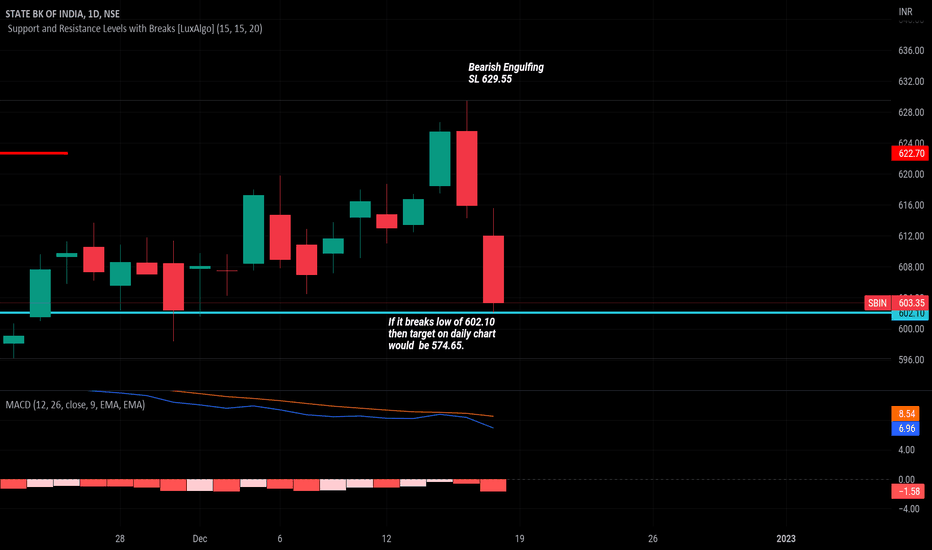

Bearish Engulfing

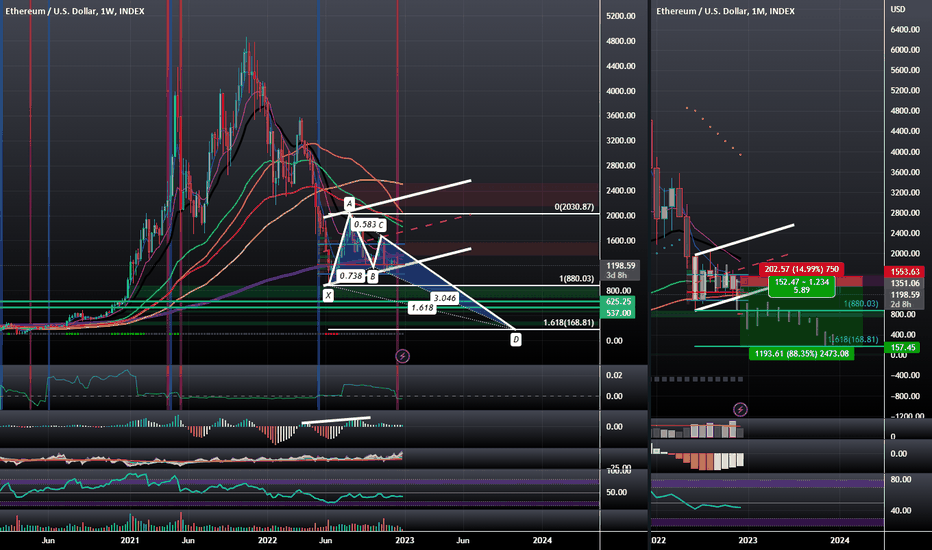

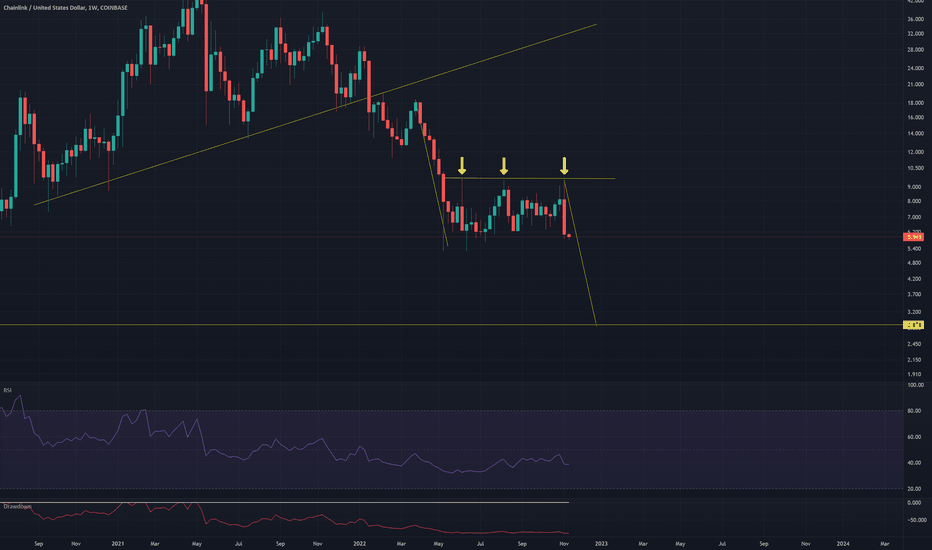

Ethereum Confirming the Bearish Breakdown to $168.81Last week i posted about this Potential BAMM and Bear Flag Breakdown on ETH that would take us to the 1.618 Fibonacci Extension if real and now this week it looks like we are confirming the BAMM Trigger Line as Resistance as the Hidden Bearish Divergence Continues