BOIL

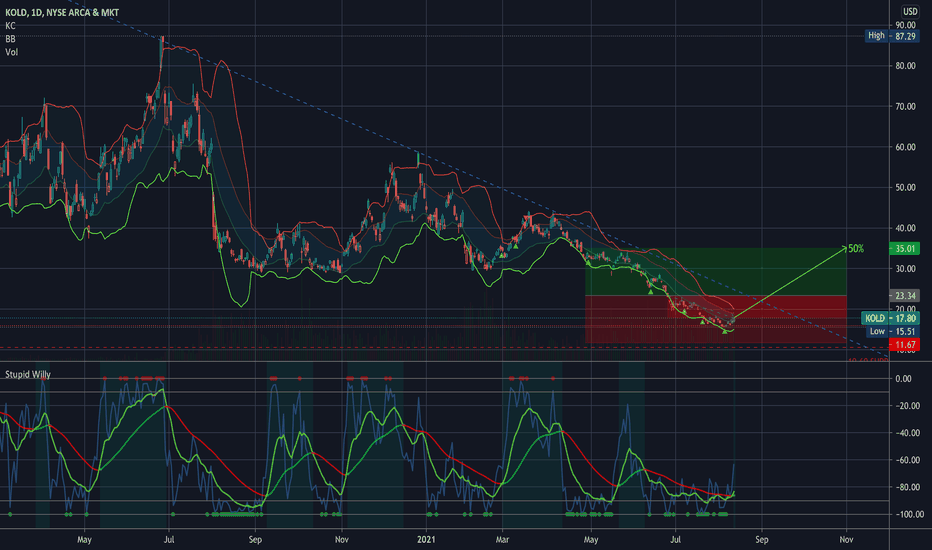

KOLD - Our Biggest Bet YetWhat is KOLD?

KOLD is 2x bear Natural Gas ETF that moves based on the price of Natural Gas futures.

Natural Gas futures shot up to insane levels this year, and we believe that natural gas prices will drop very quickly.

Natural gas futures usually rally 3-4 months before winter starts.

This is because energy providers across the world are trying to price in a good deal for when the winter season comes.

Now that winter is here and will be over quickly due to global warming, Natural Gas prices are dropping fast.

Making KOLD gain quickly.

We've been buying KOLD since it was $7, and slowly adding in at $8,$11,$12.

We will be adding more as this is one of our biggest positions.

