Avaxusdtlong

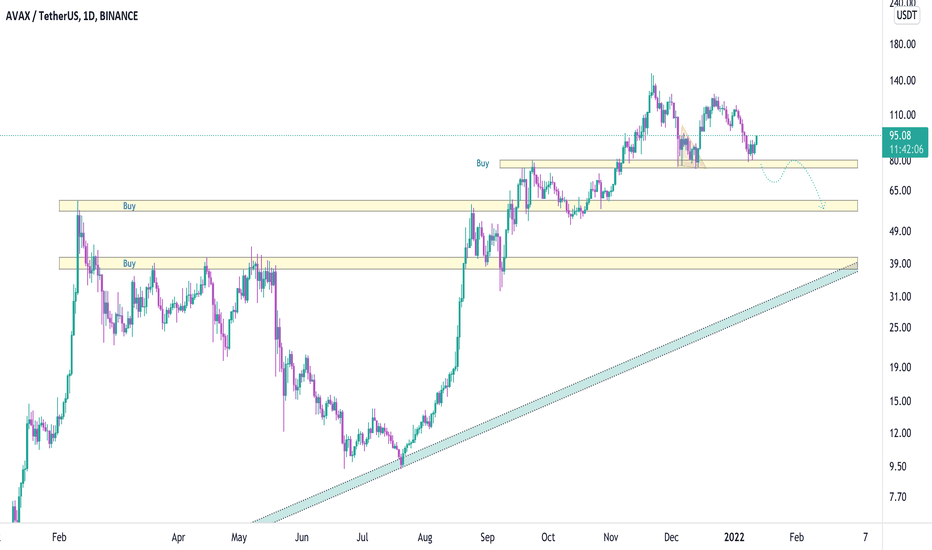

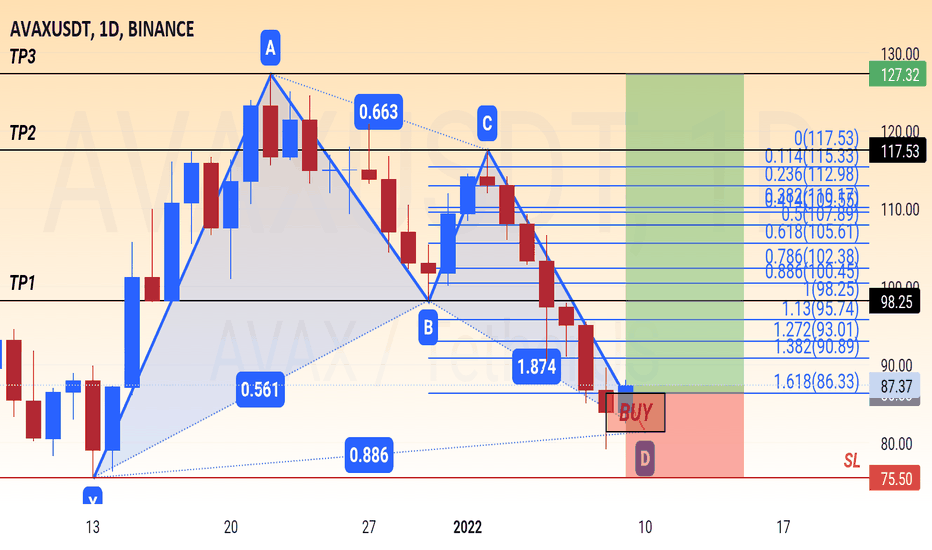

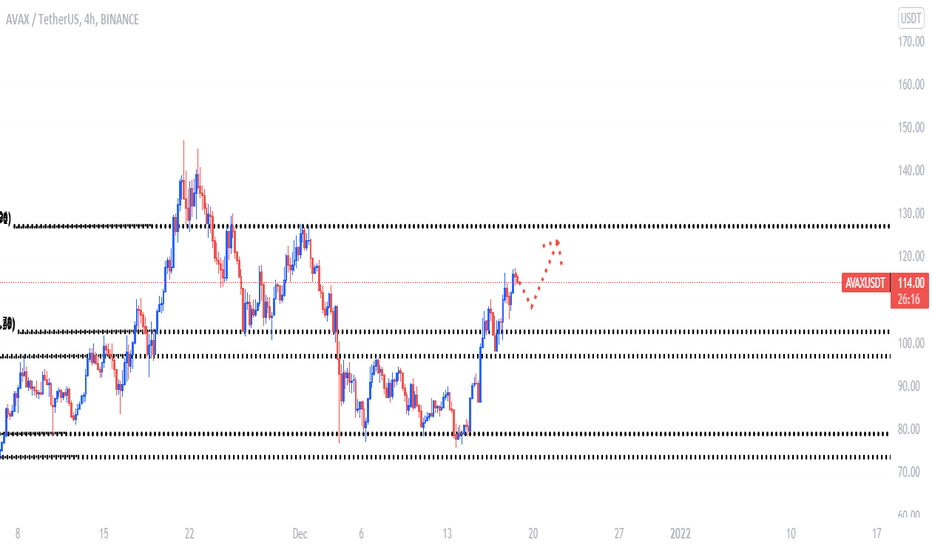

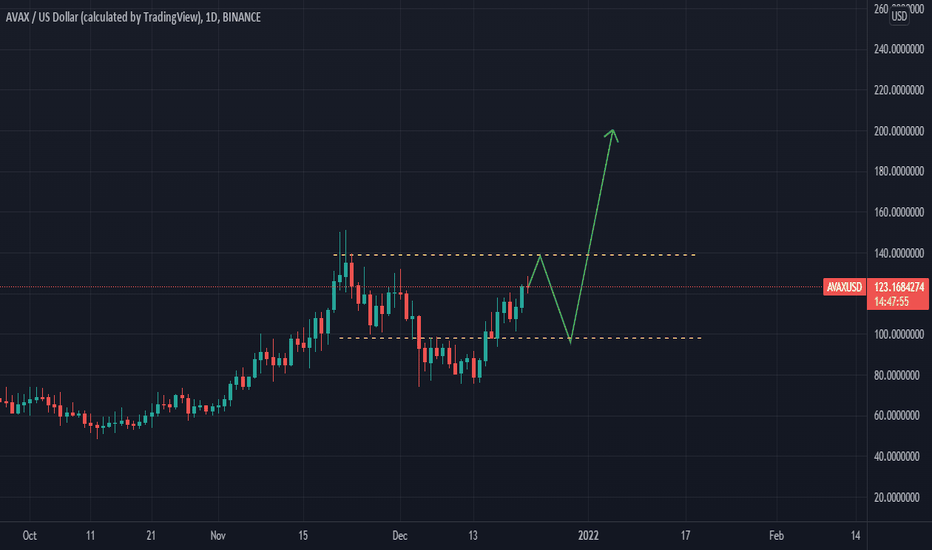

AVAXUSDT, We are in wave C or 2 ??Hello everybody

According to the chart and previous analysis, we shown on chart 3 zone that is the support zone of the price and the point of swing can be happen in there zone.

In here exactly first support zone was activated exactly.

We need to have correction of our breakwave that make ATH in here we have a wave that we can say it can be A or ABC both of the is correct and the acceptance of that to know which one we should name it is if the price can break this first support zone below the name of the wave is A and we are going to complete wave C and if the price rise up from here and can break the resistance zone at the top (ATH) we name it ABC.

Because of the movement that is hard to say which scenario can be happen we shown on chart that you can but 1 step in first support and if the second scenario happend you can buy in other support zone area to reduce average purchase.

This is analysis and you can entrance in position and spot trading with your own analysis and capital management this is just view of the analysis for helping anyone.

Good Luck

Abtin

Previous analysis :

