Beyond Technical Analysis

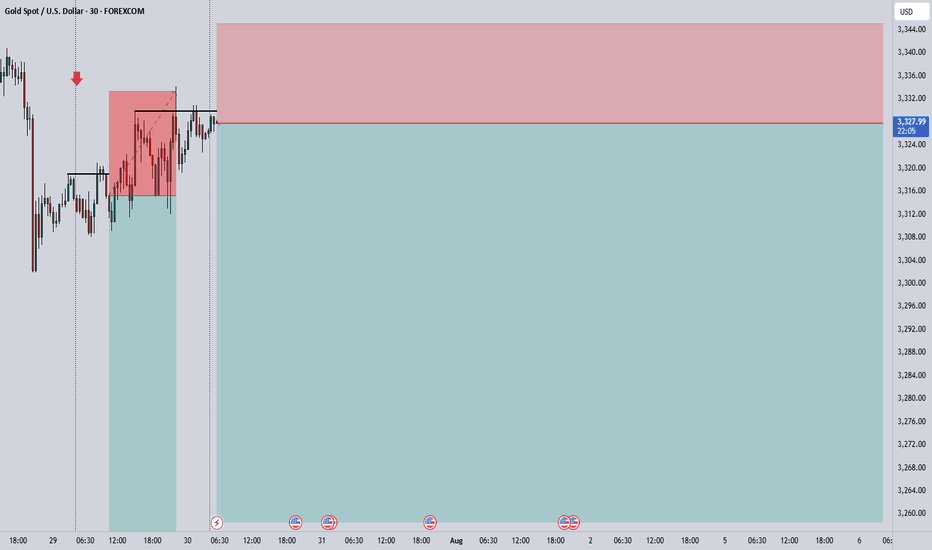

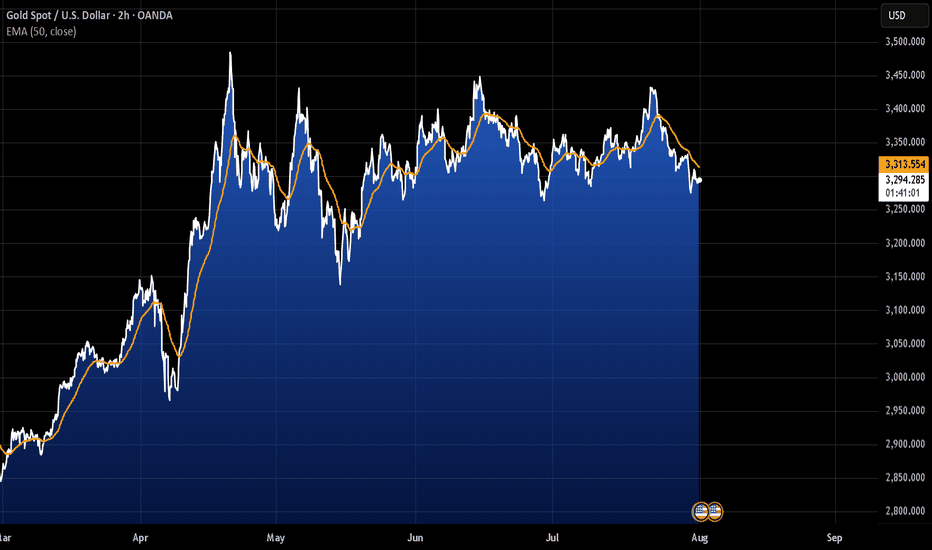

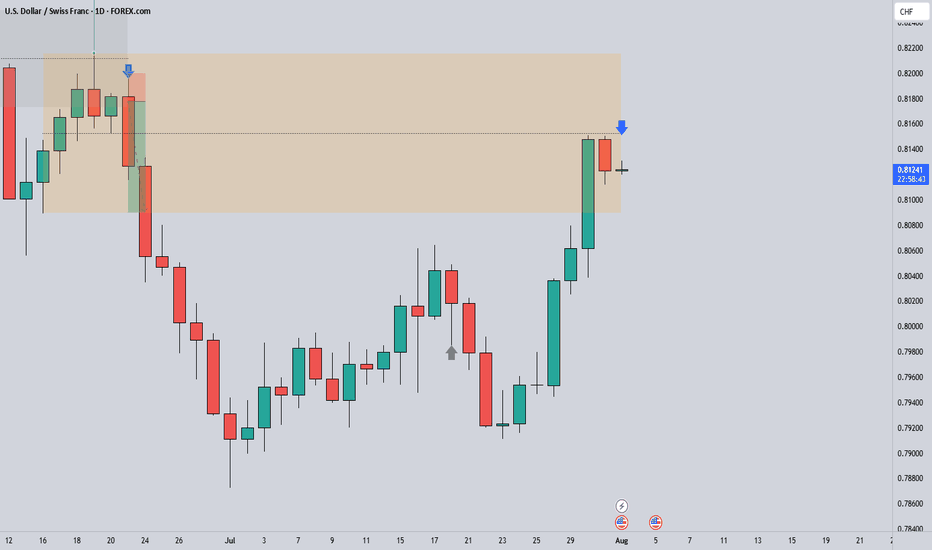

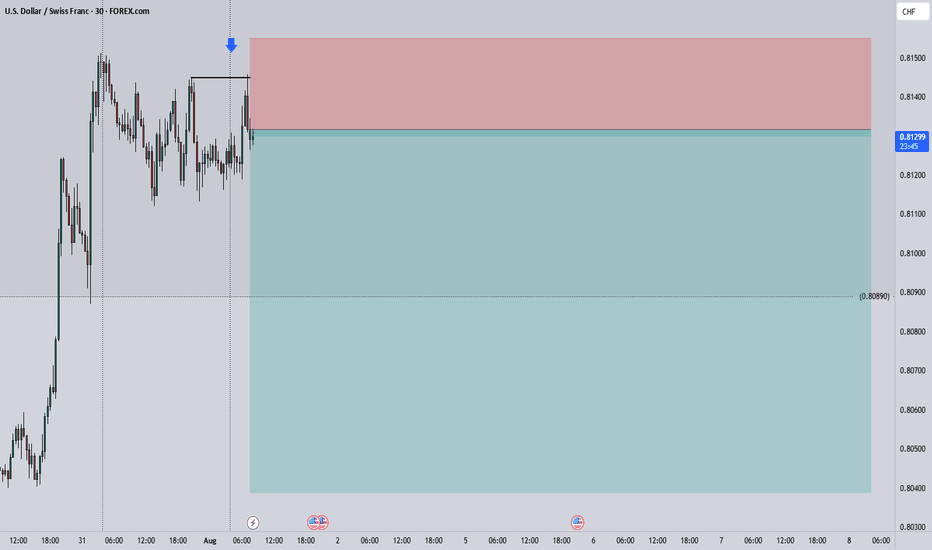

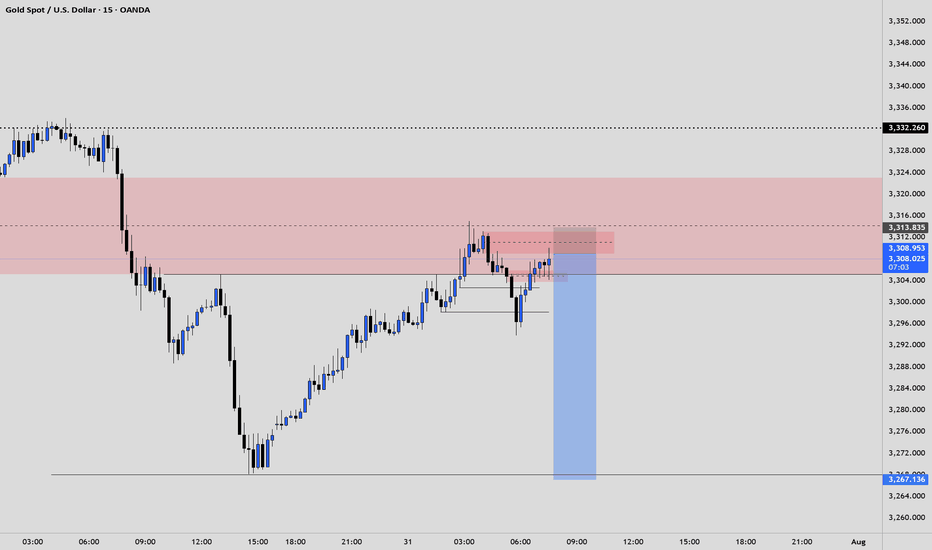

GOLD REMAINS UNDER PRESSURE AFTER U.S. INFLATION DATA📊 Market Overview:

Gold is trading around $3294, down from $3311 earlier after U.S. Core PCE and Employment Cost Index came in as expected — reinforcing the Fed's hawkish stance. A stronger dollar and rising Treasury yields continue to weigh on gold.

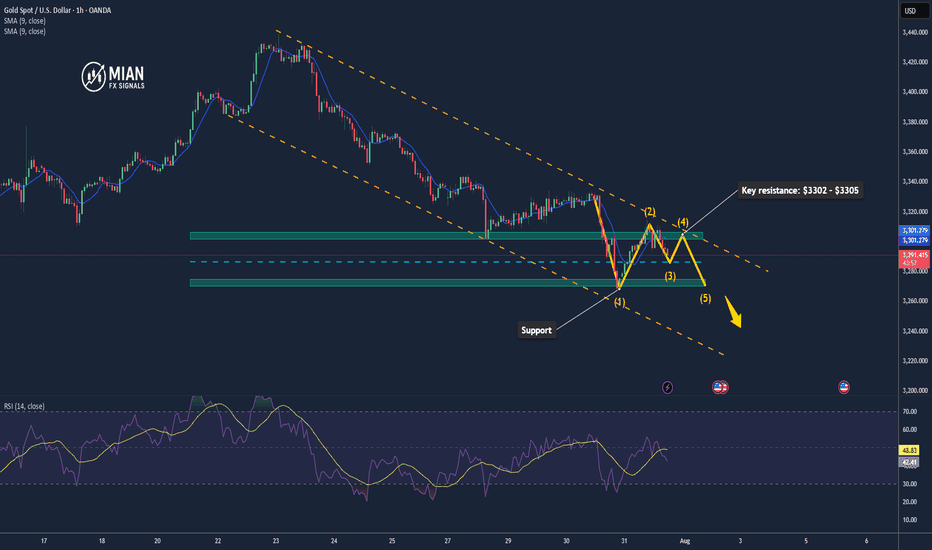

📉 Technical Analysis:

• Key resistance: $3302 – $3305

• Nearest support: $3285 – $3275

• EMA09 (H1): Price is below the 9-period EMA → short-term trend remains bearish

• Candlestick / volume / momentum: After the sharp drop, price is consolidating between $3293–$3298 with low volume. Failure to break above $3302 may trigger further downside. RSI near 45 suggests room for more selling.

📌 Outlook:

Gold may continue to decline in the short term if it fails to reclaim $3302 and the dollar remains strong through the Asian and European sessions.

