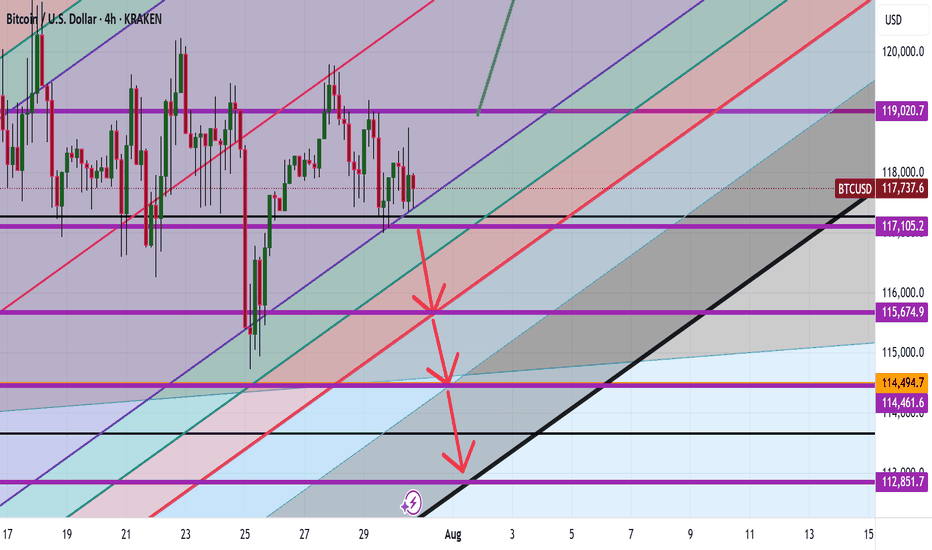

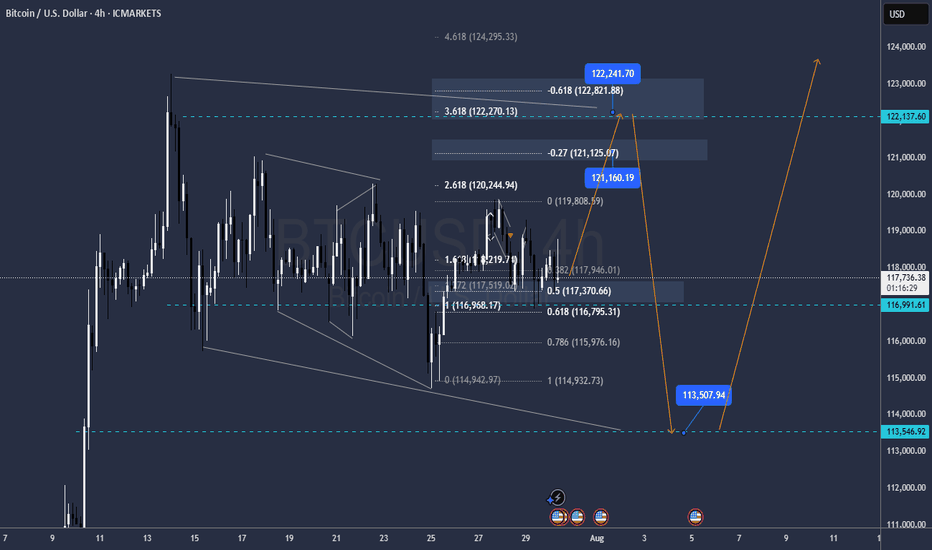

Bitcoin Are We Heading to 140K or 80K ??? Here is the Analysis Based on what is happening here is what we currently see with Bitcoin

Idea 1: If we can break 119K then here are the following levels Bitcoin can go to :

122K

126K

135K

140K

Idea 2: If we continue and break further bearish here are the levels BTC can go to

115,600

114,500

112,800

If we go below this level then a larger correction thesis would point us with a deeper bearish level

Happy Trading

Trade Smarter Live Better

Mindbloome Exchange

Kris

Beyond Technical Analysis

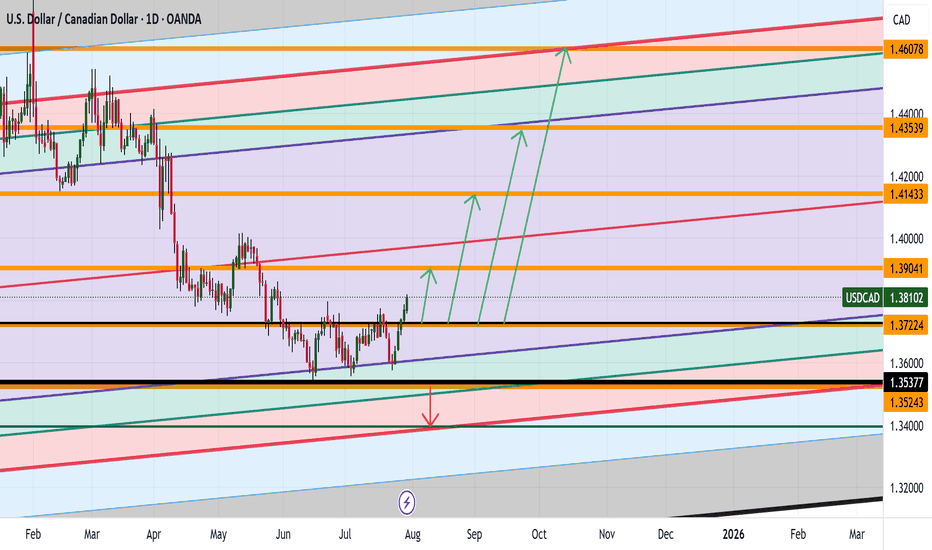

USD/ CAD Are We Heading to $1.46 Territory Watch OUT Afternoon Trading Family

Based on what we are seeing is a nice bullish run up to the following levels :

Levels To Watch For:

1) $1.39

2) $1.41

3) $1.43

4) $1.46

However be aware if we for whatever reason we sink back into the 1.35 territory then we could see a drop down to 1.34

