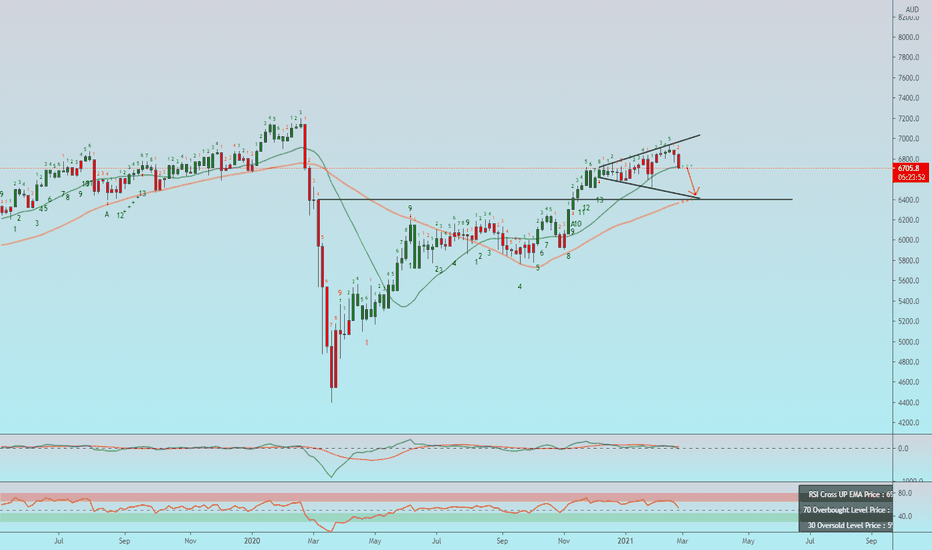

AUD - FUNDAMENTAL DRIVERS1. Developments surrounding the global risk outlook:

As a high-beta currency, AUD has benefited from the market's improving risk outlook over recent months as participants moved out of safe-havens and into riskier, higher-yielding assets. Also, as a pro-cyclical currency, the AUD enjoyed upside alongside other cyclical assets after moving into an early post-recession recovery phase with expectations of global synchronized recovery. Even though the risks remain surrounding the virus and thus global economic outlook, the success of the global vaccination roll out should prove supportive for the AUD.

2. The Monetary Policy outlook for the RBA:

The RBA continues to rule out NIRP, and with the Cash Rate at a record low of 0.10%, further reductions appear unlikely. Further easing remains a possibility through QE and the bank has stressed its commitment to purchase as many bonds as necessary to reach and maintain their 3-year yield curve control target of 0.10%. The possibility of macroprudential policies to try and curb a very hot housing market is a possible risk.

3. The country’s economic and health developments:

Australia’s successful handling of the pandemic is one of the reasons why the economy was able to see a stronger economic recovery than initially expected. On the economic front, China’s recovery remains robust, and as Australia’s biggest export destination (39.1% of total exports) their demand for Australian commodities has seen a surge in commodity prices, especially Iron (Australia’s biggest commodity export). As long as the virus remains under control, and China’s recovery and demand for commodities remains strong the outlook for the domestic economy remains positive.

