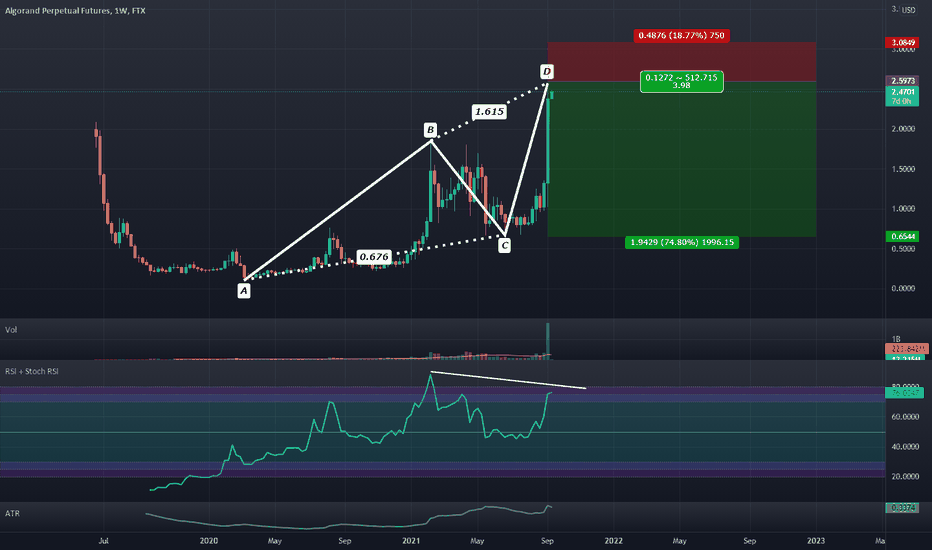

Bearishdivergence

Shooting Star Bearish Reversal Pattern Visible on the DailyIf the daily closes like this that will be a confirmed Shooting Star Candlestick Reversal Pattern visible on the daily and that will be a signal for future downside. Of course the market hasn't closed yet and this is simply and aggressive early entry into this potential future position.

I think we will make about an 80 percent retrace or test the 200 day moving average as a bearish target.

GBPCHF Intraday Sell IdeaD1 - Price respected the strong resistance zone.

Price created a false break of the range.

Bearish divergence.

No signs of trend change.

H4 - Bearish convergence.

Currently it looks like a correction is happening.

Until both the strong resistance zones hold my short term view remains bearish here.

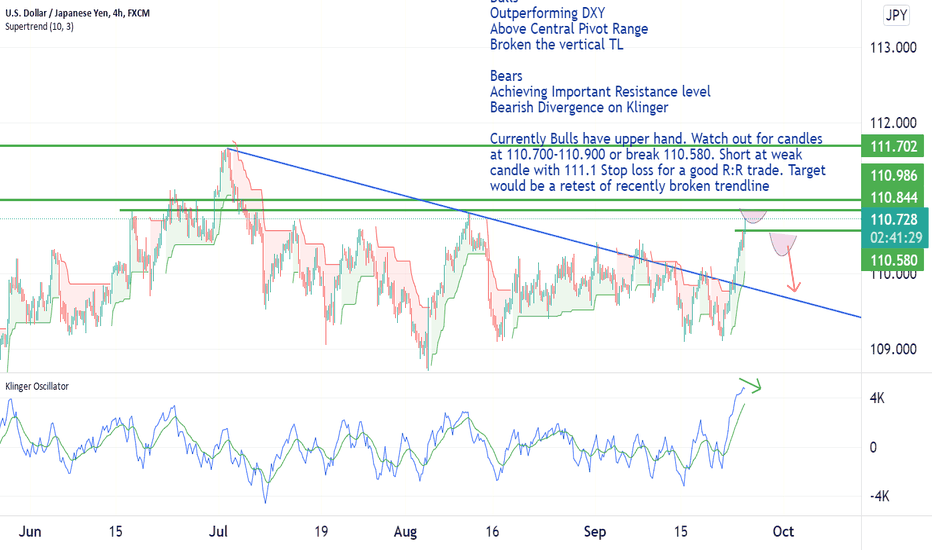

USDJPY 4H reaching the important yearly resistancesUSDJPY 4H reaching the important yearly resistances. A short opportunity is likely to emerge on weak candles at resistance or a recent bull candle break which will lead to test the recently broken trendline. Some of the oscillators and relative strength against DXY have initial indications of bearish divergence.

