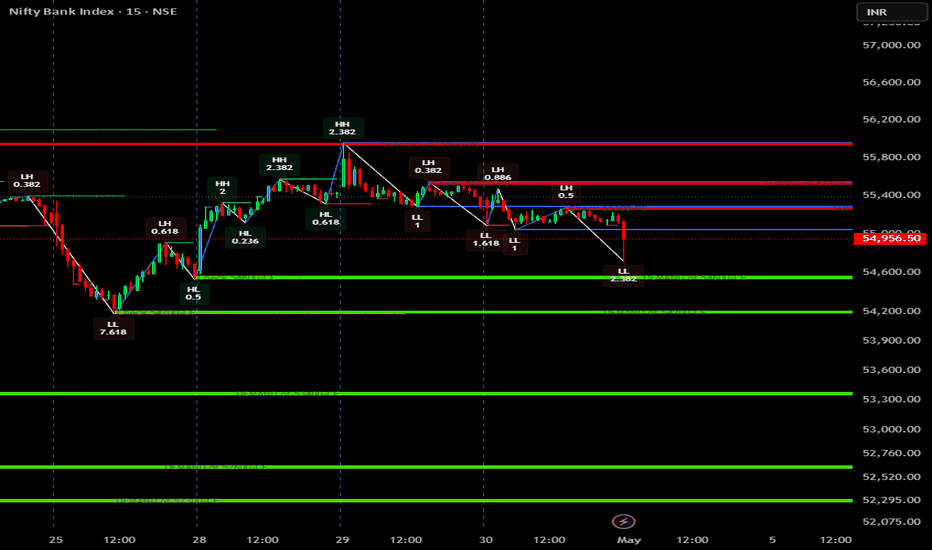

One kick towards 54250Bank Nifty Technical Outlook – 30th April

On 30th April, Bank Nifty continued to trade with a higher low, maintaining its recent structure of higher highs and higher lows. This indicates short-term strength; however, caution is warranted.

Despite the bullish structure, any adverse geopolitical event—such as developments involving PoK or Pakistan—could act as a strong negative trigger. In such a scenario, Bank Nifty may reverse sharply and head towards the downside gap zones around 54,250, 53,700, and potentially 52,300.

The broader trend remains vulnerable to news-driven volatility. Monitoring price action near key support zones is crucial.

