XBI Daily - Time to Short Bio?There's nothing I like more than spotting similar patterns when looking at charts. History does tend to repeat itself. So what we can see here is a pretty standard MACD divergence forming right now, and what looks like a copy paste of what happened a few months back. I'm short until the bottom trendline. Weekly chart not looking good either, but we'll look at that Friday. We could see a pretty "YUGE" correction next week for XBI.

BIO

BSPM going short!! *poop emoji*This one just spiked up today and it was just because the other Bio stocks ran, and we saw what the day after it ran last week. Going short on this tomorrow morning when it sets up

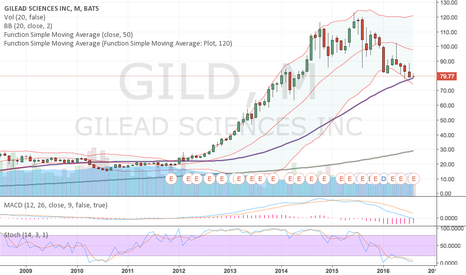

Check out monthly chartCheck Monthly chart.

GILD is one of the fastest growing company, but had to drop their share price since Hillary want to drop Drug price.

She keep repeating since last year, but it will not really damage drug price. It will actually damage CVS or insurance companies. GILD rebate a lot of money to CVS and insurance companies.

Plus, Chart is very attractive and valuation is very good compare to other companies.

Buy at : 78~83

target price 1: 108

target price 2: 112

target price 3: 120+

IBB BIOTECHRECENTLY most of the biotech companies are doing bad but somehow this ETF is going up. I saw weakness in technical analysis of monthly charts but weekly and daily needs to go down before shorting. Think this IBB bull will be ashort lived and once broken it will be a free fall zone. Leap options for short side will be a good bet. Don't go short yet but a good candidate for follow up.

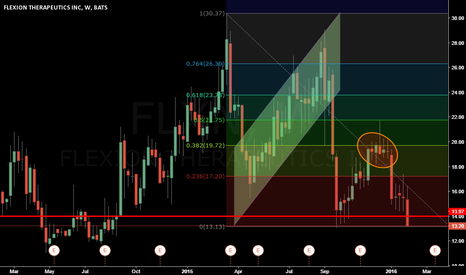

Short biotechnology again near trend line resistance Biotech bubble has burst.

Every rallies are to be sold, and despite the euphoria/new highs in S&P and Nasdaq have barely registered a decent retracement in the biotech sector..

Here's a larger picture of how far biotechs have went since 2008:

The uptrend in S&P is limited, and it will only be a matter of time before it collapses off this rising wedge. However it is also risky to go against Janet Yellen (FED) with unlimited cash in its balance sheet. A short on a specific sector would be a much safer bet.

-------------------

I'm long on ZBIO (3x short biotech ETF) at 22.51, with a target around $30~40.

ROSG Looking for a CatalystWith the new pressure on Bio's upon us I wanted to take a look at a stock I have long liked and especially like at this level. With new patents and a bunch of new drugs in the pipeline it will happen quickly and suddenly. The chart shows great strength as it has held up when others have fallen and I look for a move over the next month to 4.66. All it needs is a catalyst, what that will be I don't know but a Bio like this one has so much potential upside that buying it here should be illegal.

SPHS Oversold, Filling the Gap, cash/share > share priceSophiris Bio had a Phase III drug trial test showing the drug was not effective and the market overreacted. The chart has a cash/share value (mrq) of $1.74, the float is 16.78 Million Shares (note today's volume alone is a large part of that), so with a tiny float, more cash per share on hand than the market price, and upcoming results for new Phase III results for other products, one can see why people are buying this up right now.