Beyond Technical Analysis

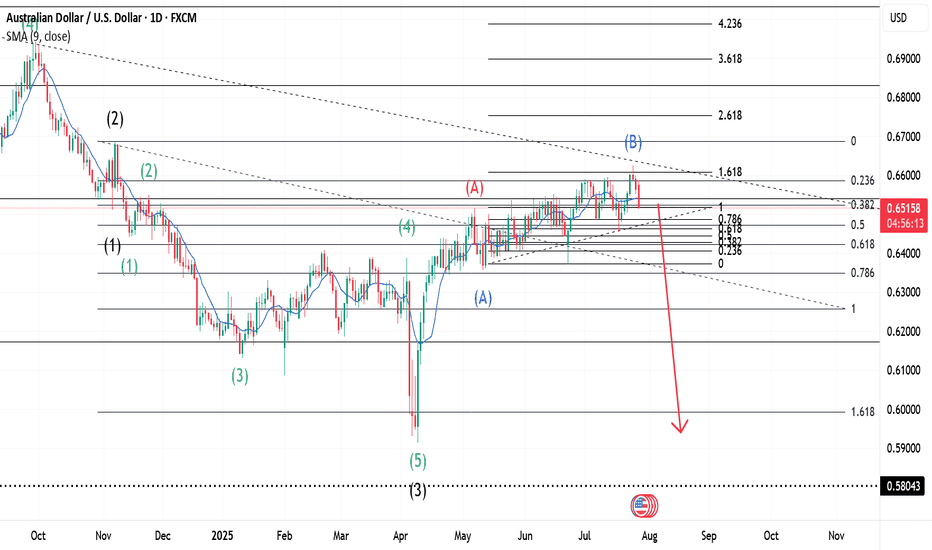

AUDUSD ~ Real Time Elliott Wave UpdatesThis is an update of an AUDUSD chart I had previously posted. We can see that Wave B(Blue) confirms at the 161.8% Fib. level and then sells. Wave B(Blue) pushed a bit higher than I had previously thought, but all other analysis remains the same. The sentiment is a for a sell. Check my previous post for more analysis on this pair.

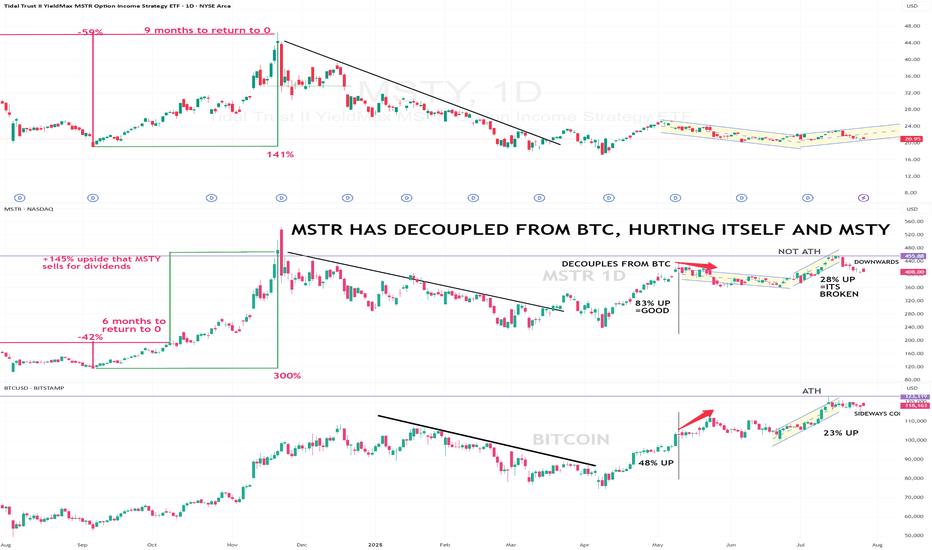

MSTR decouples from BTC, hurting MSTYI use this chart to track BTC, and MSTR so I can safely hold MSTY shares at a price that "should" be safe as long as BTC follows Global Liquidity with a 70-90 day offset (which it IS doing) and MSTR follows BTC price action with a 2x or so, multiplier, (which it WAS, until it decoupled recently). This makes holding MSTY for any share price at $23 or higher, dicey, when MSTR should be in the $500-600 range at the recent BTC ATH and MSTY share price should be in the $30 range, at least. Add to this: BTC is not enjoying the monster 400% runups it had 2021 and previous.

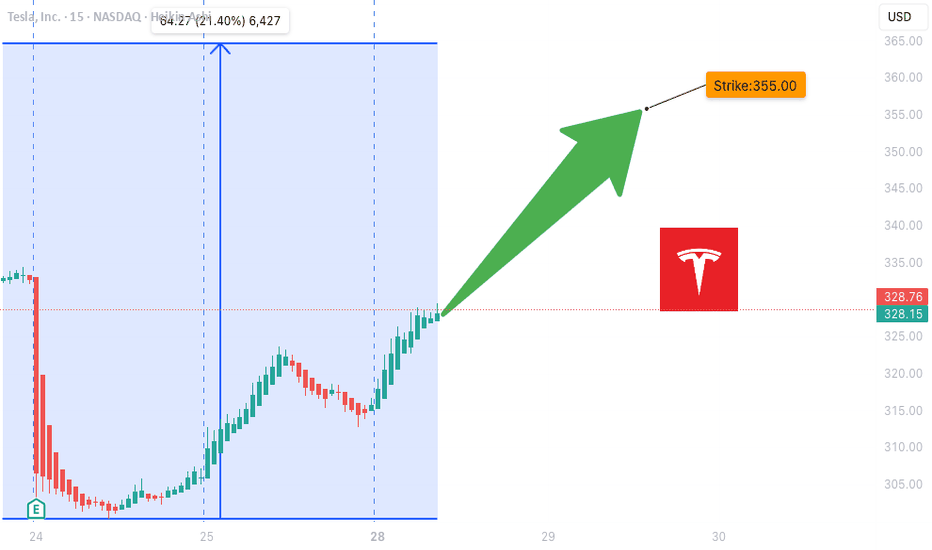

TSLA WEEKLY OPTIONS SETUP

### 🚗 TSLA WEEKLY OPTIONS SETUP (2025-07-28)

**Big Call Flow. Low VIX. Can Bulls Hold \$325?**

---

📊 **Momentum Overview:**

* **Daily RSI:** 48.2 🔻 → *Neutral-to-Weak*

* **Weekly RSI:** 57.1 🔻 → *Still bullish zone, but falling*

⚠️ **Interpretation:** Momentum is softening, trend in question.