Australia

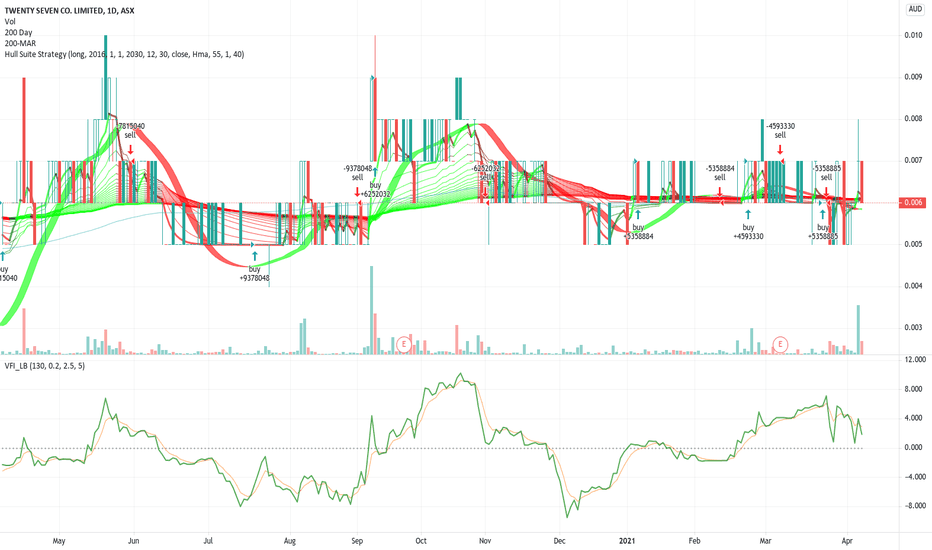

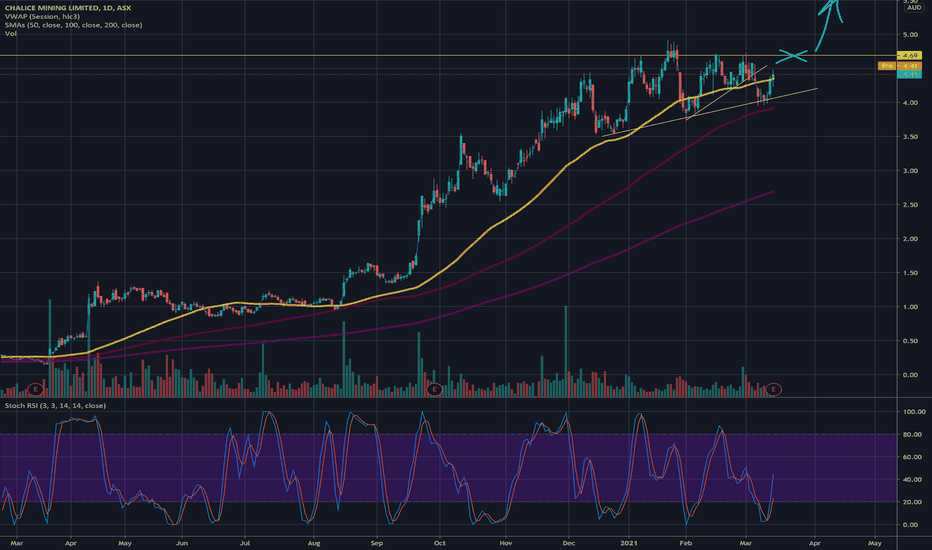

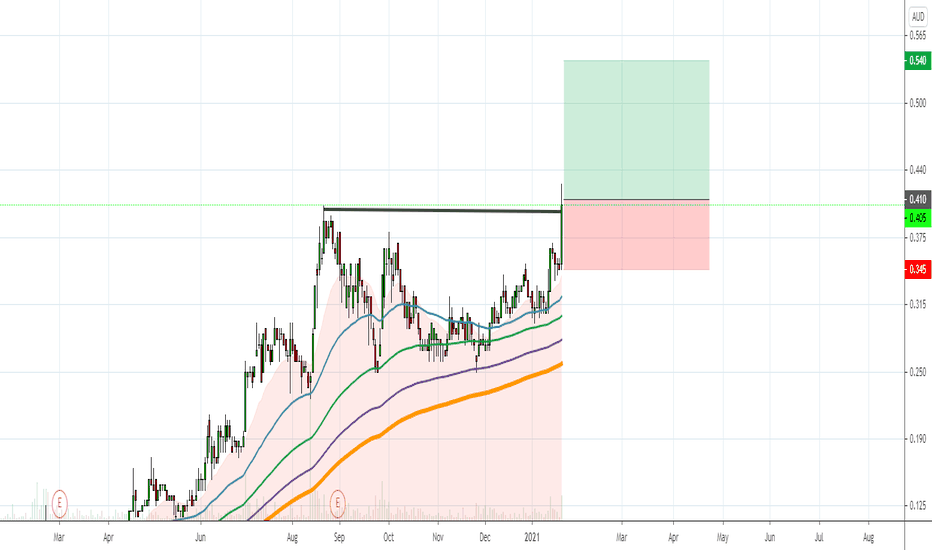

Twenty Seven Co. volume spike ($TSC)Twenty Seven Co. (TSC.AX) is a gold mining company based in Australia. A quick tour of their home page will tell you about their various projects, but at a high level and probably most imporantantly: They own a huge swath of greenstone in Western Australia as well as an actual gold mine which shut down in the 1980's when prices were suppressed. The company has recently come back with stellar results and now a JORC is about to land. This is a quick overview to point you toward a nice price spike incoming.

Financial advice disclaimer in the signature.

Good luck.

AUD BULLISHAustralia's monetary policy outlook, developments surrounding the overall risk outlook and the country's domestic situation regarding the coronavirus are the primary drivers of AUD.

As a high-beta currency, AUD has benefited from the market's improving risk outlook over recent months as participants moved out of safe-havens and into riskier, higher-yielding assets. Risks still remain, however, with regards to both the global economic outlook and

the coronavirus outlook. Nevertheless, with many countries now rolling out vaccines programs, the outlook remains overall positive, a factor which should prove supportive for AUD.

Regarding its monetary policy outlook, the RBA continues to rule out NIRP, and with the Cash Rate now at a record low of 0.10%, further reductions appear unlikely. However, further easing remains a possibility through quantitative easing and the central bank has

stressed its commitment to purchase as many bonds as necessary to reach and maintain their 3-year yield curve control target of 0.10%.

