Boeing (BA) Share Price Could Reach 2025 HighsBoeing (BA) Share Price Could Reach 2025 Highs

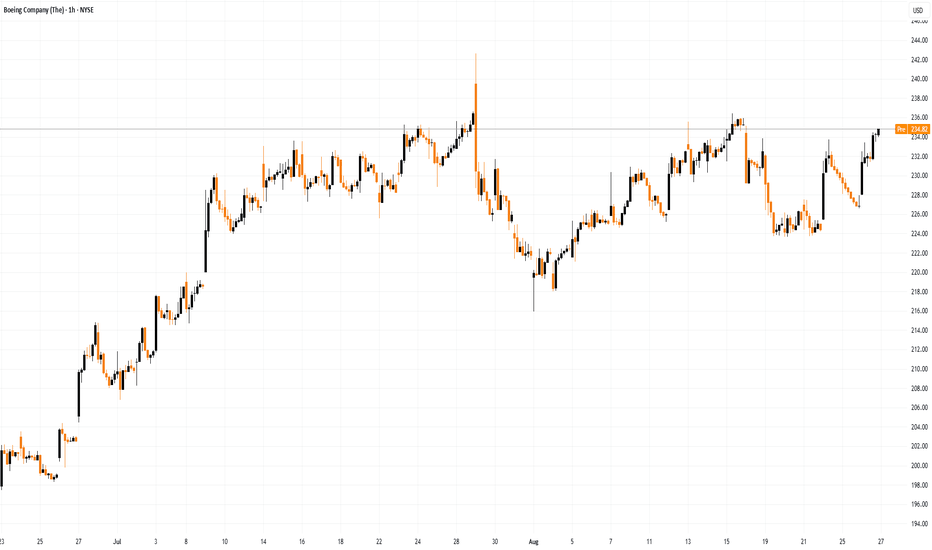

As the Boeing (BA) stock chart indicates, the price rose by 3.5% yesterday, while the S&P 500 index (US SPX 500 mini on FXOpen) gained only 0.4%. Boeing’s stronger performance reflects optimism driven by news (and market rumours) reported in the media suggesting that:

→ Korean Air has purchased more than 100 aircraft during the newly elected South Korean president’s visit to the White House;

→ Boeing is negotiating the sale of 500 aircraft to China;

→ the Trump administration may acquire stakes in companies linked to the defence sector (Palantir, Boeing, Lockheed Martin).

Technical Analysis of BA Stock Chart

BA’s price fluctuations have formed an upward channel (shown in blue). However, at the end of July, the rally encountered resistance around the $235 level:

→ following a volatility spike at the end of July (triggered by the quarterly earnings release), the price retreated towards the lower boundary of the channel;

→ in mid-August, the price turned downwards again from this level.

At the same time, we can observe a sequence of higher lows (1-2-3), emphasising that the lower boundary of the channel is acting as key support, setting the pace for BA’s growth trajectory in 2025.

It is worth noting that the stock’s oscillation between support (the lower boundary) and resistance around $235 is creating bullish patterns such as an Ascending Triangle and a Cup and Handle.

Should reports of a potential Boeing share purchase by the US government be confirmed, the BA stock price could advance to new annual highs. In such a scenario, several factors could be important:

→ the price may subsequently consolidate around the channel’s median;

→ historically, the $250–260 zone has acted as significant resistance during 2021–2023;

→ the $235 level may switch roles to become support, similar to the way $218 previously did.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Boeingcompany

