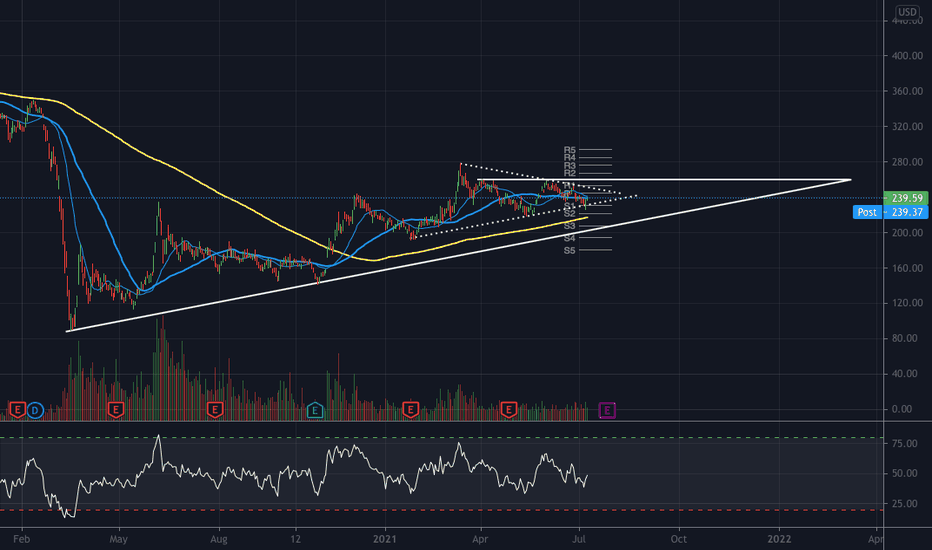

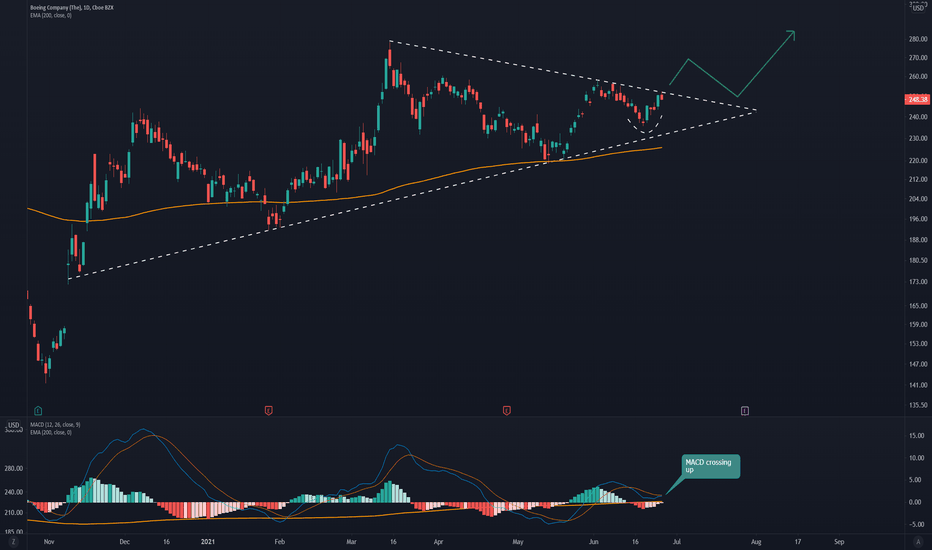

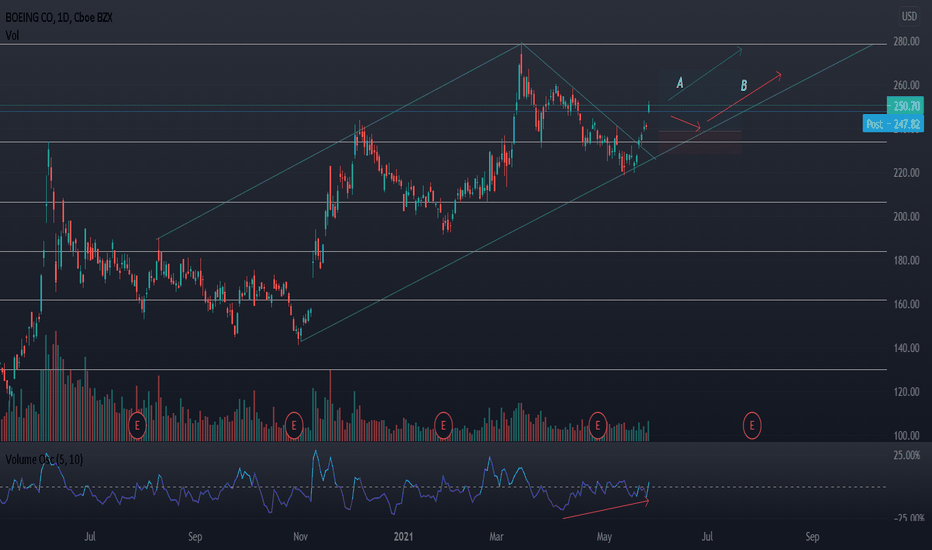

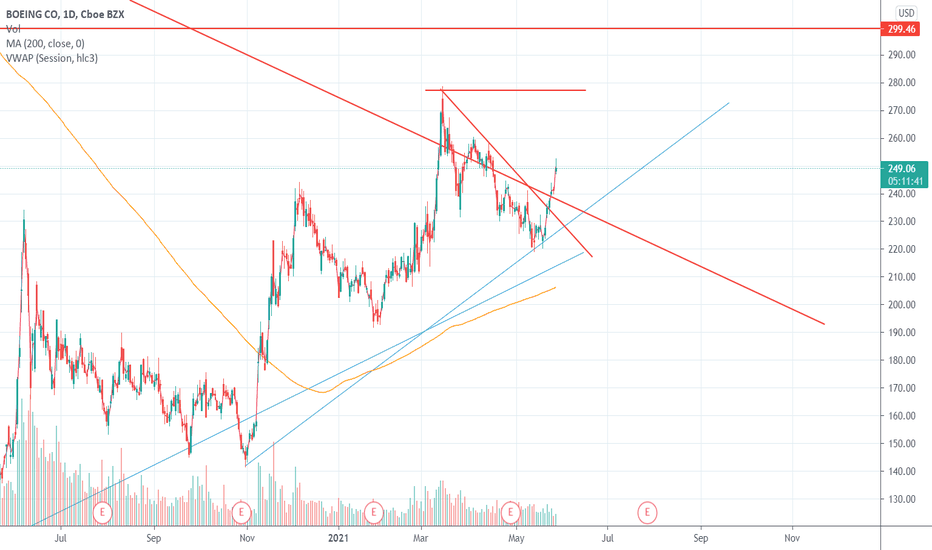

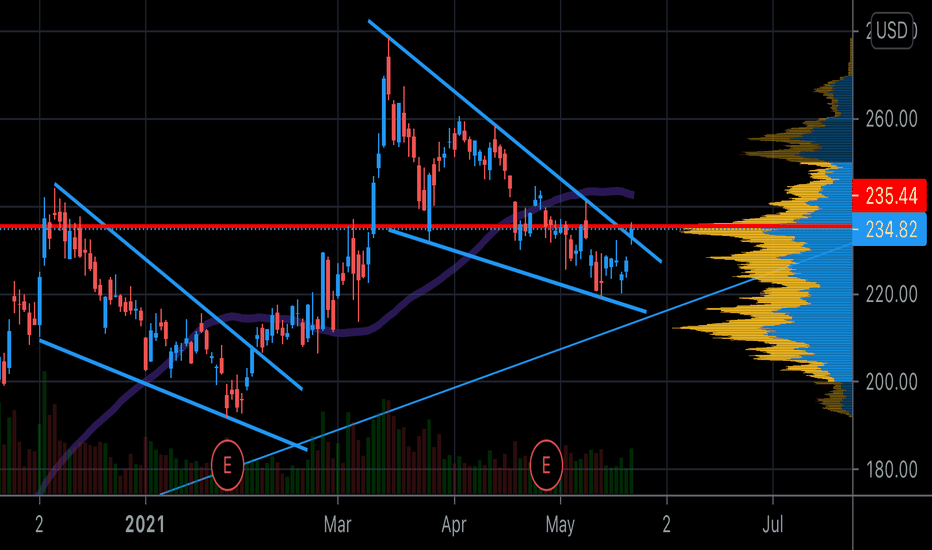

BA - Symmetrical Triangle" in an "Ascending Triangle?"Boeing received good news, "Boeing Max Edges Toward China Return as Test Flights Near."

- 20MA & 50MA above the 200MA.

- Bullish Engulfing pattern on Thursday (7/8/21) w/ strong bullish volume.

- Bounce off of Symmetrical support. Could revisit 200MA (yellow line) to test a bounce if bullish momentum is short lived.

However, I am uneasy about the market in general (inflation, COVID variations, etc.). BA could potentially drop back to $221 before climbing to $253.65, unless more good news is released.

Short Term: BULLISH (2 weeks)

Hedging with 8/20 Puts wouldn't be terrible.