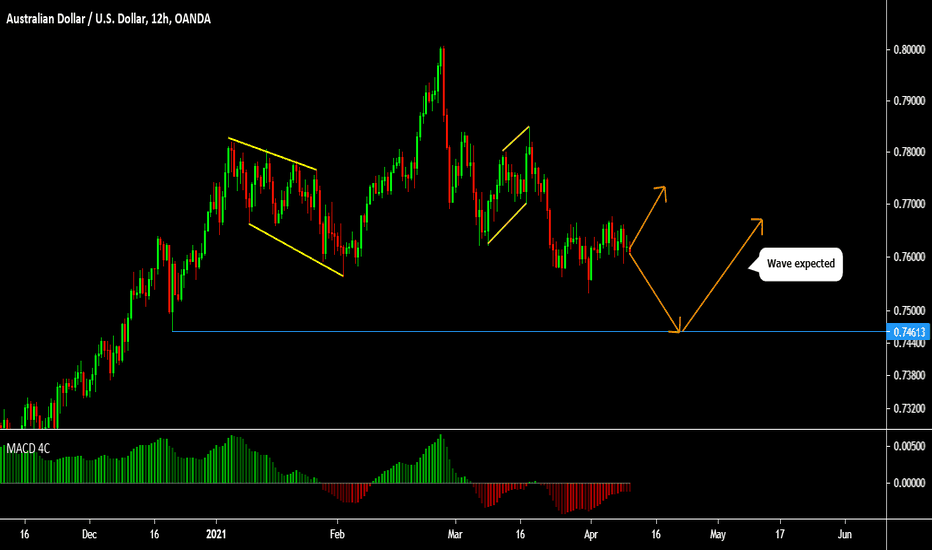

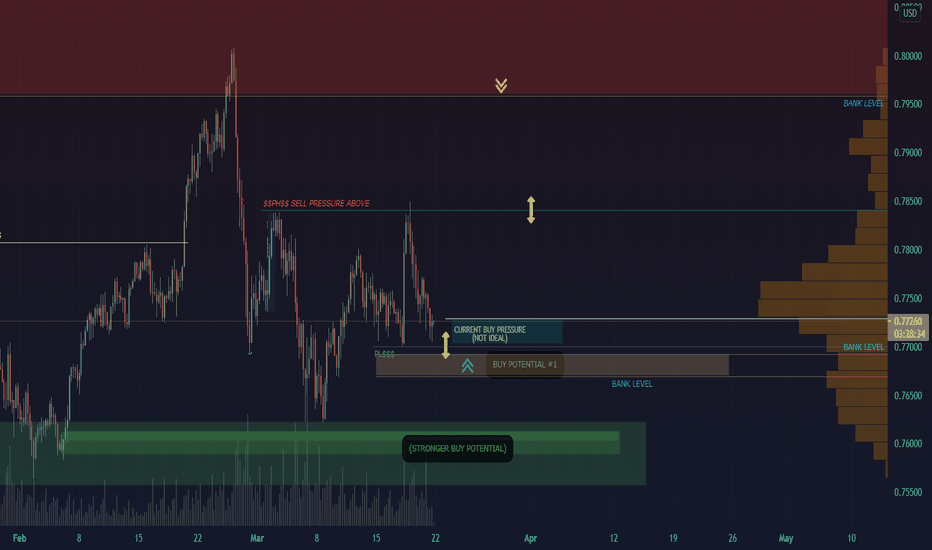

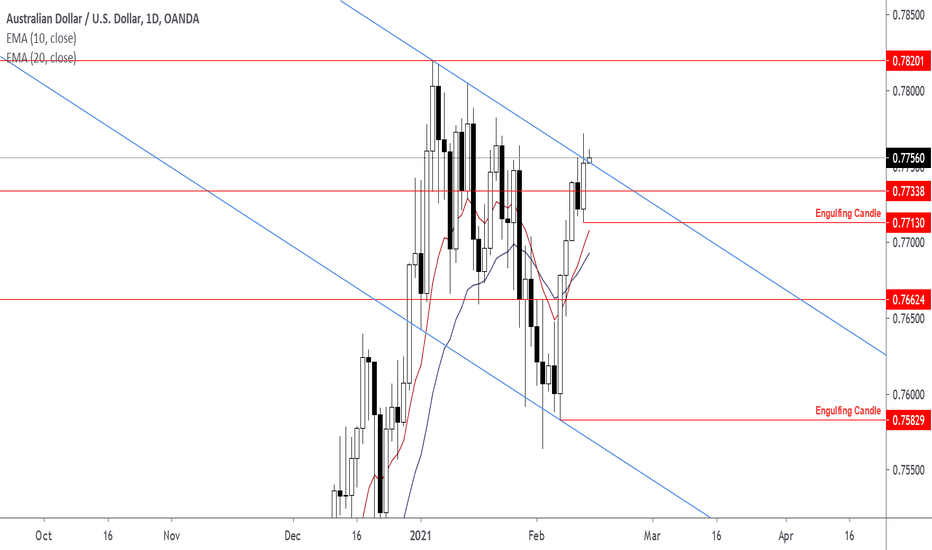

AUD/USD - BUYING POTENTIAL (MONEY REST ON BOTH SIDES)Technical Overview: - AUD/USD

Check out our previous posted analysis

Last week we anticipated a big move coming to the downside to potentially give us the opportunity to take shots on long positions.

We had also marked out the sell zones where we could expect sell pressure to come in bringing us down, more specific taking out the liquidity resting above marked level.

Currently price is on a bullish zone so the chances of seeing buying pressure now is not a surprise however we are not looking for buy opportunities in this zone because of liquidity resting below.

Analysis is only 1 piece of the puzzle 🧩

Our analysis is a sentiment for the upcoming week, month.

Use this as a weather forecast, you are the person that has to put on a jacket when it’s raining.

Trade this sentiment based off your own entry strategy at the right time.