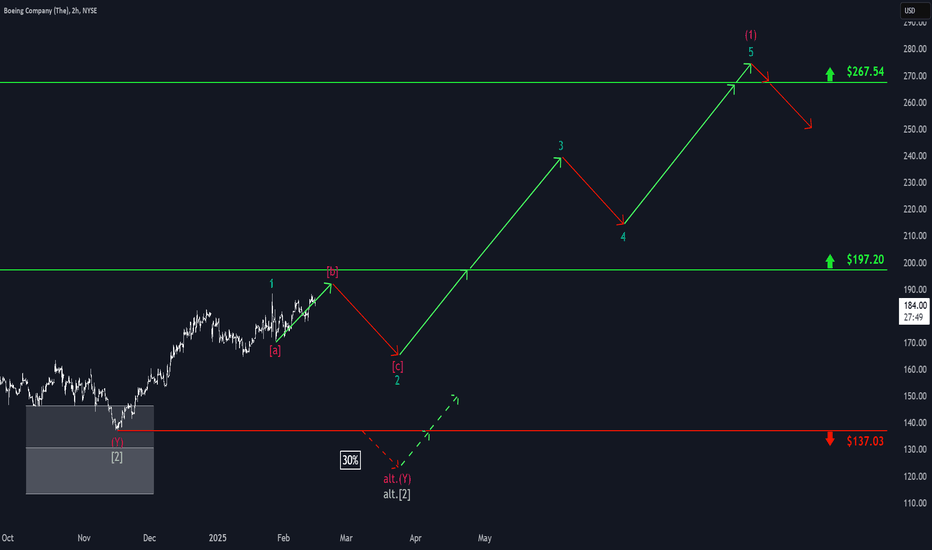

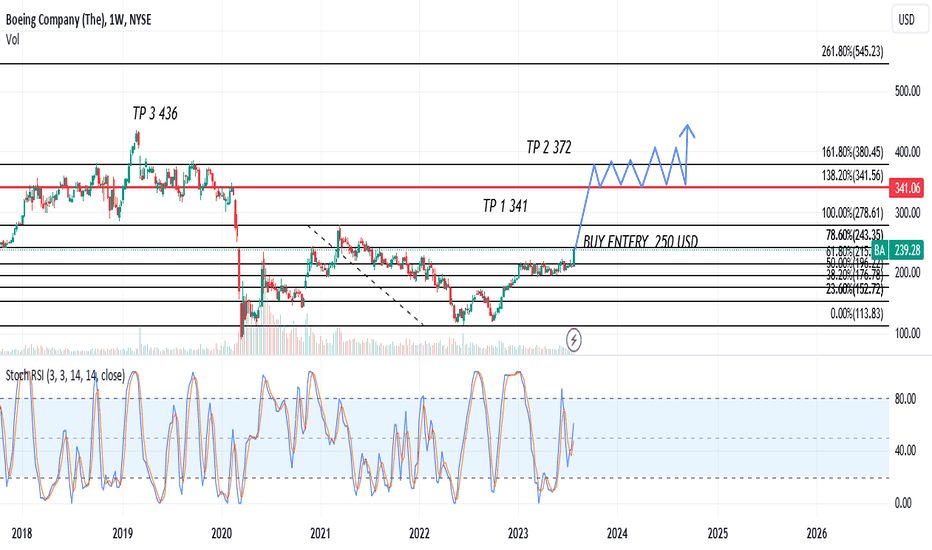

Boeing: More RoomBoeing recently climbed higher, and we still grant the magenta wave slightly more room on the upside. However, this corrective upward movement should come to an end below the resistance at $197.20 and transition into the sell-off phase of the same-colored wave . This movement, in turn, should complete the overarching turquoise wave 2 while remaining above the support at $137.03. Afterward, the price should surge beyond the resistance at $267.54, allowing the larger magenta wave (1) to conclude. On the other hand, we see a 30% chance that Boeing will form a fresh low below the $137.03 mark during the green wave alt. .

