127KMorning folks,

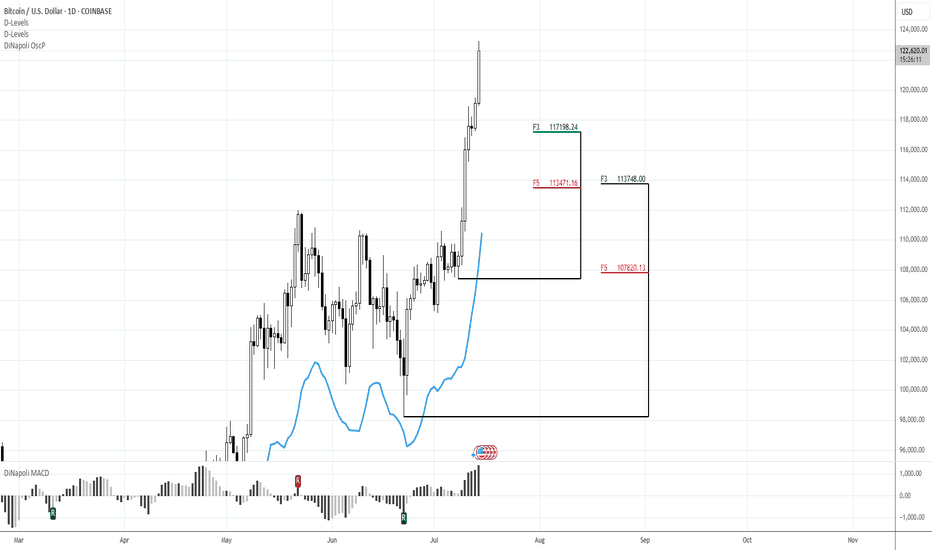

So, BTC shows even better performance that we thought, although it obviously something stands behind, this is not market-natural motion. Anyway, we consider 127K level as all-time nearest target that stands on monthly chart.

If any pullback starts (BTC now is at daily overbought and near Yearly Resistance Pivot), we keep an eye on 117.2K and 113.5K levels to decide on long entry

Bitcoin (Cryptocurrency)