#banknfity #niftybank #nifty50 #nifty

Bankniftytradesetup

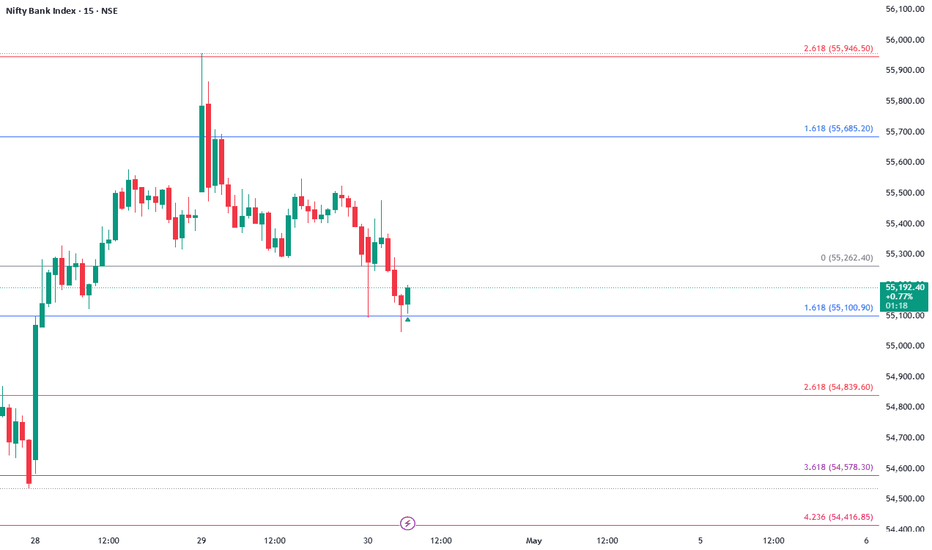

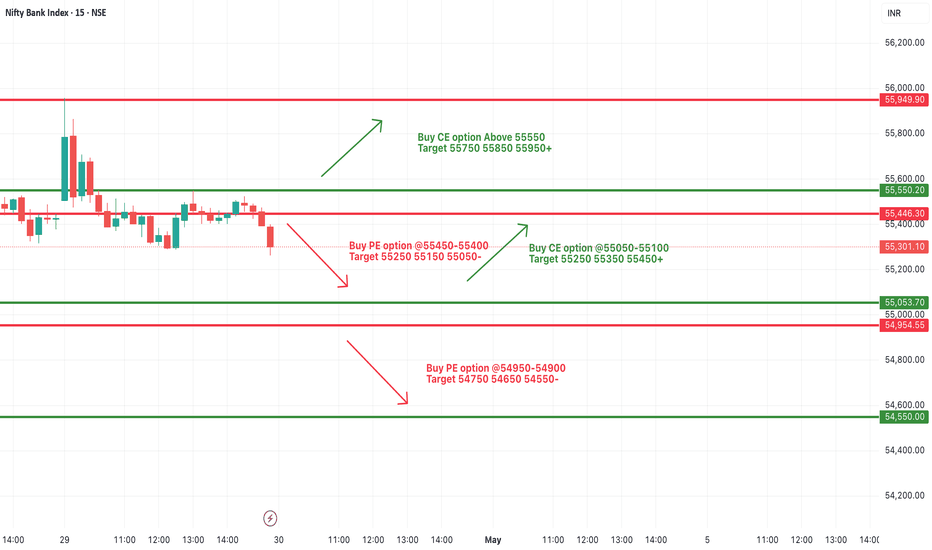

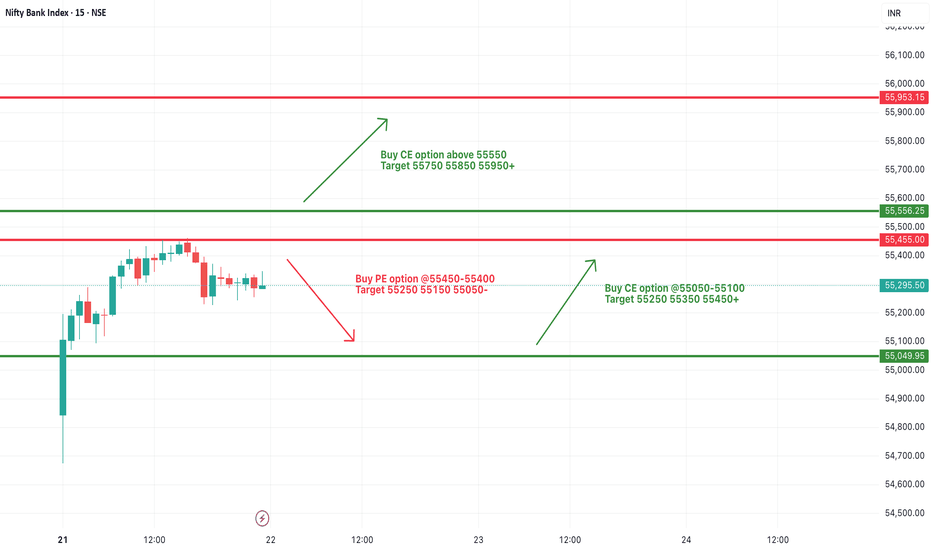

[INTRADAY] #BANKNIFTY PE & CE Levels(30/04/2025)Today will be slightly gap up opening expected in banknifty. 55050-55450 zone will be consolidation for banknifty. After opening if banknifty starts trading and sustain above 55550 level then expected upside rally upto 55950+ level in today's session. Any major downside only expected below 54950 level.

[INTRADAY] #BANKNIFTY PE & CE Levels(29/04/2025)Today will be slightly gap up opening expected in banknifty. After opening if banknifty starts trading and sustain above 55550 level then expected further upside rally upto 55950+ level in today's session. 55050-55450 zone will be consolidation for banknifty. Any major downside only expected below 54950 level.

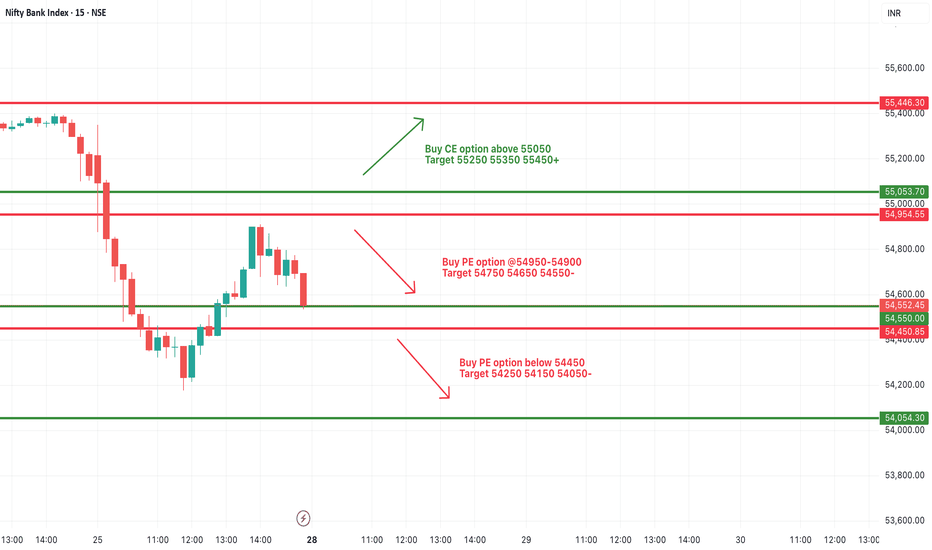

[INTRADAY] #BANKNIFTY PE & CE Levels(28/04/2025)Today will be gap up opening expected in banknifty. Expected opening near 54950 level. After opening it will face immediate resistance at this level and possible downside movement in index. Downside 54450-54550 zone will act as a support for today's session. After breakdown of this support zone can lead banknifty further downside upto 54050 level in today's session. Any strong bullish side rally only expected if banknifty starts trading and sustain above 55050 level.

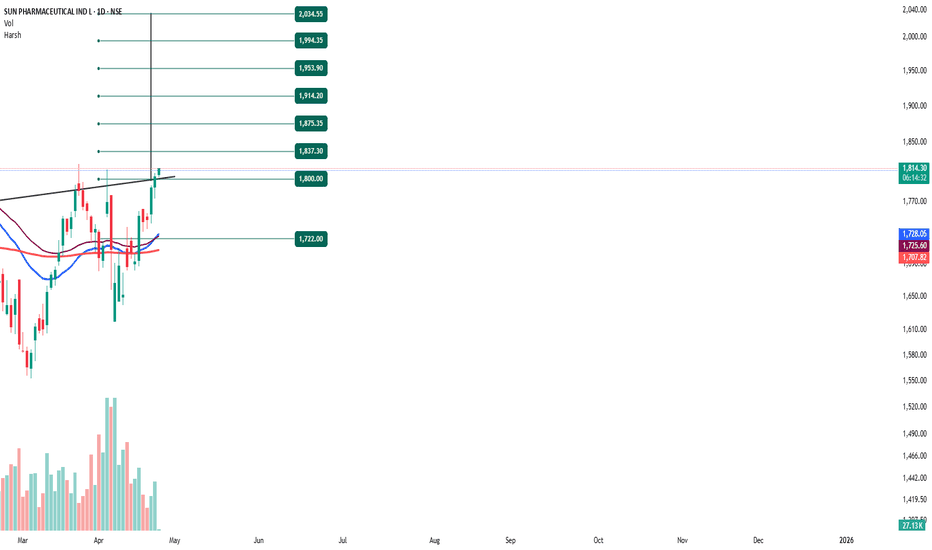

SUN PHARMA | Inverted Head & Shoulders BreakoutSun Pharma has completed an Inverted Head and Shoulders pattern on the daily chart, signaling a potential bullish reversal.