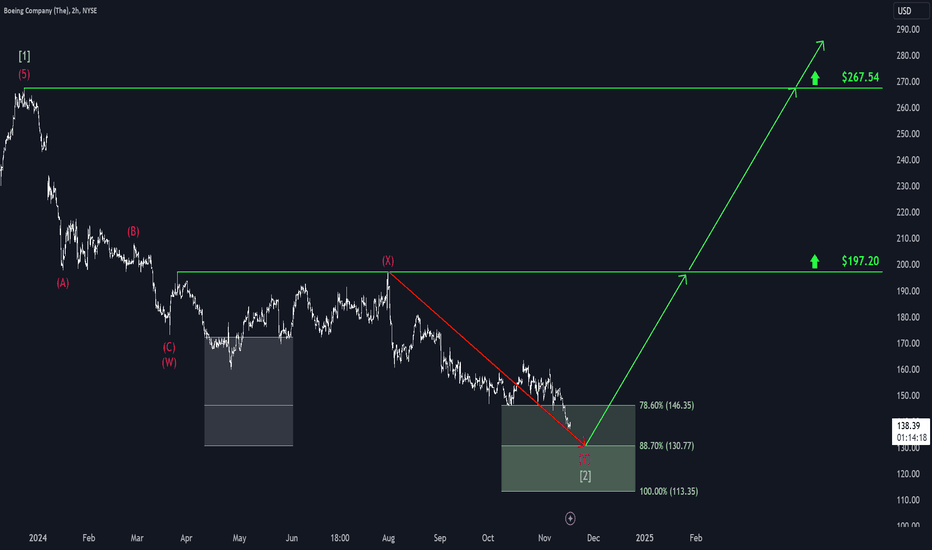

Boeing: Long Opportunities!As expected, Boeing has recently moved down into our green Target Zone between $146.35 and $113.35. Within this price range, we anticipate the low of the green wave . Once this low is established, we expect the stock to resume its upward trajectory, as the subsequent green wave should have significant potential, targeting levels well above the resistance at $267.54. Our Target Zone can thus serve as an entry point for long positions. To manage risk, traders could place a stop-loss 1% below the lower boundary of the Zone.

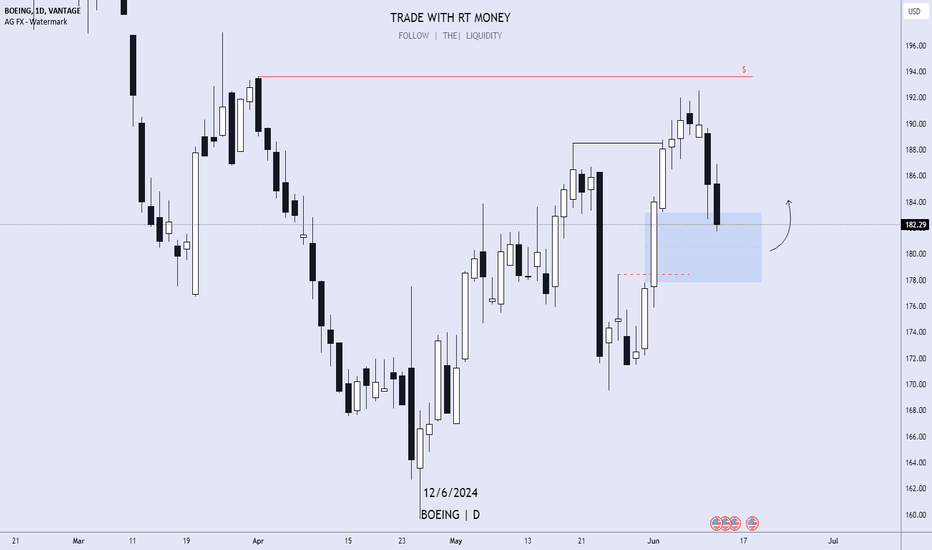

BOEING.... Potentially BULLISH!Price has traded through the swing swing high, and pulled back into the +FVG.

This FVG has a couple of confluences that support higher prices, including a Breakaway Gap, a Balanced Price Range, and an overlapping Weekly +FVG.

I believe the +FVG will hold, and push price higher.

Should the +FVG fail, the Swing Low will become the draw on liquidity.

Boeing's Medium-Term Challenges: Implications for InvestorsBoeing, a cornerstone of the aerospace industry, has outlined ambitious targets for 2025/2026, aiming for a multiyear uptick in airplane production and substantial improvement in its defense sector. However, challenges in meeting these milestones have surfaced, prompting investors to reassess the stock's trajectory and long-term potential.

