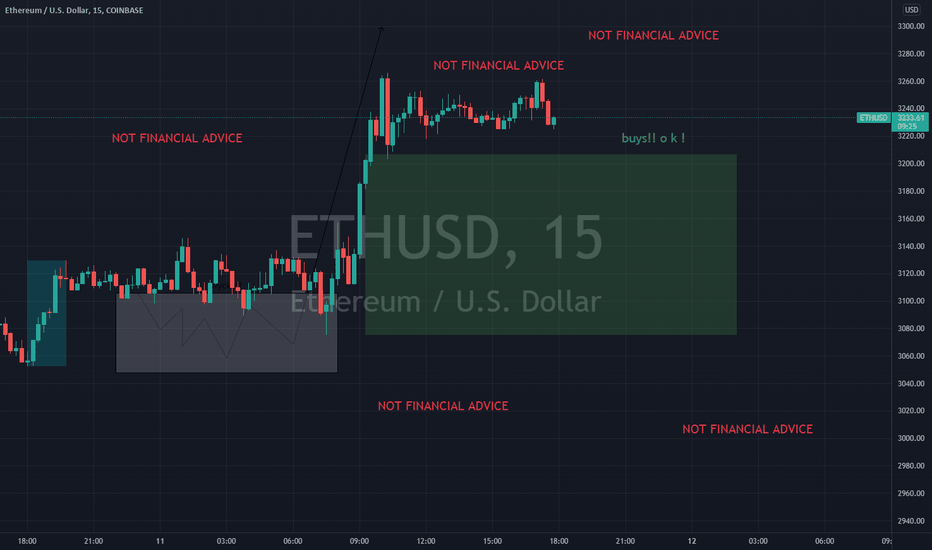

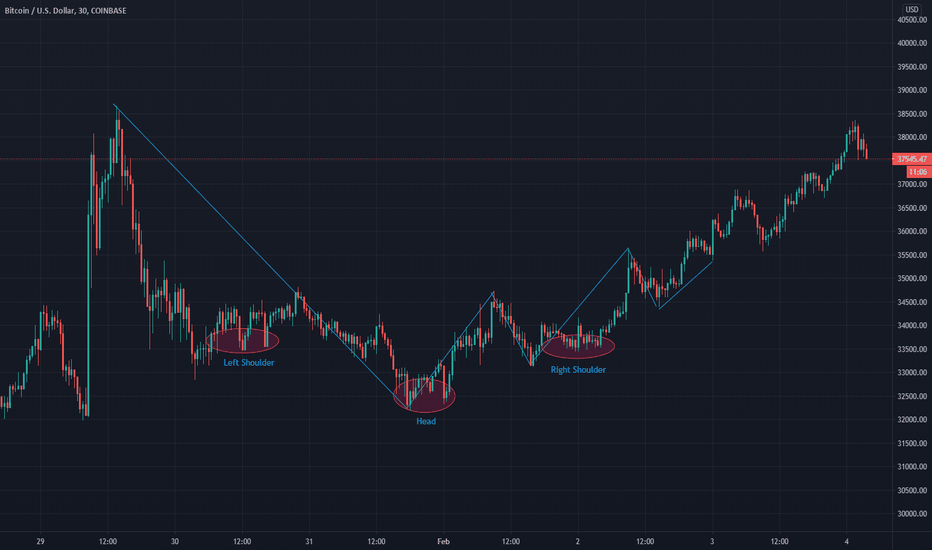

Ethereum begins its mighty march to new highs. A flavourful quesIt's simple folks. Buy low, sell high, buy low. Simply transmogaphy the shapes into a realistic plain that allows for the interpretation of an unaligned wavelength.

New opportunities crash over us like the great wave of Kanagawa, easily drowning us and reminding us that although swimming is fun, air is required for life.

