BIO

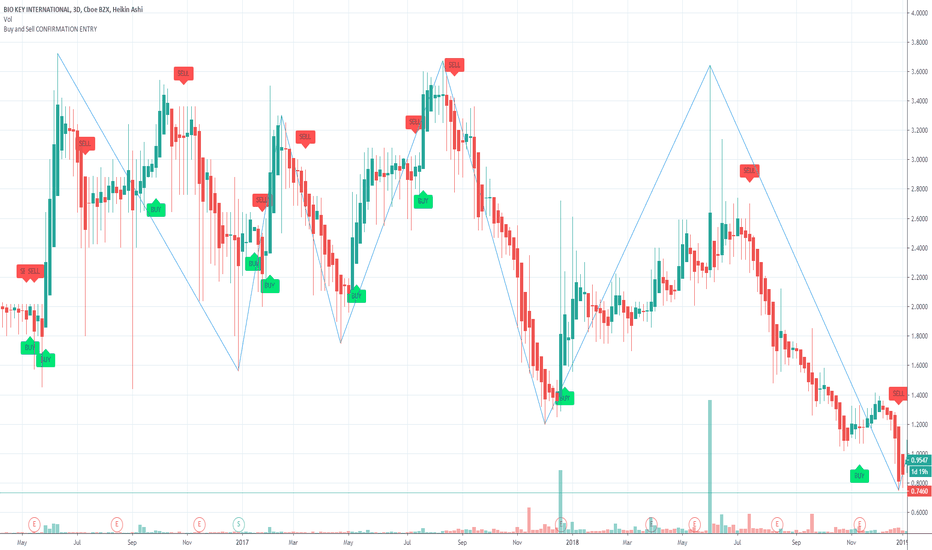

BKYI Bio Key International huge upside potentialBIO-key, Provider of Multi-Factor Identity and Access Management Solutions, Hosts Q2 Investor Call Friday, Aug 14 at 10am ET.

Innovative Credit Card Processor Clearent, LLC Switches to BIO-key’s PortalGuard Identity and Access Management Solution to Secure Customer Access and Deliver Secure Reset Capabilities.

Source: yahoo finance

The analysts are targeting a 2usd price per share.

With a market cap of only 16.5 mil but also a debt of 14.5 mil, BKYI is one of the riskiest bets on the market with a huge potential though.

The uprising volume is also a great sign.

If you are interested to test some amazing buy and sell indicators, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

