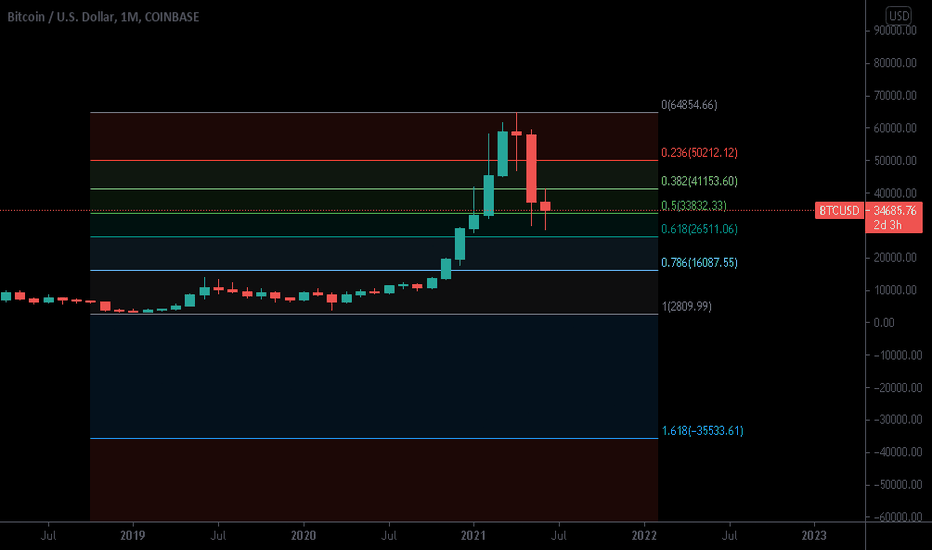

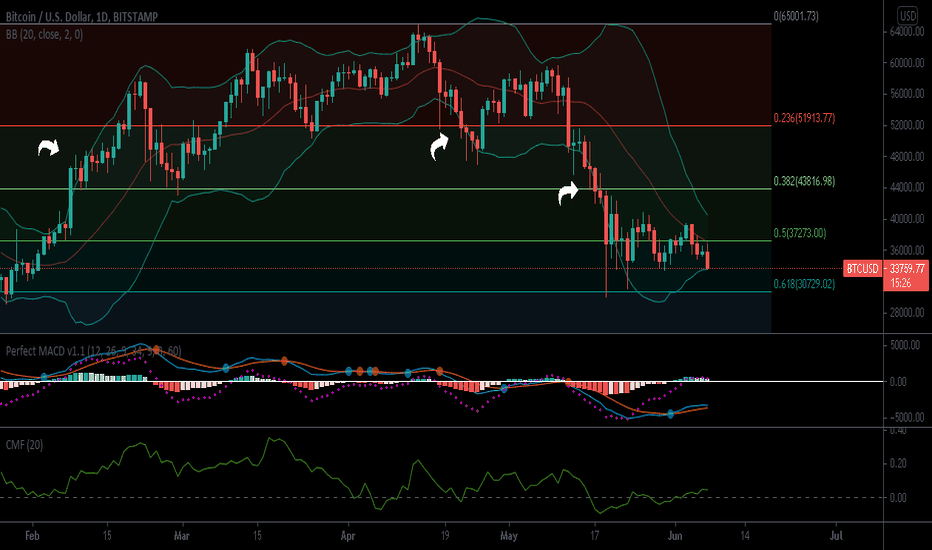

BTC Monthly cooldownLooking at bitcoins monthly chart and the first thing i realized and said to myself is "this could easily be just a cooloff or correction in the macro perspective" and that is exactly what i think. We had an explosive 6 months previous to these 3 and it really does make sense that we need a break or cooldown, and that goes for everything, we need structure/ supports/ floors in order to keep heading up, now if all continues this way we will have a decent looking monthly close for bitcoin. The key here is to definitely stay above the 0.5 FIB level like we managed to do last month and even better would be to close above last months close around 36K. Even if we don't do any of this we could still see another month of bearish momentum which is kind of likely looking at everything from a technical standpoint, but the point is this will be a tiny blip on the macroscale and a much needed cooloff, 6 months of super bullish momentum and im thinking 4 months of cooloff and then we should be back to it. Also this sort of scenario doesn't faze me really, i actually like it for the fact that i can buy more crypto at discounted prices. If you truly believe in blockchain and crypto as beneficial for the future you shouldn't worry and do not let the emotions cause you to make poor decisions, this whole space may feel like we are late but in fact we are super early imo, big companies and institutions only started buying last year and even looking at that is a very very small number of "big money" compared to what can come, countries are starting to adopt crypto and that in itself should say something! Not financial advice just my opinion

