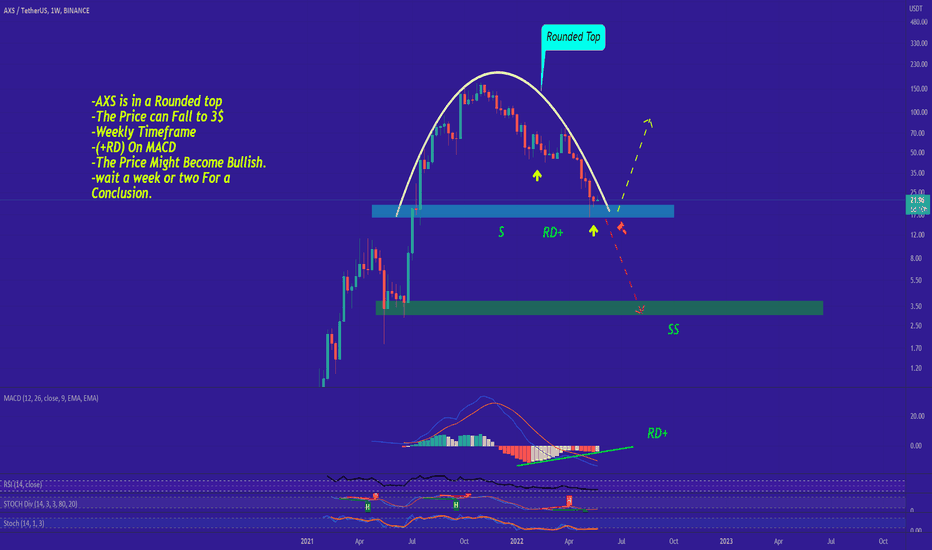

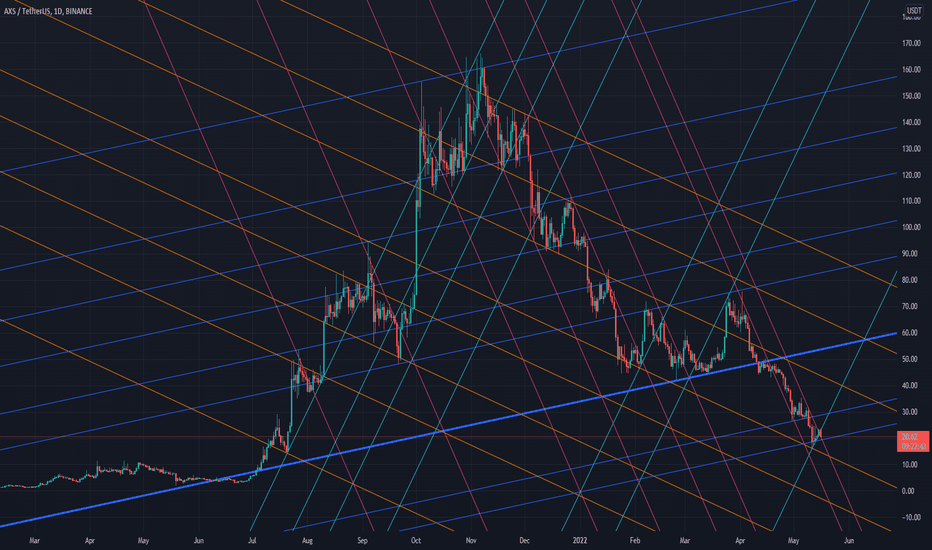

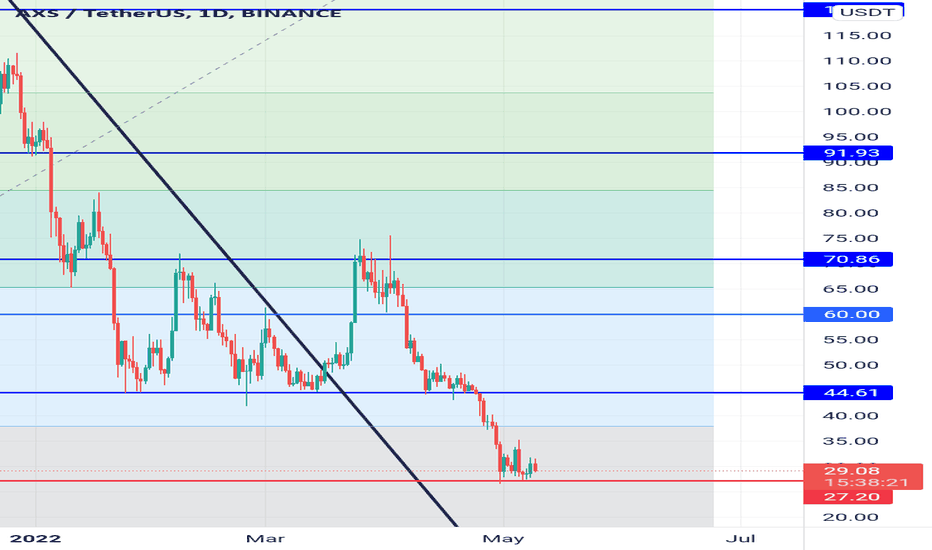

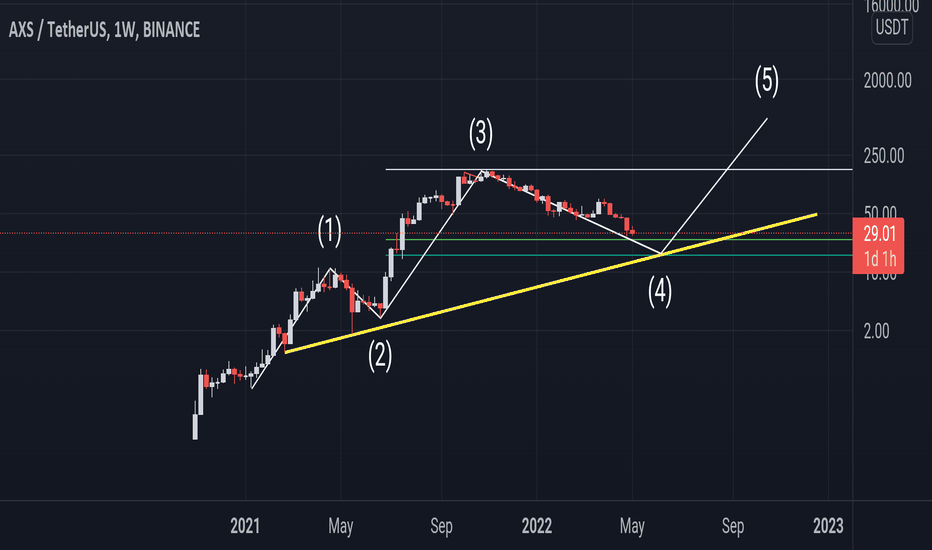

AXS is gonna Reach 3$ (or is it?)AXS is in a Rounded Top. The Price is in Big Trouble,because The Price Is in a BIG bearish Pattern (Weekly Time Frame) .The Price can Decrease as Much as The Length Between the Top and the Bottom of the rounded top and fall to 3$. BUT there is a Regular Bullish Divergence on MACD which will Make Us doubt This Movement. There is a Slight Chance that the Price would Obey this Divergence Instead of the Pattern which We Talked about. So we Can also Rely on a Bullish Scenario as well. But The Break out MUST Happen which is gonna Take a week or two for Us to come to a Conclusion about This.

-AXS is in a Rounded top

-The Price can Fall to 3$

-Weekly Timeframe

-(+RD) On MACD

-The Price Might Become Bullish.

-wait a week or two For a Conclusion.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Thank you for seeing idea .