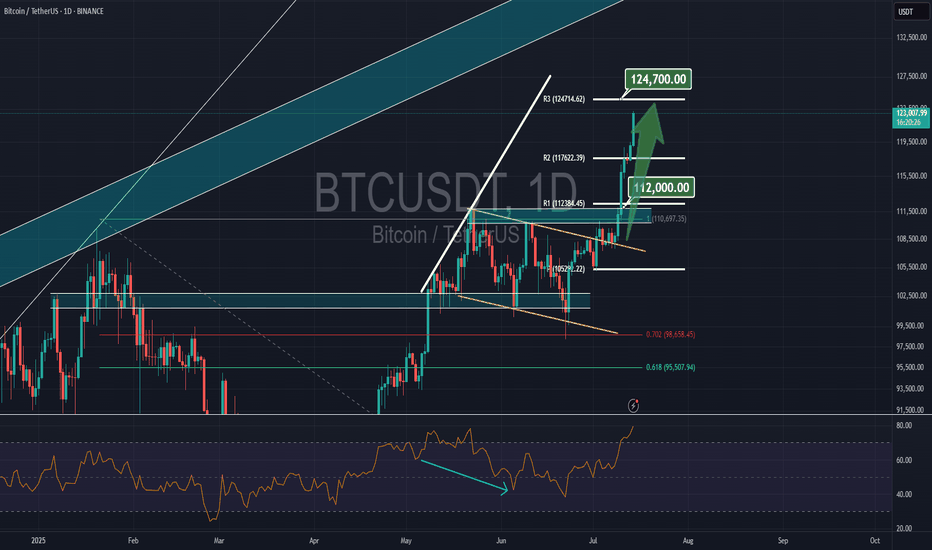

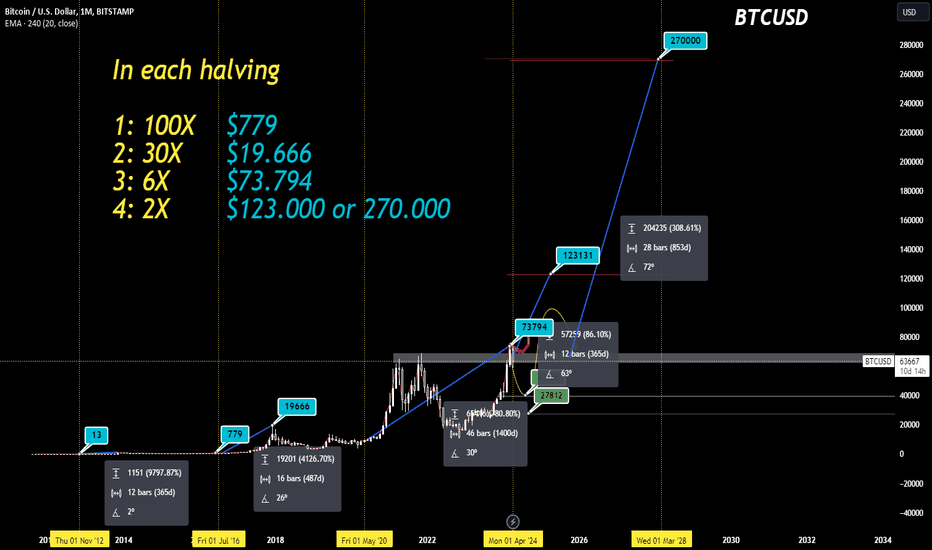

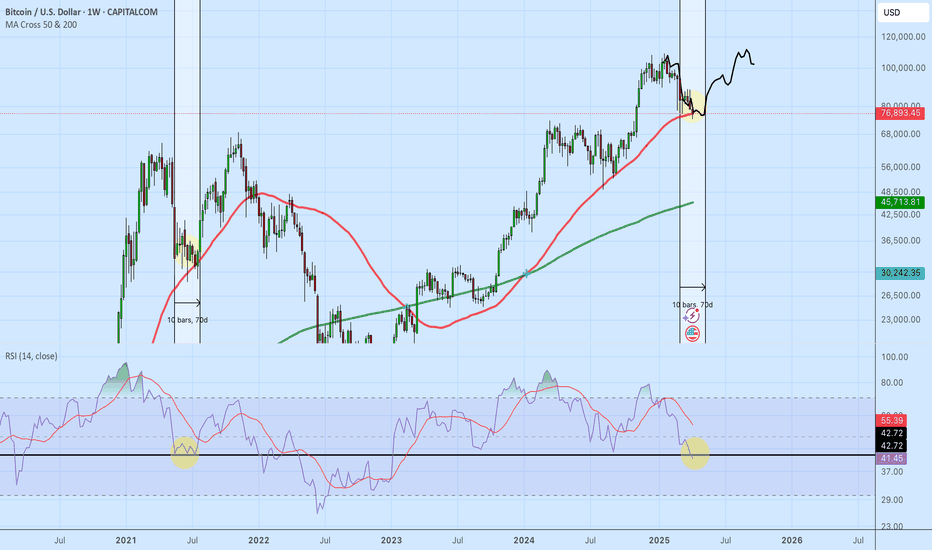

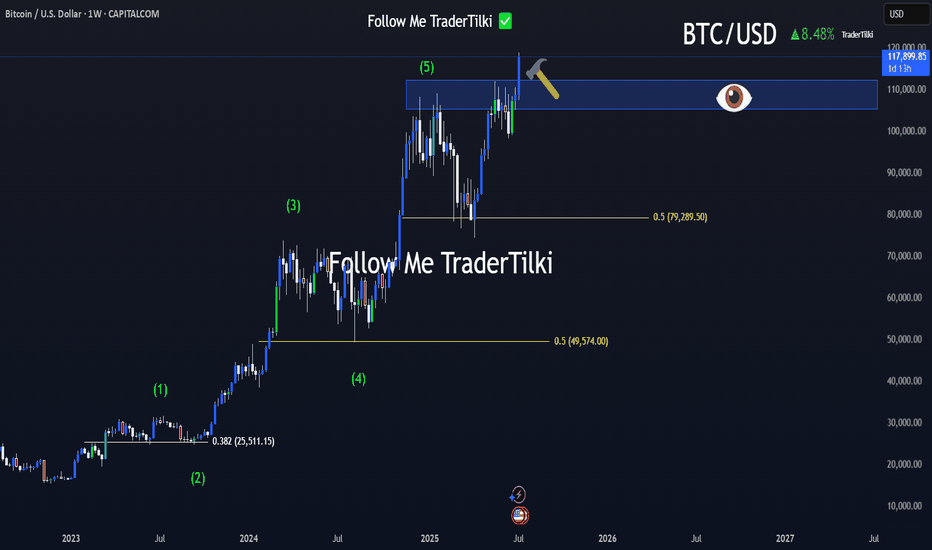

BTC: Next price Halving 📊Analysis by AhmadArz: #BTCUSD

By calculating the price growth in the 4-year halving time frame, we came to the conclusion that with the growth of the Bitcoin market cap, its growth will be halved and we can expect $120,000 from Bitcoin, and it is expected to grow up to 270,000 dollars in halvings.

🔗"Uncover new opportunities in the world of cryptocurrencies with AhmadArz.

💡Join us on TradingView and expand your investment knowledge with our five years of experience in financial markets."

🚀Please boost and💬 comment to share your thoughts with us!

BTC Weekly Update -as of Jul14🕰 Timeframe:

📆 Date:

🔎 Market Overview:

💼 Massive Institutional Inflows:

▪️ Over $1.1 billion in net capital inflows have entered spot Bitcoin ETFs in recent days, bringing the total weekly inflows to $2.72 billion so far.

▪️ The total assets under management (AUM) across all Bitcoin ETFs now exceed $150 billion, representing over 6% of Bitcoin’s total market capitalization.

⚖️ Favorable Political and Regulatory Support:

▪️ The ongoing Crypto Week in Congress is reviewing key legislative proposals like the Genius Act and the Clarity for Digital Assets Act, both of which offer promising regulatory clarity for the crypto industry.

▪️ Additionally, former President Trump’s executive order to establish a “Strategic Bitcoin Reserve” signals strong official political support for Bitcoin adoption.

📊 On-Chain & Sentiment Indicators

📦 Exchange Reserves:

Bitcoin reserves on centralized exchanges are at their lowest levels in years, suggesting a trend toward long-term holding (HODLing) and reduced selling pressure.

🧠 Fear & Greed Index:

The sentiment index remains firmly in the “Greed” zone, even hitting its highest level since May, indicating strong bullish sentiment among retail and institutional investors.

🌀 Whale Activity:

Whale wallets continue to show heavy accumulation, with large and steady transfers into private wallets, further supporting a bullish on-chain trend.

📈 Technical Setup

🔵Trend: Ranging upward

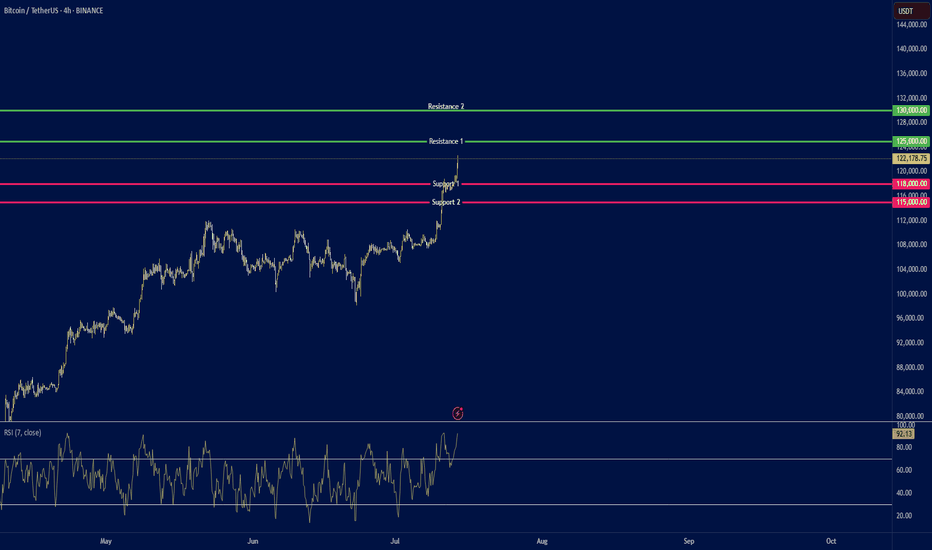

🔸 Key Support: 118,000➖ 115,000

🔸 Key Resistance: 125,000➖ 130,000

🔸 Indicators Used: RSI above 70

🧭 Next Week – Key Points

🔹 Watch for the outcomes of Crypto Week legislation in Washington — this will be a key driver for market direction.

🔹Monitor ETF capital inflows — if daily inflows stay above $500M, the bullish trend will likely strengthen.

🔹 Track the Federal Reserve's interest rate policy and the USD outlook, especially in response to inflation or other macroeconomic factors.

🔚 Summary: Final Analysis

📌 After reaching a new all-time high above $122K on July 14, Bitcoin’s bullish trend has strengthened. Strong institutional inflows and political support have reinforced the foundation for growth.

● Key Level Ahead: $125,000

● Outlook: If price consolidates above resistance, we could see a move toward $135K and beyond.

● Weekly Bias: Bullish, with potential for a pullback before continuation upward.

✅ If you like this analysis, don't forget to like 👍, follow 🧠, and share your thoughts below 💬!

Just Two Months Left: Navigating Bitcoin and Global ChangesGreetings to everyone reading these lines! Today, I want to share with you not just an analysis, but my personal reflections and feelings about the current situation in the financial and cryptocurrency markets, especially regarding Bitcoin.

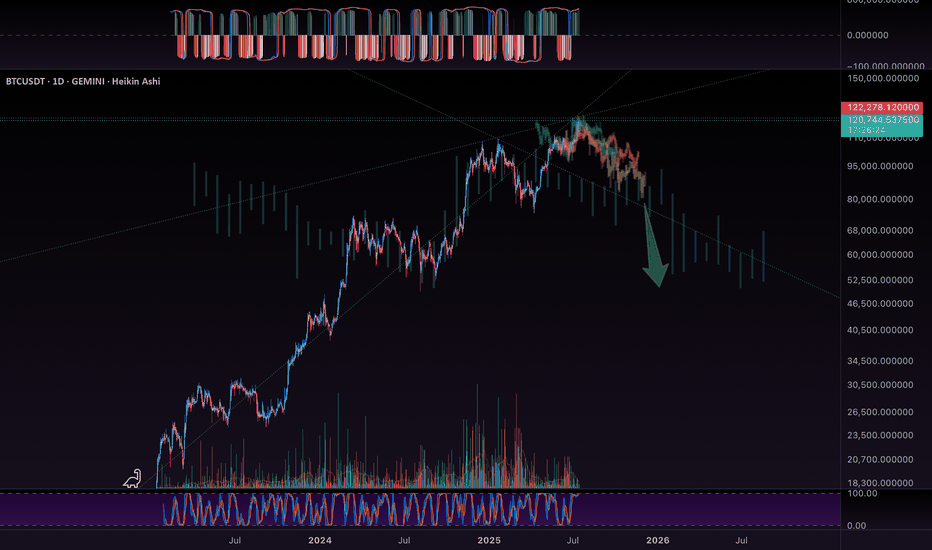

Many of you already know that I have always been a firm believer in Bitcoin’s market cycles. Right now, we are approaching the final stage of another such cycle-the distribution phase. The past few months have seen considerable turmoil: Trump's election, escalating conflicts between India and Pakistan, Israel and Iran, rising tensions between Russia and Ukraine, and not to mention China’s increasingly assertive geopolitical moves. I can't shake the feeling that the world stands on the threshold of something significant, perhaps serious. I sincerely hope I'm mistaken, but signs of a global conflict or a substantial reset in the world order are undeniably in the air.

