Range trading for a mini break out on the Italian MIBMaybe a little labour intensive for some but a safe way to book profit without much risk.

Buy and sell in 2 units at support and resistance. Move stops to protect positions. Take one unit profit at either support or resistance. Wait for break out in either direction. Repeat until breakout. Or leave it alone if it looses it's neatness and starts getting messy.

Low stress trading hopefully :)

Banks

Weekly bearish engulfing, trend line breakdown - $GS is a buy?I saw some analysts saying the $GS is cheap before earnings.

Last week we saw a weekly bearish engulfing candle (Outside bar).

This week we see trend line breakdown and a close below the 180$ resistance zone.

Even if $GS will bounce from a good report, can you really call it a "Buy"?

Ftse mib short termThe divergence between oscillator and price movement ended the up-trend started June, 2013. The price recently tested the long term support in 19.800 area, without confirming the break. The index is expected to approach the 19.600 area on the long term support, and then starting again towards higher levels.

The advice is to wait until the price reaches 19.600 zone, then buy if the support holds, or sell in the occurrence of the break of support.

BAC relative weaknessBank of America lags behind the market, ant usually that indicates some weakness. Key level in this action is $15.30, the breakdown of which previously led to a drop to $14.85. Now it acts as a resistance and underneath a bear flag has been formed, breakdown of which will attract more sales. Potential entry points are marked on the chart with orange bands.

NBG Almost finished Double Zig Zag Wave 2NBG Long term Chart:

I strongly believe we are currently in a corrective wave 2 of a long term wave C pattern that should complete near the fall, end of the year.

What I previously thought was an expanding diagonal () now appears to be a double zig zag corrective wave 2. If A=C in the corrective zig zag, then we can retrace as far as 2.95, but using channeling, fibs, and market sentiment as a whole, I believe we might start to bend up before that, around the 3.09-3.18 mark. That would be a great LONG entry.

If we dip below the bottom of wave 1 (2.90) then ALL BETS WOULD BE OFF, as wave 2 can never retrace more then wave 1. However, if this turns around when I intend, we should experience a strong wave 3 move to the upside soon.

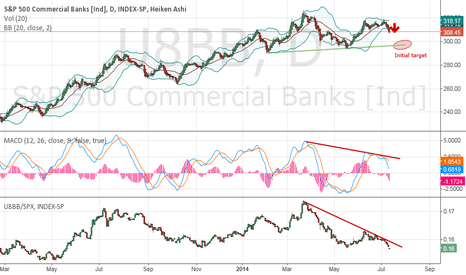

Short Commercial BanksIndustry is underperforming the S&P

Double top was formed

losing upside momentum

The industry index has recently squeezed and had a breakout lower 2 days ago