Have a nice day and Good luck

AXSUSDT

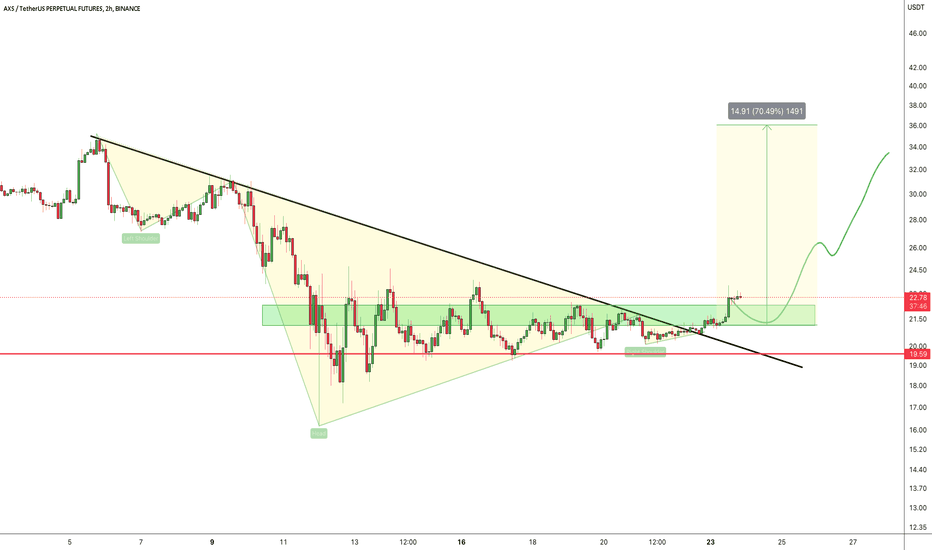

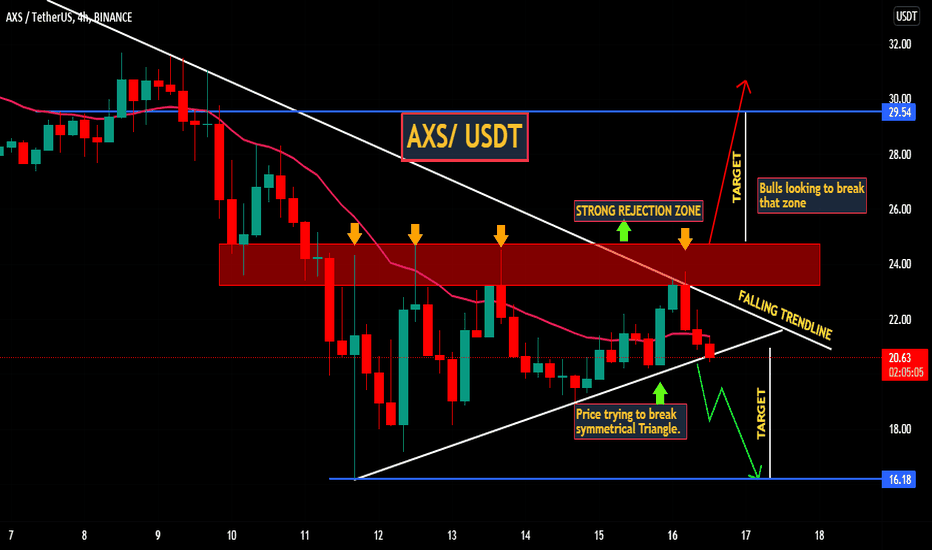

#AXS/USDT 2HOUR UPDATE BY CRYPTOSANDRS !!Hello, members welcome to AXS/USDT 2hr chart update by CRYPTOSANDERS.

I have tried my best to bring the best possible outcome in this chart.

As we can see from the above-mentioned chart the AXS/USDT brack the inverse head and shoulder pattern create and broke the neckline and retested the green zone and the current scenario we are expecting that get will go up all the way to $38.32 means almost 70%.

So if it moves to the green zone again then it will be the zone to go long on AXS/USDT

entry:-$21.10 , $22.30

target:-70%

stop-loss:-$19.60

with leverage 5x to 10x

Sorry for my English it is not my native language.

Remember:-This is not a piece of financial advice. All investment made by me is at my own risk and I am held responsible for my own profit and losses. So, do your own research before investing in this trade.

Do hit the like button if you like it and share your charts in the comments section.

Thank you.