BA

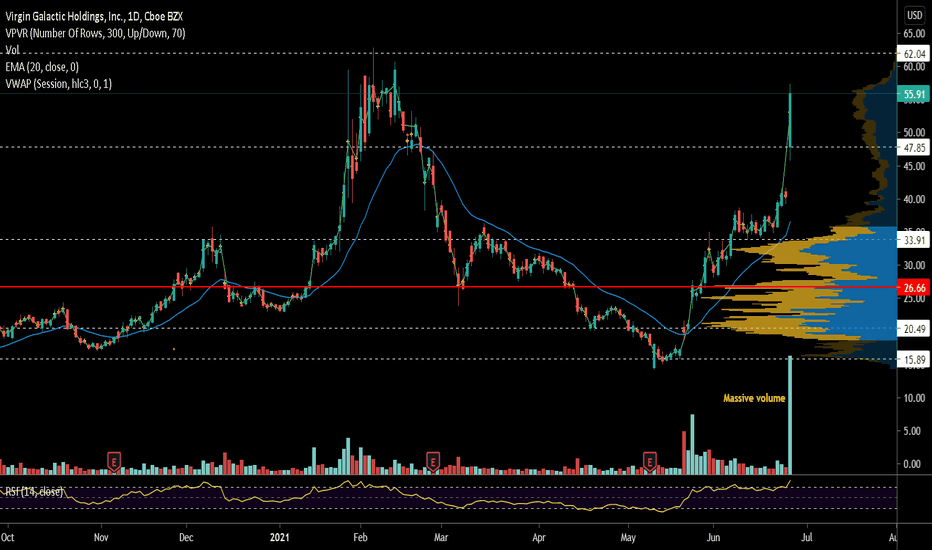

SPCE receives FAA approval to fly passengersThere is 20% short interest or roughly 34 Million shares short. Options action - On friday, there was buying in the 7/16 $60 and $70 calls. Its also one of most mentioned tickers in fintwit. On the 4 hour chart, vwap is $53. That could be good entry, if it goes to that price. Good luck!

