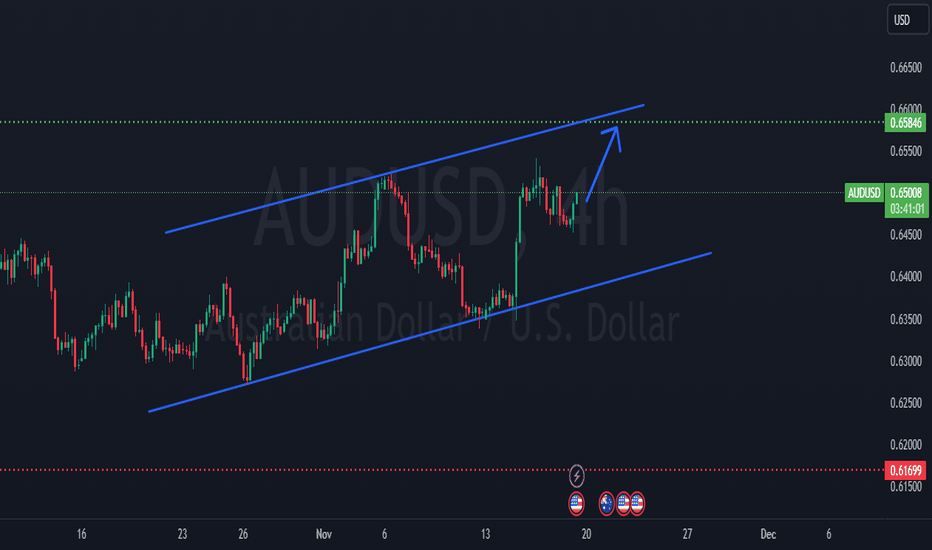

As we can see this pair is holding weekly support and moving to north and we are looking for buying opportunity for this pair now it have to retrace with DXY move to the downside till the buying zone so we are looking for these design levels so we will trade on this pair with a low risk and higher rewards its just a trade idea share ur thoughts on this pair with us & stay tuned for new entries

AUDUSD: Currency market update: USD decreased slightly, AUD AUDUSD rose 0.28% to 0.6635 following China PMI data. Manufacturing activities had their second consecutive month of decline while non-manufacturing activities bottomed out for the year. With such a situation, the market expects China to announce more economic stimulus measures