Flow with the Devil 😈

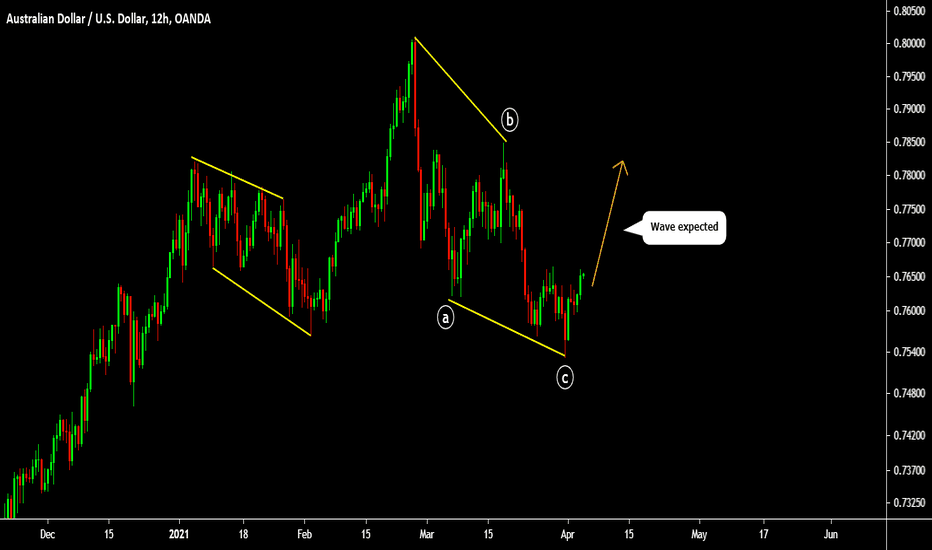

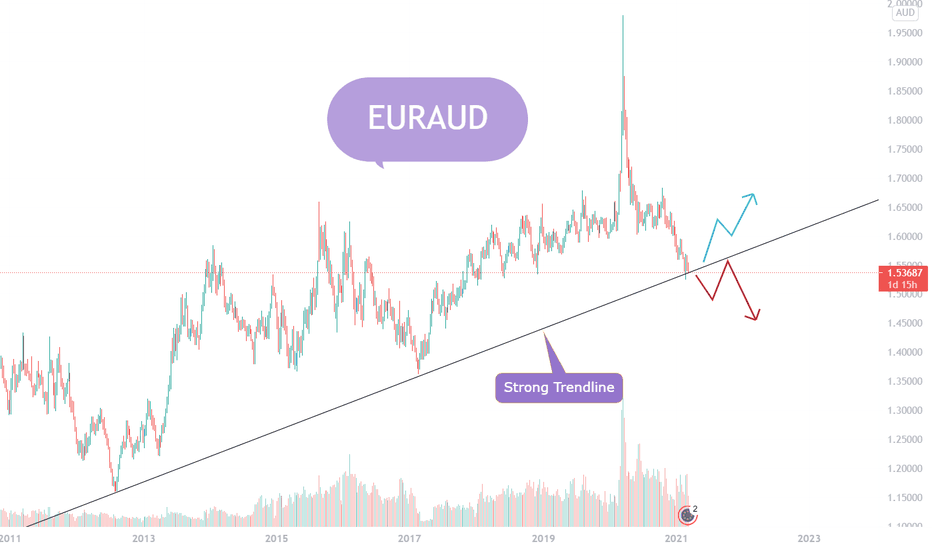

Trade with the manipulation👾

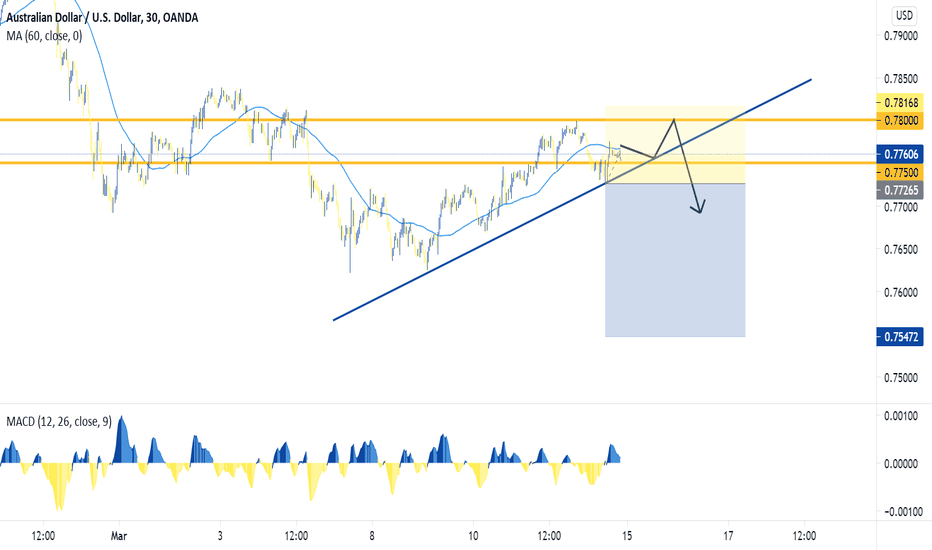

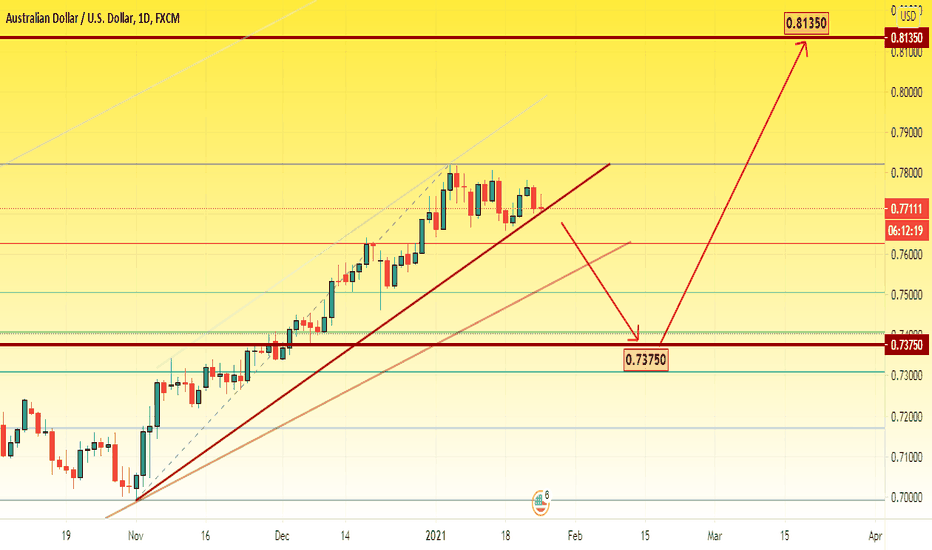

AUDUSD: Will Bears Succeed this time ?On this one, we saw that last week the price went into a bearish movement then it bounced back up. This time will the bears win the battle ? If they do, it means that our trendline shall be retested as the price is sitting around a resistance and we will sell it on it's break downward.