📈 Entry: Buy above ₹1800 (breakout confirmation)

📉 Stop Loss: ₹1722 (below right shoulder support)

🎯 Targets (based on Fibonacci extensions & previous resistance zones):

• ₹1837.30

• ₹1875.35

• ₹1914.20

• ₹1953.90

• ₹1994.35

• ₹2034.55

The neckline breakout has occurred with decent volume, reinforcing the validity of the setup. As always, risk management is key — trailing stop loss recommended as price moves in favor.

💡 Disclaimer: This is for educational purposes only. Do your own research before making any trading decisions.

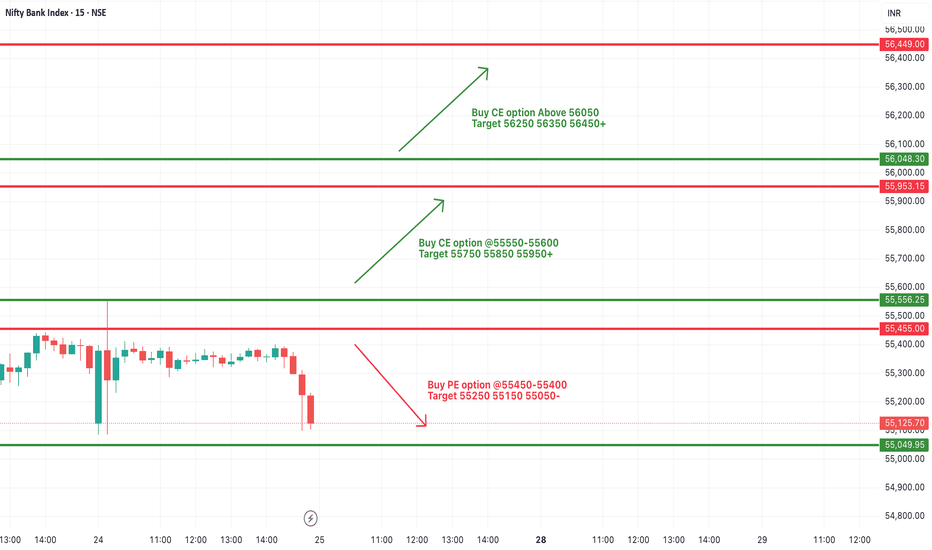

[INTRADAY] #BANKNIFTY PE & CE Levels(25/04/2025)Today will be gap up opening expected in index near 55500 level. After opening if banknifty starts trading above 55550 level then expected upside rally of 400-500+ points in opening session. This upside rally can extends for further upto 56450+ level in case banknifty gives breakout of 56050 level. Any downside only expected below 55450 level. Downside 55050 level will act as a important support for today's session.

Bank Nifty – 1 Hour Chart AnalysisThe price zone between 55,694 and 55,783 is acting as a strong resistance on the 1-hour chart. If the market moves down to sweep the liquidity around 55,551, it could potentially trigger a reversal. This liquidity sweep may give the momentum required for the price to test the resistance zone again.

However, if the resistance holds firm and rejection occurs, it could push the market further down toward the Monthly Support level around 52,441.

Disclaimer:

This analysis is for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy or sell any financial instruments. Trading in the stock market involves risk. Please conduct your own research or consult with a qualified financial advisor before making any trading decisions.

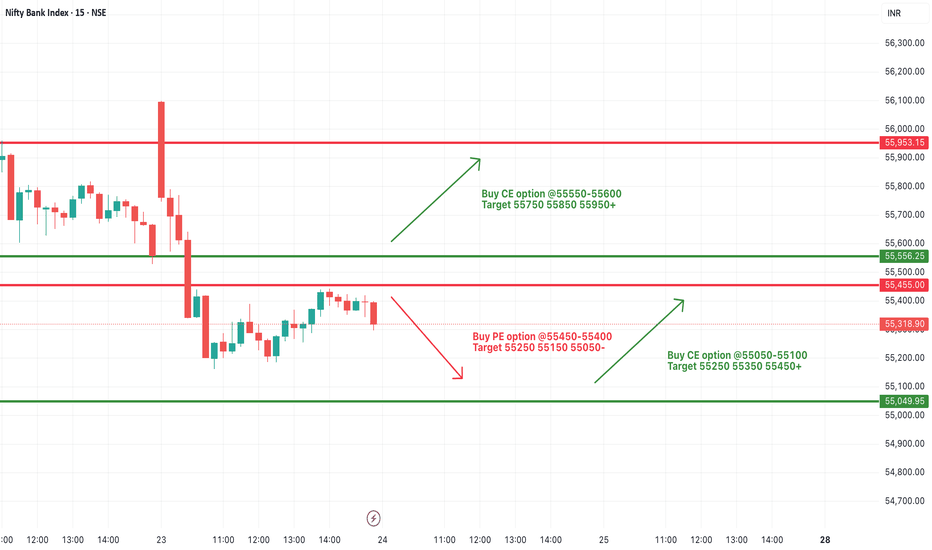

[INTRADAY] #BANKNIFTY PE & CE Levels(24/04/2025)Today will be slightly gap down opening expected in index. After opening 55050 level will act as a strong support for today's session. Expected reversal from this level. Upside above 55550 level there will be strong bullish rally expected upto 55950+ level in today's session. Any major downside only expected below 55000 level.