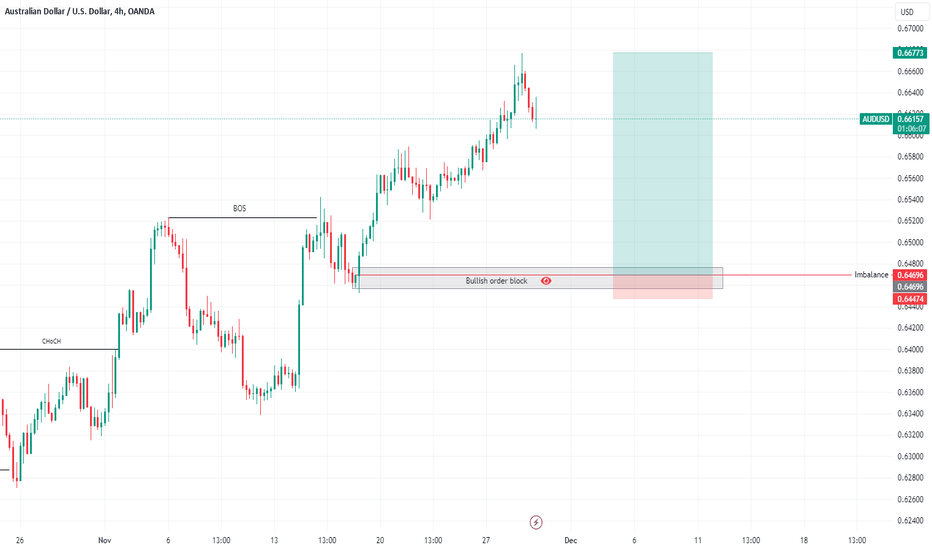

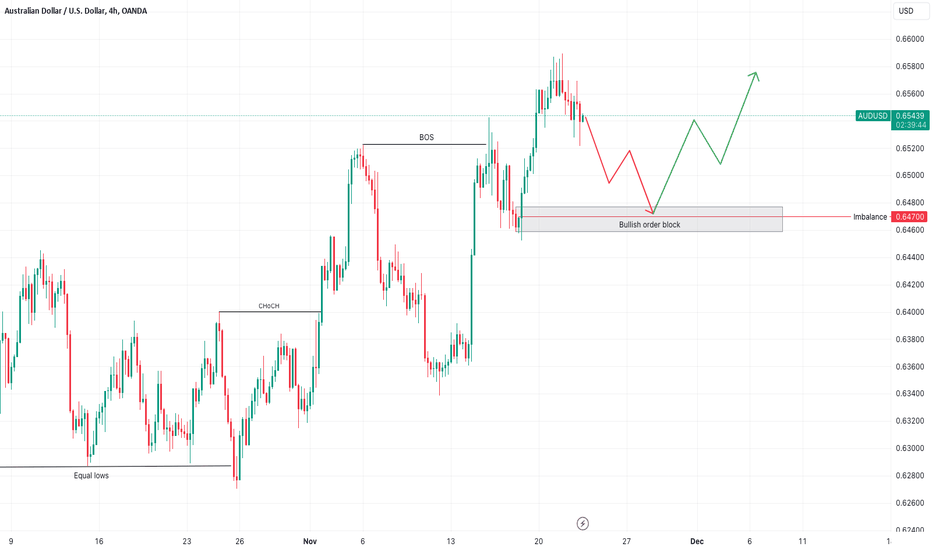

AUDUSD - Long from bullish order block ✅Hello traders!

‼️ This is my perspective on AUDUSD.

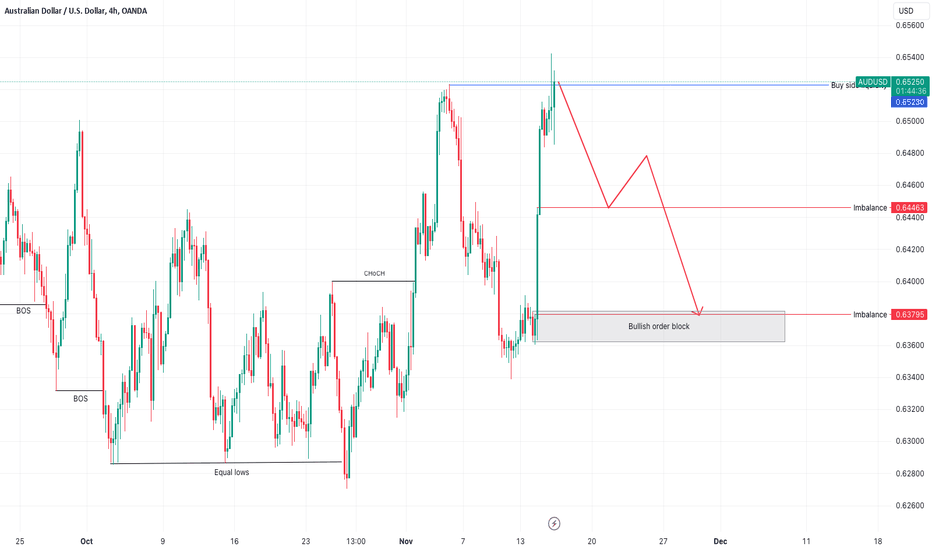

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I am looking for longs. I want price to make a retracement to fill the imbalance lower and then to reject from bullish order block.

Like, comment and subscribe to be in touch with my content!