Trade Smarter Live Better

Kris

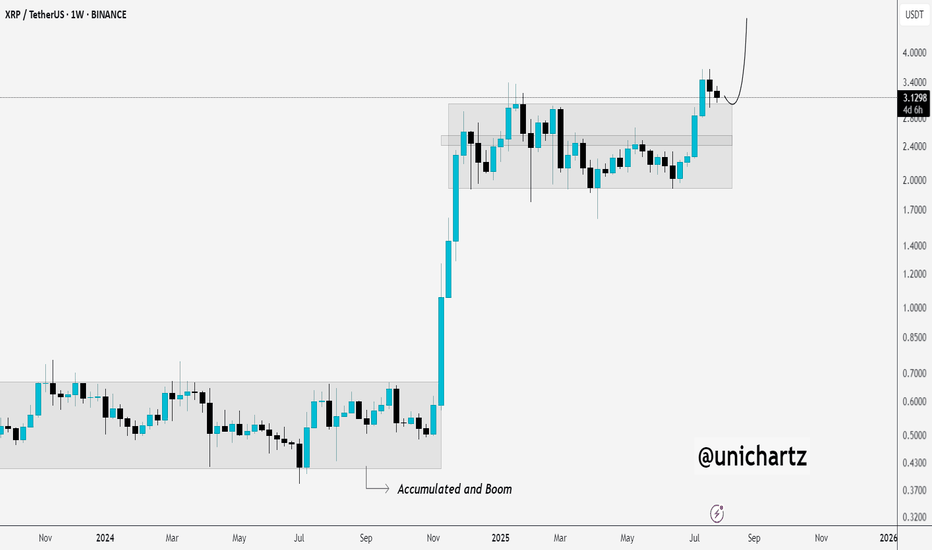

Healthy Retest After Explosive Move – XRP Eyes More UpsideCRYPTOCAP:XRP broke out of a long accumulation range and is now coming back to retest that breakout level, a classic and healthy move.

If this retest holds, we could see the next leg up kick off soon.

Accumulated. Broke out. Now confirming.

DYOR, NFA

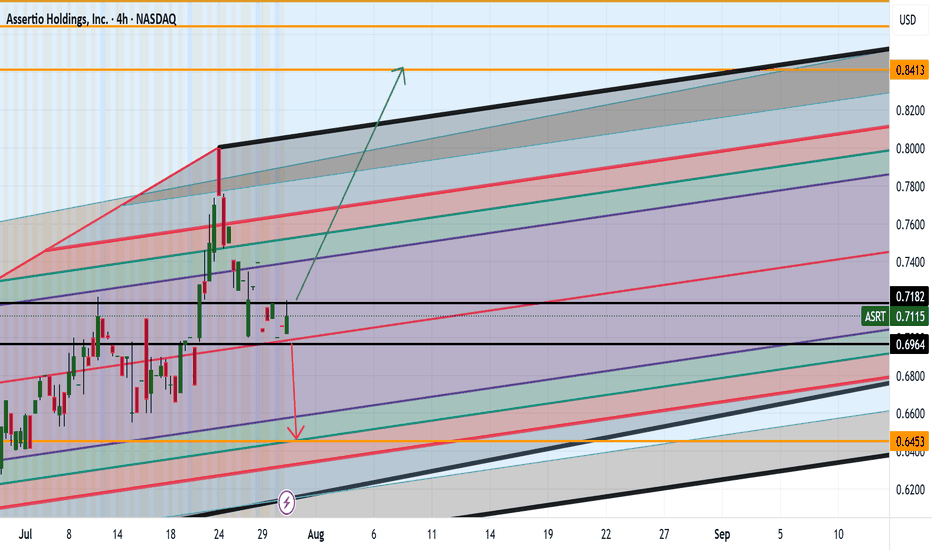

ASRT ARE WE HEADING TO .84CENTS AND HIGHER? Good afternoon Trading Family

So looking at ASRT we see two options here:

1) We break .71 cents high which then would give confirmation to a drive up to 84 cent range

2) We break below the .69 cent low which then would help us confirm a possible short down to .64 cents

Trade Smarter/ Live Better

Kris

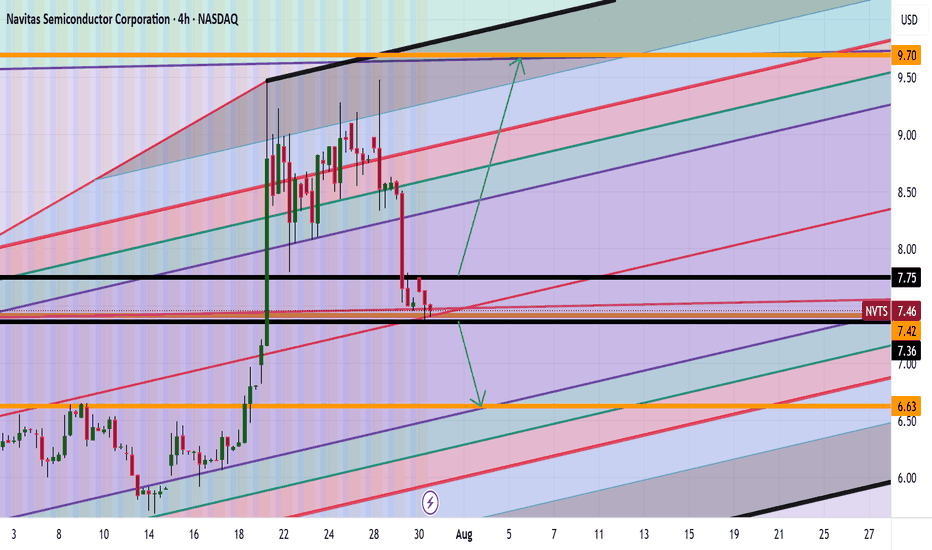

NVTS Analysis Are we Heading to $9+ Good afternoon Trading Family

Based on what we currently see with NVTS are two scenarios happening:

