Banks

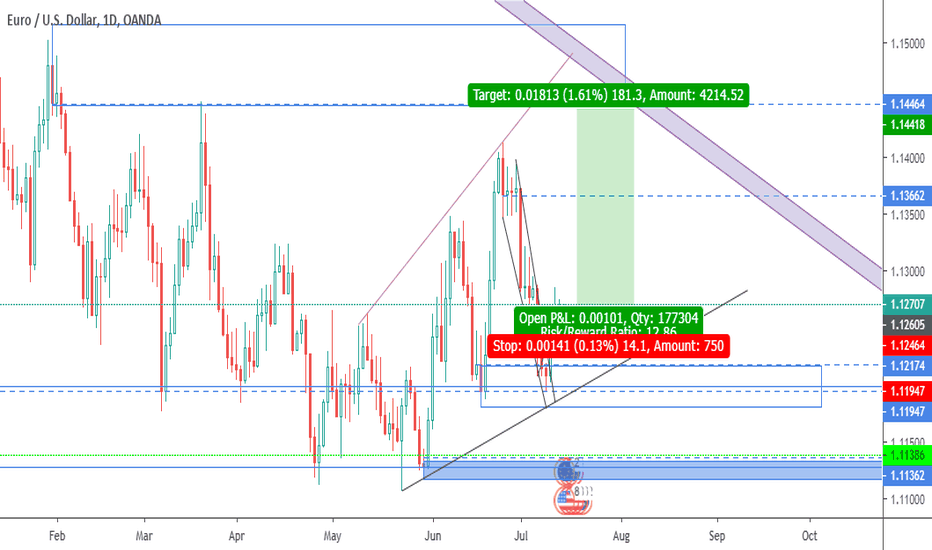

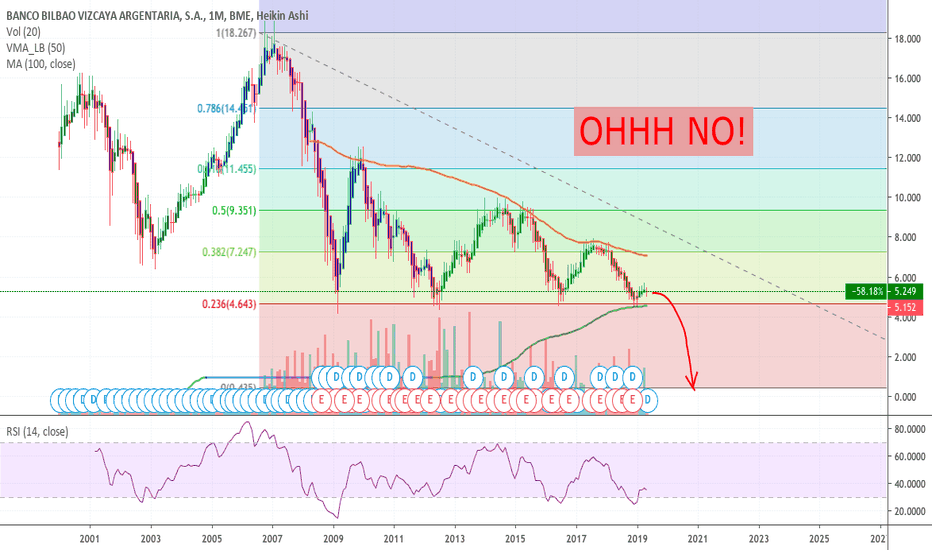

DXY to outperform majors in the coming months. BTC to perform.The world economy has already seen a major slowdown in many economic regions like the Eurozone and China. 70% of ALL countries are experiencing a slowdown in GDP growth, which is comparable to 2008 levels. Italy was expected to have a GDP growth of 1% early in the year, but forecasts have been cut down to 0.2%. Germany was expected to grow by 1.9%, but was later in the year expected to only achieve 0.8% in 2019. That is truly frightening. China the second biggest economy experienced a 1% slowdown in GDP from 6.8% to 5.8%. The US just across the ocean is actually performing quite remarkably with GDP staying at 2.4% consistently throughout the year and only seeing a 0.1% GDP expectation decline. From this, we can almost guarantee that the reserve currency of the world will almost surely outperform every other major currency. Im bullish in DXY and bearish on EURUSD.

