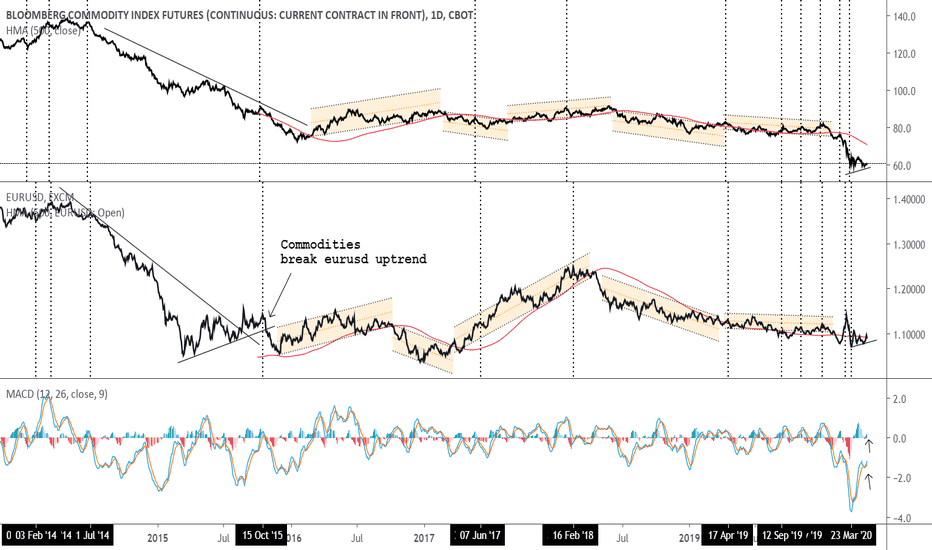

EURUSD vs commodity indexThe positive correlation between EURUSD and commodity index (negative with dollar index ) can not be refuted. And as you see, often times Commodity index leads EURUSD. A lag of 1-2 days can be observed at extremums. Why so? Euro and gbp comprise 69.5 percent of Dollar index against which all commodities are measured (gold , silver , crude oil , copper etc). Any move in commodity prices is reflected in dollar index and eurusd. With globalized economy and heavy correlation, one may claim that oil and gold prices exercise more impact on euro than ECB, interest rates or eurusd's moving averages.

Now we got two 9s (TD sequential) on commodity index and the index is likely to turn up. Right now its at S4 Woodie yearly floor pivot .

Also MACD points to a reversal in commodity index.