1) Above 7.80 highs we will thus be heading to the 9-9.7 range

2) Below 7.30 lows then we will be heading to the 6 dollar range

Happy Trading

Trade Smarter/ Live Better

Kris

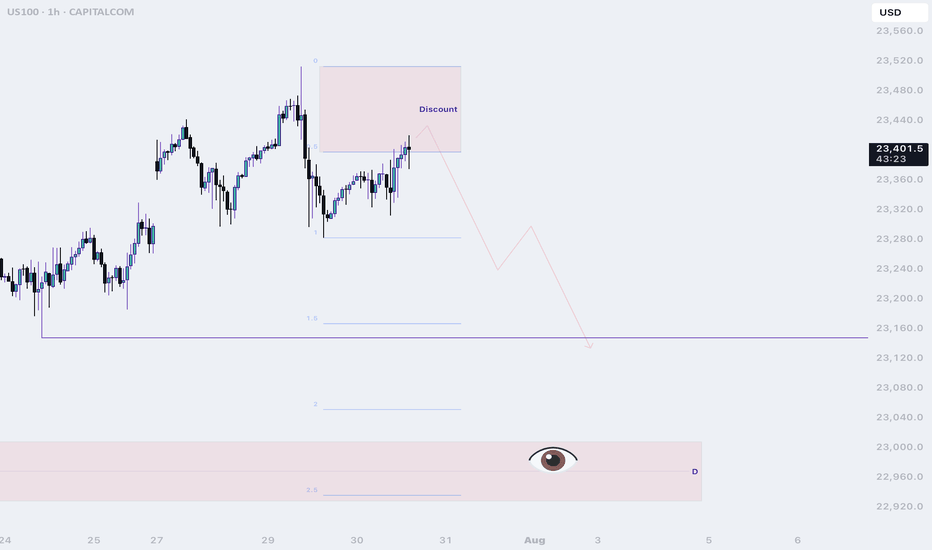

BTC FOMCOnce Again Ive the same view on BTC

There is a chance that it will go down now towards 113.500 straight so the internal buy towards 122.600 should be taken with low risk

if that level is reached the sell to 113.500 is prettyu much asured and also on 113.500 the buy to all time highs 127.500 and 133.000

GG

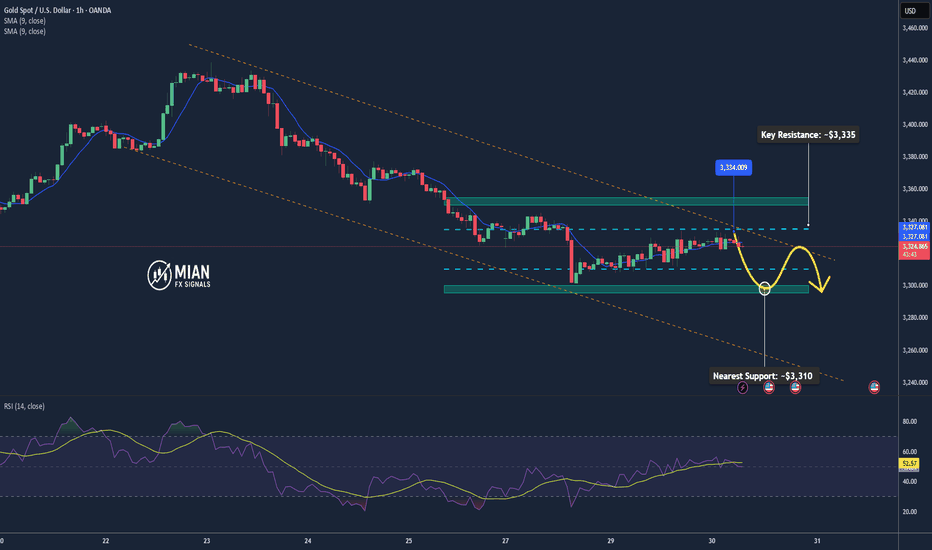

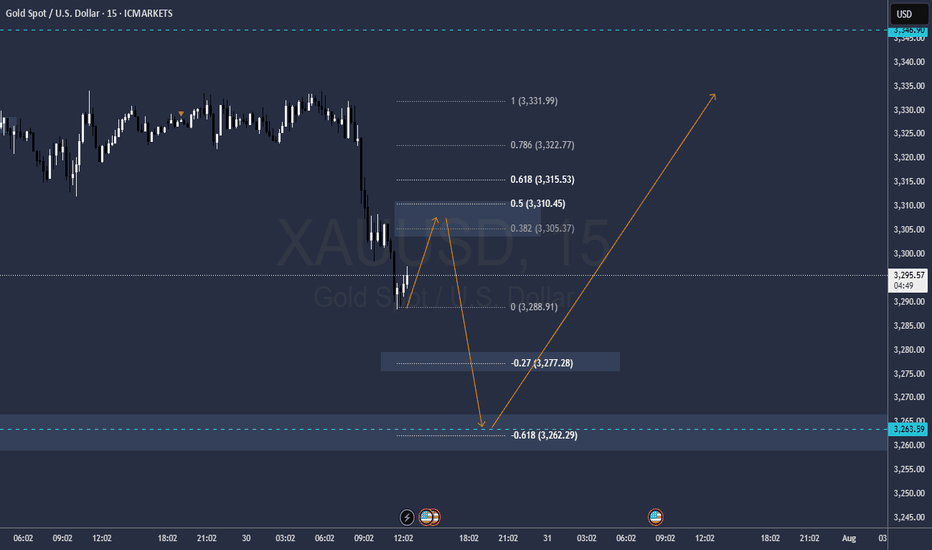

Gold May Dip Mildly Before US Data📊 Market Overview:

Spot gold is trading around $3,329/oz, up ~0.1%, supported by falling U.S. Treasury yields and a slightly weaker dollar, while investors await potential Fed dovish signals or rate cut in September . Meanwhile, easing U.S.–EU trade tensions weighed on safe-haven demand for gold.

📉 Technical Analysis:

• Key Resistance: ~$3,335–3,350 (recent highs and potential test zone)

• Nearest Support: ~$3,310 (previous stable support)

• EMA09 position: Price is above EMA9, indicating a mild bullish bias in the short term

• Momentum/Volume: RSI ~53 (neutral), MACD & StochRSI showing small buy signals. However, bullish momentum is fading, suggesting a possible mild pullback

📌 Conclusion:

Gold may dip modestly toward $3,310 if the dollar strengthens or if Fed rate-cut expectations recede. A break above $3,335–3,350 could pave the way for further gains, though current momentum remains insufficient to confirm a breakout.

