Beyondtechnicalanalysis

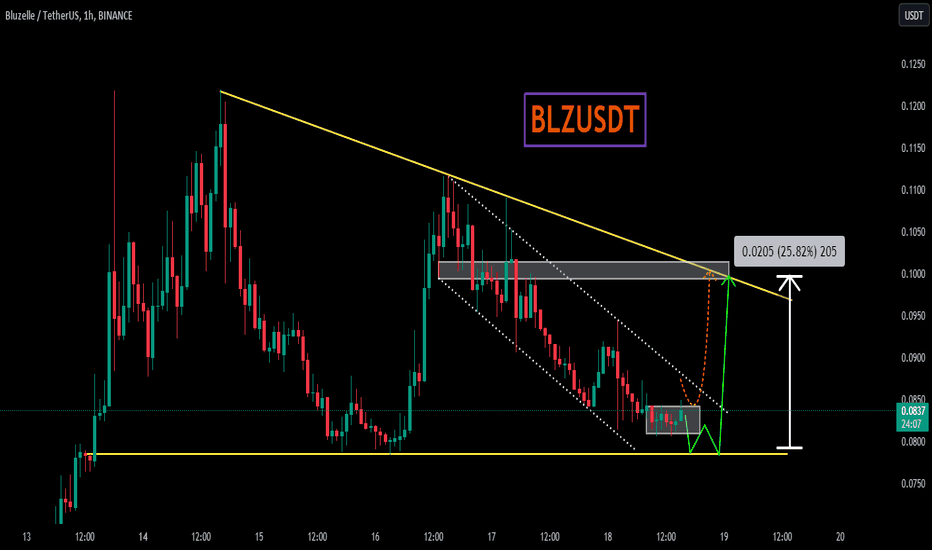

BLZUSDTBLZUSDT is at strong support zone and showing good bullish momentum.

The price is also following the local descending channel and currently the price is trading at the support of the channel which also the major support .

Will the bulls attack this support and take charge to upside?

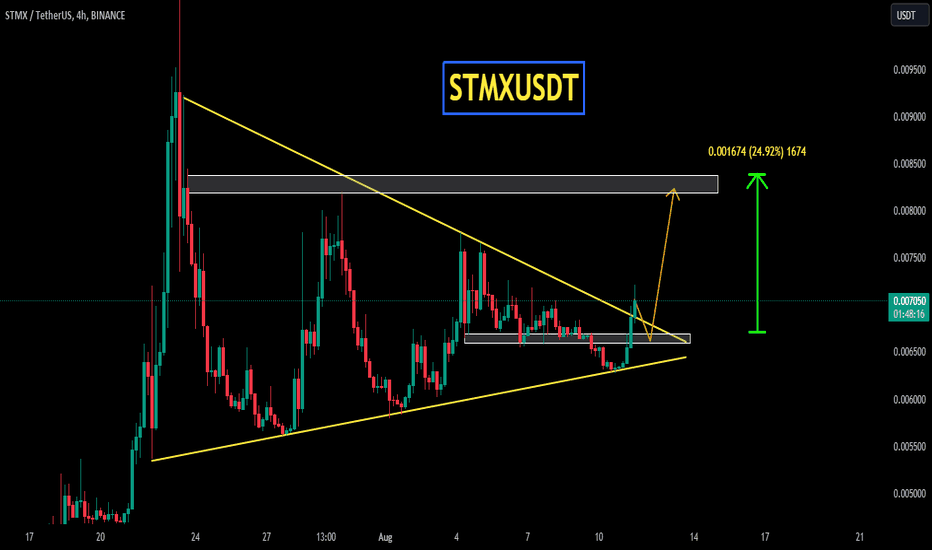

STMXUSDTSTMXUSDT was trading in symmetrical triangle and now has given the breakout from triangle.

If this breakout sustained , bulls can ride it to 0.8390 level , which almost 25% from local support area.

Will the bulls avail this opportunity and will get the minimum ride of 25% ?