📉 **Volume Context:**

* **Volume Ratio:** 1.3x ⬆️ (vs. last week)

* **Price Change:** -0.77% despite that volume

🔍 *Distribution Alert:* Institutions may be selling into strength.

📈 **Options Flow:**

* **Call/Put Ratio:** **1.70** = 🚨 *Bullish flow confirmed*

* **Volatility (VIX):** 15.16 🟢 Favorable for directional plays

✅ Strong setup for options traders riding short-term momentum

---

### 🧠 **Weekly Sentiment Scorecard:**

* ✅ **Bullish Signals (2):** Options Flow, Volatility

* ⚠️ **Neutral Signals (2):** Daily & Weekly RSI

* ❌ **Bearish Signal (1):** Volume pattern = distribution risk

**Overall Bias:** 🟢 *Moderate Bullish*

---

### 🔥 **TRADE SETUP IDEA:**

🎯 **Strategy:** Long Call Option

* 📌 **Instrument:** TSLA

* 💵 **Strike:** \$355C

* 📅 **Expiry:** Aug 1, 2025

* 💸 **Entry:** \~\$0.75

* 🎯 **Profit Target:** \$1.50

* 🛑 **Stop Loss:** \$0.45

* 🔒 **Key Support to Watch:** \$327.50 — lose that = exit fast

📈 **Confidence Level:** 65%

⚠️ **Gamma Risk:** High → trade small, manage tight.

---

### 📦 TRADE\_DETAILS (JSON Format for Algo/Backtest):

```json

{

"instrument": "TSLA",

"direction": "call",

"strike": 355.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.50,

"stop_loss": 0.45,

"size": 1,

"entry_price": 0.75,

"entry_timing": "open",

"signal_publish_time": "2025-08-01 09:30:00 UTC-04:00"

}

```

---

### 🧭 **Quick Notes for Traders:**

* ✅ Bulls have short-term edge — but **momentum is fading**

* ⚠️ If TSLA breaks below **\$325**, exit fast.

* 🔍 Watch for fakeouts: options flow is bullish, but volume says “not so fast.”

---

📊 TSLA \$355C → Risk \$0.75 to potentially double 📈

💬 Will this hold, or is it a bull trap before a dump? 👀

Comment below ⬇️ and follow for Monday updates!

---

**#TSLA #OptionsFlow #WeeklyTrade #TradingSetup #GammaRisk #AITrading #TeslaStock #UnusualOptionsActivity #SmartMoneyMoves**

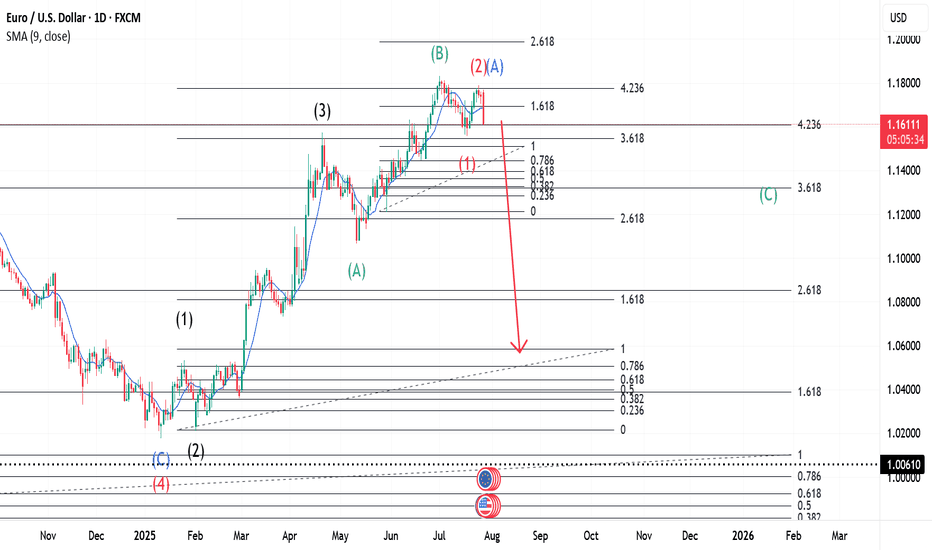

EURUSD ~ Real Time Elliott Wave UpdatesThis is an update of a chart I had previously posted. Here, we can see that Wave 1(Red) has already completed and a pullback occurred soon after, marked as Wave 2(Red) or Wave A(Blue). This has two markings because on one hand it could be a Zigzag formation or it could be the first wave of a Flat correction. All other analysis remains the same as I had previously posted. Sentiment still remains a sell.

