BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

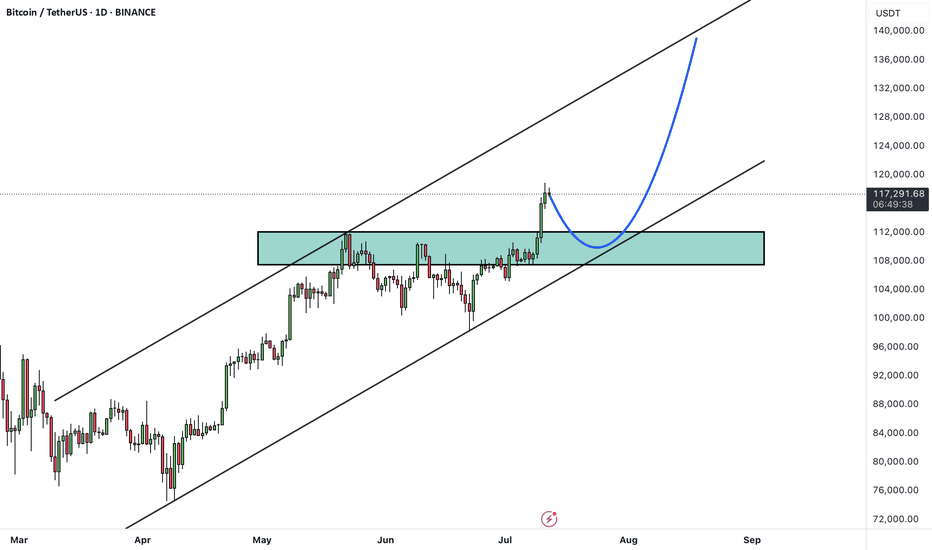

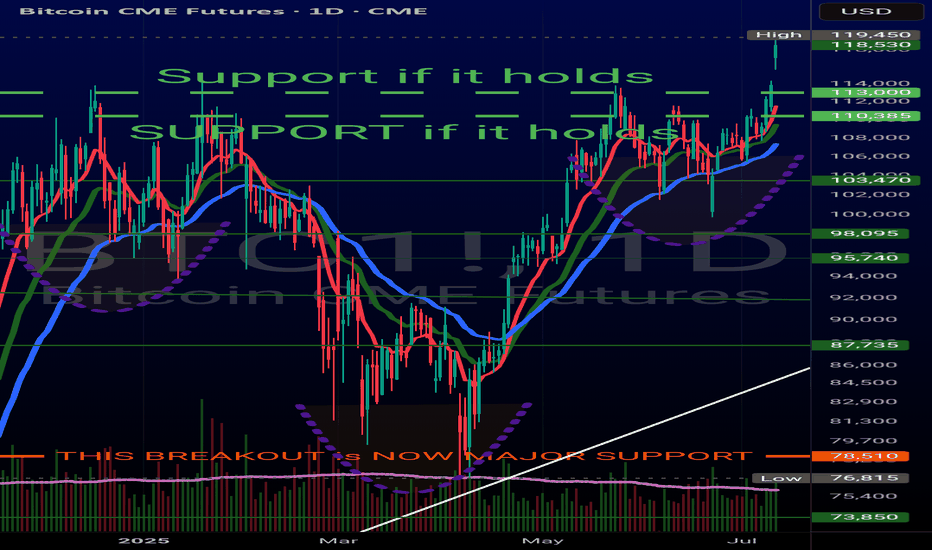

Bitcoin has recently broken above its all-time high and printed a new record high, signaling strong bullish momentum. Currently, the market has entered a consolidation phase, which is typical after such a major breakout.

A pullback toward the previous breakout level (the old all-time high) is expected, which now acts as new support.

After this consolidation and pullback, the price could resume its bullish trajectory and move toward higher targets, including the upper boundary of the current bullish channel.

As long as the price remains above the key support zone, the overall trend remains bullish and any dip could be seen as a buying opportunity within the broader uptrend.

Will this consolidation lead to the next leg up, or is a deeper correction ahead? Share your thoughts below! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

Bitcoin (Cryptocurrency)

TradeCityPro | Bitcoin Daily Analysis #126👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis I’ll review the potential triggers for the New York futures session.