💡 Suggested Trade Setup:

🔻 SELL XAU/USD: $3296 – $3298

🎯 TP: $3280 / $3275

❌ SL: $3305

🔺 BUY XAU/USD: $3275 – $3278 (if reversal candle appears)

🎯 TP: $3295

❌ SL: $3270

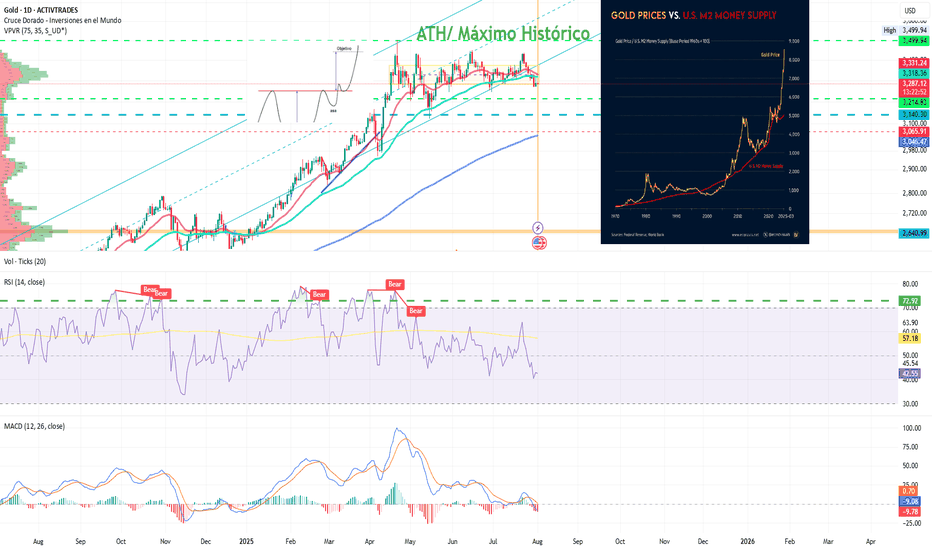

Gold: Are the Bulls Still Behind It?Ion Jauregui – Analyst at ActivTrades

Fundamental Analysis

In 2025, gold has appreciated around 27% year-to-date, reaching a peak of 33.37% at the end of April, driven by structural factors. Its strength is based on global de-dollarization, central bank purchases, persistent inflation, and expectations of real rate cuts in the U.S. Since real interest rates peaked in July 2023, gold has risen 74%, reinforcing its role as a hedge against monetary policy.

In addition, countries like China and Russia continue to accumulate gold as protection against the dollar and potential sanctions, supporting long-term structural demand. Diversifying with physical and financial gold (ETFs, mining stocks) is an increasingly common strategy in an environment of high debt, geopolitical tensions, and doubts about traditional safe-haven assets. A suggested allocation in a classic model portfolio could range between 10% and 25%, depending on the risk profile, in a typical equity-focused investment portfolio.

Technical Analysis

From a technical standpoint, gold has completed a long-term “cup with handle” formation that began in 2012, with an upside projection toward the $4,000 per ounce area. This pattern supports the continuation of its long-term upward structure.

In the short term, however, the price is in a consolidation phase after reaching all-time highs of $3,499.94 at the end of April. Since then, the lateral movement suggests a pause within the primary trend.

Technical indicators are showing mixed signals: RSI and MACD are pointing toward a possible oversold condition, suggesting a risk of short-term correction. Additionally, a bearish crossover between the 50-day and 100-day moving averages may reinforce selling pressure.

If this corrective scenario unfolds, gold could retrace toward a key support zone around $3,140, a level that has served as the base of the current range and where renewed buying interest could emerge.

Despite a possible pullback, the broader technical outlook remains constructive. Any correction would likely present tactical opportunities to re-enter the market—especially if expectations of real rate cuts or global geopolitical tensions persist.

Gold Consolidates After Highs

All in all, despite potential short-term pullbacks, gold continues to offer value as a tool for diversification, wealth protection, and a hedge against systemic risks. Its inclusion in portfolios remains relevant, even at current levels.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

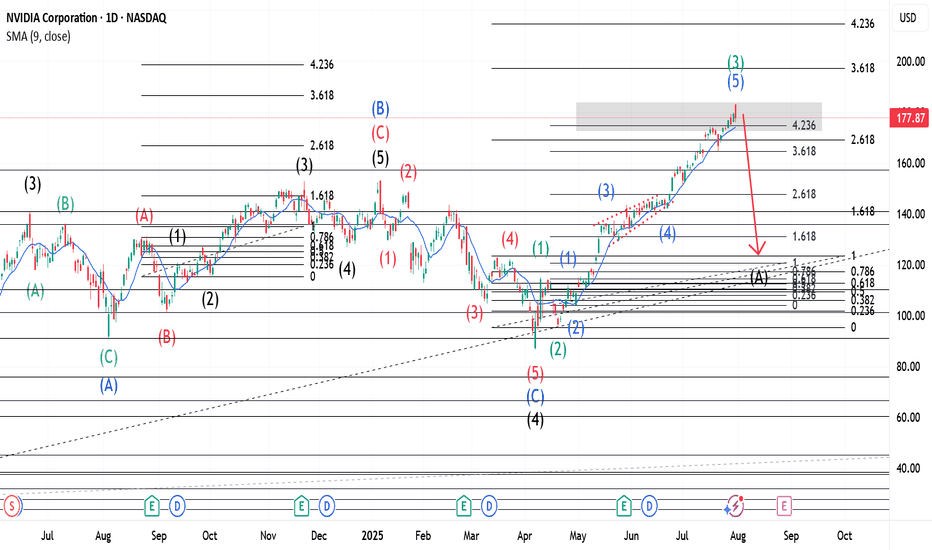

$NVDA ~ An Elliott Wave Breakdown.(Detailed Spectrum)Our Wave 2(Black) of the main wave was a Zigzag hence a Flat for Wave 4(Black). When Wave 3(Black) completed a three wave move, shown in Green, was made, hence A(Blue). Wave B(Blue) went beyond the end of 3(Black) and had 3 waves, shown in Red, also(as expected for Flats). The last of this 3 wave move(Wave c-Red) had 5 waves shown in Black. Upon completion, our Wave B(Blue) was over and we expected a Wave 4(Black). Our Wave 4 made a 5 wave move(Shown in Red) that retested at the 261.8% Fib. level. With Wave C(Blue) complete, it was coined Wave 4(Black). Wave 5(Black) was launched and has a 5 wave move shown in Green. With a Zigzag for Wave 2(Green), a Flat should be expected for Wave 4(Green). Wave 3(Green) has 5 waves with a triangle for Wave 4(Blue). A confirmation at its current location(423.6% Fib. level) would mean that Wave 3(Green) is complete and a Wave A(Black) of the previously mentioned Flat should be anticipated.

