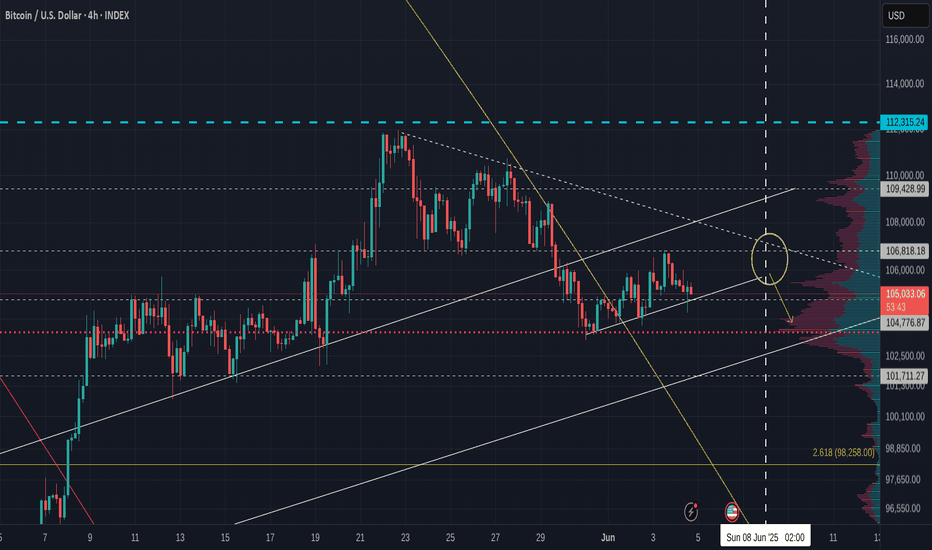

Bitcoin 4 hour update and longer term outlook for next 5 days

Bitcoin is in a Rising channel after dropping.

This can be easily called a BEAR FLAG and it needs to be paid attention to for a number of reasons.

The line of support that held PA up in May is now close overhead resistance and we are climbing towards an apex around 11 June.

PA always reacts before APEX

I would expect this to happen from the 8th June but could obviously happen before.

I can see PA dropping to around 102K, on the POC ( red dotts ) off the VRVP

We will have to see what happens form there but there is a strong line of support just below this.

The 4 hour MACD is currently being rejected from Neutral back down into oversold.

The Daily MACD is continuing to fall Bearish and will reach neutral bu the weekend, the 7th

This could be the beginning of a longer term Bearish move and could end up back in the mid 95K before it finishes over the next 8 weeks

HOWEVER, PA does have the ability to turn the tables on the newly woken Bears

We will have to take this a step at a time right now.

But as emtioned in apost earlier today, I do expect us to NOT move to much higher in the near future but more to range once again, maybe for up to 8 - 10 Weeks

We shall see and watching the Dominance chars right now is a VERY good idea

Bitcoin4hchart

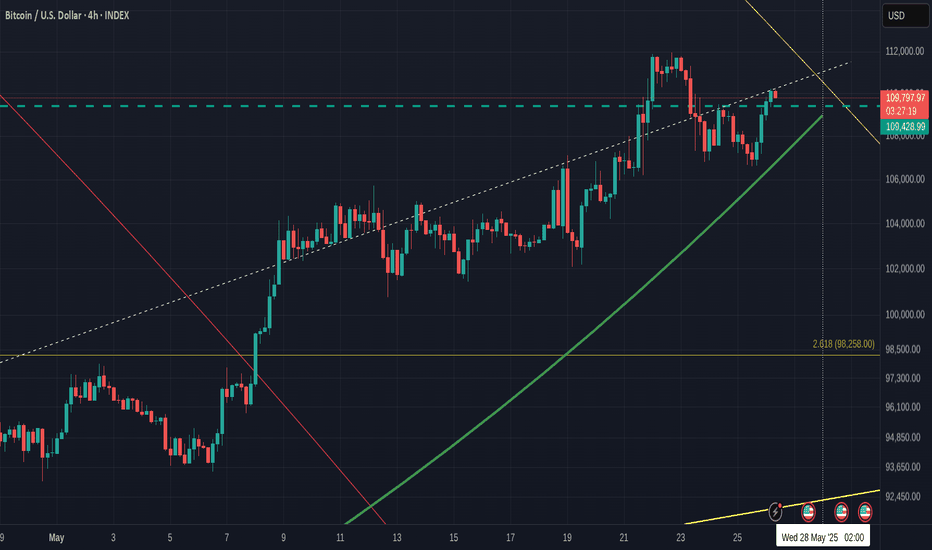

Short term BITCOIN 4 hour Chart and possible moves

As I rite this, we see PA pushing up under a line of local resistance, and being rejected.

Support is not far below on the old ATH line ( blue Dash) and below that we have the rising trned line at around 107K

So we have support all around but we are heading in to the unknown with this Fib circle that is just ahead of us.

As yet, I do not know what to expect.

Previous 618 Fib circles have rejected PA to some degree and so I will expect at least a dip in Price.

But as the MACD is nicely cooled off and rising Bullish just above Neutral, we certainly have the ability to piush through

So, We enter the unknown today but with Bullish intent and the ability to cope but we do need Caution.