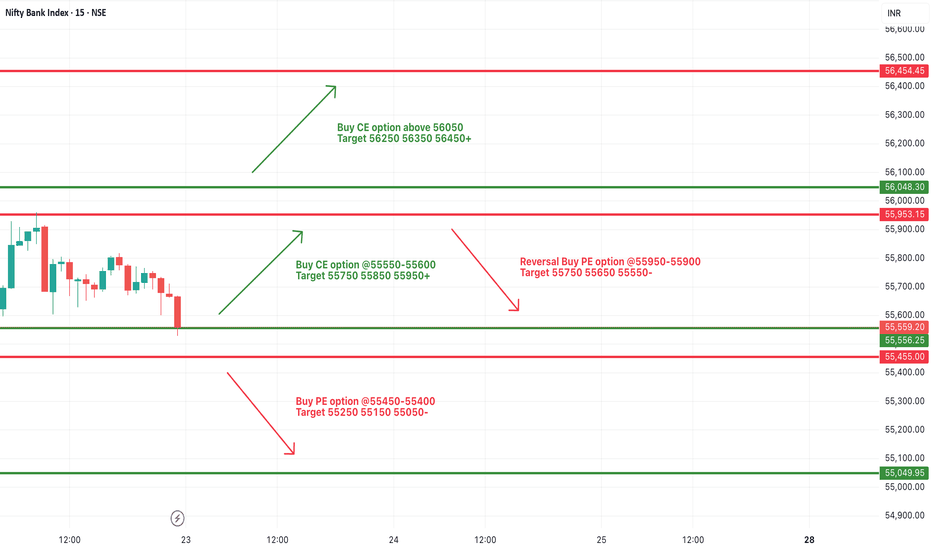

[INTRADAY] #BANKNIFTY PE & CE Levels(23/04/2025)Today will be gap up opening expected in index near 55950 level. After opening expected banknifty will trade in between level of 55550 to 55950 zone in starting session. Strong upside rally expected if banknifty gives breakout of 56000 level and starts trading above 56050. This upside rally can goes upto 56450+ level in today's session. Any major downside only expected below 55450 level.

[INTRADAY] #BANKNIFTY PE & CE Levels(22/04/2025)Today will be flat or slightly gap up opening expected in banknifty. After opening it will face immediate resistance at 55450 level. If banknifty gives breakout of this resistance zone and starts trading above 55550 level then expected strong bullish rally towards the 55950+ level in today's session. Downside 55050 will act as an important support level for banknifty.

Bank Nifty 55500CE intraday analysis for April 21, 2025On the 15-minute interval, the trend is bullish.

The 55500CE entry has been confirmed at ₹180 (since the Scalper indicator signaled a 'Buy' on the previous candle, we consider the opening price of the next candle as the entry).

The stop loss is placed at ₹104.25.

There is strong resistance at ₹306. Once the price breaks above ₹306, the immediate target is ₹379.

This is just my view. As a trader, you are advised to do your own technical study and trade with Stop-Loss.

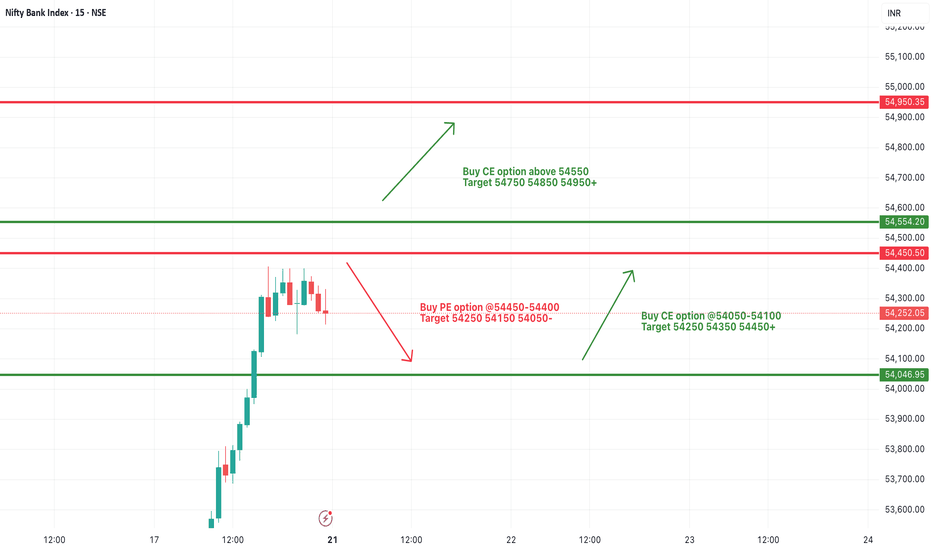

[INTRADAY] #BANKNIFTY PE & CE Levels(21/04/2025)Slightly gap down opening expected in banknifty. After opening expected downside movement upto 54050 level. 54000 level will act as a strong support for today's session. Expected reversal from this level towards the 54450+ and this can be extend for further upside rally if banknifty starts trading above 54550 level. Above this level banknifty can goes upto 54950+ level in today's session. Any major downside only expected below 53950 level.