NB: The placement of Wave A(Black) of the Flat mentioned above is purely for demonstrative purposes.

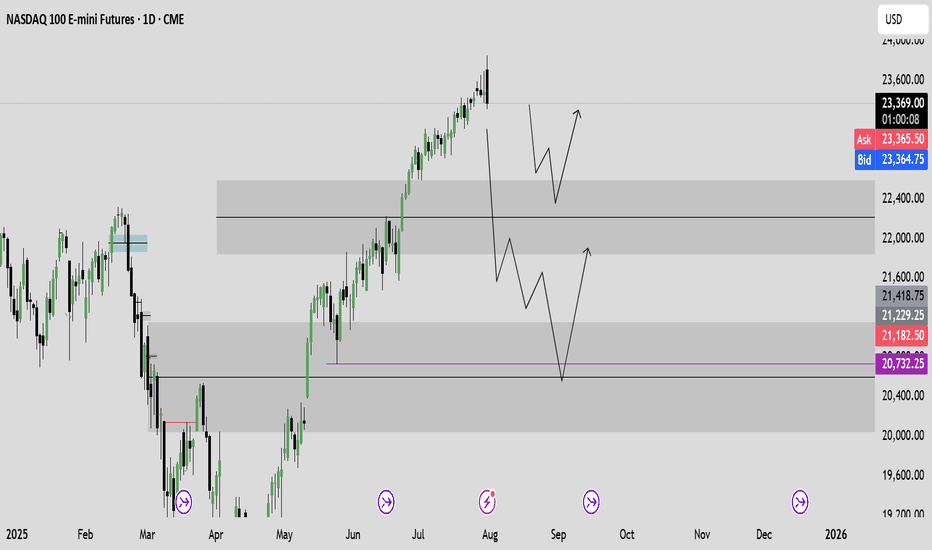

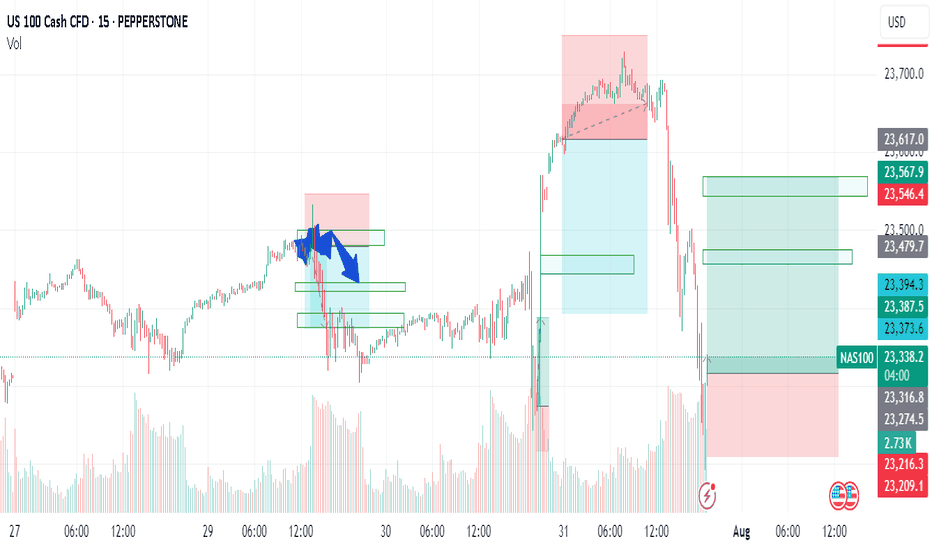

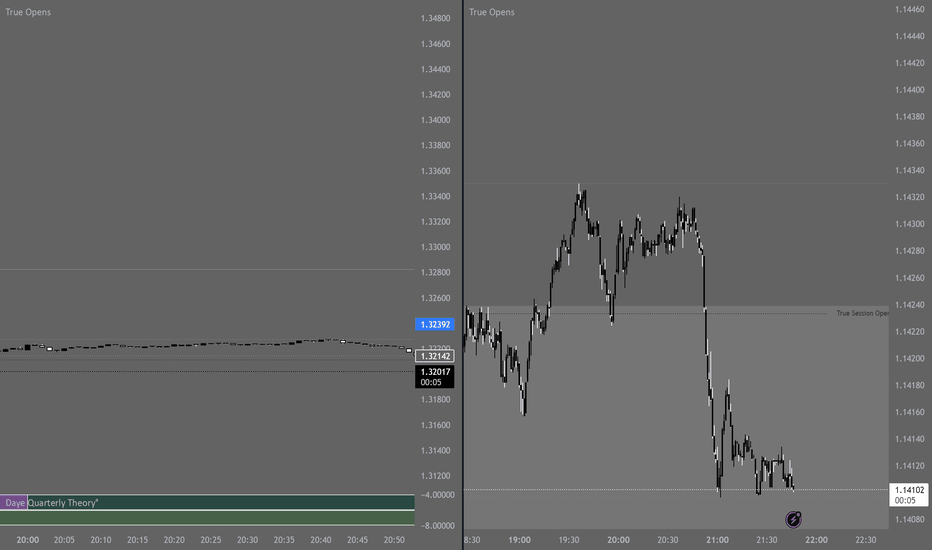

NAS - TIME FOR JUICYTeam, hope you all making a killing on SHORT tonight.

as we expected. Thank you for asking and be patience

TIME TO MAKE NAS100 GREAT AGAIN.

Sorry my entry was 23240, but now the market is 23332

you should entry small volume at the current price 23332 - if a little pull back below 23300 add more

STOP LOSS at 23230-50

TARGET 1 at 23385-23400

TARGET 2 at 23475-23515

LETS go - time to make ACTIVE TRADER ROOM GREAT AGAIN.!