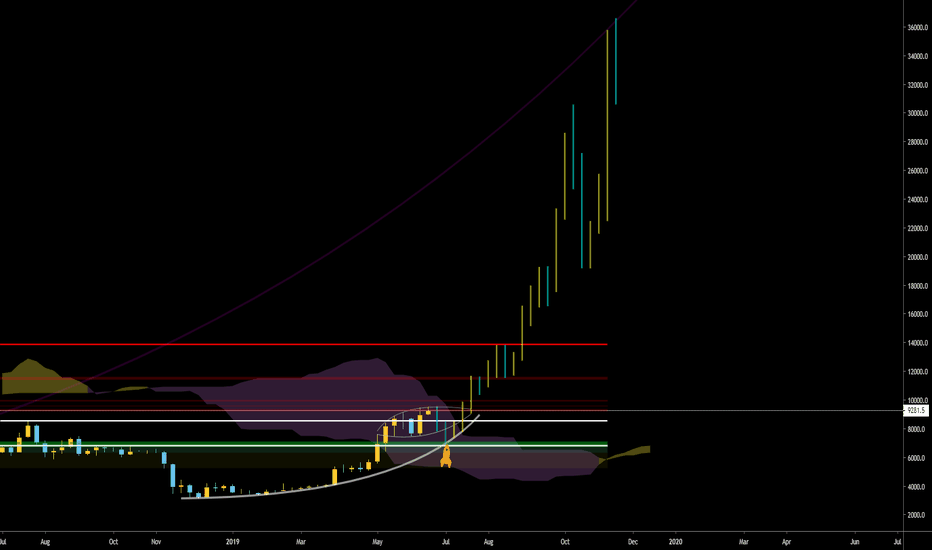

Big banks across the planet have cut interest rates to try to stimulate their economies, but the problem is that interest rates have already been low since 2010 leaving little wiggle room to leverage this tool. With a looming recession and economic bubbles in many industries, we might just be on the brink of a global depression. Many people are turning a bad eye towards banks, and how they have mishandled the current situation. Cryptocurrencies might just be a safe haven or a hedge against an economic downturn for those who manage to invest early. The problem I see here is the onslaught of late investors into Crypto that might get killed and lose all their money to another potential crypto bubble. I am bullish on BTCUSD and alts. However, I see BTCUSD performing much better than other coins because of its status amongst the common man and likely the first invstment in crypto that they do.

Dear Loch Ness Monster, Let me fulfil the 6969 - 69420 Prophecy.It is foretold a sequence of sacred numbers lies in rest as they await realisation...

Internet meme minds will collide as they overhaul the tyranny of a super-serious and totally-not-fraudulent banking cosmos. The people are prophesised to fight back against over-reaching institutional power perpetuating unnecessary war and at it's core, immoral but also unsustainable wealth inequality.

Picture Bitcoin as a successful Pac-Man and the ghosts as Wall Street's GFC inducing suits; nom nom nom.

I like trying my hand at predicting the future and my current narrative places us in a similar position right now to the roaring twenties, which was followed by the great depression. Our WW2 is climate change and our New Deal is the Green New Deal. To keep it short, Bernie Sanders and Franklin D. Roosevelt are strikingly similar.

Anyways, bitcoin's price...

I'm requesting the whale of all whales, Mr. Loch Ness to approve of successful bids from 6800, right up and no further than 6969 before the meme consciousness of the universe allows passage through the final stage of an international economic bubble: gains for days and days until our capitalist structure has the devil demanding perfect balance, as all things should be.

What goes up, must come down.

Our extended time period of Neo-Liberalism, Conservatism and Corporatism is coming to an end and sooner rather than later I believe the general population and younger generations are ready to radically change and build a better, more socialised future because we'll have to if the human race is to survive. Don't forget the chaos around the corner due to climate change as literally 100's of millions of people find themselves seeking refuge as they are displaced from their underwater and uninhabitable-ly hot homes.

I welcome the disasters of global warming because what else could bring everyone together beside such a common threat?

Selling Bitcoin at 69420 for the lols and also so I have capital available to short everything.

