ApeCoin and AXS - a race to Zero?People keep asking me "Is altcoins season coming and Which altcoins i should buy now?"

I would tell you that most of the altcoins from previous bull markets seem compromised due to unfavorable tokenomics and a looming overhang of unlocked tokens.

There's a possibility they may never recover, and it's imperative that we identify a fresh narrative for the upcoming generation of altcoins to gain popularity. In the interim, it appears most logical to maintain exposure to Bitcoin.

Crypto VCs are facing significant pressure to deliver returns to their investors.

Although certain crypto VC funds have generated returns ranging from 10 to 20 times the initial investment, others have experienced significant losses, prompting investors to opt for cashing out, even when potential returns were considerably higher.

These VC funds are expected to continue playing a pivotal role as sellers of altcoins and are compelled to liquidate their holdings.

Monitoring the token unlock schedules of these projects can yield substantial alpha, as the anticipated selling pressure is likely to lead to decreased token prices.

ApeCoin APE

As of September 17, ApeCoin is poised for yet another substantial unlock, this time amounting to $55 million, which represents 11% of the total outstanding tokens.

This is significant given the current ApeCoin market cap of $500 million. Since the last unlock on August 17, which involved 4.2% of ApeCoins (equivalent to $21 million), prices have witnessed a sharp decline of -24%. Furthermore, the one-year emission or dilution rate stands at an alarming 58%.

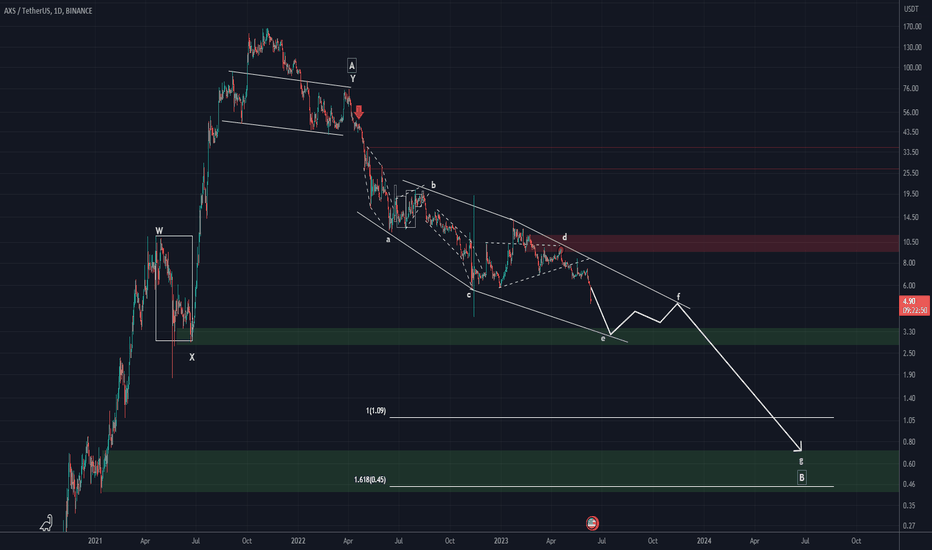

Axie AXS

On October 20, a significant unlocking event is scheduled for Axie Infinity's token (AXS), involving 11% of the total tokens.

Since the previous unlock on July 22, the value of AXS tokens has experienced a notable decrease of -32%. Presently, AXS maintains a market capitalization of $590 million, reflecting a substantial decline of -97% from its peak in November 2021 when it reached $10.5 billion. Additionally, the one-year emission rate stands at 24%.

Hard time for AXS and APE holders

Even though their prices have fallen considerably, it's difficult to envision a significant rally for ApeCoin or Axie Infinity tokens. These tokens are expected to lag behind the broader cryptocurrency market in terms of performance.

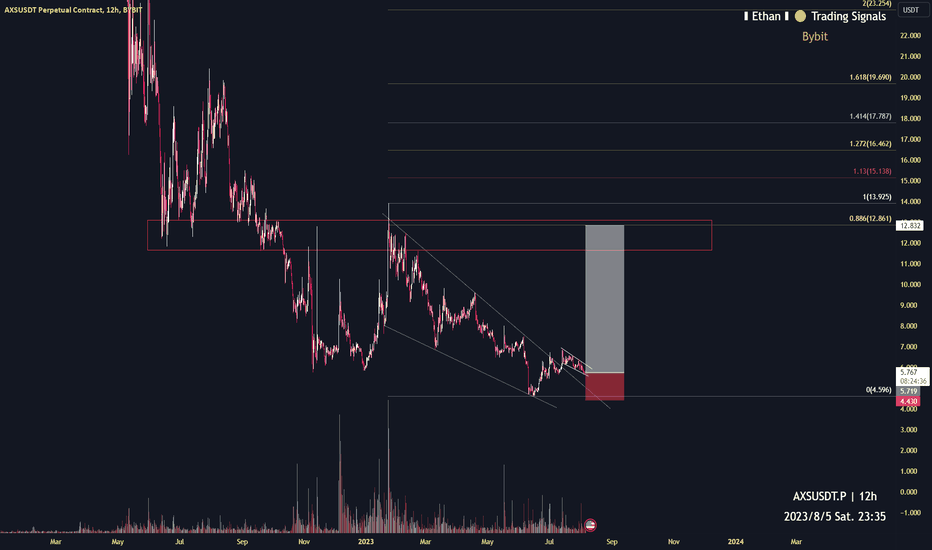

AXSUSDT

AXS/USDT Bullish Move Ahead? | AXS Analysis Today💎 Yello Paradisers! Strap in for a thrilling ride with AXSUSDT. It's currently nestled in a demand zone and is primed for a bullish ascent.