Bitcointechnicalanalysis

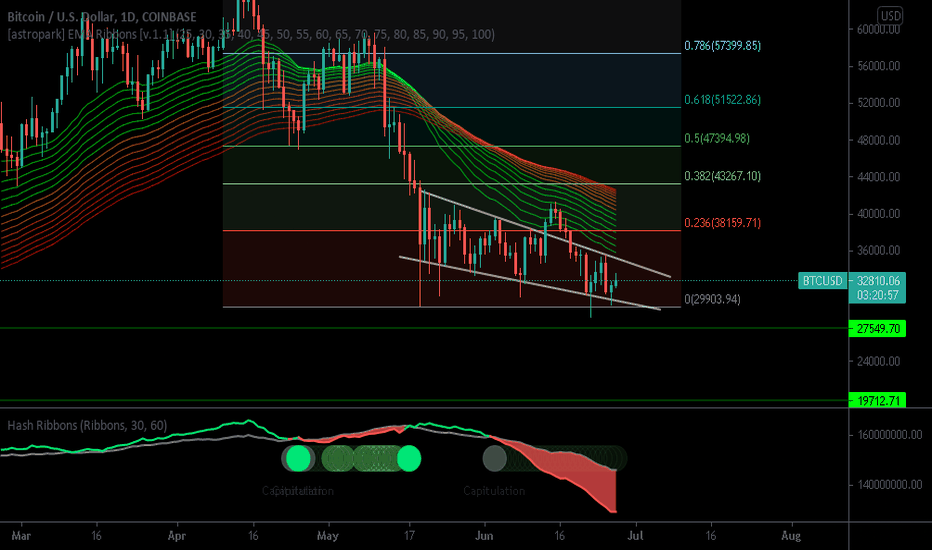

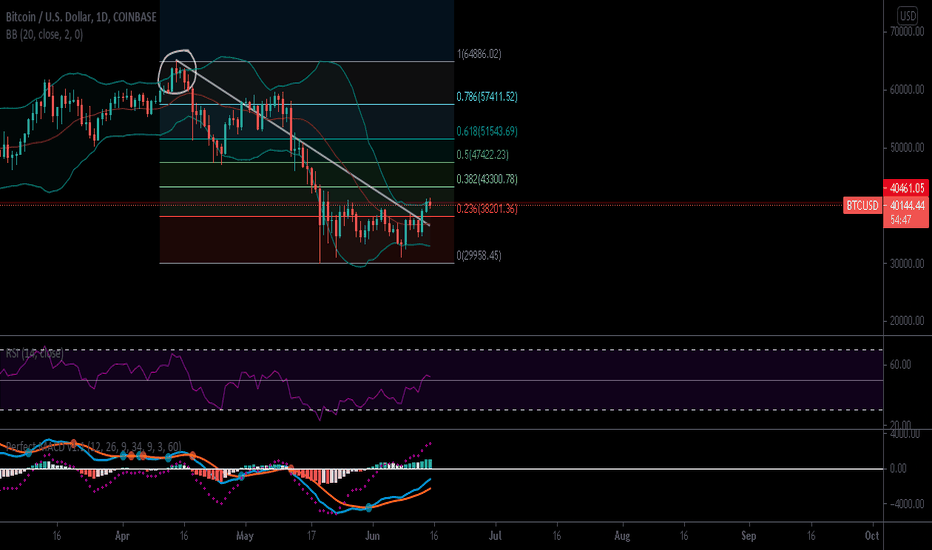

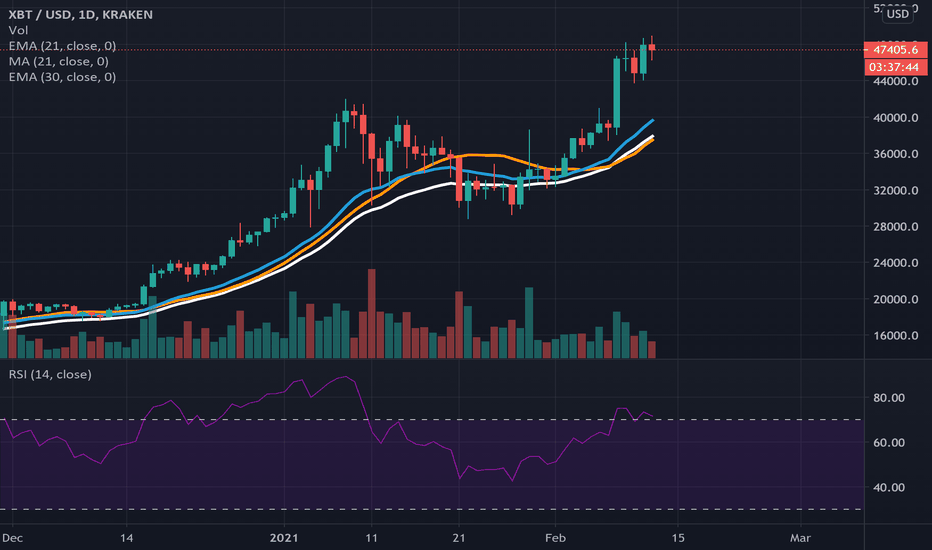

BTC going for 34K again!Bitcoins rallied the past couple days after touching off of the 0 FIB Level or 29K, as we notice we have been in sort of a slight descending channel or wedge and we have been moving sideways pretty accurately in this wedge. We definitely got a bit of room to run here potentially to the top of the wedge or aprx 34-35K. we could see a blast through but that would be kind of unlikely due to our current mini bear market or strong bear trend. One negative indicator i have been talking about recently is the EMA Ribbons we are starting to see the ribbons fully spreading out more and more bearish. the longer this goes on the longer the bear momentum will stay. Ideally we would like to see the ribbons start to compress again and start the whole process of turning back bullish, i say this because it doesn't happen overnight and can be a longer time frame switch. One of the best indicators for BTC in my opinion the.. Hash Ribbons, these don't print very often at all but when they do they do not lie, you can see this by backtesting yourself. right now we are in capitulation like we were recently and we are now looking for that "BUY" signal, we didn't get the signal last time obviously because the market wasn't ready but now this is a top inidacator that i am watching, usually after getting a buy signal we see huge bullish explosions over a longer TF not in a day, but for example a weeks or two weeks time. Not financial advice just my opinion!