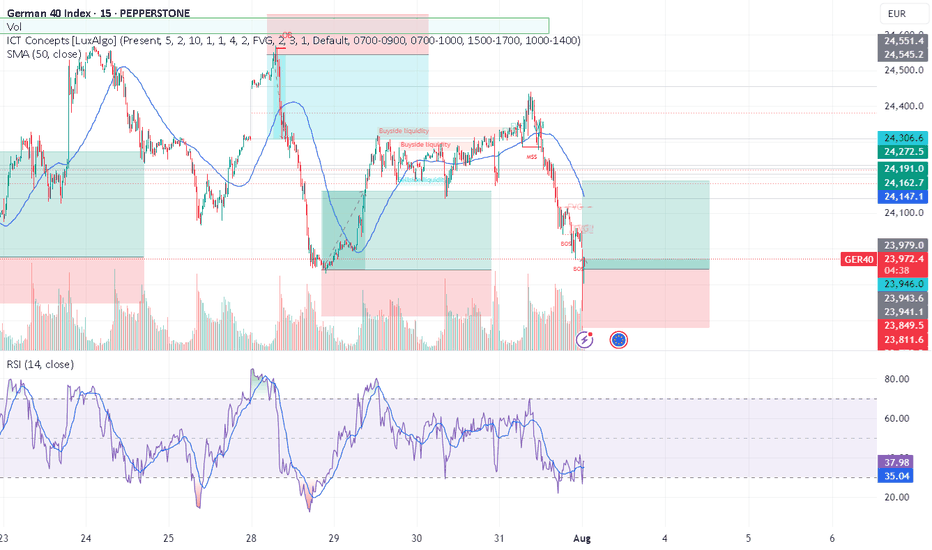

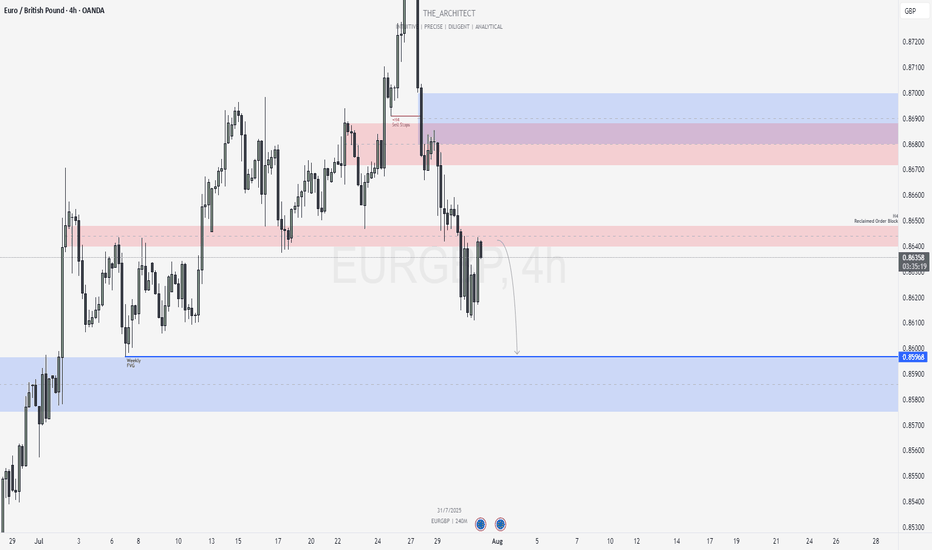

EURGBP: Bearish Continuation from Reclaimed Order Block!Greetings Traders,

In today’s analysis of EURGBP, we observe that institutional order flow on the H4 timeframe has recently shifted bearish. This provides us with a clear directional bias to look for shorting opportunities in line with the prevailing higher timeframe trend.

Higher Timeframe Context:

On the weekly timeframe, price action is currently drawing towards a Weekly Fair Value Gap (FVG). This bearish draw on liquidity confirms the macro-level bearish sentiment. With the recent bearish market structure shift (MSS) on the H4, we now have strong confluence between the weekly and intraday order flow, favoring continued downside.

Key Observations on H4:

Reclaimed Bearish Order Block: After shifting structure to the downside, price has retraced into a bearish reclaimed order block—a region previously marked by institutional selling. This return to the origin of prior sell-side imbalance offers institutions the opportunity to mitigate earlier positions and reinitiate shorts. The failure of price to break higher confirms bearish intent.

Confluence with Weekly Draw: The reclaimed order block aligns with the broader draw towards the weekly FVG, providing an optimal zone for bearish confirmation entries.

Trading Plan:

Entry Strategy: Look for lower timeframe confirmation entries within the H4 reclaimed order block.

Target: The short-term target remains the Weekly Fair Value Gap, supporting a discount-side delivery.

As always, remain disciplined in execution. Let the market confirm your bias before entering, and manage risk according to your rules.

For a detailed market walkthrough and in-depth execution zones, be sure to watch this week’s Forex Market Breakdown:

Kind Regards,

The Architect 🏛️📉

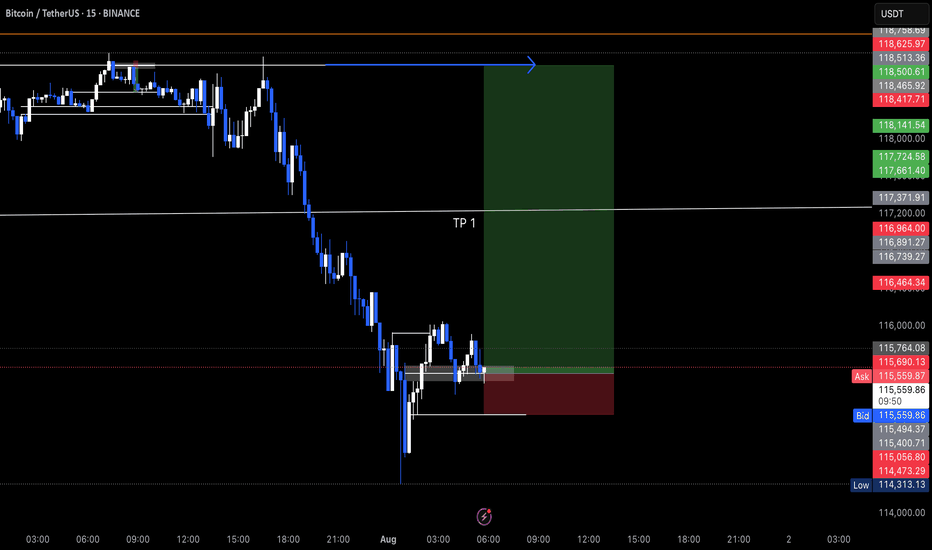

$BTCUSDT: Fictitious Fractal 136KSo. I see we are having a relatively difficult time.