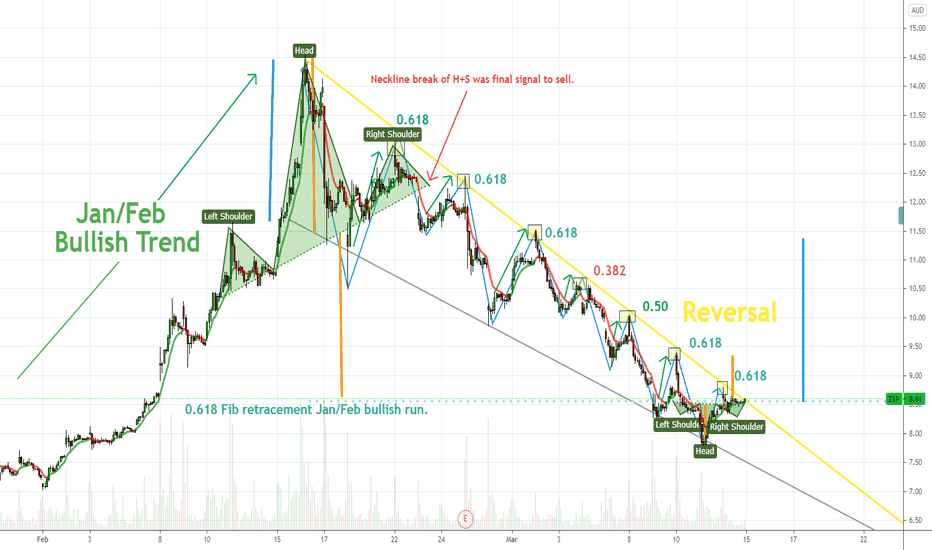

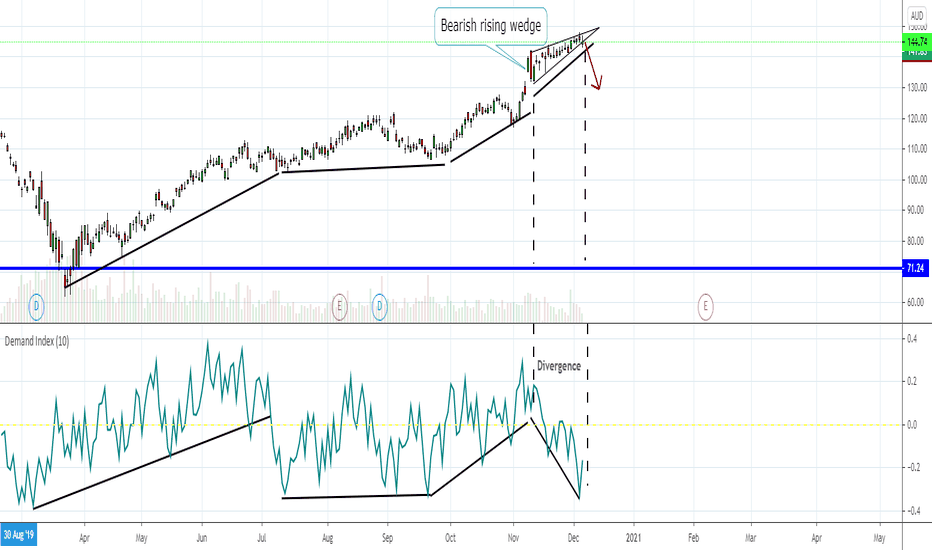

Z1P - A closer look at the Falling Wedge !What will happen in the week ahead for Z1P ? My guess is as good as yours, although I am leaning slightly to Z1P validating a counter trendline break as the money rotation slows.

The 0.618 retracement has been respected as resistance a number of times inside the falling wedge, as a result the $8.50 - $8.70 is worth watching closely. Additionally, Z1P at the longer time frame retracement (0.618) level is starting to get confluence in an oversold stoch, RSI, lower time frame MACD divergence as well which should act as strong support.