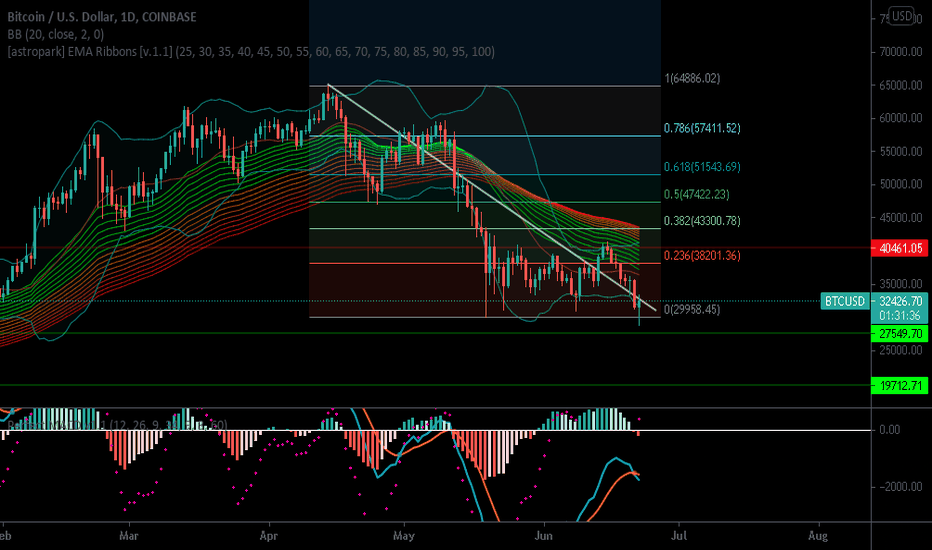

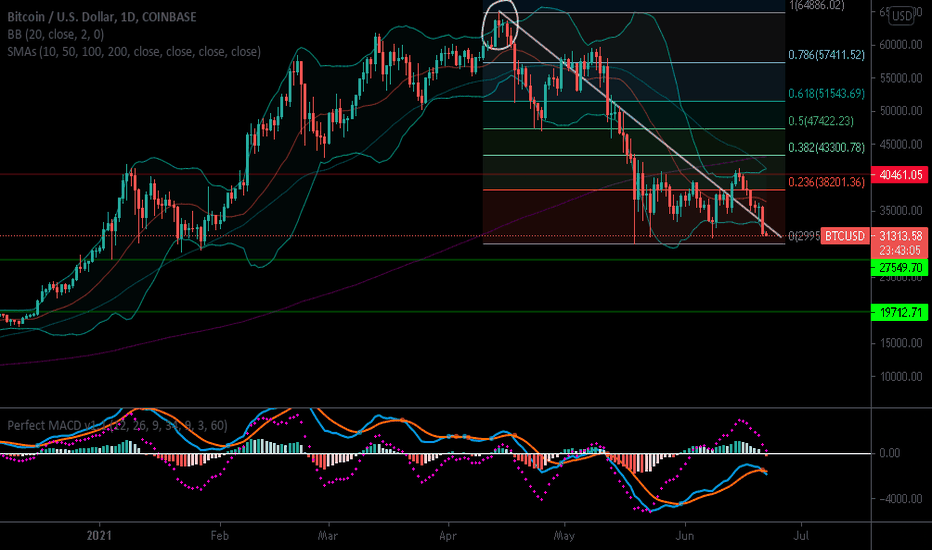

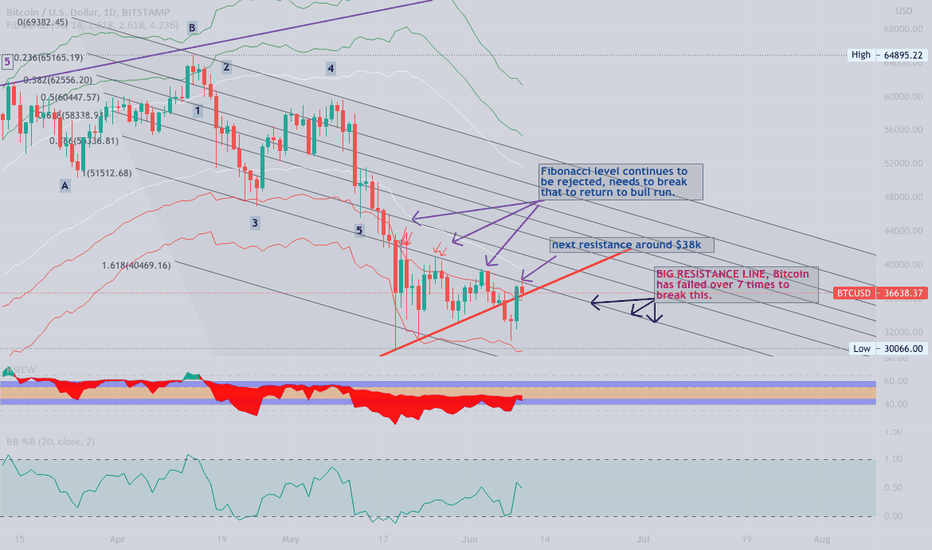

Bitcoin heading to 20K??Bitcoin took a hit today like alts did and we have rallied a little bit back up but i am not convinced the drop is over but thats my opinion. We seem to be getting stuck underneath the downtrend resistance coming from our ATH. We are looking a bit positive for our daily close coming up soon jumping back up from underneath the 0 FIB level. The MACD is holding up a little but we are still pointing down heavy and we would need a full reversal to start seeing some real upside. What concerns me the most is the SMA Death Cross of course, the bollinger bands and the EMA ribbons. We are riding the bottom bollinger band with our candles and if we keep it up like mentioned in recent TA's we will likely see heavier downside. The EMA ribbons aswell, are really almost fully flipped bearish and if we start to see separation in the ribbons with red on top the longer we are away from seeing a real uptrend and reversal, i say this because these ribbons don't flip over night as you can see looking to the left it takes quite some time and that's why we have to watch these. Now looking at support levels, the 0 FIB is getting weaker everytime we wick past it or onto it and once that breaks we are looking at 27.5K which is honestly pretty weak, but there is a chance we bounce off as we haven't seen it in quite awhile, but that depends if this very bearish momentum gains more steam. After that we see 20K aprx which is the next major support we have, we do have weaker supports in between but i would doubt they last very long with this downside pressure. Not to concerned though i view crypto as a longer term game and i don't mind when situations like this happens as i usually pick up more, not just BTC but some of my favourite alts aswell! Not financial advice just my opinion ps. If you have a plan stick to it and dont let emotions mix up your thought process causing you to make poor decisions!

BTC Death Cross!Bitcoin has been falling hard today and over the past week due to China forcing shutdowns of some major mining facilities, BTC Hash Rate fell huge time. We are fast approaching the 0 FIB which is pretty decent support but there is lots of bearish momentum. Next we look at the 27.5K Level which honestly is very shaky weak support. The next very major support is 20K Aprx. There are lots of levels of support in between but they are not as solid as 19.8K. We also see a 50 day 200 Day SMA Death cross which is very bearish but nobody for sure knows. We also are looking at the Bollinger Bands and todays candle is heavily riding that bottom band and almost everytime we do we see a small to larger sized drop, if we continue this way tomorrow there is a definite chance we see the 0 FIB and possibly the lower support levels. The MACD has flipped bearish and is pointing heavily downwards. In my opinion this is not necessarily bad this could provide good buying opportunities and we are even seeing institutional money flowing into BTC like micro strategy. My mindset is focused on the future aswell i believe crypto and blockchain will play a key role in the world in the coming years. Not financial advice