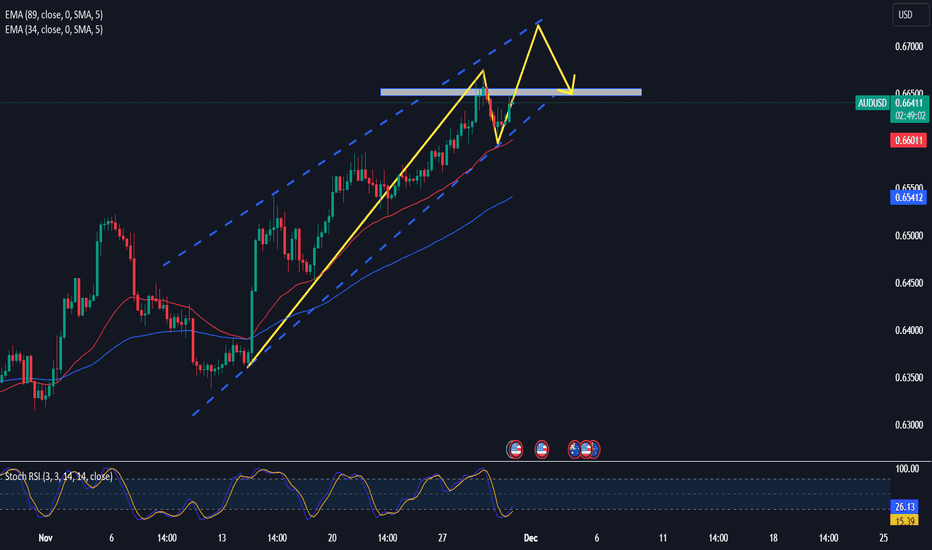

$AUDUSD Bullish Momentum LONG

The current outlook for AUDUSD reveals a compelling narrative of bullish consolidation in the short term. As outlined in the provided chart, the pair exhibits patterns indicative of a bullish stance, suggesting a period of strategic accumulation.

Technical Indicators:

Candlestick Patterns: Noteworthy bullish candlestick patterns, as illustrated, underline the market sentiment favoring the upside.

Moving Averages: The alignment of moving averages supports the notion of a consolidative phase, emphasizing the potential for an upward breakout.

Fibonacci Levels: Key Fibonacci retracement levels coincide with areas of consolidation, adding confluence to the bullish scenario.

Quantum Probability Indicator:

Intriguingly, our proprietary quantum probability indicator provides a unique dimension to this analysis. It discerns a notable buildup of buying pressure, reinforcing the bullish sentiment observed in the technical patterns. This indicator serves as a valuable complement, enhancing the overall confidence in the potential bullish trajectory. w.aritas.io

Trade Considerations:

Entry Point: A strategic entry point within the consolidation zone, following confirmation of the bullish bias, is advisable.

Take Profit (TP): Set conservative take-profit levels in alignment with key resistance zones or use a dynamic approach based on subsequent price action.

Stop Loss (SL): Implement a disciplined risk management strategy with a well-defined stop-loss, considering the recent support levels and volatility metrics.

Market Context:

Macro-level considerations, such as interest rate differentials, economic data releases, and geopolitical factors, should be monitored. Additionally, any developments in global risk sentiment may impact the AUDUSD pair.

Conclusion:

In conclusion, the AUDUSD pair presents an intriguing opportunity for traders, with a bullish consolidation pattern supported by technical indicators and reinforced by our quantum probability indicator. While opportunities exist, prudent risk management and ongoing market monitoring are essential components of a successful trading strategy.

Disclaimer: Trading involves risk, and it is advisable to conduct thorough personal research and seek professional advice before making any trading decisions.