History shows us that after major upheavals and wars, the world undergoes profound changes. It seems we are nearing such a pivotal moment within the next couple of months. For a long time, I've highlighted September 2025 as a critical point in the current market cycle, and now everything confirms this scenario.

In these unstable times, participants in the financial markets face both risks and tremendous opportunities. The distinguishing factor today is the rapid integration of artificial intelligence into all areas of life. I firmly believe that if you don't begin incorporating AI into your activities now, you risk being left behind. Personally, I'm actively integrating artificial intelligence into my professional processes and everyday life, as I see it as inevitable in our near future.

Regarding the cryptocurrency market, I'll be frank: the past couple of years have significantly changed it and even somewhat disappointed me. Liquidity has become diluted, and the market has clearly become seasonal, with brief periods of explosive growth followed by long downturns. This has led me to return to trading Forex and gold, where the market is more transparent and predictable.

Many crypto projects that seemed promising in 2017 are now nearly forgotten and stagnating. Think of Dash, EOS, Litecoin, ZCash, and others-they haven't disappeared entirely, but they no longer play significant roles in the market. The battle for user attention has become overly aggressive, and competition has devolved into chasing short-lived hype. Nevertheless, there are exceptions, such as Solana—a project that achieved success thanks to a fortunate combination of factors. Yet such projects remain exceedingly rare.

Today, I see the most promising and powerful trend as the tokenization of real-world assets (RWA). It doesn’t matter so much which blockchain will be used-the concept itself has already proven effective. While this journey won't be easy, the involvement of giants like BlackRock indicates the trend is sustainable and promising in the long run.

Overall, I am confident that financial markets and digital currencies will continue to evolve and grow. However, in about two months, I plan to adopt a bearish stance. Unfortunately, there are few signs of a quick global economic recovery. The world needs significant restructuring and changes-new rules and agreements are inevitable, and the coming year promises many notable events.

Ask yourself: Are you ready for these changes? Are you prepared to adapt to new conditions, technologies, and realities? Personally, I'm fully ready, which is why I remain active in the market, continuing to share my thoughts, assist, and engage with each of you. If you have questions, ideas, or proposals for collaboration, I am always open to dialogue and eager for any interaction.

I sincerely thank each of you for your support, comments, and attention to my posts. I stay here because I believe in the enormous opportunities available even in the most uncertain times. We have an exciting journey ahead, and I invite you to travel it together with me.

Wishing you success, profits, and above all, peace and kindness on our planet. The time of change is already here. Let’s meet it together.

Warm regards,

Your EXCAVO.

BTC - Topping outWow.. and look at those beautiful harmonic pattern fits! My eyeballs are so pleased with my work! Hehe!

These aggressive monsters like to propagate and fractal…

I met with another wizard of the charts yesterday… forecasted BTC to $5,000 !!! Holy crap!

Are you getting FEARFUL yet? Or still feeling GREEDY?

This is gonna be fun!

Check my linked idea for more insights.

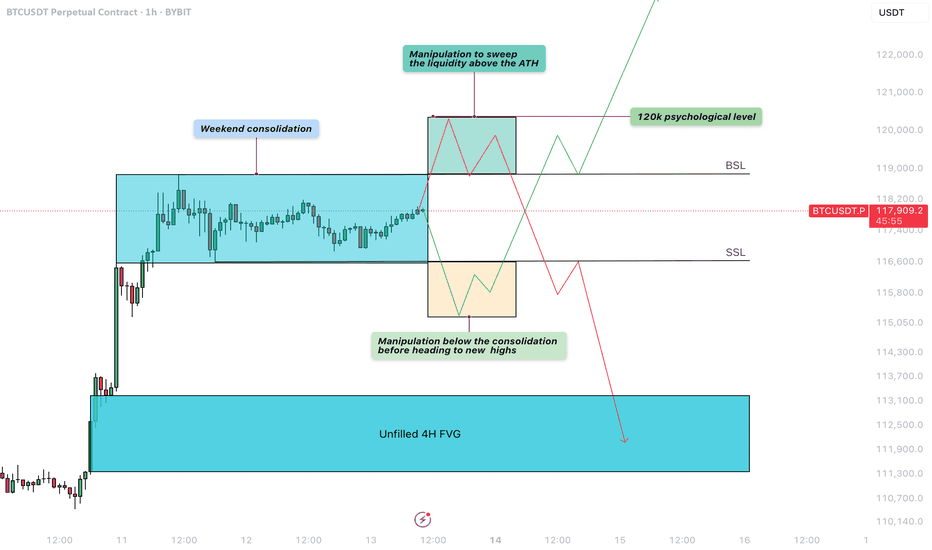

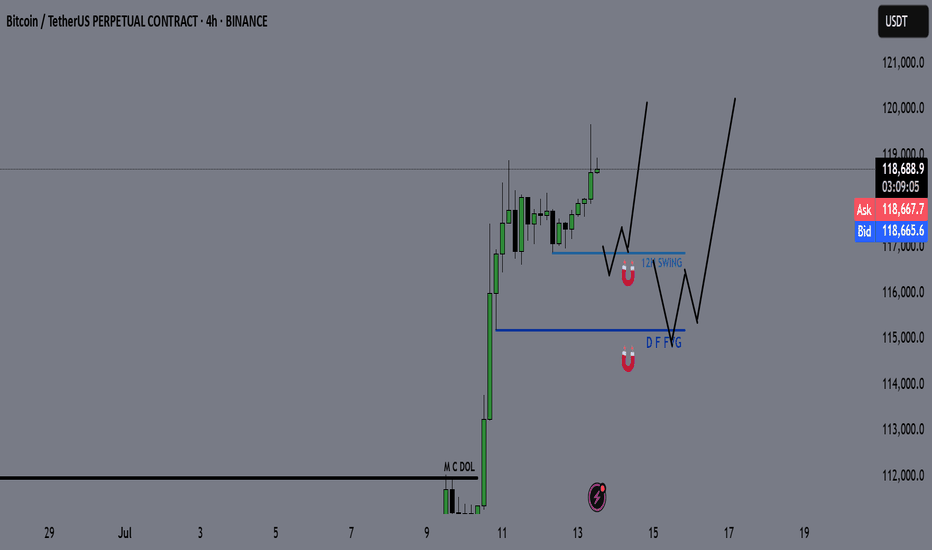

Bitcoin - Liquidity sweep before the next move!Weekend Consolidation

During weekends, Bitcoin often moves sideways as institutional players step back and retail traders prepare for the next move. During this consolidation phase between $117.000 and $119.000, liquidity builds up on both sides—sell-side liquidity below the range and buy-side liquidity above it. After these weekend consolidations, Bitcoin typically sweeps one side of liquidity before continuing in the opposite direction.

Manipulation Above the Buy-Side Liquidity

A significant amount of liquidity has formed just above the all-time high, right below the $120,000 level. Retail traders are positioning for a potential downward move, making this area a prime target for a liquidity sweep. This aligns perfectly with the psychological barrier of $120,000, a level where many traders are likely to take profits.

Manipulation Below the Sell-Side Liquidity

Over the weekend, traders are entering both long and short positions while placing stop-loss orders just below recent lows. This behavior creates a buildup of liquidity underneath the range. Bitcoin could dip below these lows to stop out retail traders before reversing to higher levels.