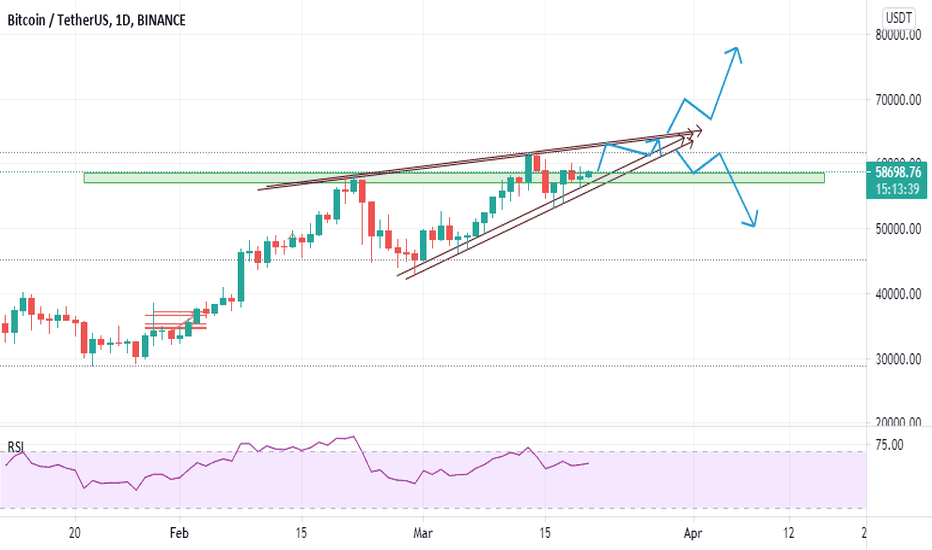

BTC Possible Climb up the Bollinger Bands??!Bitcoin has rallied pretty well the last few days after heading sideways for some time. We notice price action has pushed up towards the top of the bollinger bands, this could be 2 things, we could see a big climb up the top of the BB or we could see a fakeout sort of like what we saw at the top left of the FIB retracement. I personally think we could see a mini run up to the 0.3 FIB and then get rejected most likely, i doubt we would see a big fakeout as we haven't run up that much compared to times before, IMO we are seeing wyckoff accumulation pattern playing out or starting too, thats where i think we will see a rejection around the 0.3 FIB. The RSI is coming down towards the 50. point i think we could see a little bounce off the midline and then most likely fall back down if we reject of the 0.3 FIB. The MACD looks pretty damn good, we are seeing great separation on the MA's pushing higher and no signs of slowing down! Not financial advice just my opinion!

VERY IMPORTANT FOR BTCBitcoin seems to be building up some momentum as we notice lots of sideways movement and our bollinger bands are starting to squeeze, keep in mind this could be bullish or bearish. If you look back in time when bollinger bands begin to squeeze it is almost certain we will see at some point an explosive move, aswell with the bollinger bands as you can see marked with arrows when we begin to ride the top of the band big upwards movement occurs and same with riding the bottom band bug moves to the downside happen. now noticing our candle today is getting really close to the BB specifically the bottom band which if we continue this movement we could be in for another pullback, we don't want to see the candles start riding the bottom unless of course you buy the dips! The MACD aswell is continuing with close movement of the MA's and this is a must watch as we could definitely see a bearish cross anyday now, if this happens and we start to ride the bottom BB we can for sure expect a pullback, no way to tell how big but could be smaller or normal, i doubt a large scale pullback due to the fact we just had a major one that is out of the usual for these cycles. We are seeing some money flowing into BTC but we are starting to curl again downwards with money flowing out, we gotta see some momentum from the buyers if we are going to see a reversal to an uptrend, also need volume which has been very low. Not financial advice just my opinion!