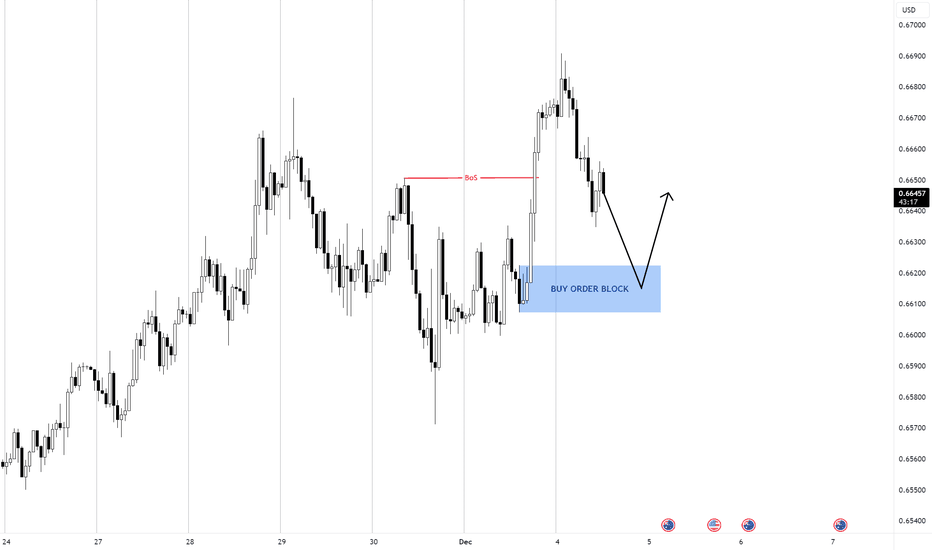

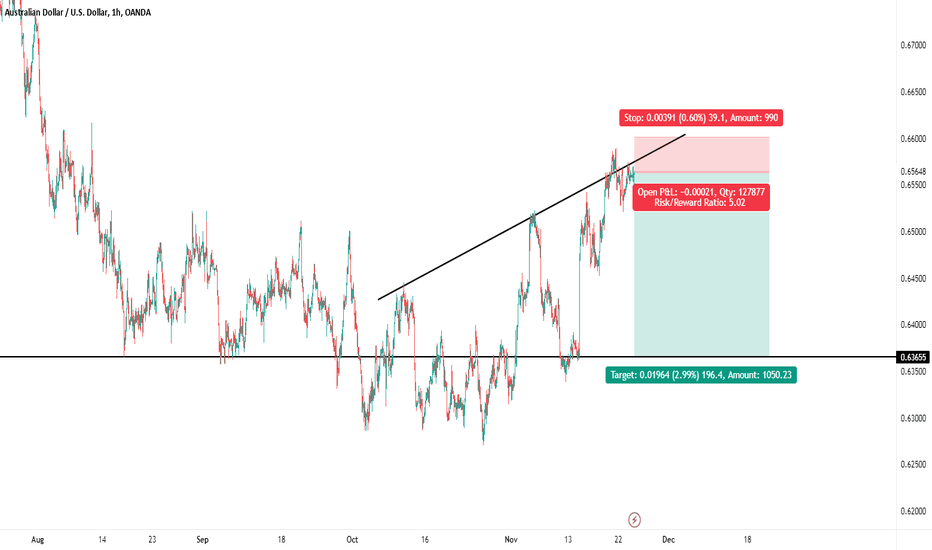

audusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

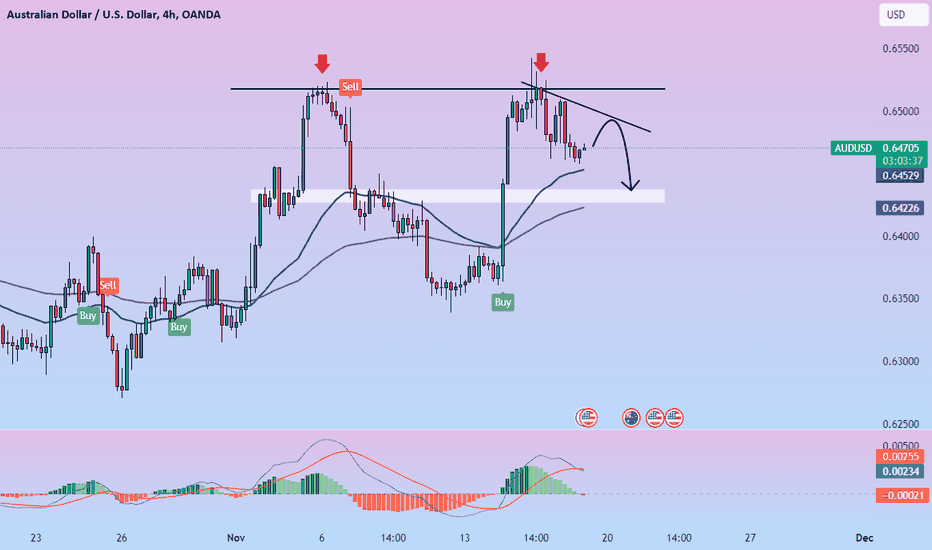

AUDUSD is ready to go shortWe are starting to see increased selling pressure at the level of 0.6565. The most recent high did not provide enough liquidity for the price to push higher again. Therefore, a sell-off is possible to target the level of 0.6435.

Subscribe to review updates and relevant analyses. Like and share! Thank you.