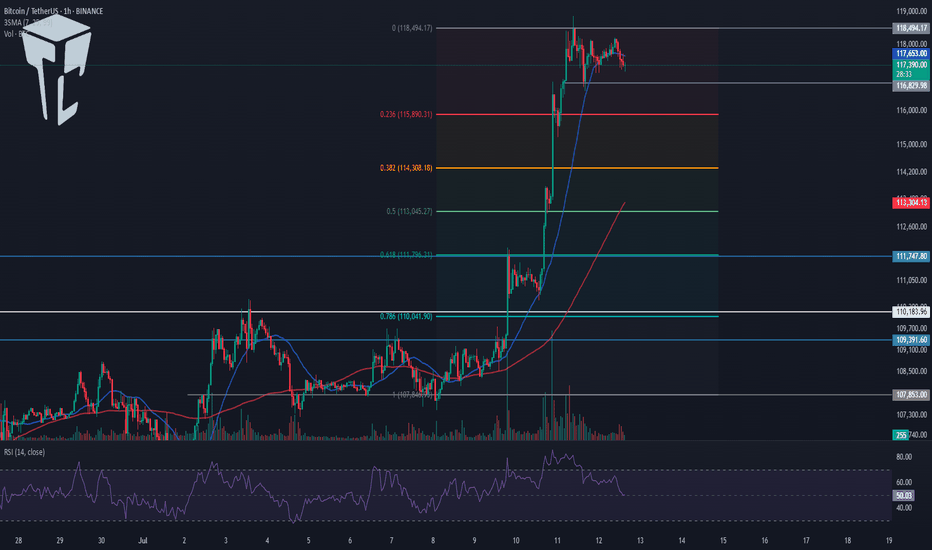

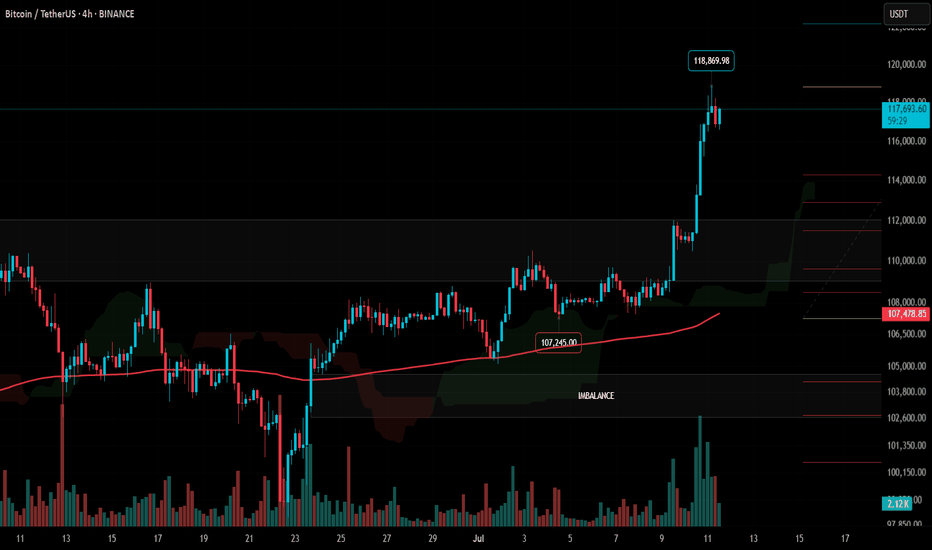

⏳ 1-Hour Timeframe

As you can see on the 1-Hour chart, Bitcoin started a bullish move after breaking the 111747 resistance, which continued up to 118494.

✨ Currently, the price is consolidating after reaching that resistance and has formed a range box between 116829 and 118494, fluctuating within this zone.

💥 The RSI oscillator has exited the Overbuy zone and is now near the 50 level. If it drops below 50, there is a possibility of a deeper correction.

⚡️ Confirmation of a deeper correction would come with a close below the 116829 level. The next support areas will be Fibonacci levels, which I have marked on the chart.

✔️ Since the SMA25 has reached the candles and there is no significant momentum yet, we’ll need to wait for the SMA99 to approach the price to see if momentum enters the market.

👑 BTC.D Analysis

Looking at Bitcoin Dominance, yesterday it reached the 64.18 support level and managed to bounce back, closing above 64.44.

🔔 Currently, it’s consolidating above 64.81, and if this holds, the trend could turn bullish for now.

📅 Total2 Analysis

Total2’s main resistance is at 1.33, but the price was rejected at 1.3 and is now correcting toward 1.26.

🔍 If the correction continues, the 0.382 and 0.618 Fibonacci levels would be reasonable areas to watch. If the upward move resumes, the next target will be 1.33.

📅 USDT.D Analysis

Tether Dominance has had a steep drop from 4.72 and has now reached 4.36. If support holds at this level, we could see a correction back toward Fibonacci zones.

🎲 A break below 4.36 would confirm continuation of the downtrend.

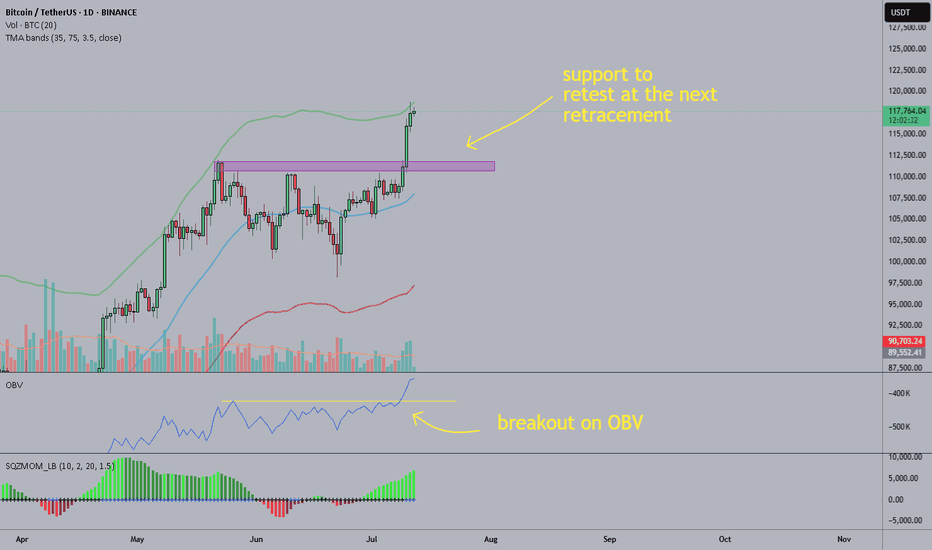

BTC: the breakout should be legitAs you can see the breakout had 3 days of rising volume and OBV also broke out so it should bne legit. On daily the upper band of the TMA bands is being tested, probably soon we'll see a retracement, I suppose the former resistance is now the support to test, however if the euphory continues we could see another peak of the price while RSI stays below the "overbought zone".

I'd look at opportunities to short although I usually don't trade BTC, I use it mostly as indicator on when to buy alts.