💎 At this moment, the asset is maintaining a pivotal support level and oscillating within a defined range. It has encountered some headwinds in the form of a bearish order block within this zone.

💎 The momentum is gathering steam, and there's a high likelihood that the price will shatter the order block to reach new heights.

💎On the flip side, if sellers gain the upper hand and the price dips below the support, it could open up an excellent shorting opportunity.

💎 Stay engaged for more savvy trading insights!

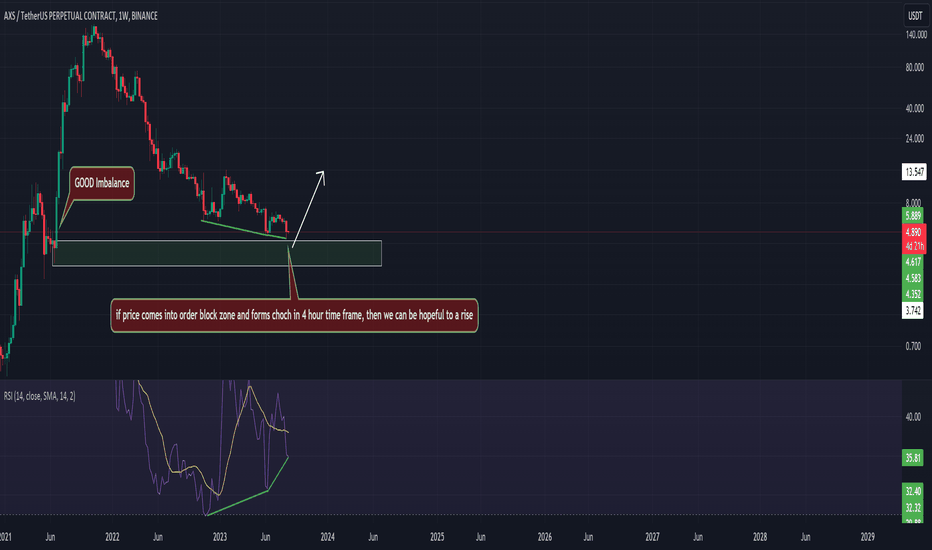

Possible risegood order block with good imbalance is spotted, a 3 push with RSI divergence is seen. If price comes in to the order block and forms a choch in 4hour time frame, then we can be hopeful to a rise.

Remember this is a position that was found by me and it is a personal idea not a financial advice, you are responsible for your loss and gain.

