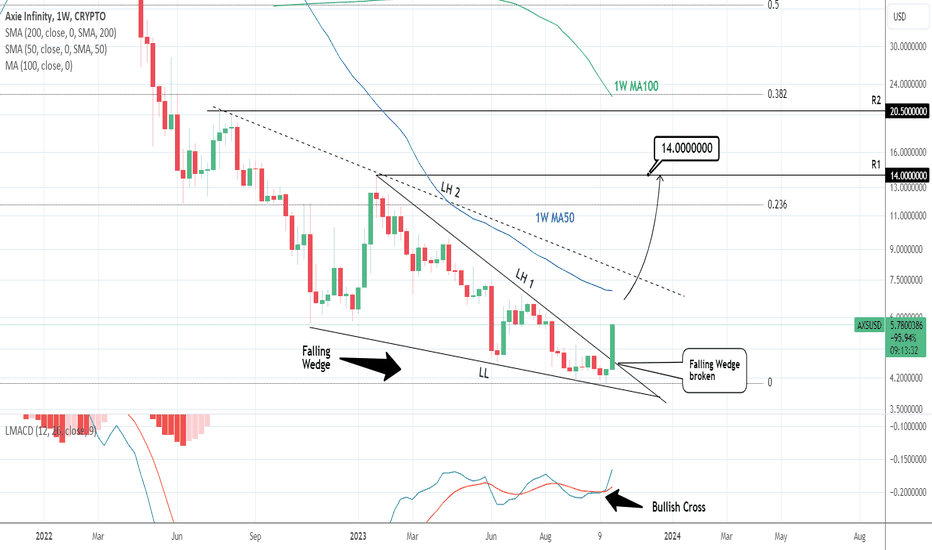

AXSUSD: Falling Wedge broken.Axie Infinity turned overbought technically on the 1D timeframe (RSI = 79.330, MACD = 0.200, ADX = 48.531) as it crossed over the LH 1 trendline, which was the top of the twelve month Falling Wedge. Despite this brute force of breakout, the 1W timeframe is still only neutral and the price remains under the 1W MA50. This is a potential indication that, along with the recently formed 1W MACD Bullish Cross, AXSUSD is underpriced on the long term and there is still strong upside left on the current rally.

Besides the 1W MA50, we have the LH2 as a Resistance right ahead of it. We are taking a low risk breakout approach on this and will buy after the 1W MA50 breaks. Our target will be the R1 level (TP = 14.000), which depending on how aggressive this rally will be from now on, might make contact with the 1W MA100 there. A break over the 1W MA100 then, targets the R2 level (TP = 20.5000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Axsusdtrading

AXSUSD: 1D MA50 rejection within the Channel Down. Bullish aboveAXSUSD is testing now the 1D MA50, which is sitting a little under the top of the prolonged Channel Down pattern that began at the start of the year. The 1D technical outlook is neutral (RSI = 46.158, MACD = -0.240, ADX = 38.786) meaning that a crossing over the top of the Channel Down will turn the trend bullish but as long as the price stays inside it, it is bearish.

This might be a rejection similar to May 17th, which dropped to a Fibonacci 2.0 Lower Low. For now we are bearish, targeting the respective Fibonacci 2.0 (TP = 3.1500). If on the contrary it breaks above the Channel Down we will buy and target the 1D MA200 (TP = 6.3500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##