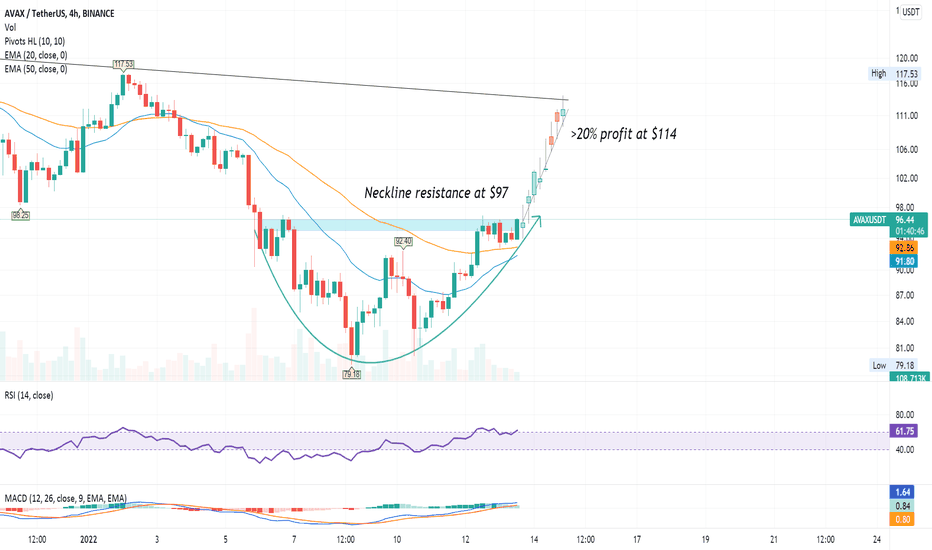

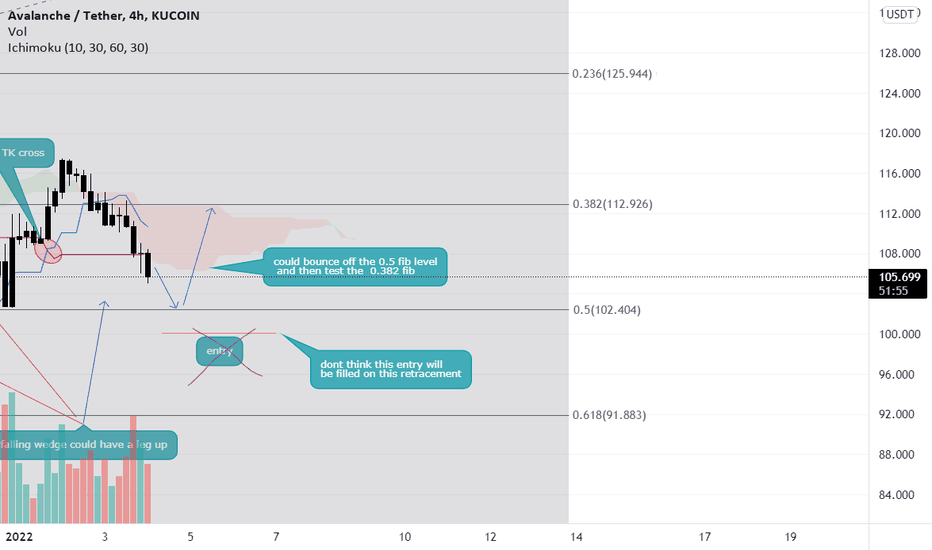

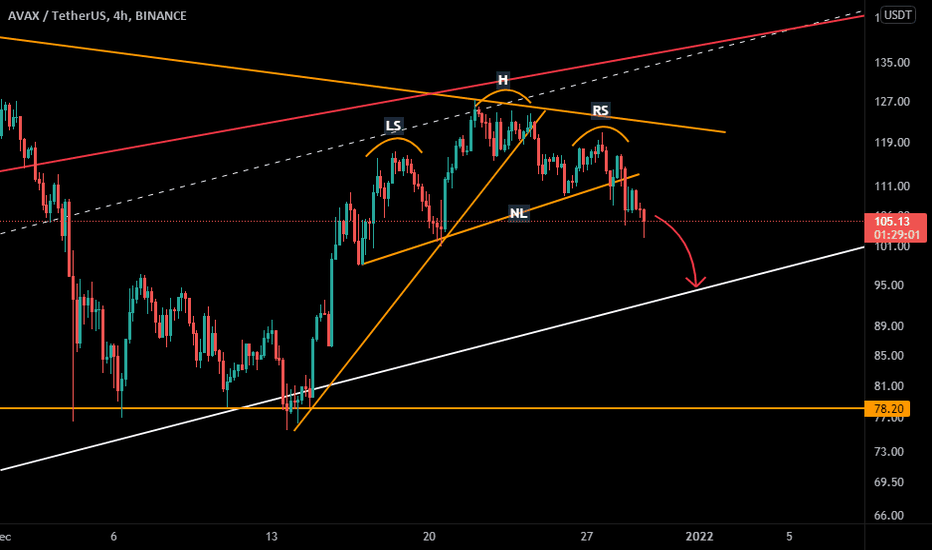

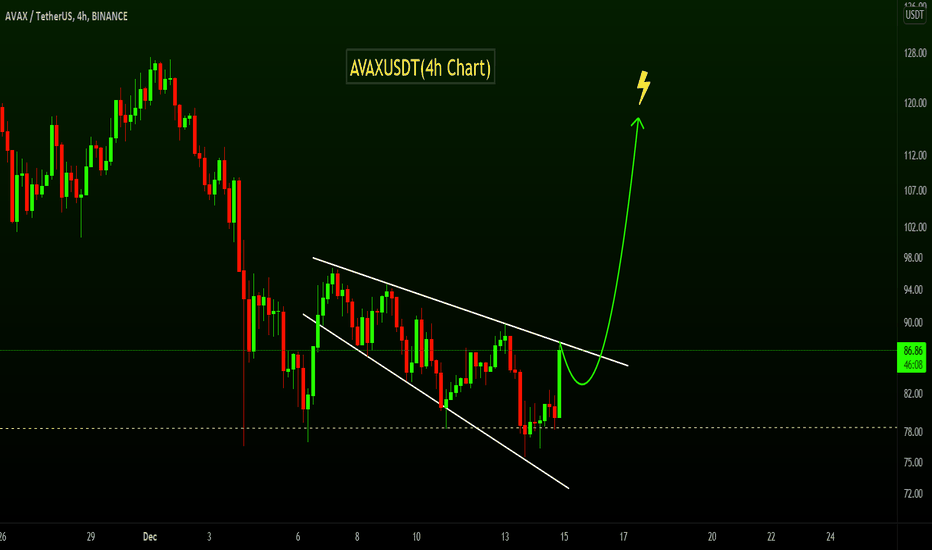

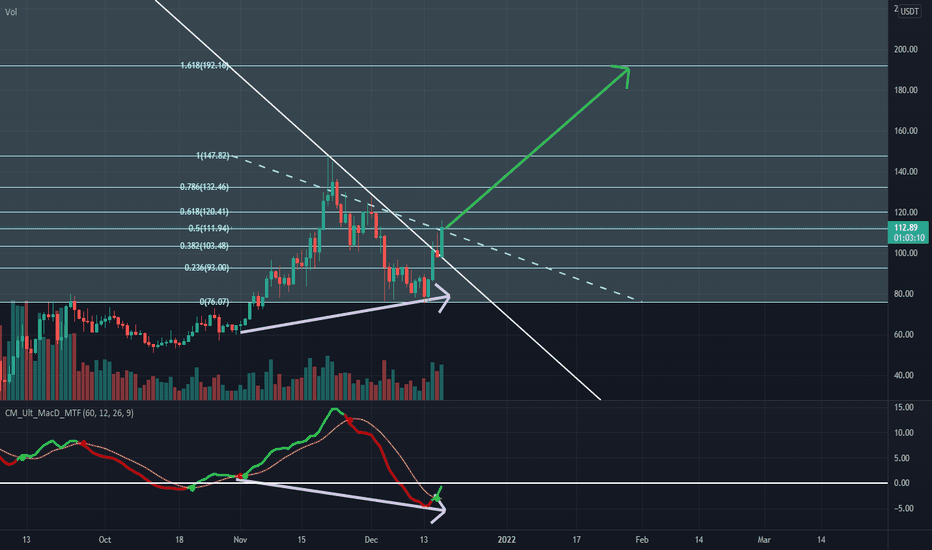

AVAX appears with a bullish pattern* AVAX in 4H time frame forms a Falling wedge pattern.

* Falling wedge is a bullish pattern which appears when the price moves between two descending trendlines forming lower-lows and lower-highs.

