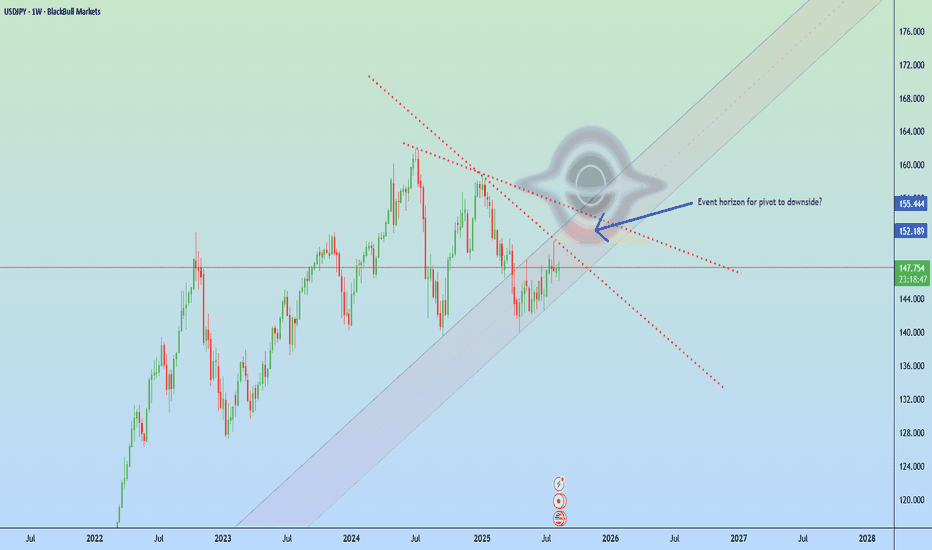

Event horizon forming for USD/JPY? U.S. Treasury Secretary Scott Bessent told Bloomberg TV that the BOJ is behind the curve and will likely raise rates. This contrasts with BOJ Governor Kazuo Ueda, who sees no urgency despite rising wages and service-sector inflation.

Bessent also called for a more dovish U.S. Federal Reserve, suggesting a total of 150 basis points in cuts, starting with a 50 bp reduction in September.

On the weekly chart, USD/JPY is trading near 147.75, holding just above mid-channel support in an uptrend from early 2024. With Japanese and U.S. rate paths potentially diverging, traders are watching for sustained downward pressure on the dollar. A key inflection zone for a potential pivot lies between 150.90 and 154.27.

Bessent

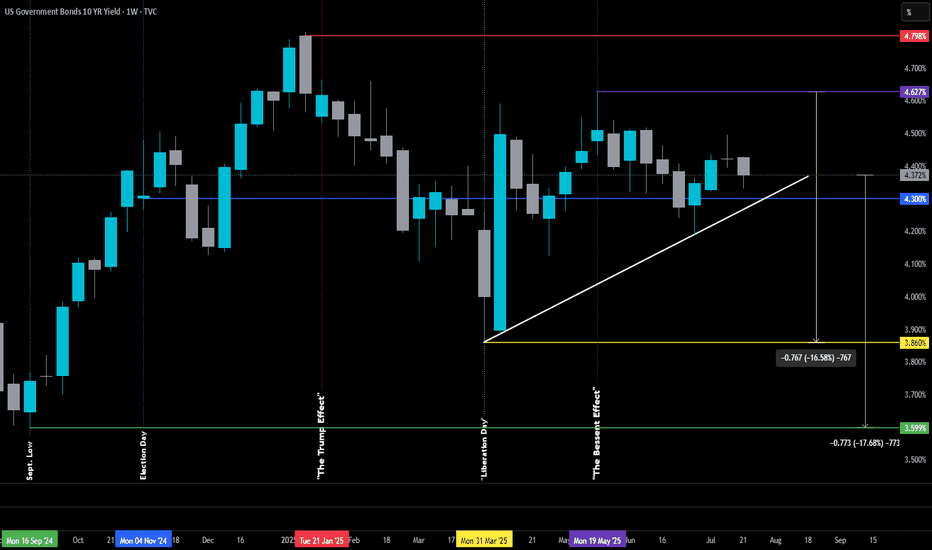

The Bessent Effect: Part I-Challenge the FedThe Bessent Effect: Part I-Challenge the Fed

Originally posted on June 30th, 2025, but it was removed by a moderator — I misinterpreted the posting guidelines (I tend to read a little too deep between the lines sometimes).

