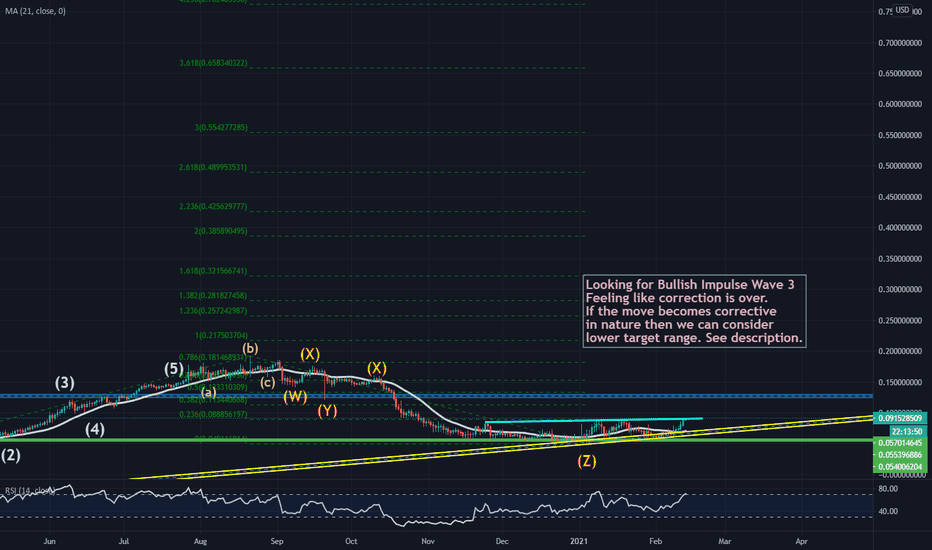

CROUSD Bullish Impulse or Corrective Extension....BITTREX:CROUSD

It appears the correction is over for CRO, it wants to fly!

If we are in a bullish impulse then we may see targets such as the 1.618% Extension or much higher, possibly up to 3.618% or higher if the market allows. But let's not get ahead of anything.

Should the move prove only corrective in nature then we can presume lower targets such as the .618% up to 1.236% Extensions.

