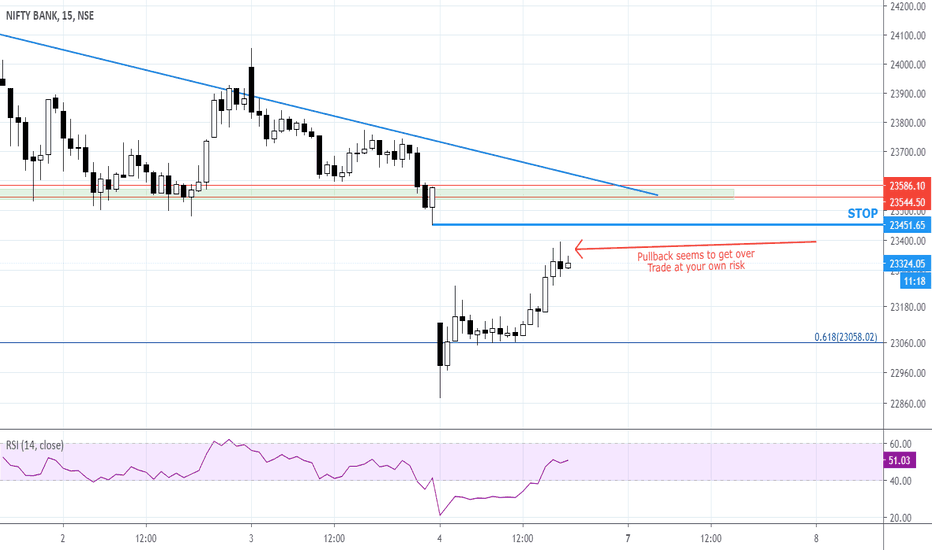

BankNifty Prediction & Analysis [12 Aug 2021]BankNifty Prediction and Analysis For Tomorrow

Bank Nifty Spot Levels to watch out for trading on 12th Aug 2021

Long Opportunity:

1. Price breaks out of 36100 and retests the level again is a good support to go long.

Short Opportunity:

1. Gap down opens below 35520 and stays below 35500 for some time and retested back the 35500 levels is a good resistance zone to short Bank Nifty.