@fabrx900

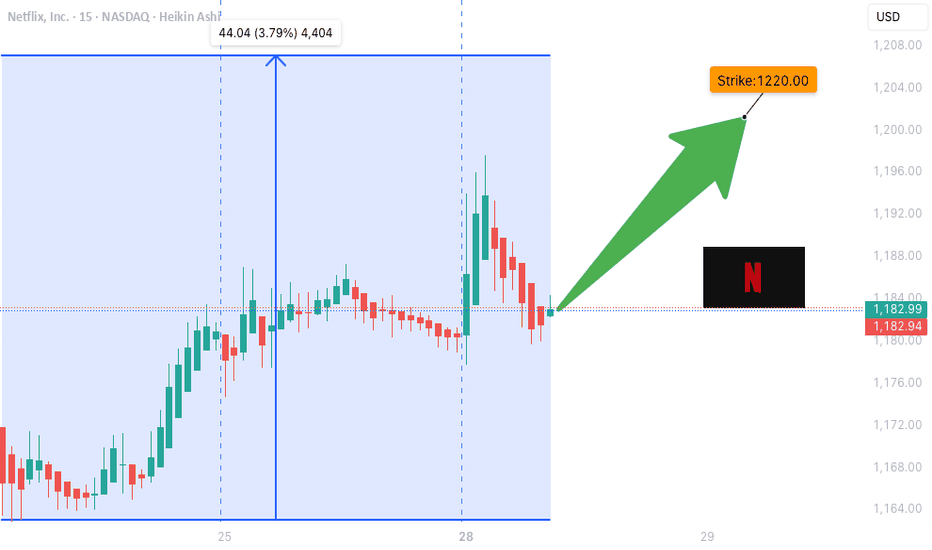

NFLX WEEKLY OPTIONS TRADE (07/28/2025)**🎬 NFLX WEEKLY OPTIONS TRADE (07/28/2025) 🎬**

**Institutions Are Buying Calls – Should You?**

---

📈 **Momentum Breakdown:**

* **Daily RSI:** Mixed ➡️ Possible short-term weakness

* **Weekly RSI:** Bullish bias intact ✅

🔥 Overall = **Moderate Bullish** trend confirmed on the **weekly timeframe**

📊 **Options Flow:**

* **Call/Put Ratio:** **2.23** 🚨

💼 Strong institutional call flow = **bullish bias** from big money

* **Strike Ideas from Models:**

* \$1260 (Grok/xAI)

* \$1230 (Gemini/Google)

* \$1220 (Meta)

* ✅ **\$1200** (Consensus Strike)

🧨 **Volume Warning:**

* 📉 Institutional participation is **lower than average**

* 🚫 Could signal weak follow-through or fading interest

---

🧠 **AI Model Consensus (Grok / Gemini / Claude / Meta / DeepSeek):**

✅ Call buying favored across the board

✅ Weekly bullish momentum confirmed

⚠️ Daily RSI & low volume = headwinds

📌 Play it smart: momentum’s real, but conviction isn’t maxed

---

💥 **RECOMMENDED TRADE (65% Confidence):**

🎯 **Play:** Buy CALL Option

* **Strike:** \$1200

* **Expiry:** 2025-08-01

* **Entry:** \~\$8.50

* **Profit Target:** \$16.00 → \$17.00

* **Stop Loss:** \$5.10

📆 Entry Timing: Monday market open

📏 Position Size: Risk-managed (2-4% portfolio)

---

⚠️ **RISK CHECKLIST:**

* 🟡 **Volume Fragility:** Institutions not fully loading

* 🟥 **Gamma Risk:** Expiry this week = possible sharp swings

* 🔴 **Daily RSI Divergence:** Short-term weakness still possible

---

📌 **TRADE DETAILS (JSON Format for Automation):**

```json

{

"instrument": "NFLX",

"direction": "call",

"strike": 1200.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 16.00,

"stop_loss": 5.10,

"size": 1,

"entry_price": 8.50,

"entry_timing": "open",

"signal_publish_time": "2025-08-01 09:30:00 UTC-04:00"

}

```

---

**TL;DR:**

🟢 Weekly bullish setup with strong options flow

🟡 Daily weakness = proceed with discipline

🎯 \ NASDAQ:NFLX \$1200C for short-term momentum upside

💬 Are you following the institutions or fading the low volume?

\#NFLX #OptionsFlow #AITrading #WeeklySetup #InstitutionalMoney #TechStocks #UnusualOptionsActivity #TradingView #MomentumTrading

ID: 2025 - 0095.5.2025

Trade #9 of 2025 executed.

Trade entry at 137 DTE (days to expiration).

Trade construct is a PDS (put debit spread) at Delta 15 combined with a PCS (put credit spread) at Delta 15. Overlapping short strikes give it the "unbalanced" butterfly nomenclature.

Sizing and strike selection is designed to keep the risk/reward "AT EXPIRATION" to a 1:1 risk profile. This lets charm work it's magic (second order greek), while exploiting the fact that this is a non-directional bias. The process is a disciplined and systematic approach letting time decay evaporate the extrinsic time value from the short options until target profit is achieved.

OF NOTE: This trade opened at EXCELLENT fills, and there is zero risk to the upside. The danger is of a catastrophic move to the downside, which will bring in phenomenal gains for ID 006 and 008. 😊

Happy Trading!

-kevin

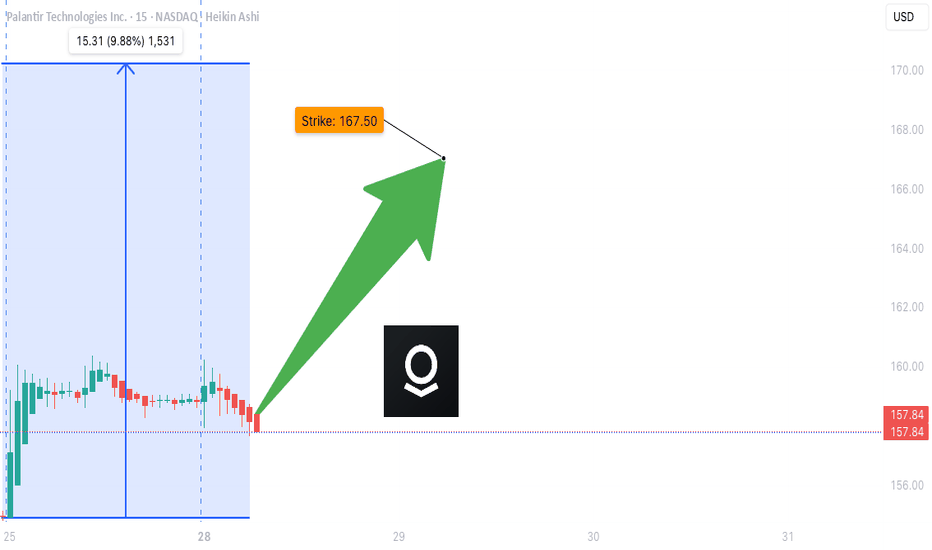

PLTR WEEKLY TRADE IDEA (07/28/2025)

**🚀 PLTR WEEKLY TRADE IDEA (07/28/2025) 🚀**

**Momentum is 🔥 but Volume is the Missing Ingredient**

---

📈 **Momentum Snapshot:**

* **Daily RSI:** 71.9 ⬆️ (🚨 Overbought but still rising)