B-wave

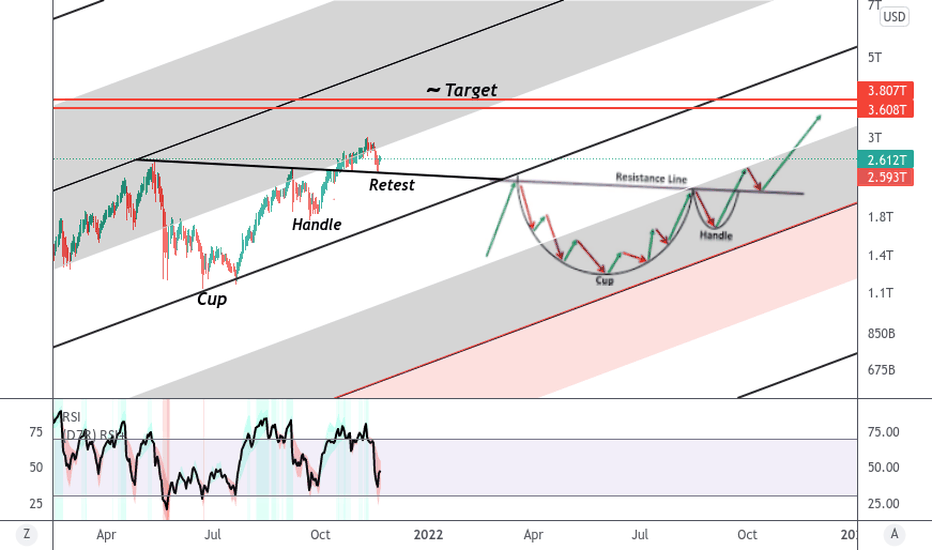

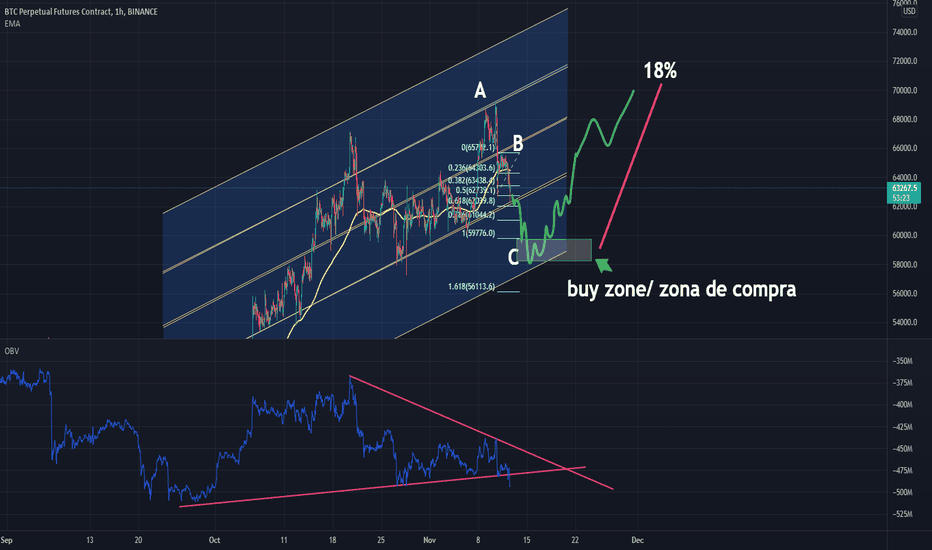

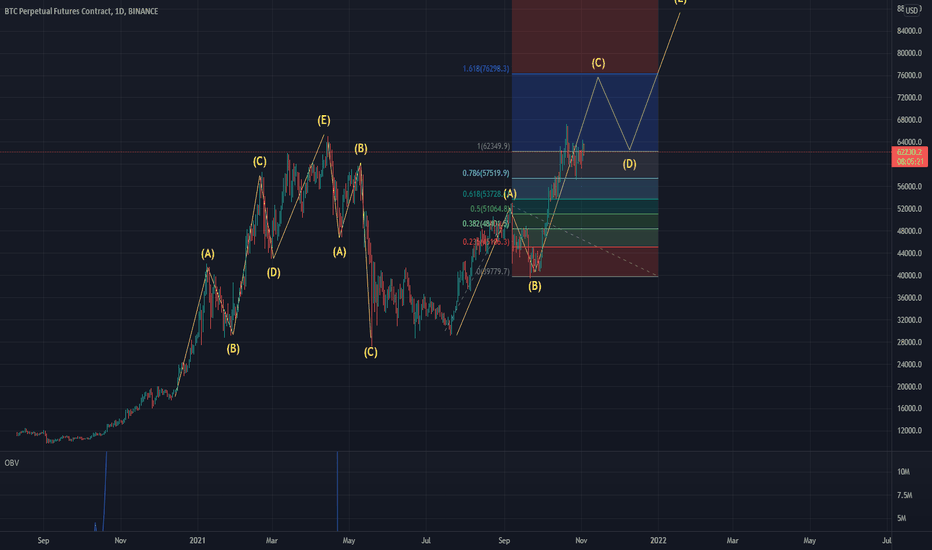

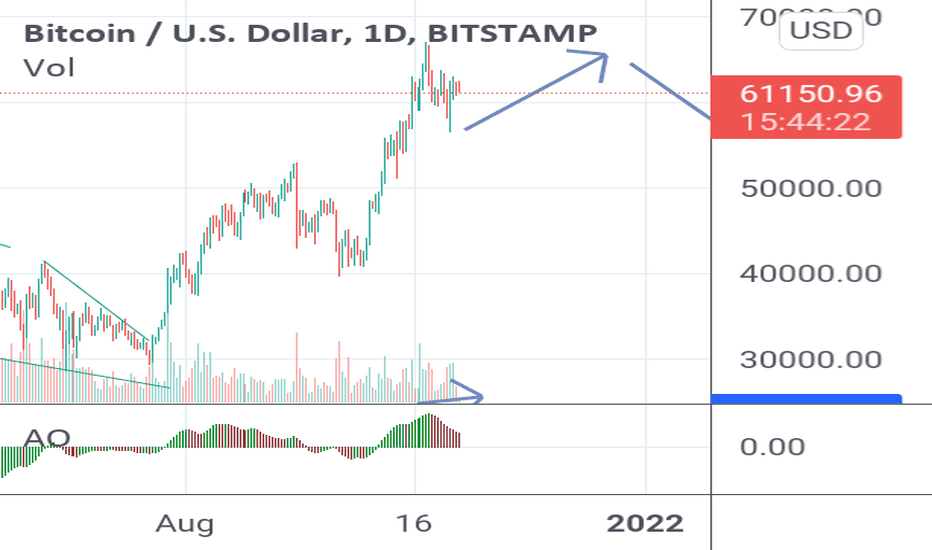

Picture Perfect Cup And Handle?Given that the market structure has been pretty weak lately, if we print another rounded top on our way up to hit the cup and handle targets, ill probably scale almost 100% out of the markets.

We've been banging against overhead resistance in the middle of this channel for some time now and i would expect a pretty substantial drop after this next leg up.

Obviously nobody knows where the next top will be but i'm aiming at 80-90K, it may break up it may break down, keep your eyes on the charts and trade accordingly.

Its good to note that as we near, what i am looking at as getting close to, the end of the cycle remember to pull profits frens.

You haven't made any money until your profits are actualized.

And as always,

Good Luck And Safe Trading.