Good luck

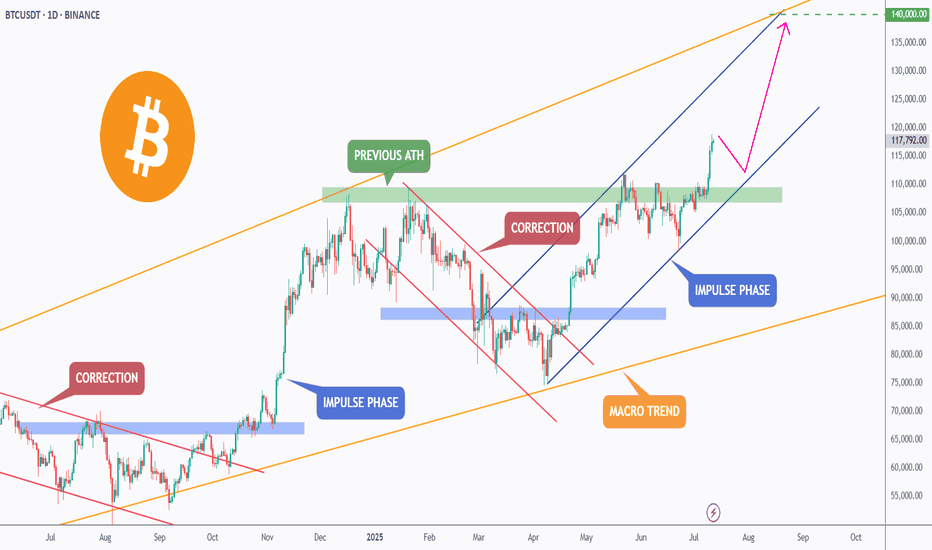

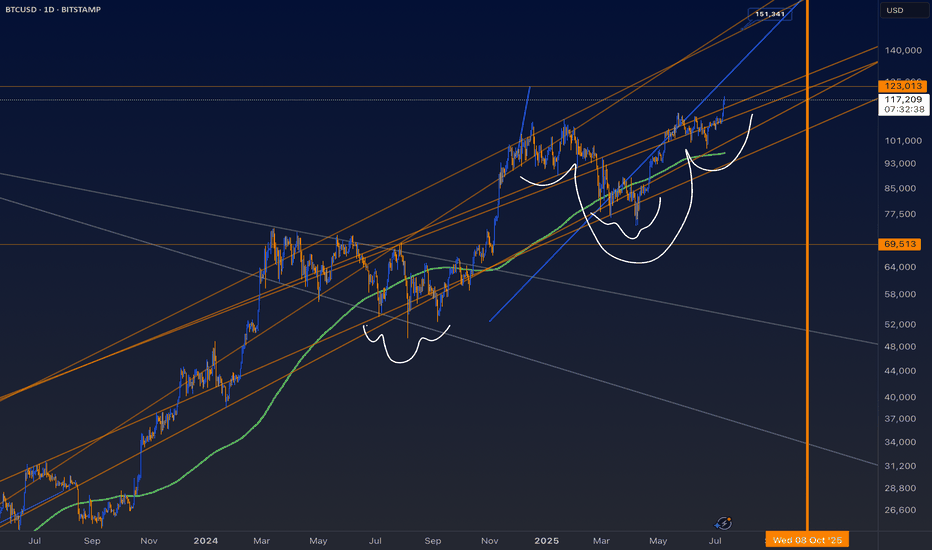

BTC is Back in Price Discovery Mode — Targeting $140K!After a clean break above the previous all-time high, Bitcoin has officially entered a new impulse phase, trading within a steep rising channel.

The green zone around the previous ATH is now acting as a strong support zone, confirming the shift in market structure.

🟠 The macro trend remains intact, and bulls are clearly in control.

🌀 Corrections continue to offer opportunities for trend-following entries, and if momentum holds, BTC could be on its way toward the $140,000 mark — the upper boundary of the macro channel.

Until then, every dip is a gift in this bullish cycle. 🔥

🧠 Trade with the trend. Manage your risk. Stay ready.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

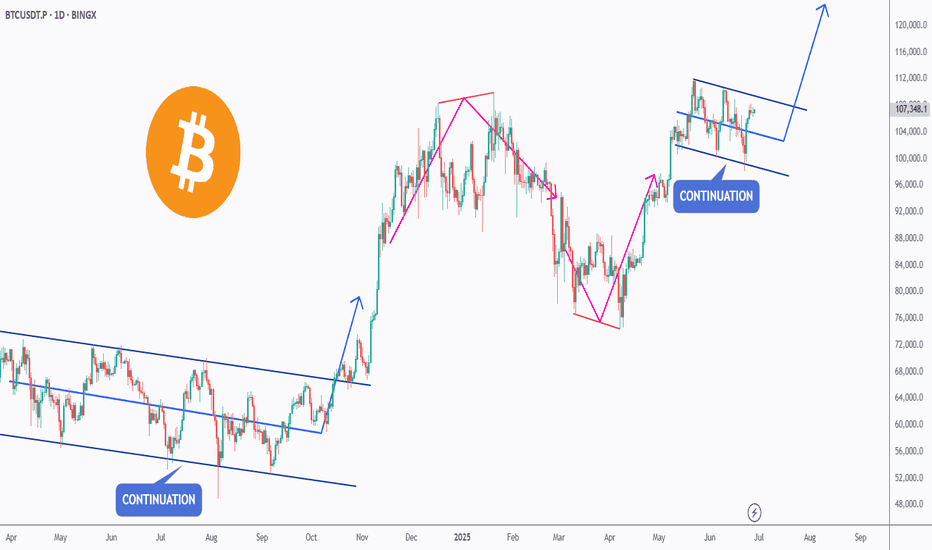

BTC - Falling Correction = Continuation?BTC has been playing by the rules lately!

Every time Bitcoin forms a falling correction, it turns out to be a bullish continuation pattern — and history might be repeating itself 👀

As shown on the chart:

Previous falling channels (flag/wedge structures) have consistently led to strong bullish impulses.

The current correction also appears to be a falling channel, hinting at another potential bullish leg soon.

As long as the structure holds and no major support is broken, the next target could be a new all-time high.

Let’s see if BTC continues to respect this textbook behavior.

📌 Remember: Falling corrections in an uptrend = healthy continuation!

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

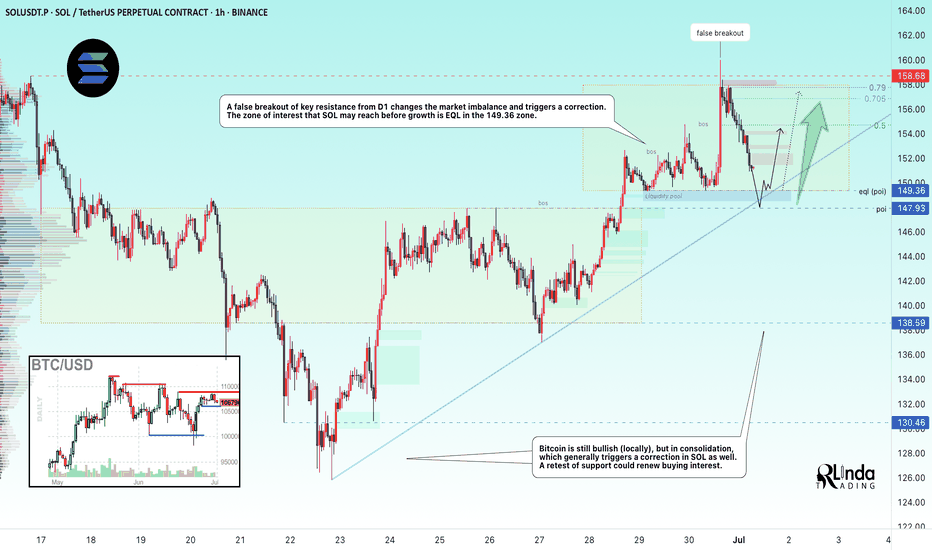

SOLUSDT → Countertrend correction and hunt for liquidityBINANCE:SOLUSDT looks quite promising on the bullish side. The price is testing one of the key resistance levels within the local trend rally. A correction is forming. Is it beneficial for us?