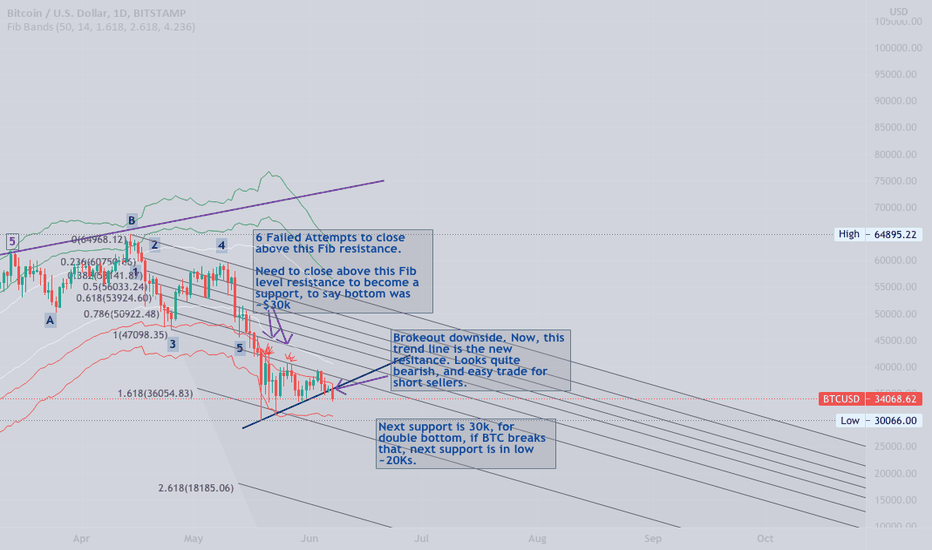

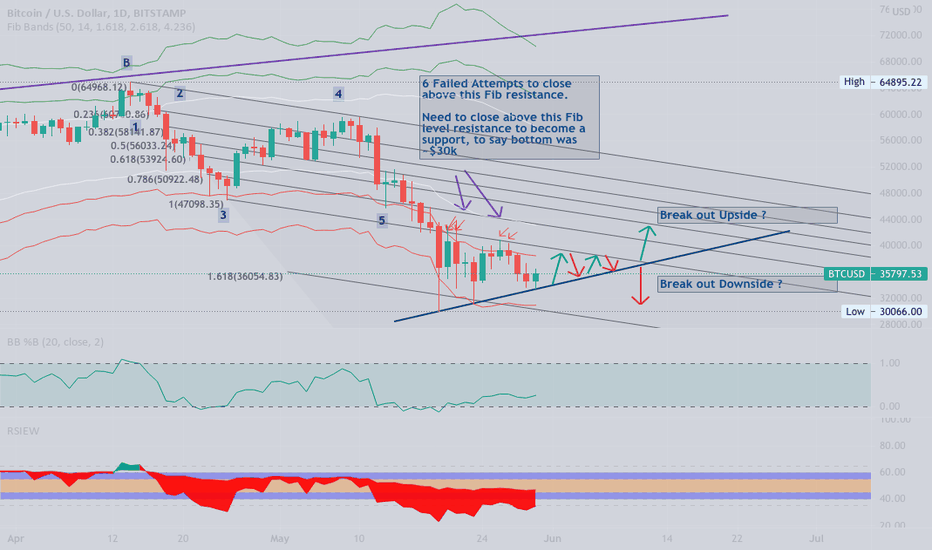

#BTC - Fibonacci support and resistanceHi,

So far, #Bitcoin broke the support and looks quite bearish, next support is 30K for double bottom support, if it breaks it, it'll invite a lot of short sellers drag it down all the way to low $20K.

PS: If TSLA confirms they sold their BTC positions, on Wednesday/Thursday SEC filing should confirm that, if that happens, it'll be a catalyst for short sellers to short BTC and push it down below $30k.

Good luck trading.

#BTC - Fibonacci Levels - Support and Resistance#bitcoin still continues sideways with more downward trending and still shows no signs of breakout to upside.

- Volatility of falling down (red candle) is stronger and faster than upward (green candle), bearish, as buyers aren't enough to pull it up strongly.

- From the chart, such pattern suggests downward probability > upward probability. There's more uncertainty over China miners who're dumping their machines and bitcoins, could continue to sell their bitcoins.

PS: Correction is tricky, nothing suggests upside bull pattern yet. I'm long #BTC but will not add unless the correction is over.

~Happy Trading.

BTC Set to Drop to $18k?I've included a link to a chart by another trader on this platform.

EDIT: I cannot paste the link due to reputation not old enough. I'm new here. But, please search

Crypto Patel: BTCUSD Again Update about Bearish Diversion( Regarding Drop $18k

At first I thought he might have a substance abuse problem, but the more I look at the broader picture, the more I believe he may be right.

Here are "fundamentals" to consider:

1. Google PERFECTLY Predicts Dumps - Use Google Trends to see that "buy bitcoin" interest has reached 100. When that value hits 100, we dump. It hit 100 last month, then we dumped 24 hours later. However, the value that was 100 last month, is now 75 which shows there is an even greater increase in Google Searches for the term.