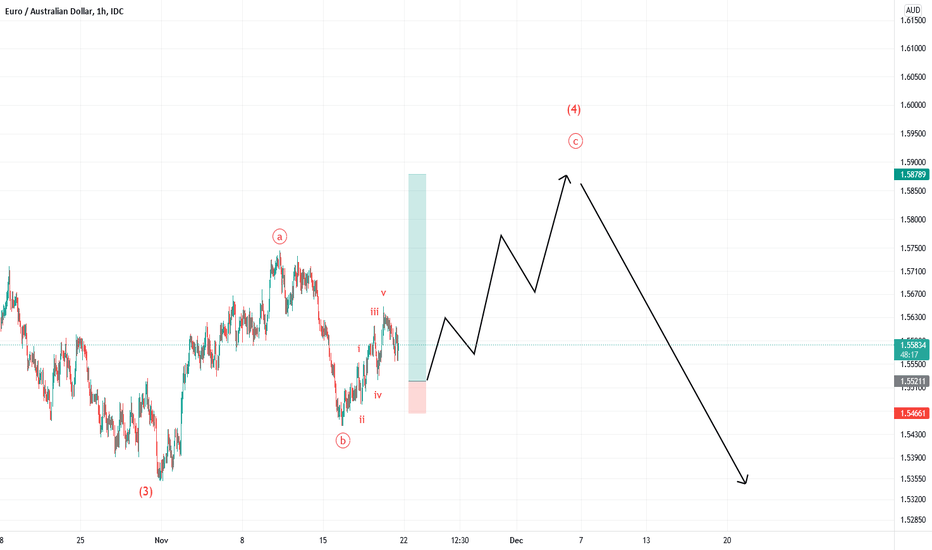

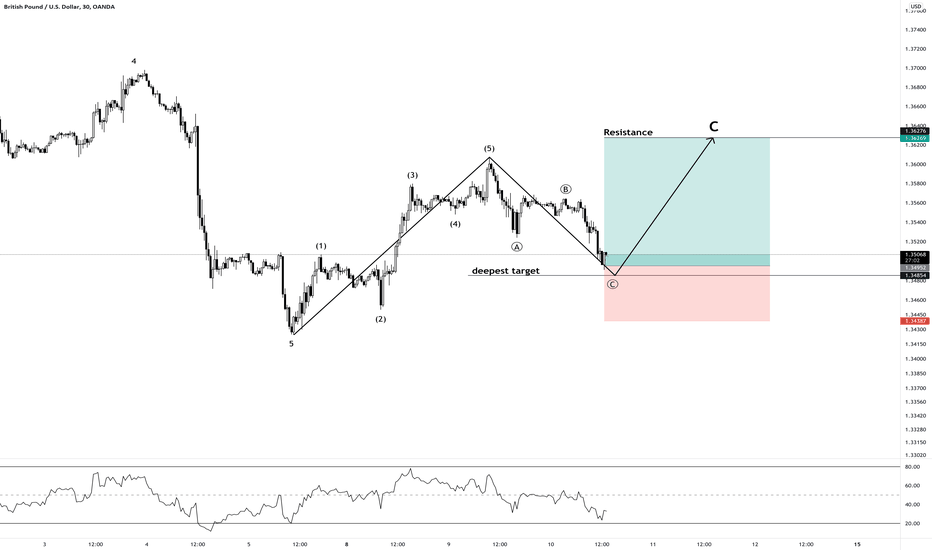

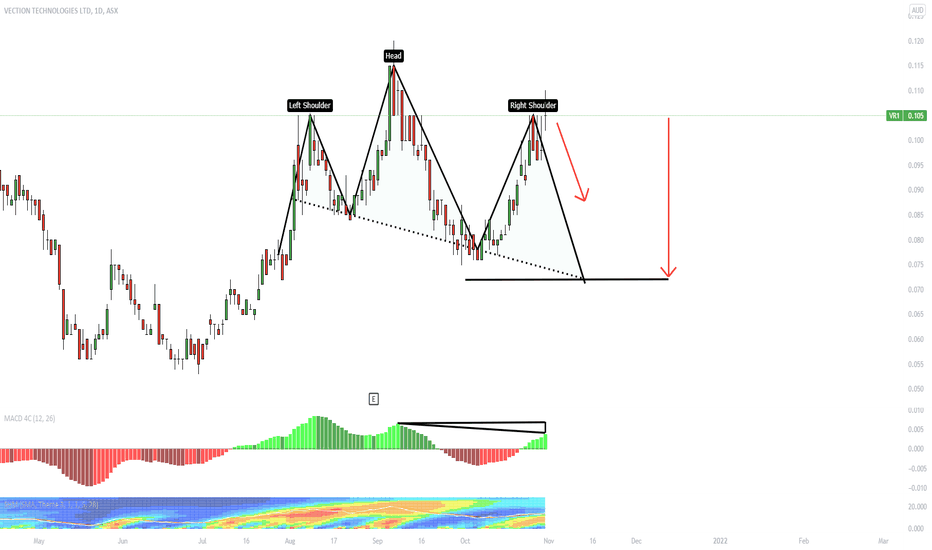

EURAUDIs in wave c. It corrects slightly downwards to complete wave 2 of wave c, and in total it will grow upwards in a wave of five waves in the form of wave c. Wave 4 will be completed in the higher time frame and then Wave 5 will start moving downwards as you can see in the figure.