On the higher timeframe, we see a change in character, a breakout of the trend resistance, and the formation of an upward trend support line. Bitcoin is still bullish (locally) at this time, but it is consolidating, which generally provokes a correction in SOL as well. Focus on the 150-149 area. If the bulls are able to keep the price above this zone after the retest, followed by the formation of momentum, this can be considered a positive medium-term sign.

Locally, the price within the trading range of 149.36 - 158 is heading towards the area of interest and liquidity (eql) at 149.36. The current sell-off is most likely triggered by a large player seeking a more favorable entry into the market.

Resistance levels: 154.75, 156.8

Support levels: 149.36, 147.93

In the current situation, it makes the most sense to consider an intraday trading strategy. A countertrend correction and a retest of support could attract buyers...

Best regards, R. Linda!

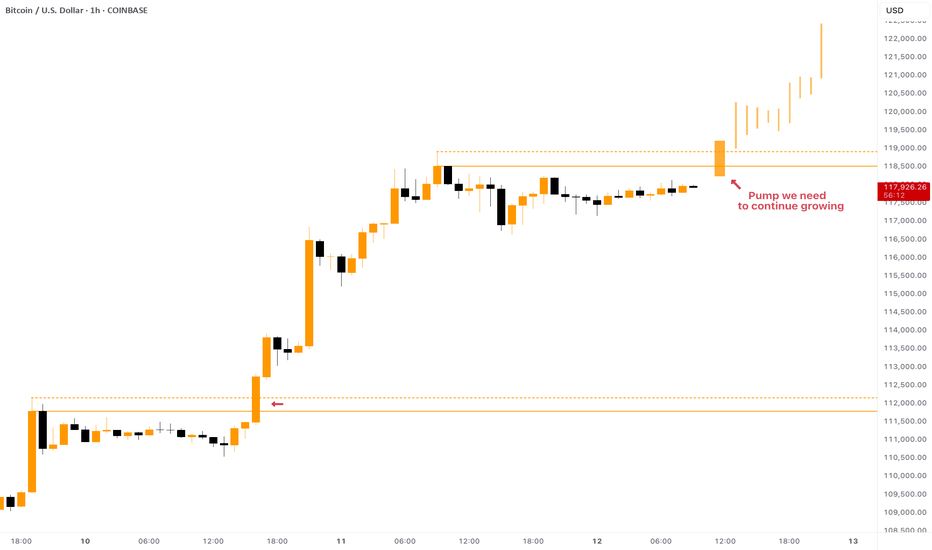

BITCOIN - Local Conditions for Growth ContinuationCRYPTOCAP:BTC showed us an astonishing growth from $108,000 to $118,000 in a few days! But what is next and where is the next target?

At the moment the price is consolidating below the ATH, in fact there are two resistances: $118,500 and $119,000. To continue pumping, Bitcoin has to break both of them with strong impulse.

To be honest , the current price development reminds me of what we've seen a couple days ago: breakout of the resistance -> consolidation below local highs -> strong breakout and growth continuation. Something similar can be expected now as well.

In the past couple of years CRYPTOCAP:BTC taught us a lesson of waiting no time to hop on the train . When it pumps - it does it quickly, just like it does it this time. So, waiting for the best entry near $109,000 - $110,000 might leave you behind while Bitcoin will be pumping towards $125,000.

Beautiful Bitcoin breakout, as called. PLEASE SEE PROFILE FOR MORE INFO!

What an absolutely gorgeous Inverse Head & Shoulder for #Bitcoin.

Had suspicion this time WAS different for #BTC.

Let's talk ROUGH ESTIMATES for social #gold.

CRYPTOCAP:BTC is no longer a hard to anticipate as it's become an institutional asset. Follow the $, volume. ETF's are performing similar. Leveraged funds, not so much

Anyway, enjoy the ride #Crypto!

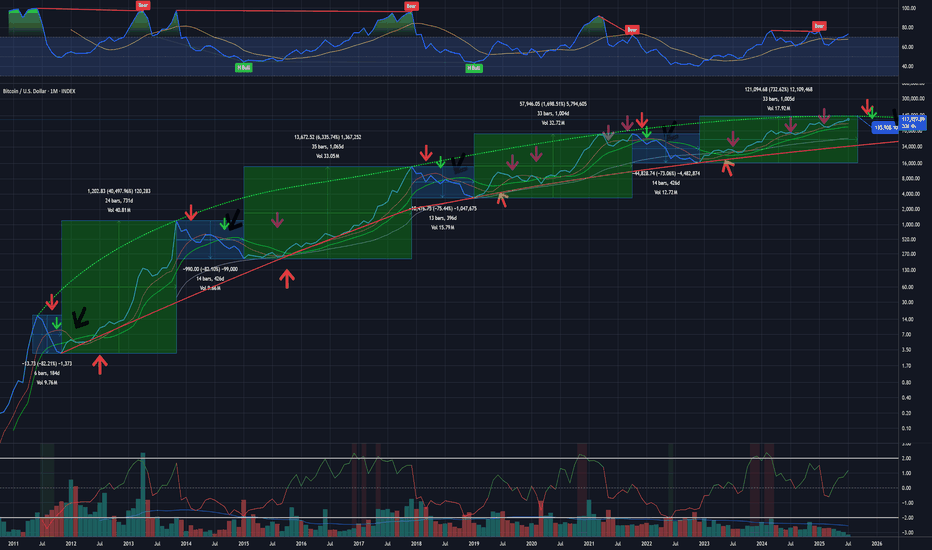

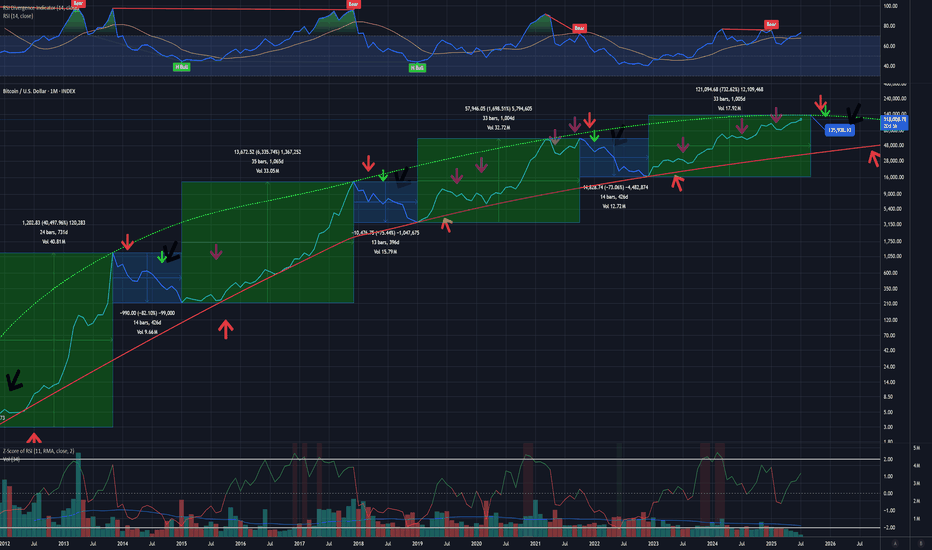

btcusd bull bear when monthly crossing DMAEvery time monthly closes below DMA 200 (Daily moving average) it could be start of bear market but it came out last times there were more fake (lila arrows).