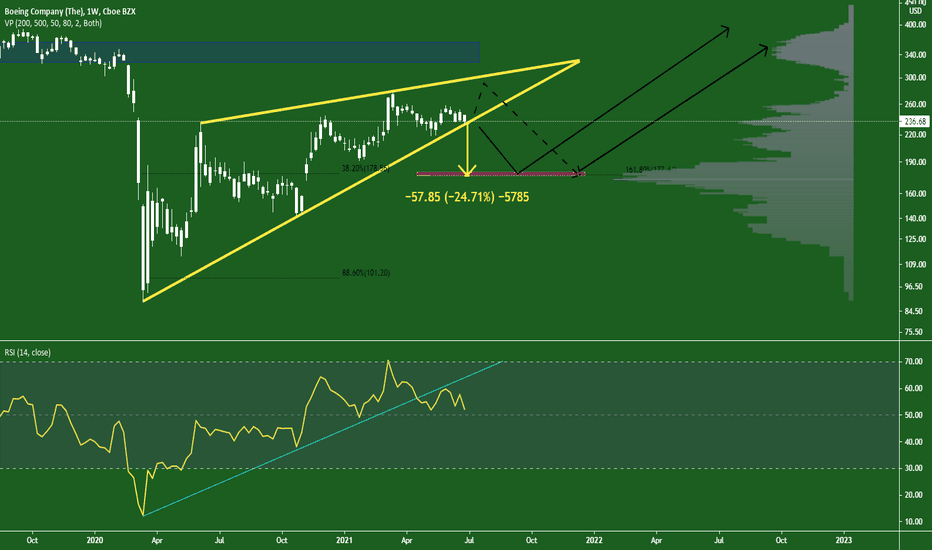

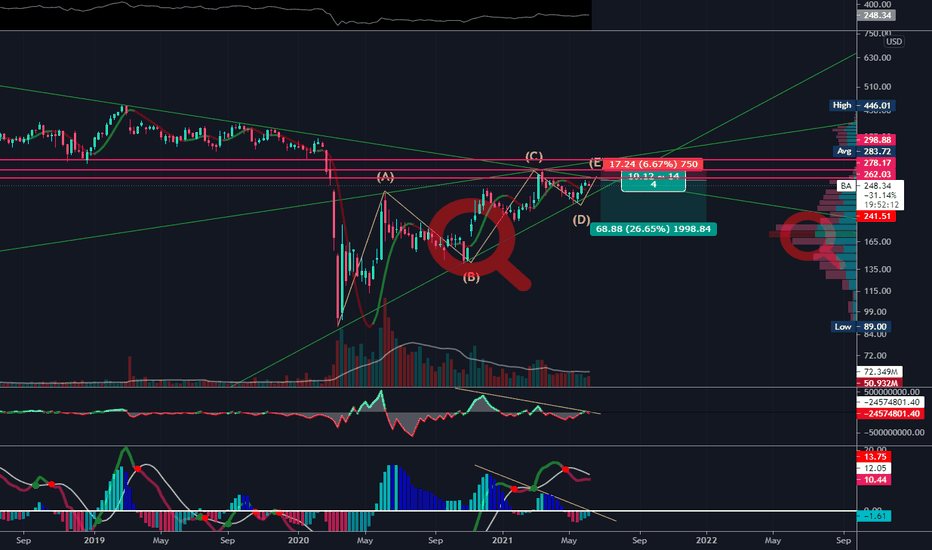

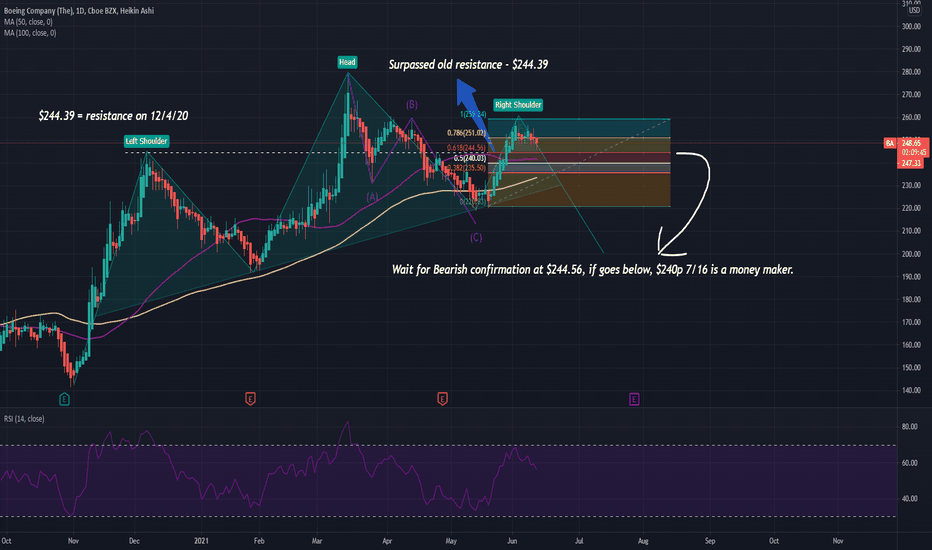

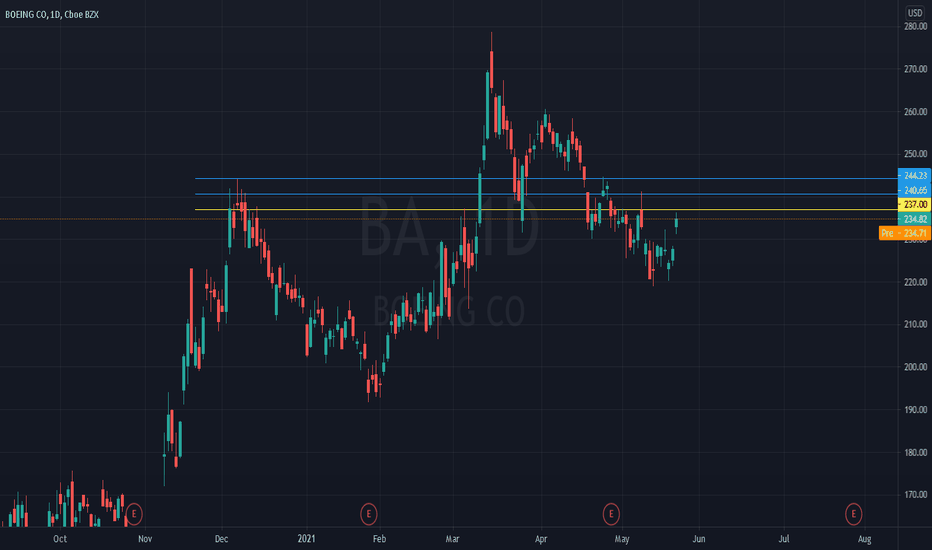

BA - HUGE PUT PLAY NEAR FUTUREAll,

This is weekly chart, but I see this playing out to the downside rather largely. In part due to the visible range/session show some low volume areas that will be slid through once breaking. Need first conformation of break but I may enter soon.