In the coming weeks, I will update the Wave 4 price target in another post.

The entry range is specified on the chart.

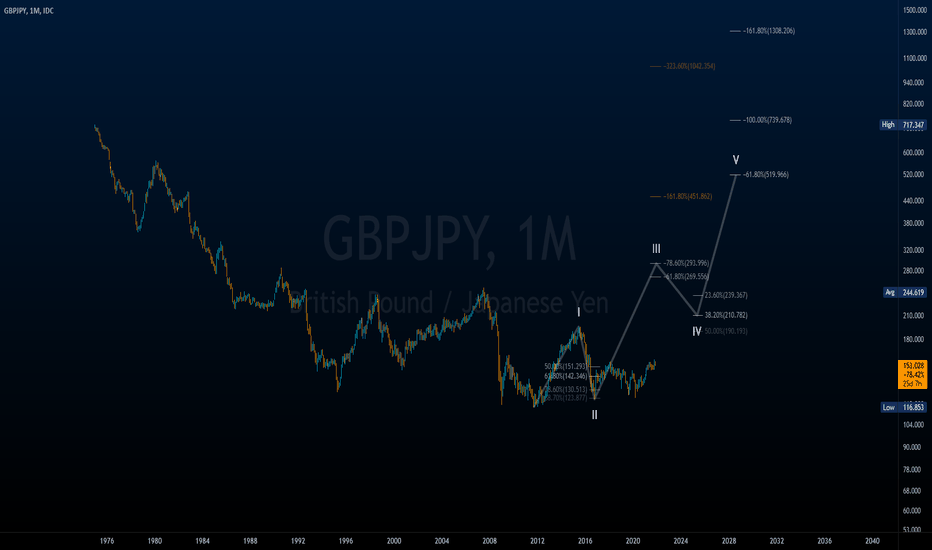

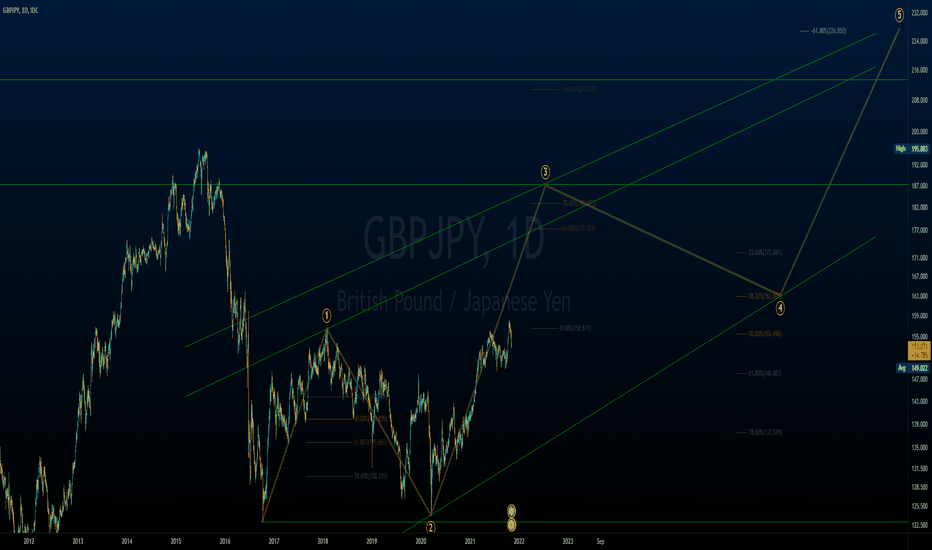

GBPJPY: Long Term Rally Seems Started?Long time after its' inception, GBPJPY seems like finally trying to stand up. It won't be easy to break decades long Bearish Bias. But we will start to see stong bulls gathering in the upcoming weeks, months...