💡 Suggested Trade Strategy:

SELL XAU/USD: $3,333–3,336

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3339

BUY XAU/USD: $3,310–3,308

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3305

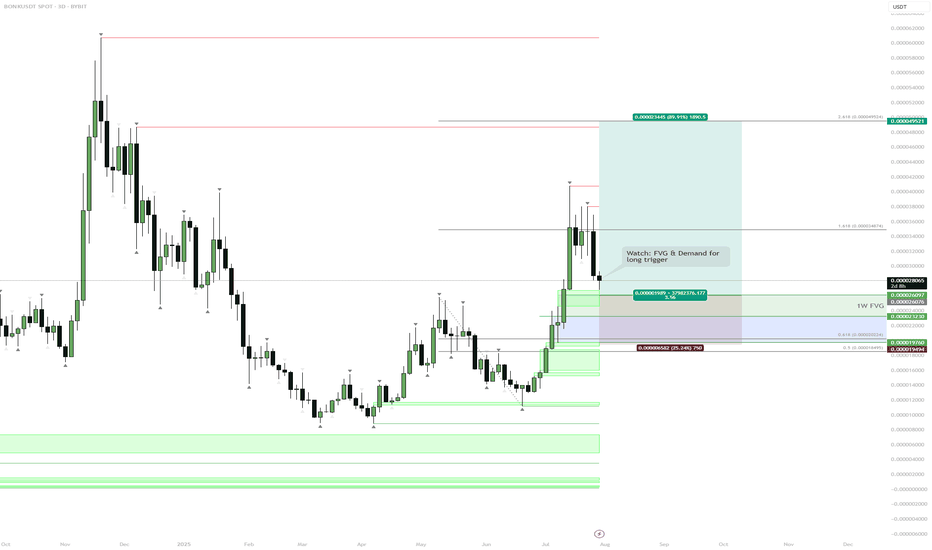

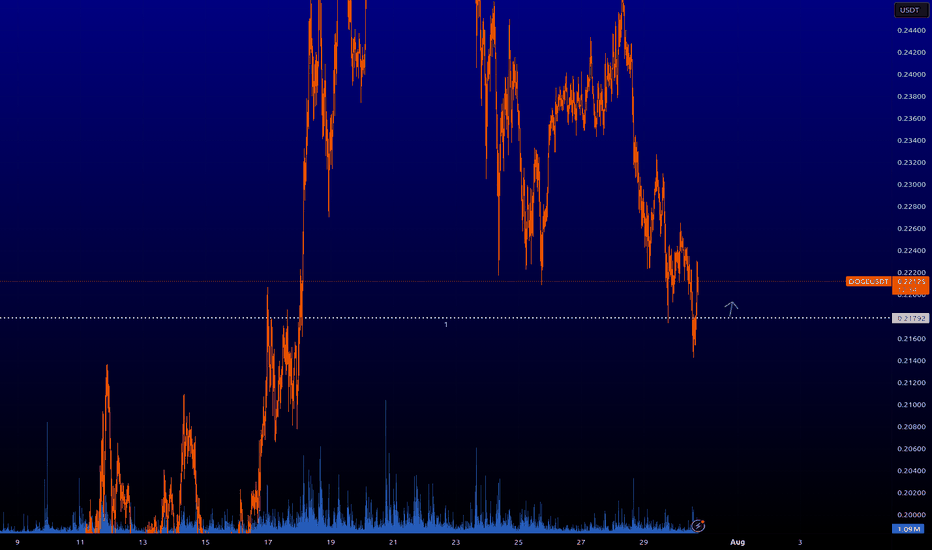

BONK | Waiting for DemandNo position yet—alerts are set for the FVG and HTF demand zone below. DOGE/BONK still showing relative strength, so patience here is warranted.

Plan:

Wait for price to tag HTF area of interest (FVG/demand).

Look for LTF trigger for a long entry.

Prefer clean sweep/reclaim for confirmation.

Reasoning:

BONK has strong momentum, but entry here is late after an extended run.

Letting the setup come to me reduces risk of getting caught in a local top.

DOGE/BONK relative strength signals not to rush.

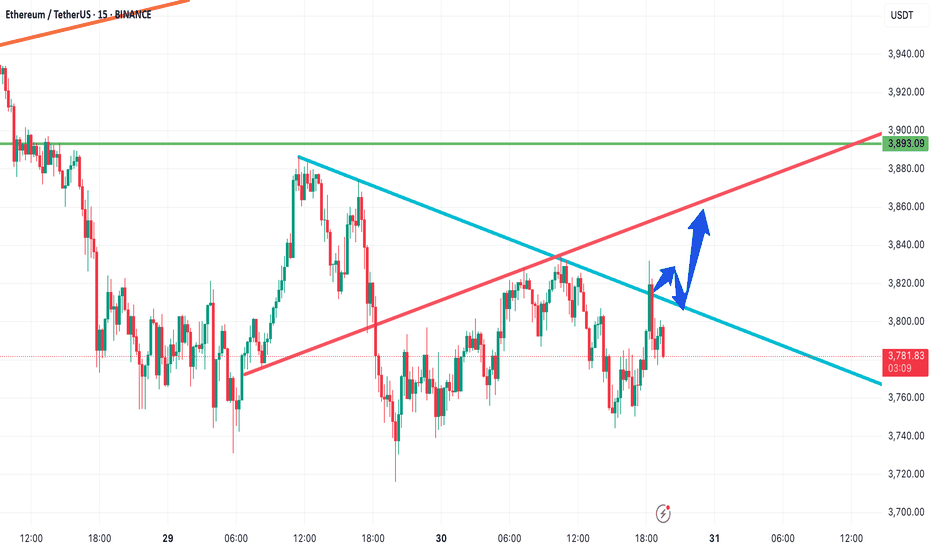

Ethereum Analysis – July 30, 2025📊 Ethereum Analysis – July 30, 2025

Ethereum is currently testing a key descending trendline (blue line).

If the price breaks above this resistance and confirms with strong candlestick closures, there's a high probability that ETH will rally toward the ascending red trendline, acting as the next dynamic resistance.

🚀 A confirmed breakout could trigger a bullish continuation, opening the door for higher targets in the short term.

However, failure to hold above this level may result in a pullback or range-bound movement.