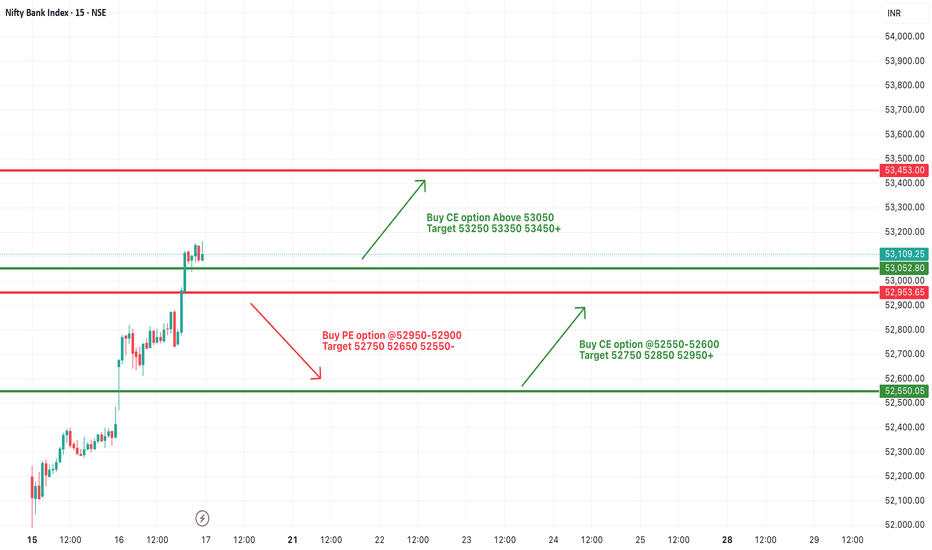

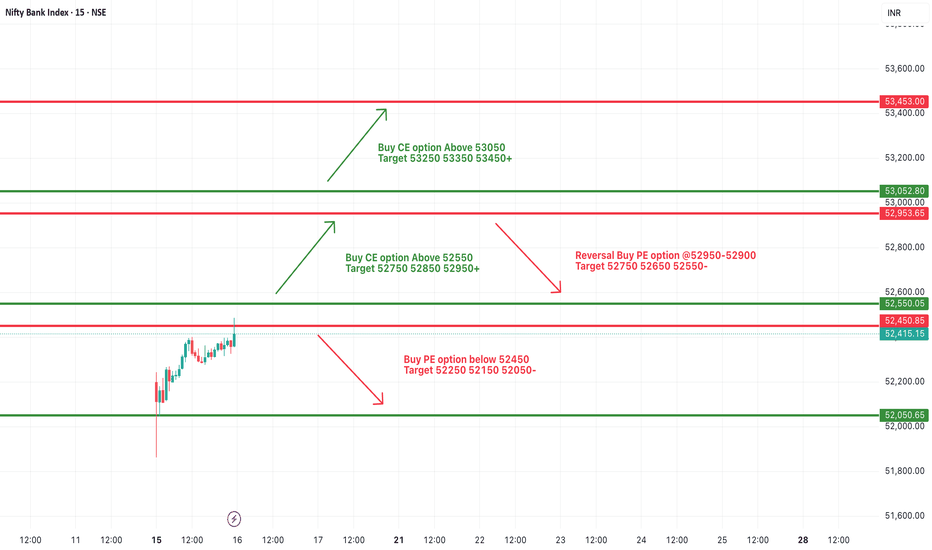

[INTRADAY] #BANKNIFTY PE & CE Levels(17/04/2025)Today will be gap down opening expected in index. After opening if banknifty starts trading below 52950 level then downside movement possible upto 52550 level. 52550 level will act as a strong support for today's session. Any downside rally can be reversal from this level. Upside rally expected if banknifty starts trading and sustain above 53050 level. This upside rally can goes upto 53450+ level.

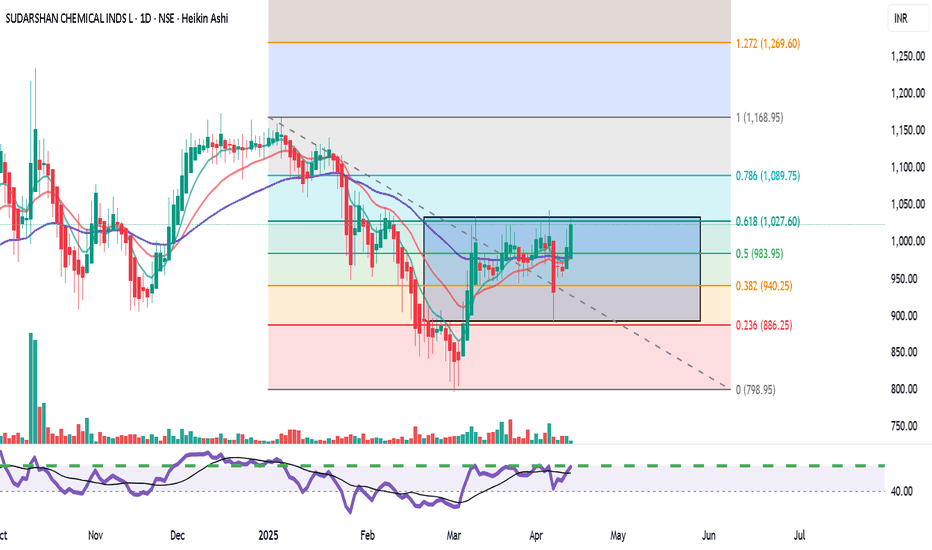

Sudarshan Chemical Industries📊 Chart Highlights:

Current Price: ₹1,023

Fibonacci Resistance: Price is approaching the 0.618 Fib level at ₹1,027.60, which is a key resistance.

Box Range: Trading within a consolidation box (approx. ₹940–₹1,030) — currently testing the upper end of the range.

Volume: Volume is moderate; not a strong breakout candle yet.