But when it croses DMA 400 then it goes into multi month sell off to DMA 1400

Currently it is close to top and start of next 400 day sell off.

Bull market lasts 1000 days

btcusd bull bear when monthly crossing DMAEvery time monthly closes below DMA 200 (Daily moving average) it could be start of bear market but it came out last times there were more fake (lila arrows).

But when it croses DMA 400 then it goes into multi month sell off to DMA 1400

Currently it is close to top and start of next 400 day sell off.

Bull market lasts 1000 days

#BTC Update #6 – July 11, 2025🟠 #BTC Update #6 – July 11, 2025

Bitcoin has surged nearly 9% from the supply zone and is currently trading around the $119,000 level. However, looking at the current volume, the momentum seems to be fading.

If a correction takes place, the potential support zones are:

✨First stop: $114,000

✨Second stop: $113,000

✨Third stop: $111,500

After a pullback, the next target may be around $122,000. However, macroeconomic risks are rising. The U.S. is considering a 500% tariff on Russia imports, and in the past, even a 100% tariff triggered a sharp drop in Bitcoin.

Since BTC has already made a significant move up, I don’t think opening a Long or Short position is wise at the moment. Just observing for now.

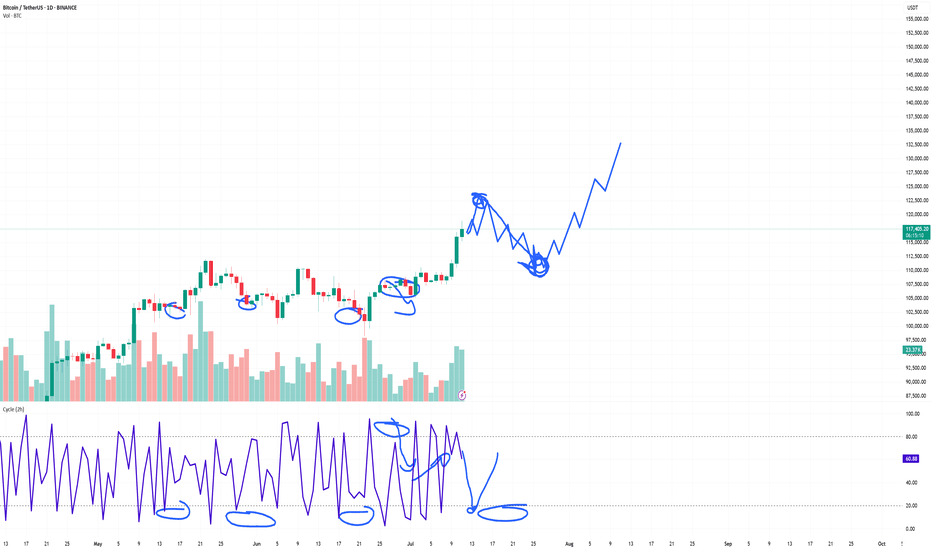

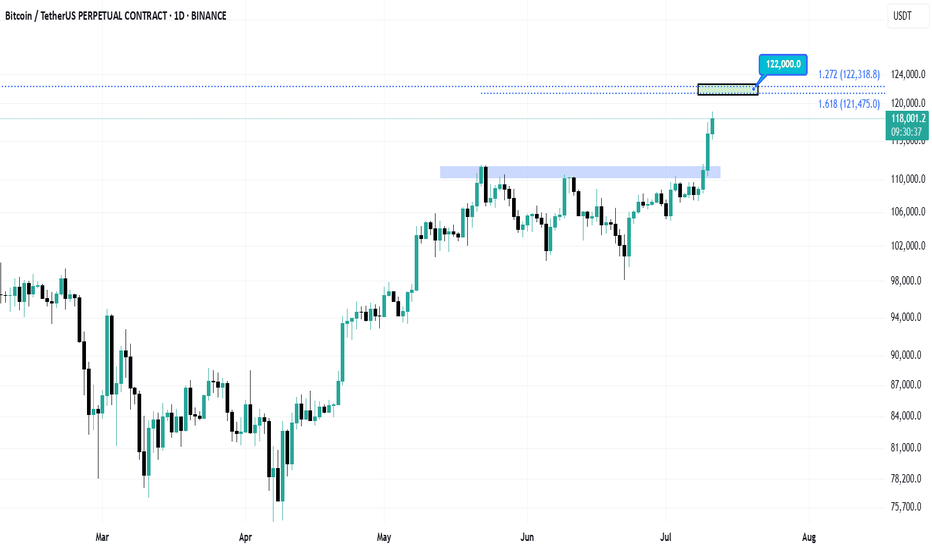

Bitcoin: Final Push in the 60-Day Cycle?Bitcoin appears to be making its final move higher within the current 60-day cycle. We could potentially see a push into the $121K–$122K range before a sharp correction takes us down to around $110K–$112K toward the end of the month, driven by the 3-day cycle timing.

After that, we’re likely to form a new 60-day cycle low, which could set the stage for a renewed move to the upside.

Is it time to go long?

At this point, the risk/reward doesn’t look favorable for new longs. Personally, I’m watching for one final push above $120K to consider opening a short position into the expected cycle low.