2. Gap Up opens but face resistance near 36100 and breaks the upward trendline is a good area to short

Visit utube for video explanation

Bankniftytrendanalysis

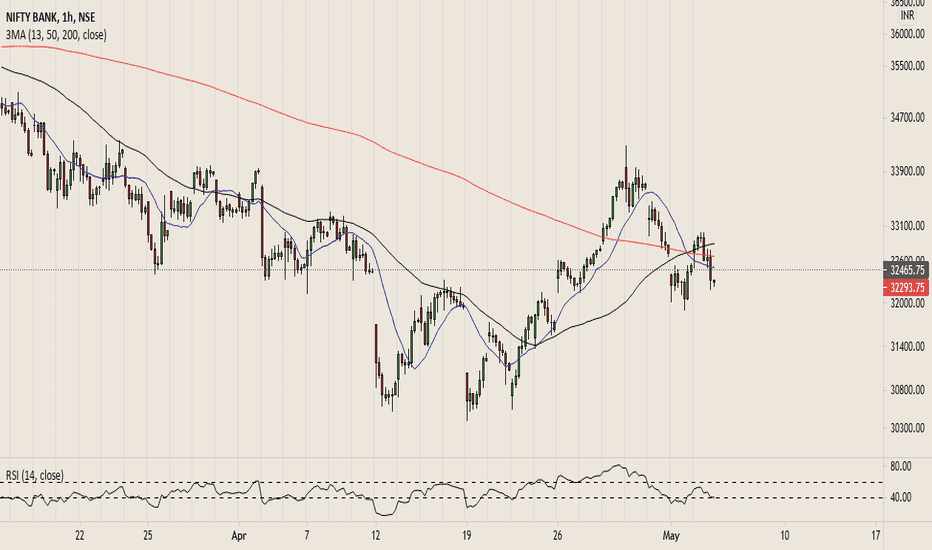

BankNifty Trade Setup [31 Aug 2020]BankNifty Index view on 31st Aug 2020

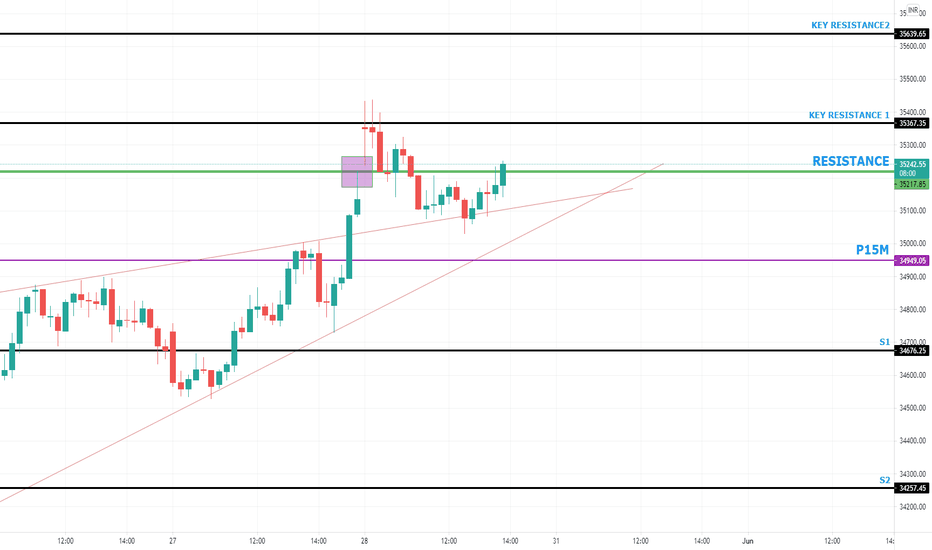

Bullish view: If price stays above the brown trendline, then look for buying opporunity only. Enter only if it comes near the trendline and support level (Blue Horizontal Line). Look for price rejection near the key support zone.

Support Zone: 24390-24420

Bearish view: If price breaks the brown trendline alongwith blue support line and retest the trendline again, then look for shorting opportunity. Look for price rejection near the key resistance levels

Resistance Zone: 24390-24420

My Personal View: BankNifty likely to retest the trendline and may respect it. So, my view is bullish and I will wait for the retracement to enter.

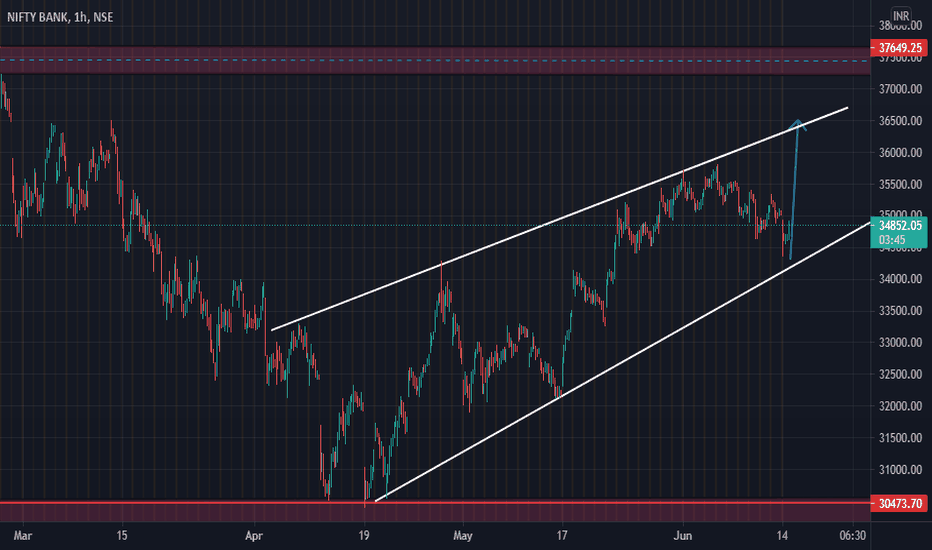

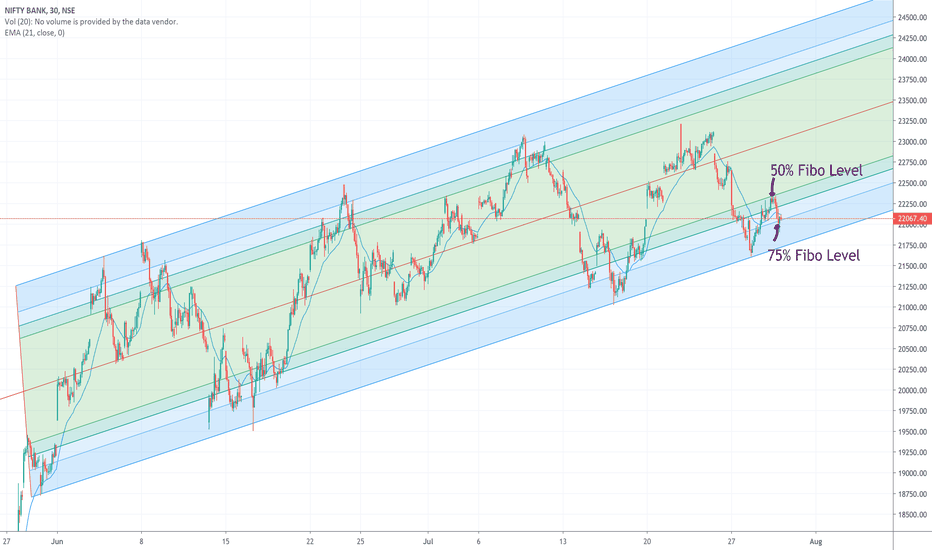

BANKNIFTY Fibonacci RetracementHi There! We can observe a channel pattern here which is respected from the beginning of June.

As you can see, BANKNIFTY tried to break the 50% level but was rejected and fell to 75% retracement level.

It could try to retrace again tomorrow (at least to 61.8% - around 200 points) but could fail again as the contracts expire tomorrow and there could be profit booking (the trend was mainly bullish for last 3 months). Also, There is some indecisiveness as we see a doji pattern forming on the daily chart today. We can take up trades based on the direction the market takes tomorrow and considering above points.

DISCLAIMER: This is only my analysis and not my advice/recommendation to trade. Please bear in mind that your call to trade is at your own risk.