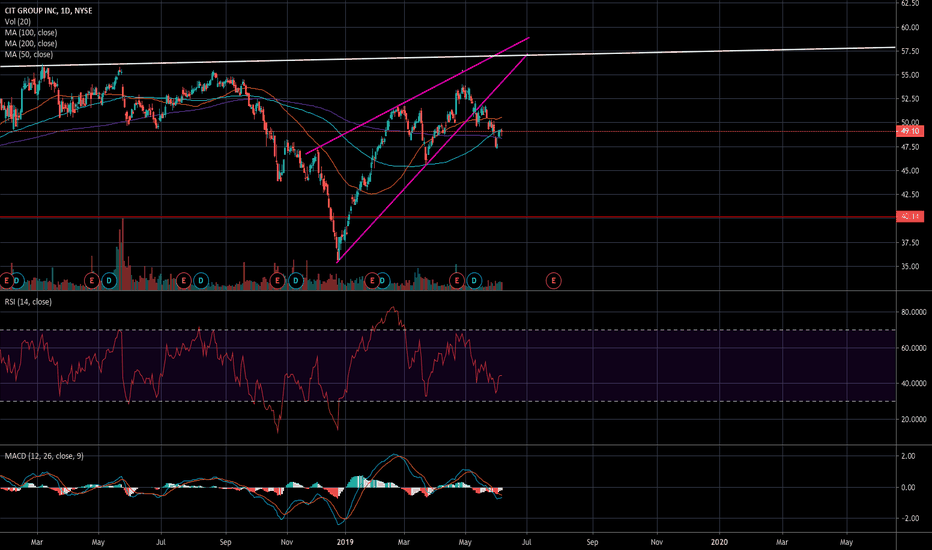

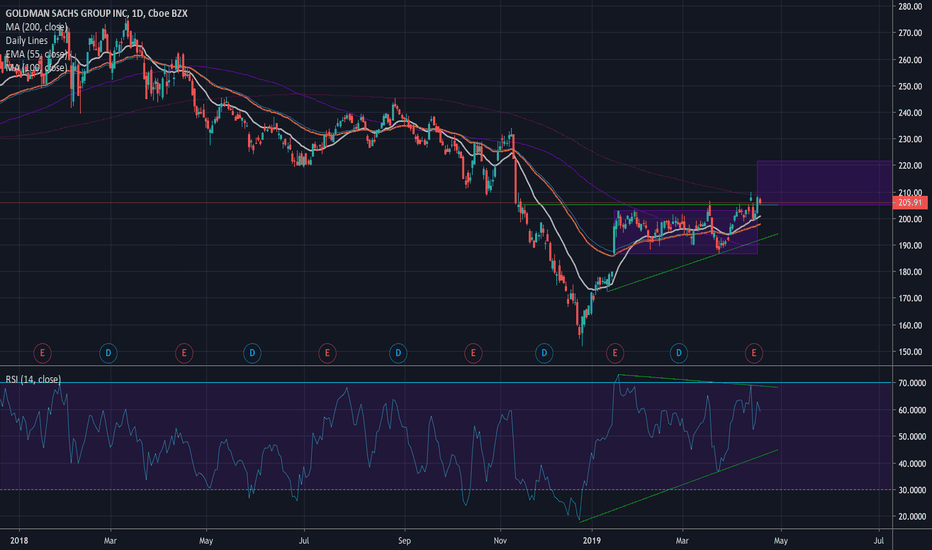

CITI: The Citi of Compton Rising Wedge, will we hit the target?Rising Wedge, will we hit the target? Will probably take some time to hit it but seeing similar pattern in BAC etc.

Hit me with a follow and let's retire.

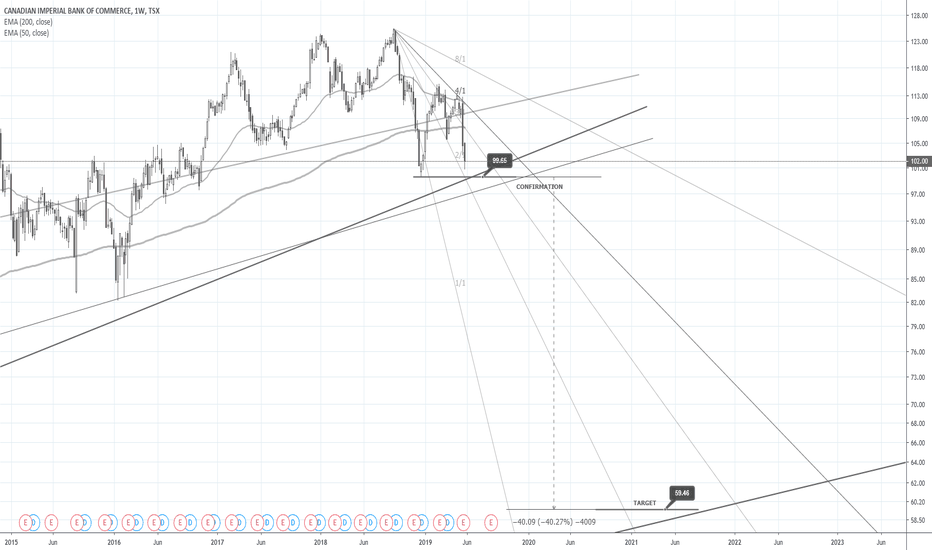

CIBC | 40% Short Trade SetupConfirmation: 99.65 (weekly candle)

Invalidation: Local high

Type of Trade: Countercyclical (EMA50 above EMA200)

Target: 56.46

TF: Weekly

Leverage: 2x

Pattern: 1) monthly rising wedge reversal with 2) break of weekly support, and 3) break of major support line.

Monthly view:

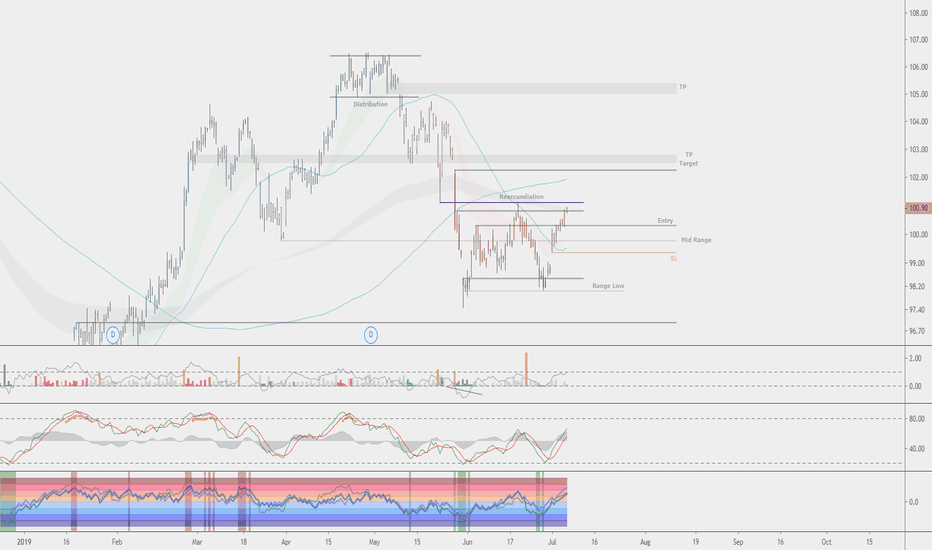

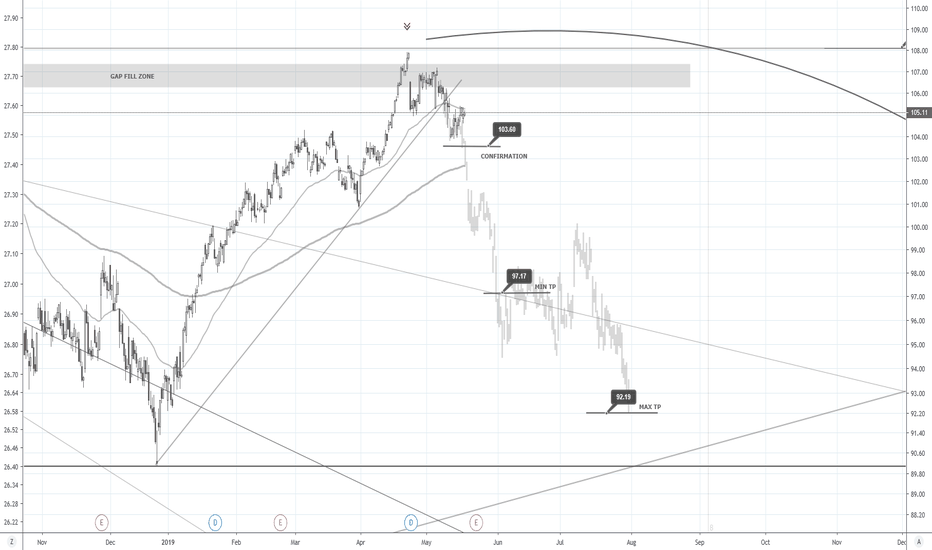

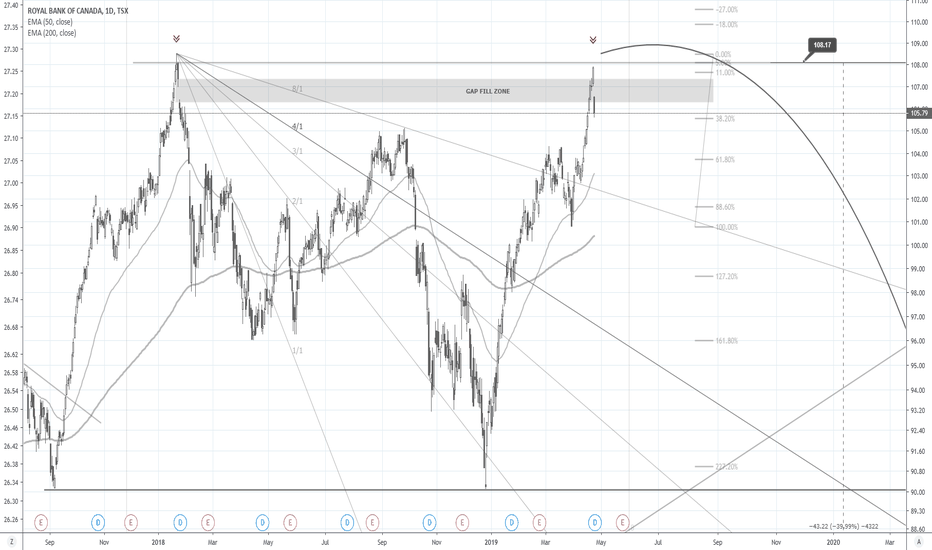

RY (Royal Bank of Canada) | 10% Short Trade SetupConfirmation: 103.60

Invalidation: Local high

Type of Trade: Countercyclical (EMA50 above EMA200)

Target: 92.19

TF:4HR

Leverage: 2x

Pattern: 1) daily double top with 2) trendline break, 3) untested 8/1 Gann, and 4) frothy fundamentals (insufficient loan loss provisions).