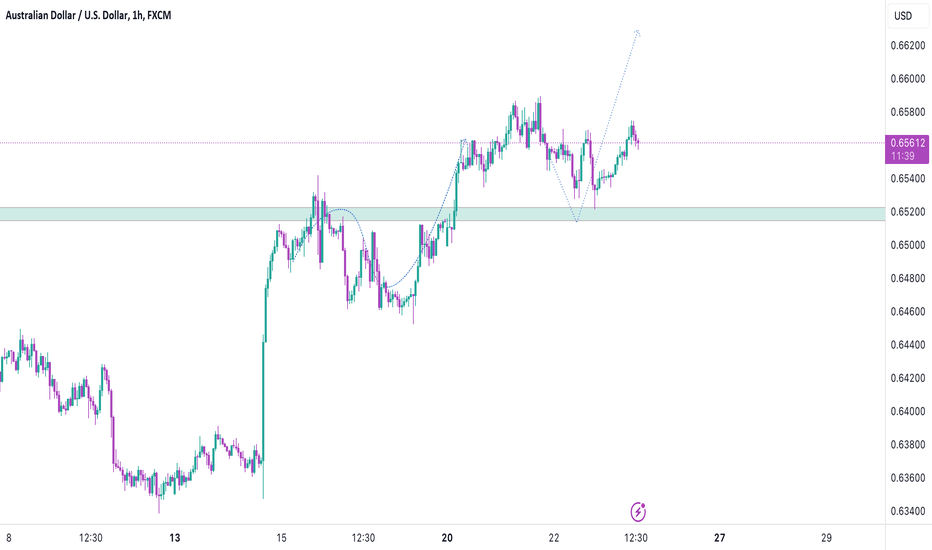

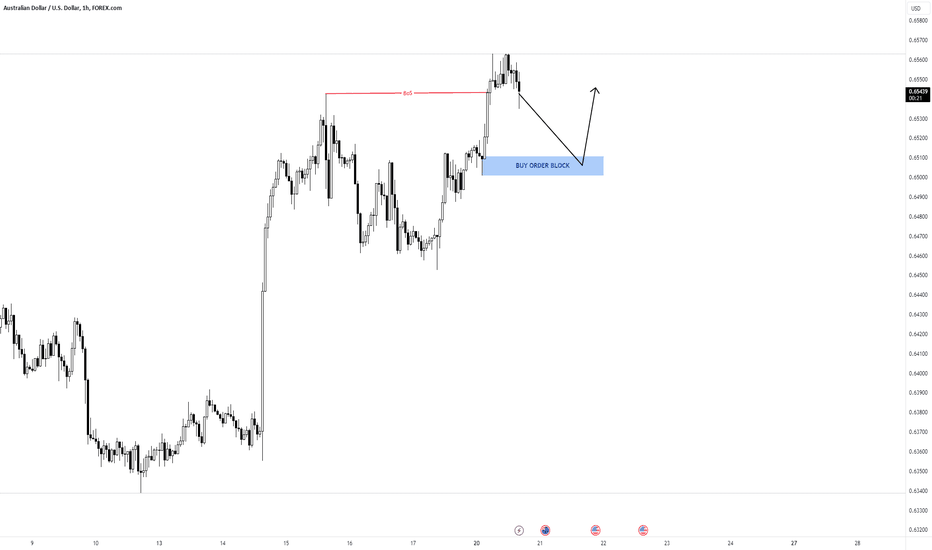

AUDUSD - Expect retracement ✅Hello traders!

‼️ This is my perspective on AUDUSD.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I am looking for long. I want price to continue the retracement to fill the imbalance lower and then to reject from bullish order block.

Like, comment and subscribe to be in touch with my content!

AUDUSDOn Friday, the US currency faced a negative start, with precious metals and other key currencies gaining strength. This trend is also reflected in this particular currency pair. In the very near future, as it approaches the level of 0.65010, there is an expectation of increased market activity and potential liquidity. Following this, there is a likelihood of a local update in the highs, indicating a shift in the currency pair's value.