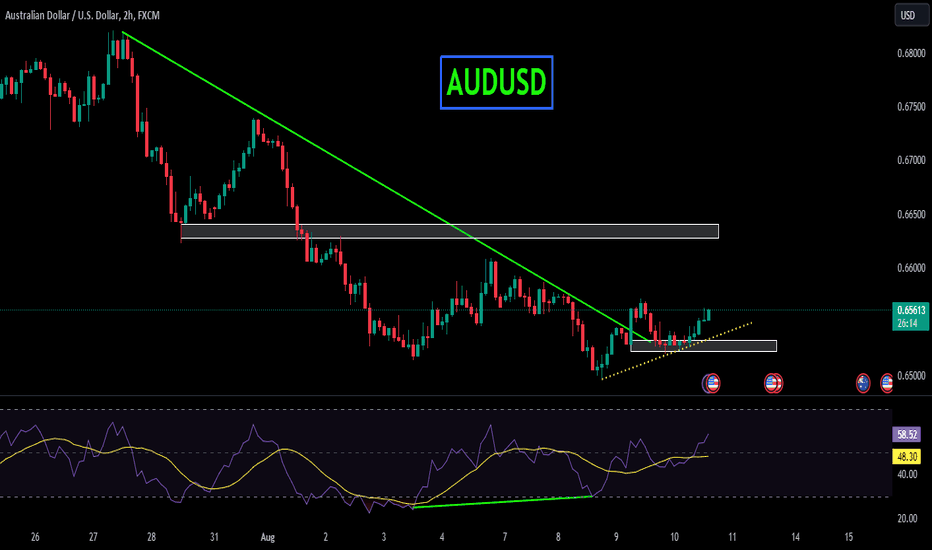

AUDUSDAUDUSD was in bearish trend from last few days and now has given the breakout from falling trendline with strong bullish divergence.

Currently the price is creating a support zone with some healthy green candles and it seems like bulls are getting ready to take control.

What you guys think of it ?

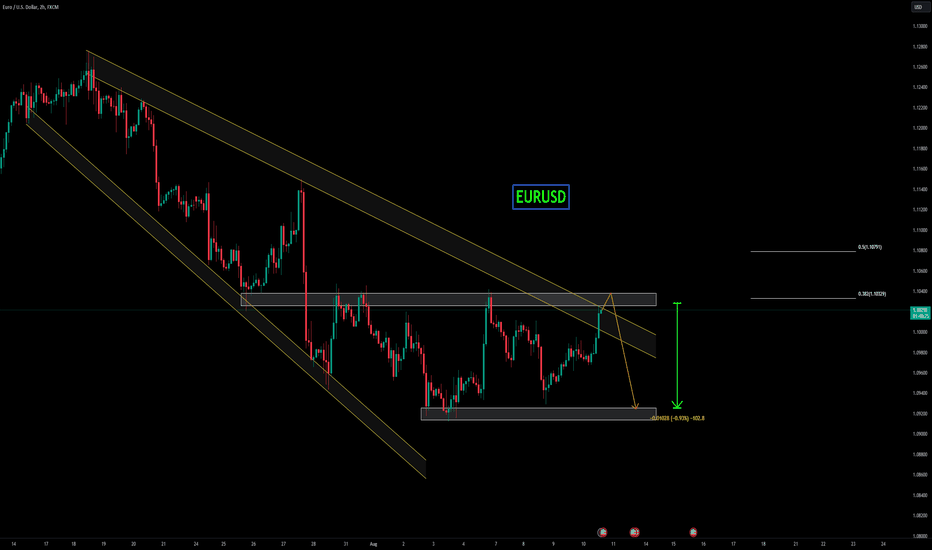

EURUSDEURUSD is trading in bearish expanding channel. As the price is heading lower the size of channel is expanding accordingly. currently the price has reached at very strong resistance area where the sellers show good strength in past.

this resistance area is also coincide with 38% Fib retracement, which is also a good confluence for sellers to attack.

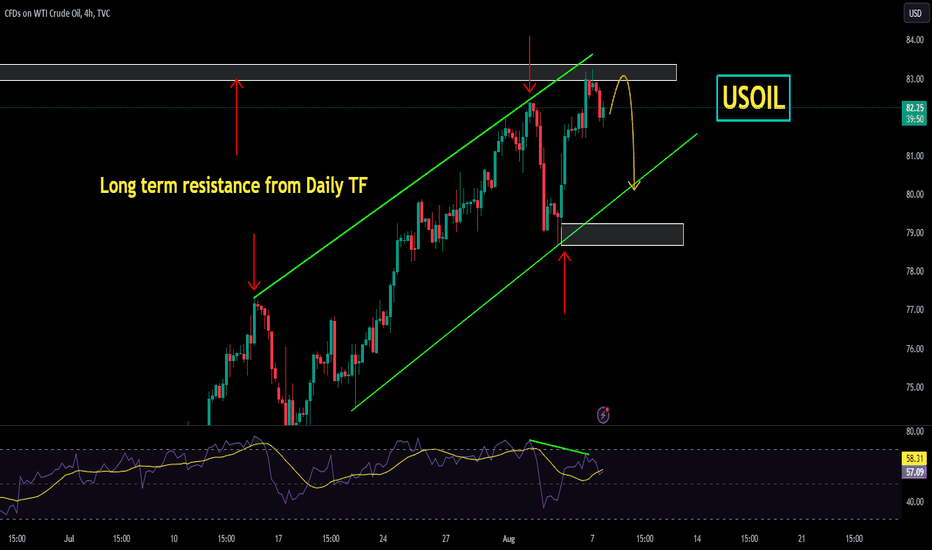

USOILUSOIL is been on enormous bull run. And now reached to daily resistance zone.

