28/10/2022 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello Guys,

Good Morning Everyone,

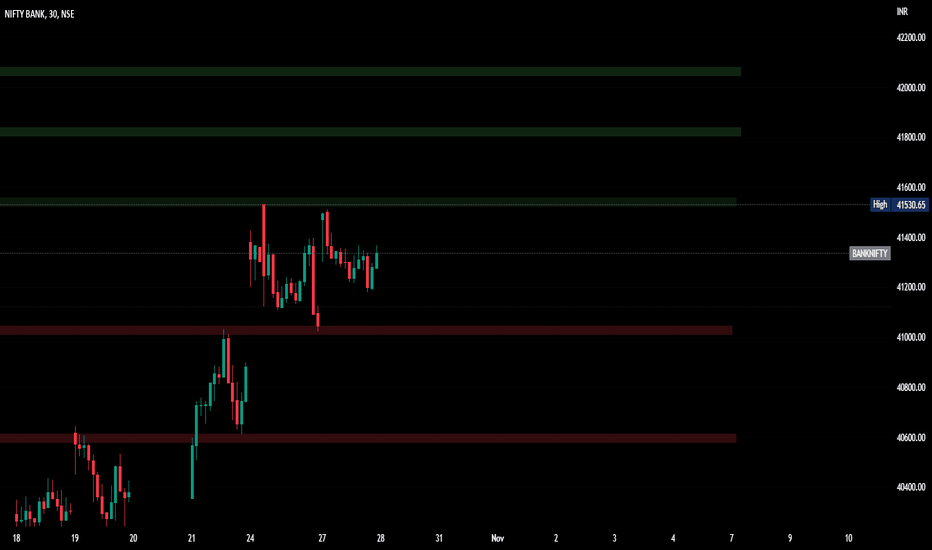

Today also banknifty will open with a gap up and second thing continues last 3 days banknifty and nifty playing in a range may be today doing well. so we have two plan .

* If Banknifty after a gap up sustain 41500 level then open target for 41800-42000

* If Banknifty Sustain below low 41000 level then open target 40800-40600

Bankniftylevels

27/10/2022 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello,

Good Morning Guys

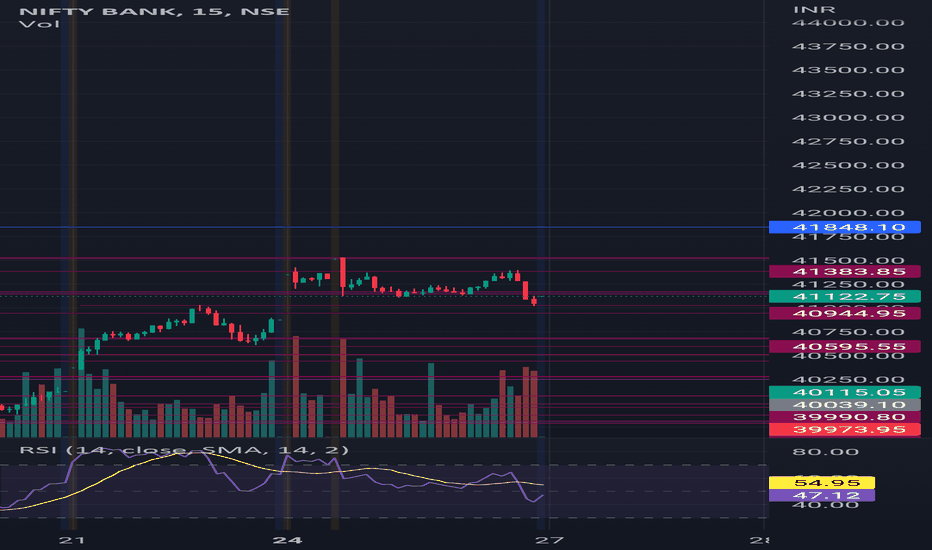

As per data Market will open with a gap up so now we have 2 option to trade the banknifty .

* If banknifty open a gap up and break last day high((41500) and sustain above you can focus for long .