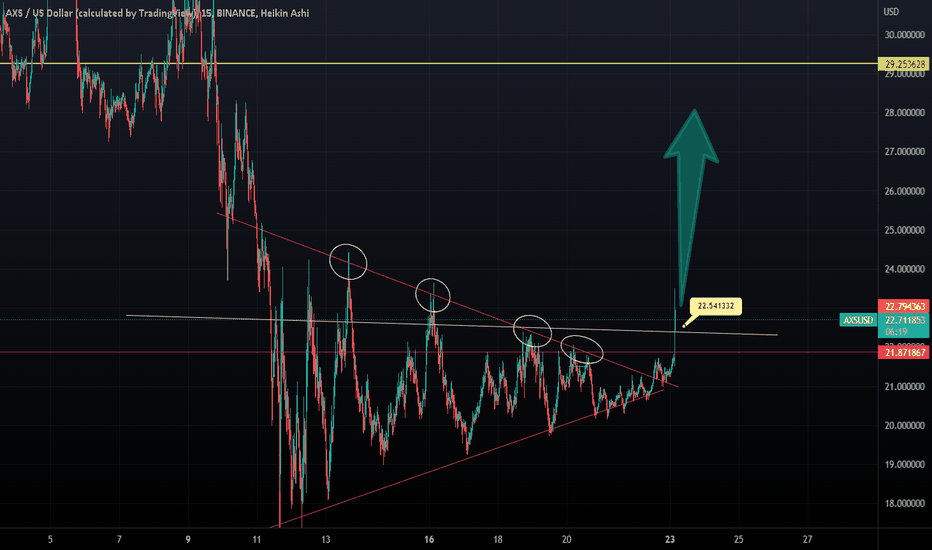

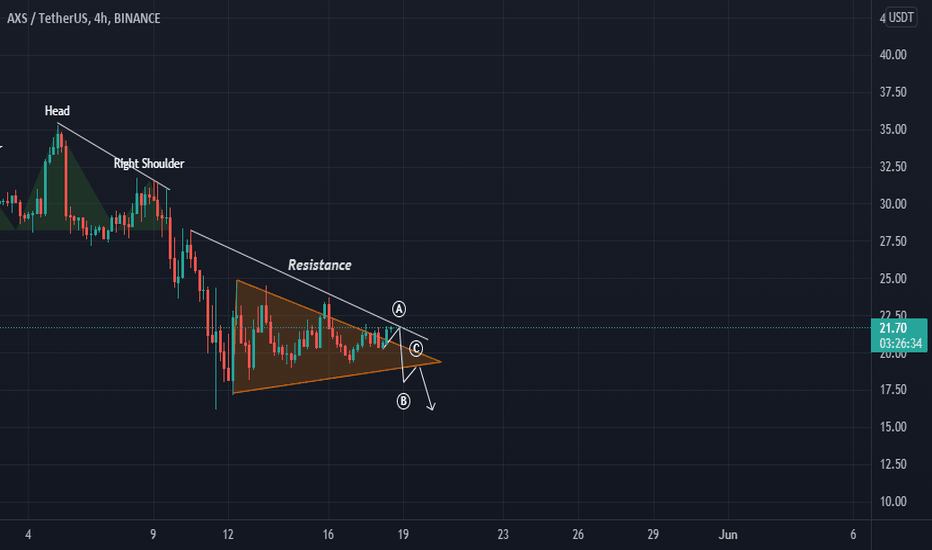

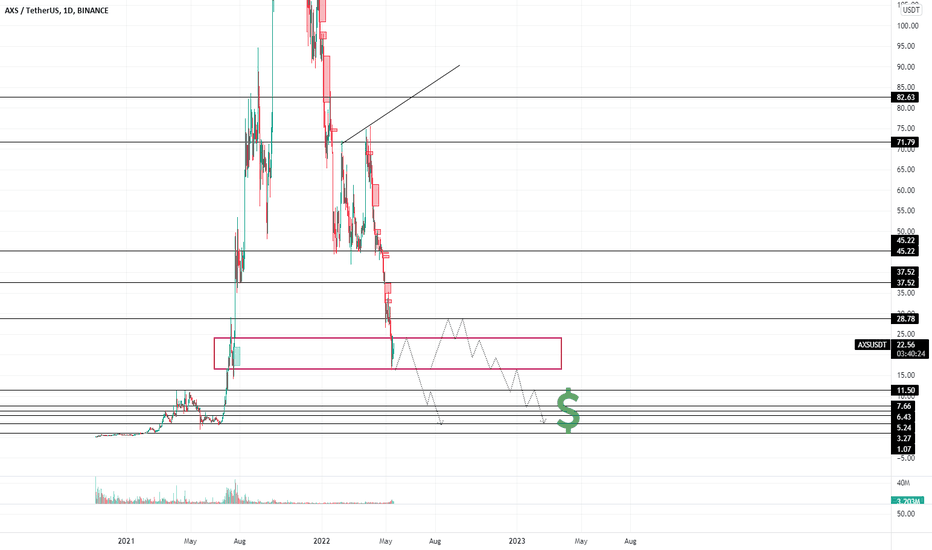

AXS SYMMETRICAL TRIANGLEA great symmetrical Triangle forming in a Bear market.....

High chance of giving a spike upwards in coming dayzz to gain more liquidity in this type of market where most of the people will try to enter a sell order....

If you can relate then do like and comment on what crypto or a stock I should analyse next ?