* **Weekly RSI:** 76.7 ⬆️ (📢 Clear Bullish Strength)

➡️ *Strong upside pressure, but entering the overbought zone*

📉 **Volume Insight:**

* Weekly Volume = **0.8x last week**

⚠️ *Weak institutional conviction during the breakout = yellow flag*

🔍 **Options Flow Check:**

* **Call/Put Ratio:** 1.09 = *Neutral*

➡️ Balanced flow = *no aggressive buying yet*

🌪️ **Volatility Environment:**

* **VIX = 15.4**

✅ Favorable for directional trades — low IV supports premium growth

---

📊 **Model Consensus Recap:**

✅ Bullish RSI momentum (unanimous)

✅ Volatility ideal for long calls

⚠️ Volume flagged as a concern by some models

📌 Final stance: **MODERATE BULLISH**

---

💥 **RECOMMENDED TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Buy CALL Option

* **Strike:** \$167.50

* **Expiry:** Aug 1, 2025

* **Entry Price:** \~\$0.74

* **Profit Target:** \$1.48 (🟢 2x return)

* **Stop Loss:** \$0.37 (🔻-50%)

📆 **Entry Timing:** Market Open Monday

📦 **Size:** 1 Contract

---

⚠️ **Key Risks to Watch:**

* 📉 Weak volume = possible consolidation before next leg up

* ⏳ Premium decay risk into expiry

* 📊 No strong institutional footprint = stay nimble

---

📌 **JSON FORMAT TRADE DETAILS (Automation Ready):**

```json

{

"instrument": "PLTR",

"direction": "call",

"strike": 167.50,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.48,

"stop_loss": 0.37,

"size": 1,

"entry_price": 0.74,

"entry_timing": "open",

"signal_publish_time": "2025-07-28 10:13:40 EDT"

}

```

---

🔥 TL;DR:

* Momentum is undeniable ✅

* Volume = suspect 🟡

* VIX = Green light for directional play ✅

💬 **\ NASDAQ:PLTR Bulls, are you ready or waiting for volume confirmation?**

\#PLTR #OptionsTrading #BullishSetup #UnusualOptions #MomentumPlay #TradingView #StockMarket

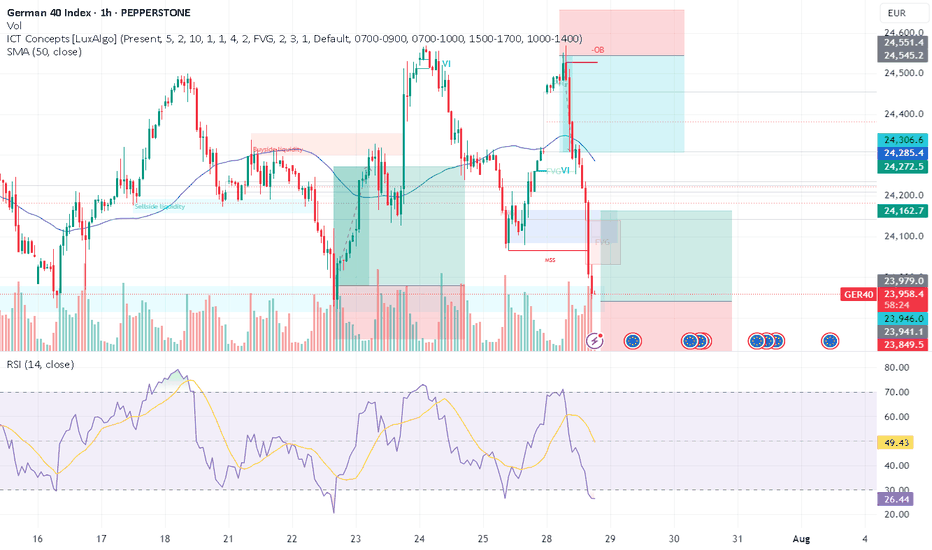

DAX / GER - ANOTHER ROUND OF ENTRY LONGTeam, we have successfully short DAX.GER earlier today with more than 300 points. both target hit

However the market has exceeding the dropping. We decide to go LONG

at the price range 23964-23945

With STOP LOSS at 23865-82

Once the trade hit above 21030-45 - BRING STOP LOSS TO BE

Target 1 at 21080-24115 = please take 50-70% volume target

30% Target remaining at 24165-24196

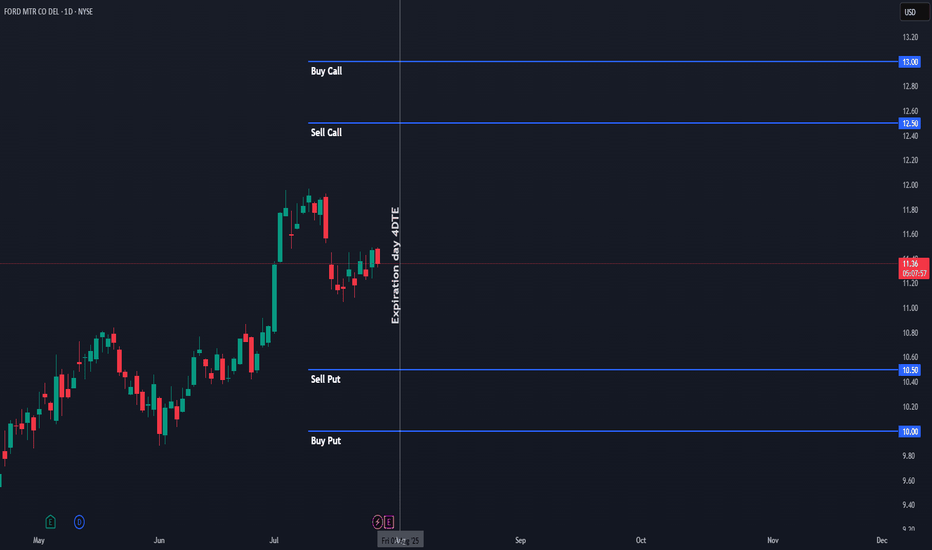

$F Iron Condor – Aug 1st Expiration | $7 Credit | I’m opening an Iron Condor on Ford ($F) with expiration on Friday, August 1st, 2025. The trade is based on the daily chart, using visible support/resistance levels to define the range. I selected strikes with approximately 0.15 delta on each side, giving the setup a high probability of success.