*After opening a gap up if banknifty not sustain last day high and play below last day high you will be alert may be banknifty moving in a range

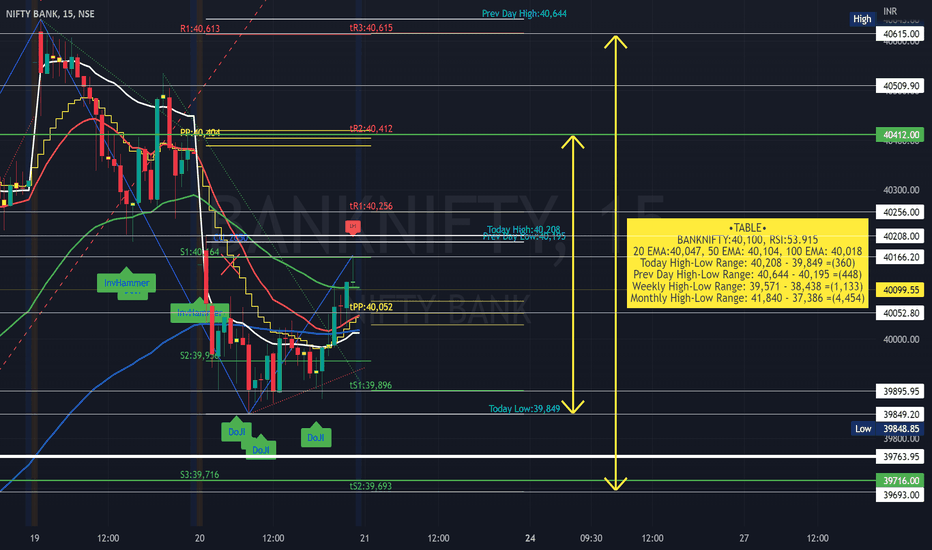

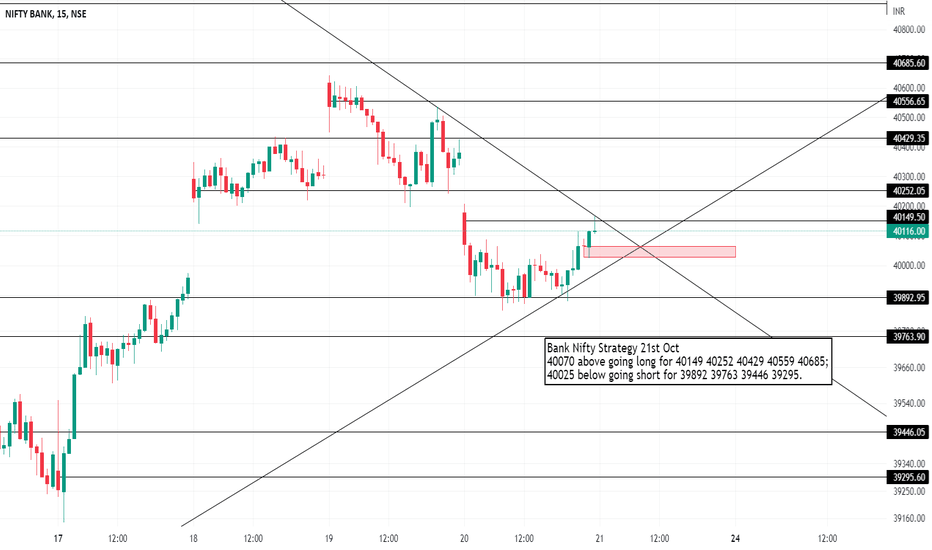

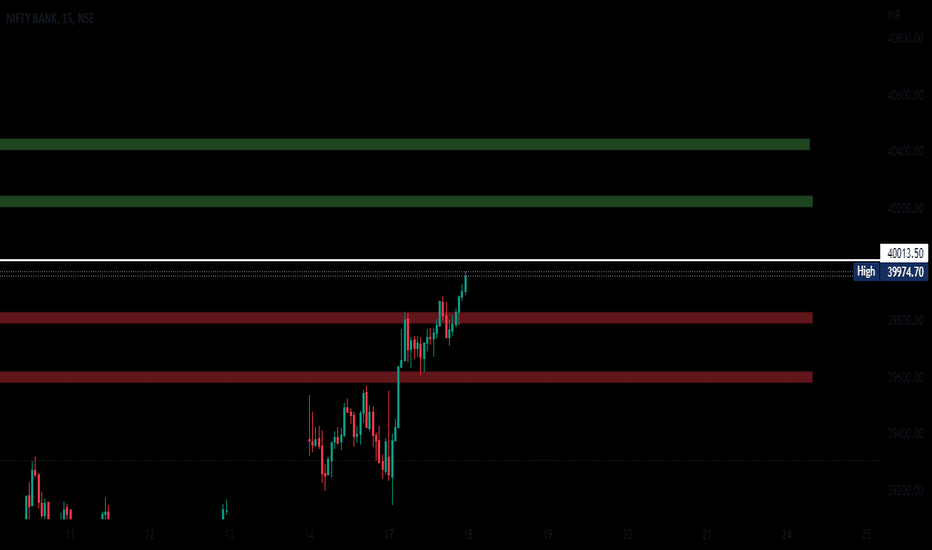

21/10/2022 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello Guys,

Good Morning Guys,