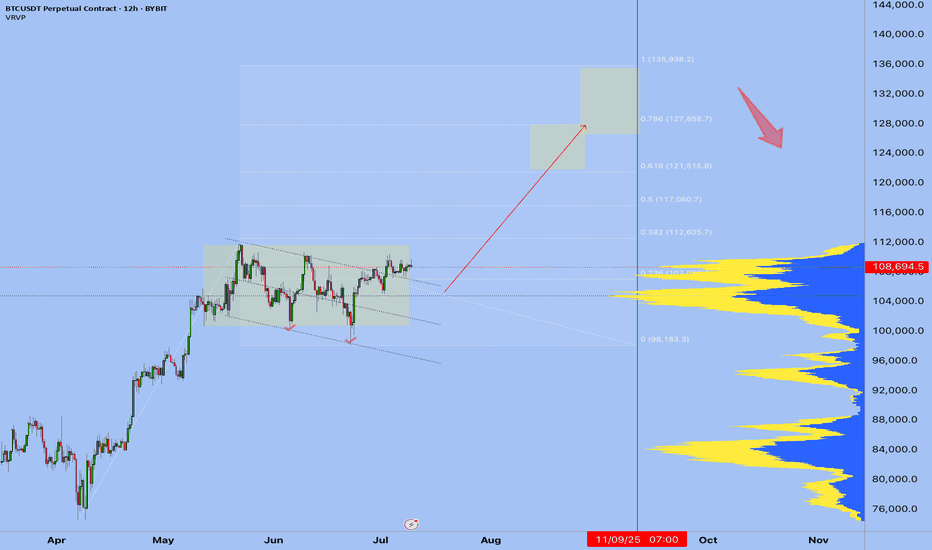

4-Hour Unfilled Fair Value Gap (FVG)

If Bitcoin sweeps the all-time high and enters a distribution phase, there’s a strong chance it will retrace to fill the unfilled Fair Value Gap on the 4-hour chart at $113.000 - $111.000. This imbalance was created during a sharp move up, leaving behind unfilled orders. Such levels often get revisited as price action seeks to rebalance.

How to Execute This Trade

Wait for Bitcoin to sweep either the low or the high of the weekend range. Avoid entering the market immediately after the sweep. Instead, wait for confirmation that price is returning back inside the range, signaling a clean sweep. On lower timeframes, such as the 5-minute chart, you can look for entry models like an inverse Fair Value Gap to refine your entry.

Final Thoughts

At this point, it’s unclear which direction Bitcoin will take next. The best approach is to wait for a clear liquidity sweep and signs of a reversal before entering any trades. That said, there’s a possibility we may first move up to test and claim the $120,000 psychological level before revisiting and filling the lower 4-hour imbalance zones.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like and leave a comment, I’d love to hear your thoughts!

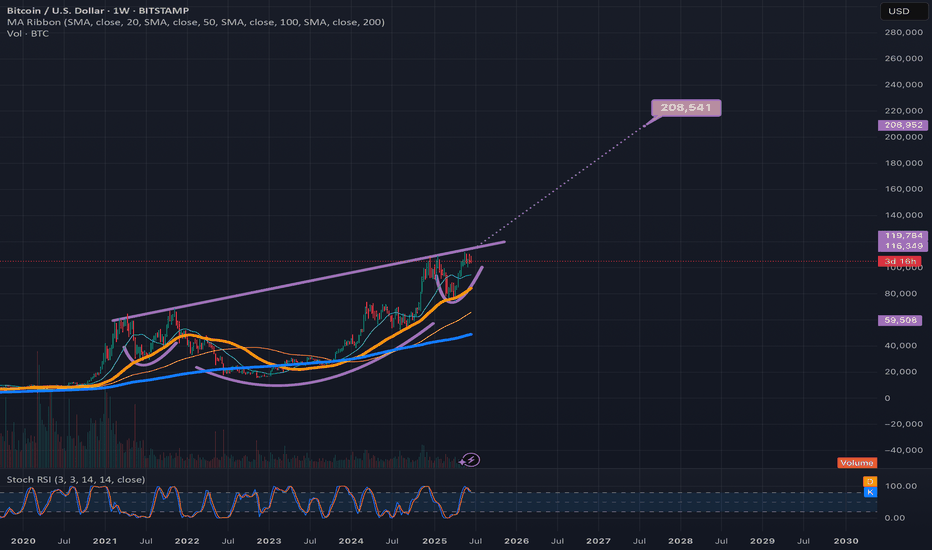

Ascending Inverse H&S on the BTC weekly chartThe longer it takes to break above this neckline the higher the breakout target will be. I have arbitrarily placed the measured move line at July 18th 2025. If the breakout were to happen on that day the measured move target is around 208k, which could take quite awhile to reach or if we entered a truly hyperparabolic blow off top we could reach such a target way quicker than when the dotted measured move line reaches it. *not financial advice*

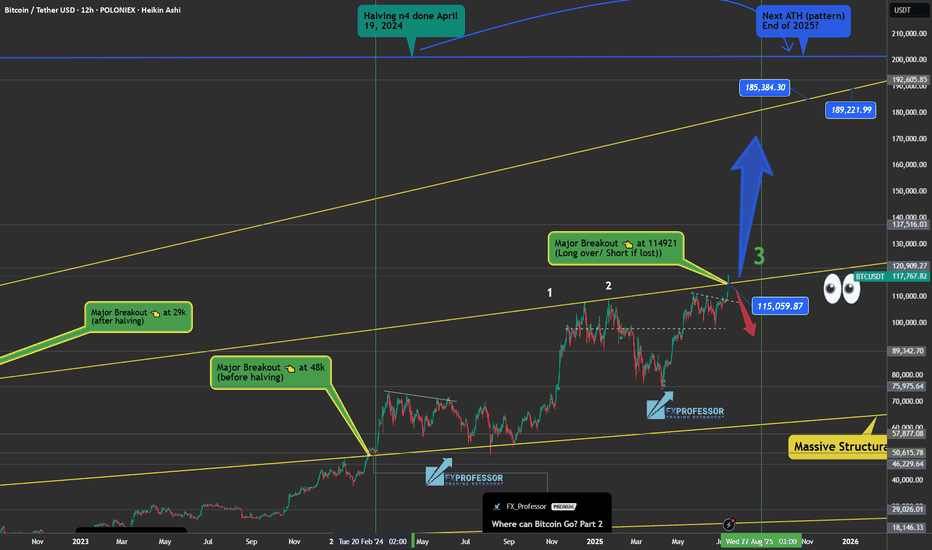

Why This Breakout Feels Like $29K and $48K – Big Moves Ahead?🤔📊 Why This Breakout Feels Like $29K and $48K – Big Moves Ahead? 🚀📈

Hey everyone! It’s Saturday, July 12th , and while the markets take a breather, it’s the perfect moment to zoom out and assess the bigger picture . Are we in for another retail weekend surge?

Let’s break it down 🔍👇

After closely analyzing the charts, one thing becomes clear — this breakout is structurally similar to the previous key breakouts at $29K and $48K. In both historical cases, price surged significantly without immediately retesting the breakout level.

➡️ Back in 2020, price exploded +144% above the yellow level before ever coming back to test it.

➡️ At $48K, a similar move of +49% occurred before signs of exhaustion and a retest emerged.

Fast forward to today: We've just broken above a massive ascending support zone — $114,921–$115K — and the market shows no intention of pulling back yet. This tells us something powerful: Momentum is in control.

💡 According to my technical roadmap, we may not see a retest of $115K anytime soon. Instead, the next target zone lies around $182K–$189K, depending on velocity and sentiment. With halving-to-ATH cycles historically lasting ~550 days, we’re well within that bullish window.