RSI: Trending upwards, nearing overbought (above 60), positive momentum.

Heikin Ashi Candles: Showing bullish strength.

✅ Recommendation: BUY (on confirmation)

📌 Buy Entry:

Buy above ₹1,035 only on breakout confirmation with volume (i.e., daily close above ₹1,035).

🎯 Targets:

Target 1: ₹1,090 (Fib 0.786 level)

Target 2: ₹1,170 (Fib 1.0 level)

Target 3: ₹1,270 (Fib 1.272 extension)

❌ Stop Loss:

Place SL around ₹980 (just below the Fib 0.5 level and EMA cluster)

⚠️ If Rejected at ₹1,030:

Consider range trading: Sell near ₹1,030 with target ₹940–₹950 and SL ₹1,040.

Wait for a clean breakout or breakdown before taking large positions.

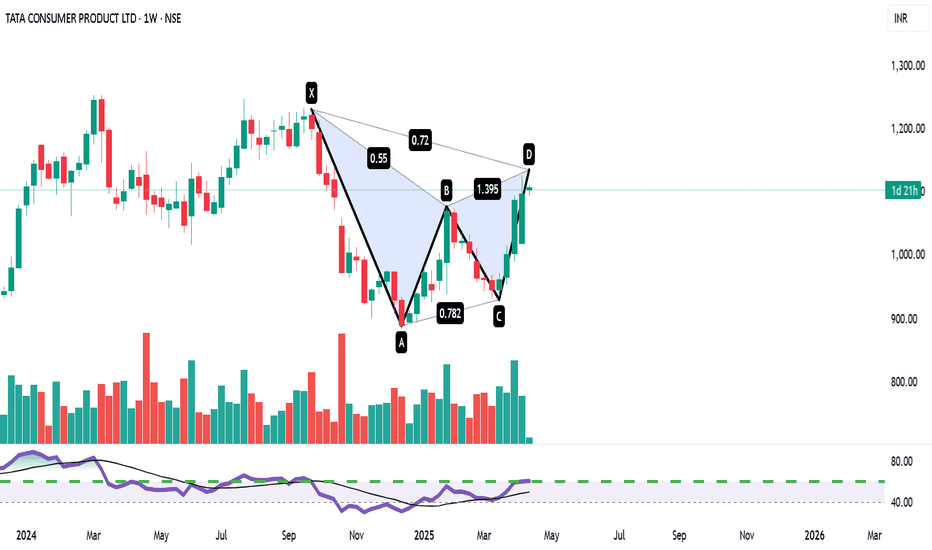

Tata Consumer Products Ltd a bearish harmonic Gartley pattern Tata Consumer Products Ltd has formed a **bearish harmonic Gartley pattern, completing at point D near the 1.395 Fibonacci extension—typically a reversal zone. RSI is near overbought, suggesting caution. Based on this technical setup, the stock may face **selling pressure**, making it a sell recommendation with a target of ₹1,040 and a stop loss at ₹1,135. If the price breaks above ₹1,135 with strong volume, trend bias can shift bullish, but currently, it's best viewed with a short-term bearish outlook.

for educational purposes only

[INTRADAY] #BANKNIFTY PE & CE Levels(16/04/2025)Today will be gap up opening in banknifty. After opening if banknifty starts trading above the 52550 level then this bullish rally can goes upto 52950 level in opening session. This can be extend for further 400-500+ points in case banknifty gives breakout of 53000 level and sustain above 53050 level. 52950 level will act as a resistance for today's session. Any reversal can gives downside movement upto 52550 level. Any major downside only expected below 52450 level.

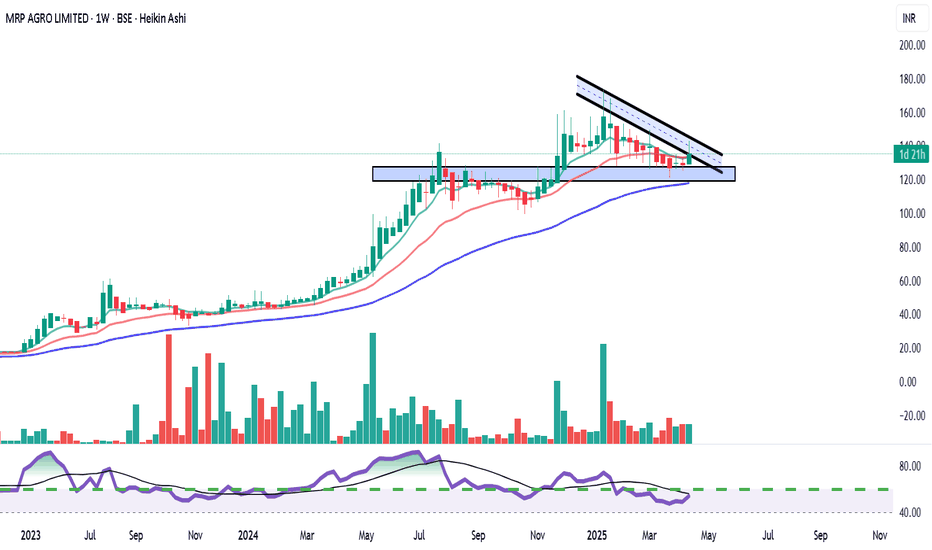

MRP Agro Ltd shows strong fundamentals with significant revenue MRP Agro Ltd shows strong fundamentals with significant revenue and profit growth, high ROCE (39.2%) and ROE (30.3%), and is almost debt-free, making it a financially sound company. Technically, the stock has bounced from a support zone with a bullish breakout from a falling wedge pattern, suggesting potential upside. Based on both technical and fundamental analysis, a buy is recommended with a target of ₹160 and a stop loss at ₹120, for a short- to medium-term horizon (3–6 months). However, investors should monitor liquidity and watch for dividend announcements.