PT#1: 195

PT#2: 188

PT#3: 163

Then swap to long once confirmed

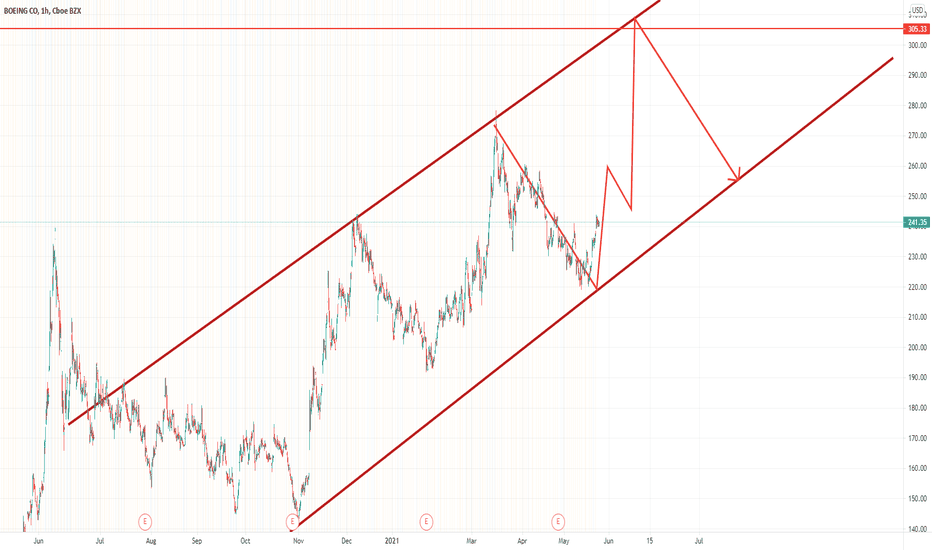

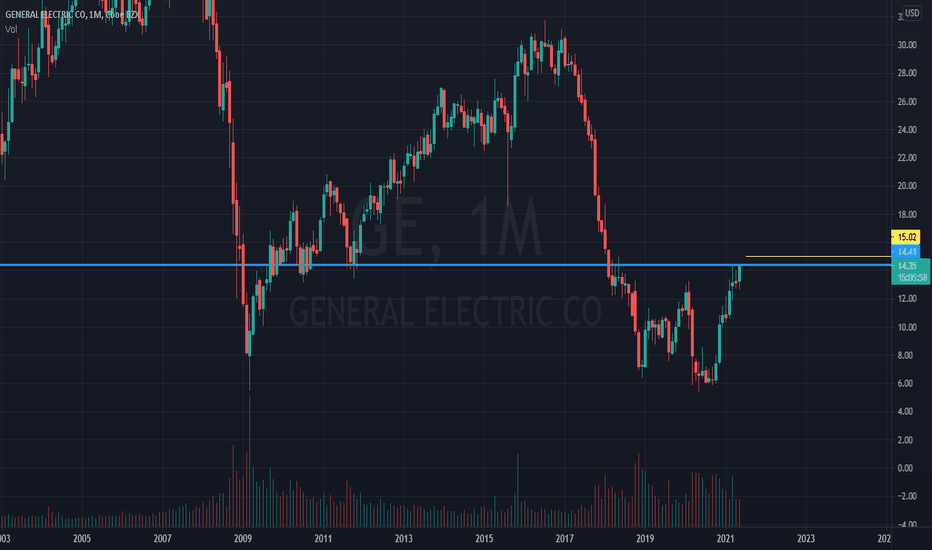

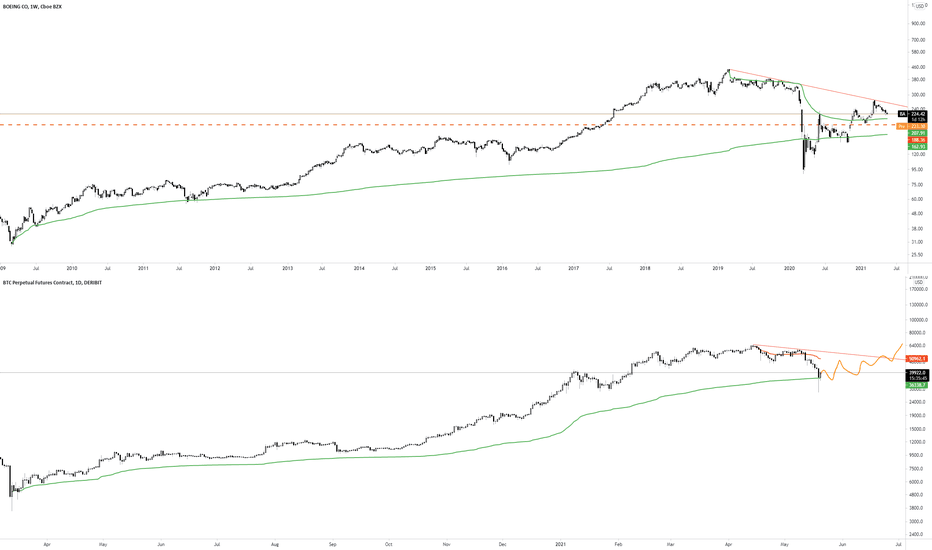

BA aka Boeing IdeaG'day Guys.

Today we analyse BA aka Boeing.

Since last drop from previous high on Feb 11, 2020 at 349.76 its took around 1 month to reach low area on Mar 18, 2020 at 89.19 Low.

In progress of recovering, and started to create uptrend channeling on Oct 30, 2020 at 153.74 area and take 3 month to break previous high that happen on Jun 8, 2020 at 241.24 area which is new high was 244.24 on Dec 20,2020

This showing that BA was improving positively.

Next target that for this pair will be 305.33 area. If this happen, new high will be created before Feb 11,2020 crash.

Let's see what happen next.