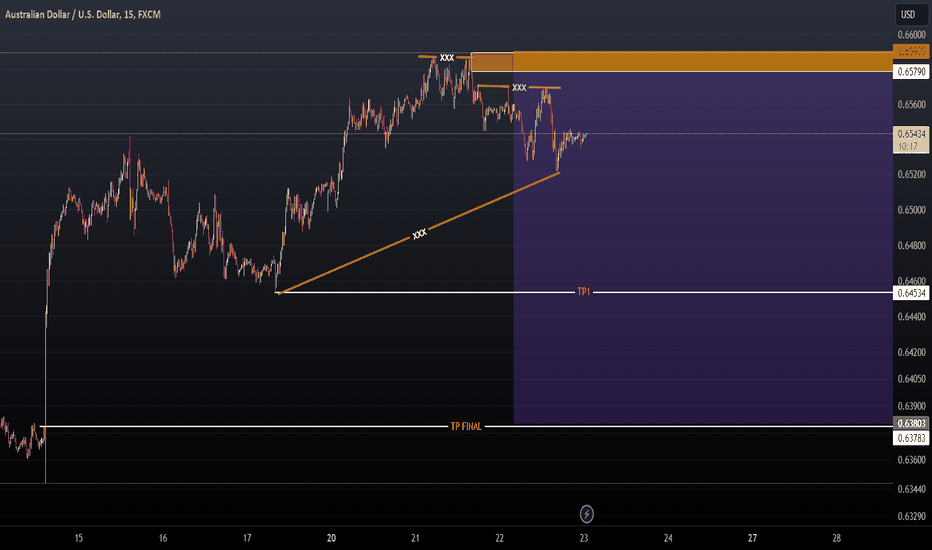

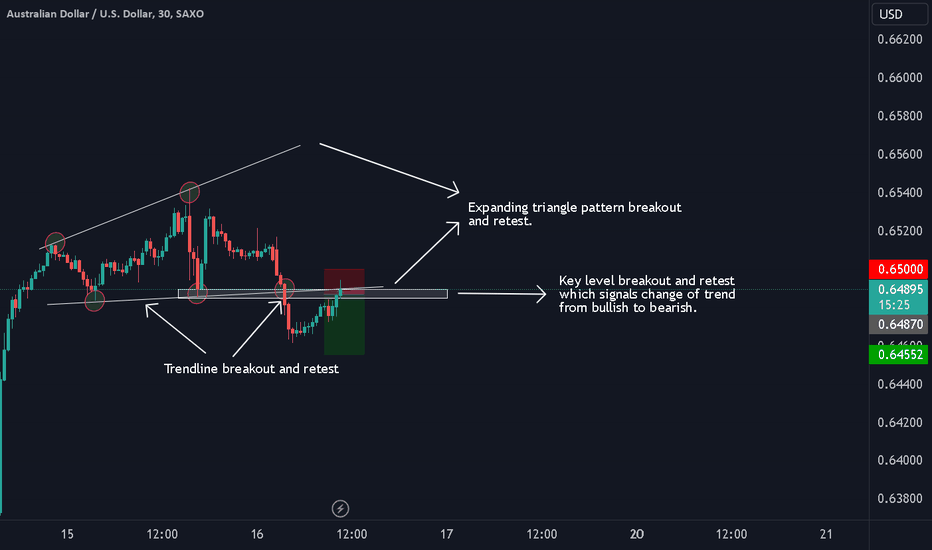

AUDUSD Expanding Triangle Pattern BreakoutWe expect further downside on this pair, signalled by the formation of an expanding triangle pattern breakout. We can also see the breakout, close and retest of the price below the key level on lower time frames, further supporting our directional basis. The trend has changed from bullish to bearish.

💡 AUDUSD : Signs of a downtrend➡️Yesterday, the D1 bar in AUDUSD witnessed a decrease, closing above the low of the same bar, initially indicating a false break and subsequently confirming this deceptive move. This implies a weakening stance for AUDUSD D1 near the upper boundary of the cumulative price range. The overall structure of AUDUSD D1 remains in a sideways movement.

➡️Although AUDUSD experienced a bounce, it retraced, forming a lower price peak. The H1 structure of AUDUSD shows a downward bias. If there is a rebound in the retest mentioned above, it presents a selling opportunity. Alternatively, if the price breaks higher and retests the previous peak, it might be prudent to adopt a wait-and-see approach for a potential buying opportunity.

AUDUSD → Struggles to extend upside 0.6520The FX:AUDUSD pair faces pressure around 0.6520 in the late European session. The rally in the Aussie asset stalls as investors await the United States Retail Sales data for October, which will be published at 13:30 GMT.

As per the consensus, consumer spending contracted by 0.3% against 0.7% growth in September. Weak consumer spending data would put more pressure on the US Dollar. The US Dollar has been facing a sell-off due to easing consumer inflation in the US economy.

The US inflation report for October indicated that the headline inflation grew at the slowest growth in more than two years. The annual headline CPI rose by 3.2%, softened from estimates of 3.3% and the former reading of 3.7%.