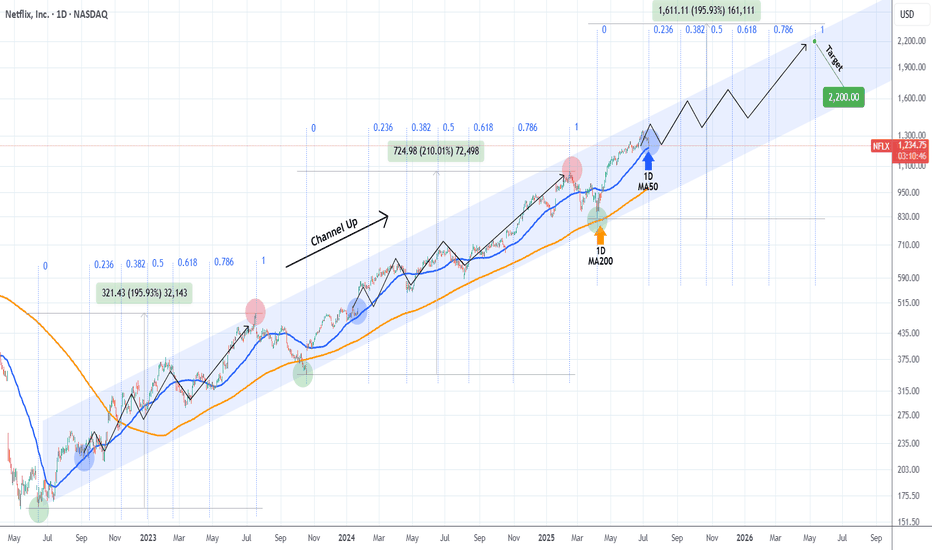

NETFLIX 1D MA50 test is a new buy opportunity.Netflix (NFLX) has been rising non-stop since the April 07 bottom on the 1D MA200 (orange trend-line). This bottom has been the latest Higher Low of the 3-year Channel Up that started on the June 14 2022 bottom.

This kickstarted its third long-term Bullish Leg. The previous two have been fairly similar (+210% and +195.93%) so we can assume a minimum total rise of +195.93% until the next top (Higher High of the Channel Up).

We can also see that on each Bullish Leg, after the initial rebound, the stock always tested the 1D MA50 (blue trend-line) around the 0.236 Time Fibonacci level. That has always been the best buy opportunity of that stage.

As a result, we believe that the recent short-term correction is a buy opportunity in disguise, targeting a Higher High at $2200.

Check out our previous analysis on Netflix:

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

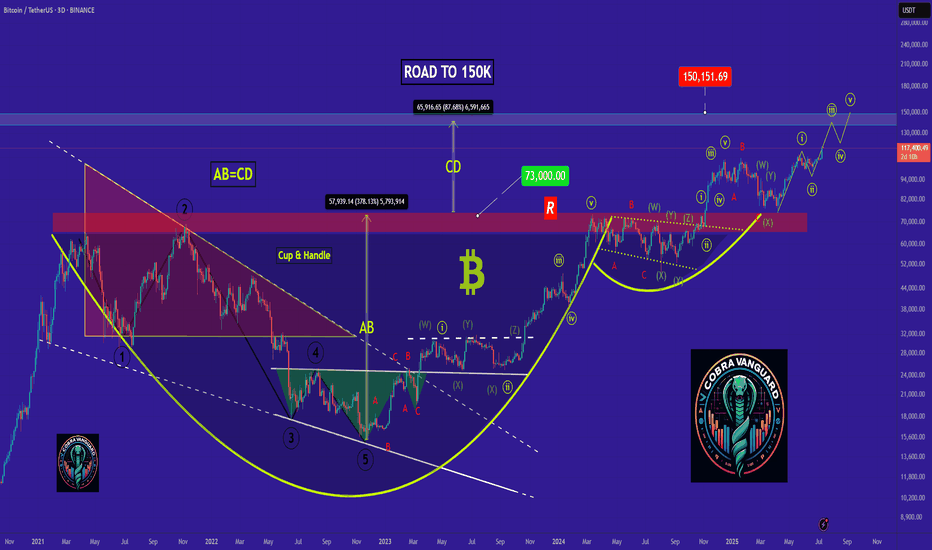

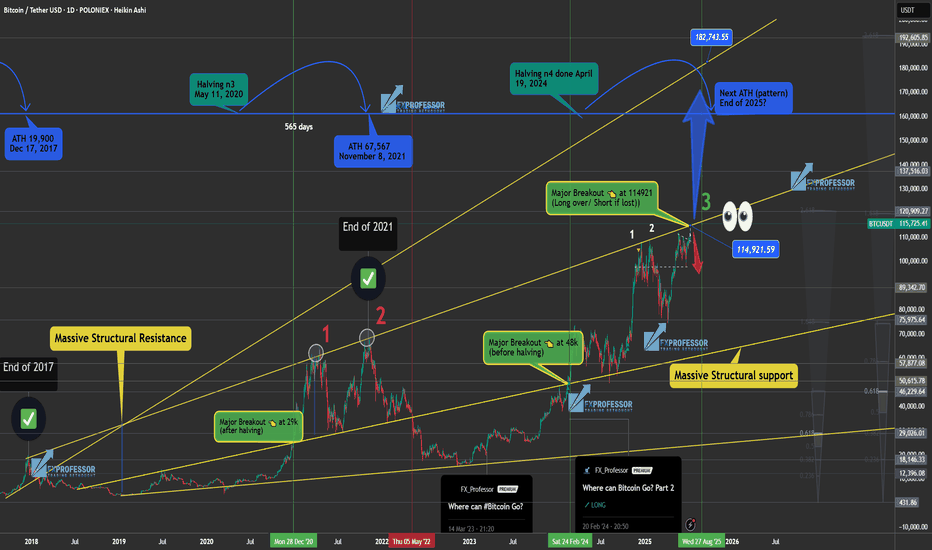

Where Can Bitcoin Go? Part 9 – Breakout and History in Motion🌋🚀 Where Can Bitcoin Go? Part 9 – Breakout and History in Motion. 🔓💥

The breakout over 114900 has happened.

After 2 rejections, years of preparation, and countless fakeouts… Bitcoin has finally cleared the $114,921 barrier.

We are now officially in price discovery mode within the upper resistance channel.

📍 As long as BTC stays above $114,900 – we are long.

This level is now our trigger line. Lose it? Flip back to short bias. Hold it? There’s only one word: 🚀

🔑 Context:

We’ve tracked this structure since 2023 using a 1-2-3 model based on macro highs. The third test is always the decider — and this time, we broke through.

✅ Test 1: Rejected (2021)

✅ Test 2: Rejected (2025)

✅ Test 3: Breakout confirmed (July 2025)

Now compare that to previous cycles:

2016 halving → ATH in 2017

2020 halving → ATH in 2021

2024 halving → ATH coming by end of 2025?

🧭 Based on this map, BTC’s next structural targets are:

→ $137K

→ $160K

→ $182K+

But there’s a catch: if we fall back below 114,900, the entire breakout thesis is at risk. This is now a binary zone.