My expectations are in this range for the next appx. 125 days - 365 days.

Downside: 68.6k-69.9k

Topside: 100k to 136k (round to 150k)

I drew this fractal by hand and I want to watch it closely.

I expect in the next few weeks we hit 100k and then do a nice rug to 69k range.

This is probably wrong.

I pretty much extrapolated the red brush circle into a weeks long fractal.

I am longing all the dips to 68k.

Enjoy.

Mr. Storm.

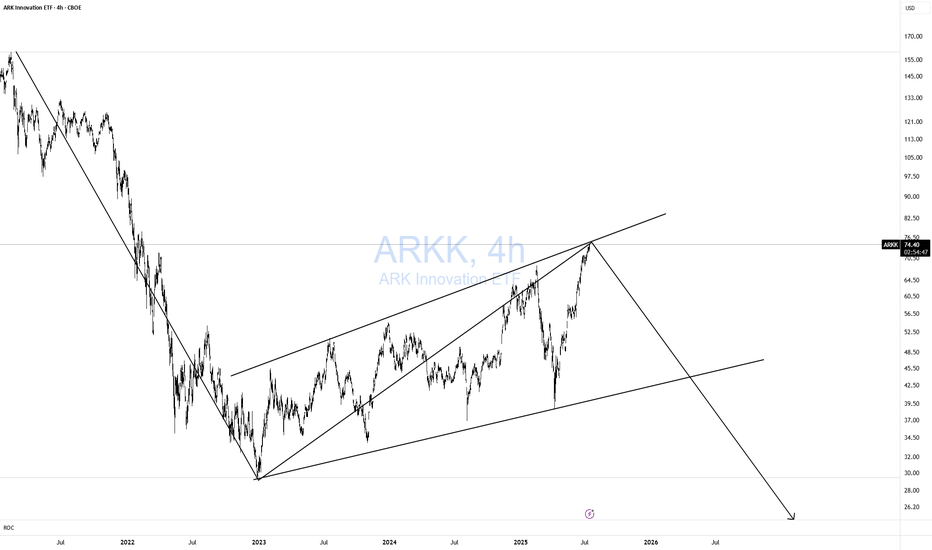

ARKK DOOMED!Classic 123 wave move down! As I like to say Short when no one else is looking! Not when everyone is looking. TOO LATE!

Simple but very effective pattern with excellent risk-reward. Remember, I am a macro trader, so don't expect to see a return on this investment tomorrow.

I won't get into the macro stuff.

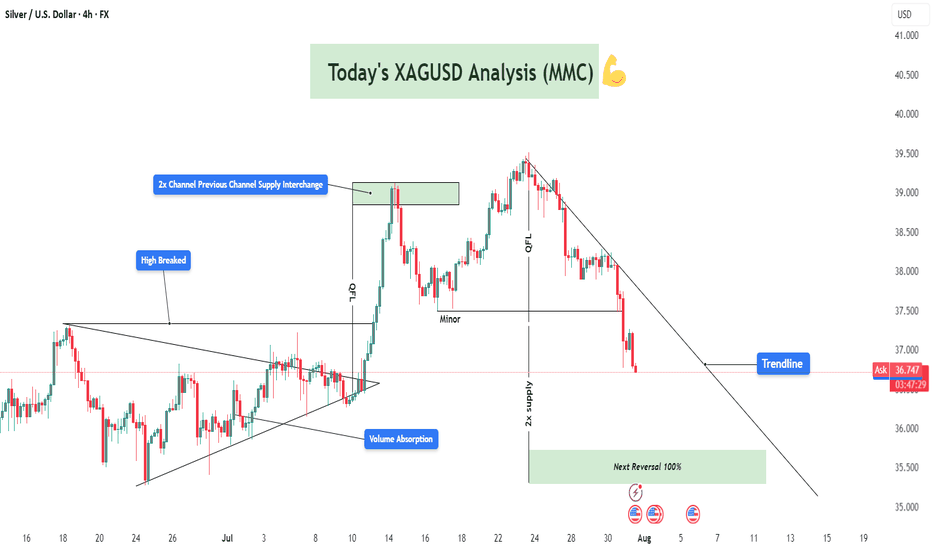

XAGUSD Analysis : Bearish Setup 2x Supply to Next Reversal Zone🔍 Market Context & Technical Overview

Silver (XAGUSD) has recently gone through a sharp corrective phase after breaking above a key structural high and retesting previous resistance. The current price action reflects a clean MMC-patterned behavior, including volume absorption, QFL trap, and interaction with a descending trendline that has now become critical for further directional bias.

🧠 Key Observations Based on MMC Principles

🔵 1. Volume Absorption at the Triangle Breakout

After a prolonged consolidation phase inside a triangle pattern, volume absorption took place—indicating hidden accumulation.

A breakout above the structure was confirmed with momentum (also breaking a previously established “High Breaked” level).

This breakout led to a vertical move towards the 2x Channel Supply Interchange Zone, where price reversed sharply.

🟥 2. Supply Interchange Zone (2x Confirmed)

Price encountered resistance at the green supply block, which acted as a 2x supply zone—a critical confluence where previous sellers re-engaged.

This area had previously served as the channel boundary, creating a supply interchange effect.

⚠️ 3. QFL Zone Trap (Fake Momentum)

The price printed a QFL structure, where it created a flat base, faked a move up, and quickly reversed.

The QFL base acted as a trap for late buyers, which aligned with the start of a bearish phase that is still ongoing.

📉 4. Downtrend & Trendline Respect

Price has respected a strong descending trendline since the reversal at supply.