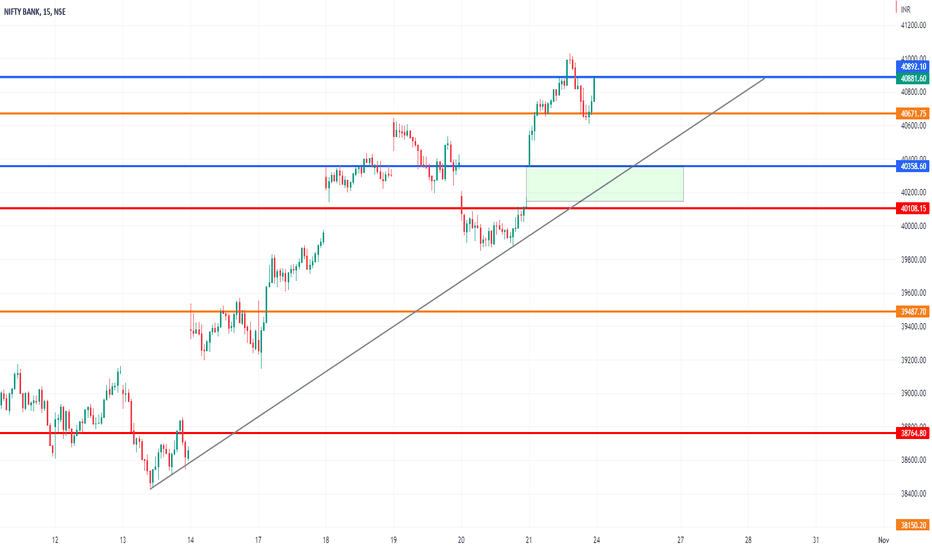

As per global market over view Banknifty today will open flat. Now we have two option to trade.

*If banknifty today break and sustain above the yesterday high that was 40200level then open target 40400-40600

* Or banknifty break the the trend line and sustain below yesterday low that was 39800 level then open target 39800-39600 NSE:BANKNIFTY