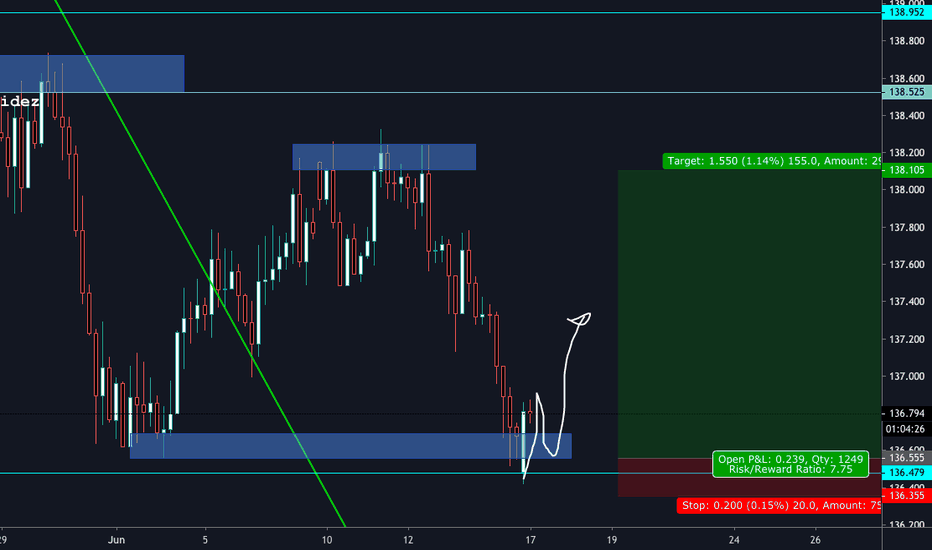

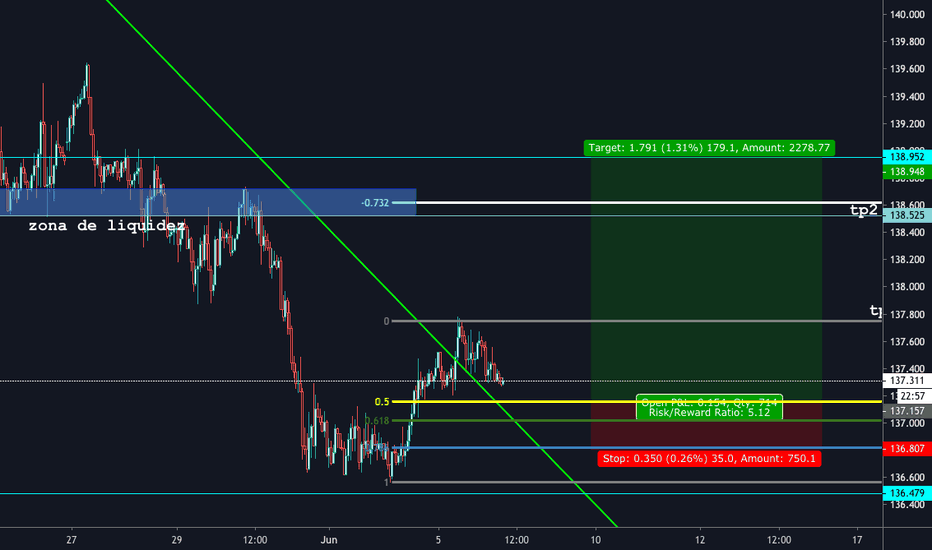

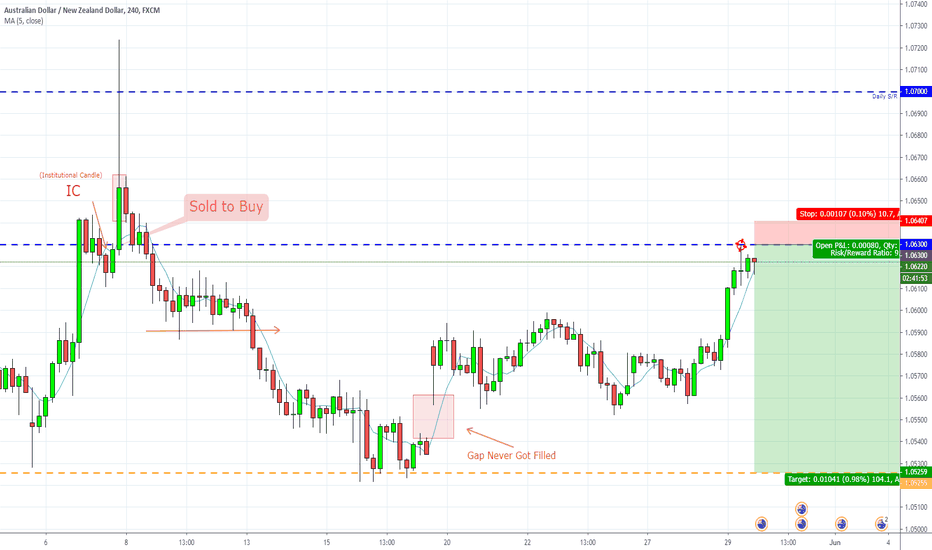

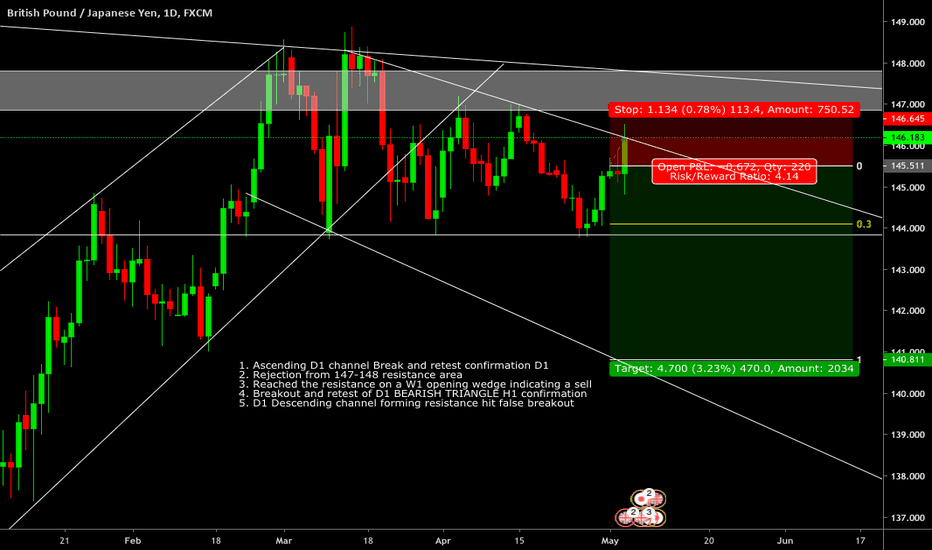

Consolidation = ManipulationBanks are back at it again with yet ANOTHER manipulation scheme. We aren't missing this one though. we made it through the sweep/spring phase, and now we just wait for the retest and confirmation. Risk carefully, boys!

Are you interested in being apart of a team of full time traders. Giving signals, and bouncing ideas off one another with a positive environment? Have access to some of the top traders in the world? Have an educational platform specifically for trading? IF any of these interest you feel free to message me at any time. I'll be more than happy go over the full details of ImarketsLive.