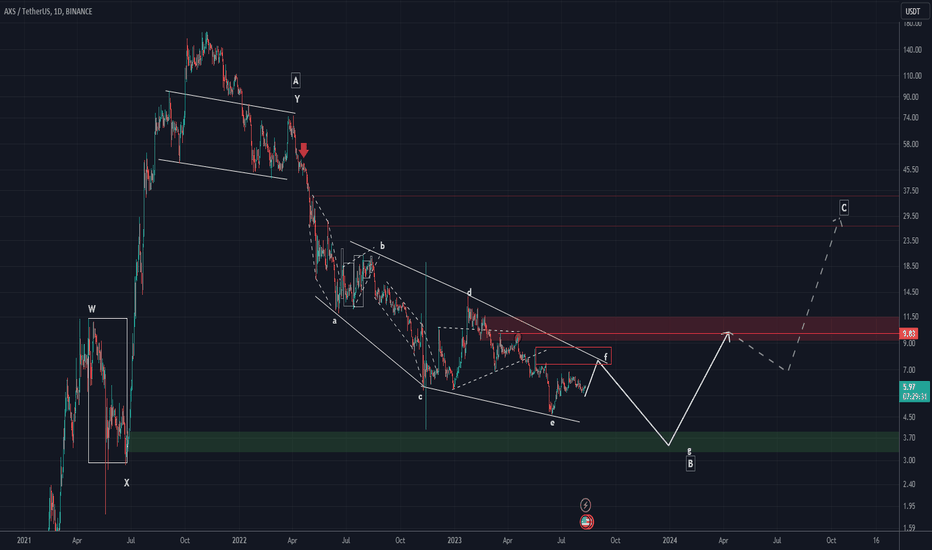

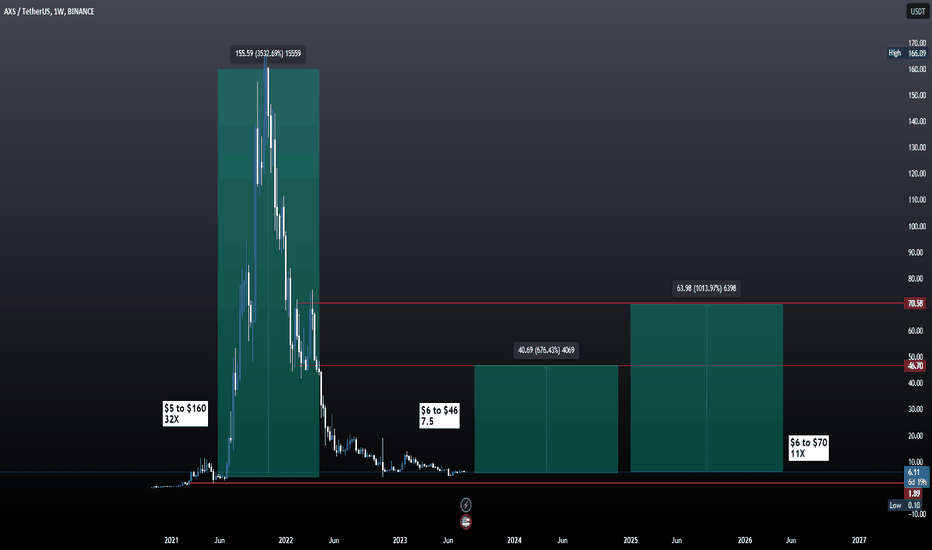

AXS CAN CLIMB UP TO 600%Hi, dear traders. how are you ? Today we have a viewpoint to BUY/LONG the AXS symbol.

We have already analyzed AXS. Given that our diametric is forming with a gentler slope, the green range for AXS is expected to be a trend changer.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

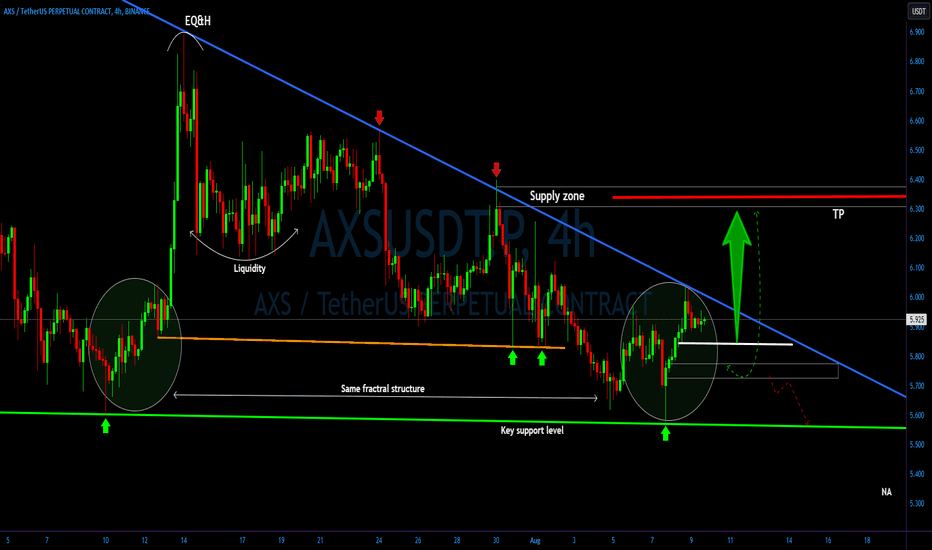

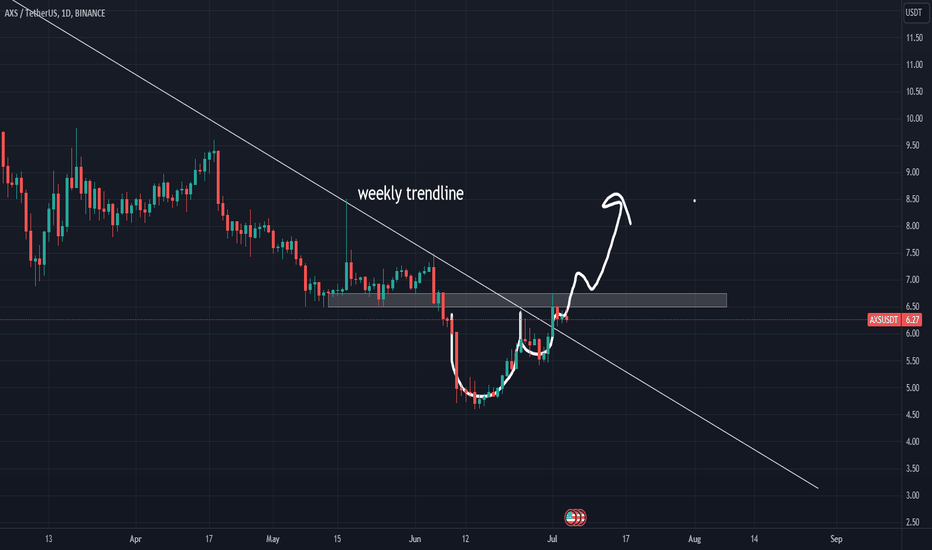

AXS/USDT upward momentum? 👀🚀 AXS today analysis💎It's currently maneuvering around a pivotal support level, echoing a familiar fractal structure.