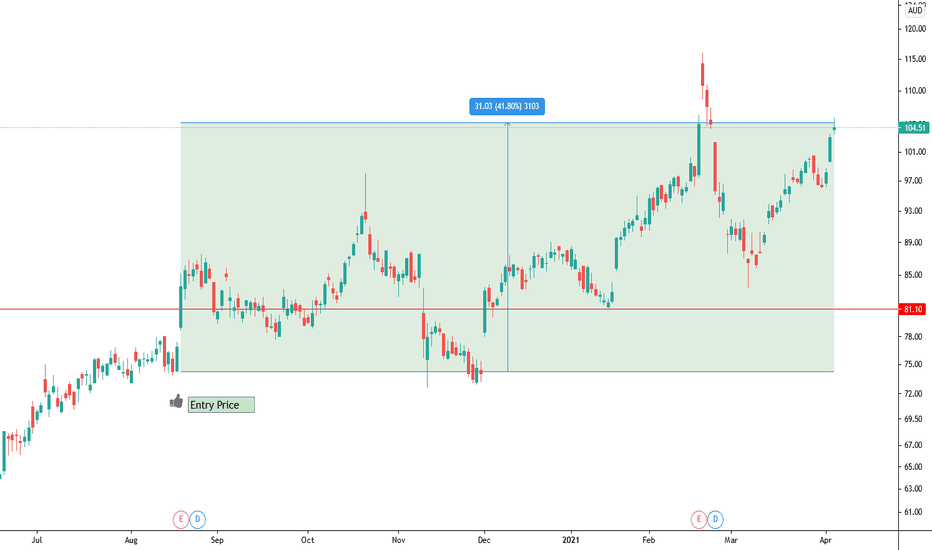

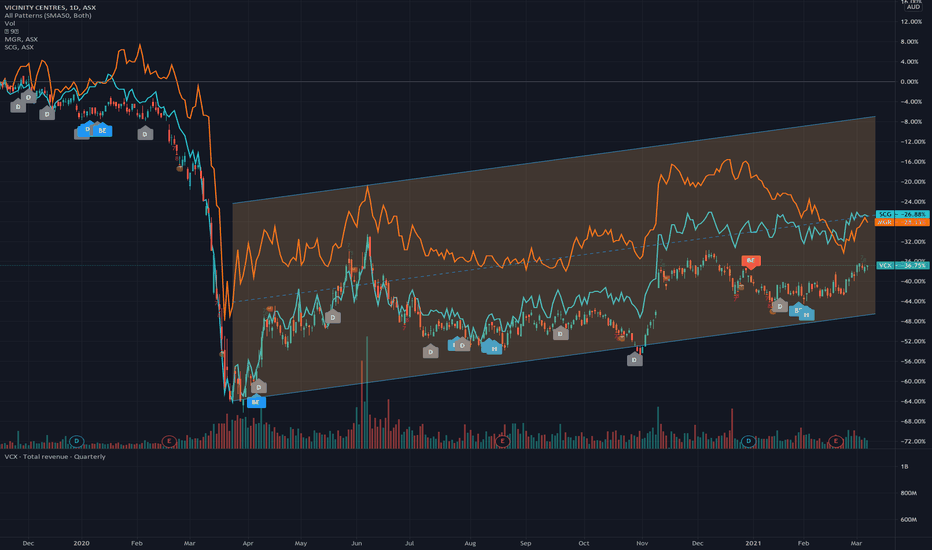

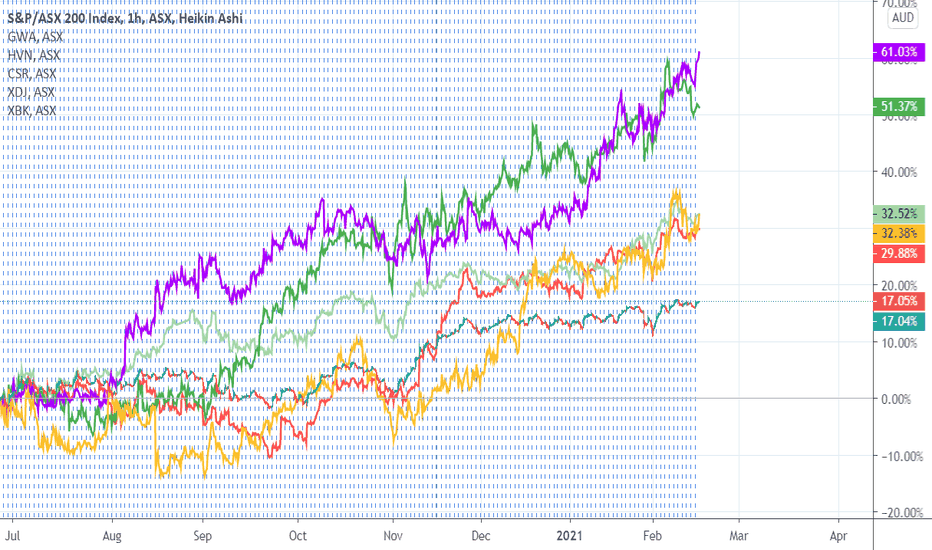

Your stomach in knots? Maybe these could cheer you upI am sure this is not the best time to make stock pick. But the market is actually not as bad as it may seems. If I look at my recent pick, actually only the china related stocks like BEKE/YSG are down because of the downtrend sentiment with nasdaq. If you look at my pick in ASX, all of the are still up since my recommendation, actually way up.

One of the thesis I like a lot is about post covid recovery. I made some pick on travel and resources and they still hold strong. And today I want to make a few more recommendation on properties REITs because of a few reason

- unemployment and spending will improve post covid, people would definitely look into the property market again

- Australia gov is loosening the immigration policy to attract high income immigrants from Hong Kong, China and South East Asia which would drive an upward demand on property.

- stock price of property REITS are still way below water compare to mar-2020 when the stock market melt down.

There are a lot of REITs available in the ASX market, and I am just sharing a few which contain a good mix of residential, retail and industrial. Of course i like their recent price action on the charts.

I personally would spread an equal amount of investment across these three and look for at least 30% gain in 3 months.

ASX:VCX

ASX:SCG

ASX:MGR

Good luck guys.