📌 Keep both the blue and red trendlines on your chart — they’re currently the most critical zones to watch for potential entries or exits.

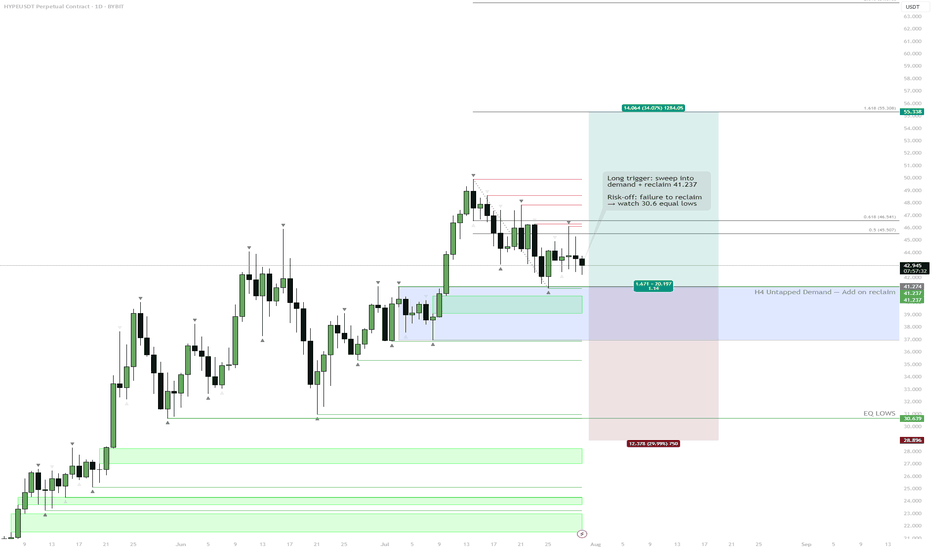

HYPE | Sweep & Reclaim SetupPlan:

Watching for a sweep into the blue H4 Untapped Demand zone, then a reclaim of 41.237 (green line) to add longs.

Ideal target: new ATH and 55 extension.

If the blue zone fails or we can't reclaim 41.237, risk-off mode: equal lows at 30.6 could be the draw.

Reasoning:

A sweep into demand would reset local liquidity and trap late shorts.

Reclaiming 41.237 confirms a shift in momentum and invalidates the breakdown.

Structure is bullish above 41.237; below, risk increases for deeper downside.

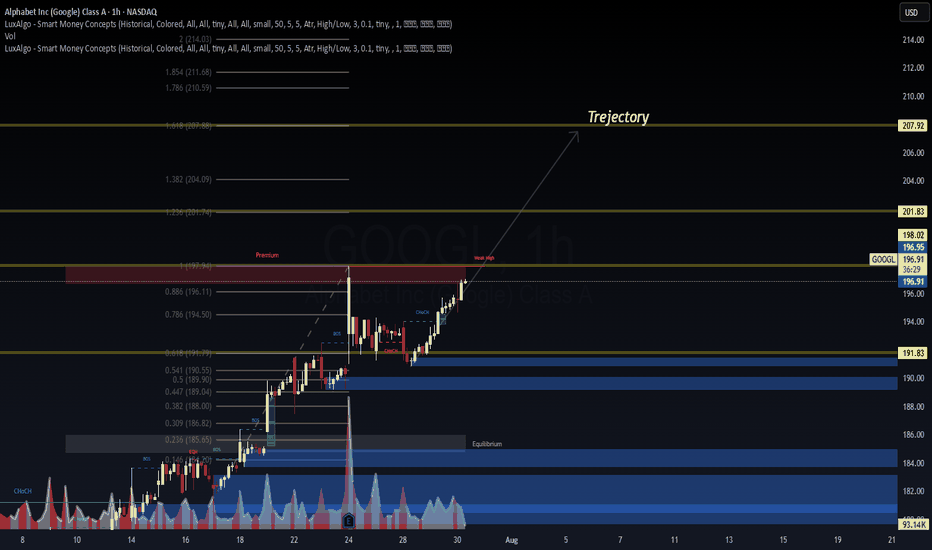

GOOGL Forecast – Dual AI Model Confirmation📊 GOOGL Forecast – Dual AI Model Confirmation

🔹 Posted by WaverVanir | VolanX Protocol

NASDAQ:GOOGL is showing strong bullish structure backed by both Smart Money Concepts (SMC) and AI model consensus.

🧠 VolanX AI Protocol Forecast (30-Day)

🎯 Target: $223.08 (+13.3%)

📈 Accuracy: 98.2%

📉 Drawdown: 0.00% (Backtested)

🧮 Sharpe Ratio: 7.70

🔵 Rating: Strong Buy

📉 WaverVanir DSS Model (Sentiment Score: 83)

🔸 30-Day Target: $198.47

🔸 Micro pullback expected before resuming uptrend

🔸 Ideal for refining short-term entries

🔍 SMC Structure:

BOS + CHoCH Confirmed

Premium zone at $197.94 cleared

1.236 Fib target: $201.83

1.618 Fib confluence: $207.92

Trajectory path = $223.08 if liquidity extends

📌 Strategy:

Entry: ~$196.95

TP1: $200.89

TP2: $223.08

SL: $188.80

R:R ~ 3.2:1

📢 Signal powered by WaverVanir DSS + VolanX Protocol

This is institutional-grade AI meets market structure.