💎 A few days back, AXSUSDT skillfully formed equal highs, subsequently embarking on a downward trajectory. This move was accentuated by a liquidity sweep and a transformation from demand to supply.

💎 Presently, with the recurrence of a similar fractal pattern, we anticipate AXSUSDT to embrace a bullish trajectory, mirroring its previous actions at this level.

💎 In the dynamic world of crypto, staying informed and adaptable is key. Stay tuned for more updates and enjoy your trading journey

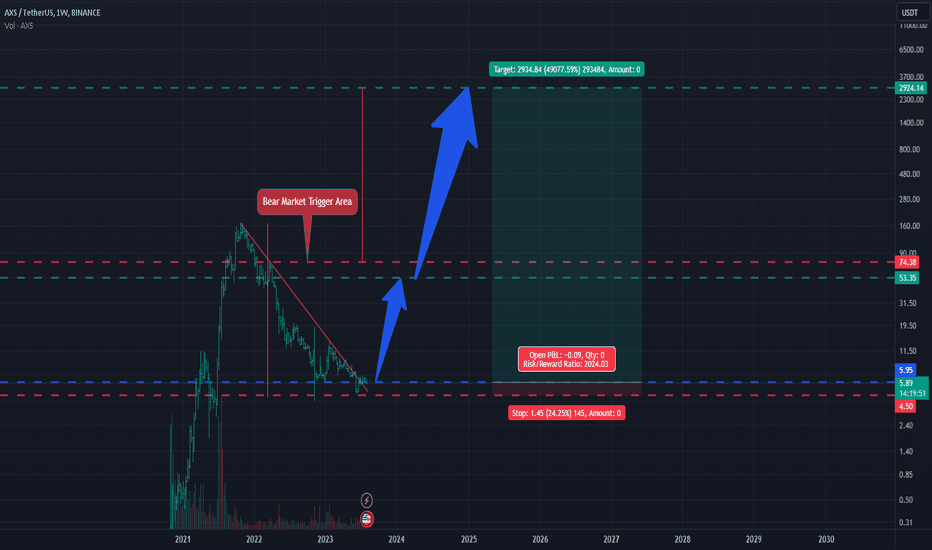

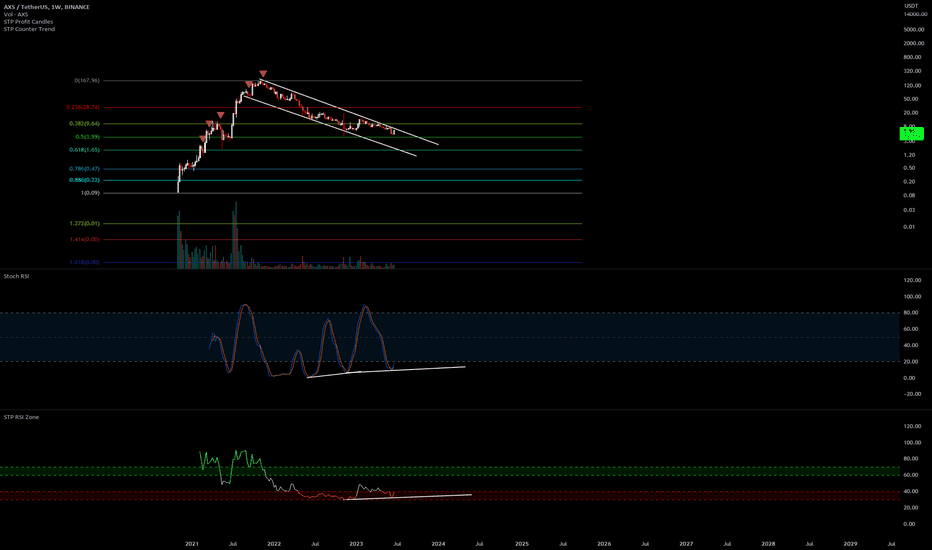

AXS and the 2024 Risk to reward Potential opportunity Hi Everyone;

today we have one of the best risk to reward Investment opportunity

it is more than 2024 times the risk and the chart is look very promising.