⚠️ What to Watch:

📌 Support Retests:

Expect volatility around the 114.9–116K level. This zone will now be stress-tested.

📌 Media Frenzy vs Structure:

As hype increases, stick to levels — not noise.

📌 Ultimate FOMO vs Breakdown:

Hold structure = ATH potential

Lose structure = Down we go, potentially hard.

🎥 Missed the full structural breakdown?

👉 Watch “Where Can Bitcoin Go? Part 8” for the blueprint

👉 This is now Part 9 – The terminal move has begun

We are now playing for cycle maturity – this could be the final leg before topping out in late 2025.

Let’s trade it with clarity, not emotions.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

🚨 BITCOIN HAS BROKEN OUT but keep in mind: under 114900 be OUT!

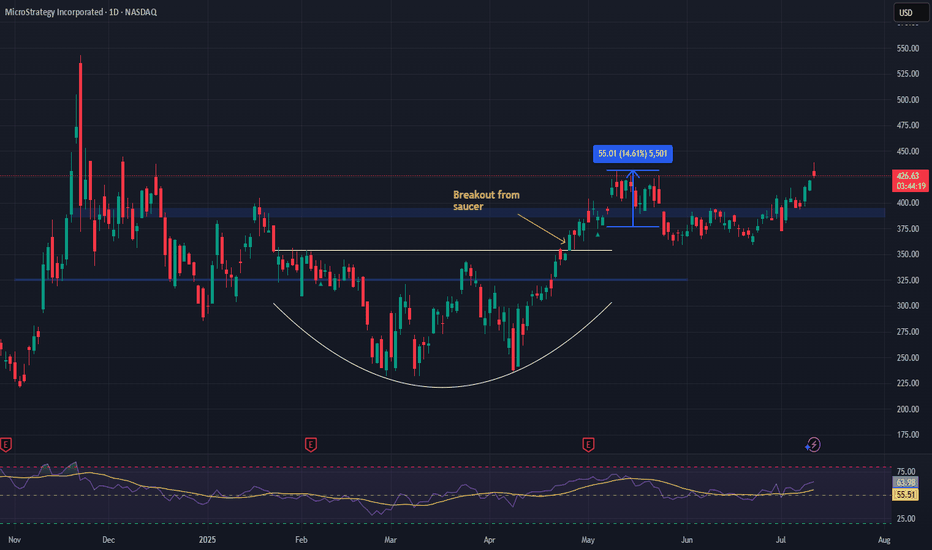

MicroStrategy ($MSTR) – Bitcoin Proxy Setting Up AgainMicroStrategy Incorporated NASDAQ:MSTR remains the definitive institutional proxy for Bitcoin exposure, uniquely combining its enterprise software operations with a high-conviction, leveraged Bitcoin accumulation strategy. Its $1.42B BTC purchase in April 2025 further cements this thesis, making MSTR a prime vehicle for traders seeking amplified BTC exposure via equities.

Since our May 5th analysis, MSTR has rallied ~14.61%. We’re now eyeing a re-entry opportunity on a pullback to the $394–$387 zone, aligning with technical support and previous consolidation.

🎯 Bullish targets remain unchanged: $490.00–$500.00, backed by Bitcoin strength and MicroStrategy’s unwavering strategy.

🔁 Re-entry: $394–$387

🟩 Targets: $490–$500

#MSTR #Bitcoin #CryptoStocks #BTC #StockMarket #TechnicalAnalysis #MicroStrategy #HighBeta #CryptoExposure #TradingSetup

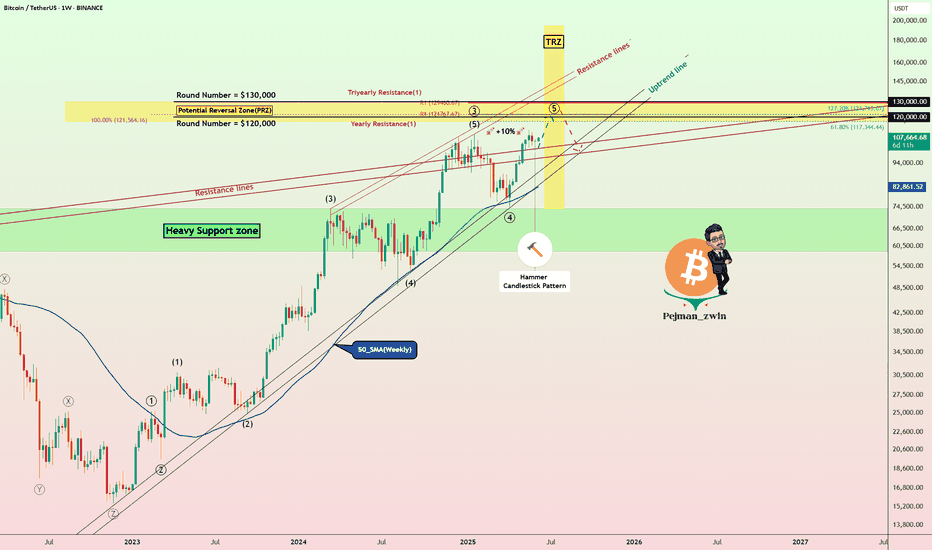

Bitcoin’s Final Wave & Time Reversal Zone _ New ATH Loading?Today, I want to analyze Bitcoin ( BINANCE:BTCUSDT ) on the weekly time frame and answer these questions :

Can Bitcoin create a new All-time High(ATH) or not!?

At what price range can Bitcoin's uptrend end!?

When can we expect the uptrend to end!?

Please stay with me.

Bitcoin appears to have managed to break the Resistance lines , although we saw a fake break a few months ago , and it also appears to have a Hammer Candlestick Pattern in the previous weekly candle , which could signal the completion of Bitcoin's pullback to the Resistance lines(broken).

In terms of time , if we want to analyze the Bitcoin chart and look at Bitcoin's past, in general, the months of June(Average=-0.13%/Median=+2.20%) and especially July(Average=+7.56%/Median=+8.90%) have been among the most productive months for Bitcoin , and the months of August(Average=+1.75%/Median=-8.04%) and September(Average=-3.77%/Median=-4.35%) were the months when Bitcoin had a correction . Technical analysis tools show the end of the upward trend and the beginning of Bitcoin's correction at the Time Reversal Zone(TRZ=June 23 to August 4) .

In terms of Elliott Wave theory , Bitcoin appears to be completing the main wave 5 , as the main wave 3 was extended .