on the MACD. We have a Bearish Engulfing on the Monthly and just recently closed the Weekly below the POC as well as triggered tthe CAI. I think this gives great reason to believe that ETH will be coming down to lose 88% of it's value meanwhile other coins like XMR, XRP, and LTC will significantly gain in ETH Value.

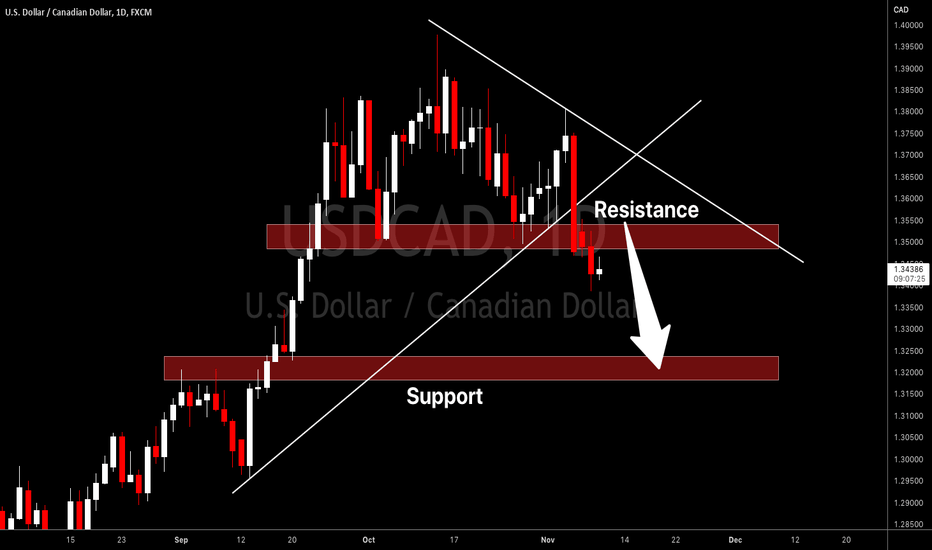

USDCAD I Structure broken - next moveWelcome back! Let me know your thoughts in the comments!