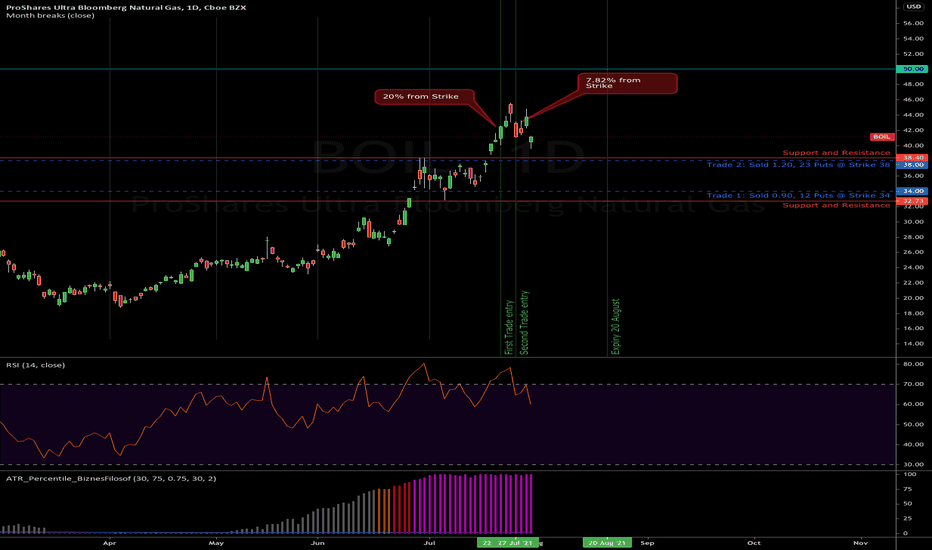

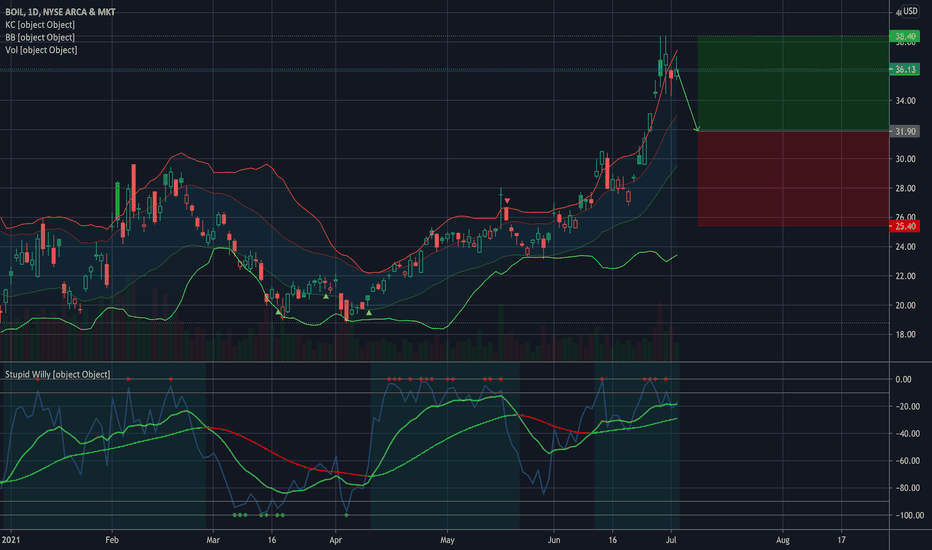

BOIL ETF Bullish inclined Naked Puts 20 Aug ExpiryBoil is a new ETF that I am trading to shield myself from inflation concerns. So far it has only risen even when inflation concerns are impacting the market negatively, even oil and gold saw drops.

I entered two trades with one being tighter than the other (Trade 2), with a bid to get a better price at a strike supported by a strong resistance and bullish momentum. Still in hindsight I think this is a tad too aggressive. Will not do this again.

BOIL is based on Natural Gas Futures.

Prices for the fuel are soaring across the globe as scorching weather stokes demand for electricity to run air conditioners.

In the U.S the rally is also underpinned by concern about a potential supply shortfall in the winter, when gas consumption peaks as homes and businesses crank up the heat. Stockpiles are already below normal for the time of year, and production growth has been restrained