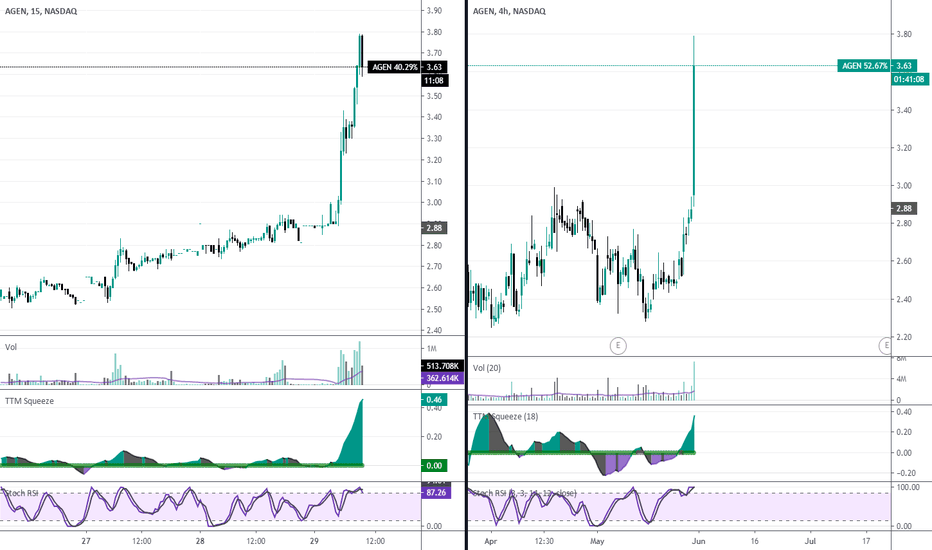

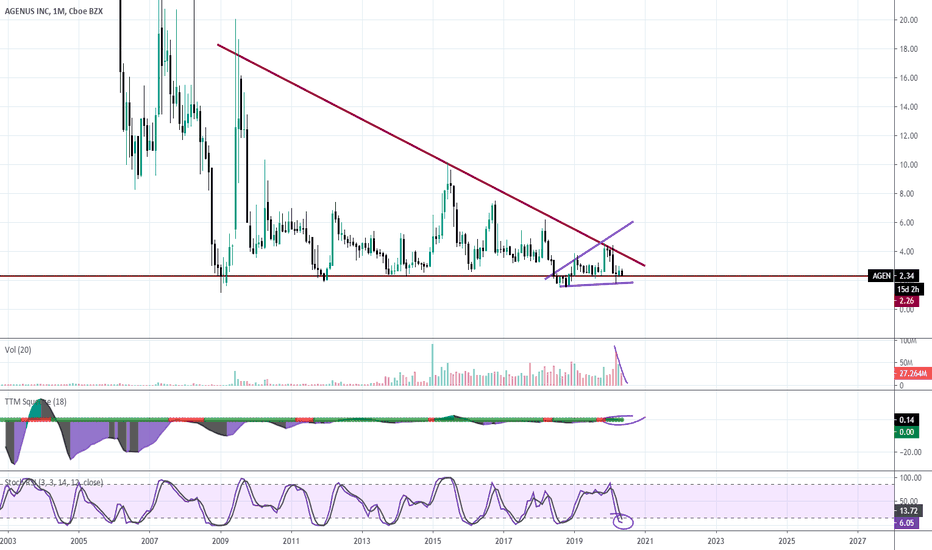

AGEN - See Past Post - This ride isn't overAll,

See my previous post on my baby aka favorite stock. My entry was $2.28 on this. There pipeline was epic, FDA approvals and no price movement. Now it just hit every scanner and radar out there. I would not buy in now of course, but over time it will come back and retest the last high it left from. It may happen quickly but I would put my alert around 50% of the big bar. I will update later on re buy ins for this stock.

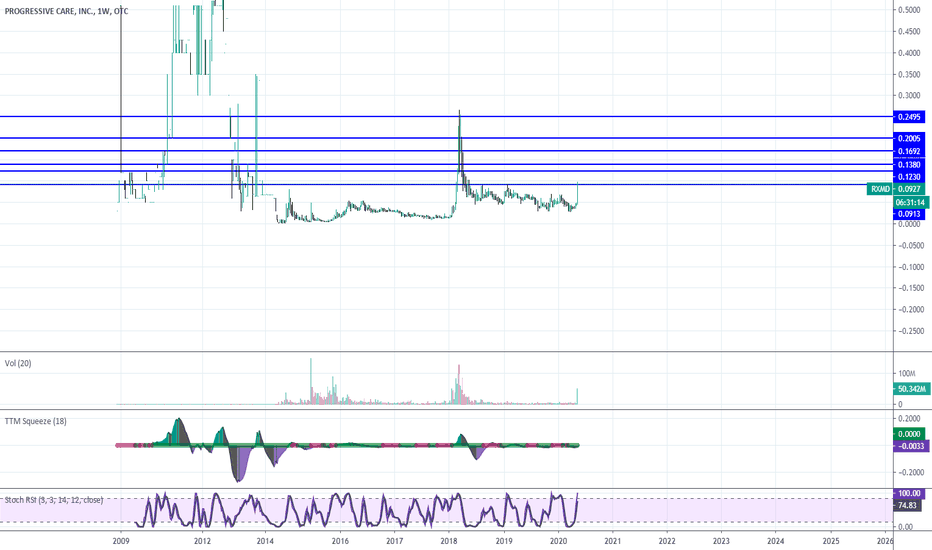

RXMD - Roll the Dice on the OTC?First off, THIS IS A RISKY BET. I got in at .082 yes... less than a dime. There was news they are doing antibody COVID testing. This got 40M volume x8 its relative volume. Like I said extremely risky. Watch it today and see what happens. Personally I just bought 3000 shares because I don't care if I lose $250 just to see.

finance.yahoo.com

Quick Pump and Dump | THMODo Not Trade This! I'd personally wait for a retest around $6.90 before making my move. Might buy a few shares for fun tomorrow and see how it rolls.