2. The Fear /Greed Index has been at an average of 92 all week. When the BTC fear greed index is at 92 for this many daily candles, we dump.

3. The "News" has been agressively selling BTC; magazines, television, radio programming. When the "news" sell BTC, we dump. NEVER FORGET when CNBC aired programming where they gave us a click by click tutorial on how to buy XRP when it was $3.25.

4. BTC has NOT touched the 21 Weekly EMA this entire cycle so far, and it did so 6 times the last cycle.

After looking at the charts, I can now see a sub $20k BTC in the picture.

ESPECIALLY since Kraken e-mailed users the other day informing them that BTC will never be lower than $30k again.

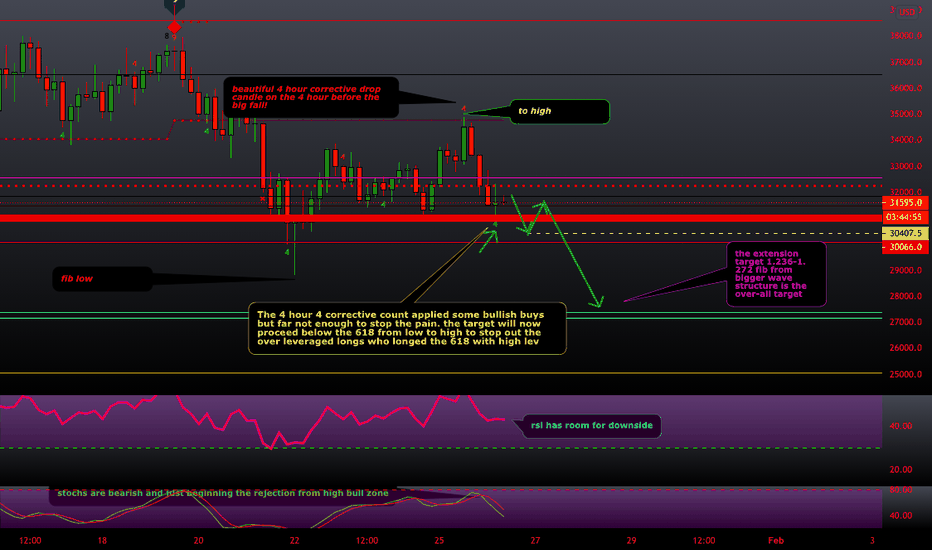

Self explanatory bitcoin SHORT TARGETFOLLOWING THROUGH! been calling the overall structure pretty BOSS lately so lets see if we continue the predictions. I am short from higher levels and will hold until I see 27500 . I WILL ONLY EXIT IF I SEE RESISTANCE RECLAIMED AS SUPPORT ON 2HOUR TIME FRAME OR ABOVE!

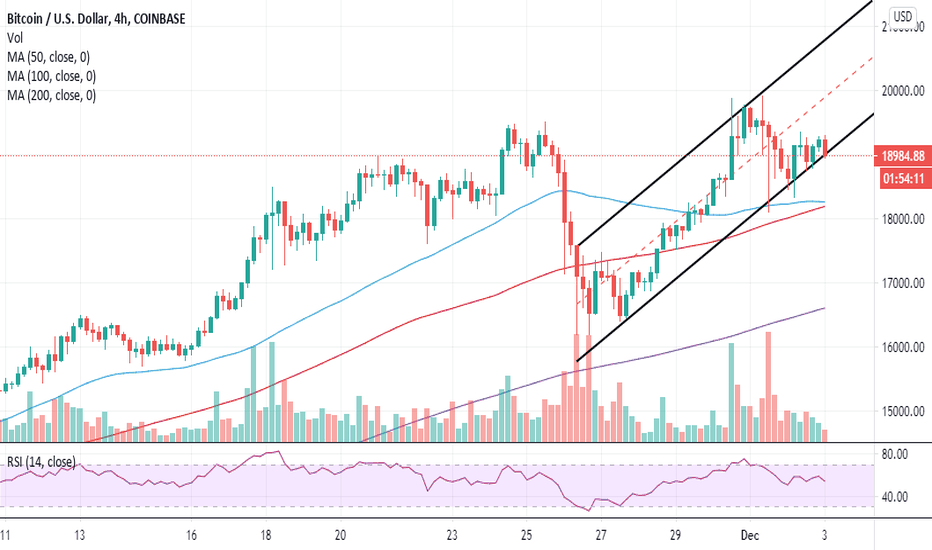

Bitcoin in a precarious situation: To dive to $18,000?

Bitcoin is on the cusp of a breakdown to $18,000 before resuming the uptrend to $20,000.

On-chain metrics reveal a single bump, slightly above $19,000 that must come down to pave the way for gains to higher levels.

Bitcoin appears to have a clear path to the coveted $20,000. However, attempts to break out to the higher levels have proved unsuccessful in the last 48 hours. Resistance has continued to intensify under $19,500.

At the time of writing, BTC/USD is teetering slightly above $19,000 amid developing bearish pressure. The desire among the bulls is to hold above the ascending parallel channel’s lower boundary support.

However, the most probable price action is to drop toward $18,000 before a significant reversal comes into the picture. Beneath, $19,000, the 50 Simple Moving Average and the 100 SMA on the 4-hour chart are in line to offer support and absorb some of the selling pressure

Short term technical analysis reinforces the bearish technical picture with the Relative Strength Index gradually moving towards the midline. Moreover, it is doubtful that the channel’s lower boundary support will stay intact, especially now that sellers are pushing to regain full control over the price.