Management's vision for 2025/2026 includes achieving $10 billion in free cash flow (FCF) after deducting capital spending, a target crucial for Boeing's financial health and investor confidence. Yet, recent setbacks, including manufacturing quality issues and delays in Boeing 737 deliveries, have cast doubt on the feasibility of these goals.

The delay in reaching these targets is not solely due to supply chain disruptions but also stems from persistent manufacturing quality problems, exemplified by recent incidents like the Alaska Airlines flight panel blowout. These challenges have prompted management to postpone 2024 guidance, signaling potential hurdles ahead.

Furthermore, Boeing Defense, Space, and Security (BDS) have consistently reported losses, adding another layer of complexity to Boeing's roadmap. While industry peers face similar margin pressures, Boeing's reliance on fixed-price development programs in a challenging economic environment exacerbates the situation.

Despite these setbacks, Boeing's CFO remains optimistic about reaching the $10 billion FCF target, albeit acknowledging potential delays. The timing of achieving this milestone carries significant implications for investors, with projections suggesting a potential stock return of up to 56% if achieved by 2025.

However, Boeing's current debt obligations underscore the urgency of achieving these targets for debt repayment and future investments. CEO David Calhoun's indication of a new Boeing plane not before 2035 emphasizes the importance of maximizing FCF in the interim.

While Boeing's long-term prospects remain promising, investors must consider the timing nuances of its FCF generation and operational challenges. Other aerospace stocks may offer better short-term prospects, highlighting the need for Boeing to demonstrate consistent operational performance to regain investor confidence.

In conclusion, navigating Boeing's medium-term challenges requires a careful assessment of its ability to overcome manufacturing hurdles and achieve its FCF targets. While the stock holds long-term potential, addressing current setbacks is essential to reinforce investor trust and pave the way for future growth.

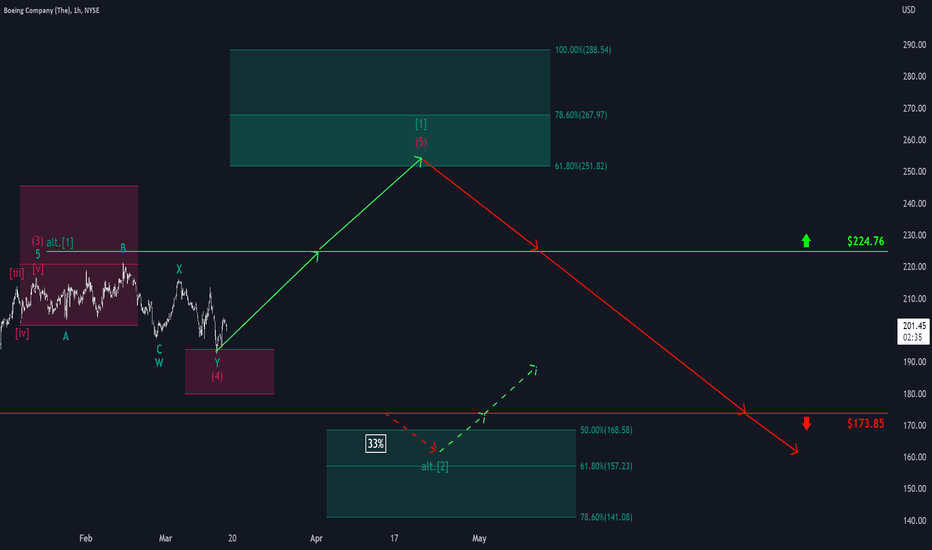

Boeing: Aerobatics ✈️Welcome to Boeing’s aerobatics-show! Watch with bated breath as the share is taking off from the magenta-colored zone, propelling toward the resistance at $224.76, which it should conquer soon to conclude the loop of wave 1 in green in the green zone between $251.82 and $288.54. Then, in a death-defying stunt, Boeing should drop back below $224.76 and dive below the support at $173.85 afterward. However, there is a 33% chance that Boeing could curb its boost earlier, slipping below $173.85 prematurely to develop wave alt.2 in green into the green zone between $168.58 and $141.08. In that case, wave alt.1 in green would have already been finished in January.