For premium crypto & option signals, direct message me or @Kyer

DotcomJack | Easy Loot

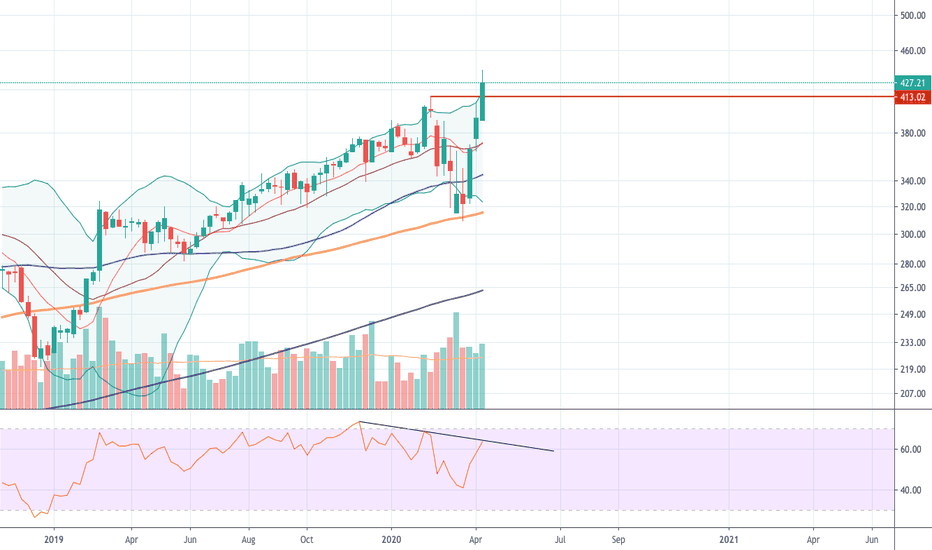

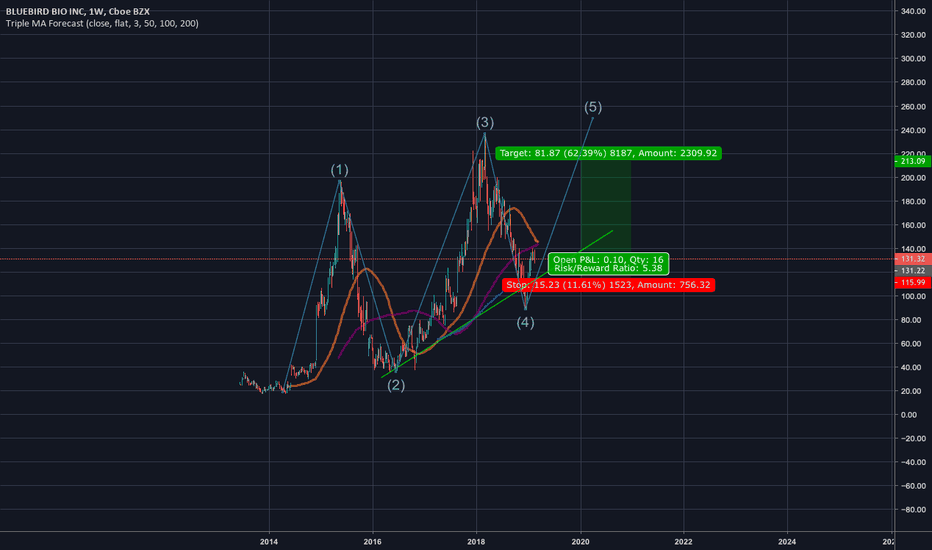

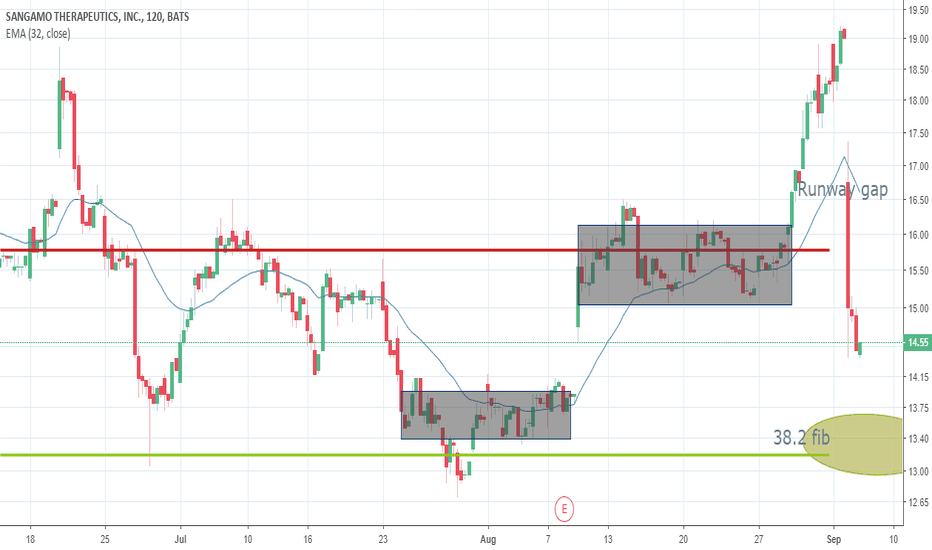

BLUEBIRD BIO INC - AWESOME TIME TO LONG THIS STORYAnother pharma company - with amazing correct Elliot 5 waves which you can try to ride.