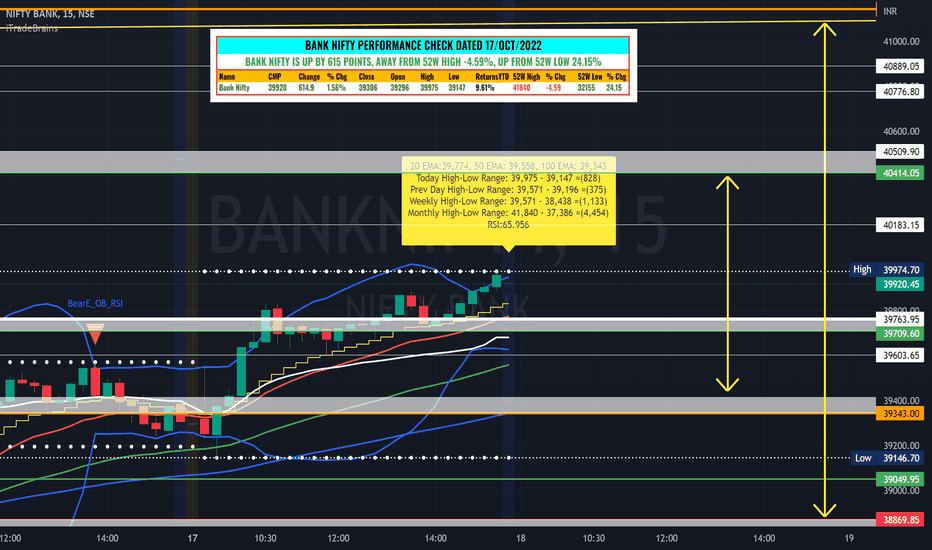

Bank Nifty Levels & Strategy for 21/Oct/2022Dear traders, I have identified chart levels based on my analysis, major support & resistance levels. Please note that I am not a SEBI registered member. Information shared by me here for educational purpose only. Please don’t trust me or anyone for trading/investment purpose as it may lead to financial losses. Focus on learning, how to fish, trust on your own trading skills and please do consult your financial advisor before trading.

BANK NIFTY

Bank Nifty slipped in red and Bears are trying to regain the control. Today, once again Bears as well as Bulls were rewarded who traded based on good quality setup. Buy on only when price action indicate you to buy & vice versa in case of sell. PCR is indicating weakness & weakness in Indian Rupee is hurting Indian traders. We have Diwali two days of Diwali vacation prior to October expiry. Please avoid trading (specially buying) in weekly options. Your overnight position must be hedged & trade based on good quality trade setup.

Bears have slightly upper hand at higher levels. Shall we continue to buy on dips & sell on rise with strict SL untill market trend is clear? Yes, I think so. Please share your thoughts.

BANK NIFTY SCORECARD DATED 20/OCT/2022

BANK NIFTY IS DOWN BY -274 POINTS

Name Price Previous Day Change % Change

Bank Nifty 40100 40373 -273.65 -0.68%

India VIX 17.23 17.49 -0.25 -1.46%

OPTION STATISTICS BASED ON 27/OCT/2022 EXPIRY DATA

Max OI (Calls) 41000 (Open Interest: 1750875, CE LTP: 120)

Max OI (Puts) 39000 (Open Interest: 1507475, PE LTP: 72.7)

PCR 0.84 (PCR is in bearish zone)

Bank Nifty Calls:

ATM: Short Buildup, OTM:Short Buildup, ITM:Long Liquidation, FAR OTM:Short Buildup

Bank Nifty Puts:

