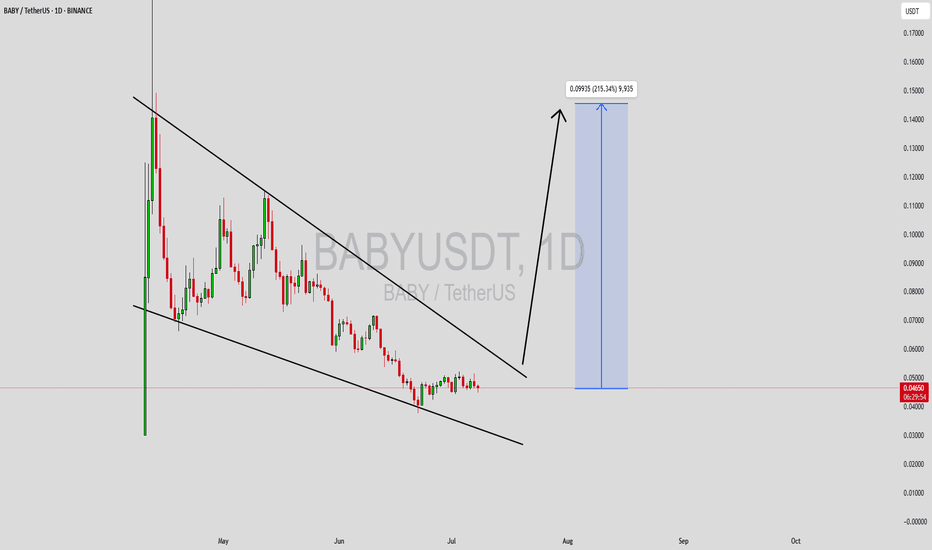

BABYUSDT Forming Falling WedgeBABYUSDT is showing an exciting setup for traders and investors alike, as it forms a clear falling wedge pattern on the chart. This classic bullish reversal pattern often signals that downward momentum is exhausting and a powerful breakout could be on the horizon. Based on this setup, BABYUSDT holds the potential to deliver substantial gains in the range of 190% to 200%+, making it one of the most attractive altcoin plays to watch right now.

One of the key factors strengthening this breakout thesis is the consistent and healthy volume profile supporting this pattern. A falling wedge breakout accompanied by strong volume is a reliable sign that buyers are stepping in aggressively, fueling the momentum required to push prices higher. As more investors take notice of this breakout opportunity, the probability of a sustained rally becomes increasingly likely.

Additionally, the BABYUSDT project continues to gain traction among retail and institutional investors, with growing community interest and active social buzz. This surge in investor sentiment can create a positive feedback loop, driving more accumulation and helping the coin achieve its projected upside targets. The combination of technical precision, supportive volume, and investor enthusiasm makes BABYUSDT a compelling candidate for any crypto watchlist.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Babybtc

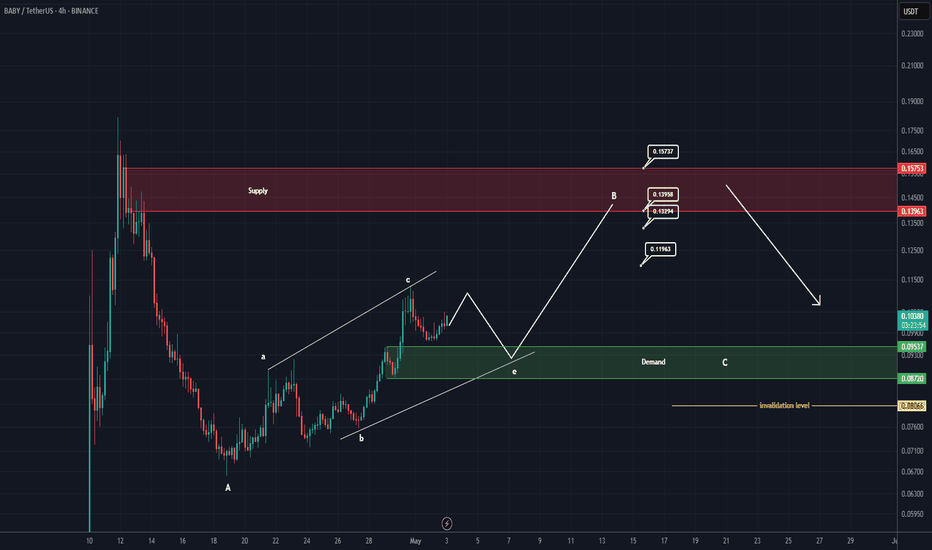

BABY Looks Bullish (4H)Note: Given the corrective nature of the market, only consider entering this symbol within the green zone. Move to break-even at the first target.

According to the Baby structure, this symbol appears to be aiming to remain bullish.

From the point where we placed the (A) on the chart, expansion waves have started on this symbol.

As long as the green zone is maintained, the price can move toward the targets.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You