I expect breaking the previous bear market key point will clear the way to the final target

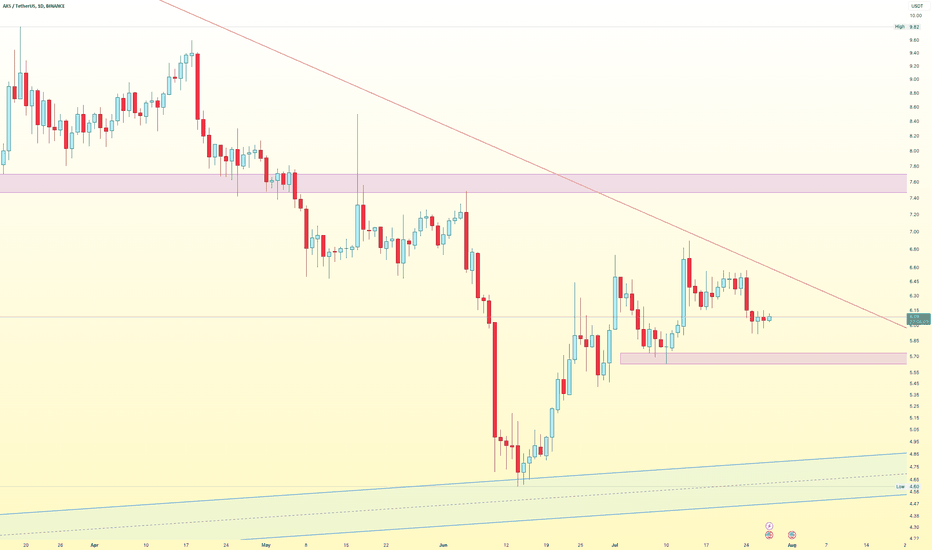

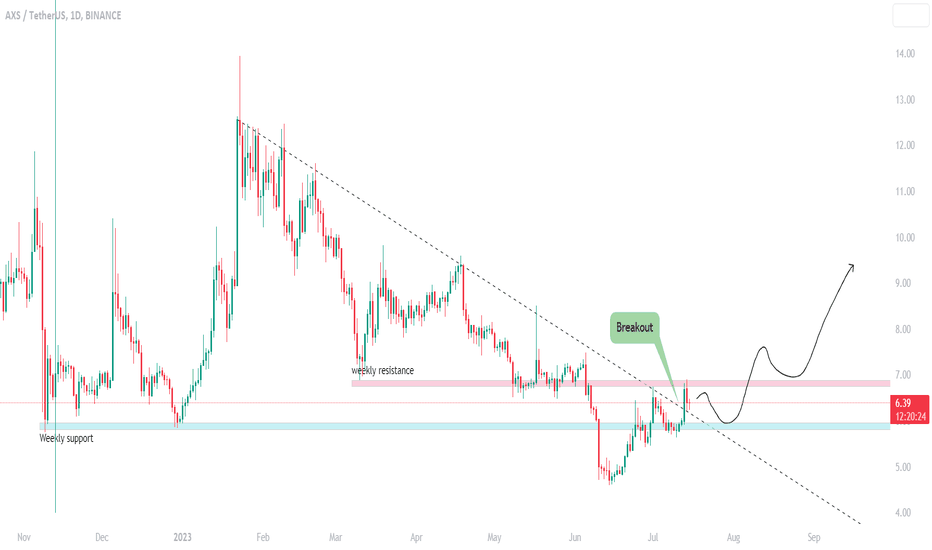

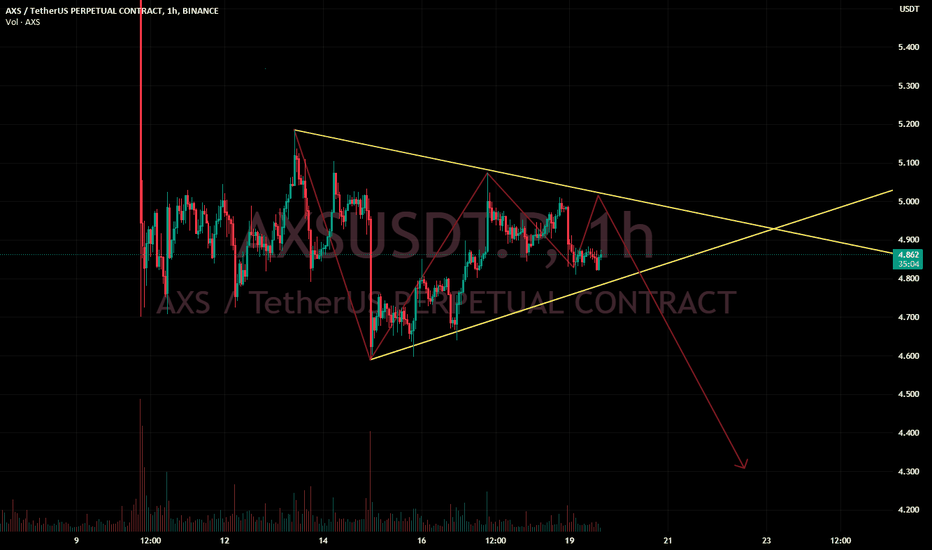

AXSUSDTBINANCE:AXSUSDT has been in a downtrend since late January, each time meeting resistance from the downtrend line marked on the chart and pushing the price lower.

However, we are now seeing the price stabilize and the downtrend line break. The price trend has changed from down to up, which can be confirmed with higher pivots.

I try to wait for a retest after the trend lines break or find a complete confirmation of the end of the previous trend. In this case, we can wait for the price to test $6 again or wait for the upper resistance to break, which is marked with a red box on the chart.

However, in general, we should expect the start of an uptrend at least up to 9.5 USDT.

The overall trend is expected to be bullish.