ATM: Long Buildup, OTM:Short Buildup, ITM:Short covering, FAR OTM:Short Buildup

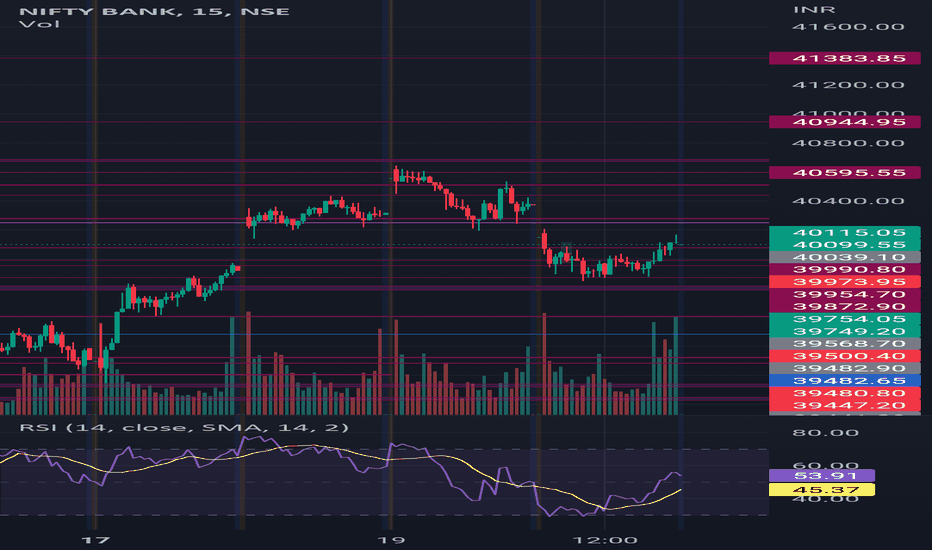

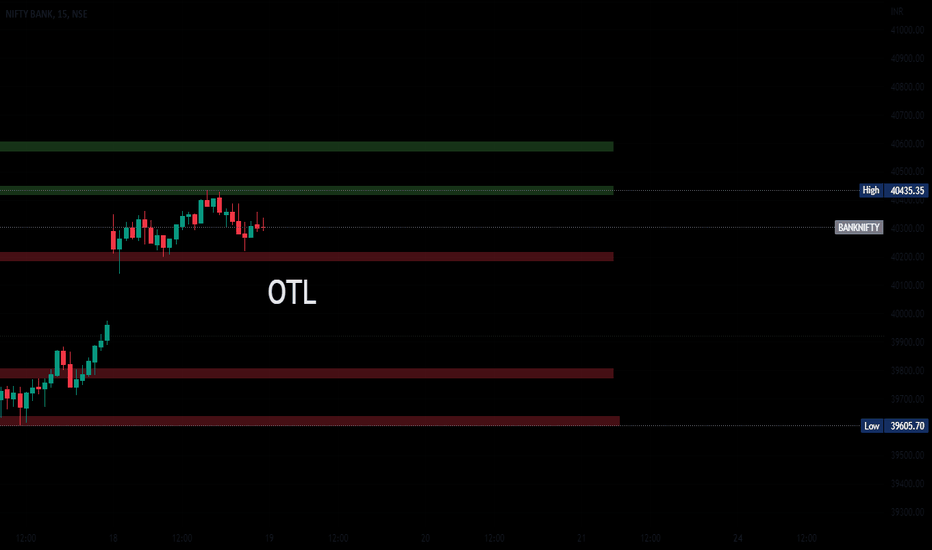

20/10/2022 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello guys,

Good Moring everyone,

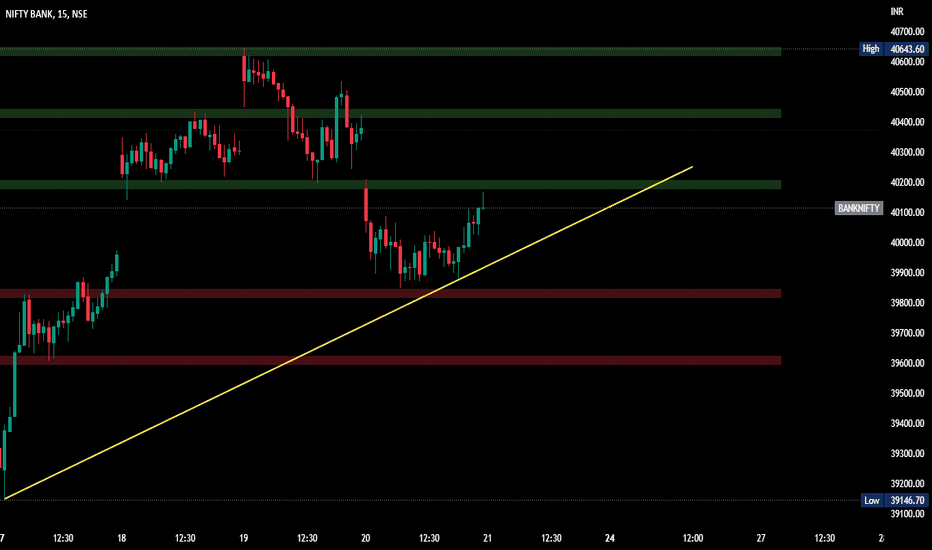

Today banknifty will Open a big gap down now we have two option to trade.