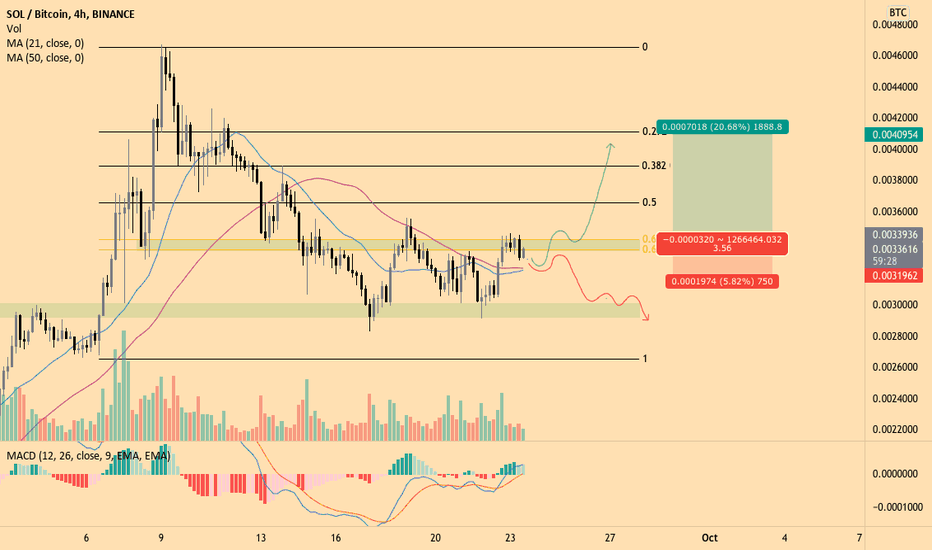

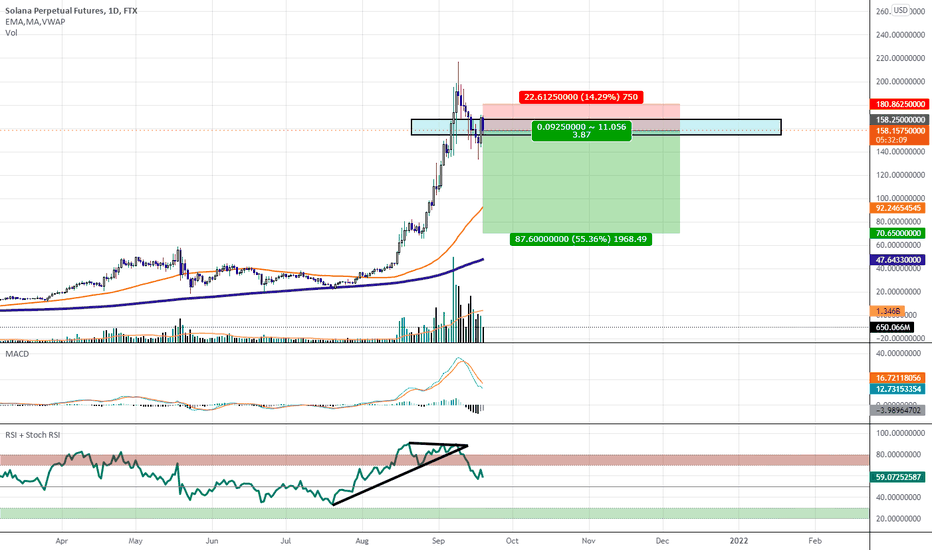

Solana hurdles to overcomeIf I'm being bullish - which in the long term I am for Solana - I could see this as a buying opportunity here.

What needs to happen in my opinion:

- 21MA (blue) needs to cross over 50MA

- Price needs to break golden pocket

- Price needs to break strong support zone

What could signal a turn for worse:

- Price currently below golden pocket & strong support zone

- 50MA could cross below 21MA

- MACD showing bearish divergence on its lagging line

What are you betting on?

