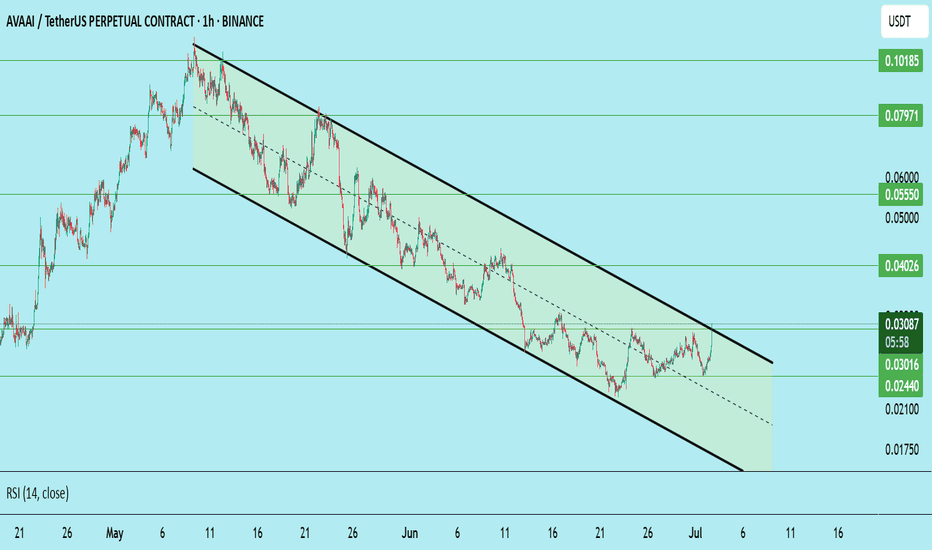

AVA/USDT – Long-Term Bullish Reversal in PlayAVA has been trading within a well-defined downward channel for weeks, making consistent lower highs and lower lows. However, price has now broken above the upper boundary of the channel with strong volume and momentum, signaling a potential trend reversal.

Technical Analysis:

Channel Breakout:

Price has successfully closed above the descending trendline (channel top), confirming breakout and bullish intent.

RSI Surge:

RSI has shot past 80, a sign of strong bullish momentum. Short-term pullbacks may occur, but long-term sentiment is shifting.

Higher Lows Forming:

Structure is starting to shift from bearish to bullish, especially with current candle body closings above $0.03016.

Volume Spike:

Notable increase in buying volume, often seen before trend flips in micro caps or small altcoins.

Key Levels to Watch:

Support Zones:

$0.03016 – Key breakout level; should act as support now

$0.02440 – Historical accumulation zone

$0.02100 – Long-term base support

Resistance / Target Zones:

T1: $0.04026 – Local structure and previous consolidation

T2: $0.05550 – Psychological and technical resistance

T3: $0.07971 – Major reversal zone

T4: $0.10185 – Long-term target from macro high

Stoploss:

$0.02400 (close below re-enters channel and invalidates breakout)

Entry Idea:

Accumulation Zone: $0.029–$0.031

This is the ideal area for positioning with minimal risk and a good reward ratio.

Not Financial Advice | DYOR Always