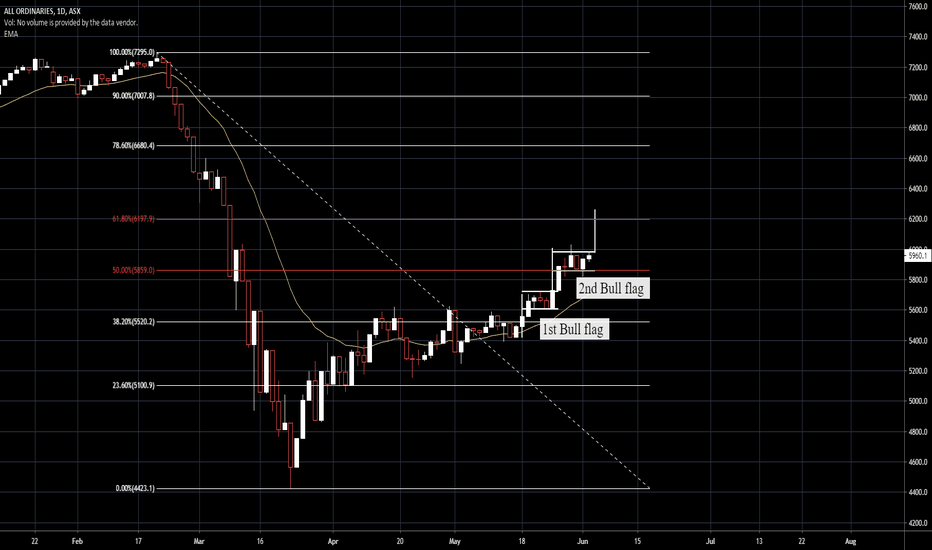

XAO - All Ordinaries - Bull Flag - Gold UpdateQuick update on XAO and the broader Aussie market.

It seems that insanity is the path of least resistance and the major index is set to target the 61.8% fib level, around the 6,200 level.

This measured move higher from the bull flag would als coincide with the 61.8% fib level.

The combined 'big 4 banks' are also signaling that a potential move higher is on the cards, with a measured breakout from a symmetrical triangle pitched at the 50% fib retracement.

I am also watching Aussie gold, looking for a pullback closer to the 2,500 price range.

Although in fairness, an entry even at these levels would still be quite a nice initial entry point on the yellow metal, with the vast global QE efforts to reinflate global equity markets set to lead to higher inflation (or even just perceived higher inflation).

Overall the Aussie equity markets look set to move higher, gold looks set to move slightly lower/ sideways and the real economy still looks battered and bruised. I am still on the lookout for the inevitable 2nd leg lower, but i am also keenly aware that throwing money at a short trade is not the best course of action in the face of global efforts to reflate the markets.

-TradingEdge