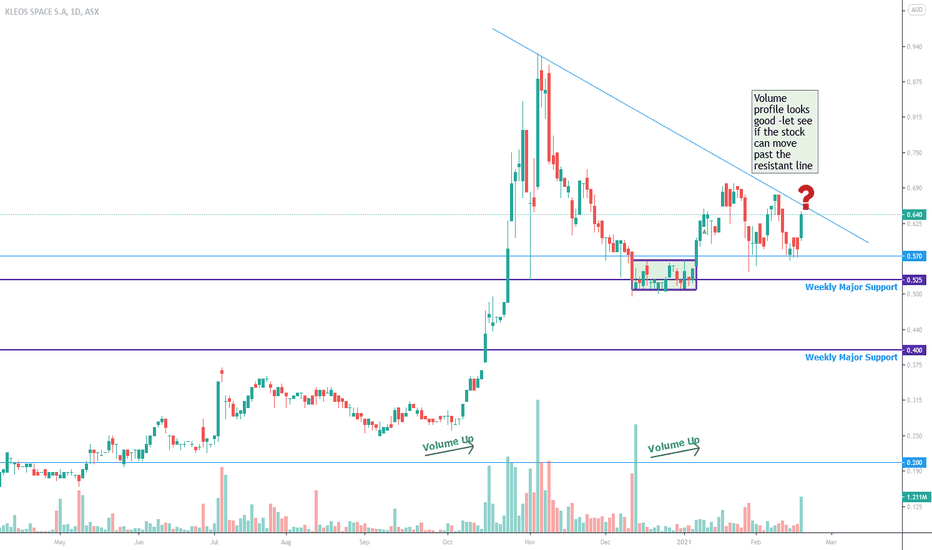

ASX:KSS KLEOS Space SA - #KSS chart updateKleos Space, a space-powered Radio Frequency Reconnaissance data-as-a-service company, on the successful deployment of its first four Scouting Mission satellites (KSM1). Based in Luxembourg, the company only started three years ag

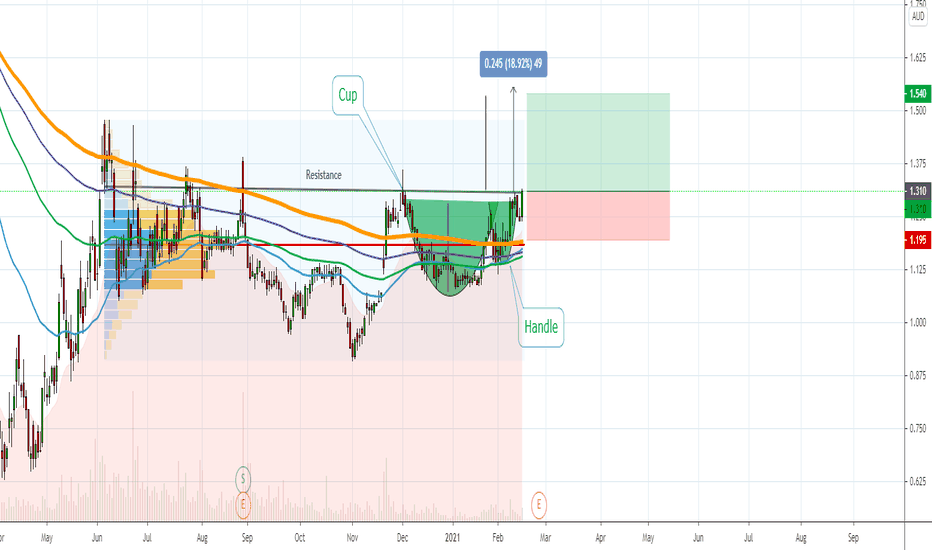

HUMM - Is it ready to breakout with the other BNPL players?Technicals - Chart suggests Humm looks ready to jump on the back of the momentum in the BNPL space (ZIP, APT etc).

Looking for a break through resistance with a bullish candle which lilkley results in the resistance becoming strong support. Looks a good risk reward trade.

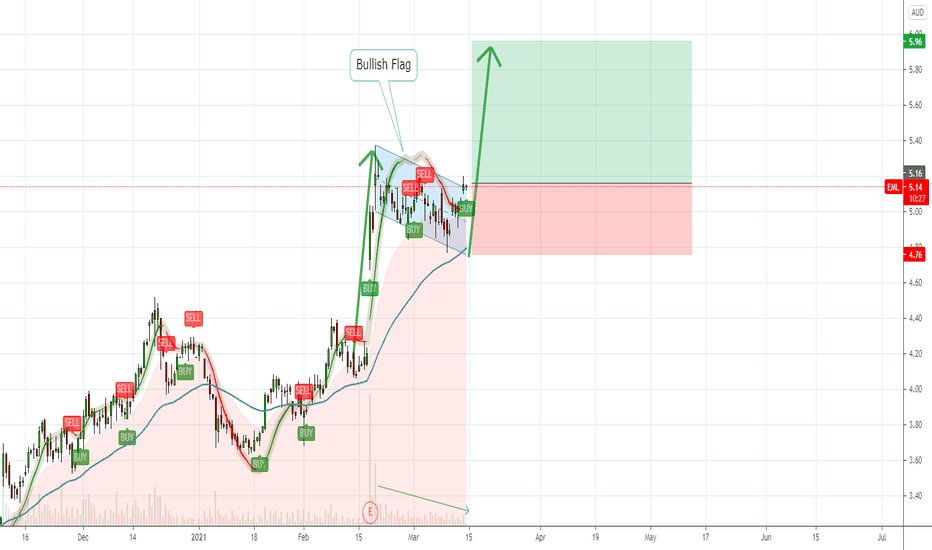

TLX - Bullish Technicals - High probability!Ive been looking for a high probabilty/good spot to trade TLX. Has been showing up in my scans for a while. This looks like the opportunity. Still only 1 billion market cap and has loads of potential.