*After a big gap down if banknifty taking support from 39800 will focus on CALL side target level yesterday high(40600)

* If banknifty after a big gap down break 39800 level and making resistance zone we will focus PUT side open level 39200

19/10/2022 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello,

Good Morning Guys,

Now we have to Ways

* If banknifty open yesterday low (40200) above and sustain then it will be it go up side open target 40600

*if banknifty open yesterday low(40200) and sustain then it will be go down side so open target 39800

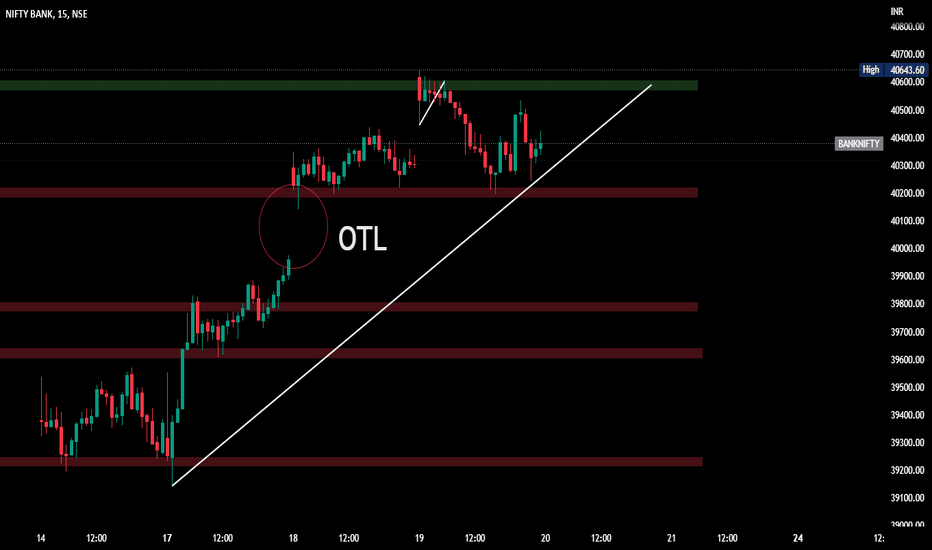

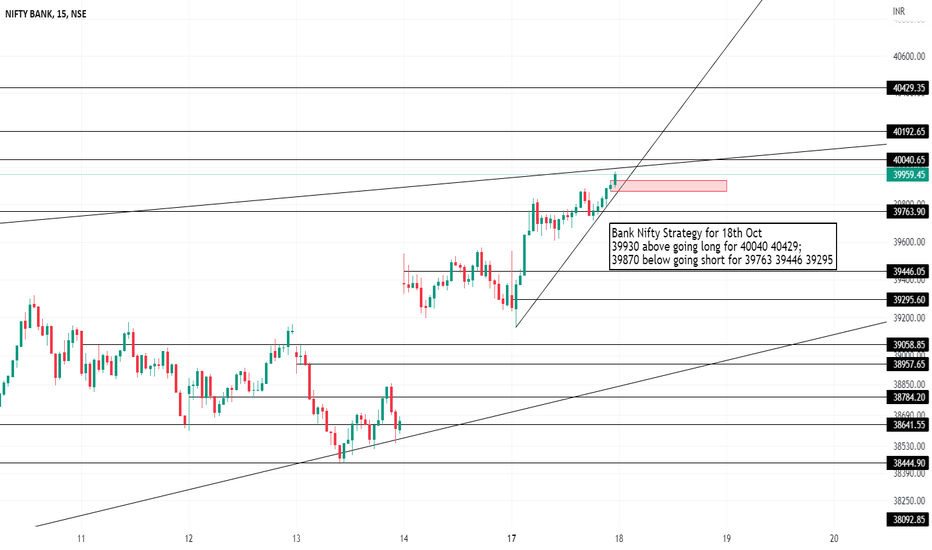

18/10/2022 BANKNIFTY SUPPORT AND RESISTANCE ZONEHello Good Morning Guys,

After A trending day may be banknifty today playa in a range so major level 40000