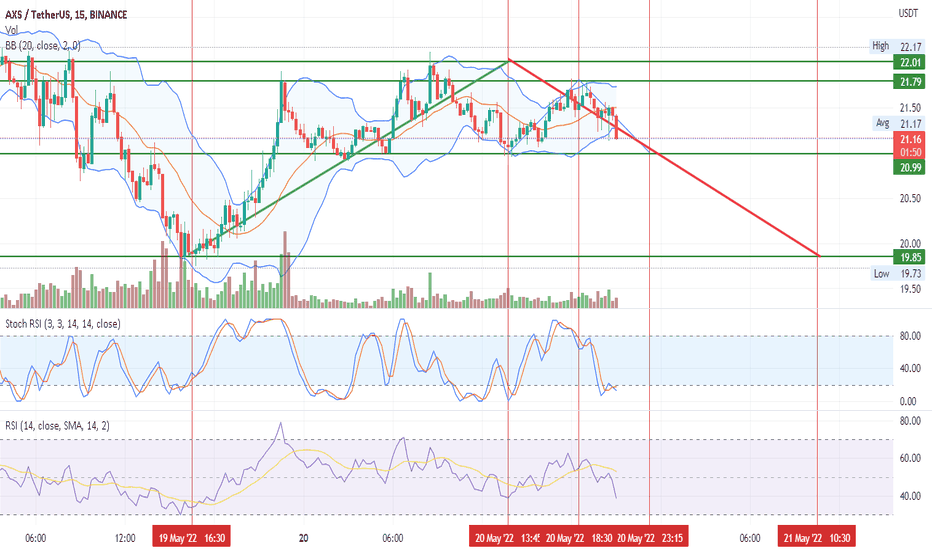

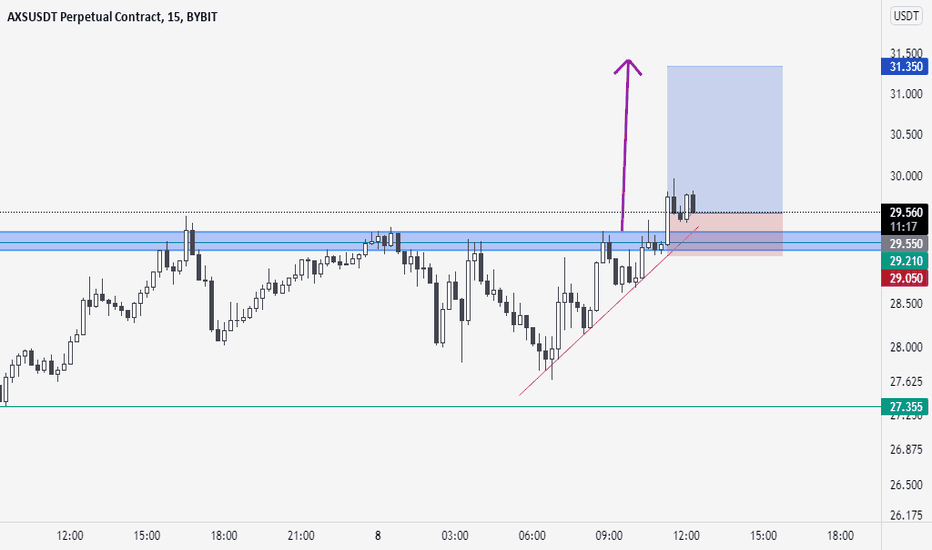

Short-term Trading Tricks on AXS Metaverse TokenBINANCE:AXSUSDT

Good evening Indonesian time everyone. I hope all of us are happy, tonight I want to share an analysis regarding the $AXS token, based on analysts, the AXS token will continue to decline until 23.15 Western Indonesian Time, after that we make a purchase and set it to take profit of 1.5% to 1.5%. 2%. because tomorrow will probably be around 9-10 pm western Indonesian time, there is a possibility that $AXS will drop back to at least $20.