AUD/USD aims to climb above the immediate resistance plotted from August 15 high around 0.6520. The Asset aims to stabilize above the 50-day Exponential Moving Average (EMA), which trades around 0.6420, indicating that the near-term trend is upbeat.

The Relative Strength Index (RSI) (14) attempts to shift into the bullish range of 60.00-80.00. If the RSI (14) manages to do so, Australian Dollar bulls will get strengthened further.

A decisive break above August 15 high around 0.6522 will drive the asset to August 9 high at 0.6571. Breach of the latter will drive the asset towards August 10 high at 0.6616.

On the flip side, fresh downside would appear if the Aussie asset drops below October 03 low around 0.6286. This would expose the asset to 21 October 2022 low at 0.6212, followed by 13 October 2022 low at 0.6170.

AUD/USD: The impact of Xi-Biden's San Fran face-offThe AUDUSD and NZDUSD led the rally against the US dollar yesterday and are doing the same again today.

The surprising low inflation number from the US is what caused the rally yesterday. But today we have a new event that could be driving sentiment in these pairs. This event is still underway, so it still to play out completely, and its consequences still to be digested and figured into the market: This event is the meeting of Chinese President Xi Jinping and US President Joe Biden in San Francisco.

The meetings represent a cooling of trade (and otherwise) tensions between the two countries.

What next?

A weak support has been established around 0.64828. I would like to see the pair probe for a close closer to 0.65400 before concluding that there is a definite bullish bias. We will be watching news reports about the mood of the meeting and any outcomes to gain an understanding of the fundamental drivers for the AUD.