And considering JPY is a safe-haven, think about the inflation awaiting us :)

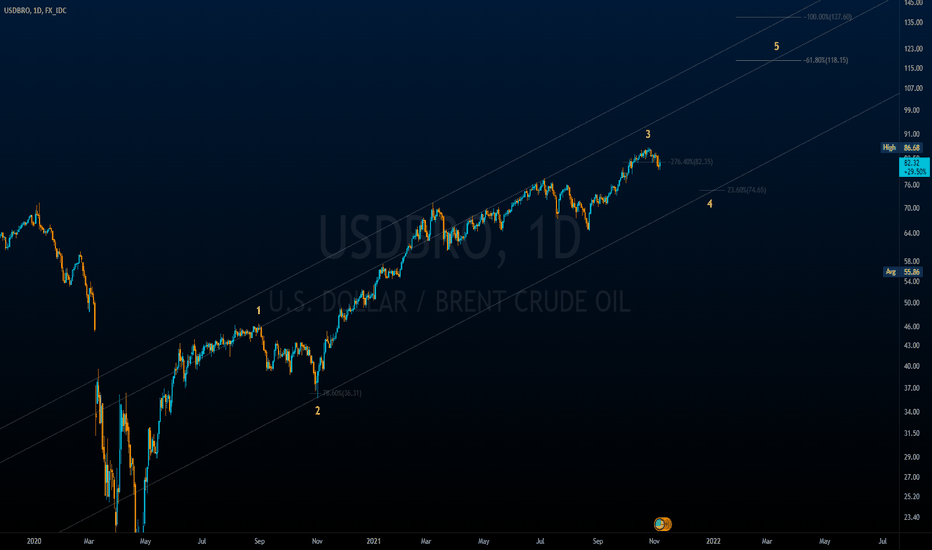

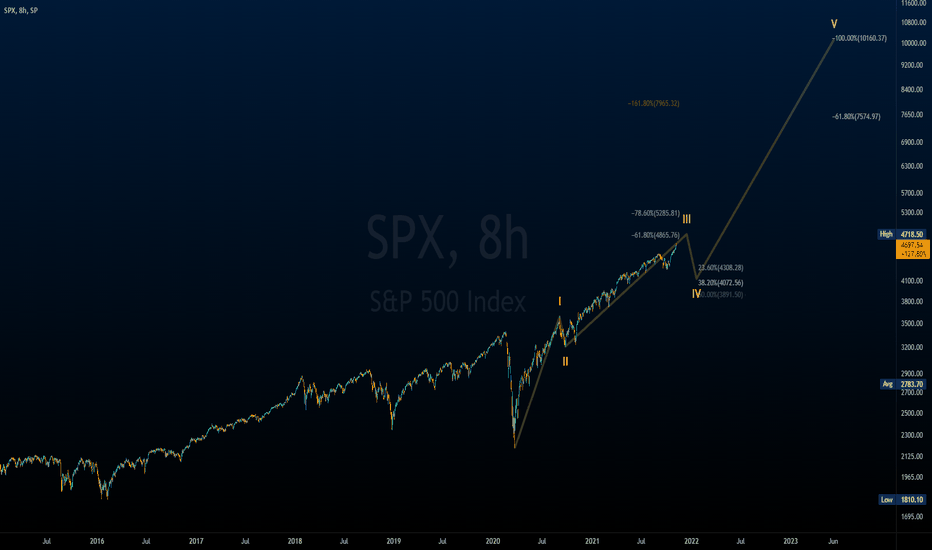

SPX: Long Term OutlookMeasuring the rally to see how next episodes could unfold. Currently 3rd wave's ending extension is happening. It will end up with double-top h&s formation, then we'll look for #4.

if #3's extension will complete at 61.8% or lower, then #5 strongly possible can suggest 10K for the final range.