1. Buy 131.32

2. Take profit: 213

3. SL: 115.90

RISK/REWARD: 5.38, potential profit 62.39%

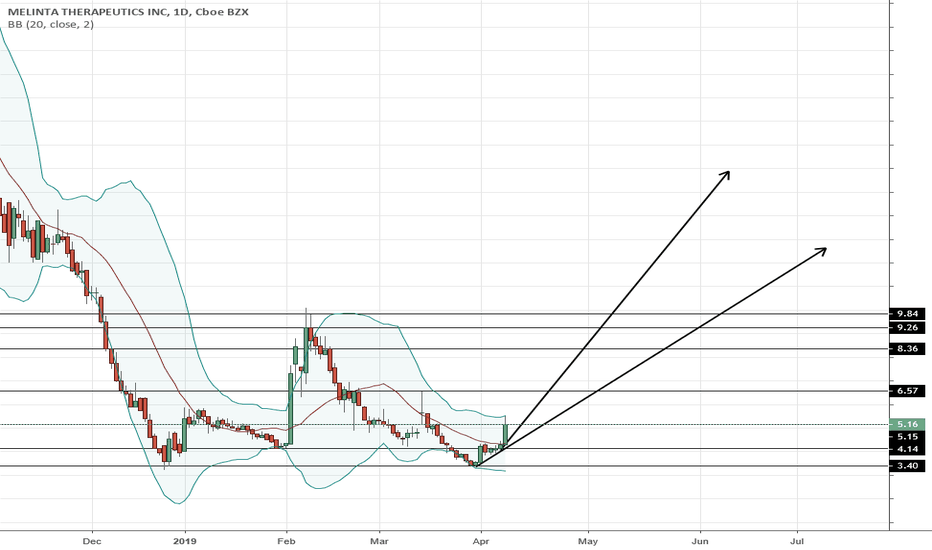

$MLNT Breaks Out Ahead of Upcoming 9 Presentations at ECCMIDVery undervalued stock. 52 Week High was $46.00 52 Week Low was $3.22 Revenue for the 4th quarter of 2018 was $35.5 million, an 739% increase year over year. Total revenue for the year is $96.4 million. Could do 2x-3x from this level.

Key data presentations at ECCMID 2019 include:

Integrated Symposium Presentations

•“Update on acute bacterial skin and skin structure infection: current challenges and new therapeutic agents,” chaired by Javier Garau, M.D., Ph.D. (Saturday, April 13, 1:30 - 3:30 p.m., Hall D)

•“Light and shadows in the management of serious MDR G-negative infections,” chaired by Matteo Bassetti, M.D. (Monday, April 15, 4:00 p.m. – 6:00 p.m., Hall F)

Oral Presentation

•Abstract No. 3623 (Sunday, April 14, 11:00 a.m. - 12:00 p.m. CET, Exhibit Hall L): Development and Validation of a Risk Stratification Score for a Mixed Gram-Negative and Gram-Positive Infections among Patients Hospitalized with Skin and Skin Structure Infections in the U.S., Y. Tabek, BD.

Poster Presentations

Meropenem/vaborbactam (VABOMERE®)

•Abstract No. 8308 (Saturday, April 13, 3:30 - 4:30 p.m. CET, Paper Poster Area): Activity of meropenem-vaborbactam and single-agent comparators against KPC-producing Enterobacterales isolates from European countries (2016-2018) stratified by infection type, M. Castanheira, JMI Laboratories

•Abstract No. 2825 (Monday, April 15, 12:30 - 1:30 p.m. CET, Paper Poster Area): Multicenter Evaluation of Meropenem/Vaborbactam MIC Results for Enterobacteriaceae and Pseudomonas aeruginosa Using MicroScan Dried Gram-Negative MIC Panels, A. Harrington, Loyola University

•Abstract No. 4780 (Monday, April 15, 12:30 - 1:30 p.m. CET, Paper Poster Area): ETEST meropenem/vaborbactam for antimicrobial susceptibility testing of Enterobacterales and Pseudomonas aeruginosa: performance results from a multi-centre study, C. Anglade, bioMérieux, Inc.