I expect Bitcoin to trend higher(+10%) in the coming weeks and create a new ATH . New ATH could be created in the Potential Reversal Zone(PRZ) and TRZ , and then we can wait for the start of the main correction .

What do you think about Bitcoin’s future movement? Can Bitcoin create a new ATH? When and at what price?

Note: If Bitcoin falls below $100,000, we should expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), weekly time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

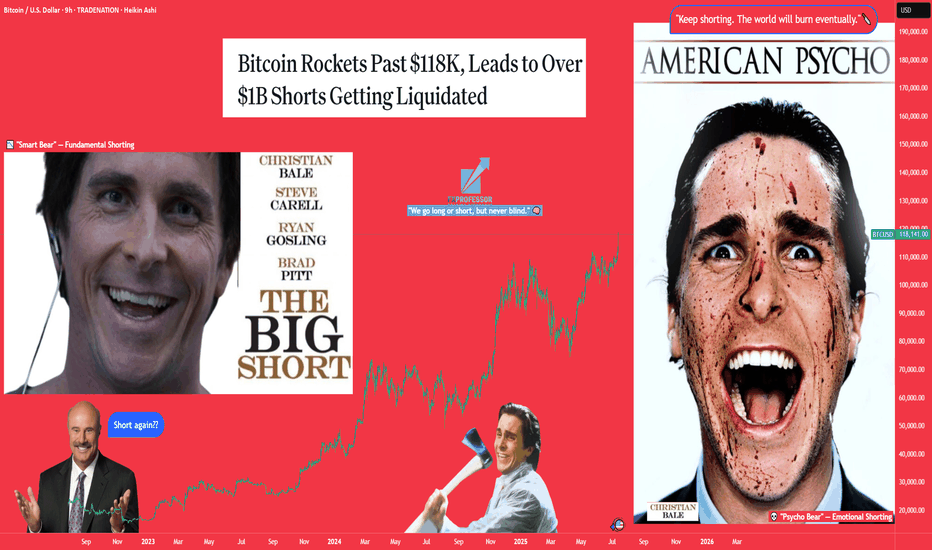

Shorting Isn’t the Problem. Being a Psycho Bear Is.😵💫🪓 Shorting Isn’t the Problem. Being a Psycho Bear Is. 🔻📉

Hollywood is never wrong:

The genius from The Big Short is the psycho from American Psycho .

Same actor (C. Bale) — two sides of the same trader.

🎭 I made this chart because I see this often on TradingView:

People who prefer to short. Hoping for collapse.

Even Rooting for war. To Celebrating blood short profit.

Perma-bears who hate seeing price go up because they missed the trade.

Let’s be real — that’s not trading.

That’s emotional self-destruction masked as 'strategy'.

We just saw over $1B in shorts liquidated as Bitcoin ripped through $118K.

And still — some refuse to let go of their bias.

This chart says it all:

🔹 The "Smart Bear" — does research, uses structure, trades what’s real.

🔻 The "Psycho Bear" — needs things to collapse, just to feel right.

💔 And here’s the truth I want to share with you today:

If you catch yourself unable to celebrate others making money ,

If you feel angry when price pumps and you missed it,

If you’re wishing for collapse or chaos just so you feel seen...

Something’s off. That’s not trading. That’s pain talking.

Buying is more than just a trade — it’s hope , it’s optimism , it’s love .

Being bullish is an act of belief in the future.

And yes — we sometimes need to short. We do it with clarity.

But I’m a bull who sometimes must go short. Not a bear who wants the world to burn.

“We go long. We go short. But we never go blind.”

📉 Don’t let bitterness guide your charts.

📈 Let discipline, structure — and a bit of heart — guide you instead.

One Love,

The FXPROFESSOR 💙

⚠️ Disclosure:

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

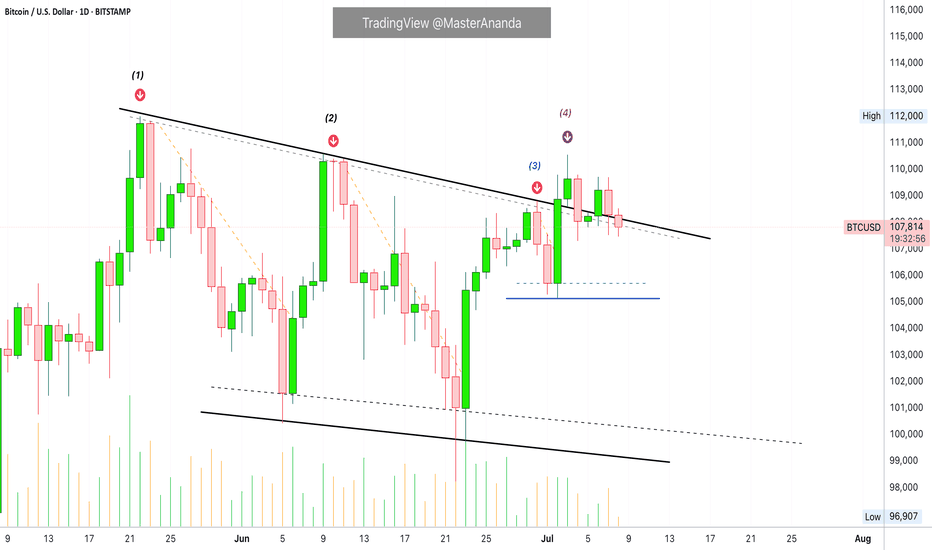

Evolving Price & Candle Patterns: BitcoinLook what is happening here with the candle patterns and price action. In the most recent challenge of resistance something changed. Change is good. It can mean the end of this sideways period.

At (1) Bitcoin finds resistance and immediately starts a decent. The same happens at (2). When we reach (3) everything changes. (1) & (2) produced a low and lower low. The down-move was extended. (3) produced only two red candles, a strong higher low and the third day was a full green candle moving above the descending trendline resistance. The price pattern is now erratic, completely different to previous moves.

Now, consider (4). If the strong green candle was intended as a bull-trap, then we would expect a down-move to follow right after the peak, just as it happened with (1) and (2). But nothing, after (4), Bitcoin has been sideways within the bullish zone.

This change is good, bullish.

A drop can develop anytime but the market already had two changes to produce a down-wave, (3) and (4). The fact that a down-move didn't materialize means that the market has something different in store for us, change. This change is good because when resistance is challenged, prices tend to drop when the market is moving within a range. No drop can signal the end of the range trading which in turn can translate into the start of the next bullish wave.

If this idea turns out to be true, Bitcoin will start growing within days. Growth should be strong because consolidation has been happening for months.

Namaste.