for educational purposes only

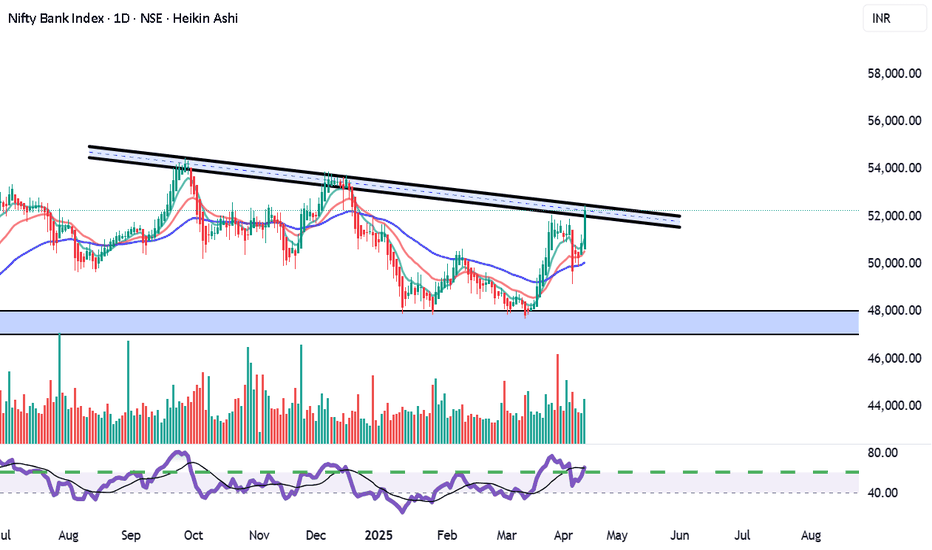

Nifty Bank Index Chart Observations:

Pattern:

Price has been forming lower highs, suggesting a descending trendline resistance.

There's a visible breakout attempt above this trendline now.

Support Zone:

Strong demand zone between 46,800 – 48,000, which was respected multiple times.

Indicators:

RSI is near the overbought zone, but not showing divergence.

Volume has spiked on the breakout – bullish confirmation.

Heikin Ashi candles are strongly green – good momentum.

✅ Bullish Scenario (If breakout holds):

Entry Zone: On retest of the breakout trendline (around 51,500–52,000).

Target Levels:

Short-term: 53,500

Medium-term: 55,000–56,000

Stop Loss: Below 50,500

❌ Bearish Scenario (If breakout fails):

Invalidation Level: If it closes back below the trendline with high volume.

Re-entry zone: Watch the 48,000 support area again.

Short Target (if breakdown from support): 46,000–45,000

Swing Traders: Wait for a pullback toward the trendline and enter on bullish confirmation.

Positional Traders: Enter partially now, add more on pullback confirmation.

Risk Management: Keep positions light until breakout is fully confirmed.

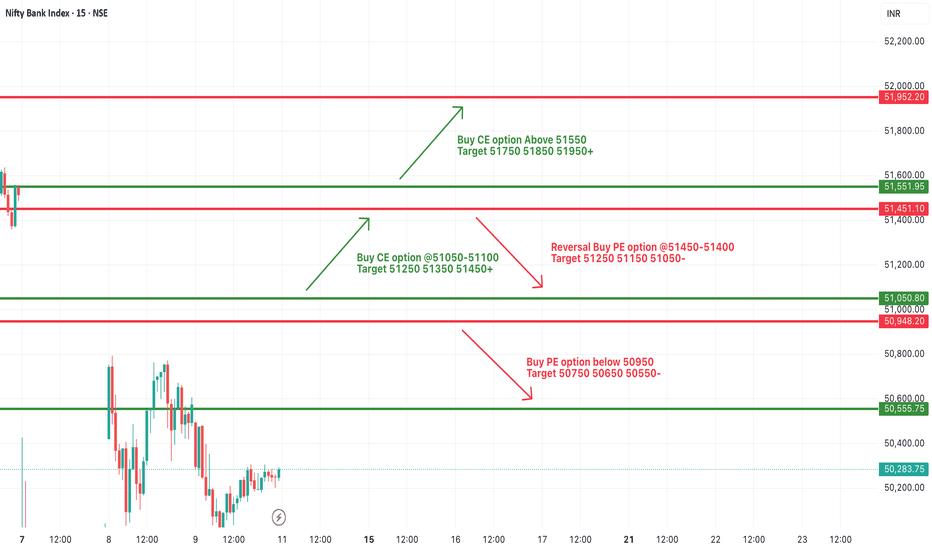

[INTRADAY] #BANKNIFTY PE & CE Levels(15/04/2025)Today will be gap up opening in banknifty. Expected opening near 51500 level. After opening if banknifty starts trading and sustain above 51550 level then possible further upside rally of 400-500+ points in index. Any downside possible below 51450 level. Downside 51050 level will act as a strong support for today's session. Now any major downside only expected after breakdown of this support zone.

[INTRADAY] #BANKNIFTY PE & CE Levels(11/04/2025)Today will be strong gap up opening expected in banknifty. Expected opening above 51000 level. If banknifty starts trading and sustain above 51050 level then expected further upside rally upto 51450+ level and this can be extends for further 400-500+ points if gives breakout of 51550 level. Below 50950 level expected downside movement in index upto 50550 support level.