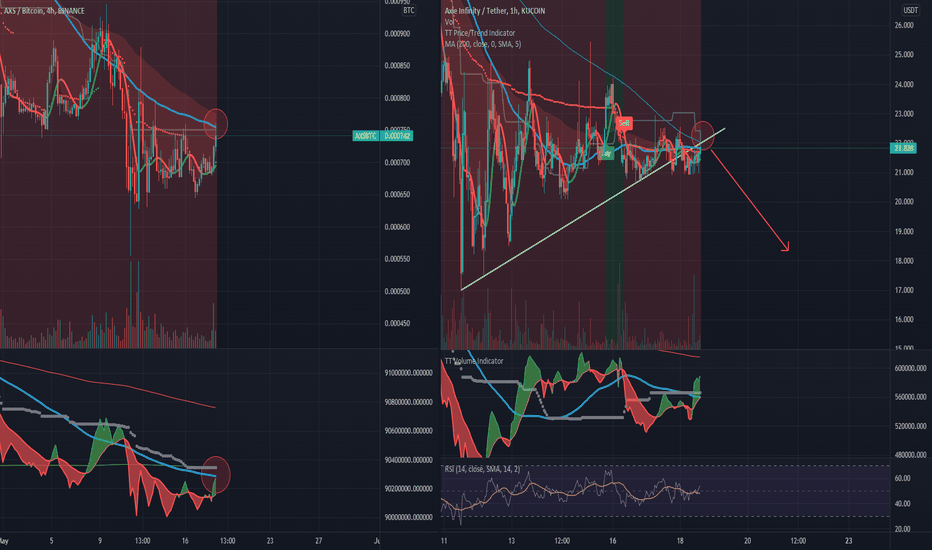

AXS SHORTAXS SHORT

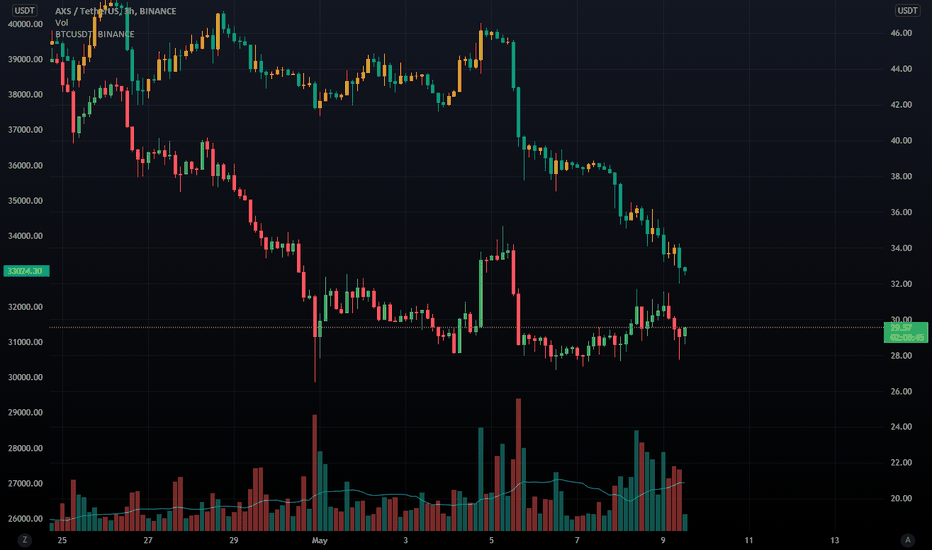

AXS/BTC Rejected on the 4 Hour - it's weak against BTC. If BTC drops (very likely from here) AXS will give a fantastic short return.

Also AXS just fell out of Bear Flag and retested the trendline + 200MA = down

Target is 13.69 (percentage drop of bear flag)

Stop Loss 22.61

Risk 1

Reward 20

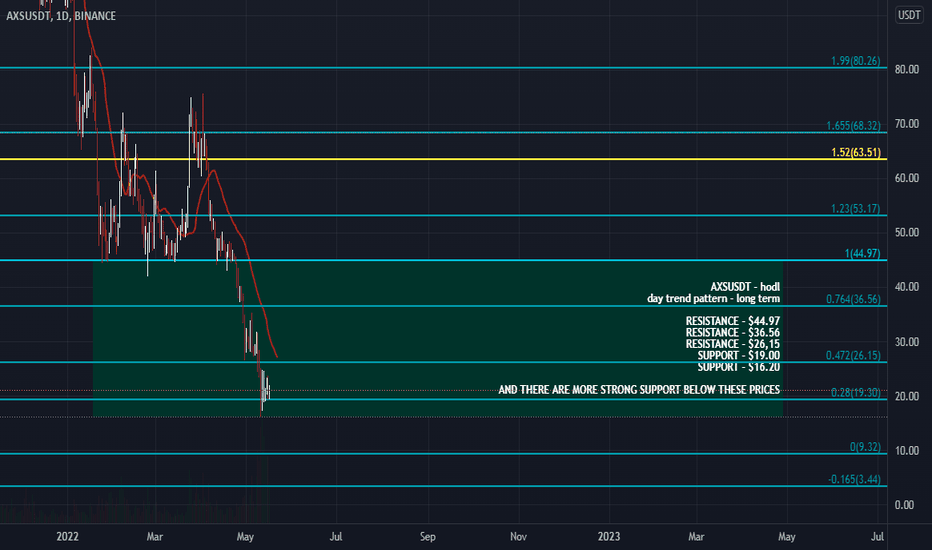

AXSUSDT - Long Term HodlThe drop was brutal and it was cause because of massive dump of LUNA and UST,

what caused crypto market to crash even harder.

AXS is recently at the very bottom level of its price.

AXS propably worths much more than it currently is in those "OVERSOLD" time (may - 2022)

1. Spot trading grid bot - best profits at HODL

2. Lending Crypto - that's the 2nd best strategy to earn on HODL that I've done (Kucoin has great "Crypto Lending" system)

3. Staking and other "Freeze you coin to Earn" options -

10% APR? 20% APR? 100% APR?