**USDCAD - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

Brian & Kenya Horton, BK Forex Academy

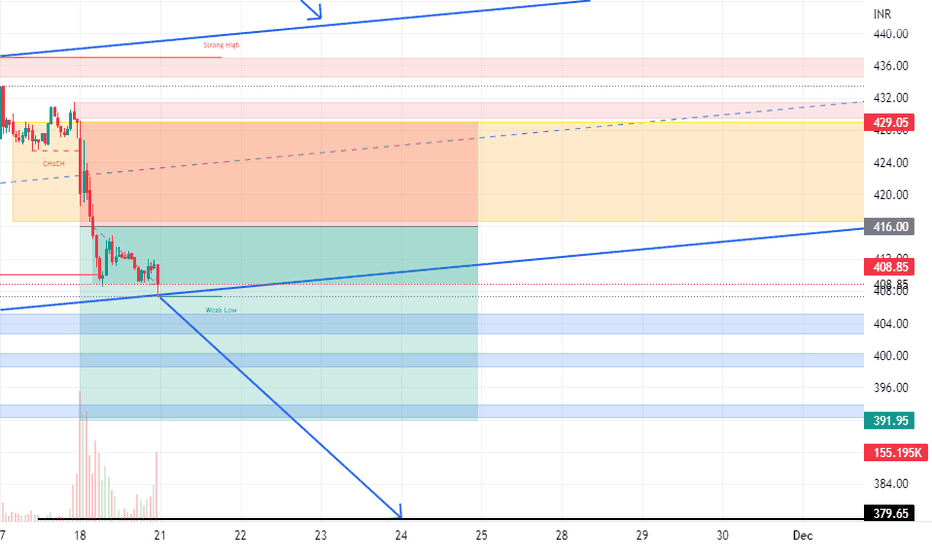

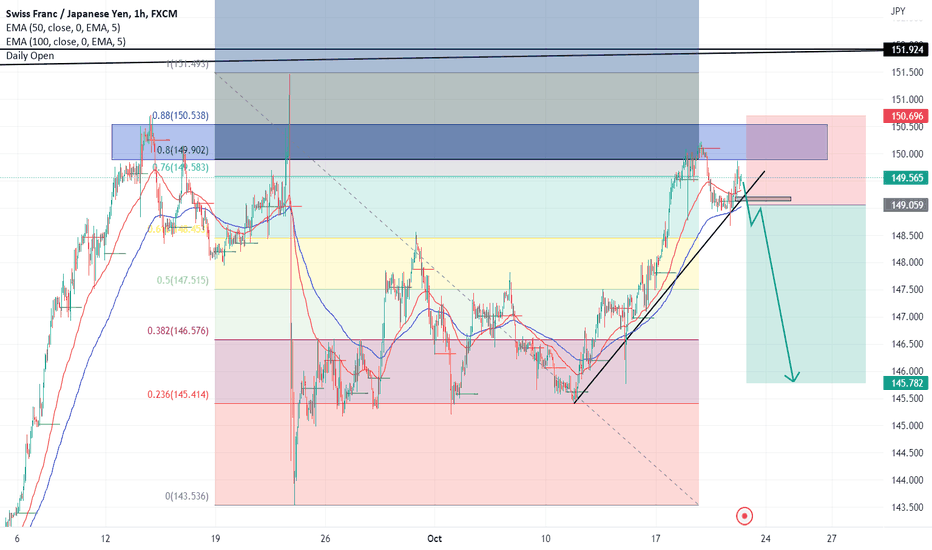

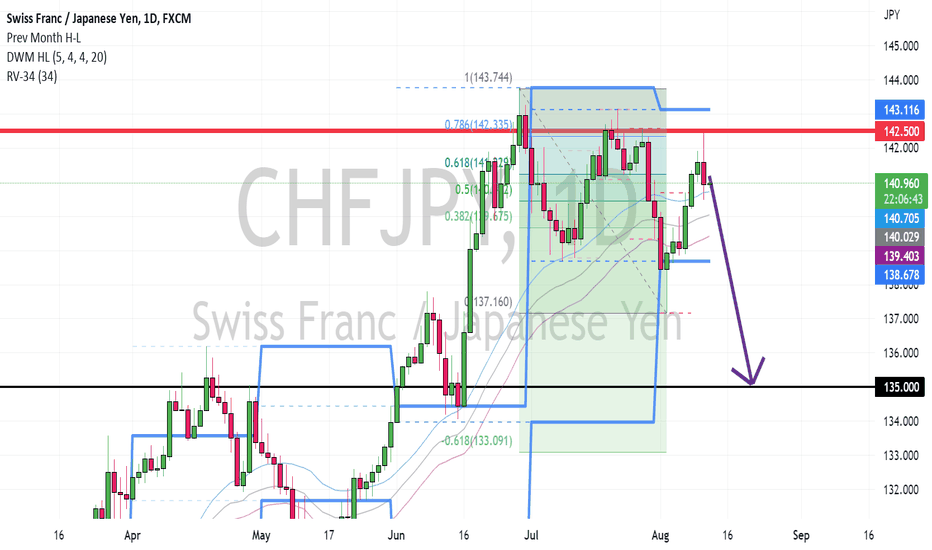

CHFJPY to fallOn weekly timeframe, CHFJPY has reached an overbought zone (RSI), an intersection between upper channel and horizontal support.

On lower timeframe, we've seen a big rejection recently, and then a correction upward : here we reach the 80~88% fib levels of the last rejection (D1), with a bearish engulfing pattern yesterday. This behavior can be a potential sell signal.