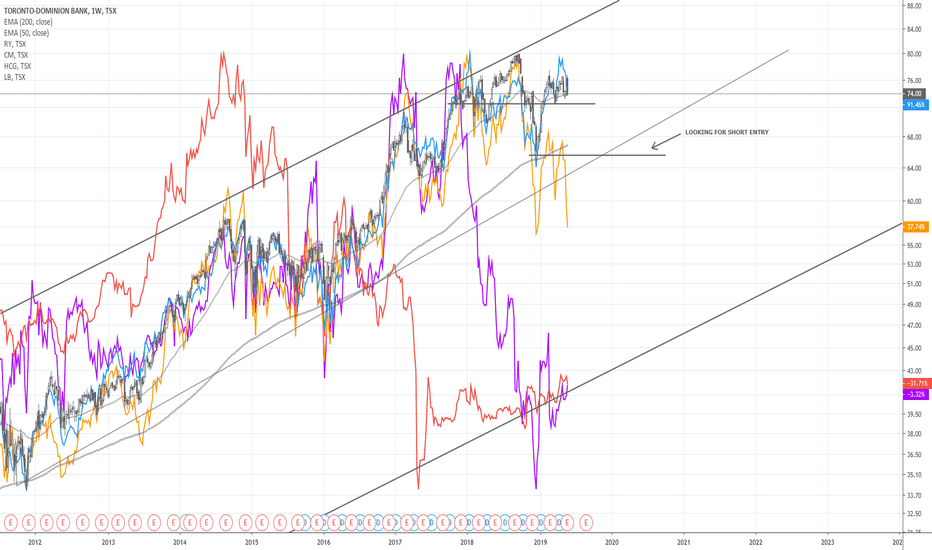

RY (RBC BANK) | Watch For Rejection and New DowntrendRY has filled a gap created back at the beginning of 2018 and we also see a potential large double top formation on the daily and weekly timeframes that is being formed by rejection. This is an opportunity to position short for a new downtrend on the lower timeframes, looking for support on the 8/1 Gann and as low as the 4/1 Gann.

On the larger timeframe, don't forget Steve's trade (targets are my own though):

PS. Some Index funds might be worth shorting as well.

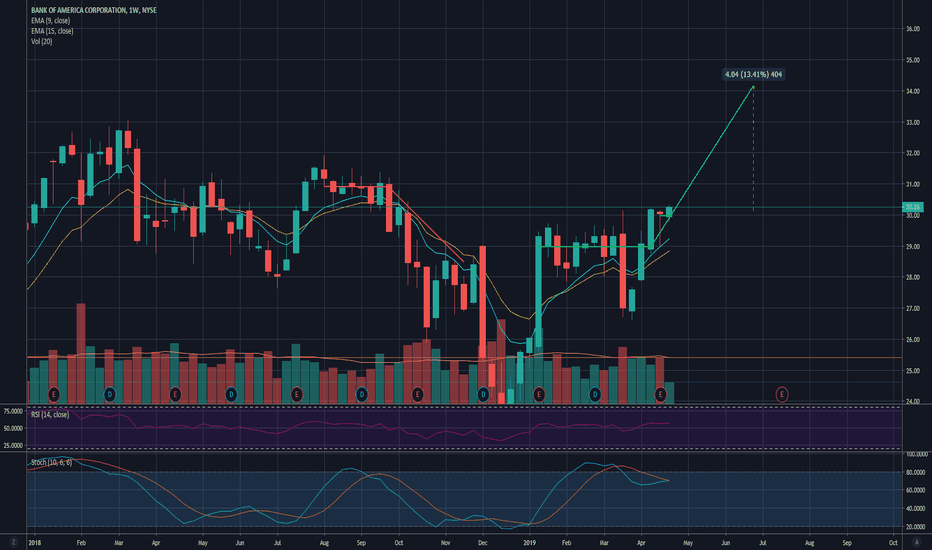

BAC to New Highs (at least since the housing collpase)After 12 weeks of consolidation BAC broke out last week. Suggested increase of 13.4% or around a $4.00 move.

Two things to keep in mind are:

1. The resistance that will be met at 33.05, the highest price since 2009

2. One week didn't touch the mode, usually I don't chart a consolidation unless every candle in the consolidation touches. This was otherwise a pretty nice consolidation so I went ahead with it anyways.

