Beyondtechnicalanalysis

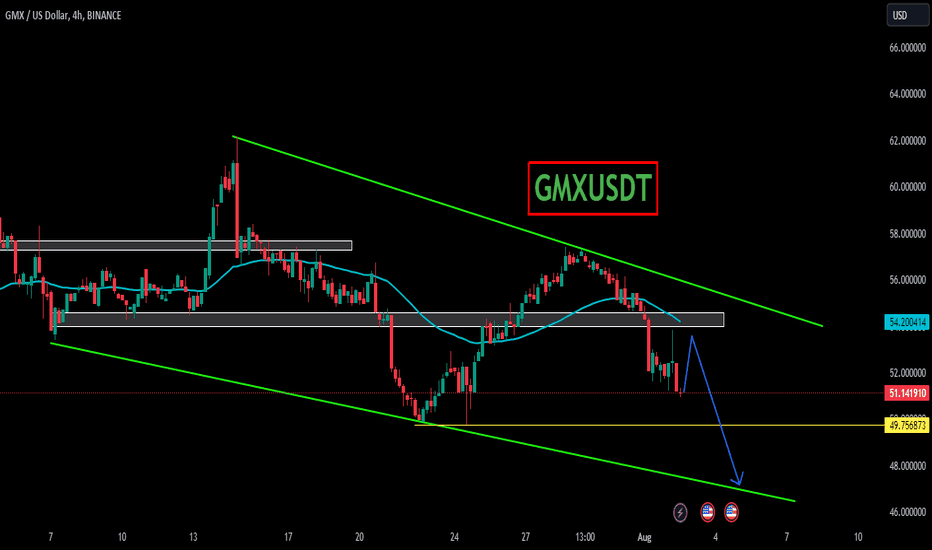

GMXUSDTGMXUSDT is trading in bearish channel and smoothly following technical pattern of break and retest of structure. currently the instrument is retesting the broken support level and seems like it is getting ready for another sell off.

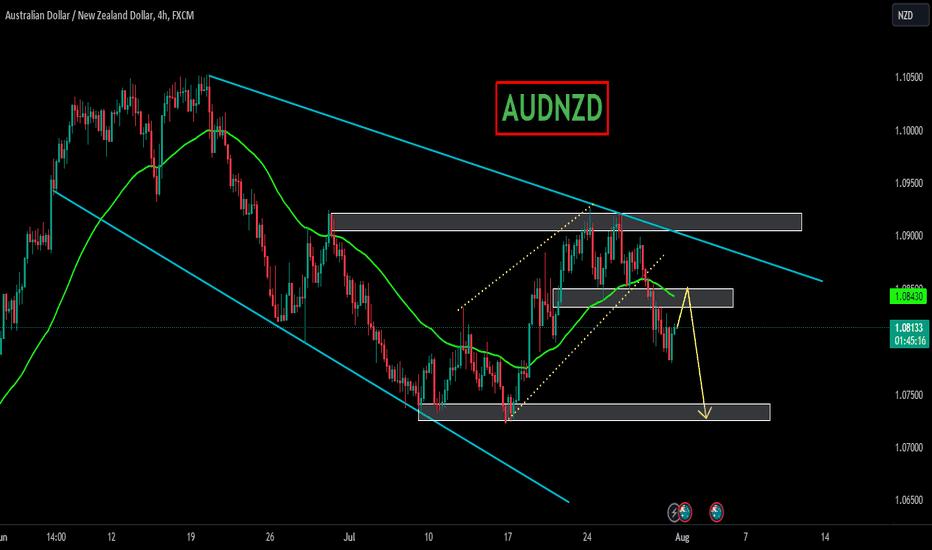

AUDNZDAUDNZD is trading in long term bearish channel and respecting well the highs and lows of channel. price formed temporary small bullish channel within large bearish channel but failed to sustain. Currently the pair is retesting the broken support level and it seems like the pair is heading to further downside.

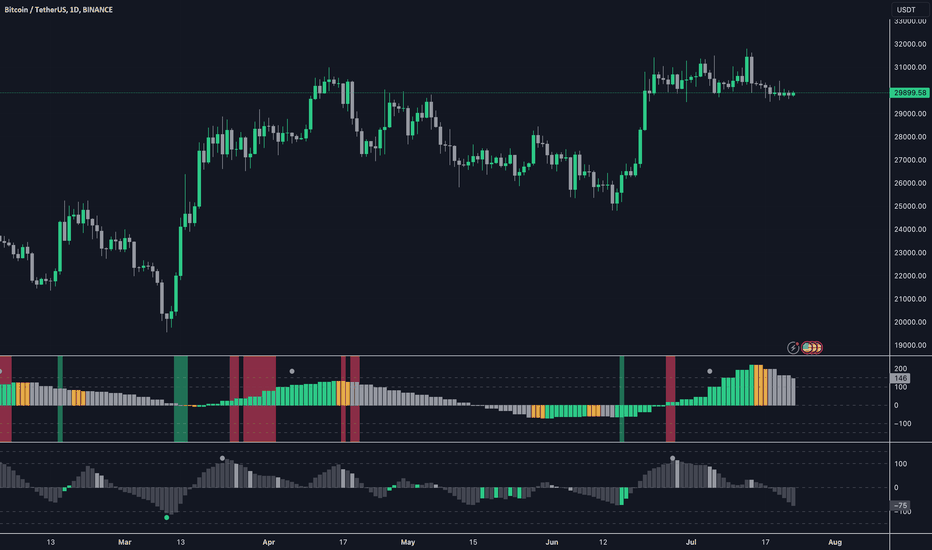

Bitcoin - What to expect?In this analysis, we will focus on KUCOIN:BTCUSDT 's price movements and the PVVM (Price-Volume-Volatility-Momentum).

Macro PVVM:

The Macro PVVM represents the long-term trend of BINANCE:BTCUSDT . As we can observe, the Macro PVVM has been fluctuating in the overbought zone between 101 and 221 over the analyzed period. Currently, it stands at 146, indicating a positive but slightly weakening long-term trend. While the value remains above 0, suggesting a bullish outlook, traders should closely monitor any further decline towards the bearish territory.

Micro PVVM:

The Micro PVVM reflects the short-term trend. Over the past days, it has oscillated between 33 and -75 signifying a bearish short-term momentum.

Key Takeaways:

1. On the last two days, we observed that the Macro PVVM decreased from while the Micro PVVM also decreased. This indicates a bearish macro trend and a bearish short-term movement.

2. Both the long-term and short-term indicators align in showing a bearish sentiment, suggesting potential further downward movement for BITSTAMP:BTCUSD .

Conclusion:

Given the current analysis, traders should exercise caution in entering long positions due to the weakening long-term trend. Short entries might be considered.