⚠️ "Daily crypto market analyses I provide are personal opinions & not financial advice. Trading carries risks, so do your own research & seek advisor's help."

Don't forget to like and comment

Sand OutlookI expect a bounce from the current price to two mentioned targets. SAND has been recently added to allowed trading crypto in Hong Kong which pumped the price. Afterwards, it was target by SEC and labelled as a security and price dumped. I am following this token for years now. It is a mid-risky token; therefore, you can take the huge plunge from $0.61 to $0.33 by SEC as a buy opportunity.

AXS Axie Infinity and the Altcoin Season ThesisIf you haven`t sold the speculative bubble:

Then you should know that the recent developments in the cryptocurrency market, particularly the favorable court ruling for Ripple Labs, signal an optimistic start to a new altcoin season.

With the federal judge ruling that some of Ripple's sales of the XRP token do not fully meet the definition of a securities offering, it instills confidence in the altcoin space.

This ruling brings clarity to the regulatory landscape and alleviates concerns surrounding XRP, leading to major cryptocurrency exchanges, including Coinbase, relisting the token. The reintroduction of XRP to these platforms demonstrates growing acceptance and renewed interest in this altcoin.

The anticipation surrounding the approval of a spot bitcoin ETF in the United States adds to the positive sentiment in the market.

The successful launch of a previously approved ETF in Europe further reinforces the upward trend for altcoins.

The recent court ruling that declared XRP as not a security sets a precedent that could potentially benefit other cryptocurrencies currently classified as securities by the SEC. In the SEC's case against Binance, they designated 10 cryptocurrencies, including BNB, BUSD, SOL, ADA, MATIC, ATOM, SAND, MANA, AXS, and COTI, as securities.

Additionally, in the SEC's lawsuit against Coinbase, they named 13 cryptocurrencies, reinforcing their stance on SOL, ADA, MATIC, SAND, and AXS, and adding CHZ, FLOW, ICP, NEAR, VGX, and NEXO to the list.

This development showcases the increasing institutional acceptance of cryptocurrencies and creates a ripple effect across the market, providing a boost for various altcoins, including AXS Axie Infinity, for which my price target is $8.00.

Looking forward to read your opinion about it!

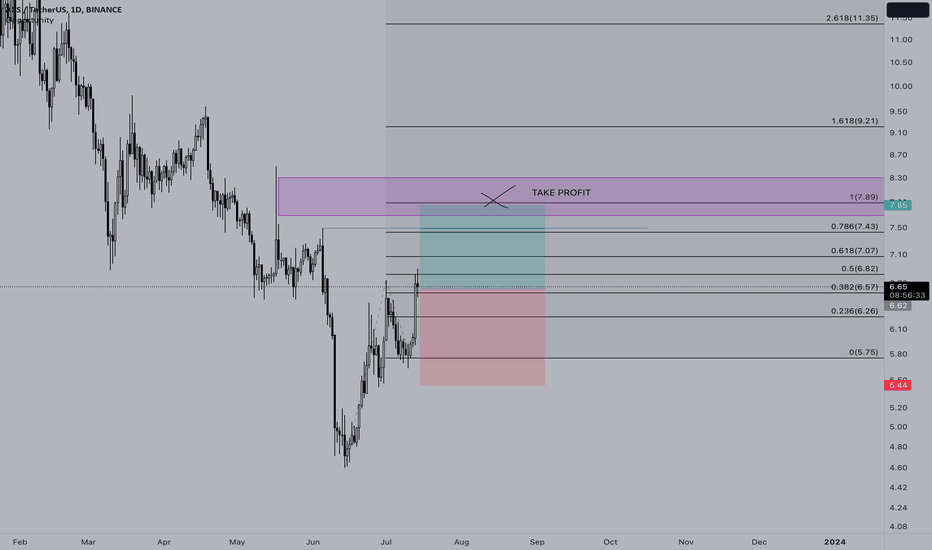

AXSUSDT Potential Short-Term Trend Reversal💎#AXSUSDT is finally showing higher highs and higher lows, indicating a potential shift in the short-term trend towards bullishness. However, it's important to keep in mind that the long-term trend remains bearish, as #AXS is still within a descending channel.

💎When looking at the support and resistance levels, price has been oscillating around the 50% Fibonacci support throughout the week, with bulls successfully defending this level so far. On the other hand, the $6.5 resistance level has been held by sellers. Considering these factors, it's reasonable to expect range-bound trading in the coming days. However, given the proximity of the price to the Fibonacci support, buyers may find a favorable risk/reward opportunity.

💎Bullish invalidation would occur if there is a break below the recent lower low at $5.4, while the next key resistance level is at $7.1. The significance of the $7.1 resistance is derived from its confirmation by two Fibonacci retracement levels, the Volume Profile indicator, and its alignment with the top of the descending channel.

Stay vigilant, Paradisers, as we monitor the dynamics of #AXSUSDT and await a decisive move that will shape its future trajectory.