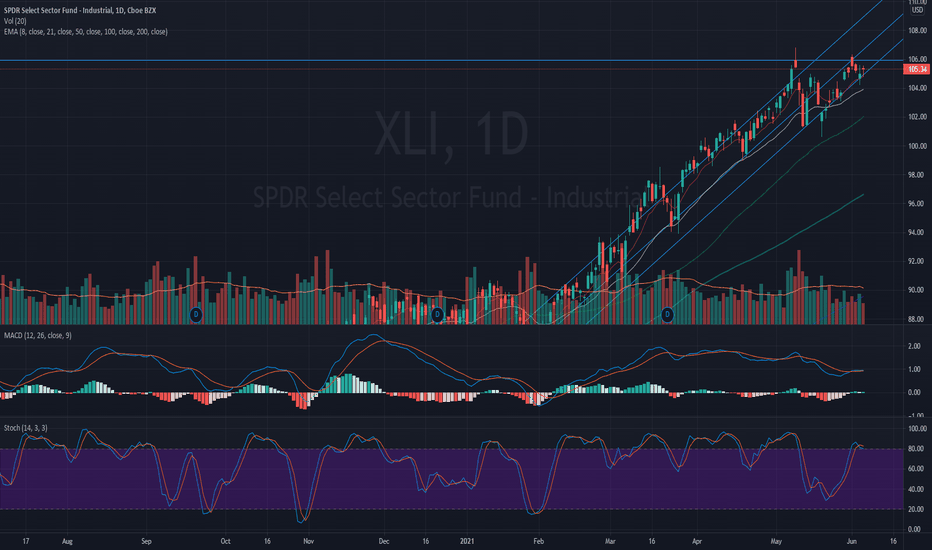

Industrials needs a breatherXLI, the Sultan, was the ultimate DOW mover. He ruled over everyone including hedge fund managers. Tuesdays action to the upside was great but gave it up at the end of the day. Wed and Thursday continued to the downside. On Friday, the Sultan tapped the 8 day EMA and came back up but closed below previous day high. The issue with XLI is the channels are small. If this low channel is to break, look out below cause I'm thinking of a 3 point move down to 102 as support. Based on HON, FDX, and UPS, Sultan's rule might be done for this coming two weeks.