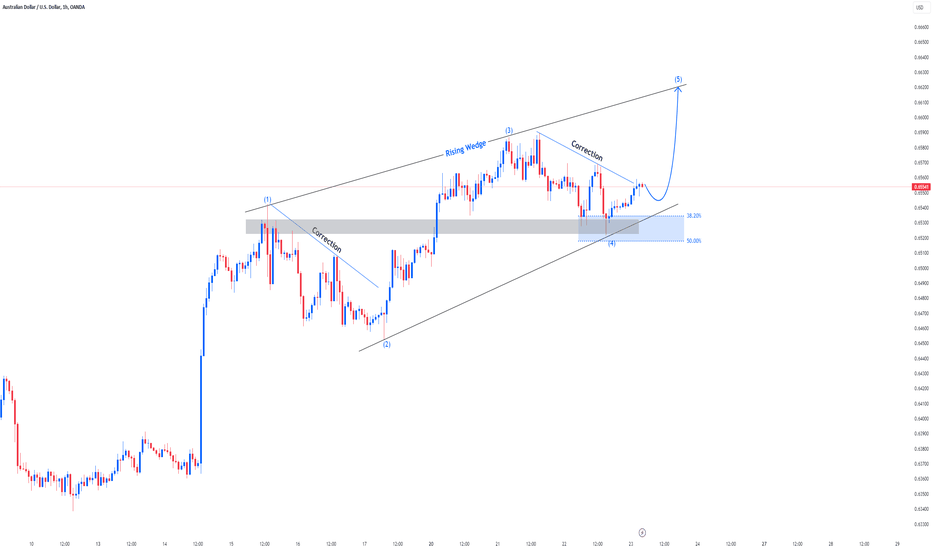

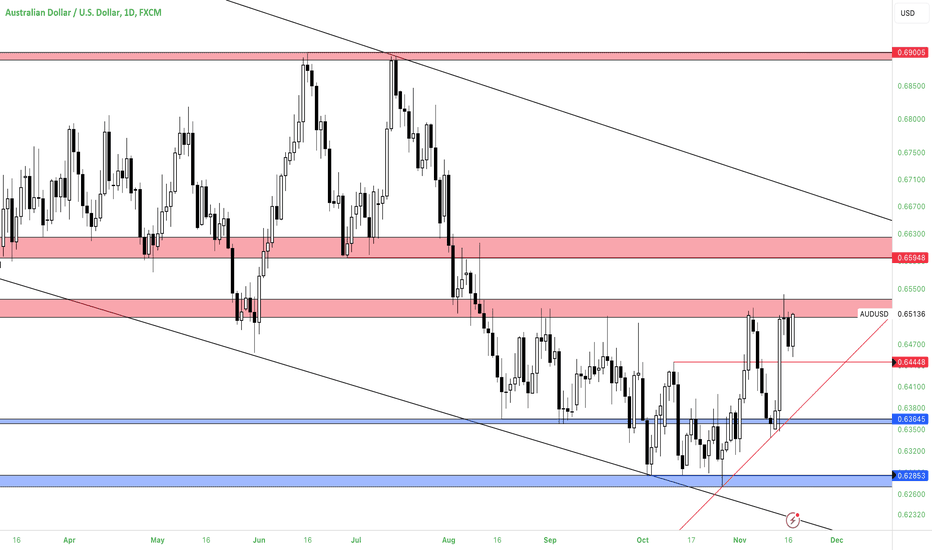

AUDUSD - Potential retracement ✅Hello traders!

‼️ This is my perspective on AUDUSD.

Technical analysis: As we can see here price changed the character and now we could see bullish market structure. After taking buy side liquidity I see price to make a retracement to fill the imbalances lower and then may be a rejection from bullish order block.

Fundamental news: Tomorrow will be released Unemployment Rate on AUD. If the result is negative, it will support our idea.

Like, comment and subscribe to be in touch with my content!