Based

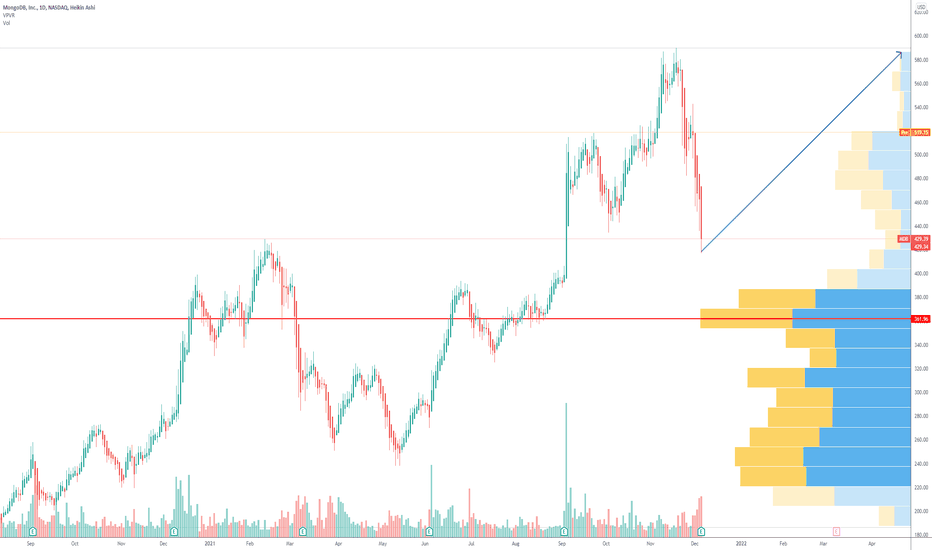

MDB MongoDB revenue increased 50% YoYMongoDB's fiscal third-quarter revenue increased 50% year over year.

Revenue growth rate increasing from 39% growth in the first quarter of fiscal 2022 to 44% in fiscal Q2 and now 50% in fiscal Q3.

MongoDB's 50% revenue growth put total revenue for fiscal Q3 at $227 million.

This was far beyond analysts' average forecast for revenue of $205 million during the period. (fool.com)

With this growth rate and cloud-based database needed for the upcoming metaverses, i think MDB MongoDB can reach all time high by the end of the year.