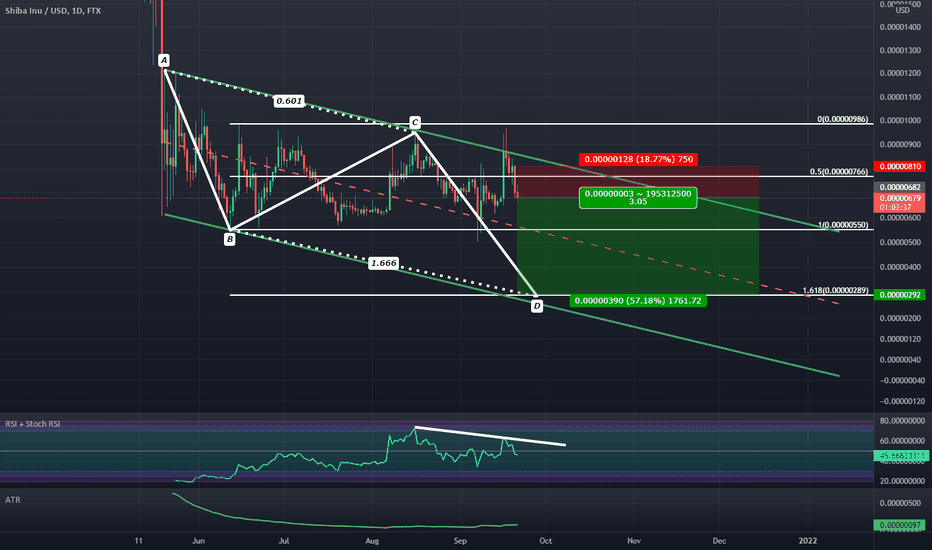

Solana Attempting To Breakdown Through A Point Of ContentionThe zone i have highlighted on the chat is the range between the top and bottom of a high volume daily doji and we're overbought on the weekly showing bearish divergence on the RSI while on the daily RSI we are breaking down after being overbought; If we break below the zone i have highlighted then i expect to see a huge move down to the moving averages.

