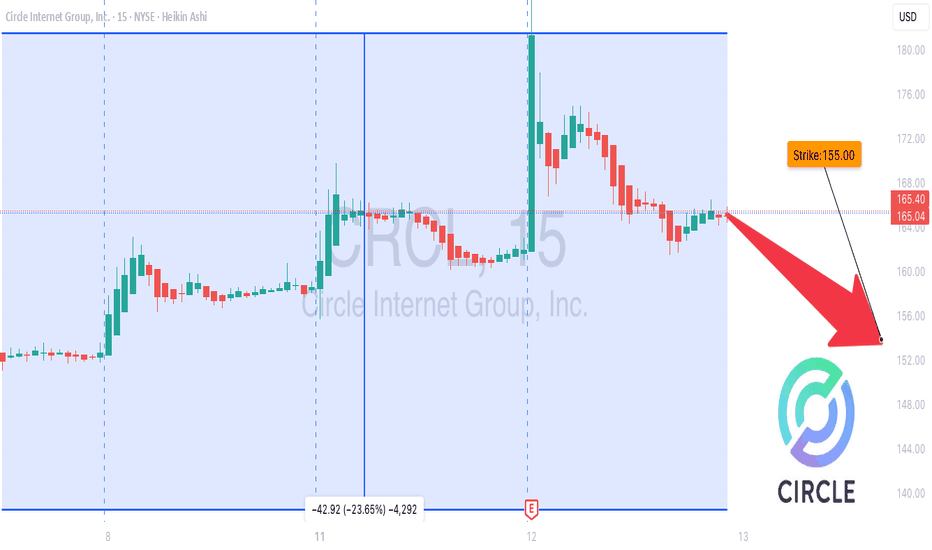

CRCL on the Edge: Bearish Play Loading… 📉 CRCL Weekly Options Alert (Aug 12, 2025)**

**Bias:** ⚠ **Neutral → Bearish** — Weak volume + bearish weekly RSI

📊 **Quick Stats:**

* **Daily RSI:** 40.8 ↗ (bullish divergence from oversold)

* **Weekly RSI:** 58.7 ↘ (bearish drift)

* **Options Flow:** Call/Put = **1.19** → neutral

* **Volume:** 1.0× last week — no institutional conviction

* **Gamma Risk:** Moderate — 3 DTE & rising time decay

💡 **Consensus Take:**

* Lack of strong buying pressure + bearish weekly trend = higher downside risk short term.

**Trade Idea:**

* **Type:** Naked PUT

* **Strike:** \$155.00

* **Expiry:** Aug 15, 2025

* **Entry:** \$6.22

* **PT:** \$10.90 (+75%)

* **SL:** \$2.80

* **Confidence:** 68%

* **Entry Timing:** Open

⚠ **Risks:**

* Earnings news could swing price violently

* Daily RSI divergence could spark short-term bounces against your position

---

**📈 TL;DR:**

Weekly trend still weak, volume flat, options flow balanced → bearish skew.

\#CRCL #OptionsTrading #WeeklyOptions #PutOptions #OptionsFlow #StockMarket #TradingSetup #BearishTrade #TechnicalAnalysis #OptionsAlert

Bearishtrade

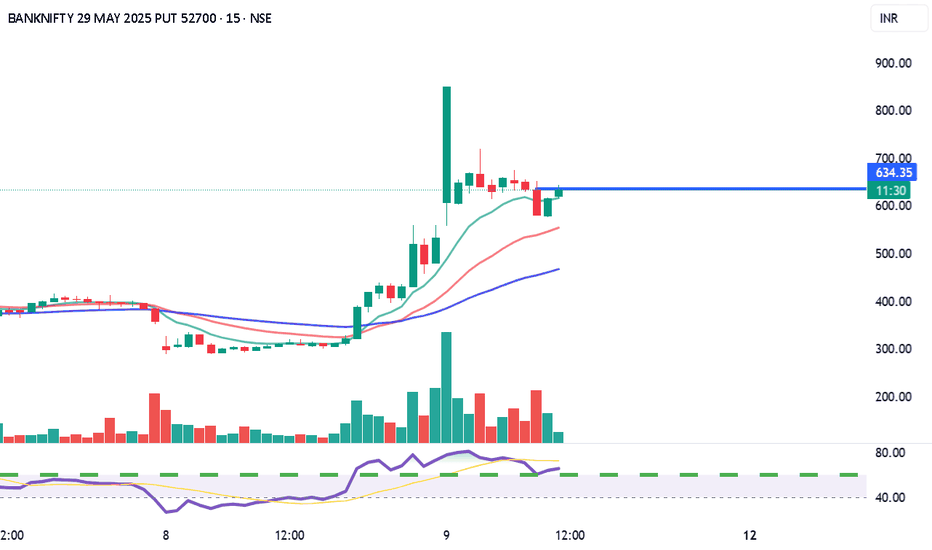

BANKNIFTY 52700 PE (29 May 2025 Expiry) – Intraday Options Type: Intraday | Put Option (PE)

Strike: 52700

CMP: ₹635.00Recommended Buy Range: ₹626.00 – ₹631.00

Target Achieved: ₹730.00 ✅

Stop Loss: ₹570.00

Profit Booked: ₹94.35 / +18.45% 🟢

⏱️ Timeframes: 15min & 1H

This was a quick momentum scalp based on:

🔻 Weakness in BankNifty index with rejection near key resistances

📉 Bearish candles on 15min + volume confirmation

🔄 Entry near VWAP zone, breakout of structure support

For Education Purposes Only