If we follow correlation to compare currencies, we find more confirmation : USDJPY has reached very high levels too fast, becoming overextended, and JPY will probably start a correction soon, meanwhile USDCHF is retesting a daily resistance for the fourth time, giving bullish signals, not yet an overextended move.

Goodluck,

Joe.

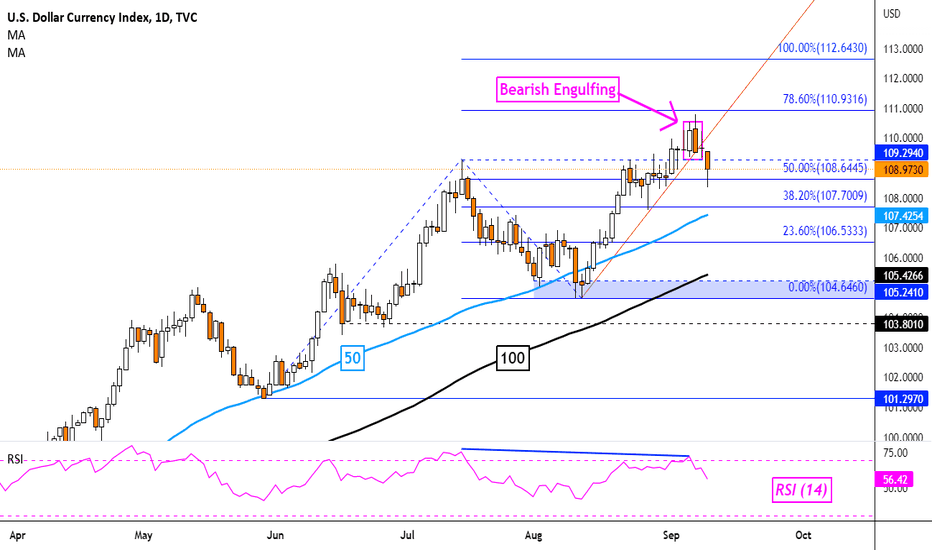

US Dollar Reversal Signals Brew, But Will the Key Uptrend Hold?The DXY Dollar Index confirmed a breakout under a near-term rising trendline from August as prices confirmed a Bearish Engulfing candlestick pattern.

This might open the door to some weakness in the near-term. But, will the dominant uptrend hold?

Keep a close eye on the 50- and 100-day Simple Moving Averages (SMAs). These could reinstate the dominant upside focus.