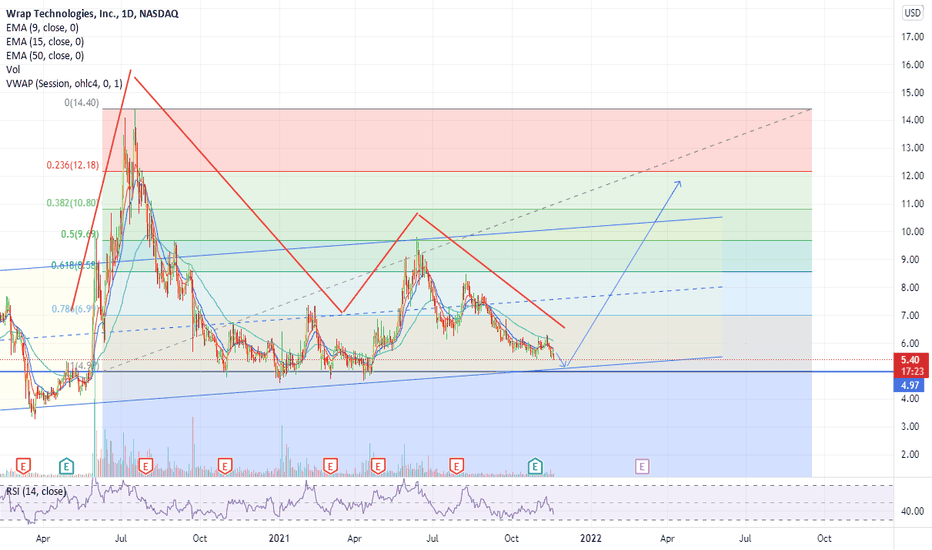

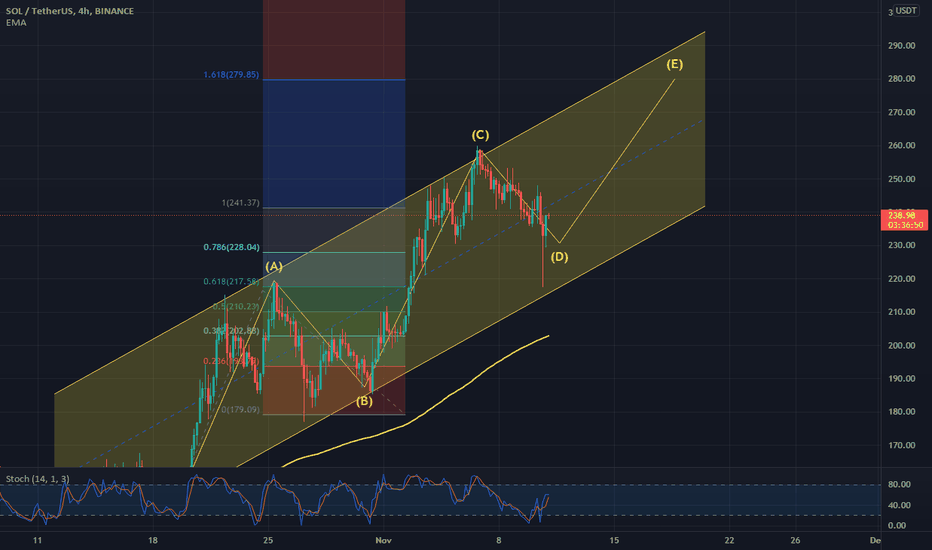

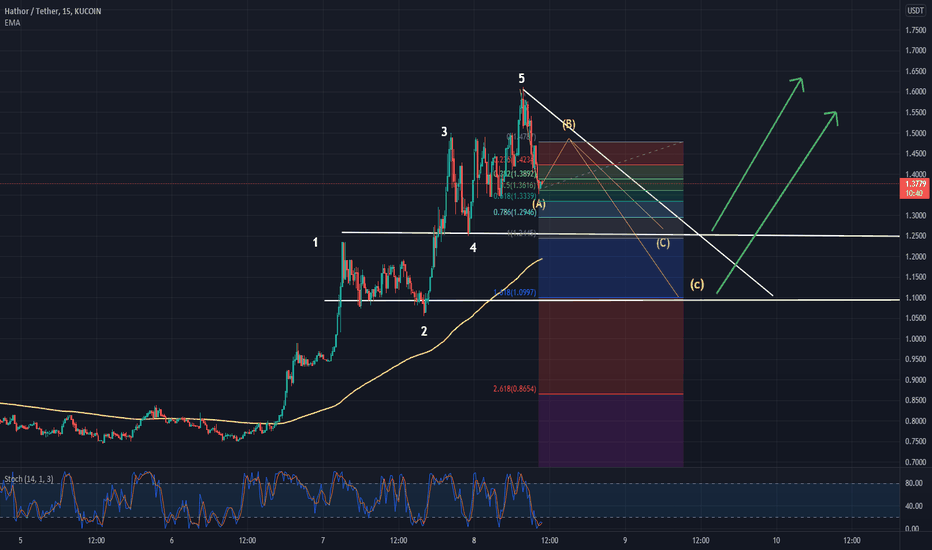

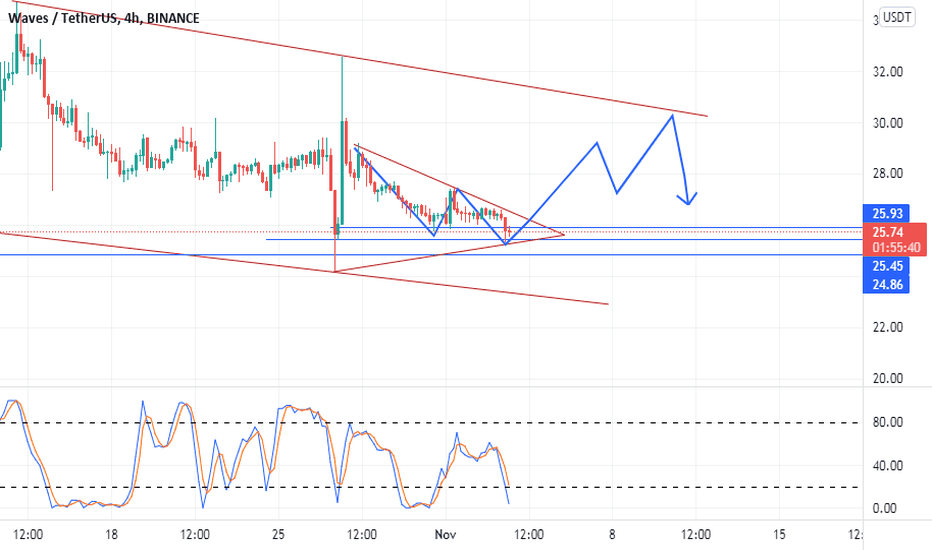