Technicals - Bullish flag + acscending triangle pattern. Entry - Bullish candle breakout of flag/triangle pattern.

Fundamentals - Cutting edge of significant unmet medical needs in oncology & continues to aggressively pursue opportunities for the company’s suite of pharmaceutical products

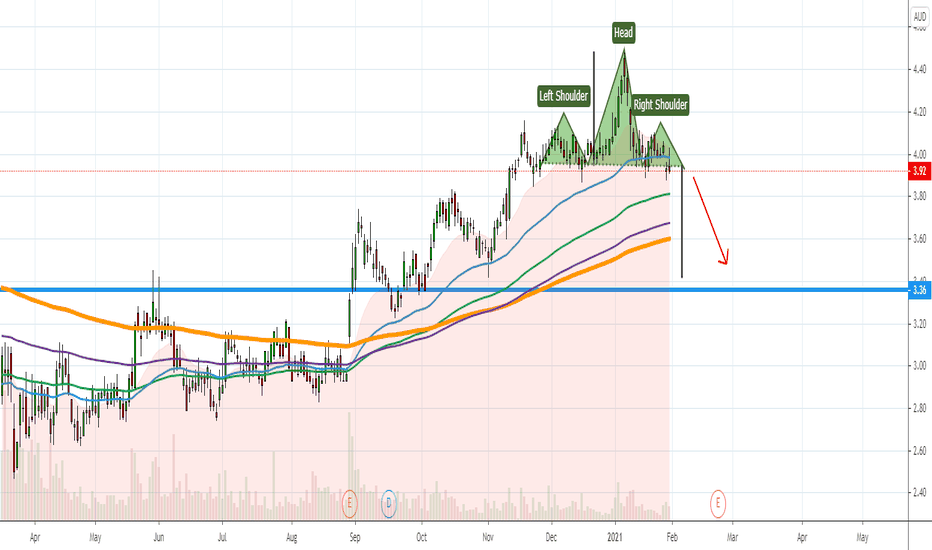

Head & Shoulder formation - CGC !!Very obvious H&S pattern formation in the CGC chart. If the neck line breaks CGC may head a fair bit lower.

Interestingly, CGC, also peaked & started heading down after this ASX announcement:

cdn-api.markitdigital.com

make of it what you will.

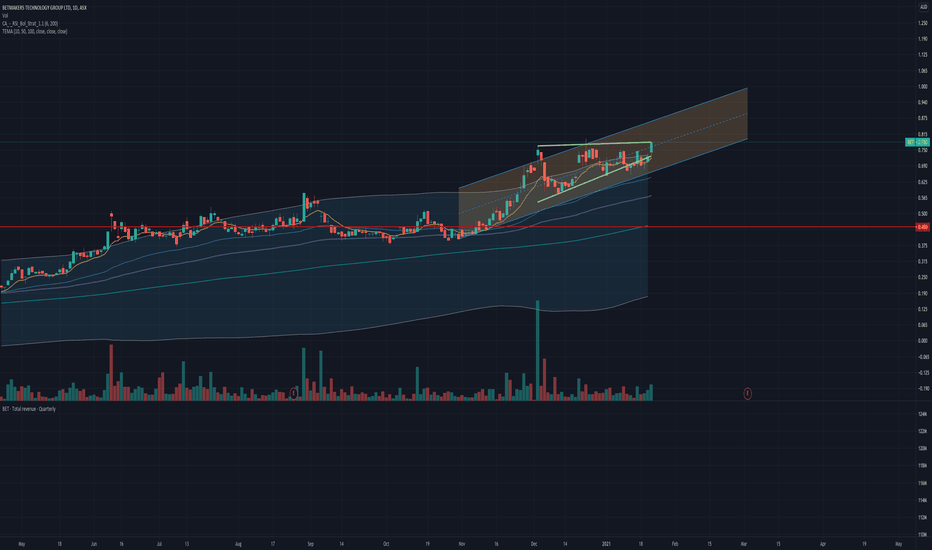

Longing on ASX:BET - uptick started todayThe ASX market appears to be heating up.

Following on my other thesis on ASX marketing such as ASX:APT , ASX:CCP and ASX:Z1P , the other pick which I expect to see a lot of actions is ASX:BET .

There are a few catalysts for BET during the few weeks:

1. It has just completed a round of SSP with over subscription hotcopper.com.au

2. Its price action has started an upward trend ever since the Dec 2nd with large transaction vol on that day, and showing consolidation ever since.

3. Contrast with the Gaming/Online Sport books in the US market, most of which has gone up 30-50% since Dec, the deregulation of online sport betting in the US market should benefit BET as well.

4. The upward candle of Jan 21st apparently is testing its all time high at 0.795.

I am expecting BET to hit the 0.995 range before its earning release on Mar 2nd.

Full disclosure, I put my $$ behind my thesis and just built a position @ 0.77 with a 10% stop loss @ 0.7.

HTG - High Growth potential - Bullish Chart!Nice looking chart. Moving on strong volume. HTG is Still a relatively small market cap which could easily grow earnings quickly, particularly if the CV environment persists. Expecting continuation of bullish trend.

Key technicals - Breakout of wedge and all time high which likely acts as strong support moving forward.

Key Fundamentals - Leading Remote IT technology company focusing on the bullish resources sector. Will grow strongly for the forseeable (CV)+ moving into US and Europe markets is planned.