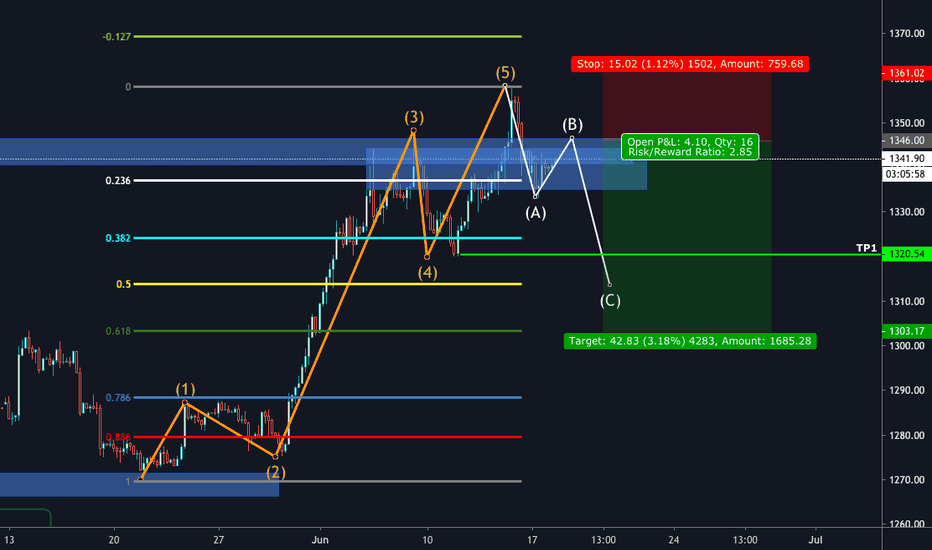

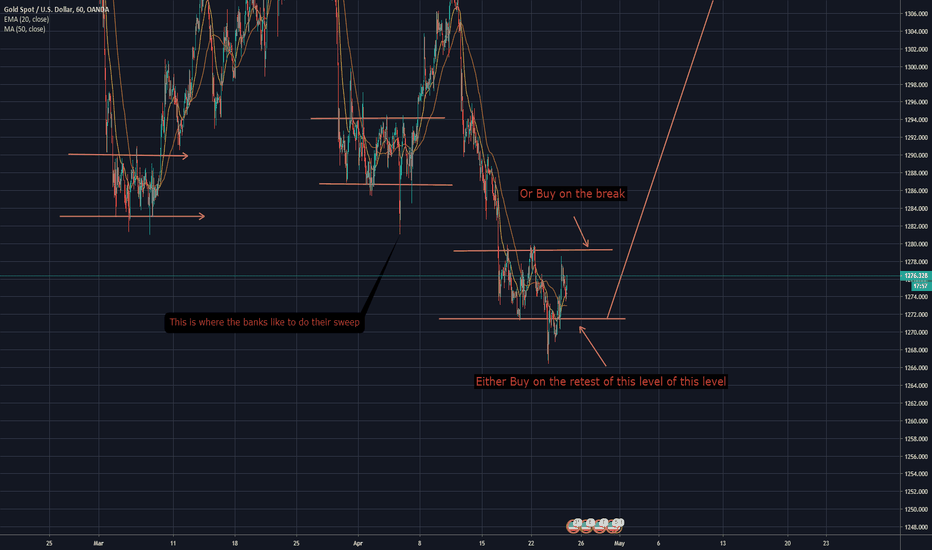

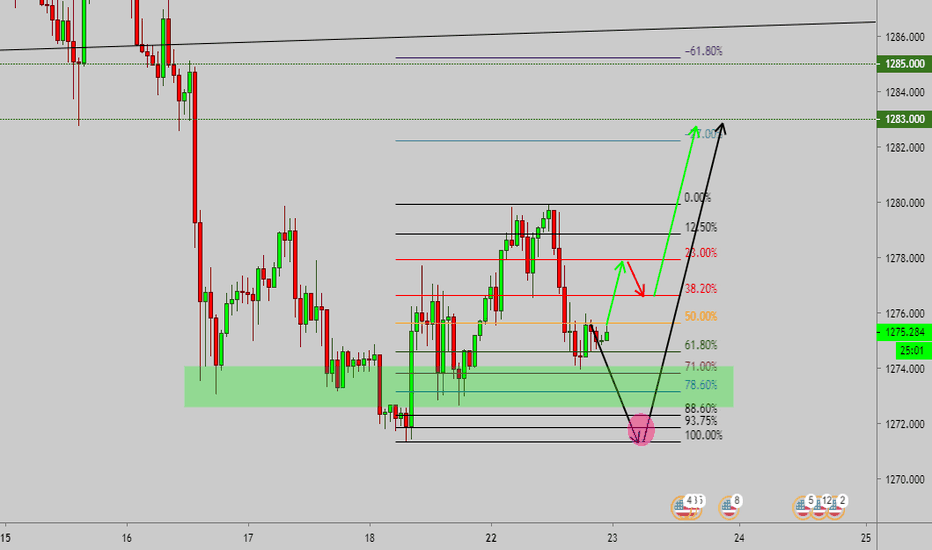

XAUUSD LONG BUYExpecting price to drop lower supporting my break retest and enter strategy.

looking for a pullback closer to the 100% on the fib before looking to get into a buy.

if we see a buy i will be looking at key levels of 1283 to be hit. gold has been on a bullish run of late and without any major good news revolving around economies we can only assumed that gold is to climb higher.

lets see how this plays out and secure the bag together.