* Price above the upper descending trendline can give a bullish move towards $115 levels.

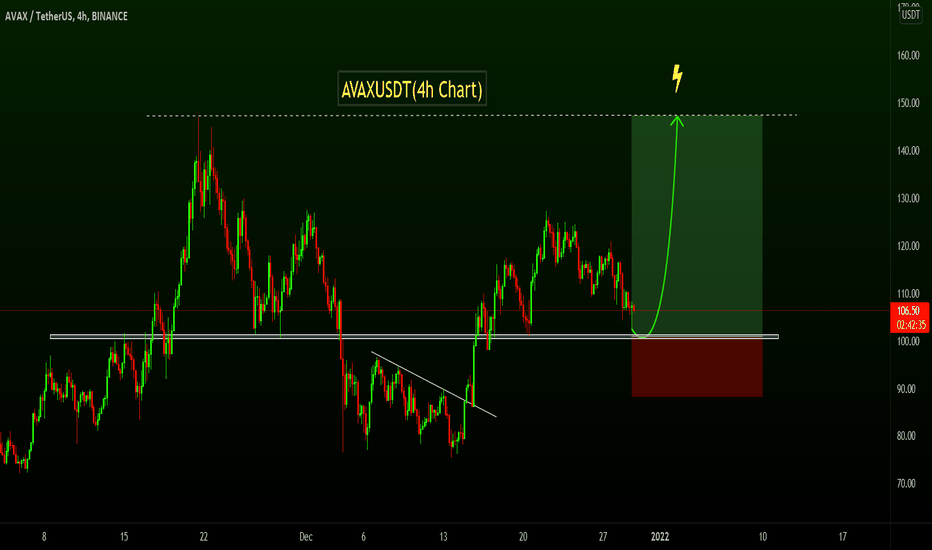

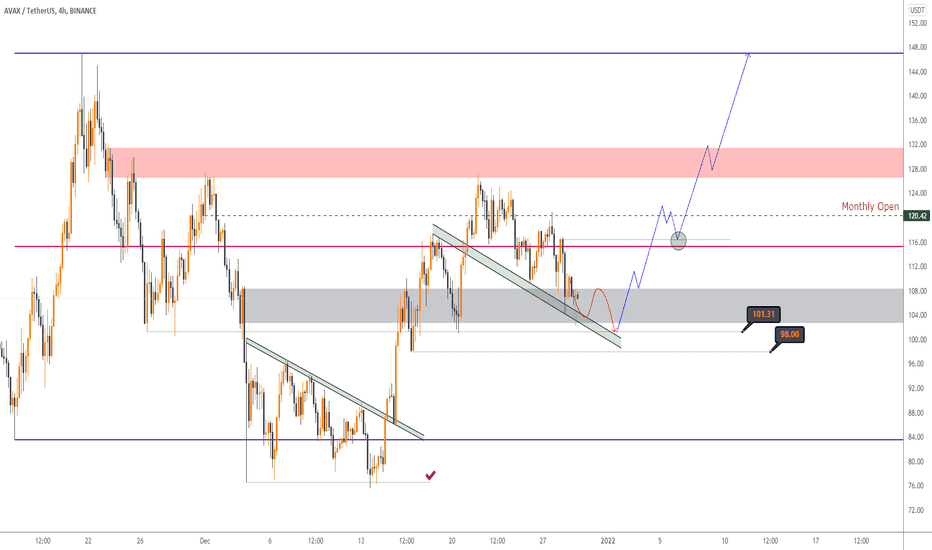

AVAXUSDT - Reversal from support zone!!AVAXUSDT (4h Chart) Technical analysis

AVAXUSDT (4h Chart) Currently trading at $105.8

Buy level :Above $103

Stop loss: Below $88

TP1: $116

TP2: $127

TP3: $134

TP4: $147

Max Leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts.