#GOOGL #VolanX #WaverVanir #AITrading #SmartMoneyConcepts #SMC #Fibonacci #SwingTrade #Forecast #TradingView #StockSignals #InstitutionalAlpha #DecisionSupport #MachineLearning #DSS

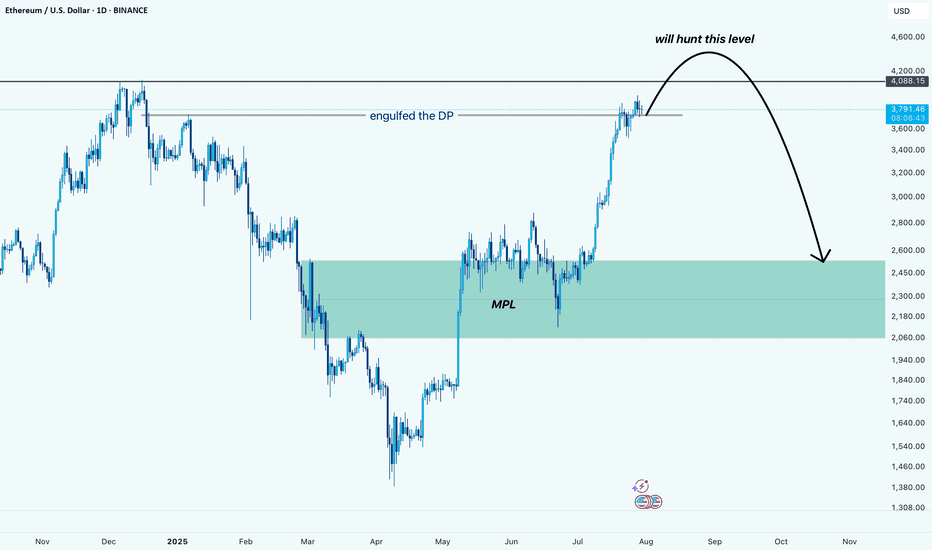

ETH (just a perspective): Potential Liquidity Grab Before DeeperPrice has engulfed the DP and is now pushing higher. Based on the current structure, it looks like ETH wants to hunt the liquidity resting above the $4,080 level.

After grabbing that liquidity, we might see a sharp reversal back down toward the MPL, which sits in the $2,100–$2,500 zone. This area is a strong demand zone and also where the most pain would be felt for late buyers, making it a key level to watch.

⚠️ This is not a prediction, just a perspective based on price behavior and structure.

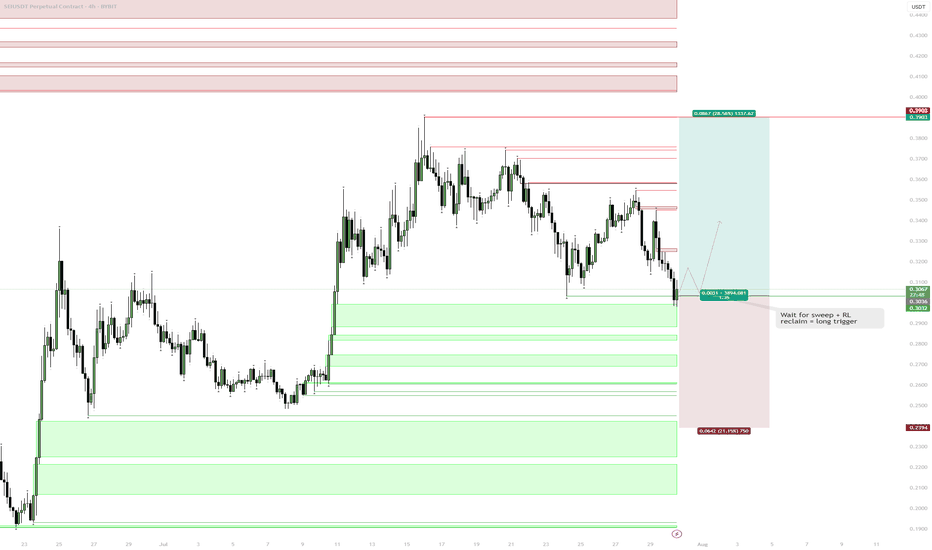

SEI | Setup: Sweep & Reclaim Scenario:Wait for a sweep of the range low (RL) into the Daily FVG (gray box).

Look for a reclaim of RL as the trigger for a long.

Reasoning:

Sweep into FVG traps late sellers and sets up liquidity for a reversal.

Reclaiming RL after the sweep signals strength and confirms a local bottom.

No need to chase entries—best R:R is after liquidity is cleared and level is retaken.