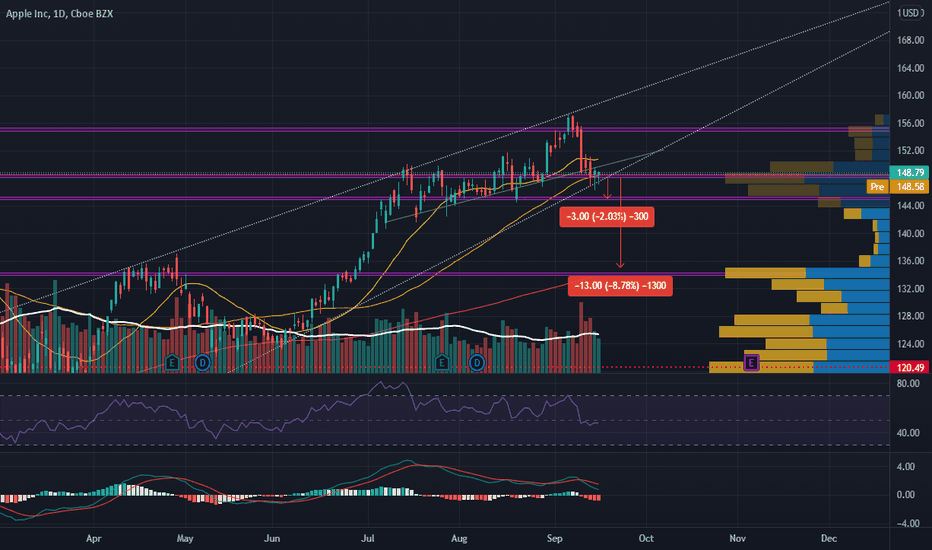

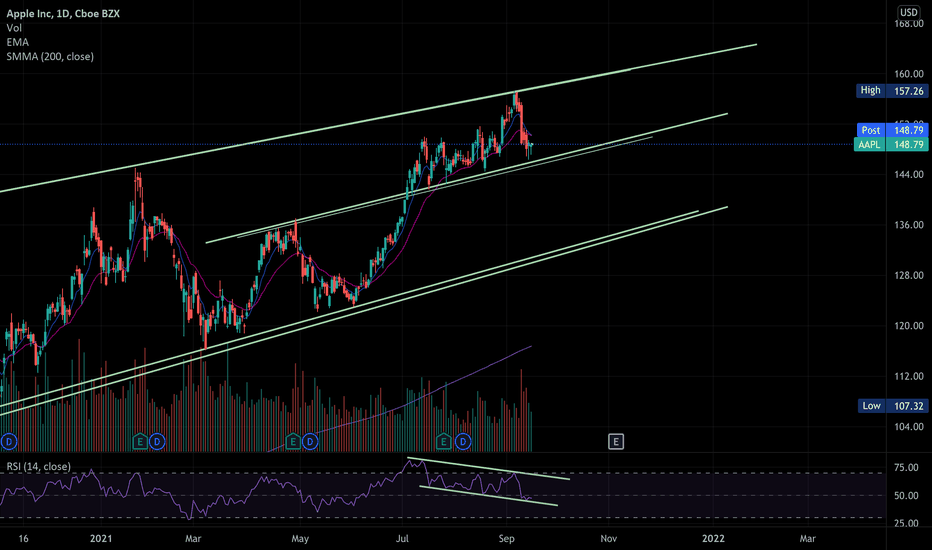

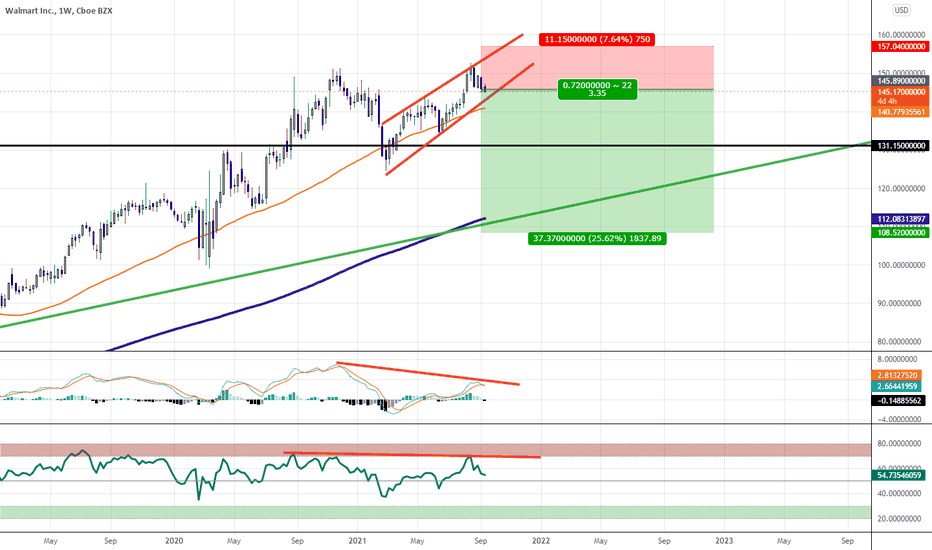

Bearish Sentiment on $AAPLRecent News - Apple reloads its stock with "new products" which aren't so new but with a higher price tag (Bearish). Epic Games v Apple (Bearish). Losing the fourth Apple car exec this year (Bearish). Quad Witching Sept 2021 (Leaning Bullish).

Trend - We're just coming off a bullish trend that helped us reach an ATH of $157.26. We broke that trend with a strong pullback from ATH with the Judge's ruling over Apple's in-app purchases. We're also still in this wedge pattern, which I believe we'll break from it within this month (hopefully next week).

Candles/Volume - We saw three wide body candles with strong, above average volume to validate them. We currently have two hammers with average volume which indicates that the buyers are holding at the ~$148 support level (could possibly be a reversal - volume makes me think not). I can see the buyers becoming exhausted and the price dropping down to the next support level of ~$145. If by chance the buyers don't step in at that price or they become overwhelmed, we can easily see the stock drop -8.78% from ~$148 to ~$135.

MA - The 200 MA has also be a previous strong support. Which it would currently fall at ~$135 if the market decided to pull back.

RSI - Starting up from July 7 to present. There is a bearish divergence on the RSI.

MACD - I believe it's just starting to pickup momentum with the signal line already having crossed over the MACD line. We also see a bearish divergence with the MACD, just like we saw with the RSI.

Constructive criticism would be appreciated.