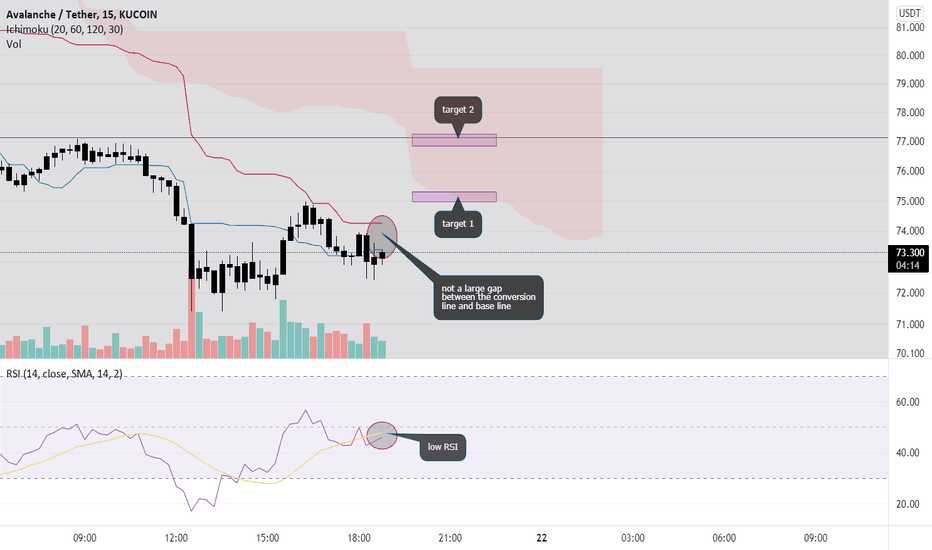

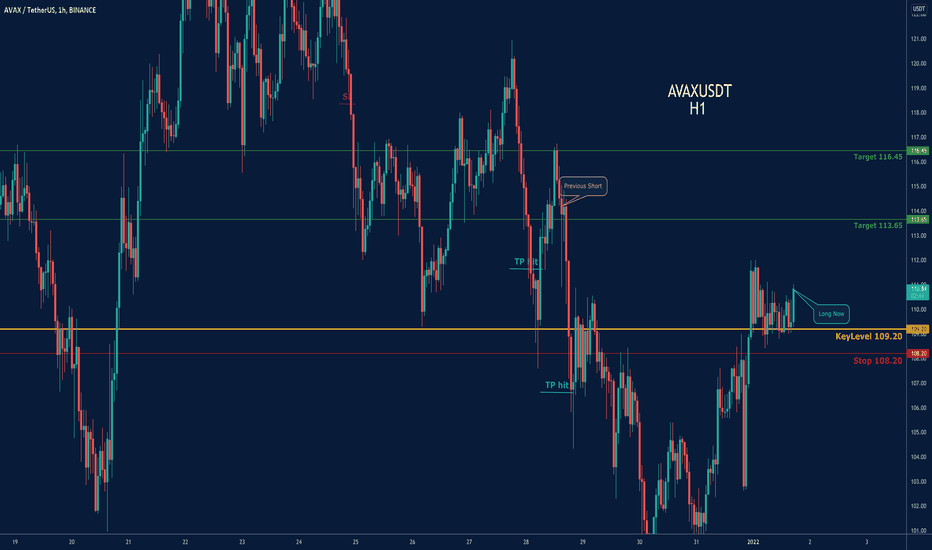

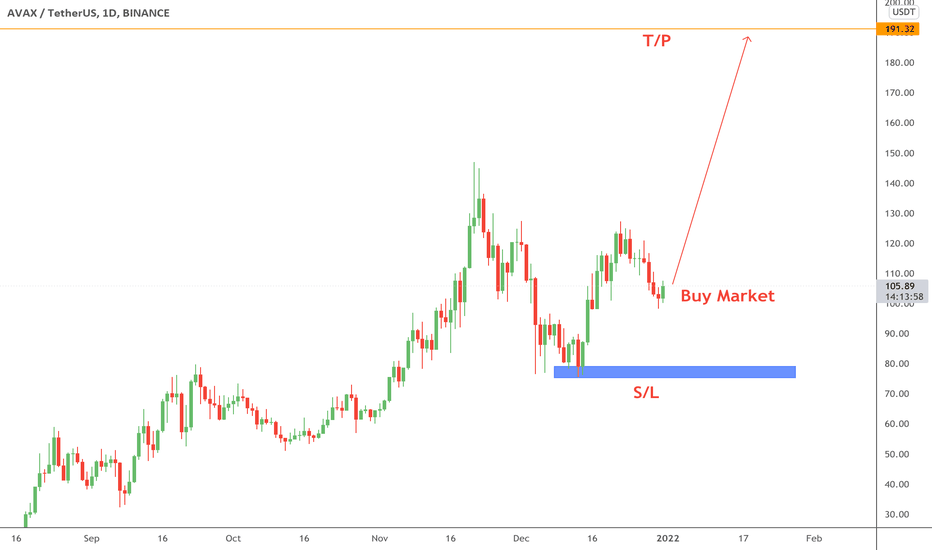

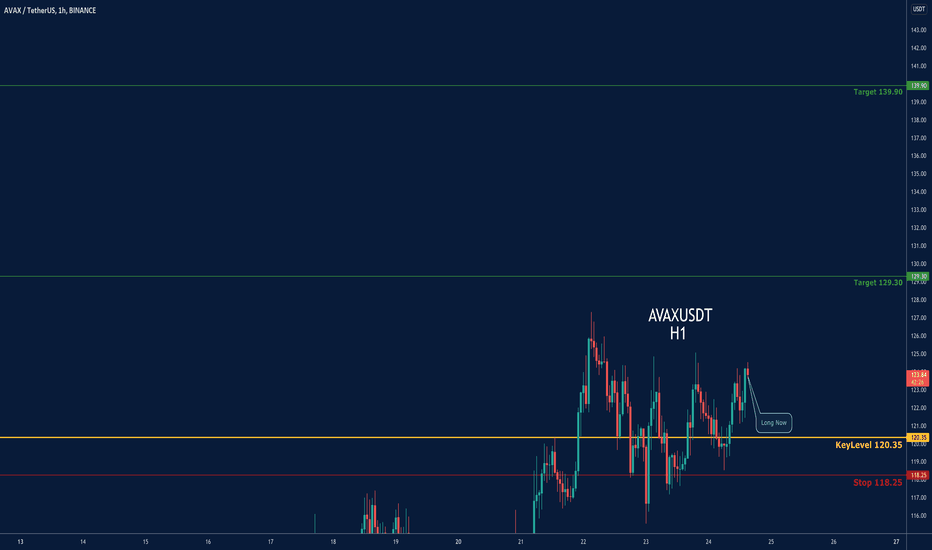

AVAXUSDT-LONG

Based on technical factors there is a long position in

AVAXUSDT Avalanche

Score 3️⃣

🔵Long Now or set on Key Level 109.20

🟢Target 1 113.65

🟢Target 2 116.45

❌Stop loss 108.20

#K_Level

Every signal has a score from 1 to 5, so accordingly adjust your risk for each signal. The signals with the score of 5 are the most probable ones.