🔹 Total premium collected: $7 per contract

🔹 Stop loss: Defined at 50% of the premium collected (~$3.50)

🔹 Trade logic: We want $F to stay within the range throughout the week to let theta do its job.

🔹 Exit plan: If the price approaches either short strike, I will consider exiting at break-even or take a controlled loss.

This is a non-directional options strategy designed to benefit from time decay and low volatility. The setup is ideal for sideways price action, with no major catalysts expected during the week.

🎯 Target: Full profit if price stays within range until expiration.

❌ Stop: Exit if the price threatens any wing – max loss capped at 50% of the premium received.

This trade combines high probability with well-defined risk and is perfect for consistent weekly income when the market shows indecision or chop.

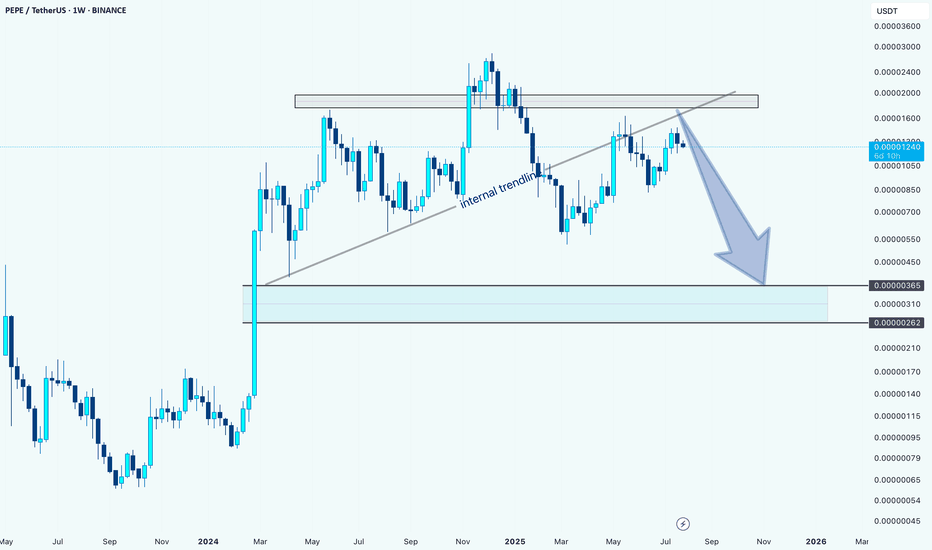

PEPEUSDT: Bearish Outlook After Internal Trendline BreakHello guys.

PEPE has tested the internal trendline multiple times and finally broke below it, signaling potential weakness. Price also failed to reclaim the key supply zone above.

Internal trendline broken

Rejection from a key supply zone

Potential move toward the demand zone around 0.00000262–0.00000365

Unless bulls reclaim the broken trendline and break above the recent highs, the bias remains bearish with a possible continuation to the downside.

Technical Analysis WeeklyGermany 40 remains in a bullish trend and is currently in a pullback phase. It trades at 24,308, almost identical to its VWAP of 24,307.5. The RSI at 54 suggests a pause in momentum. Support is found at 23,786 and resistance at 24,650.

UK 100 is in an impulsive bullish phase, breaking above previous highs with price at 9,145 well above the VWAP at 8,970. The RSI is at 73, indicating strong buying pressure. Support is at 8,748 and resistance is at 9,101.

Wall Street continues its bullish trend, pausing near recent highs. The price is at 44,880, above its VWAP of 44,445. RSI at 63 confirms steady bullish momentum. Support sits at 43,921 and resistance at 44,880.

Brent Crude remains in a broad neutral trend with short-term range-bound action. Price is at 6,768, just under VWAP of 6,866. RSI at 45 reflects a lack of directional conviction. Support is at 6,717 and resistance at 7,015.