Resuming the uptrend entails clearing the 78.6% Fibonacci extension at 110.9316. That exposes the 100% level at 112.643.

TVC:DXY

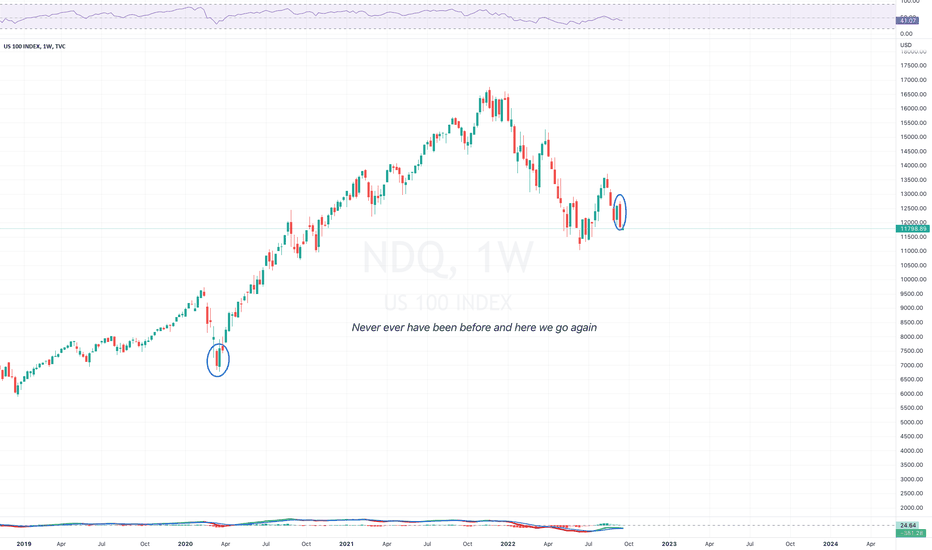

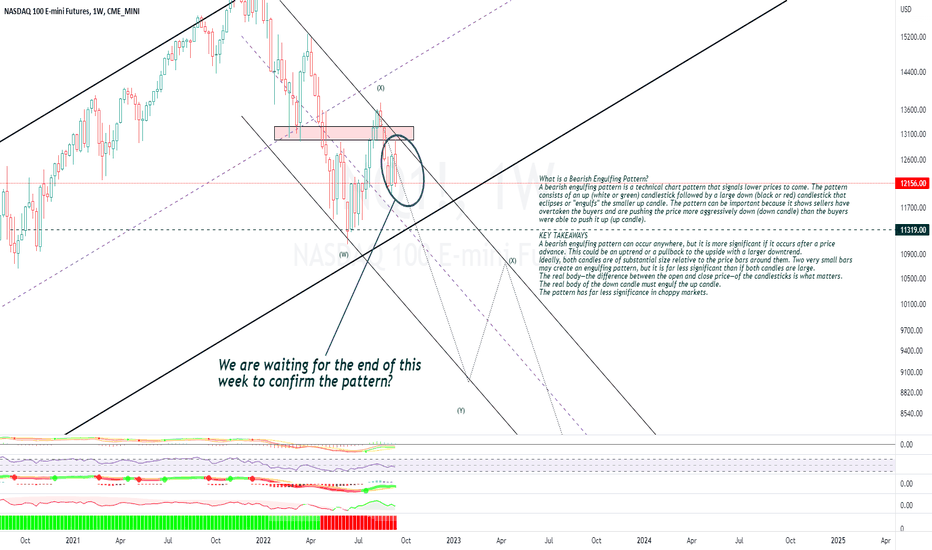

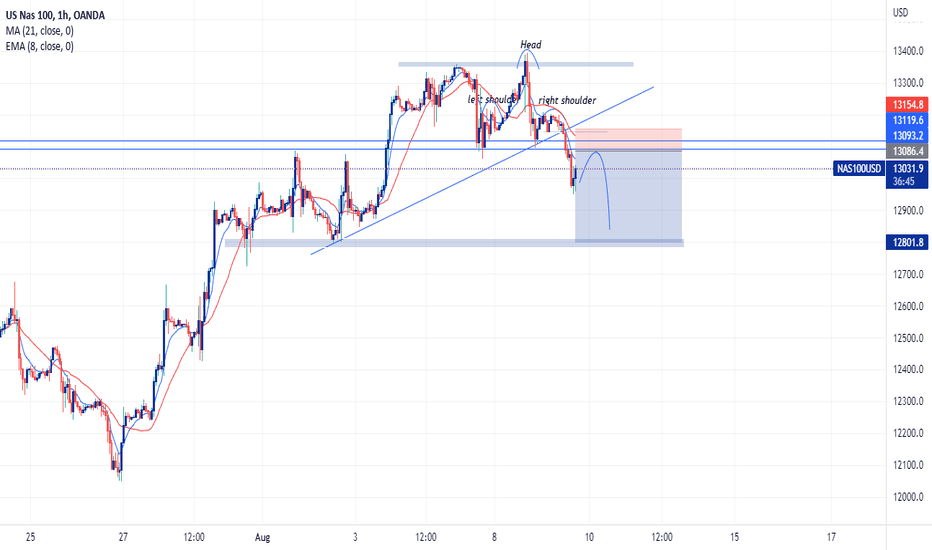

NAS100 ShortOANDA:NAS100USD

Nasdaq has broken it bullish move. The head and shoulder pattern was an indication of trend changing to bearish and the pattern proved to be bearish. Currently awaiting on a retest at key support turned into