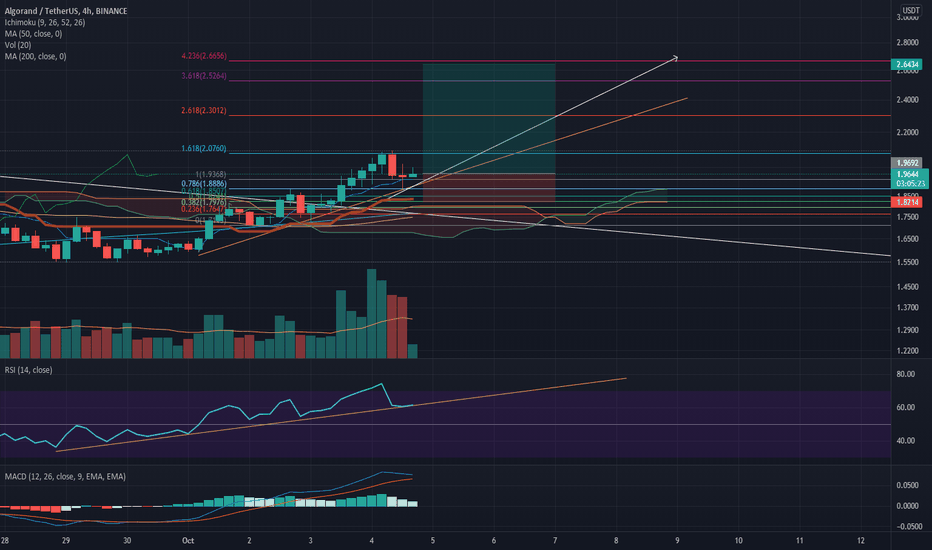

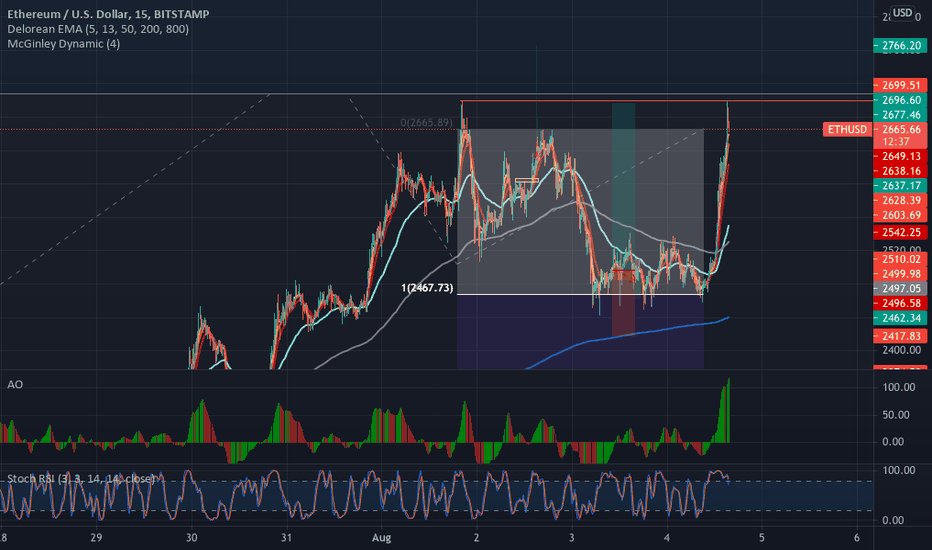

30% profit in case of formation of an upward trendYesterday, fortunately, with a suitable volume, the downtrend line was broken and we saw a pullback to it in the four-hour time frame.

Due to the formation of a new uptrend, I pulled a TREND-Based Fib at the beginning of the trend and as it can be seen in the picture, it worked well. Due to the formation of Doji on the support of 1 Fibo and the good support of the trend line, I expect the resumption of the uptrend and the most important resistance along the trend of $ 2, which is the resistance of Rand number and 1.618 Fibo Nachi, and in case of failure 2.3 I consider $ and $ 2.8 to be the most important resistances.

In the daily timeframe, we also had a continuous Wedge that broke, and I expect the price to increase as much as the norm, which is exactly $ 2.8.