Please support our activity with your likes and comments.

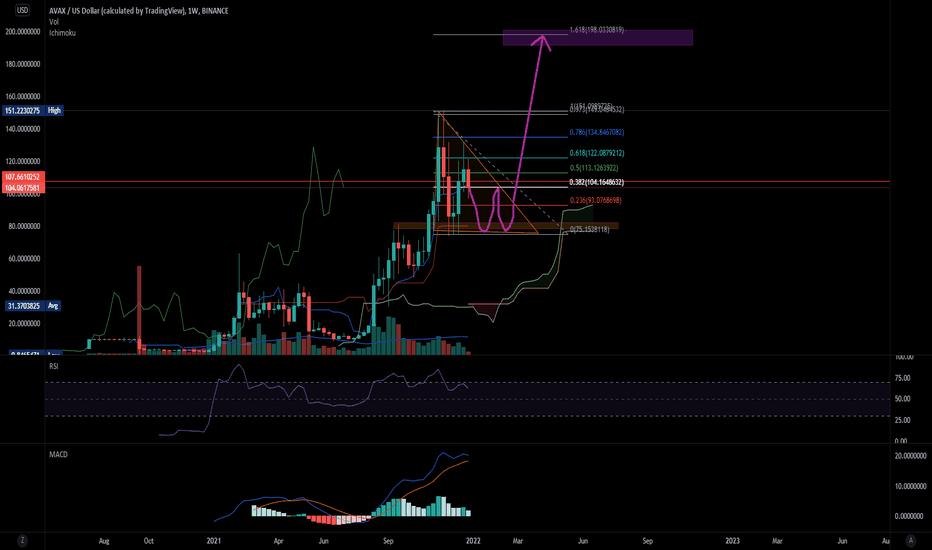

avax/usdAVAX - avalanche will explode soon, maybe march or april (IDK exact time)

SO that i'm holding it

In my opinion, we will see avax deep again (~80 bucks)

Cause this rocket is in triangle and it will explode in few months

shortly i will say, avax target is ~190-200$

from now it will be 2x (~100%)

but if avax will drop on deep (~80$) then profit will raise to 2.5X

WISH U LUCK!