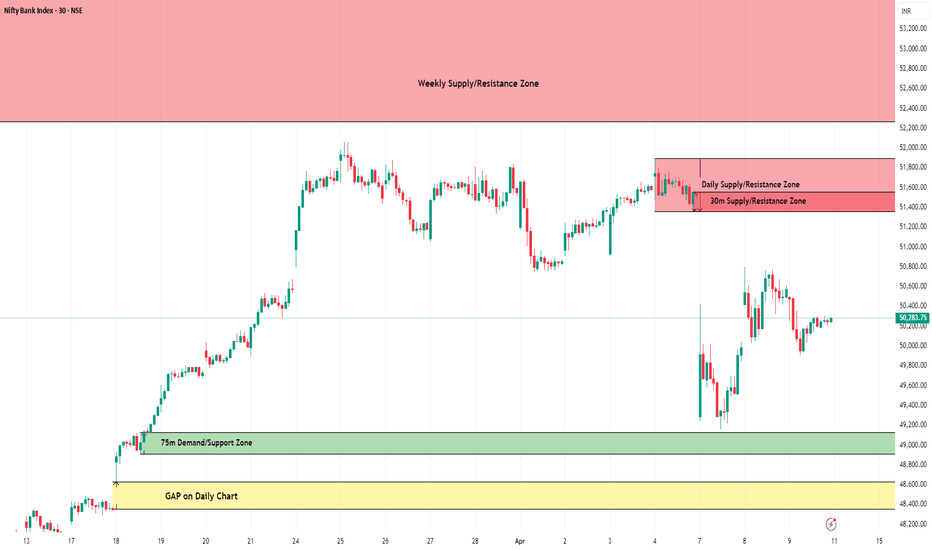

BankNifty Intraday Support & Resistance Levels for 11.04.2025🔄 Quick Recap since the last update (21.03.2025):

BankNifty rallied to a high of 52,063.95 on 25th March, piercing through the earlier mentioned Weekly Supply Zone by 84 points. But the bullish momentum was short-lived. Following Trump’s tariff announcement, BankNifty plunged sharply, dropping over 2,800 points to hit a low of 49,156.95 on 7th April.

🌍 Global sentiment has been shaken, but signs of recovery are emerging. Dow Futures have rebounded 4,000 points (10%), currently trading around 40,700 — a hopeful sign, but volatility remains elevated.

📅 On Wednesday (09.04.2025):

BankNifty opened with a gap-down, hit high of 50,496.90, and made a low at 49,910.85 before settling at 50,240.15, down 271 points for the day.

🔹 Trend Analysis:

Weekly Trend (50 SMA): Sideways

Daily Trend (50 SMA): Sideways

📉 Demand/Support Zones

Near Demand/Support (75m): 49,215.95 – 49,698.05

Gap Support (Daily Chart): 48,354.15 – 48,629.45

Far Support: 47,700 – 47,850 (multiple time tested on Daily Chart)

Major Support: 46,077.85 (Low of 4th June 2024)

Far Demand/Support (Daily): 44,633.85 – 45,750.40

📈 Supply/Resistance Zones

Near Supply (30m): 51,360.40 – 51,559.20 (Inside Daily Supply)

Near Supply (Daily): 51,360.40 – 51,893.60

Far Supply (Weekly): 52,264.55 – 53,775.10

🔍 Outlook:

With both trends turning sideways, BankNifty remains in a consolidation phase. Bulls are currently trapped under a strong resistance zone starting from 51,360, while downside support begins near 49,200.

Considering the volatile global setup, we may see a range-bound move with sharp intraday swings. The index must cross 51,900 decisively for any further upside. Until then, sell-on-rise near supply and buy-on-dip at demand continues to be the approach. Stay cautious. Trade levels, not emotions.

📢 Disclaimer: This analysis is intended for educational purposes only. It is not investment advice. Please consult your financial advisor before making any trading decisions.

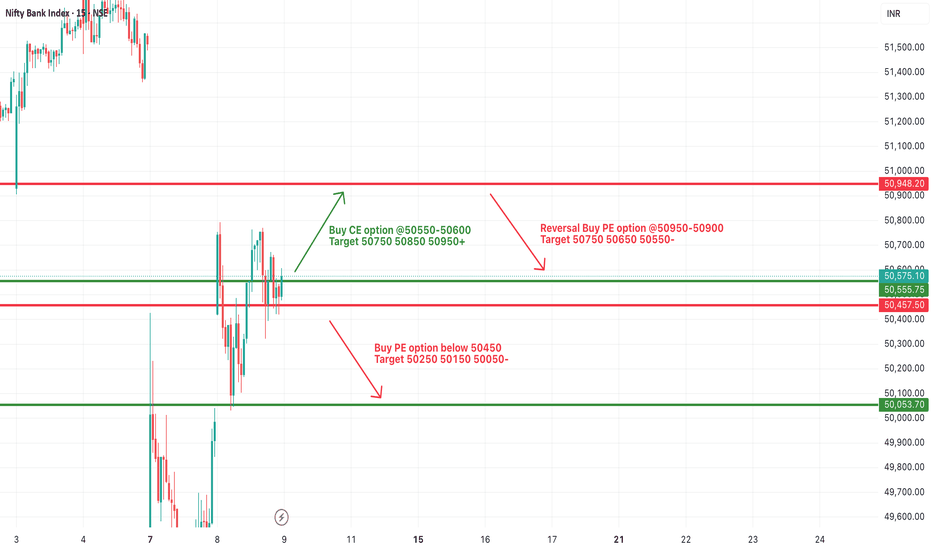

[INTRADAY] #BANKNIFTY PE & CE Levels(09/04/2025)Today will be flat opening expected in index. After opening if banknifty sustain above 50550 level then expected upside movement upto 50950 in today's session. Major downside expected if banknifty starts trading below 50450 level. This downside rally can goes upto 50050 support level. 50000-50050 is the important support for index. Any Strong downside only expected below this support zone.