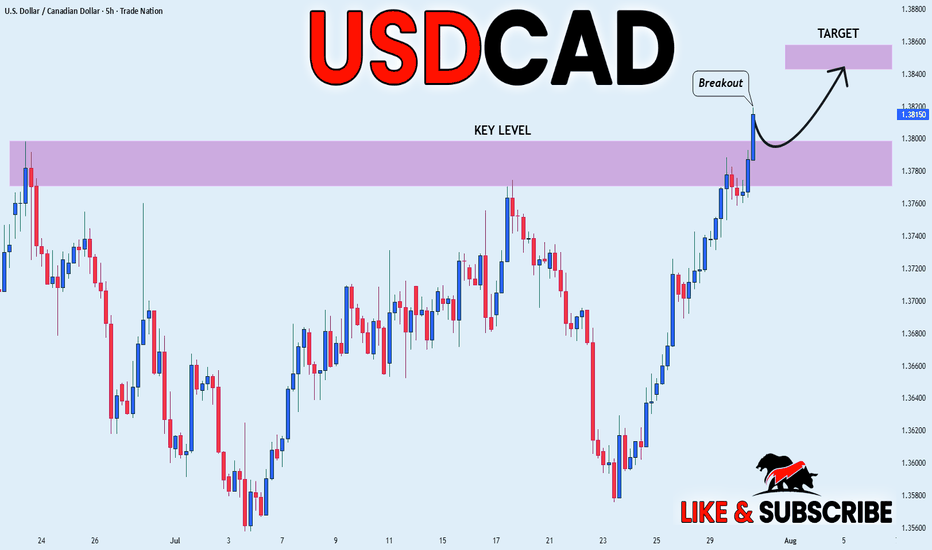

USD_CAD BULLISH BREAKOUT|LONG|

✅USD_CAD is going up

Now and the pair made a bullish

Breakout of the key horizontal

Level of 1.3800 and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

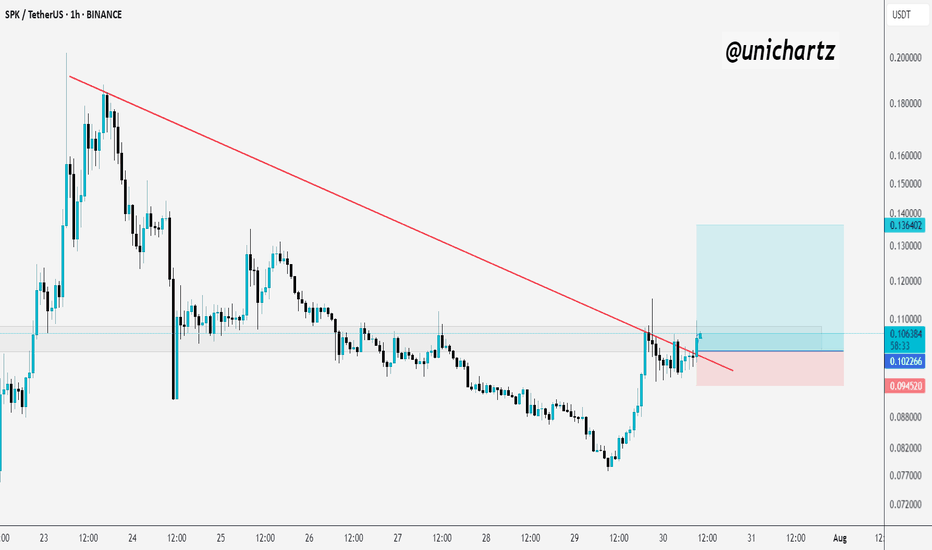

SPK Breaks Trendline – Long Setup with R:R 5.7INDEX:SPK Breaking the Downtrend – Long Setup in Play

SPK has finally broken out of its falling trendline after days of compression. Price is now testing the breakout zone with a small consolidation — a classic sign of strength building.

If momentum continues, we could see a solid upside push.

✅Trade Setup (Long):

Entry: 0.1009

Stop Loss: 0.0945

Target (TP1): 0.1364

DYOR, NFA

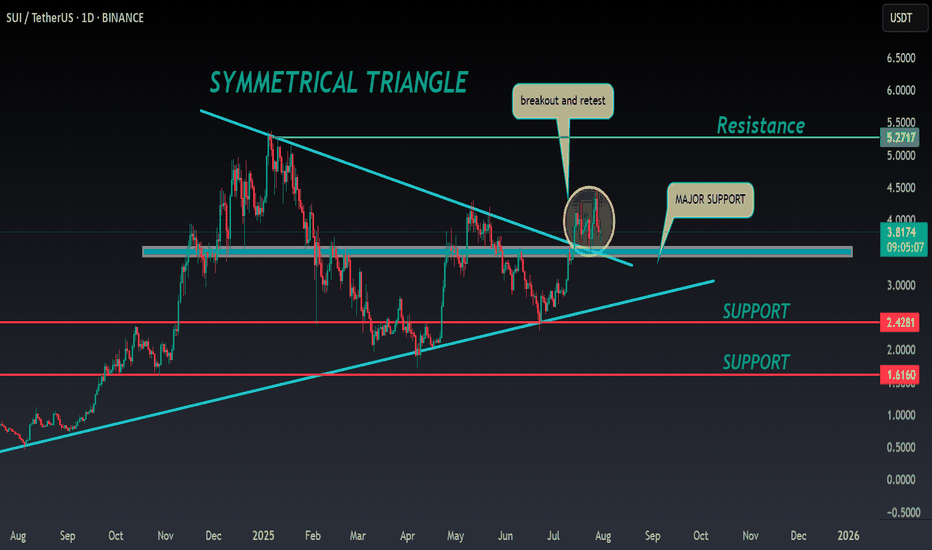

SUI ANALYSIS🔮#SUI Analysis 💰💰

#SUI is trading in a symmetrical triangle in a weekly time frame and if it breakouts with high volume then we can see a bullish momentum in #SUI. Before that we will see little bit bearish movement towards its support zone and that a bullish movement.

🔖 Current Price: $3.81

⏳ Target Price: $5.27

⁉️ What to do?

- We can trade according to the chart and make some profits in #SUI. Keep your eyes on the chart, observe trading volume and stay accustom to market moves.💲💲

🏷Remember, the crypto market is dynamic in nature and changes rapidly, so always use stop loss and take proper knowledge before investments.