resistance. A bearish engulfing pattern will be a confirmation to go short on Nasdaq.

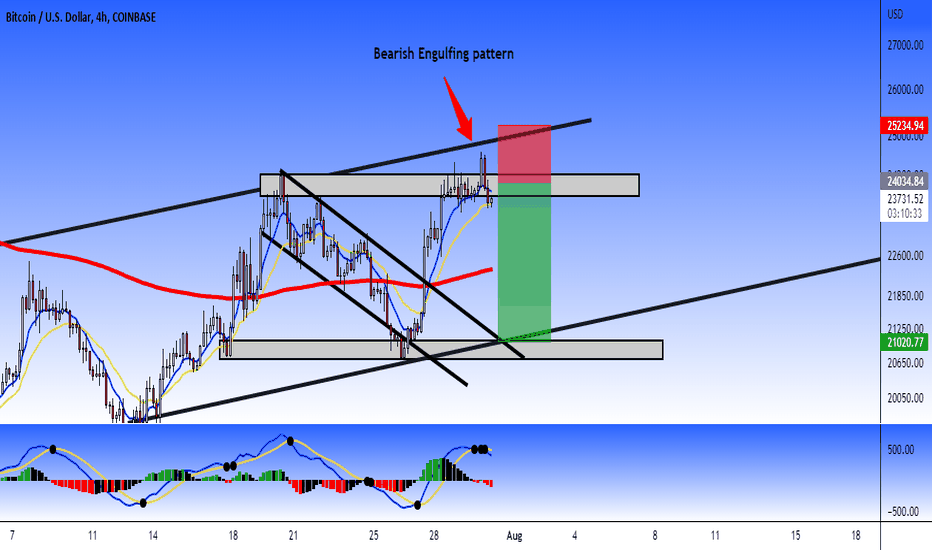

BTC/USD: bearish engulfing patternBitcoin forming a bearish engulfing pattern in H4 timeframe in the good zone to short into this chartist pattern (bearish channel perspective)

Trade Info:

1) Entry: $24,050 USD (sell order limit)

2) Stop Loss: $25, 230 USD

3) Take Profit: $21,000 USD

4) Risk/Benefit: 1:2

I hope that this analysis support you to short Bitcoin