Remember the channel support/last entry right after the Iran-Israel ceasefire on June 23rd? That’s been a defining entry and it’s still playing out beautifully. So we wish for geopolitical stability and peace.

So, while it’s easy to feel left out — don’t short, don’t sulk. This may be our moment to ride the wave long. 🎯📉📈

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

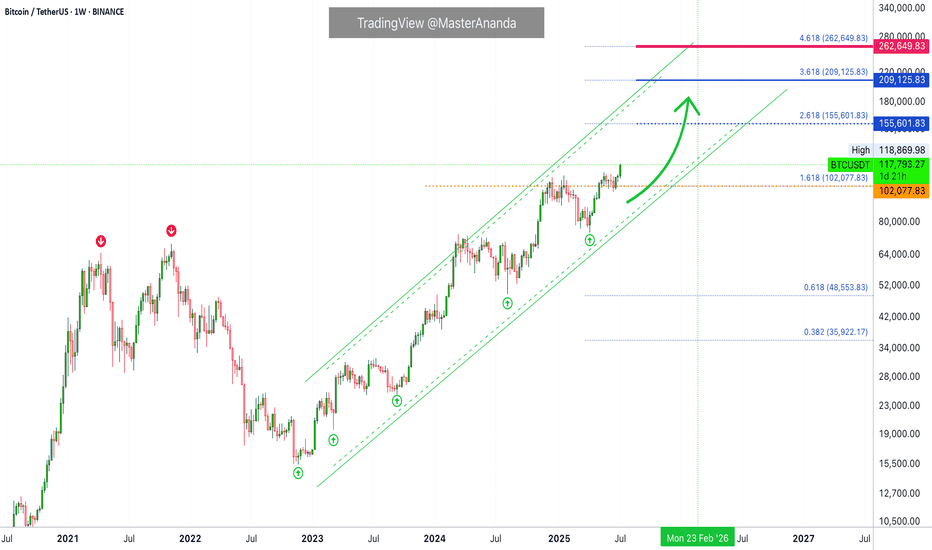

Bitcoin Crash? No! The Bullish Wave Starts Now! $155,601 Next!Some people are still expecting for "Bitcoin to go down." Poor bastards, the advance is just starting. Bitcoin just broke out of a 210 days long consolidation phase. After this huge, long-term consolidation, expect a major advance. Next target is now set at $155,601.

This week is the first week green after the consolidation finally ends. The market was sideways for seven months, with some fluctuations, and the result is a bullish breakout. Why a breakdown? Why expect a drop? If the market just broke up—think about it—why would it go down?

If resistance is confirmed; you remember the range between $100,000 and $110,000. If resistance is confirmed then Bitcoin would start crashing down from $110,000. If the break of $110,000 does happen and Bitcoin moves to $112,000 as a bull-trap, then you would expect a major crash happening from $112,000 and no more. But, reality is saying, showing, something much different. We have a major advance. Resistance has been flipped into support.

Now, the first that is needed is the weekly close. It is still very early into this move but Bitcoin is showing maximum strength. Remember the altcoins? These confirm that the advance is just new, early, because these are recovering from all-time lows or major lows. There is still plenty of room for growth.

My people, wake up! Bitcoin is going up.

The next target is $155,601 and it can go higher, this is only the mid-term target based on the long-term. When Bitcoin consolidates for 7 months, it tends to grow some 137% on average, it can be less but it can also be much more. And it tends to grow at least for 1-2 months, but this also is just the average, Bitcoin can grow straight up for 4 months.

So, are you still bearish?

Oh please no! The bulls already won.

The 2025 bull market final phase starts now, soon you will experience a marketwide bull-run. We have not seen the euphoria phase, this is only the start. Prepare for additional growth.

I am calling out all of the bears, never bet down on Bitcoin; Bitcoin is going up.

Namaste.

BITCOIN 2025 - THE LAST HOPECRYPTOCAP:BTC currently finds itself at the intersection of geopolitical tensions and broader macroeconomic uncertainty. Although traditionally viewed as a hedge against systemic risk, it is presently exhibiting characteristics more aligned with high-risk assets. The FED's forthcoming policy decisions will likely play a pivotal role in determining whether Bitcoin stabilizes or experiences further downward pressure.

The chart represents the most optimistic scenario for Bitcoin to date

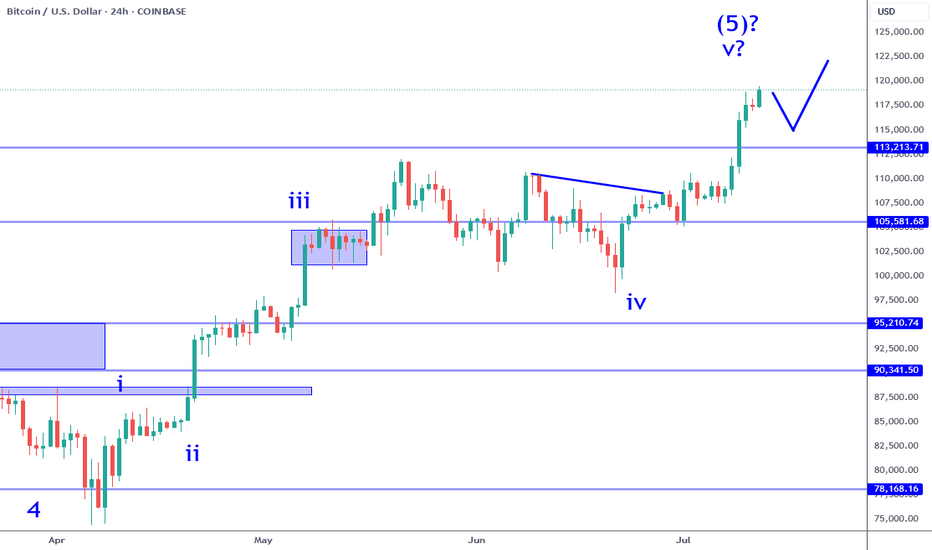

Bitcoin: 3 Of 5 Sub Waves In, Two To Go.Bitcoin not only reached my 113K profit objective, it blew right through it and is now closing in on the 120K objective. I have been writing about this Wave 5 formation for weeks now. 3 sub waves can be counted in the current move, which means Wave 4 retrace and then one more leg higher which can put price anywhere above 120K. Whole numbers, especially every 10K points, like 130K, 140K, etc. serve as psychological reference points. The main thing to keep in the forefront of your mind is once the 5th wave completes, the probability of a BROAD corrective move becomes highly likely.

This move largely has to do with the combination of the effects of the U.S. tariffs and a declining faith in the U.S. dollar. Either way, the reasons do not matter. What matters is the RISK. Wave counts are a measure of emotion in the market and have nothing to do with fundamental drivers. 5th Waves usually represent the situation where the market becomes saturated on one side (all the buyers have bought for now etc.). While the market can still continue higher for irrational reasons, 5th Waves mean it becomes highly vulnerable to bearish catalysts which can suddenly come out of nowhere.

My Trade Scanner Pro called a long two weeks ago which reached its profit objective on this time frame. There have been multiple opportunities to participate on smaller time frames for swing trades and plenty of day trade signals. As Bitcoin continues to complete this 5th Wave, it is best to avoid new investments at these levels because of the risk, and just trade the price action. As for investors, there is no reason to take profits YET, in terms of sell signals, but watch for large reversal candles around 120K, 125K or 130K. The LEVEL and the CONFIRMATION is what should help in your decision to lock something in.

Thank you for considering my analysis and perspective.