Spot Trading Grid Bot provides better APR% even during Bearing Market than any other option would? (if im wrong pls let me know)

The higher stake APR% the higher inflation - thats how AXS has lost over $100 since Christmass time 2021 (it offered 100% staking APR%)

4. Airdrops - Never done - I think it might worth - LONG TIME free gift alike

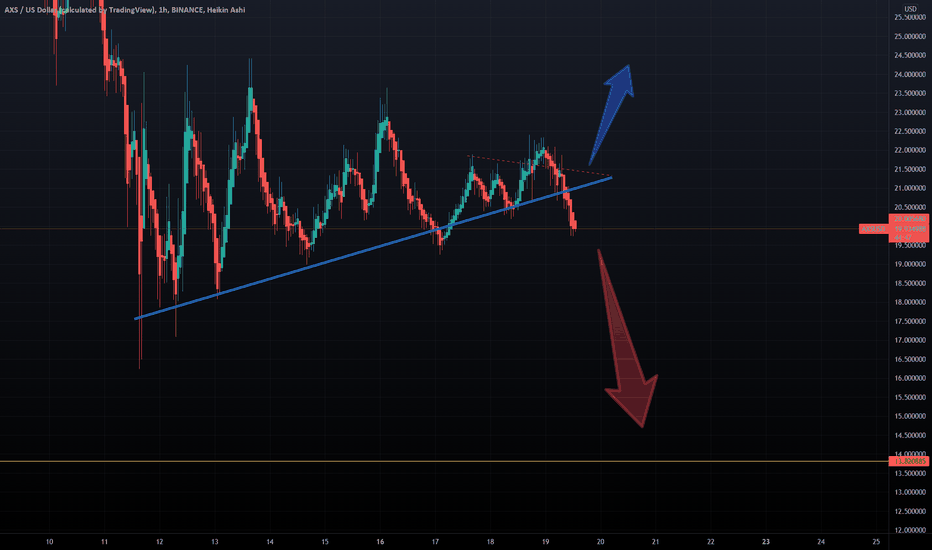

[ALTCOIN] AXSUSDT TREND LINE ANALYSISHello, everyone

We're a team that specializes in chart analysis

We will always analyze and provide you with charts to help you sell

There are so many trading laws and there are so many good technologies that come with them, but I'm confident that the trend line is really strong.

If you read the point of view and get to know the line, every line will adjust

Thank you.

------------------------------------------------------------------------------------------------

Chart Analysis Content -

#AXSUSDT Analysis

#AXS #AXS Trend Line Analysis

AXS is still trapped in the pink line, which is on a sharp downward trend.

I tried to pierce the pink line, but it looks like I'm going to fail the test.

If the test is successful, it will soar along the sky blue line, which is a sharp upward trend, and eventually settle on a bold blue upward trend.

Safe trading is when the blue bull market is on the rise and a test is successful.

AXSUSDT - SETUPAXSUSDT price has shown weakness at LTF after breaking the symmetrical triangle. If Bears contains the momentum we can expect a LL once as the Price is already trading below EMA 21. Price hit the strong resistance zone which may irritate the BULLS again and again. So selling on strength will be a strategy until bullish indications.

