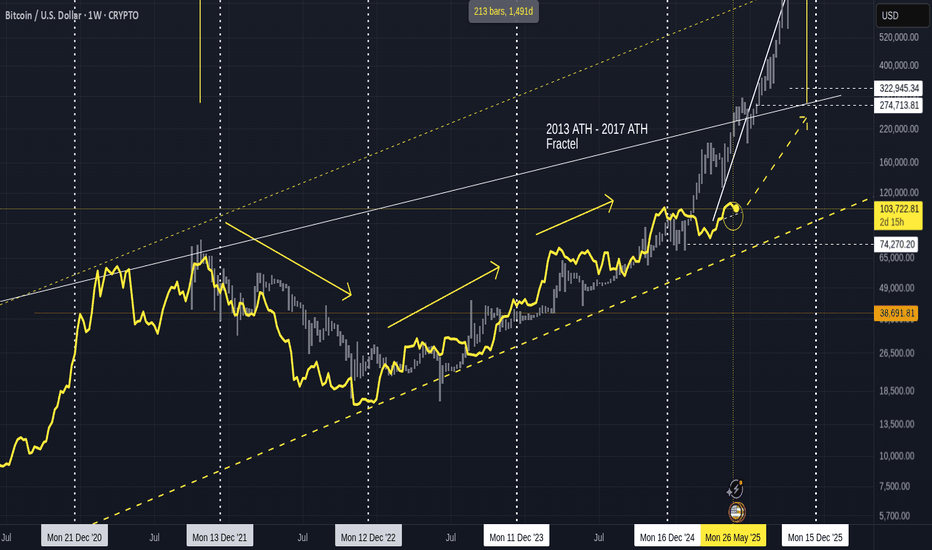

Quick BITCOIN update using old Fractal chart - a small red June

Bitcoin appears to be taking a rest when it is strictly not required.

We are heading towards the 2nd dashed arrow, which as I pointed out months ago is a very possible and more realistic path for Bitcoin to take this cycle.

We have left the 2013 - 2017 Fractal and yet are likely to follow the idea of moving higher to a new ATH from this level off the Fractal.

PA entered that circle I drew back in Feb and is still in it right now, as we can see in the chart below

We can also see how PA has bounced off the 50 SMA on this daily chart.

This does NOT guarantee a continued move higher but it may offer some levels of support.

Should this fail, we do have various levels of support down to around 94K

I will refer back to a previous post and mention that to some extents, I am expecting a RED June. This does not need to be a Big candle, just 1 usd less than the open price wil create that.

104648 was the open price, so, we can easily stay above 100K and create that red candle.

Why do we want a red candle..?

Because, to put it simply, statistically, we have a better chance of continued monthly Green candles after a red june this time

I will attach the chart below so you can read about this in more detail.

This may or may not be good for ALTS>.... but I do not have many now.....just my preference