In past bears took benefits from this level multiple time and turn the trajectory of commodity.

Like in past , this time it is also looks like bears were waiting for this level again, as it can be seen from the chart that bullish momentum being fade out.

more ever bearish divergence also suggesting a control of bears is starting now.

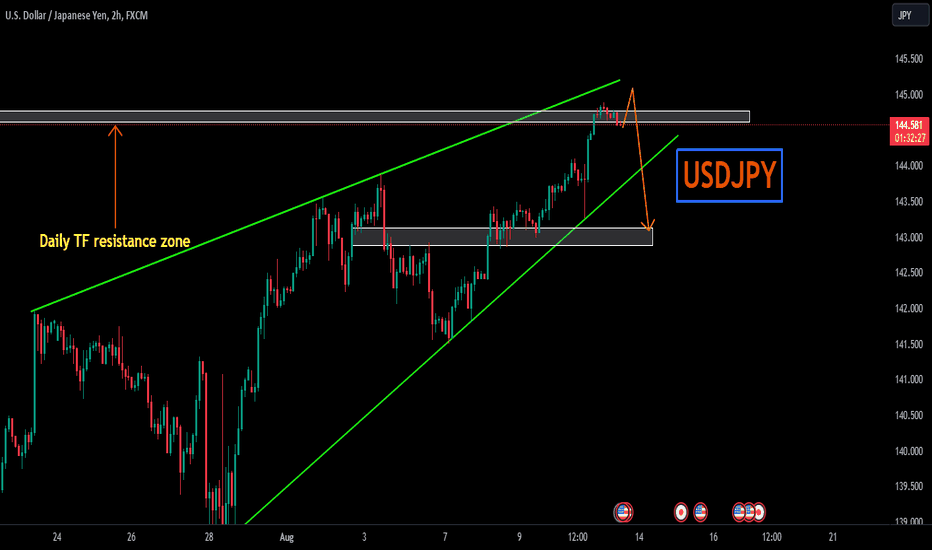

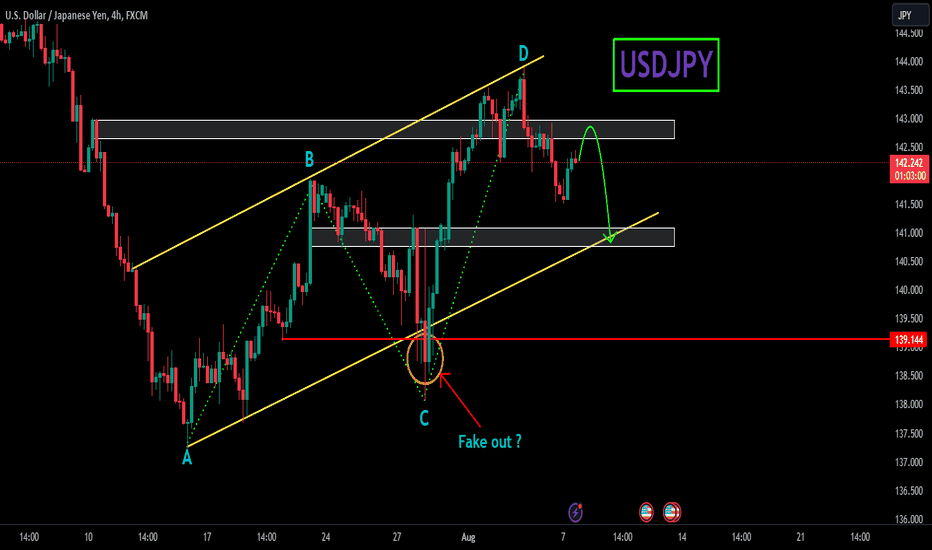

USDJPYUSDJPY is trading in bullish parallel channel and completed the AB=CD pattern within the channel. After pattern completion the pair is lacking bullish momentum starting to change its direction from bullish bearish and seems like bears are taking control. If the bears continue to took control , their next target will be 140.80 region followed by 140.