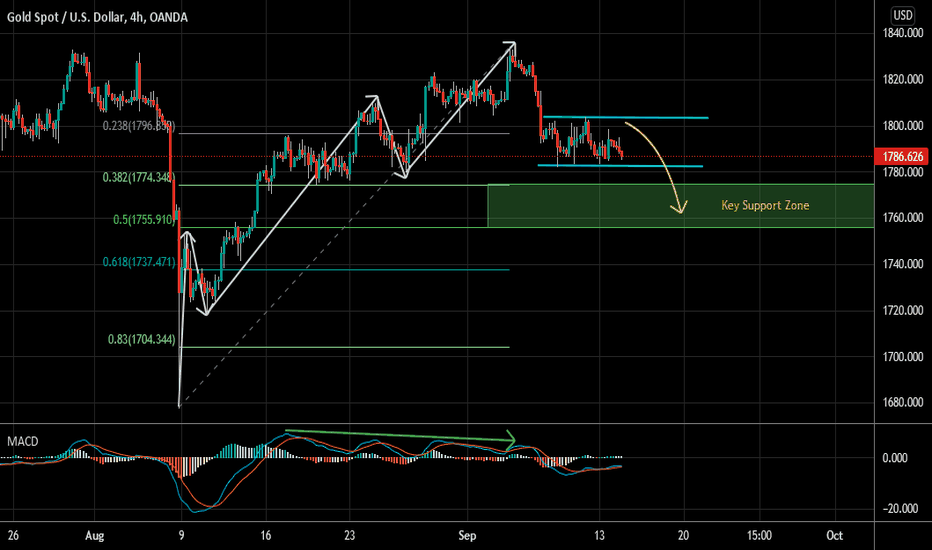

Gold Short Term Sell IdeaH4 - Triple wave to the upside which ended with a bearish divergence.

Currently it looks like a correction is happening.

After the first leg to the downside, it looks like a flat correction is happening in the form of a range now.

Until the top of this range holds my short term view remains bearish here and I expect the price to move lower towards the key support zone formed by the 38.2% - 50% Fibonacci retracement zones of the triple cycle.

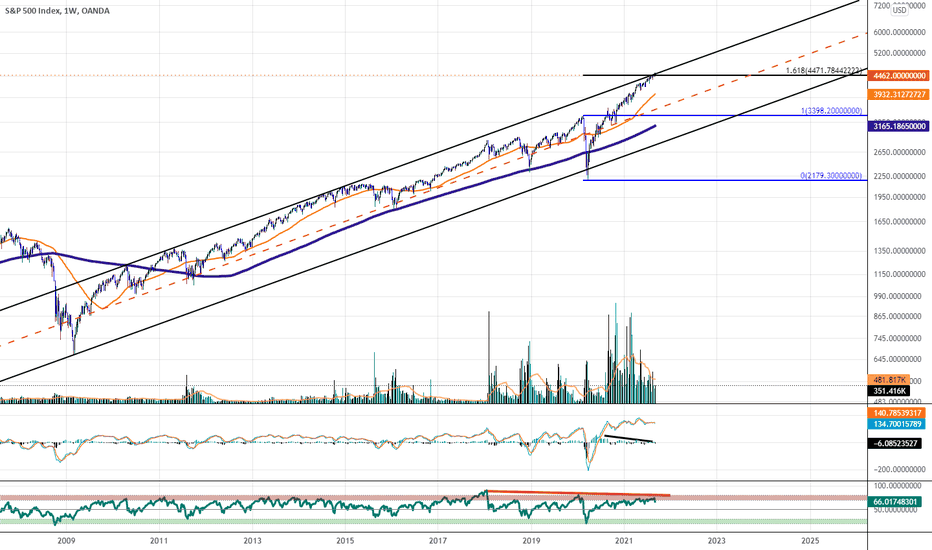

Bearishly Engulfing The Weekly At Critical Levels: SPX Update #3I have been tracking this channel for awhile and giving occasional updates on the price action within it and i am seeing that we bearishly engulfed the weekly at the top of the channel as bearish divergence continues this may signal that this would be the last week we see any sort of attempt to achieve higher highs for a long time.

Additionally we are at a 1.618 Fib extension so this would be the perfect area to reverse from.