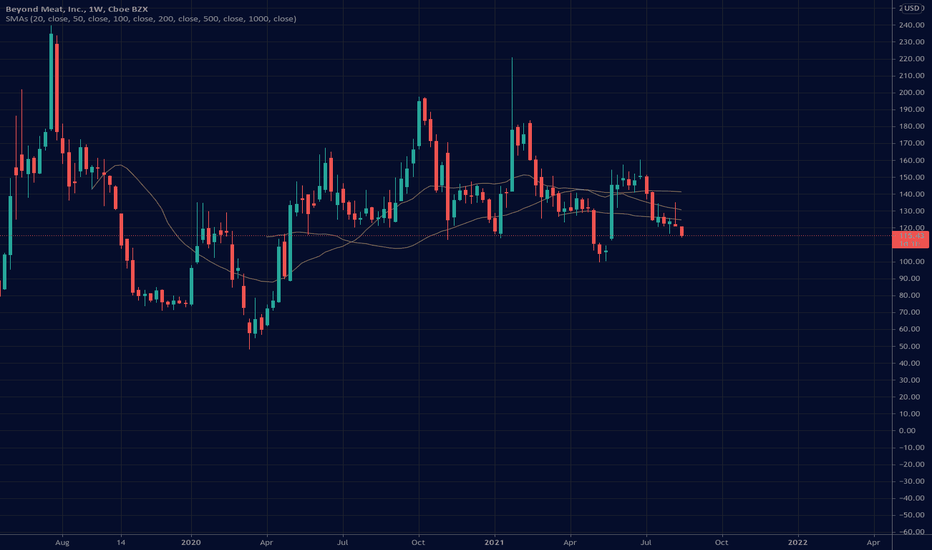

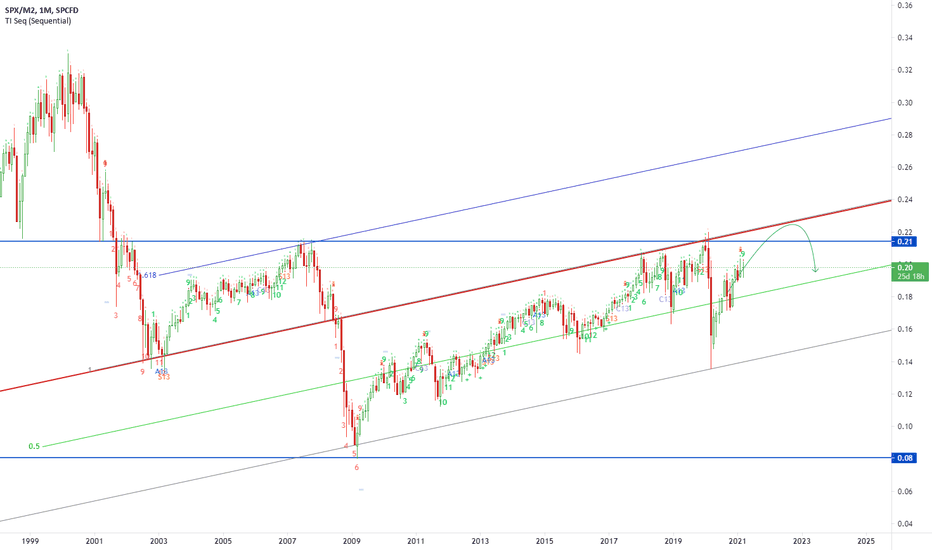

What Analysts Got Wrong about the Recent Volatility.Since I'm not a professional analyst, I've sunk many hours of research in the past week to understand the recent move in the market on a deeper level. Here are my findings. I hope you find this informative.

I've been hearing different analysts' opinions about the recent move in the stock market. I heard the money is moving from tech stocks to banks, or from growth stocks to value stocks. I'm here to say that neither is true. NASDAQ:GOOG is a tech stock and it's been rising. NASDAQ:COST is a value stock and it's been falling. Observe different stocks and you'll find numerous examples. The recent move is rather about companies in debt vs companies with free cash flow . It turns out that when interest rates are raised, it can be predicted with certainty that more money is going to flow into servicing existing debt rather than into productivity. Watch this talk with Brent Johnson to understand this concept, minute 50 to 60. Banks, who recently had their debts quantitatively eased, have more room to buy corporate bonds from companies like GM and Ford. This debt is used to service older debt. The big money, which understands this debt-based economy well, knows precisely where value is going when interest rates rise. Big money used their tried-and-tested calculations and decided to move their investments from free-cash-flow companies, to debt-generating companies. That's what's been happening, and that's the reasoning behind it.

However, there is a point the smart money is missing and they keep missing it and never learn. There is much more value to reap from technology and innovation than there is in loan interests. This value of tech is not priced into their tried-and-tested calculations. It's probably too uncertain for them. But realize that when companies like Amazon, Apple, Google, Facebook, and Tesla create value through technology, they are carrying the rest of the useless debt-generating economy on their backs and creating prosperity for the entire nation and for the world. Real value is in productivity. The United States has moved slowly after WW2 from an industrial exporter to a liquidity and debt exporter of sorts, which also reflected on the US's internal economy. And that weakened the industrial sector over the decades and bubbled the financial sector to an overwhelming extent that it's sucking more and more money from productive businesses and pouring it into existing debts with the purpose of buying more time. The retail investor should learn and understand this in order to position themselves with high conviction on the side of technology and simply hold stocks like Tesla for a decade. You are already benefiting the economy by saving money aside and putting it in the right place and of course the reward is high.

Let me know your thoughts. I probably made mistakes and left some statements in need of more elaboration.