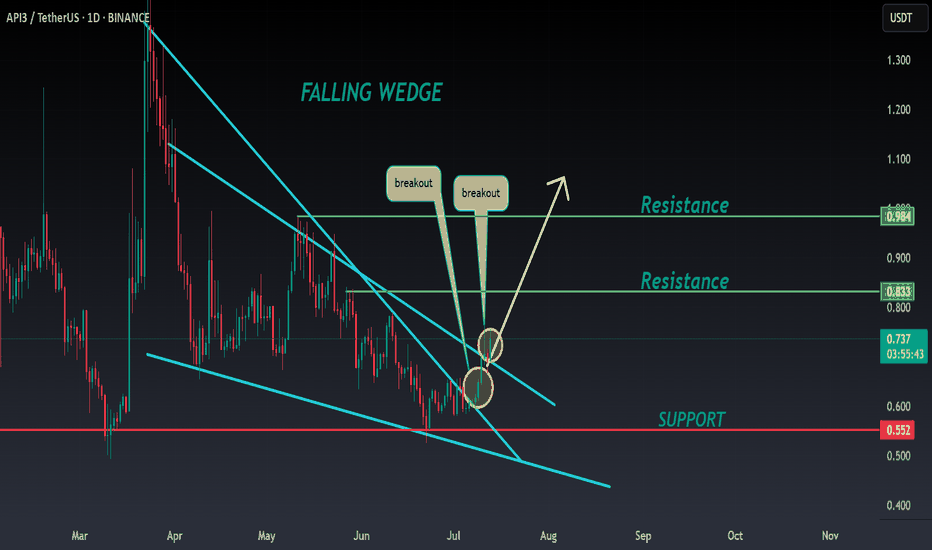

API3 ANALYSIS🚀#API3 Analysis :

🔮As we can see in the chart of #API3 that there is a formation of "Falling Wedge Pattern". In a daily timeframe #API3 broke out the pattern. Expecting a bullish move in few days if #API3 retest the levels

⚡️What to do ?

👀Keep an eye on #API3 price action. We can trade according to the chart and make some profits⚡️⚡️

#API3 #Cryptocurrency #TechnicalAnalysis #DYOR

BTC – Textbook Pullback. New ATHs. What’s Next?Back in mid-June, I published a BTC update calling for a local correction into HTF demand while most were screaming bear market and waiting for deeper breakdowns.

Price action played out exactly as forecasted.

BTC swept the $100k swing low, front-ran my first demand zone by $400, and launched into a powerful reversal — just like it did back in April, where it also front-ran the key HTF demand before rallying.

That move took us straight into new all-time highs (ATHs) — now trading comfortably around $118k.

🧠 What Happened?

✅ Liquidity sweep of the prior low

✅ Front-run demand zone (perfect HTF structure)

✅ Strong bullish reaction and higher high

✅ Confluence from USDT.D rejection at 5.25%

✅ Alts showing signs of strength as BTC rallies

The entire setup aligned perfectly across BTC, USDT.D, TOTAL, and OTHERS.D — all of which I’ve been tracking in tandem.

🔮 What Now?

With BTC now in price discovery, I expect continuation higher — but not without the possibility of a short-term pullback.

📉 A potential retest of the $108k zone isn’t off the table. This level aligns with:

- Prior breakout structure

- Range high retest

- Local demand before continuation

But even if we go straight up — I remain HTF bullish into the final phase of this cycle, supported by:

- USDT.D structure still bearish

- BTC.D showing signs of distribution

- ETH.D and OTHERS.D gaining momentum

- Altseason rotation already starting to pick up

🧭 The Macro Outlook

The 4-year cycle projection still points to a Q3 2025 top — likely between August late and September based on historical cycle timing, but this could deviate.

That gives us a window of 2–3 months for this final leg to unfold — and it’s already in motion.

Stay focused. Stick to your plan. Ride the trend, don’t chase it.

Let me know what levels you're watching next, and whether you think we get that $108k retest — or we go vertical from here.

1D:

3D:

4D:

1W:

1M:

— Marshy 🔥

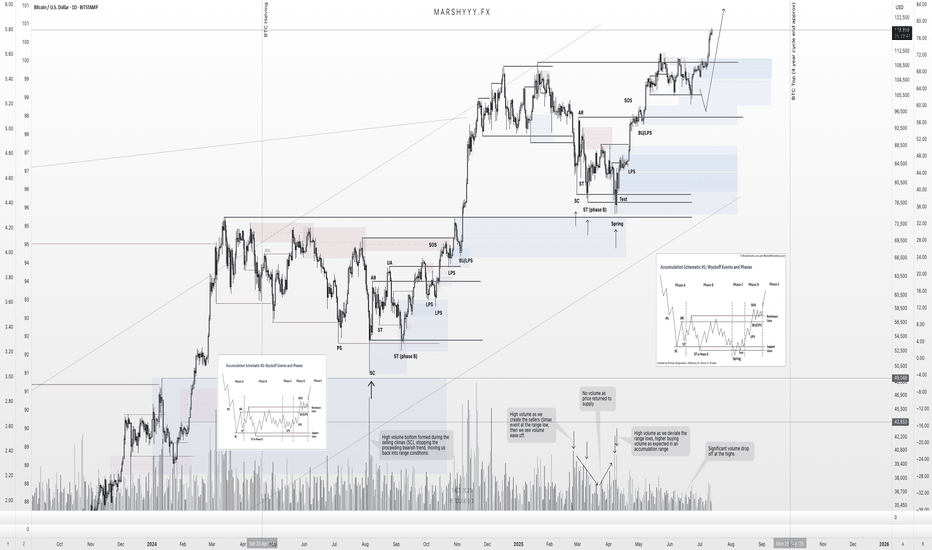

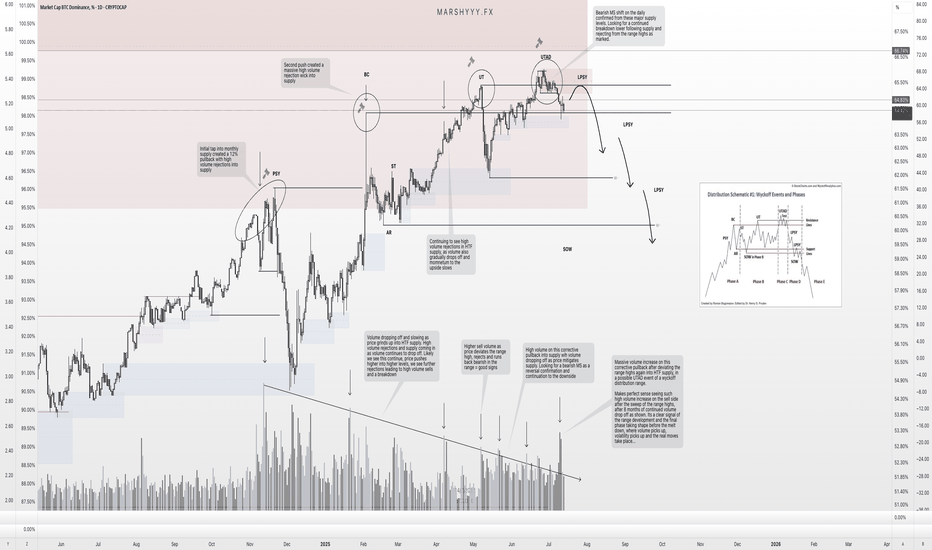

BTC.D – Distribution Confirmed. Is the Final Altseason Next?Over the past couple of months, I’ve been tracking the development of a potential high time frame (HTF) Wyckoff distribution range forming on BTC Dominance (BTC.D), and it’s now looking like that structure is starting to break down.

Back on June 14th, I noted that while we hadn’t confirmed a trend shift yet, BTC.D was showing strength and likely to push into the 65% region, with altcoin weakness to follow. The very next day, I shared my idea of a potential Wyckoff distribution forming — and since then, it’s followed that path almost perfectly.

🧠 What’s Happened Since?