Meanwhile, IntoTheBlock’s IOMAP chart reveals that the flagship cryptocurrency is facing a tough resistance between $19,021 and $19,079. The seller congestion must be weakened before BTC blasts massively to $20,000. Here, nearly 694,000 addresses had previously bought roughly 458,000 BTC.

On the downside, the king of cryptocurrencies is sitting on areas with immense support, likely to invalidate the bearish outlook eyeing $18,000. For now, the most robust anchor zone lies between $17,882, $18,442. Here, approximately 579,000 addresses had purchased nearly 368,000 BTC. Therefore, consolidation might take precedence between $18,500 and $19,000 before a significant breakout comes into the picture.

Bitcoin intraday levels

Spot rate: $19,050

Relative change: 170

Percentage change: -0.9%

Trend: Bearish

Volatility: Low

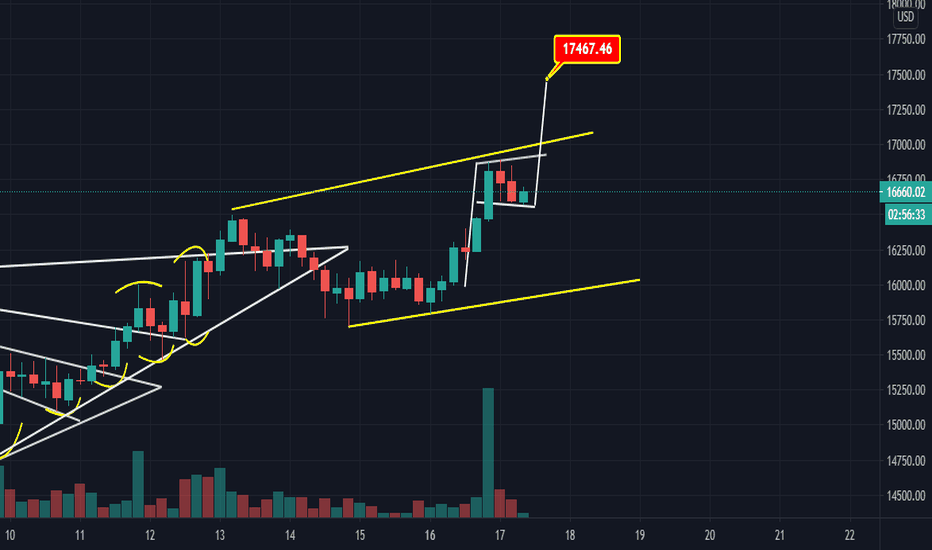

My take on BTCUSDMy analysis of BTCUSD is simple and straightforward. We should watch and see if it's going to break above 14.5k or the bears will jump in at the longer-term resistance line. Bitcoin is more likely going to drop to the 13.6k support on the 4HR chart if 14.5k is not broken. If that happens, we might see a further drop to 12k.

However, closing daily candles above 14.5k is a sign that Bitcoin will head back to 16k and 17k eventually.

I'm more bearish, but the news and the USA elections may not respect technical analysis.

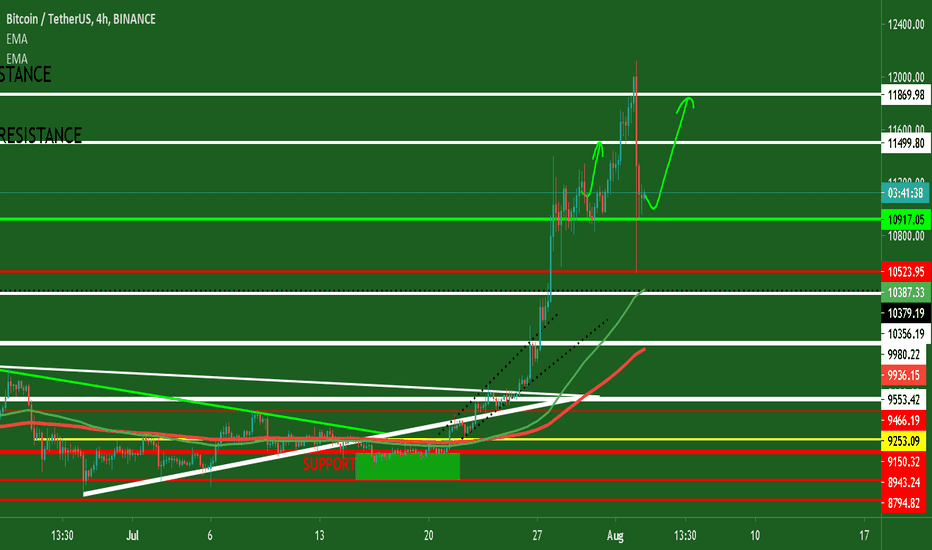

Long Position: Bitcoin into the descendent triangle!!!IN H1 timeframe there is a good opportunity to buy Bitcoin just for gains limited, because Bitcoin is formed a descendent triangle and trend is becoming morbearish!!! Now, we are in this simetric triangle flag, but as reference we touch an important support that bulls are make resistance on this zone!!!

Remember that in H4timeframe there's a limited gains until the $11,540 USD. And approximately in this price, we turn to put in short position approximately at $11,500-$11,600 that is a good zone to short position until the $10,500 USD to pick down benefit on Bitcoin.

And rememebr that we're here into this simetric triangle of re-accumulation, but for the next days we hope htat Bitcoin is leading to the $10,500 USD to then, put long position!!!

Good luck on this long posiiton trade.

I put a buy order limit at $11,260 USD wiht a SL at $11,080 USD and my target profit will be $11,540 USD.