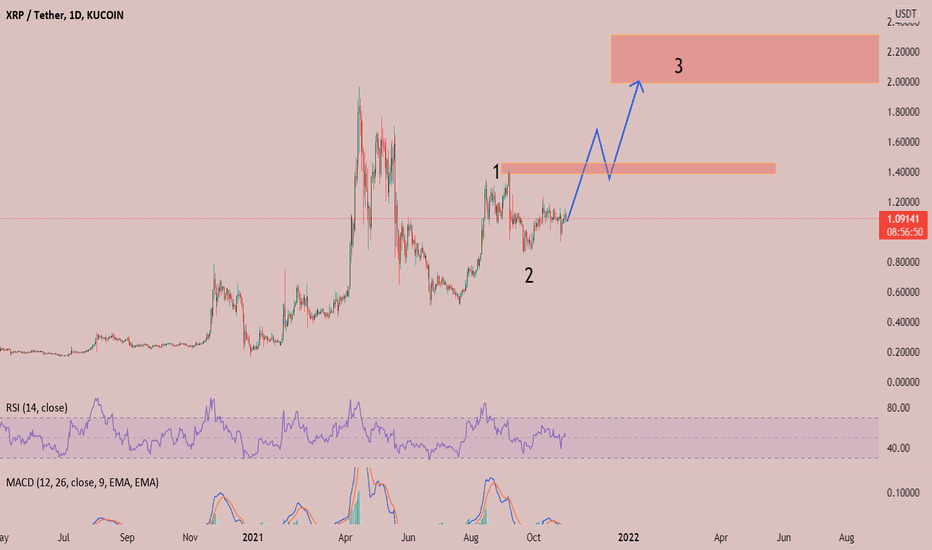

Wave next moveWave looks good and is it on its support you can long it with low leverage