Gas only makes up 34% of total US energy consumption

Trade 1

Sold 12 Puts @ 0.90 Strike 34

Max Gain: Est $1080

% Distance to Strike: 20%

Trade 2

Sold 23 Puts @ 1.20 Strike 38

Max Gain: Est $2760

% Distance to Strike: 7.82%

Total BP Block: 75K

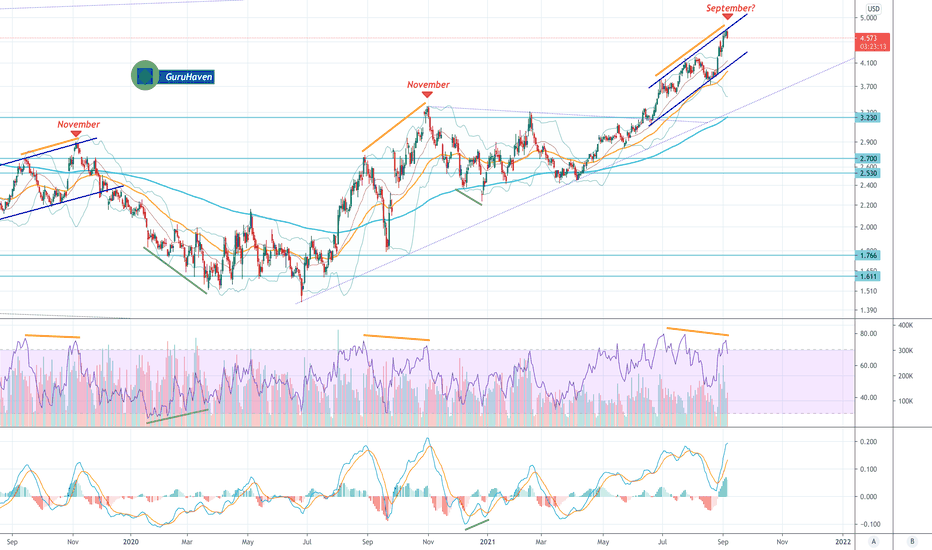

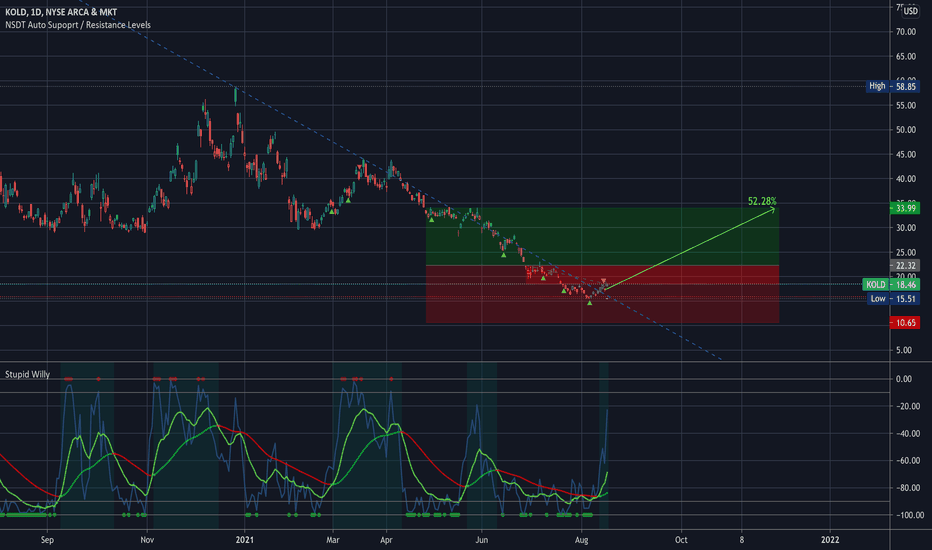

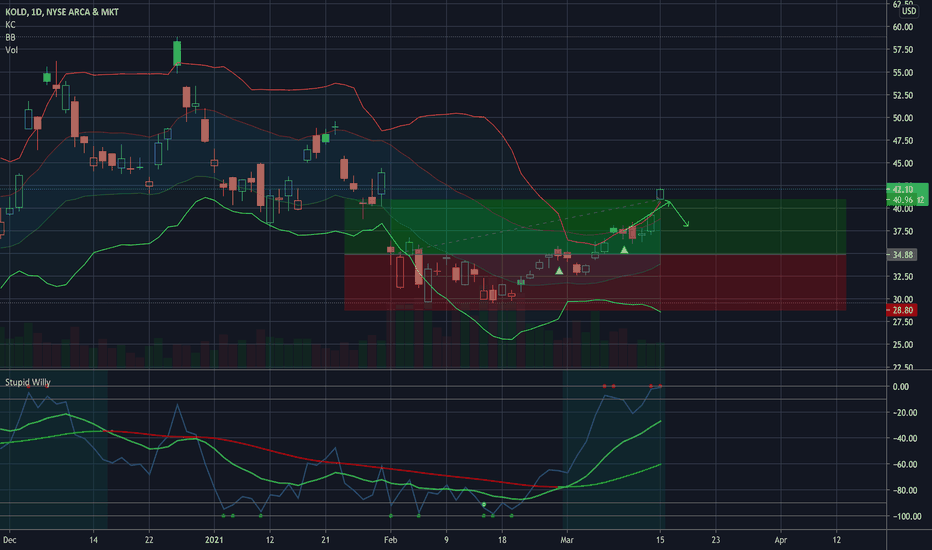

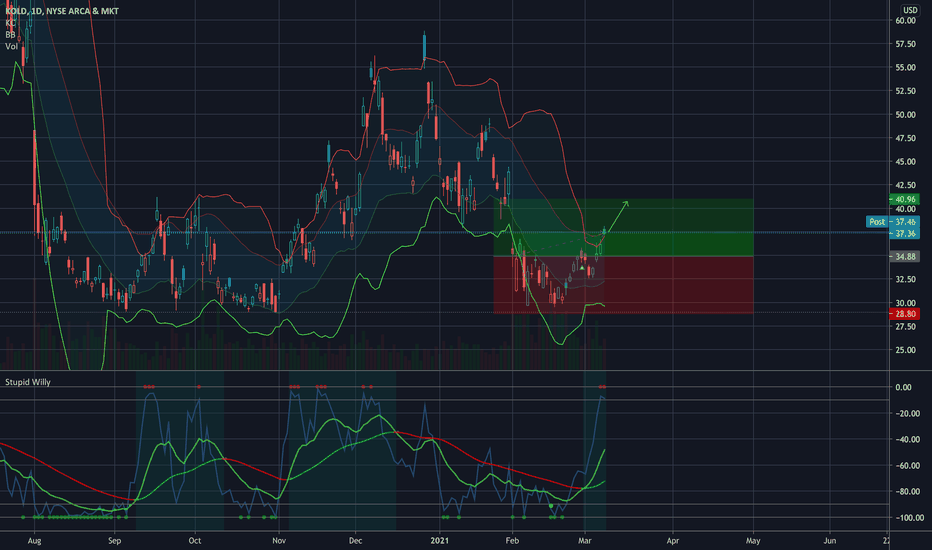

$KOLD Target 33.99 for 52.28%$KOLD Target 33.99 for 52.28%