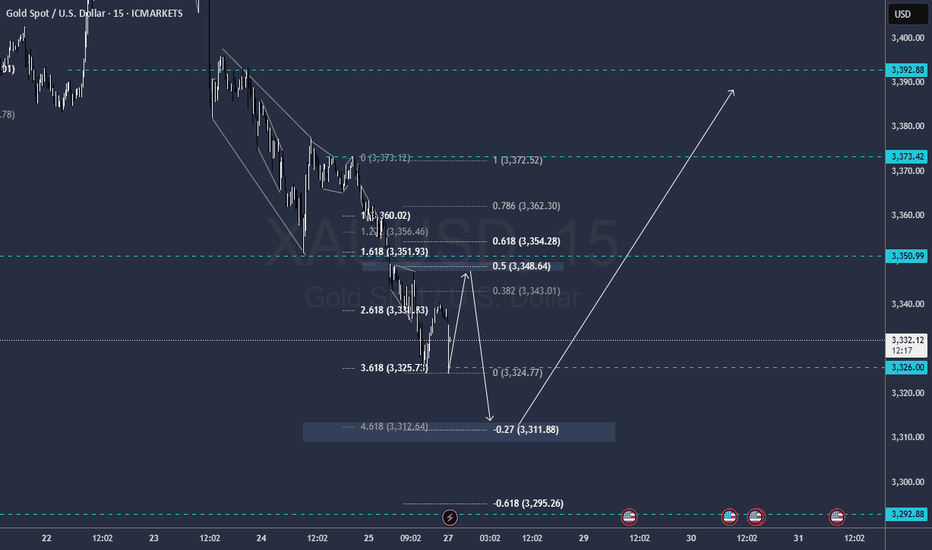

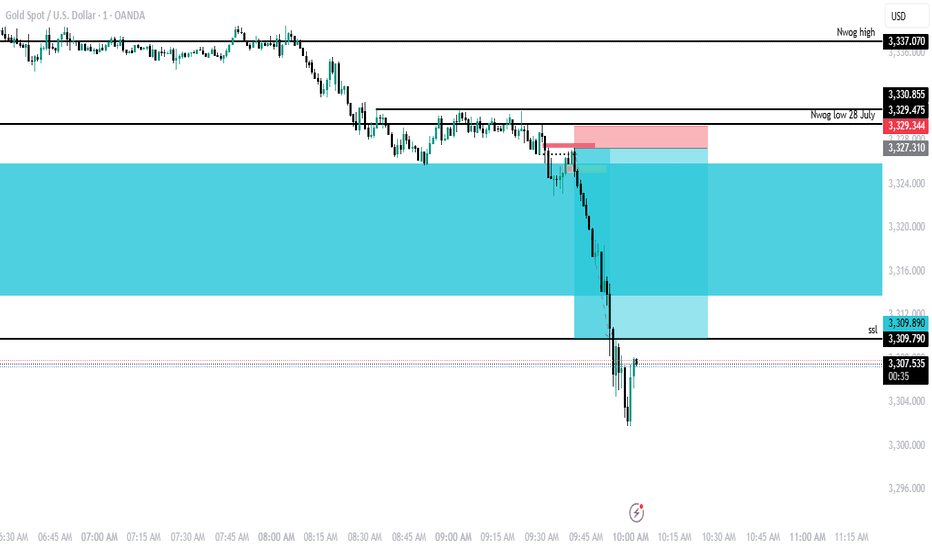

Gold continues to trade sideways within a broad range. It trades at 3,337, nearly equal to its VWAP. The RSI at 47 suggests balance. Support is found at 3,290 and resistance at 3,407.

EUR/USD holds a bullish trend while undergoing a correction. It trades at 1.1740, close to its VWAP at 1.1699. The RSI at 59 shows mild positive momentum. Support is at 1.1585 and resistance at 1.1814.

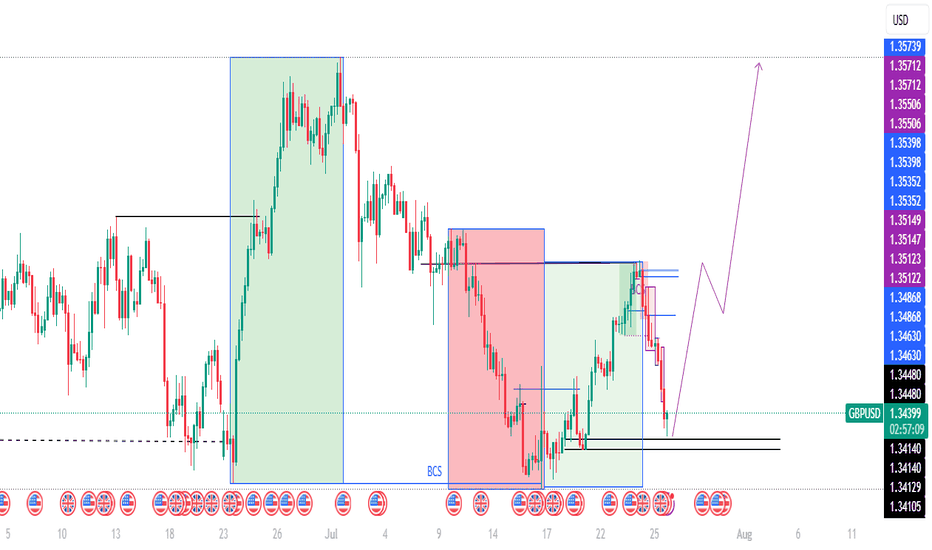

GBP/USD is in a bullish trend but under corrective pressure and seemingly turning rangebound. The price is 1.3433, slightly below the VWAP of 1.3511. RSI is at 42, hinting at waning momentum. Support is 1.3336, resistance at 1.3687.

USD/JPY continues in a neutral trend but could be about to break higher, currently ranging around 147.66 and VWAP at 147.00. RSI at 57 shows a modest bullish bias after having pulled back from overbought territory. Support is at 144.54 and resistance at 149.46.

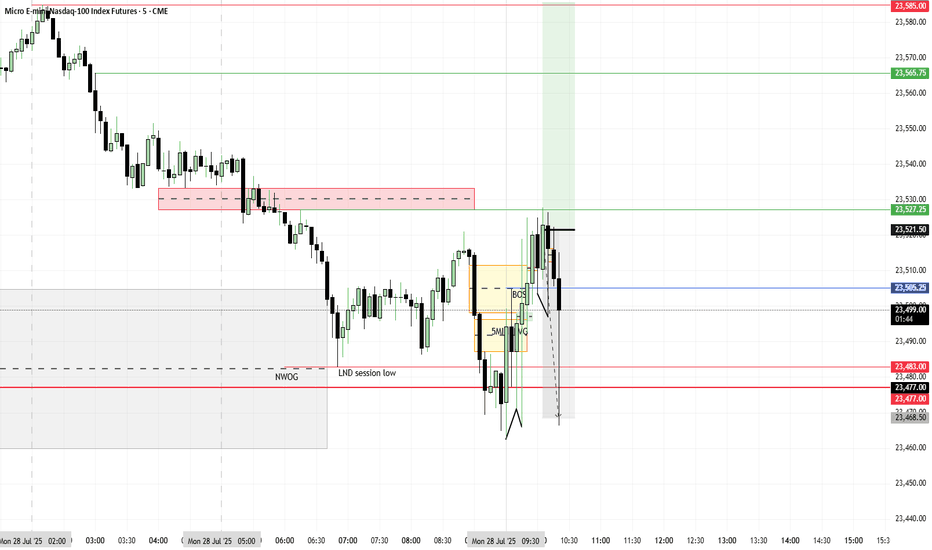

ICT CONCEPT OF LOOKING FOR THE FIRST FAIR VALUE GAP AFTER 9:30 This was my short idea that turned out profitable today with an 8.5RR. My bias was bearish, and once I noticed bullish PD arrays failing, I waited until 9:30 local NY time to look for the first FVG after that. I identified a SIBI with a 1-minute bearish order block after 9:30. I used the SIBI as an entry point for a sell, with my take profit set at a low from last week's New York trading session.