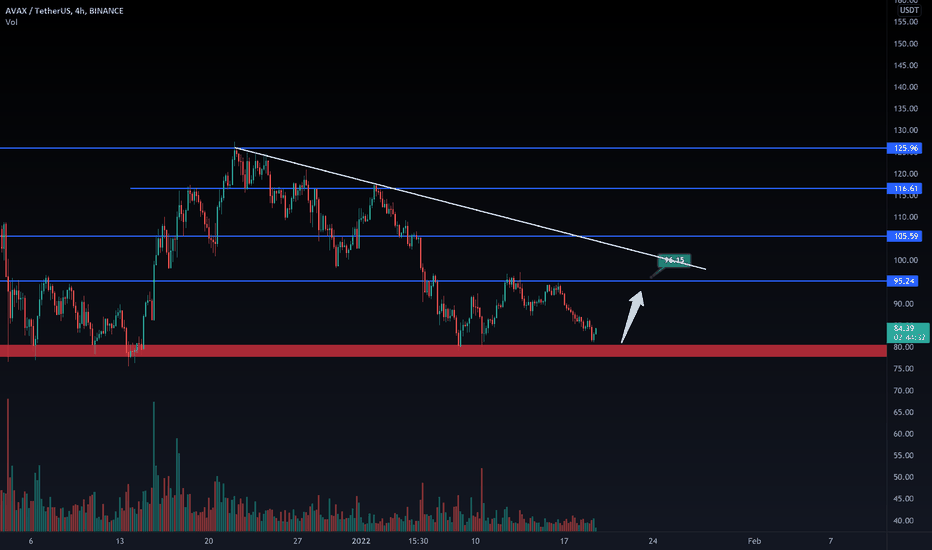

AVAX/USDT : Take the opportunity to survive or dive below $80 ! BINANCE:AVAXUSDT

Hello everyone 😃

Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it !

Currently, we have a consolidation that is channeling into support.

Price usually bounces from these levels.

🔴 If this level is lost, it opens up the possibility of retracing back to 85-80.

Otherwise, we should bounce here and break above the green dotted line and breaking the local market's structure of the consolidation.

Strong candle above, re-test the level then target the weekly range high, would be the plan.

I would take the aggressive LONG from the bottom of channel and ride it as I mentioned above; But have to mention the importance of any rejection below this level, Which could lead the pair below our Weekly range !

📚 So you might ask your selves, Why would take the aggressive plan here in the middle of market's craps ? So let's a quick note below 👇🏼

- The pros of taking an aggressive trade : can allow you to position early, less chance of missing entry, etc, but the setup has a lower probability of success

- The pros of taking a conservative trade : higher probability that the trade is successful (more conditions trigger) but can be more difficult to position.

So now you can find-out that I'm eying the possibility of catch the falling knife with a tight stop-loss as a candle close trigger !

So you need to manage your risks directly and I would suggest to point the support loss as a hold confirmation below $98...

Hope you enjoyed the content I created, You can support us with your likes and comments !

Attention: this isn't financial advice we are just trying to help people on their own vision.

Have a good day!

@Helical_Trades

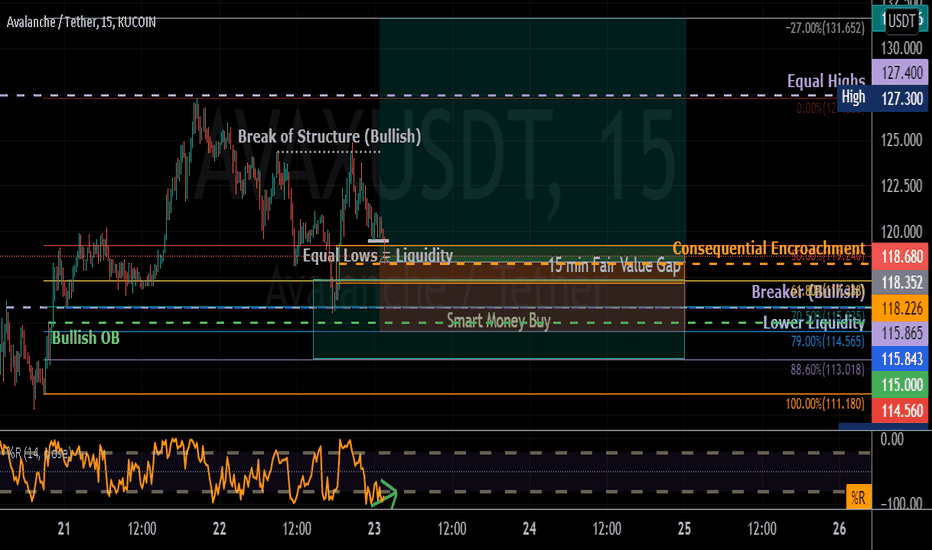

$AVAX - Buy Now or Maybe 115-117 *SMT**SMT = Smart Money Theory = everything you think that is not retail related to trading. First, SMT does not believe that triangles, wedges , trendlines , channels, harmonics, etc. has any effect on how price reacts. The second is to recognize that the price is not random, it is set by an algorithm controlled by those that control the asset. The Third thing to remember is price will move toward Liquidity and Balance. That's the basics. The rest is very unique in the vocabulary you need to have and the concepts that wrap around these ideas.