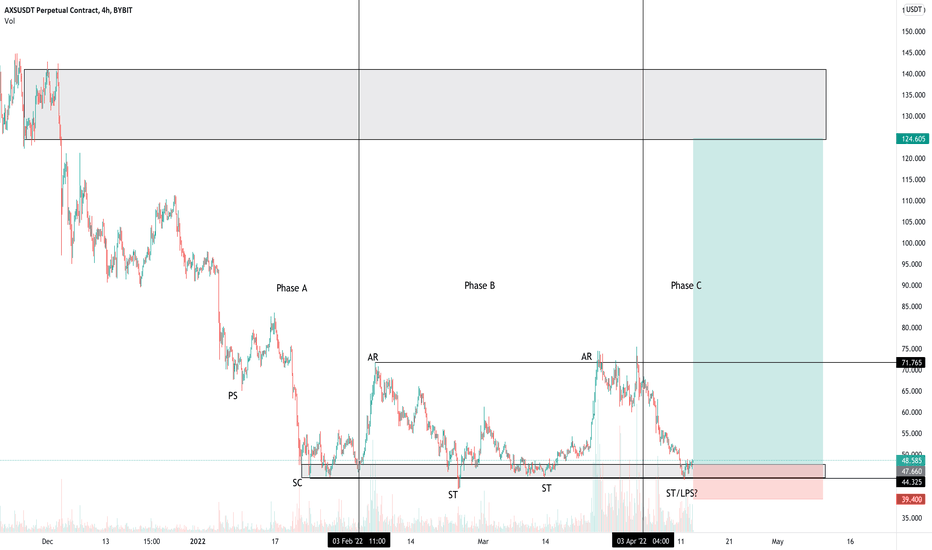

AXS/USDT Wycoff AccumulationAXS/USDT

🟢entry: $47.660- $44.495

❌stoploss: $39.400

🎯tp1: $124.605

🔼potential %profit: +161.45%

🔽potential %loss: -17.33%

r/r: 9.32

Hi Everyone,

🧩AXS appears to be undergoing Wycoff Accumulation. During Phase A, we saw a -52% mark-down with moderate volume to Preliminary Support (PS) and a -67% mark-down to Selling Climax (SC) with moderate-high volume. After establishing a tight range for 2 weeks after SC, an automatic rally began with high volume.

🧩After the first AR, Phase B began, establishing a much larger trading range. Within Phase B, we see 2 Spring Tests (ST) with moderate-low volume. Following the second ST, there was another large AR with high volume. Beginning with the second AR and through today’s date, we see sustained moderate-high volume, especially compared to the previous trading volumes. This can be interpreted as large operators fully committing to large-scale accumulation.

🧩As price is currently at the bottom of the trading range, it is probable that we are coming to the end of accumulation by large operators and will see one last ST to establish the final shake-out before a mark up to begin Phase D.

🧩Based on this analysis, I am entering a swing long. I will enter at the bottom of the trading range and patiently hold the position, watching for price to demonstrate LPS and SOS to confirm my analysis. I will sell half of the position in the annotated range of anticipated distribution and keep half the position to be placed as price establishes the actual distribution range.

Check back for updates as the position progresses.

Feedback and constructive criticism is always appreciated.

✌️All good luck and always practice strict risk management!

AXS Hacked - No more players means the Ponzi is over - CollapseThe collapse of AXS after $600M hack and all funds stolen. Funds were sent into Tornado Cash. After multiple cycles it is so hard to trace. Most crypto was withdrawn in exchanges in countries the US can not extradite.

People have stopped playing as players can not withdraw funds. Players in PH have stopped coming to work. SLP is worth almost nothing so there is no incentive to play.

Only a matter of time before it collapses to nothing. The ponzi is over

www.vice.com

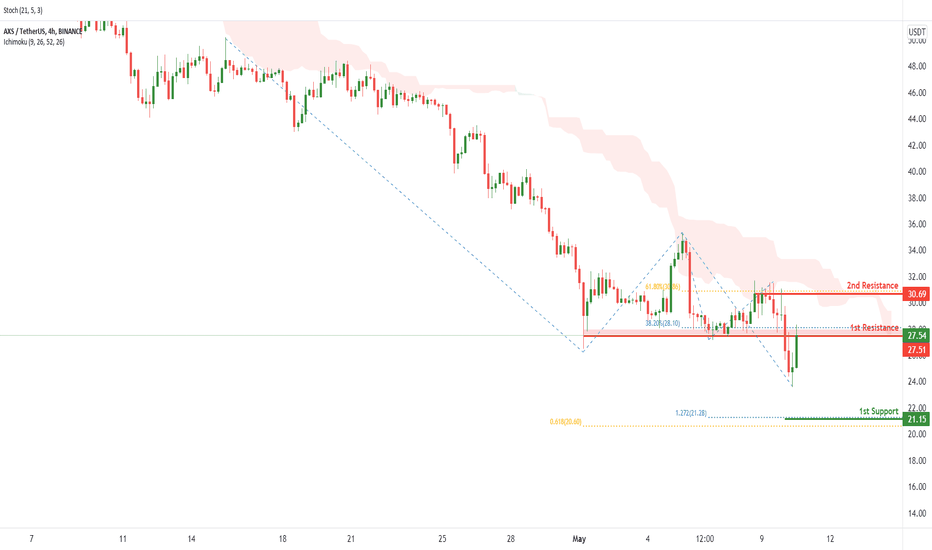

AXSUSDT potential for a drop! |10th May 2022On the H4, with price moving below the ichimoku cloud resistance, we have a bearish bias that price will drop to our 1st support at 21.15 where the127.2% Fibonacci projection and 61.8% Fibonacci projection is from our 1st resistance at 27.51 in line with the horizontal pullback resistance and 38.2% Fibonacci retracement. Alternatively, price may break 1st resistance structure and head for 2nd resistance at 30.69 where the 61.8% Fibonacci retracement and horizontal swing high resistance is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.