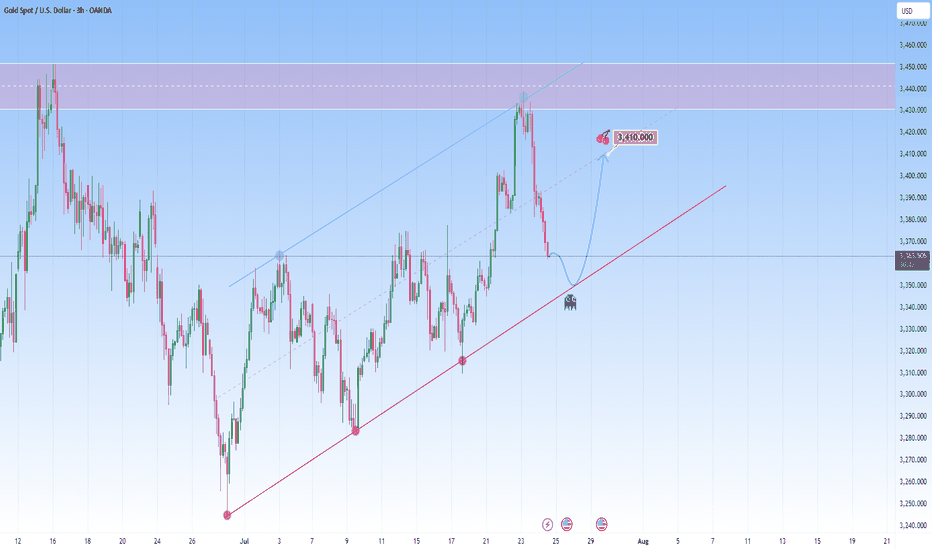

GOLD Reawakened: Corrects firmly but conditions remain bullishFrom a technical perspective Gold is climbing in a parallel channel, clearly bullish with a rhythm that’s hard to ignore. Price just bounced off the resistance with force, a classic overextension flush.

And the market is now approaching the lower boundary of this projected channel. This confluence of technical support is likely to attract renewed buying interest.

I expect it to bounce back toward 3,410, somewhere around the middle of the channel. The move up may not be determined right away. It could be consolitaing, fake dips first, or sudden acceleration.

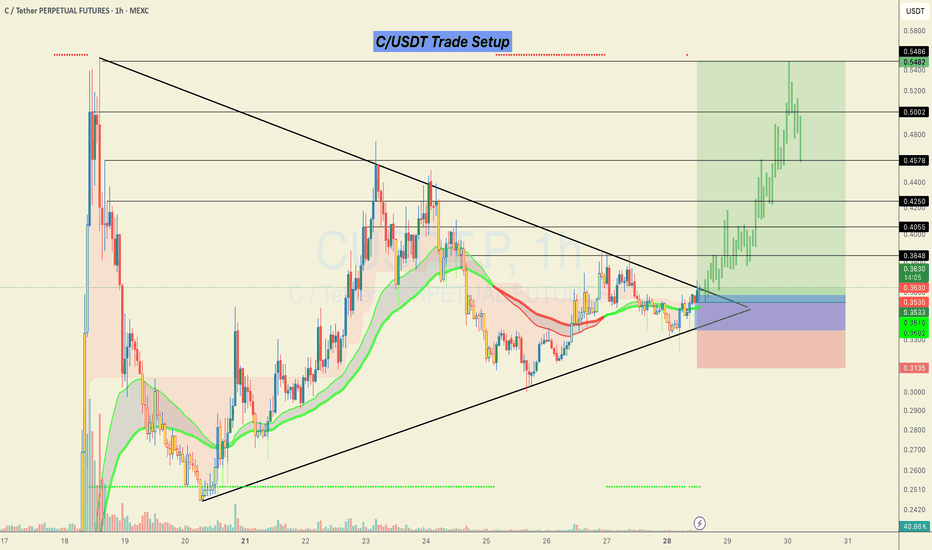

#C/USDT Looks ready for a 50% bullish move.C/USDT Trade Setup 📉

Currently forming a strong breakout structure after a long consolidation inside the triangle.

📌 Accumulation Zone:

0.3350 – 0.3580

🎯 Targets (Black Horizontal Levels):

0.4055

0.4250

0.4578

0.5002

0.5486

🛑 SL: Below 0.3135 (previous structural low)

Price broke out with solid momentum and retested the breakout zone. As long as we hold above the EMAs and the structure remains intact, continuation toward higher levels is likely.

This is a low-risk, high-reward setup as long as the risk is managed properly.

> Not financial advice. Trade at your own risk.

Do hit the like button if you want me to post more of these setups here.

Thank you

#PEACE

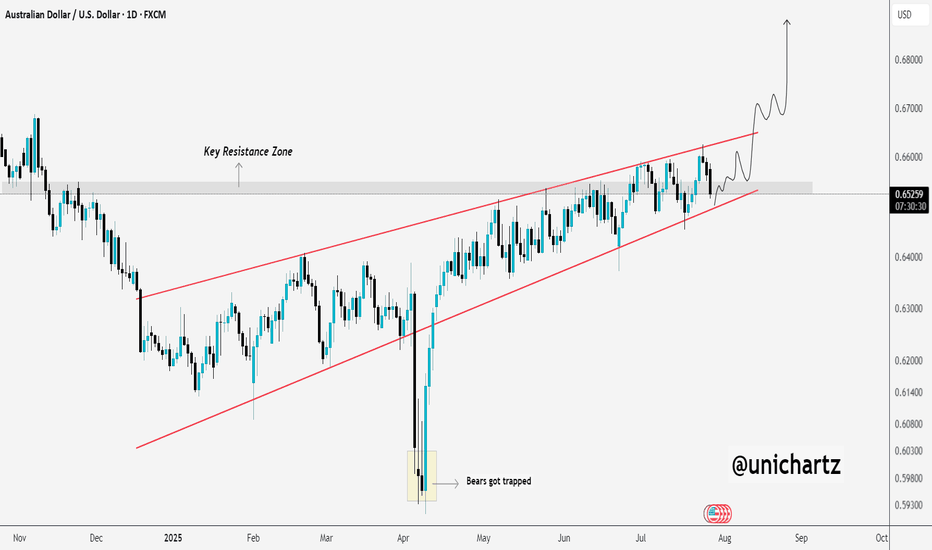

This Chart Screams Breakout – Are You In?AUD/USD – Bullish Setup Brewing

AUD/USD has been respecting this rising channel beautifully, with clean higher highs and higher lows.