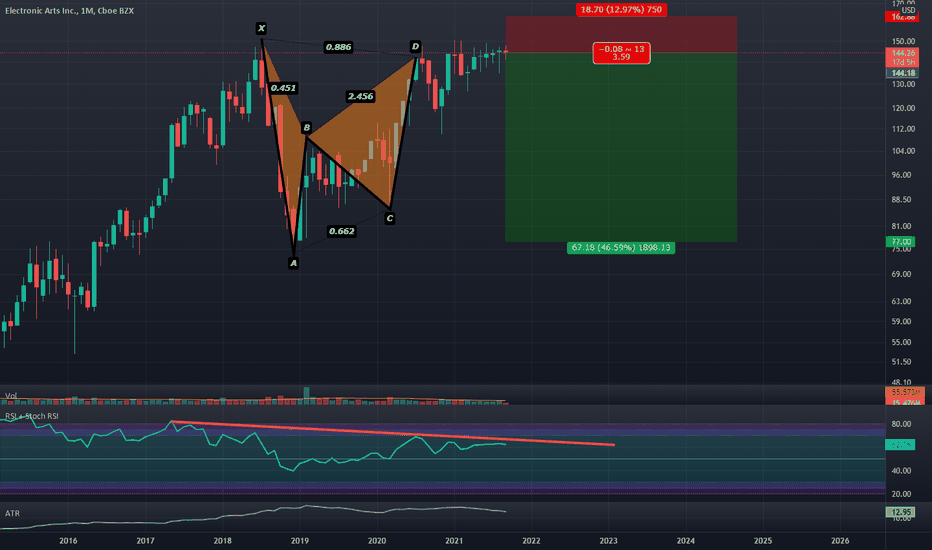

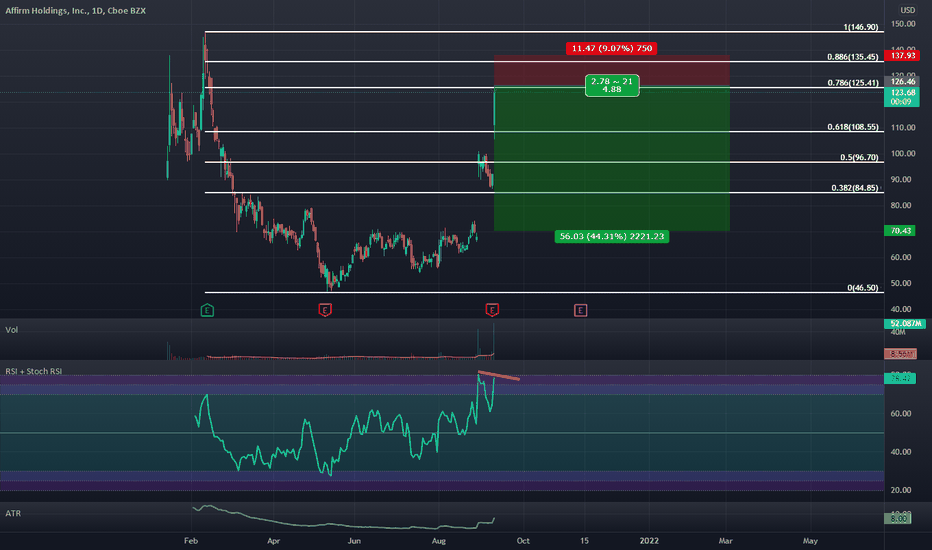

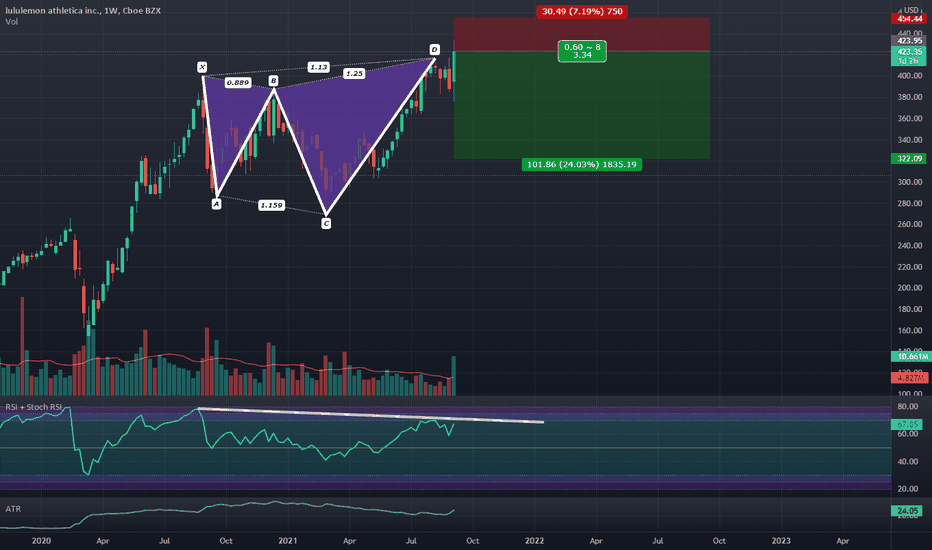

Bearish Shark May Be Looking To Trap A lot of Bulls.We have a Bearish Shark visible on the Weekly with Bearish Divergence and a Huge Spike in Weekly Volume after an extreme upside Breakout. I never heard of this stock before and i hardly know what they do but just looking at it tells me that there are a lot of bulls betting for more upside up here and that any amount of selling below the breakout zone can easily lead to a very steep decline.