#SUI #Cryptocurrency #Pump #DYOR

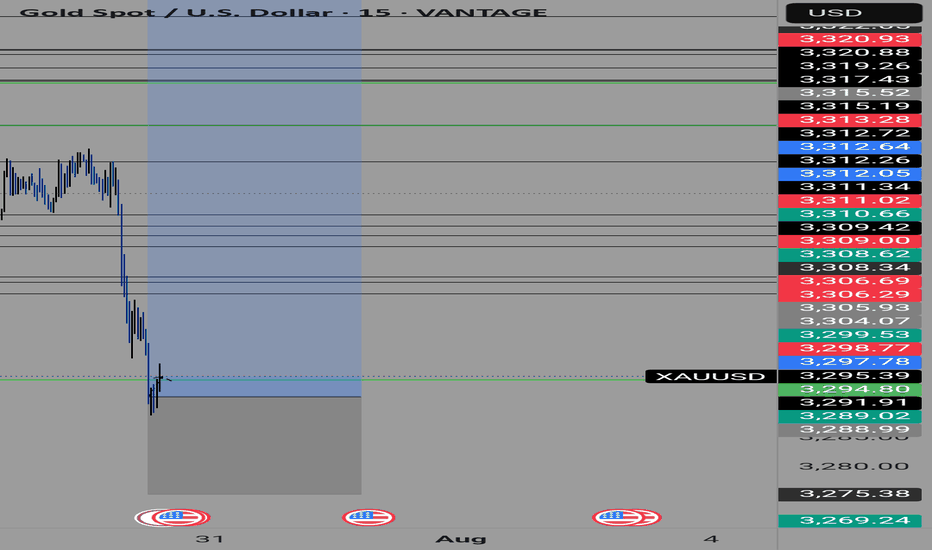

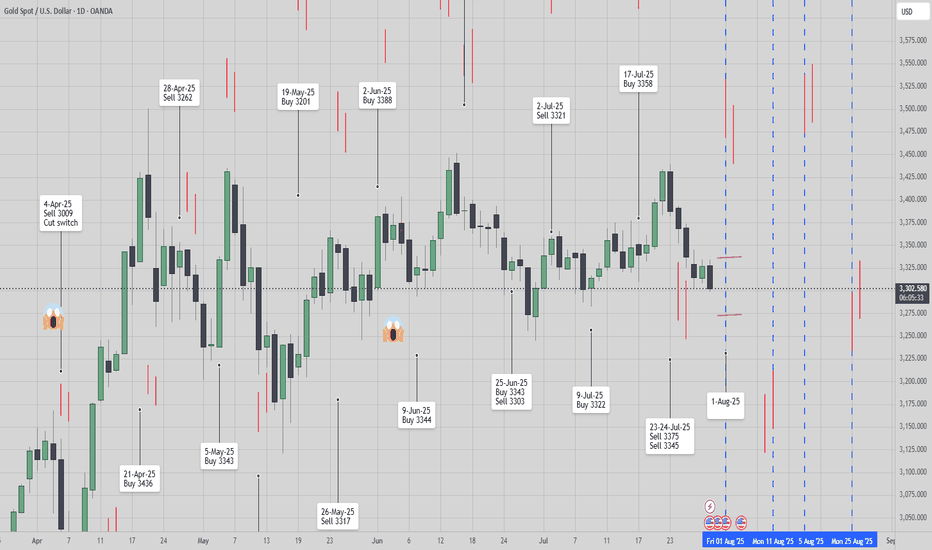

[ TimeLine ] Gold 31 July 2025📆 Today’s Date: Wednesday, July 30, 2025

📌 Upcoming Signal Dates:

• July 31, 2025 (Thursday) — Single-candle setup

• July 31–August 1, 2025 (Thursday–Friday) — Two-candle combined range

🧠 Trading Outlook & Notes

✅ Gold has recently dropped sharply from 3439 to 3298, and current conditions suggest this bearish momentum may continue.

✅ I’ll be actively trading both the July 31 and July 31–August 1 setups as part of my ongoing strategy testing and live analysis.

✅ This method and timing structure can also be applied to other assets like BTC, the US Index, and various commodities.

⚠️ For those taking a more cautious approach, it’s absolutely okay to skip the single-candle setup on July 31 and wait for the more confirmed 2-day range setup (July 31–August 1).

📋 Execution Guidelines

🔹 Range Identification:

• Let the Hi-Lo range of the chosen candle(s) form completely.

• Purple lines will mark these ranges on the chart.

• After the daily close, charts will be updated to include a 60-pip buffer, Fibonacci zones, and relevant indicators.

🔹 Entry Conditions:

• Trades are triggered only if price breaks above/below the full range, including the buffer zone.

🔹 Risk Management – Recovery Logic:

• If the Stop Loss is triggered, the trade is exited or switched, and the next valid breakout setup will use a doubled lot size to attempt recovery.

📉📈 Chart Snapshot

🔗 Paste this in TradingView: TV/x/fykxBG6w/

📌 Stick to the plan, follow the system, and let the chart lead the way.

🛡️ Capital protection comes first — always manage your risk.

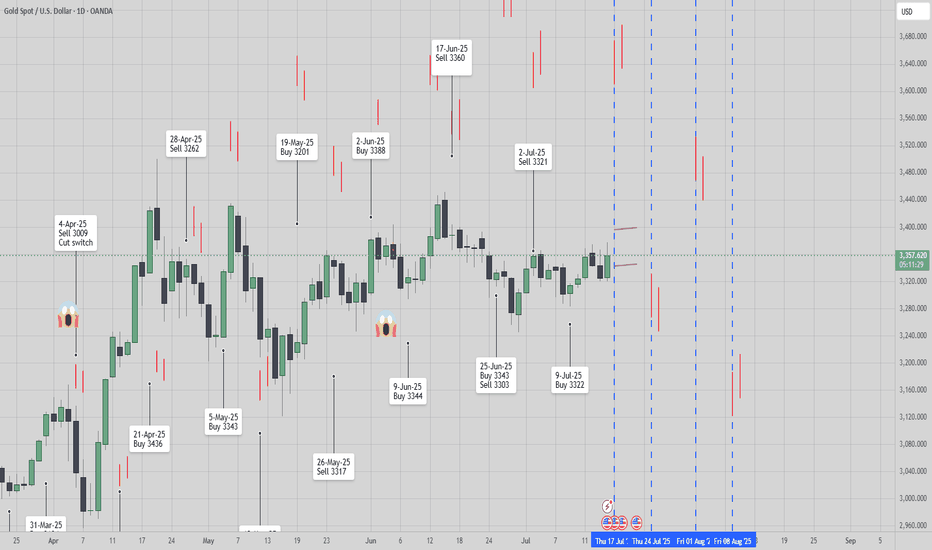

[ TimeLine ] Gold 17 July 2025📆 Today is Wednesday, July 16, 2025

📌 Upcoming Signal Dates:

• July 17, 2025 (Thursday) — Single-candle setup

• July 17–18, 2025 (Thursday–Friday) — Two-candle combined range

🧠 Trading Plan & Notes

✅ Gold recently moved in a wide range between 3365 to 3282, and by the time this signal is published, we’re seeing signs of a strong reversal.

✅ I will be trading both the July 17 and July 17–18 signals as part of my ongoing live research and strategy development.

✅ The same timeframe and signal approach also applies to other instruments such as BTC, US Index, and several commodity pairs.

⚠️ If you’re feeling cautious or risk-averse, it’s perfectly fine to skip the July 17 single-candle setup and wait for the 2-day range (July 17–18) for added confirmation.

📋 Execution Plan

🔹 Range Formation:

• Wait for the Hi-Lo range from the selected candle(s) to fully form.

• Ranges will be marked with purple lines on the chart.

• After market close, the chart will be updated with 60-pip buffer zones, Fibonacci retracement levels, and supporting indicators.

🔹 Entry Trigger Rule:

• Entry only if price breaks out beyond the defined range, including the 60-pip buffer.

🔹 Risk Management – Recovery Strategy:

• If Stop Loss (SL) is hit, the trade will be cut/switch, and position size doubled on the next valid breakout signal to aim for recovery.

📉📈 Chart Reference

🔗 Copy & paste into TradingView: TV/x/6x8VJKs1/

📌 Stay disciplined, trust the process, and let the chart guide your decisions.

🛡️ Manage your risk — protect your capital.