* If banknifty open gap up and taking a retracement above 40000 then we focus on long side. level (40200-40400)

* Either banknifty open gap up and taking retracement and moving below 40000 then focus on short side level (39800- 39600)

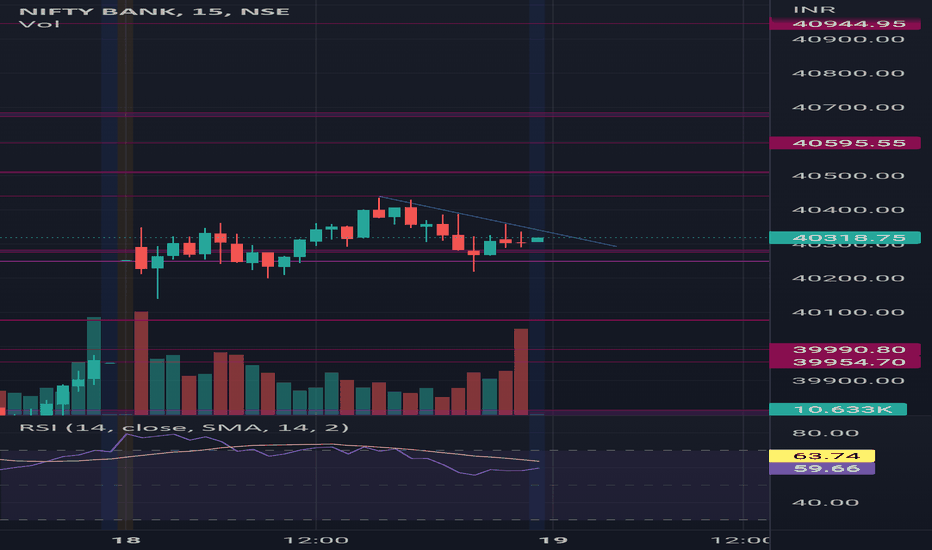

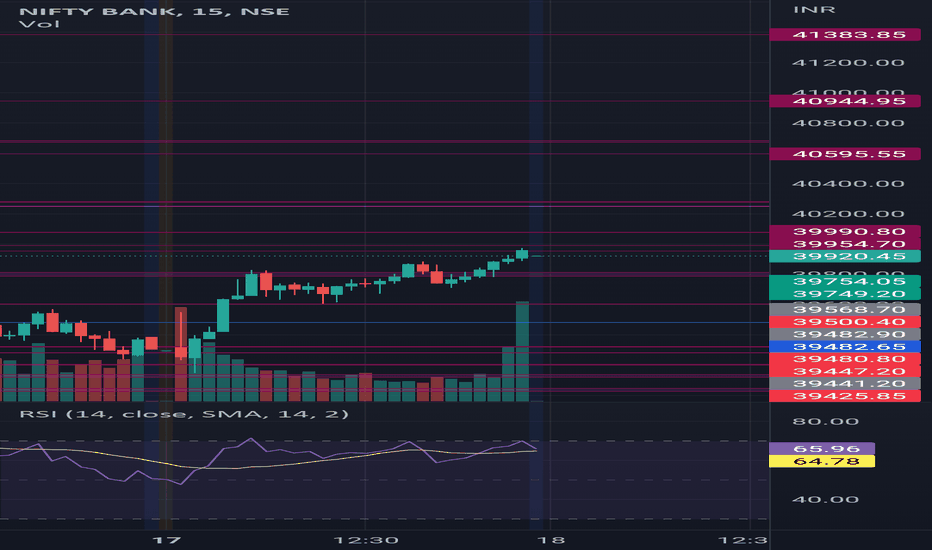

Bank Nifty Levels & Strategy for 18/Oct/2022Dear traders, I have identified chart levels based on my analysis, major support & resistance levels. Please note that I am not a SEBI registered member. Information shared by me here for educational purpose only. Please don’t trust me or anyone for trading/investment purpose as it may lead to financial losses. Focus on learning, how to fish, trust on your own trading skills and please do consult your financial advisor before trading.