Each retest has resulted in a lower high, confirming the bearish structure is intact for now.

Currently, the price is trading below this trendline, reinforcing short-term bearish sentiment.

📦 Key Levels to Watch

Zone/Level Type Role

38.70 – 39.20 2x Supply Zone Strong resistance, reversal origin

37.40 – 37.60 Minor Level Short-term support turned resistance

36.00 – 35.40 Next Reversal Zone ✅ High-probability long area, MMC expects reaction

Trendline Dynamic Structure control, needs break for bullish shift

🔁 Scenarios Based on Structure

📈 Scenario 1: Bullish Reversal from Green Demand Block

Price is approaching the next MMC reversal zone (green box below 36.00).

MMC logic suggests a 100% probability of bullish reaction based on:

Volume cycle completion

Downward exhaustion

Proximity to previous institutional accumulation zones

Expected move: bounce toward trendline retest and minor resistance at ~37.50.

📉 Scenario 2: Break Below Green Zone = Panic Sell

If the green zone fails to hold:

A panic drop toward 34.80–35.00 is possible.

However, based on MMC mapping, this is less likely without a major macro catalyst.

💡 Strategic Thoughts (MMC Traders’ Lens)

We’re observing a classic MMC Phase 3 correction following Phase 2 expansion.

The current cycle favors reaccumulation, especially if a wick or engulfing candle forms inside the green zone.

Price action traders should wait for confirmation (e.g., break of trendline, bullish structure on 1H) before entering.

📌 Educational Trade Plan (Not Financial Advice)

Setup Entry Zone Stop Loss Target 1 Target 2

Reversal Long 35.80 – 36.20 35.40 37.50 38.70

Trendline Break Long Above 37.10 36.40 38.00 39.00

Bearish Continuation Below 35.40 36.10 34.80 33.90

🧾 Conclusion & Final Note

Silver is trading at a make-or-break point as it approaches a high-probability reversal zone, identified through MMC methodology. Watch the price action near 36.00 closely—it holds the key to whether we begin a new bullish phase or extend this bearish cycle.

✅ MMC traders will stay reactive, not predictive, and align with structure.

🚨 Patience is key—let the market show its hand before commitment.

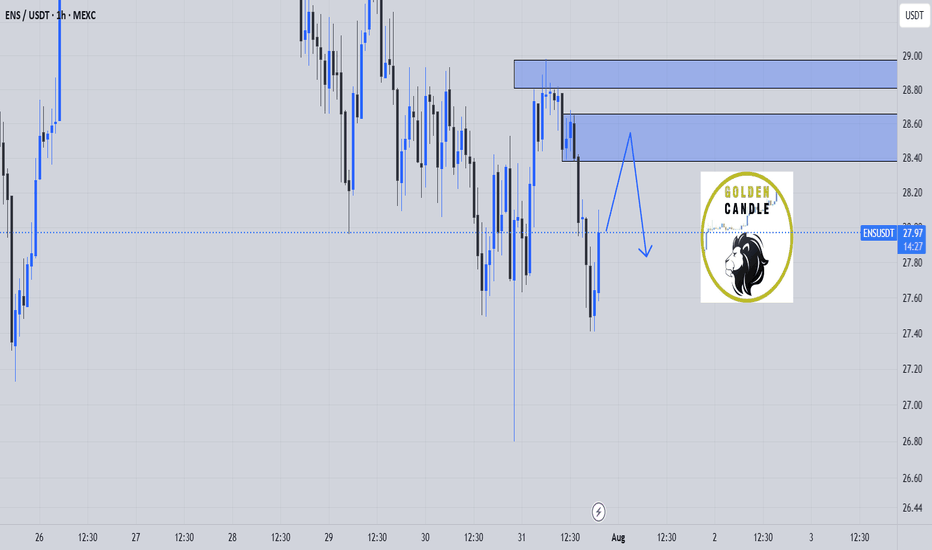

ens sell midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

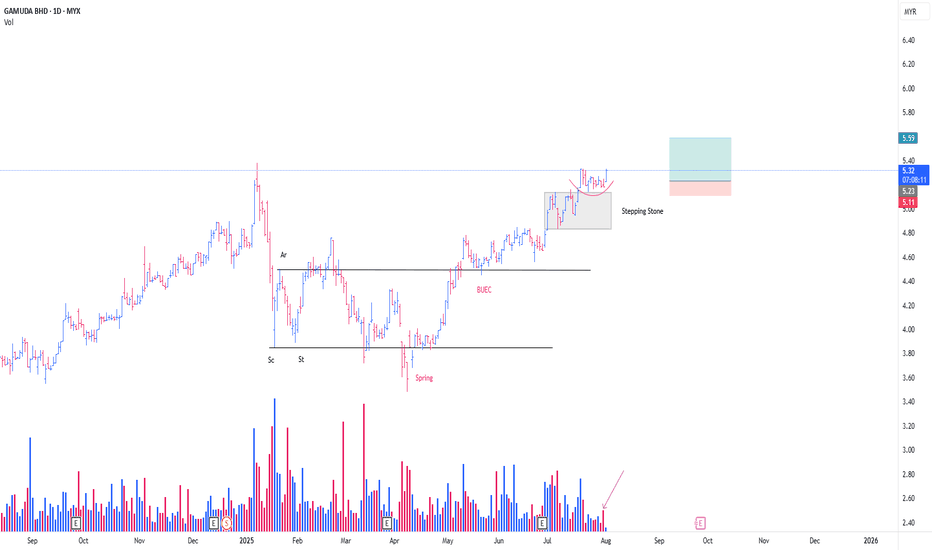

GAMUDA CONTINUING MARKING UPThis is just a continuation from my previous thesis

**pls refer to the link below

I just want to mention that there is another formation of feather's weight (FW) (**Red line) since the Stepping Stone (SS)

I would be labelling this FW as a form of SS

It would be interesting if today's Bar / Candlestick, able to commit above yesterday's Bar/Candlestick (31/7/25)