✅ Sweep of the HTF range high at ~65%

✅ Second deviation of the highs

✅ Volume divergence into supply — declining volume + strong rejection candles

✅ Formation of a UTAD (Upthrust After Distribution)

✅ 1D bearish market structure break after the sweep

✅ Price now back inside the range

This is textbook distribution behaviour — even if it doesn’t follow the Wyckoff schematic to the letter, the key elements are present: deviation, volume drop-off, and structural breakdown.

🔮 What Comes Next?

BTC.D is currently holding inside a prior unmitigated daily demand, but given the structural shift, I’m expecting:

A pullback to 65–65.5% (daily supply + range high retest)

Then a continuation bearish, targeting:

🔸 49% (prior accumulation range high)

🔻 46% (FVG fill + range breakout retest)

These lower targets align with where I expect altcoins to top out — so as BTC.D breaks down, I expect capital to rotate hard into ETH and alts, triggering the final phase of altseason before the macro cycle top.

⚠️ Why This Matters

This distribution range has been developing since late 2024, and with BTC.D now showing bearish market structure, combined with:

- ETH.D flipping bullish

- OTHERS.D pushing higher

- Stablecoin dominance pairs breaking down

…we’re seeing confluence across the board for a risk-on altcoin environment.

I believe this is the setup that leads to the final euphoric altcoin rotation before the 4-year cycle top prints later this year.

📌 Watch for the retest. Watch for the rejection. The breakdown will be fast.

This is the window — time to stay sharp.

Let me know in the comments if you’ve been tracking this too, or drop your altcoin rotation picks.

— Marshy 🔥

1D:

3D:

1W:

1M:

Bitcoin - BTC | Weekly Market Recap & Outlook 13.07.2025What Happened Last Week?

Bitcoin broke out of the recent downtrend structure and established a bullish leg with clear momentum.

The breakout was supported by volume and price structure, suggesting a trend reversal rather than a temporary deviation.

Weekly Bias and Strategy

The current outlook is bullish.

A retracement or sideways consolidation between the $120,000 and $114,000 zone is possible.

This zone may act as accumulation before further upside.

Key Points of Interest (POIs):

12H Swing Liquidity (turquoise line)

Daily FVG (blue line)

These levels will be monitored for long setups with confirmation on lower timeframes.

Macro Consideration – Fed Chairman Jerome Powell

Recent market speculation has increased regarding Jerome Powell potentially stepping down as Chair of the Federal Reserve.

If such a resignation is confirmed, it may act as a significant bullish catalyst for Bitcoin and other risk assets, possibly accelerating upside without allowing for any meaningful pullback.

Summary

• Bullish breakout confirmed

• Long bias maintained unless major invalidation occurs

• Watching retracement levels for entries

• Macro catalyst (Powell resignation) may trigger strong continuation without retrace

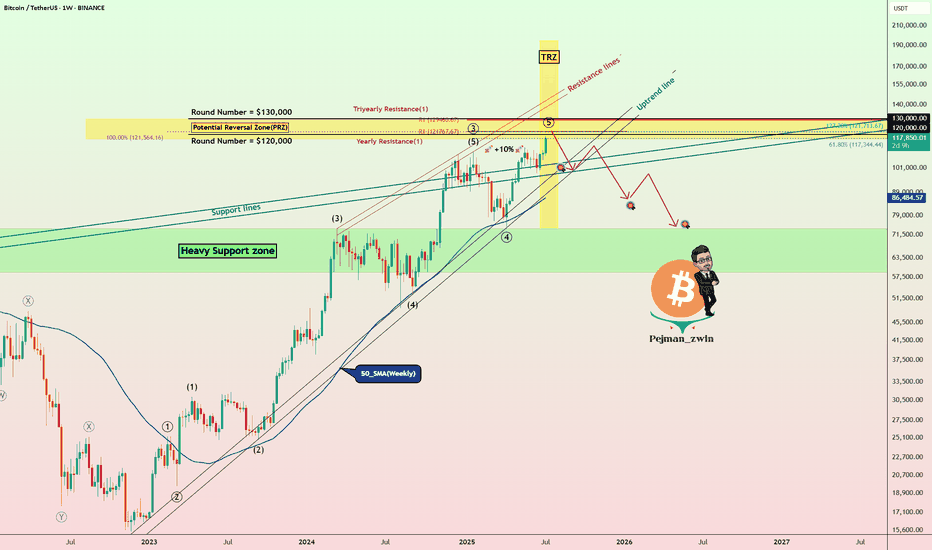

Bitcoin Roadmap=>End of RallyBitcoin ( BINANCE:BTCUSDT ) has gained nearly +10% in the recent weekly candle so far. The question is where this rally could end up. So to get to that zone, let’s go to the weekly timeframe .

Before we start this analysis, let’s take a look at my last analysis on the weekly timeframe , which was well into the Potential Reversal Zone(PRZ) . ( Analysis time: 9 JUN 2025 )

Bitcoin has now entered the Potential Reversal Zone(PRZ) and Time Reversal Zone(TRZ=June 23 to August 4) , and these zones could be the zones where this Bitcoin rally will end. Do you agree with me?

In terms of Elliott Wave theory , Bitcoin appears to be completing a main wave 5 , as the main wave 3 was an extended wave . The main wave 5 could end at the Potential Reversal Zone(PRZ) .

I expect Bitcoin to start a main correction from the Potential Reversal Zone(PRZ) and could continue to support lines and near the $105(at least) .

What do you think about the end of the Bitcoin rally?

Note: Sell orders near $120,000 are very heavy.

Note: Cumulative Long Liquidation Leverage attractive volume for liquidation.

Note: If Bitcoin goes above $130,000, it can continue to rise to the Resistance lines (near $150,000).

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), weekly time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

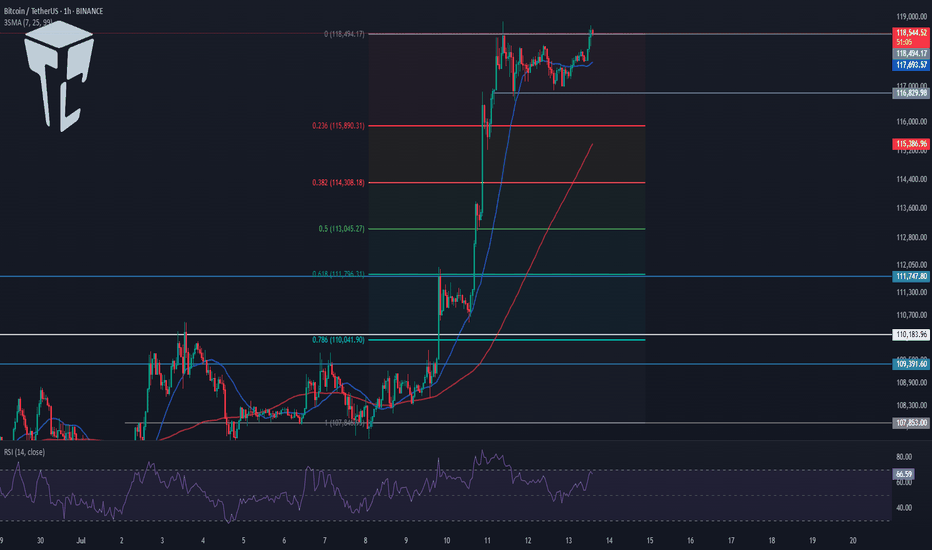

TradeCityPro | Bitcoin Daily Analysis #127👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and the key crypto indexes. In this analysis, as usual, I want to review the New York session futures triggers for you.

⏳ 1-Hour timeframe

In the 1-hour timeframe, as you can see, Bitcoin, after the correction down to the 116829 level, is now breaking the 118494 top again.

🔔 This move can potentially start Bitcoin’s next bullish leg. In that case, I think this leg will be a strong one because the correction was very shallow and didn’t even reach the 0.236 Fibonacci level, so the price may perform another sharp move.