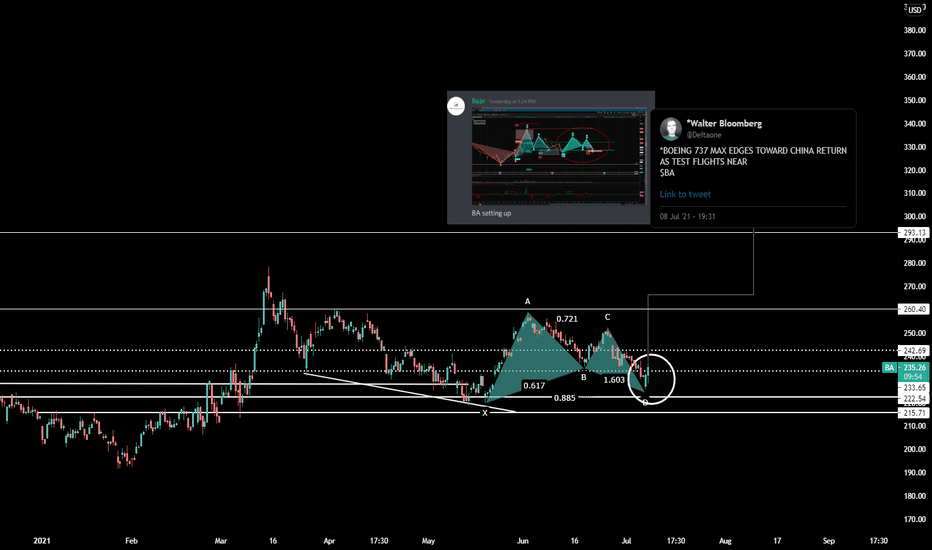

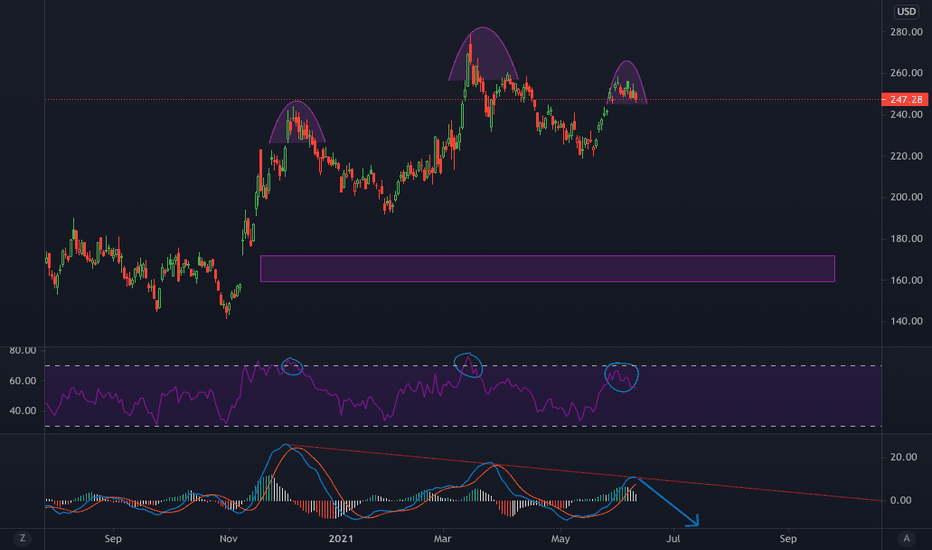

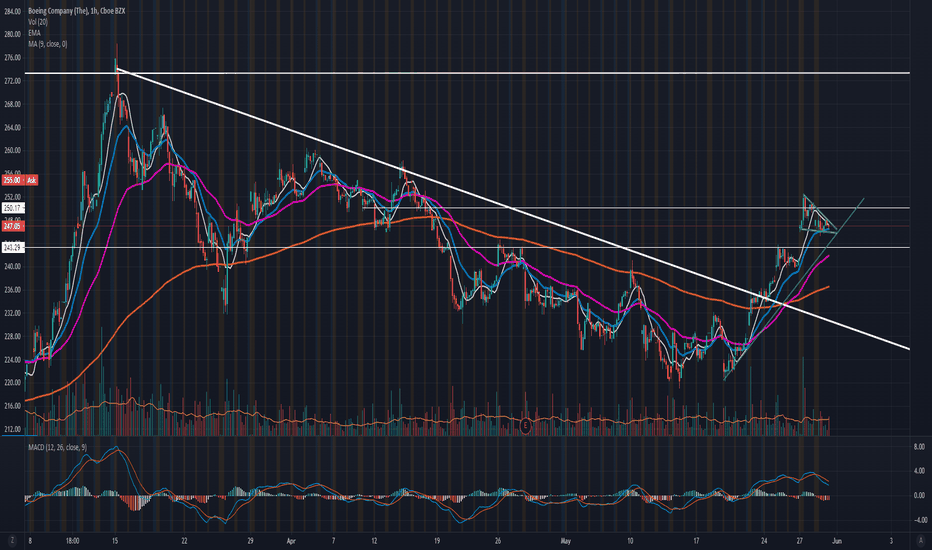

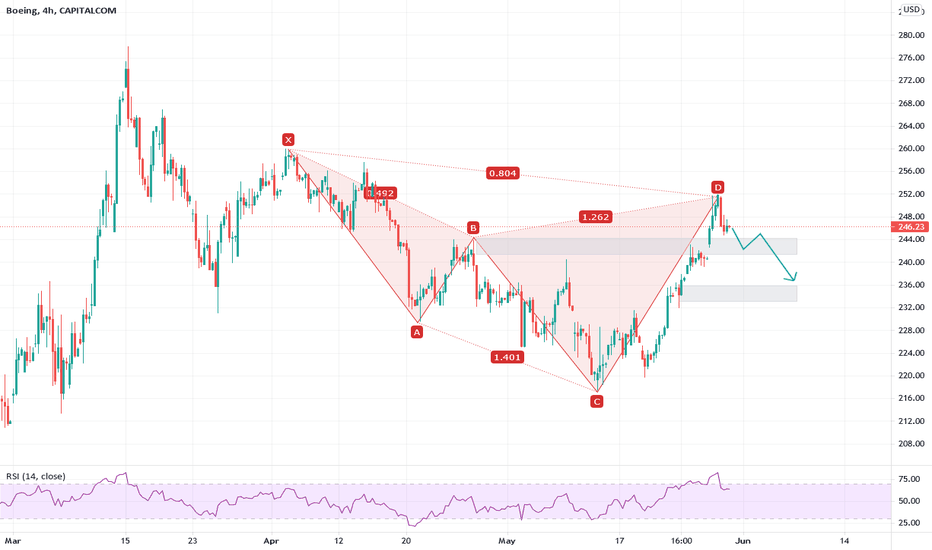

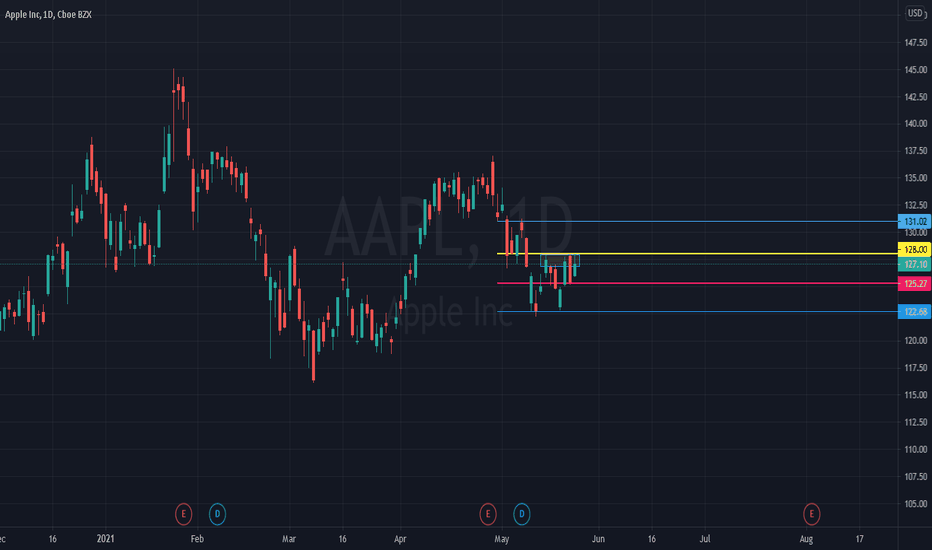

#BA - Two path, same destination. Since March 15th, BA has been struggling with a two month downtrend after a good 2020 price recuperation.