•Abstract No. 7426 (Tuesday, April 16, 12:30 - 1:30 p.m. CET, Paper Poster Area): An FDA-approved study for an AST disc 510(k) submission: comparison of an oxoid AST disc to a predicate AST disc for meropenem-vaborbactam, N. Hunter, Thermo Fisher Scientific

Delafloxacin (BAXDELA®)

•Abstract No. 6363 (Monday, April 15, 1:30 - 2:30 p.m. CET, Paper Poster Area): Delafloxacin tentative ECOFF values for common Gram-positive and Gram-negative bacteria, G. Menchinelli, Università Cattolica del Sacro Cuore

Oritavancin (ORBACTIV®)

•Abstract No. 4151 (Monday, April 15, 1:30 - 2:30 p.m. CET, Paper Poster Area): Oritavancin Activity against Staphylococcus aureus Clinical Isolates Causing Serious Infections in Hospitalized Patients in Europe (2017-2018), C. Carvalhaes, JMI Laboratories

marketwirenews.com

I GUESS ITS REALLY TIME THIS PENNY STOCKS GG TO RISE GUESS ITS REALLY TIME THIS PENNY STOCKS GG TO RISE

CHART LOOKS PRETTY GD

PROMISING CO.

VANGUARD DID ALSO ADD MILLIONS IN IT RECENTLY WITH MANY OTHERS

HOPE YOU GUYS WILL EARN SOME TOO

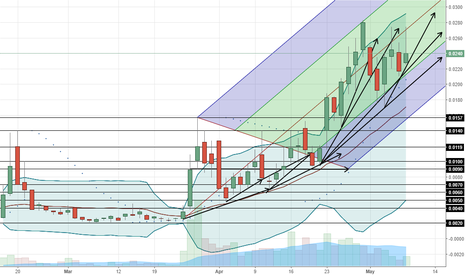

$CELZ Still Kicking Ass on the Way Up$CELZ Remains unstoppable into the Mid May Bio Conference where they will be presenting, DD below in links.

$CELZ Continues North with Accelerating Accumulation$CELZ is currently on a clear and clean breakout in anticipation of the May 18th- 21st Presentation at the American Urological Association Convention in San Francisco.

An 8K was released recently showing that shares were issued at .10 and as high as .30 levels

The following link shows that the CEO has been buying on the way up as well:

backend.otcmarkets.com

Look who covered $OWCP (Which ran from .003 to >> $3.05) and has been covering CELZ since Feb 18, 2018 (PPS @ .0094 at that time) CORRELATION? ;-) ----> t.co

Also forgot to mention the debt is almost completely eliminated from the books :-)

$CELZ Begins Breaking out on High buy Volume on News Release$CELZ broke above prior high on the last leg after a release of 8-Ks showing the clearing up of the rest of the company's debt and notes.

Item 1.01 Entry into a Material Definitive Agreement

Effective April 11, 2018, Creative Medical Technology Holdings, Inc. (the “ Company ”) amended promissory notes issued by it and by its operating subsidiary, Creative Medical Technology, Inc., to Creative Medical Health, Inc. (“ CMH ”), the parent of the Company, to permit the conversion of the notes into restricted shares of common stock of the Company. The 8% promissory notes were originally issued February 2, 2016, in the principal amount of $50,000, on May 1, 2016, in the principal amount of $50,000, and on May 18, 2016, in the principal amount of $25,000. The conversion formula on the principal and accrued interest on the amended notes is 120% of the 30-day volume weighted average price (VWAP) for the Company’s common stock traded March 1, 2018 through March 30, 2018. Immediately upon amendment of the notes, CMH converted the total outstanding principal and interest of the notes, which was $136,003. The VWAP for the 30-day period ended March 30, 2018, was $0.0138 and the number of shares issued to CMH for the conversion was 9,855,290 restricted common shares.

Item 3.02 Unregistered Sales of Equity Securities

In connection with the conversion of the notes disclosed under Item 1.01 above, the Company issued 9,855,290 shares of common stock to CMH without registration. The issuance of these securities was made pursuant to Rule 506(b) of Regulation D promulgated by the SEC under the Securities Act as a transaction not involving any public offering. No selling commissions or other remuneration were paid in connection with the issuance of these shares.

Item 8.01 Other Events

On April 12, 2018, the Company issued a press release announcing the amendment to the CMH notes and the conversion of the notes into common stock of the Company.

From April 12, 2018 through April 19, 2018, we issued an aggregate of 114,017,952 shares upon the conversions of outstanding notes and 15,009,325 shares upon the cashless exercise of outstanding warrants. These conversions were made pursuant to the exemption provided by Section 3(a)(9) of the Securities Act of 1933. As a result of these issuances, we have outstanding 609,062,989 shares of common stock as of April 19, 2018.