💥 On the other hand, the RSI oscillator is entering Overbuy, which increases the probability of a bullish scenario and a sharp next leg.

📈 If the 118494 level is broken, we can open a long position. We already have suitable confirmations for this position since volume and RSI are aligned with price, and also the SMA25 is supporting the price and pushing it upward.

👑 BTC.D Analysis

Let’s move on to Bitcoin Dominance. The dominance trend is still bearish and continuing downward.

⭐ Currently, it’s sitting on a key support at 64.44, and breaking this level can continue the bearish move in dominance.

📅 Total2 Analysis

Let’s go over Total2. Yesterday, after correcting to the 1.26 level, it seems the next bullish move has started and it’s heading toward 1.3.

🎲 The main resistance I see for Total2 is still 1.33, and I believe this will be the main ceiling that Total2 will struggle with.

📅 USDT.D Analysis

Moving on to Tether dominance. This index is still dropping and is now sitting at the 4.36 support.

✨ Breaking this level will start the next bearish leg, and the price can move toward 4.22. If a correction occurs, the first level will be 4.49.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Weekly Close Watch: Bitcoin’s Key Level Could Shift the ChartsGood morning, Guys

There's only 1 day and 13 hours left until the weekly Bitcoin candle closes.

It's crucial that this candle closes above the 112,331 level with strong volume. Anyone experienced in economics and technical analysis knows just how significant this is.

If we get that close above the level, I’ll share a powerful analysis with a clear target.

I want to sincerely thank everyone who’s been supporting my analyses with likes—your support is

my biggest source of motivation when it comes to sharing content.

Much love to you all—we’re more than just a community, we’re a family. 💛

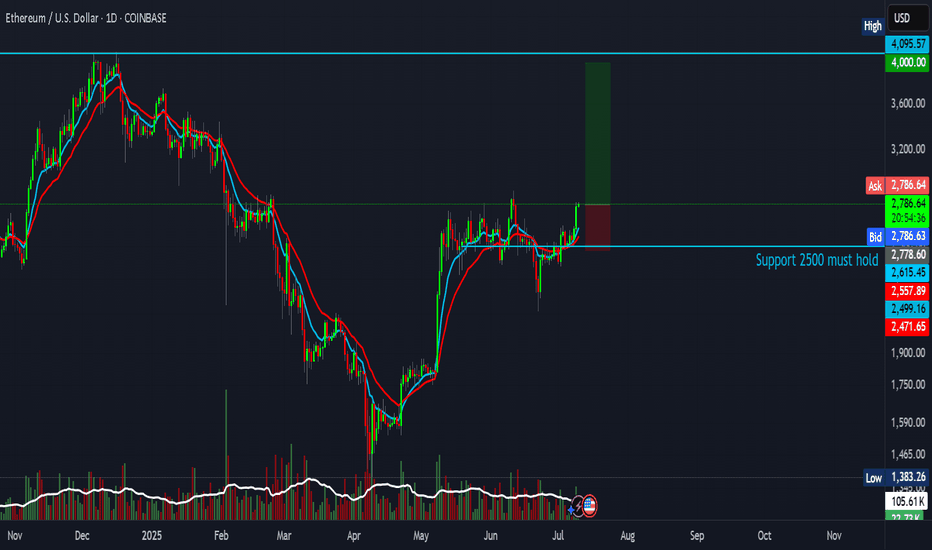

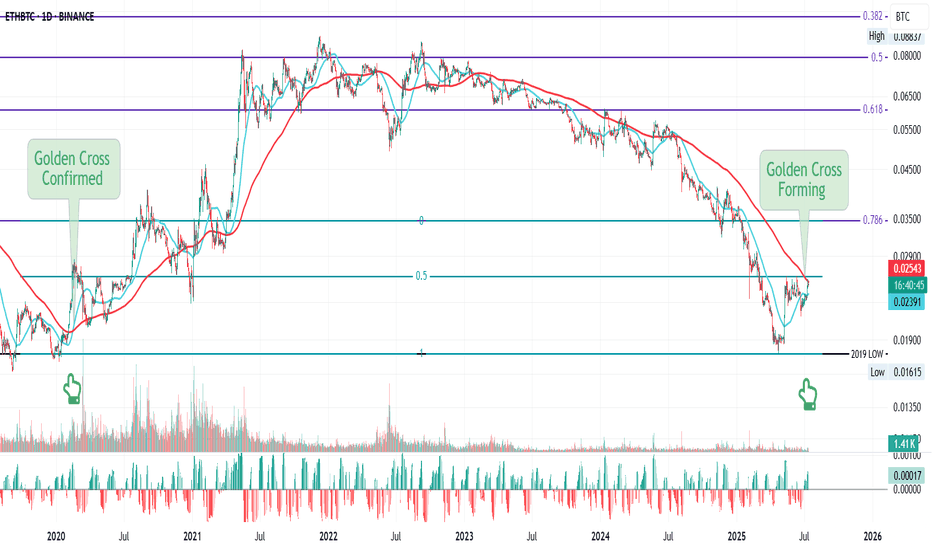

ETH/BTC: Golden Cross Reloaded?This is ETH/BTC on the daily chart.

A major event is about to unfold: the golden cross, where the 50MA crosses above the 200MA.

The last time this happened was in early 2020, around the same price zone, right after a bounce off the 2019 low double bottom and a rejection from the 0.5 Fib level, which sits halfway between the 2019 low and the 0.786 Fib.

In 2025, we’re seeing a strikingly similar pattern:

– Price bounced off the 2019 low

– Got rejected again from the 0.5 level

– And now appears to be gathering strength to flip that level and the 200MA to confirm the Golden Cross

Always take profits and manage risk.

Interaction is welcome.

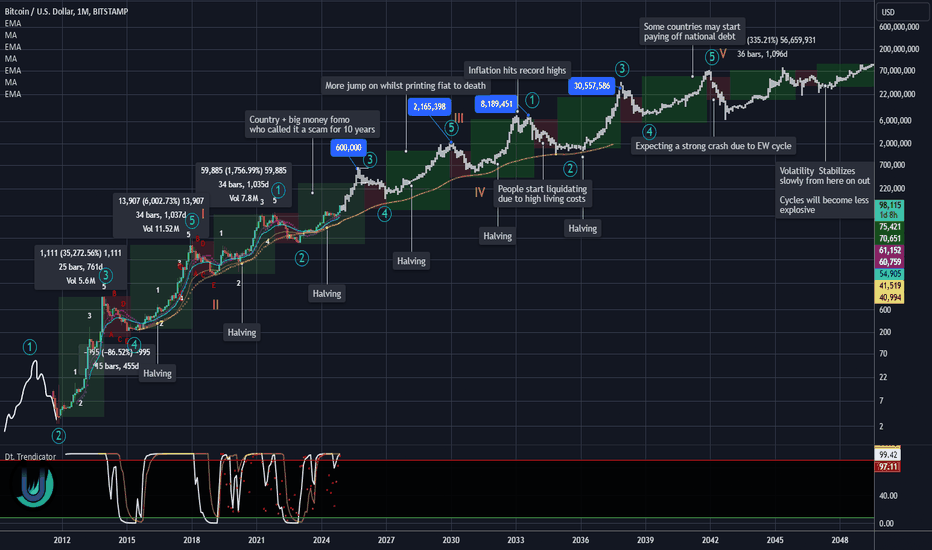

20 year long BTC analysisTaking into account the halvening and the recent bullish news of countries and big companies wanting to establish a BTC reserve. I think we can see some crazy cycles in the future.

These entities are most likely planning to hold for a minimum of 20 years. And countries won't be shy to print some extra dough for it. Some may see it as an opportunity to finally get rid of their national debt.

As long as fiat exists BTC will most likely keep going up. Its that simple.