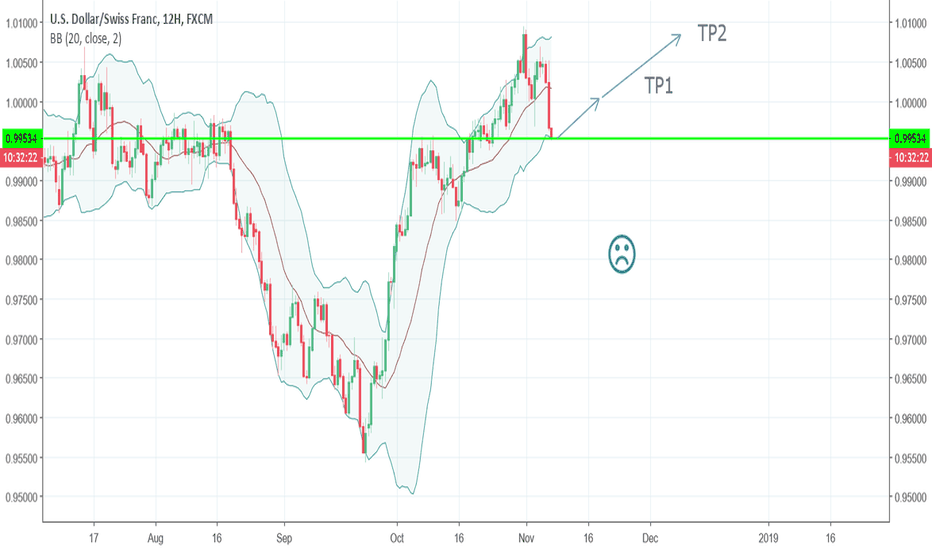

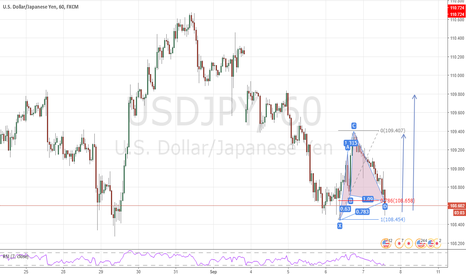

USDJPY bullish cypher as entry reason for structure base tradeUSDJPY bullish cypher as entry reason for structure base trade

USDJY is giving at market a long opportunity with this bullish cypher. Looking at D1 and H4, is can be seen as an entry reason for a longer term long entry

Entry @ 108.55

SL @ 108.11

If you decide to take Cypher's traditional TPs:

TP1 @ 108.80

TP2 @ 109.00

If you decide to take longer term TPs:

TP1 @ 109.33

TP2 @ 110.22

As always, comments are welcome

---------------------------------------------

"Build a plan, follow it consistently"

Regards

Rafael

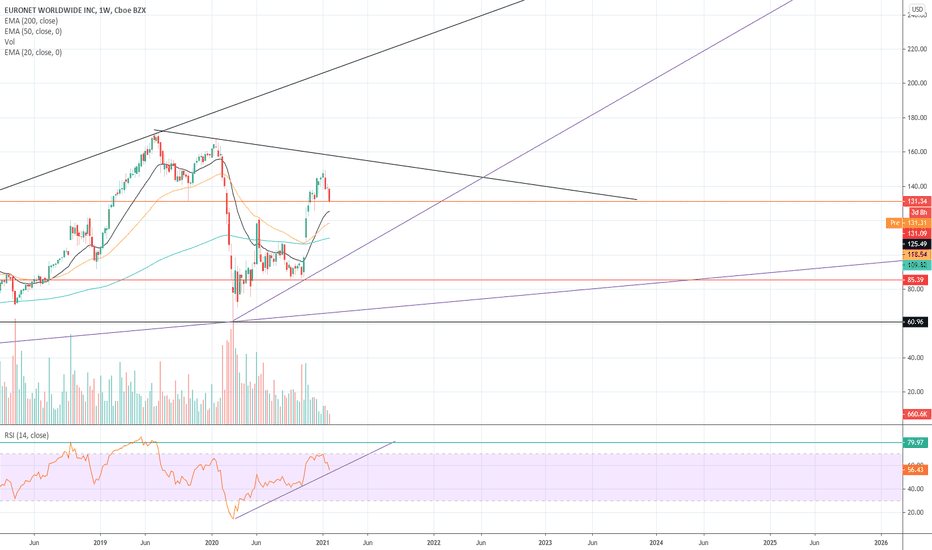

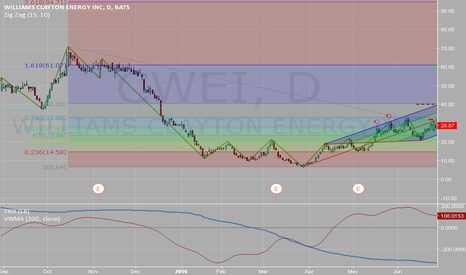

CWEI analyse long termI think that CWEI will rise to 60 or less if the stock come back to 40,00 $.

I think so due to the fact that

·the price just broke 1 ( 0.28 )Trend-Based Fib Extension

· also it broke the down trendline

· it just had an pullback in the pitchfork you could see in the picture

· also an uptrend just started

Bat and Cypher patterns and structured based tradeThis is my first Publish Idea this would be a cypher and a bat pattern ( I set thouse patterns based on my own rules )

but before that there is a structured based trading oportunity, so with any luck we could get 2 consecutive trades with STOP AND REVERSE

NOTE: I Know my english sucks so don't bother leting me know that xD