-Noticed the huge selling blocks (*Purple Arrow)

EP n SL as attached (Position Intiated @ 31/7/25)

PureWyckoff

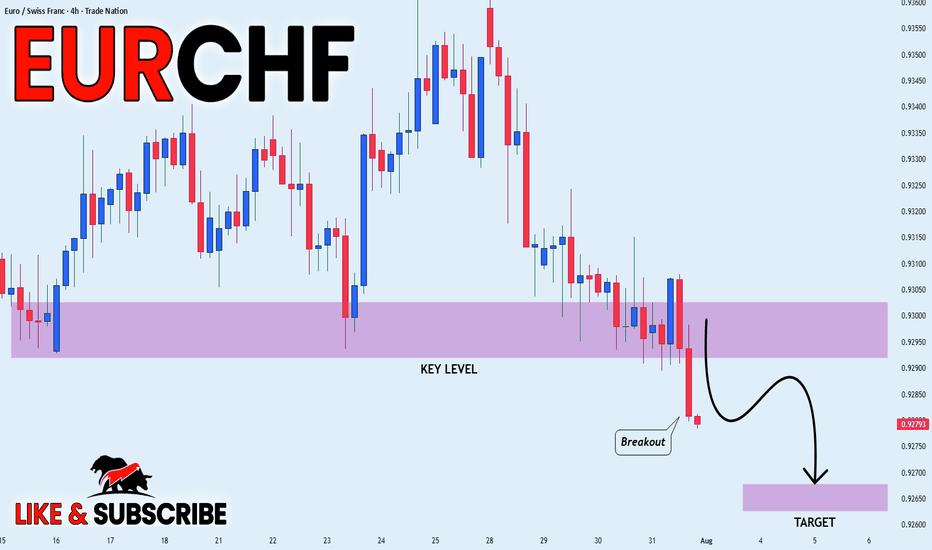

EUR_CHF WILL KEEP FALLING|SHORT|

✅EUR_CHF broke the key

Structure level of 0.9295

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of the

Broken level is complete

A rebound and bearish

Continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

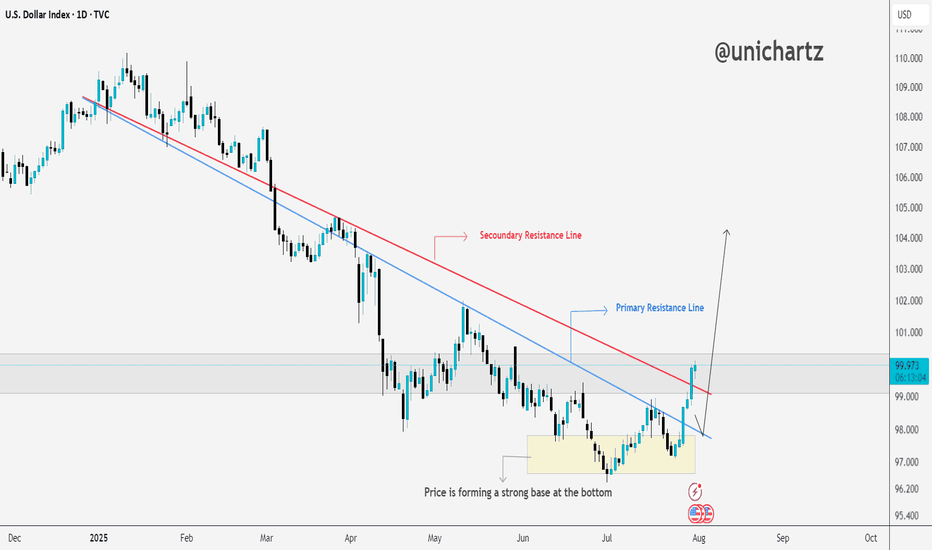

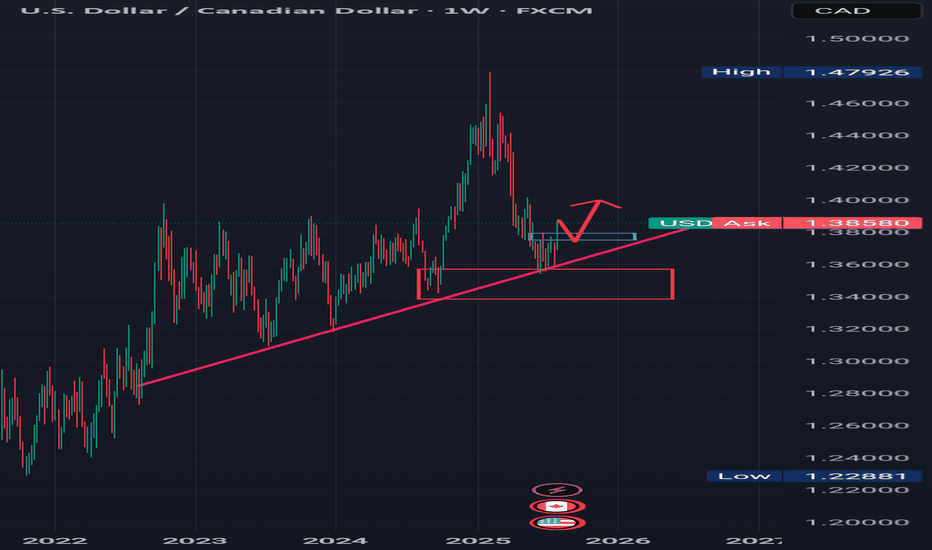

TREND REVERSAL CONFIRMATION Looking at the weekly timeframe for USDCAD, we can see that price action has respected a rising trendline and also reacted to a weekly bullish order block.

The Sell momentum for USDCAD has come to an end, so now we saw price action accumulating around the rising trend line and bullish order block.

Now there's a minor resistance which is indicated with a small blue rectangle in which price action has broken to the upside, I'm expecting price to complete an impulse correction leg or retrace to the blue rectangle or minor resistance and then from there continue to the upside.

........,...,.............................................

Please share your thoughts on this analysis, do you think the downward trend is over.