trade at your own risk

sl=24.5

Tp=28$

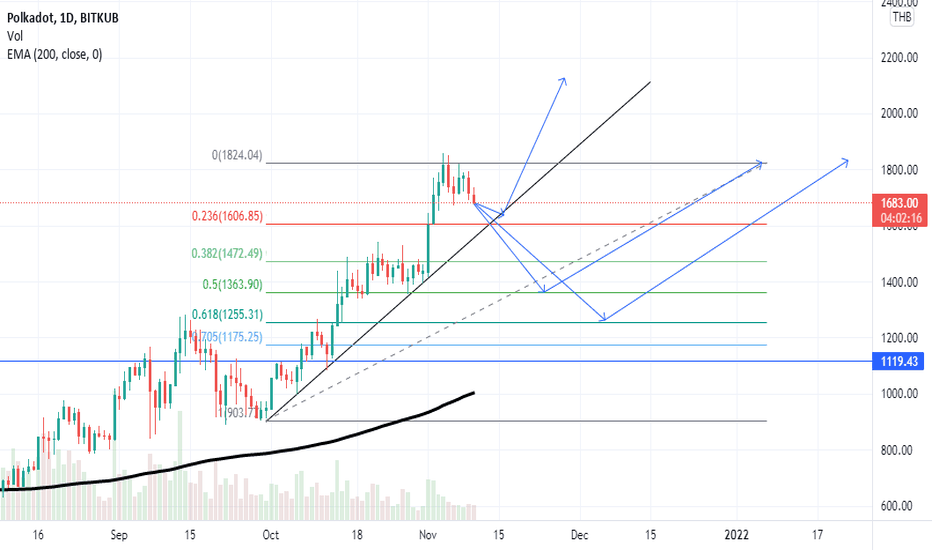

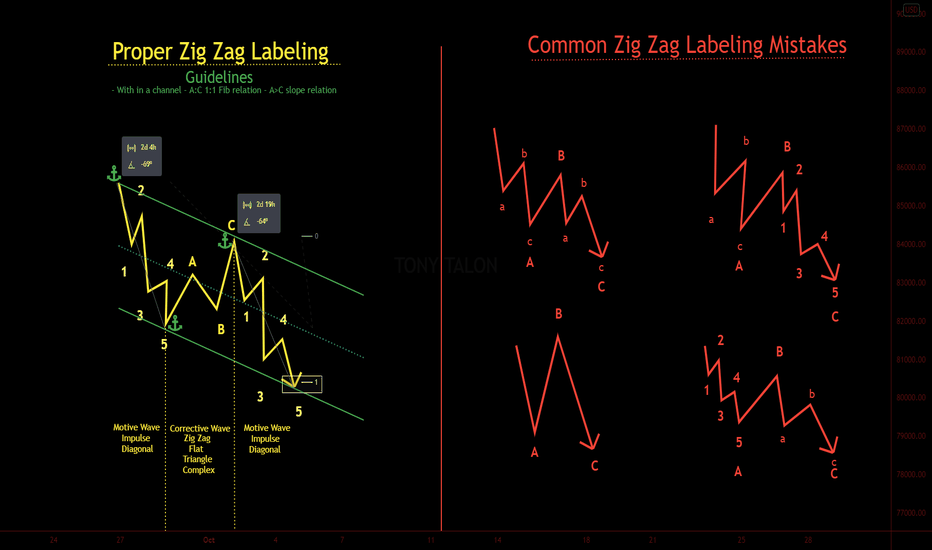

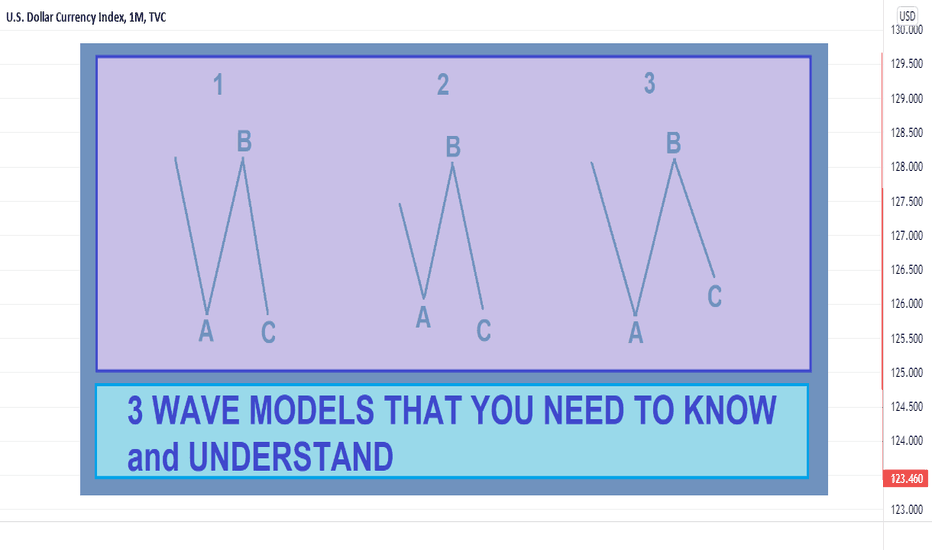

3 Wave Flat Patterns to Know and Understand📕📗📘In Elliott wave theory, a flat is a figure consisting of three waves, the ends of which are called ABC . This is a corrective pattern going against the trend. This pattern may look like a simple range that spends more time on sideways movement than on a real price increase. The pattern, as a rule, is a shallow pullback of the previous trend and can sometimes be a "flag" of the general flag pattern .

❗️In fact, there are 3 types of flat correction: regular (1), elongated (2) and launched (3). The name of the template by which you identify the correction is not as important as what it implies. In each of the above-mentioned corrections, lateral consolidation is implied, which will eventually resolve as a complete recovery of the model and continuation of the trend until entering the flat model.

📊Trying to define a plane Elliott wave , we are looking for several characteristics.

1.ABC-plane subwaves (regardless of the 3 types above) are divided into 3-3-5.

2.In the flat, look for the second wave or the "B" wave, which rolls back by 78-138% from the "A" wave.

📈The three waves on the plane ( ABC ) are divided into 3-3-5, which means that there are 3 sub-waves in leg "A", 3 sub-waves in leg "B" and 5 in leg "C". underwater waves in it. Since both branches "A" and "B" contain three subwaves each, this illustrates the struggle of the instrument to create a new trend against the previous trend. Consequently, prices eventually fluctuate sideways, eating up more time than prices.

📉When defining corrective patterns, one thing should be kept in mind: there will always be five sub-waves in the "C" legs (the only exception is triangles, since they contain only three sub-waves). Therefore, if you see a 5-wave movement preceded by several 3-wave movements, count in reverse order and see if the flat pattern works.

🚀Flats appear where any three-wave corrective movement can manifest itself. For example, you will find flats in the position of the 2nd or 4th wave of the pulse, in the wave "B" of the zigzag , in the waves W, Y, Z or X of the complex correction, or in the waves "A" of the wave of another flat. However, one corrective structure in which you won't find a flute is triangles. Triangles are constructed from zigzags or other triangles.

🍁As a result, their identification in real time may be difficult. Go to the next higher trend level to see what the larger structure might be, and use wave measurements to anticipate the end point of the pattern. Since they essentially form a range, range trading methods and risk levels are recommended for trading on them.