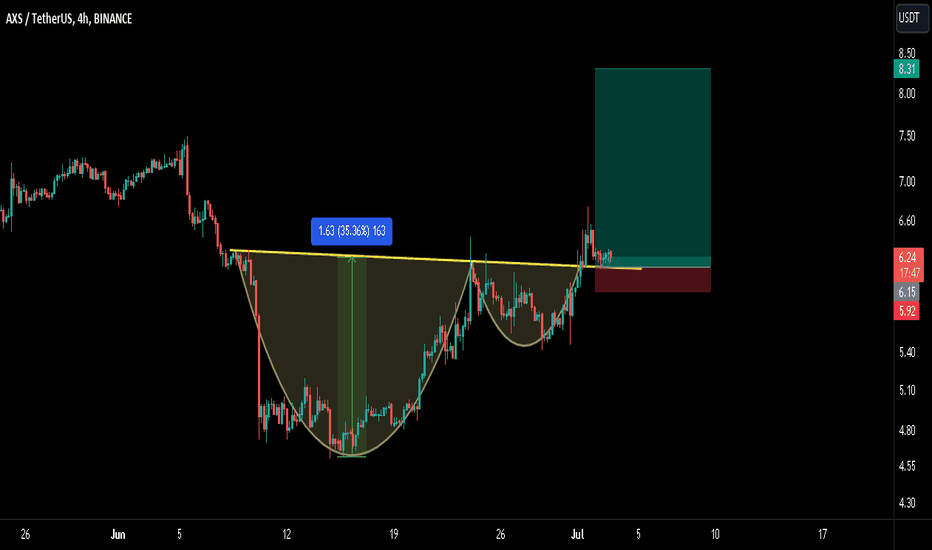

AXS/USDT LONG SETUP!!Hello everyone, if you like the idea, do not forget to support it with a like and follow.

Welcome to the AXS/USDT trade setup.

AXS looks good here. Breaks out from the cup and handle pattern in 4hr time frame and currently retesting the neckline. After this successful retest, we can expect a good 30-35% move to the upside. Long some here and add more in the dip.

Entry range:- $6.10-$6.25

Target1:- $6.80

Target2:- $7.44

Target3:- $7.86

Target4:- $8.30

SL:- $5.90

Use low leverage (5x-6x)

If you like this idea then do support it with like and follow.

Also, share your views in the comment section.

Thank You!