Its clear how the downtrend was loosing volume and strength with the pass of the days.

We can observe, a really good bounce on 220-225 price level (Previous key resistance) and a breakout of the midterm downtrend.

Still really far from 2018-2019 prices, BA its showing a decent recovery and I think our first target is the last maximum at 278 USD. Last week we had a +14% increase, so I expect a little correction here and a bounce at 240 USD level. (or maybe not). Two possible paths, but the same destination.

A

- Opening position: 250USD

- Stop Loss: 230 USD

- Price target 1°: 278 USD

- R/R: 1.44

B

- Opening position: 245USD

- Stop Loss: 230 USD

- Price target 1°: 278 USD

- R/R: 2.77

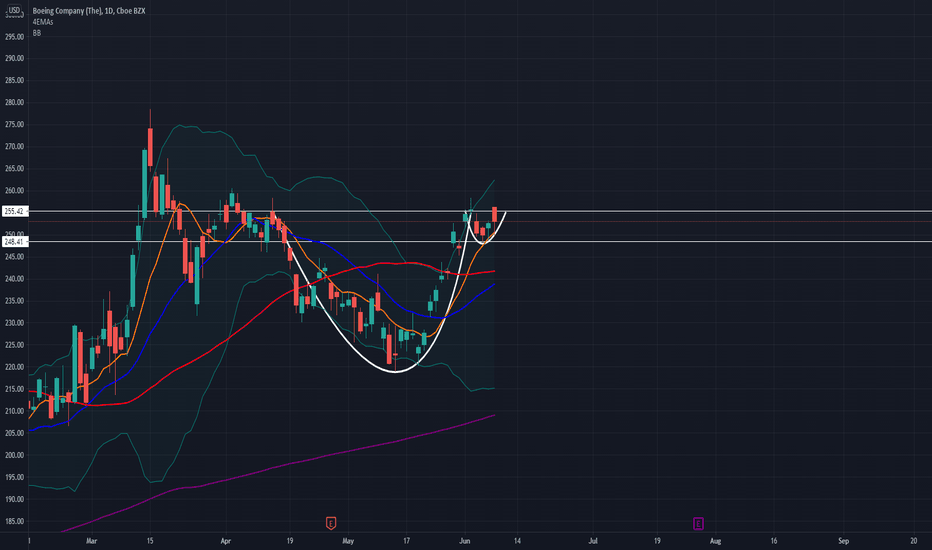

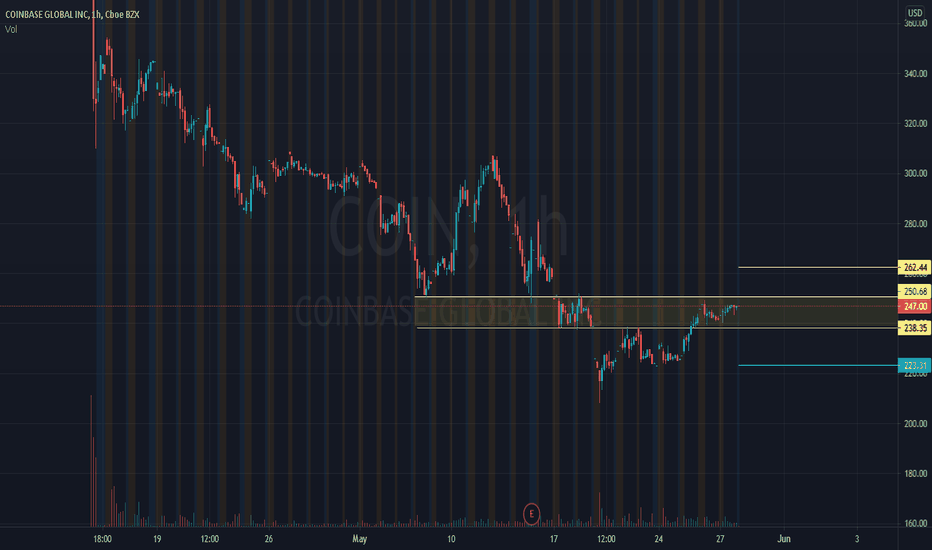

Might keep moving up, test 260, then 277 resistance levels.Please note this is only an idea, invest at your own risk.

Resistances shown in red, supports or trendlines in blue .

I believe it will try to test the 260 resistance, if it breaks above, then expect a retest of a strong 277 resistance. 261->275 could be an easy ride.

Stock is back above 200MA, but short-term MA do not look too confident yet.

Happy to get feedback on my idea.

BA out of descending wedge with bounce on retest! BREAKOUT ALERTThe last two times BA has seen this defending wedge breakout since the covid drop it’s seen multi day runs. This could be the start of another leg up and possibly the 300 move. Will be looking to play the breakout not longer dated calls since it’s been so news driven. Will just buy and roll shorter calls as the opportunity presents itself. It has been so news driven I don’t want to play the longer calls and tie up capital. Will be looking at the MA for scales 50 MA is shown and just above current levels.