FOLLOW MY SOCIALS

Youtube Channel - Learnitempire

Personal Instagram- Vellly

Instagram - Learnitempire

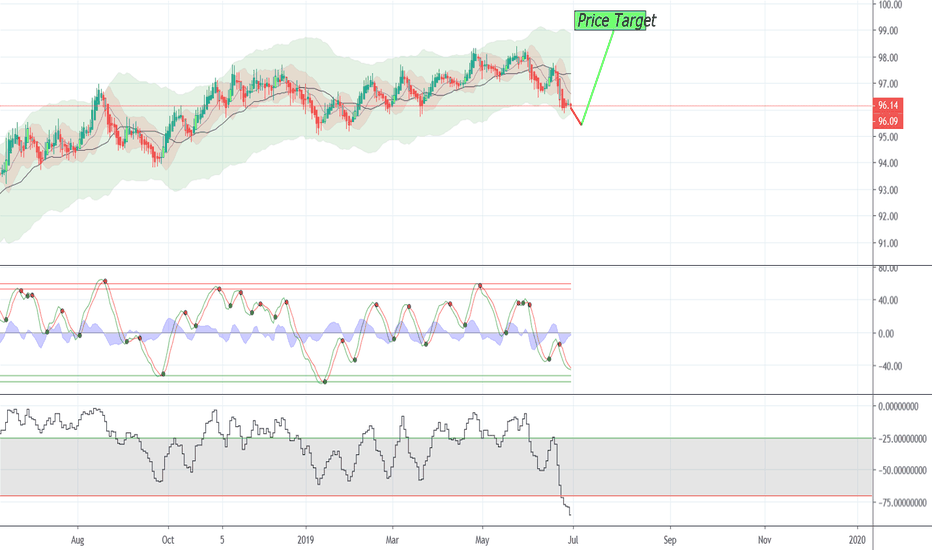

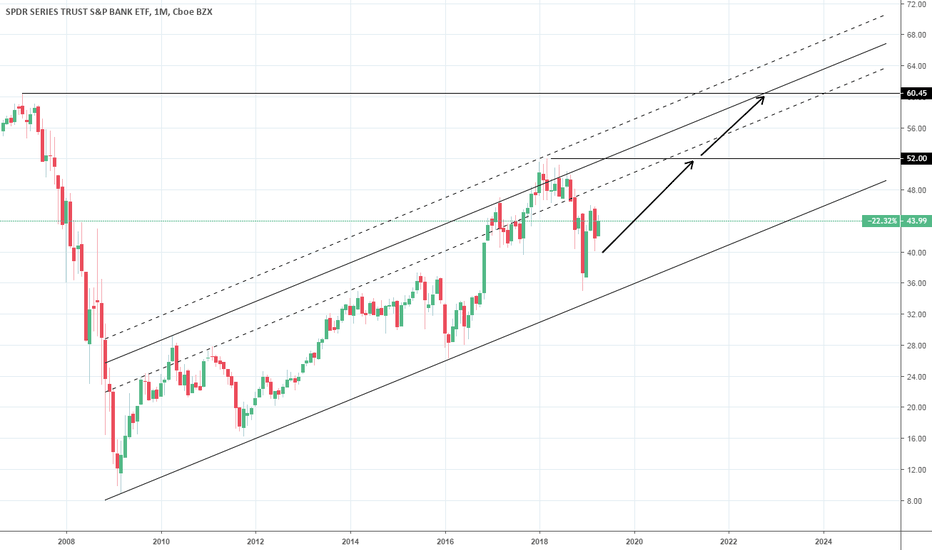

Good investing opportunity on the U.S. banking sector.The KBE ETF, which tracks an equal-weighted index of U.S. banking stocks, has been rising on a very steady 1M Channel Up since the 2008 financial crisis and has recently rebounded on the latest Higher Low (RSI = 50.776, MACD = 0.640, Highs/Lows = 0.0000). This presents a good buy opportunity on banking stocks, which are expected to outperform the market in the coming years. Our long term target is 52.00 with 60.45 in extension.

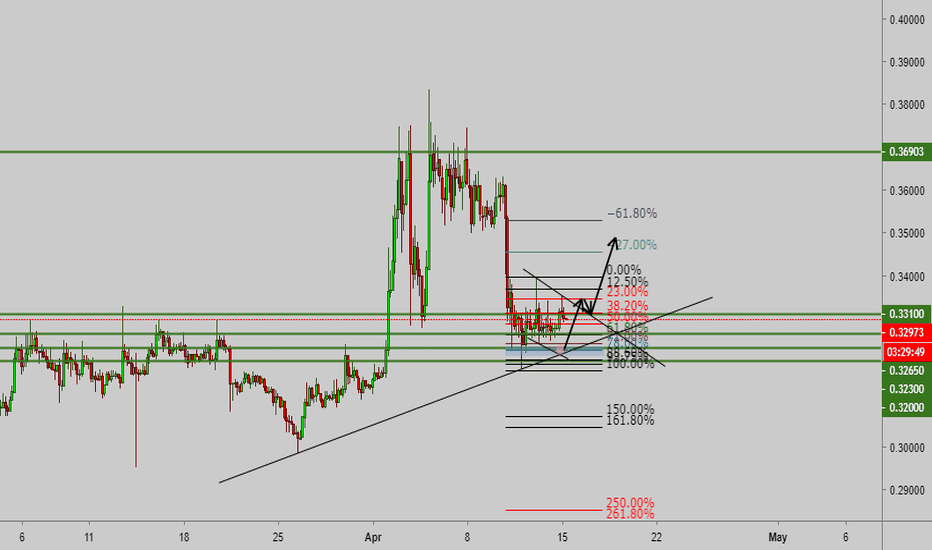

XRPUSD BUYLooking for price to drop down towards a key level of 32300 before we see a strong push towards 35200.

Lets see what happens for the week ahead, this is more of a swing trade.

lets sit tight and make sure we secure the bag on this one because everyday is Monday day!

Follow our social platforms

Instagram : Vellly

Instagram: Learnitempire

Follow and subscribe to our youtube channel for more content to come!

Youtube : Learnitempire