BANK NIFTY

Bank Nifty performed as expected. Traders who simply followed the technical pattern got rewarded heavily. Once Bank Nifty has given breakout above VWAP & 13EMA then throughout the day not even a single candle closed below 13 EMA/VWAP on 15 min chart. Those who shorted initially, took SL and reversed the trade for wonderful one way relief rally. Retail traders got caught again. FIIs have heavily added bullish positions in F&O contracts, US market is trading in green today and majority of the retail traders did exactly opposite to what FIIs did. May GOD bless retail traders. Please don't get carried away in one direction. Bank Nifty is in oversold zone now.

We have to be patient enough to make some money and follow our rules without fail. Shall we look for buy on dips near major support levels & sell on rise opportunities if you get good trading setup ????? Yes, I think so. What do you think?????

BANK NIFTY SCORECARD DATED 17/OCT/2022

BANK NIFTY IS UP BY 615 POINTS

Name Price Previous Day Change % Change

Bank Nifty 39920 39306 614.85 1.56%

India VIX 18.42 18.26 0.16 0.88%

OPTION STATISTICS BASED ON 20/OCT/2022 EXPIRY DATA

Max OI (Calls) 40000 (Open Interest: 2227475, CE LTP: 9.05)

Max OI (Puts) 37000 (Open Interest: 3057025, PE LTP: 363)

PCR 1.48 (PCR is in overbought zone)

Bank Nifty Calls:

ATM: Long Buildup, OTM:Long Buildup, ITM:Short covering, FAR OTM:Long Buildup

Bank Nifty Puts:

ATM: Short Buildup, OTM:Short Buildup, ITM:Short Buildup, FAR OTM:Short Buildup

Please do share your comments. Let us work & win together. Have a very happy, healthy & profitable day ahead!

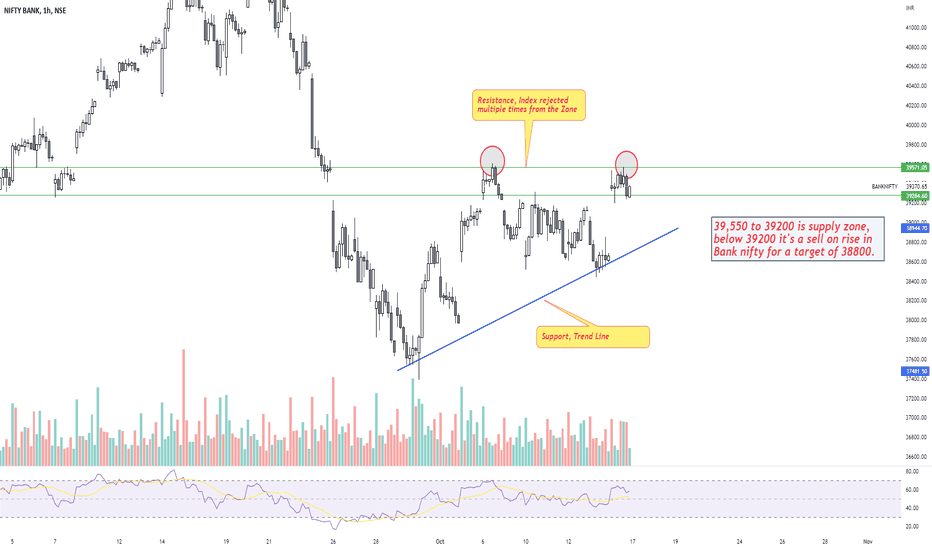

38500- 38800 zone may act support BankNifty — Last friday there was a gap up but index failed to hold at these level and we saw a selloff from these levels.

Situation 1- After gapdown index may take support @ 38800 level and bounce towards 39550.

Situation 2- If index failed to hold above 38500 then further correction possible.

#Note - The idea is shared for educational purpose and not a trade recommendation, Please trade after consulting your trade advisor. We don't give any assurance of profit or loss.