AVAX has short term break of structure that is bullish where these candles have closed above the previous candles close. We missed the initial great buy, the pullback into the 61.8% level of this chart. However. The current high is a about 1 cent off from another daily high, Creating a false " resistance. I say false because the next time it runs up to that point it will break resistance. It may break it by very little which will cause the liquidity to flood the market (this area of $127.3-$127.4 is where buy stops and sell limits rest) Smart money will punch through that area to flood the market with liquidity chasing the chart down for a short period, and then reverse it back up hitting following stop losses or shortly placed stop losses. Taking the retail traders out. Happens every time. The real question is, where to buy?

There are close equal lows on a 15/5 min time frame that could produce a little bit of liquidity underneath. about where it is now near the 119.5 area. The chart could push below that and spark more liquidity but I have a feeling if it did that it would drop down to the consequential encroachment of $118.226 or fill the fair value gap down to $117.16. The furthest I think it could go down would be $115 where there is a Bullish order block resting. and at that point price would reject it and send flying back up.

Additionally the only indicator I use, The Williams %R, which is more of a volatility indicator, is at the over sold condition. That doesn't guarantee a biuy right away, but we're more likely to see it possibly be more oversold to the areas I suggested and then turnm around.

As I'm typing this, it got under the Bullish breaker creating a bearish breaker. So I'd be betting on $117-$115

Good Luck and Good Trading! :)

COINBASE:AVAXUSD

BINANCE:AVAXUSDT

HUOBI:AVAXUSDT

OKEX:AVAXUSDT

COINEX:AVAXUSDT

FTX:AVAXUSDT

POLONIEX:AVAXUSDT

BITFINEX:AVAXUSD

KRAKEN:AVAXUSD

AVAXUSDT - Broadening wedge PatternAVAXUSDT (4h Chart) Technical analysis

AVAXUSDT (4h Chart) Currently trading at $86.5

Buy level :Above $87.5

Stop loss: Below $78

TP1: $94

TP2: $105

TP3: $116

TP4: $127

Max Leverage 2x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts.

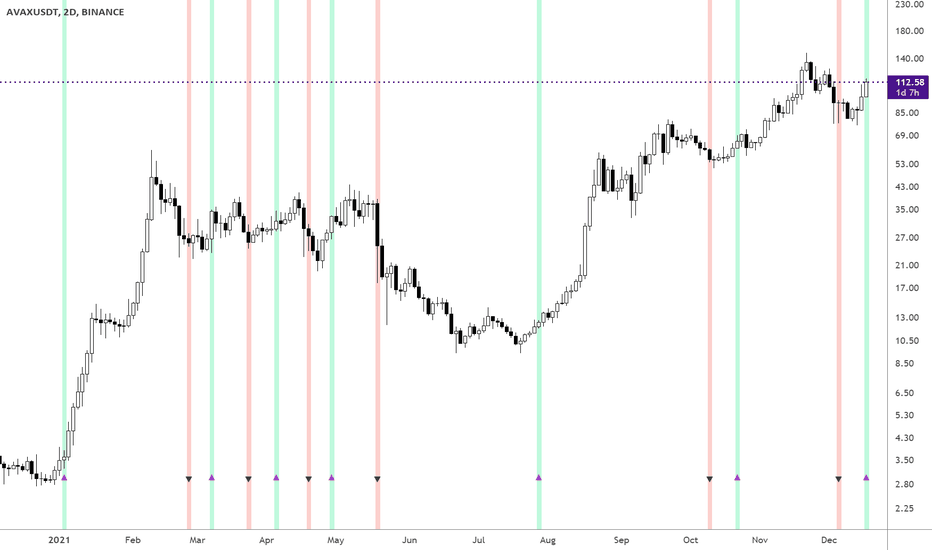

AVAX/USDT starting to look bullish. Time to long? In the chart I am using the Supertrend Ninja indicator, which is a trend-following indicator.

When the background of the candlestick closes green with an upwards pointing pink arrow. It indicates a possible bullish (up)trend. I want to see more confirmation of this possible trend before making an entry. To enter a trade placing an order a few ticks above the candle high would be sensible. The idea behind this, is that we only want to enter a trade when it has shown a trend continuation.

The Supertrend Ninja indicator gave only 6 bullish signals for the 2 day chart in 2021. And it's forming its 7th today. It still has over more than 1 day and 7 hours before candle close.

Is AVAX gonna be making a new ATH? I'll be watching AVAX like a hawk.

Namasté

Disclaimer: Ideas are for entertainment purposes only. Not financial advice. Your own due diligence is highly advised before entering trades.

Past performance is no guarantee of future returns.