For context, the original version didn’t include the White or Green lines.

June 30th post:

The 10-year Treasury yield is the heartbeat of commercial lending — it’s what sets the tone for everything from real estate financing to economic sentiment. And interestingly, it’s now hovering right around the same level it was on Election Day 2024 (Blue Line), which feels like a lifetime ago in policy terms.

So what’s happened since then? Quite a bit.

Yields peaked the week before Inauguration Day (Red Line), then began a steady decline — until we were hit with what can only be described as "Liberation Day Tariff Whiplash."

The tariffs, announced in early April (Yellow Line), spooked the markets — particularly the ever-watchful Real Money Investors (think central banks, pension funds, and the ruthless whales). Their reaction? A spike in the 10-year, as they scrambled to reassess risk and reposition.

Plot twist: Trump’s unleashing of Scott Bessent.

Since stepping into the role of Treasury Secretary, Bessent has taken the reins of U.S. economic diplomacy. By late May (Purple Line), he was already deep in talks at the G7 meeting in Banff, hashing out trade dynamics and currency cooperation with global finance leaders. And — perhaps not so coincidentally — since then, the 10-year has been on the decline again, even as the Fed remains firm in its refusal to cut rates.

Here’s the big takeaway: there's a strong chance we could see rates — the ones that actually move the real estate market and reflect how the “real players” feel — drift back down to their pre-tariff levels. That is, before Tariff Derangement Syndrome set in. And probably before they shoot back up to the peaks we saw just as Trump returned to the White House.

In short: the 10-year might be hinting that the worst isn't over — but we could be in for a stretch of green pastures before we hit the next storm.

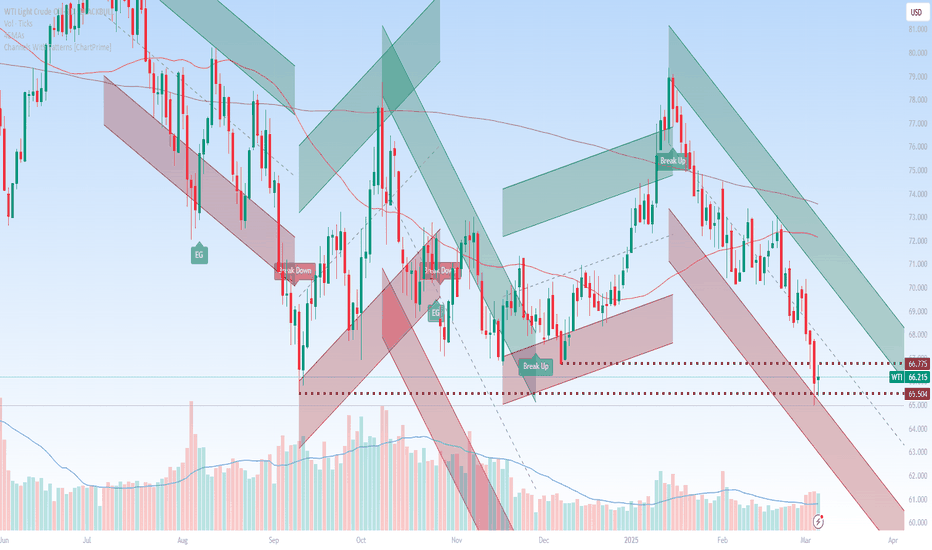

Treasury Secretary Bessent: Make Iran broke again Treasury Secretary Scott Bessent, speaking at the Economic Club of New York, said the U.S. is enforcing sanctions on Iran for “immediate maximum impact,” warning that Iranians should move their money out of the rial.

The goal is to cut Iran’s oil exports from 1.5 million barrels per day to near zero.

His comments came as oil prices fell to multiyear lows on Wednesday, driven by concerns that tariffs on Canada, Mexico, and China could slow economic growth and weaken crude demand.

Following Bessent’s remarks, both U.S. crude and Brent prices turned positive, with JP Morgan analysts noting that a decline in Iranian supply is currently the only bullish factor for oil prices.

Bessent also signaled that the administration is prepared to impose full-scale sanctions on Russian energy if it helps lead to a ceasefire in Ukraine. This is a welcome shift from the Trump administration, who so far has only been pressuring the victim of the war rather than the perpetrator.