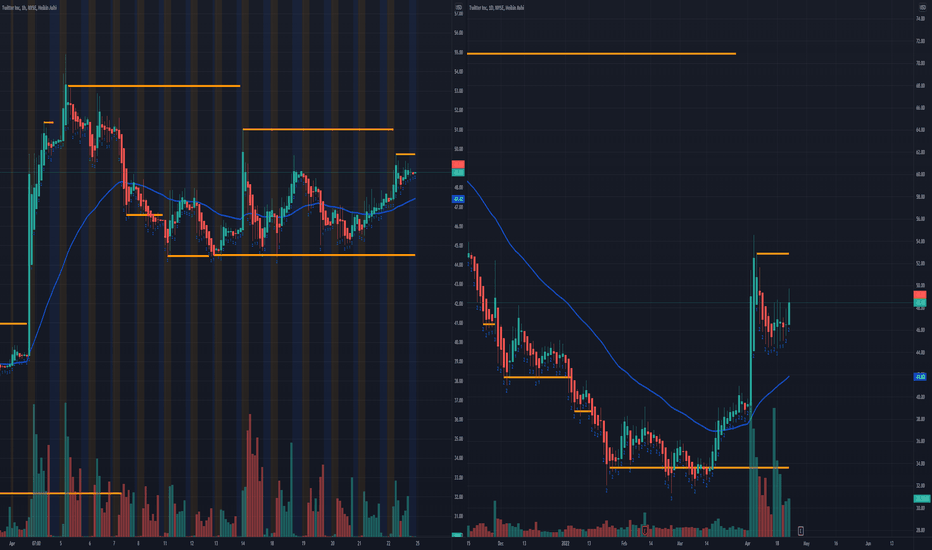

$TWTR consolidating.. to the up side?$TWTR rises after Elon musk bought a 9.2% of Twitter a few days ago and slowly pulls back, and the price consolidate for a few days. despite the 2 day selloff in the market especially in technology stocks, Twitter held up the price between $44-49 and close slightly higher before the market close last Friday.

From a technical perspective, there's a high possibility that twtr could break out next week if it continues to consolidate and if the market decides to bounce after last week's selloff. also, keep in mind that #TWTR earnings are coming up. so play cautiously. in my experience when the company has earnings announcement after market close. the stock usually rises when the stock misses the earning estimate and pulls back after-hours after the announcement. but when the stock has good earnings the stock sells off and rises after the announcement after the market closes. it also sometimes consolidates for the whole day before earning announcement after market close. but this is just my observation of every earnings announcement and I'm sure you notice this kind of movement before.

Below is my strategy for day trading or scalp play for TWTR

TWTR: Day trade or scalp target play: 04/25/22

Buy call above 49.43 sell at 50.70 or above.

Buy puts below 47.70 sell at 46.77 or below.

option open interest: ideal expiration date: 4/29/22 (risky) 5/06/22, 5/20/22, 6/17/22

Hello everyone,

Welcome to this free technical analysis . ( mostly momentum play )

I am going to explain where I think this stock might possibly going the next day or week play and where I would look for trading opportunities

for day trades or scalp play.

If you have any questions or suggestions on which stock I should analyze, please leave a comment below.

If you enjoyed this analysis, I would appreciate it if you smash that LIKE button and maybe consider following my channel.

Thank you for stopping by and stay tune for more.

My technical analysis is not to be regarded as investment advice. but for general informational proposes only.

