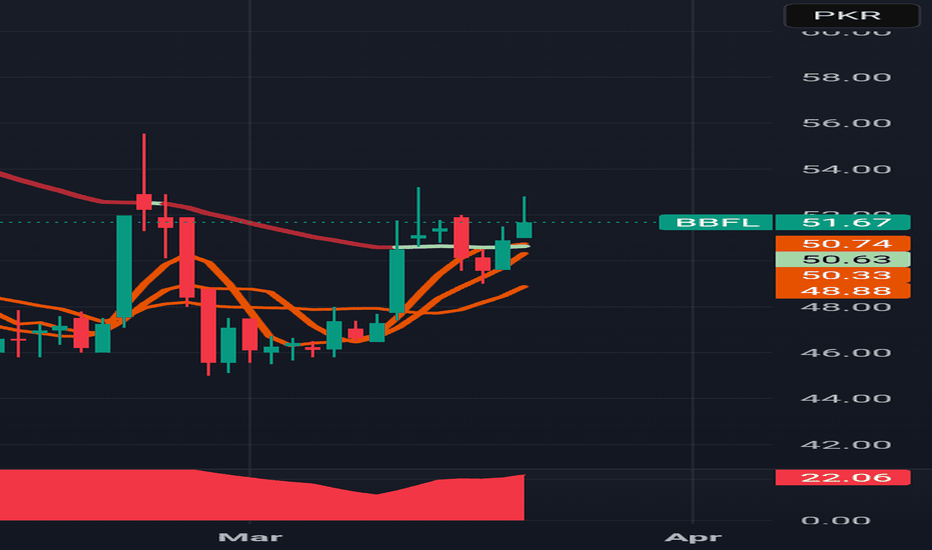

BBFL – Big Bird Foods Limited: Range Breakout SetupBBFL has been moving sideways for months, locked inside a consolidation box 🟧. Price is holding well above the key support zone and building energy for the next decisive move. A breakout above the range could open the door to strong upside momentum.

🔑 Key Levels:

CMP: 47.37

Support / Stop-loss: 44 🛡️

Range Resistance: 55.5 🚧

📌 Trading Plans:

Plan 1 (Aggressive):

Buy @CMP or on dips to 45.5

SL: 44 ❌

TP1: 52 🎯

TP2: 55 🎯

Plan 2 (Conservative):

Buy only above 55.5 on closing basis ✅

TP1: 63.7 🎯

TP2: 69.5 🎯

TP3: 77.7 🚀

⚡ BBFL is at a make-or-break zone. Holding above support keeps bulls in control, while a breakout above 55.5 could trigger the next rally.

BBFL

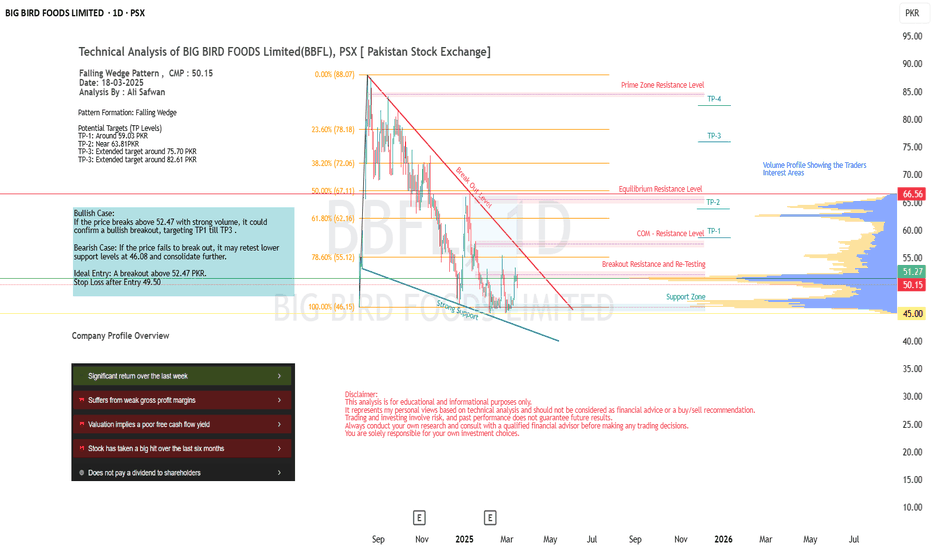

Technical Analysis of BIG BIRD FOODS Limited(BBFL), PSX

Technical Analysis of BIG BIRD FOODS Limited(BBFL), PSX

Falling Wedge Pattern , CMP : 50.15

Date: 18-03-2025

Analysis By : Ali Safwan

Pattern Formation: Falling Wedge

Potential Targets (TP Levels)

TP-1: Around 59.03 PKR

TP-2: Near 63.81PKR

TP-3: Extended target around 75.70 PKR

TP-3: Extended target around 82.61 PKR

Bullish Case:

If the price breaks above 52.47 with strong volume, it could confirm a bullish breakout, targeting TP1 till TP3 .

Bearish Case: If the price fails to break out, it may retest lower support levels at 46.08 and consolidate further.

Ideal Entry: A breakout above 52.47 PKR.

Stop Loss after Entry 49.50

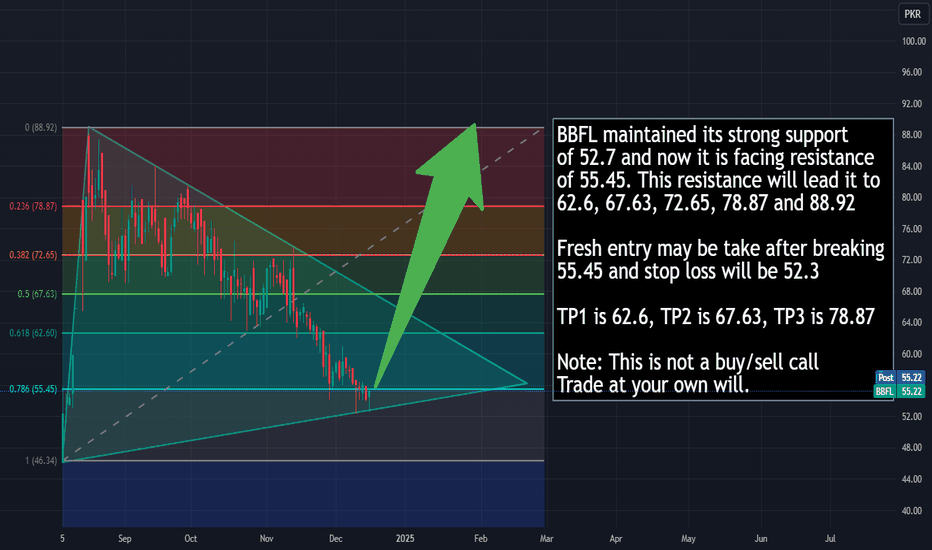

BBFL is ready to flyBBFL maintained its strong support of 52.7 and now it is facing resistance

of 55.45. This resistance will lead it to 62.6, 67.63, 72.65, 78.87 and 88.92

Fresh entry may be take after breaking 55.45 and stop loss will be 52.3

TP1 is 62.6, TP2 is 67.63, TP3 is 78.87

Note: This is not a buy/sell call

Trade at your own will.