Back in April, we saw a classic bear trap, price wicked below support, lured in shorts, and then reversed sharply. That fakeout sparked a strong rally and confirmed demand.

Currently, price is consolidating near the Key Resistance Zone and bouncing off the lower trendline again a sign of strength.

If this pattern continues, we could soon see a breakout above the upper trendline, potentially sending AUD/USD flying toward 0.68+.

Outlook:

As long as the structure holds, dips are for buying. Bulls remain in control.

DYOR, NFA

Thanks for the reading

Report - 28 jully, 2025Executive Summary

In a historic move to defuse transatlantic trade tensions, the United States and the European Union have struck a landmark agreement imposing a 15% blanket tariff on EU goods. The deal, brokered between President Trump and EC President Ursula von der Leyen, includes sweeping European commitments to increase purchases of American energy and military equipment—amounting to more than $1.35 trillion. This not only averts a trade war but realigns fiscal, defense, and industrial policy across the Atlantic. Meanwhile, Germany will escape EU sanction for deficit overruns due to elevated defense spending, and China has intensified its diplomatic push to lead AI governance, openly challenging U.S. technological hegemony.

These developments unfold amid a broader recalibration of global capital flows, with Chinese investors pouring record funds into Hong Kong equities, Brazil doubling down on BRICS despite tariff threats, and private equity investors increasingly opting for liquidity over continuation vehicles. All these signals point to a shifting world order, where economic fragmentation, tech rivalry, and military investment dominate the strategic calculus.

Market Reactions

Markets have reacted with cautious optimism. The resolution of the US-EU dispute has removed one of the most immediate risks to global trade, stabilizing risk sentiment. Equities across developed markets are firmer, while defense, energy, and industrial stocks in the U.S. have caught a fresh bid. European auto and export sectors remain under scrutiny given the tariff imposition, despite the broader stability.

The dollar softened slightly on expectations that the trade deal will reduce the likelihood of retaliatory disruptions, even as tensions over chip tariffs and Brazil’s alignment with BRICS persist. Gold briefly rallied but then settled as inflation expectations were tempered by diplomatic de-escalation. Oil prices remain subdued as demand signals remain weak despite energy reordering.

Fiscal and Political Implications

The US-EU agreement marks a major geopolitical win for Trump. The EU's commitment to spend $750 billion on U.S. energy and $600 billion on military procurement illustrates a fundamental pivot in the bloc’s external policy alignment. Politically, this underscores Washington’s ability to extract economic concessions under threat of tariffs—further validating Trump’s unilateralist negotiation style.

Germany’s exemption from EU deficit procedures further highlights Brussels’ strategic flexibility in an era where defense is taking precedence over fiscal austerity. Berlin will be allowed to run a deficit of 3.3% of GDP in 2025, thanks to a “national escape clause” invoked to cover expanded defense spending. This sets a precedent for other member states to follow suit, potentially unleashing a wave of fiscally supported rearmament across the EU.

Meanwhile, China's unveiling of a 13-point AI governance plan signals an emerging regulatory bifurcation in global technology. The push for a UN-backed AI governance body—and the positioning of its open-source models for Global South collaboration—challenges U.S. regulatory primacy and may spark a new front in the AI cold war.

Strategic Forecasts

The medium-term outlook is increasingly defined by strategic spending, tech sovereignty, and the weaponization of trade. The U.S. will likely continue to deploy tariffs not just for balance-of-trade concerns, but also to enforce strategic compliance. This tactic will carry mixed implications for global markets: inflationary near-term, but ultimately supportive of U.S. industrial and defense equities.

Europe’s gradual pivot toward U.S. alignment will create internal friction, especially among member states hesitant to cede strategic autonomy. At the same time, China’s AI diplomacy and Brazil’s defiance of U.S. tariffs will continue to fragment global consensus, creating an increasingly multipolar and protectionist macro environment.

Continued uncertainty around the Federal Reserve’s independence—as Trump ramps up pressure on Powell—will contribute to short-term volatility in bond and currency markets. The likelihood of delayed rate cuts or a politically forced pivot is increasing.

Risks and Opportunities

Risks include renewed tariff escalations, especially targeting tech, chips, and Brazil. Europe’s fiscal leniency could spook bond markets if perceived as unsustainable. In private equity, continuation vehicle fatigue risks forcing markdowns across illiquid portfolios.

Opportunities emerge in defense, energy, and AI-linked equities. The U.S. stands to benefit from a surge in industrial demand, while Chinese tech firms could capitalize on regulatory arbitrage in emerging markets. Open-source AI adoption will favor hardware and semiconductor exporters, particularly in Asia.

Asset Impact Analysis

Gold (XAUUSD):

Gold showed initial strength on trade fears but retraced as the deal lowered immediate inflation risk. With Powell’s position under political threat and long-term fiscal expansion in play, the bullish bias remains intact. Expect gold to test $3,400 in Q3 if Fed guidance shifts dovishly. Near-term support lies at $3,300.

S&P 500 (SPX):

Markets welcomed the trade clarity and defense spending surge. Industrials, defense, and energy are clear beneficiaries, while tech gains from relaxed macro pressure. Continued pressure on Powell could add volatility.

Dow Jones (DJIA):

Dividend-heavy Dow components in defense and manufacturing are poised to outperform. Trade normalization and fiscal leniency in Europe favor global cyclicals.

USDJPY:

With Japanese inflation slightly below forecast and the BoJ still cautious, yen strength is capped. U.S. political drama may induce mild USD weakness but not enough to break 145 convincingly.

DXY (US Dollar Index):

The dollar may weaken modestly as tariff resolution reduces safe-haven demand and the Fed comes under pressure to cut. A break below 103.00 would confirm a bearish turn.

Crude Oil (WTI):

Oil remains stuck in a neutral range. Although the EU will buy more U.S. energy, weak demand signals and lackluster PMI data keep prices rangebound. A breakout above $72 requires more forceful geopolitical tension.