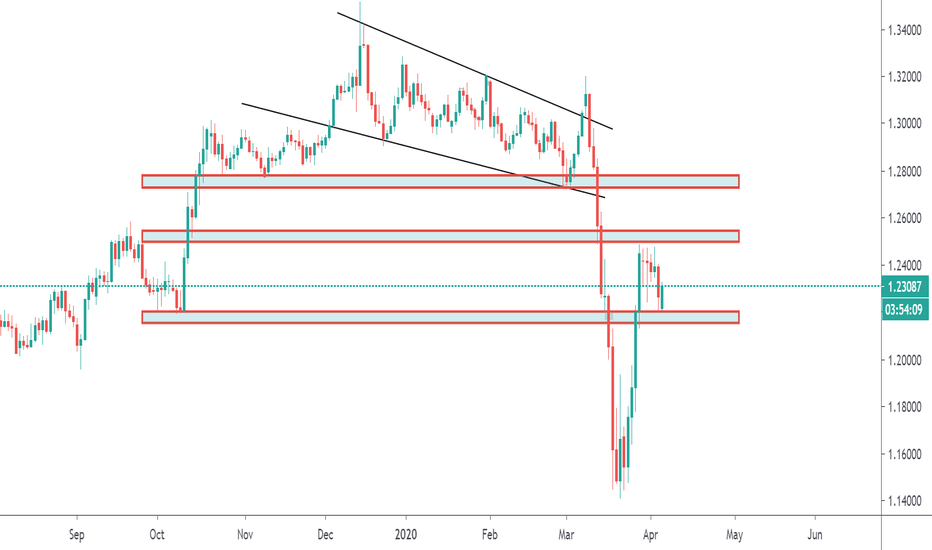

Bearishlong

GBPUSD: TIME TO BUY ?According to technical analysis, looking at GBPUSD the success of bears moing price below 1.22000 support confirms the reversal of the general short term trend which was bearish. On a long term perspective, the overall trend is still downward. The return of the GBPUSD bulls by pushing price above 1.24 -1.27 resistance level may give some new hope but until 1.3500 zone is broken, GBPUSD is in a downtrend.

Risk Warning : The risk of loss in trading Foreign Exchange (FOREX) can be substantial.

You should therefore carefully consider whether trading is suitable for you in the light of your financial condition.

Goodluck !

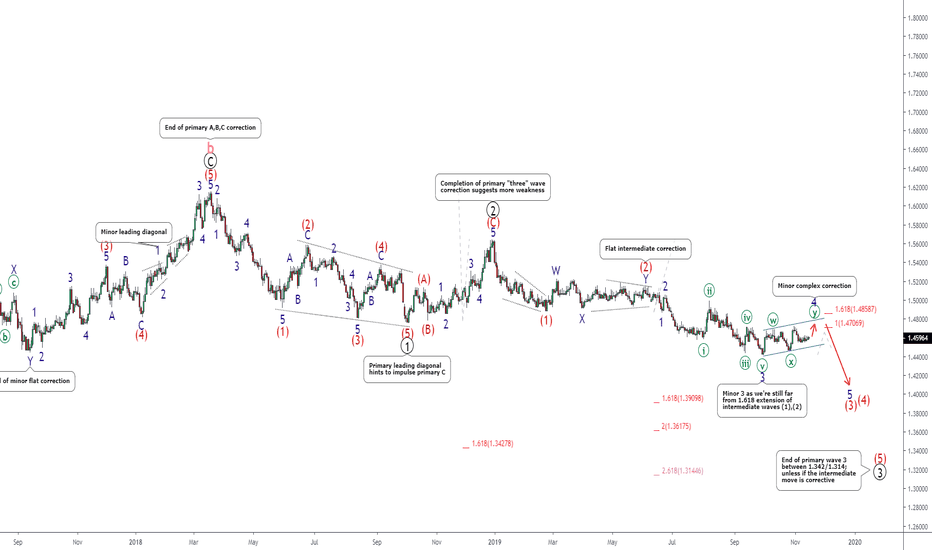

ORBEX 360°:EURCAD Minor Correction Likely to Drive Prices Down!LONG short-term to complete the complex correction; 1.4700-1.4860

SHORT medium-term, where intermediate wave (3) concludes its course; 1.39120-1.3425

SHORT medium/long-term, where primary wave 3 completes its course - only valid if the primary impulse is not an A,B,C correction; 1.3625-1.3150

SHORT longer-term, where primary 5 completes the cycle degree correction; 1.29