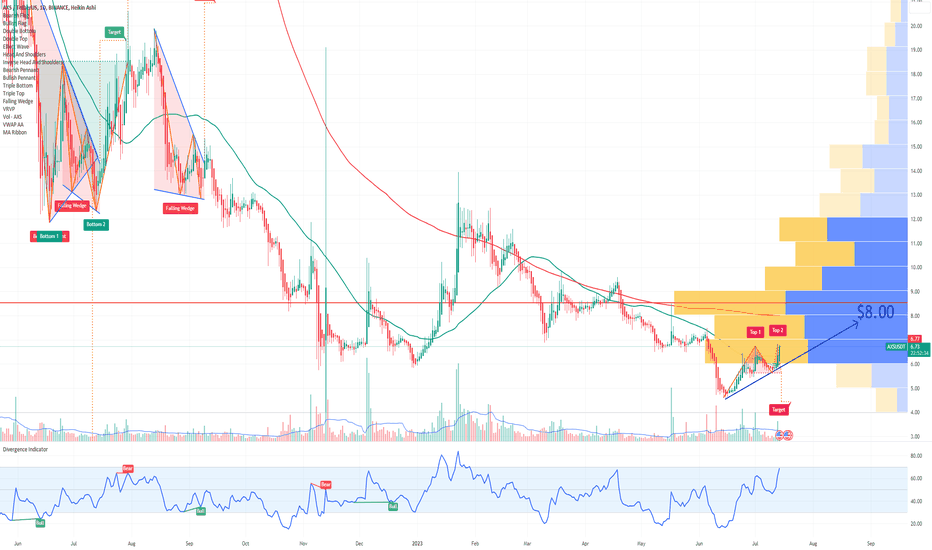

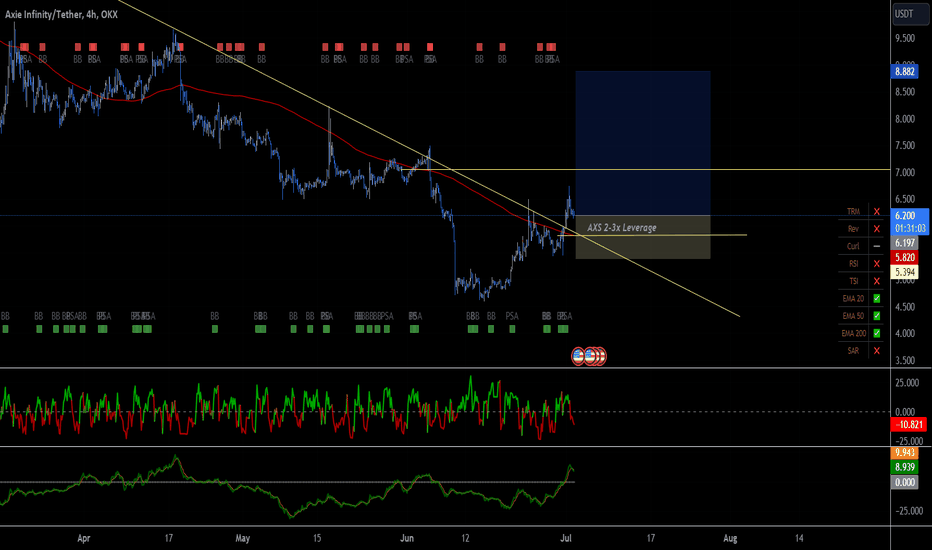

📉 Downward Channel & Weekly Bullish Divergence on $AXSHey traders! Today, I want to discuss an intriguing chart pattern I've identified on NYSE:AXS (Axie Infinity). Let's explore the downsloping channel accompanied by weekly bullish divergence and assess its implications for potential price action. 📊💡

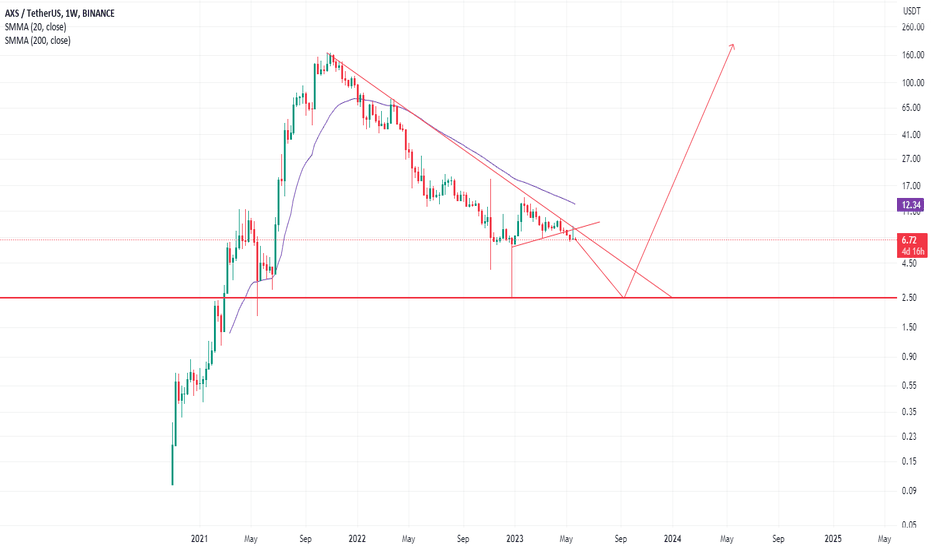

Pattern: Downward Channel & Weekly Bullish Divergence 📉🔽

Symbol: NYSE:AXS 💰

Overview:

A downsloping channel is a notable chart pattern characterized by a series of lower highs and lower lows. Additionally, the presence of weekly bullish divergence further strengthens the potential for a reversal. Let's delve into the downsloping channel and bullish divergence on NYSE:AXS in more detail. ⚡💹

Key Features of the Downward Channel & Weekly Bullish Divergence on NYSE:AXS :

Channel Formation: Observe the well-defined downsloping channel, which consists of a series of lower highs and lower lows. This indicates a prevailing bearish trend. 📈📉

Weekly Bullish Divergence: Notice the bullish divergence forming on the weekly timeframe, where price creates a lower low while the corresponding oscillator indicator forms a higher low. This suggests a potential shift in momentum. 🚀📈

Trading Strategy:

Entry Point: Consider entering a position once NYSE:AXS breaks out above the upper trendline of the downsloping channel, supported by the confirmation of bullish price action and the weekly bullish divergence. This breakout could signal a potential trend reversal and the start of an upward move. ⬆️💰

Stop-Loss: Implement a stop-loss order below the recent swing low or below the lower trendline of the channel to manage risk and protect against potential downside. ⛔️📉

Target Levels: Identify key resistance levels or previous swing highs as profit targets. Adjust your position size and take profits accordingly. 🎯📈

Risk Management:

Maintain proper risk management techniques, including position sizing, setting stop-loss orders, and adhering to your trading plan. Be aware of the risks associated with trading cryptocurrencies like $AXS. ⚠️💼💡

Disclaimer: Trading cryptocurrencies involves risks, and it is crucial to conduct thorough analysis and seek professional advice before making any investment decisions.

#DownslopingChannel #BullishDivergence #AXS #AxieInfinity #Cryptocurrency #TrendReversal #TradingStrategy #TechnicalAnalysis

In conclusion, the downsloping channel and weekly bullish divergence identified on NYSE:AXS indicate a potential reversal in the making. However, wait for a confirmed breakout above the upper trendline and validate the bullish price action before considering any trades. Stay tuned for further updates on $AXS! 💹🚀

(Note: This post is for informational purposes only and should not be considered as financial advice.) 💡💼📚

The AXS chart is terrible (1D)Hi, dear traders. how are you ? Today we have a viewpoint to SELL/SHORT the AXS symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You