Good luck!!!

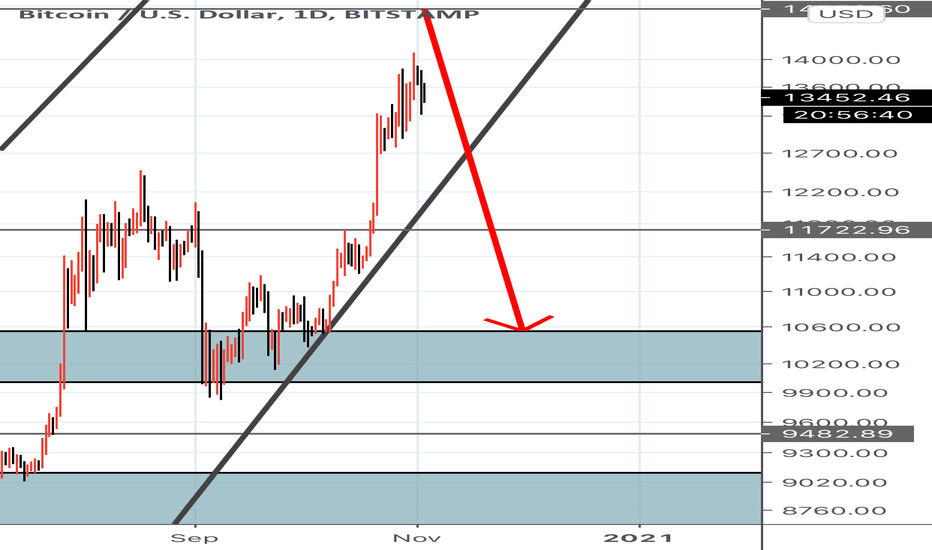

Bitcoin Technical Analysis: BTC Retreat Imminent

Bitcoins bullish momentum loses steam on encountering the 50-day EMA resistance.

Declines linger as long as BTC cannot climb above the 50% Fibonacci level.

Bitcoin explored levels in the key support range between $10,000 and $10,200 earlier this week. The last few days have been used by the bulls to correct the retracement from the resistance at $11,200. Initially a hurdle at $10,600 sent buyers back to the drawing board. However, Bitcoin sprung upwards once again on Thursday. This time the hurdle at $10,600 was easily pushed into the rearview. Unfortunately, bulls seem to be struggling with the resistance at the 50% Fibonacci taken between the last swing high of $12,484 and a swing low of $9,050.

The Relative Strength Index (RSI) has recovered from levels closer to the oversold but is holding ground at the midline. A sideways movement suggests that bulls are getting exhausted. It is essential that the resistance at $10,788, a confluence formed by the 50-day Exponential Moving Average (EMA) and the 50% Fibonacci level is overcome.

The movement to the north will give the flagship cryptocurrency energy to bring down the resistance at $10,800. Buyers will also get an opportunity to shift their focus to $11,000 and $11,200, respectively.

It is worth mentioning that the failure to rise above the immediate resistance at the confluence could culminate in Bitcoin settling for a retreat in order to create demand at lower levels. On the downside, support is envisaged at the 100-day EMA. If declines overshoot this zone, the support range at the beginning of the week will come in handy. Note that, September’s primary support at $9,800 remains intact and the last resort that could be used to halt declines eyeing $9,500 and $9,000.

Bitcoin Intraday Levels

Spot rate: $10,706

Percentage change: -0.32%

Relative change: -0.34

Trend: Short term bearish bias

Volatility: Low

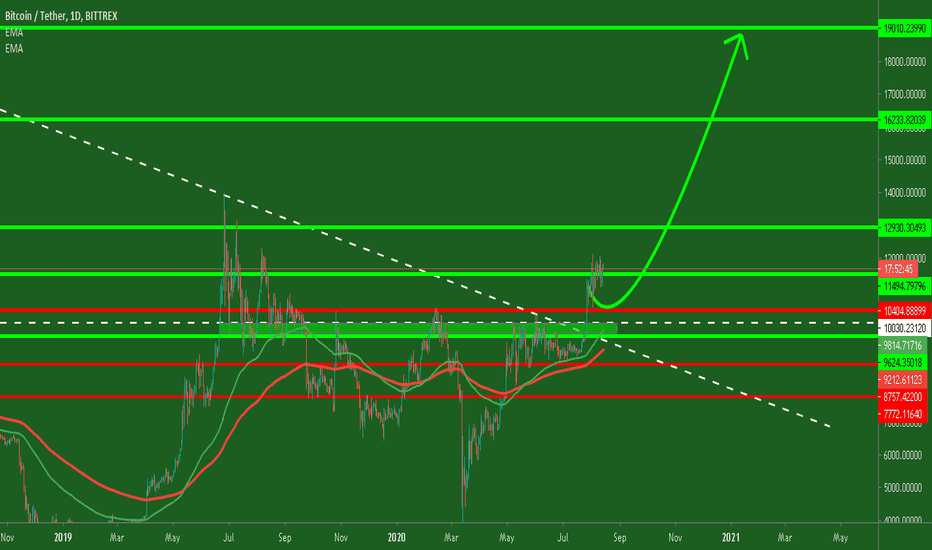

Golden Cross, Death Cross, and Halving - Time ComparisonsUsing a 50/200 MA I've laid out time frames between the various occurrences of golden crosses, death crosses, and halvings.

Wanted to share with the community and see what theories any of you may have from seeing this and if you're noticing any patterns.