If you know anything about Natty and my setups with natty you KNOW this will happen… kind of like this… perhaps with a little adjustment.

I did add some yesterday but was unable to update... sorry y'all...

I really kind of miss UGAZ / DGAZ right now…

-----

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

ONLY ADD at support levels & FIB levels… labeled

I start every position with .5 - 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

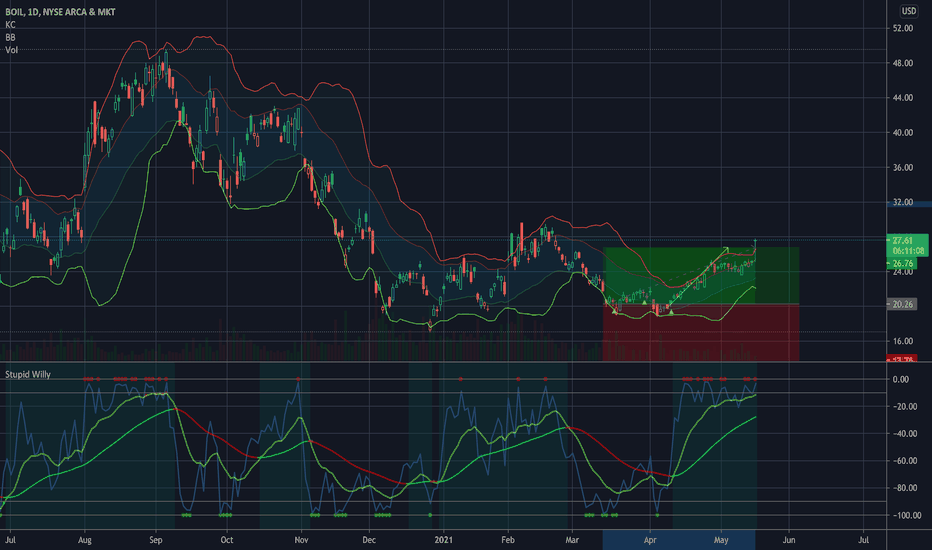

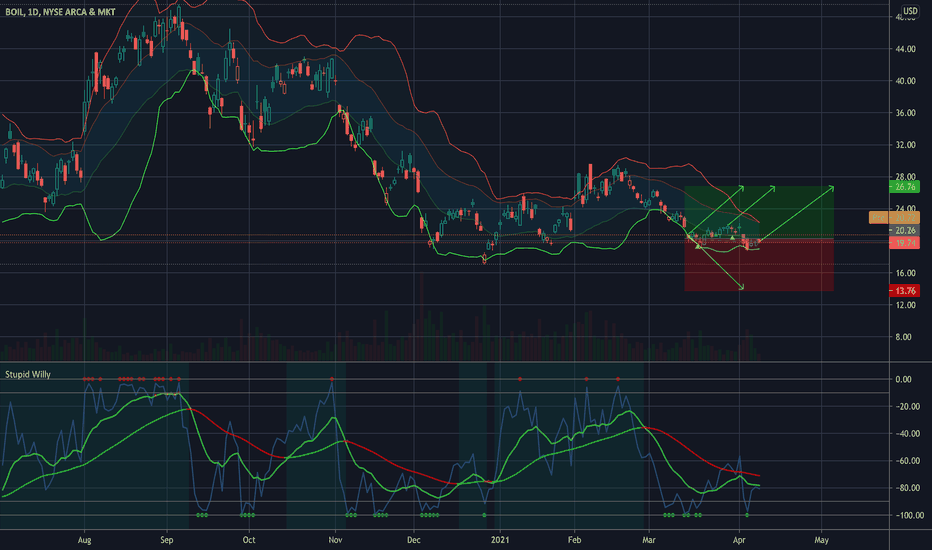

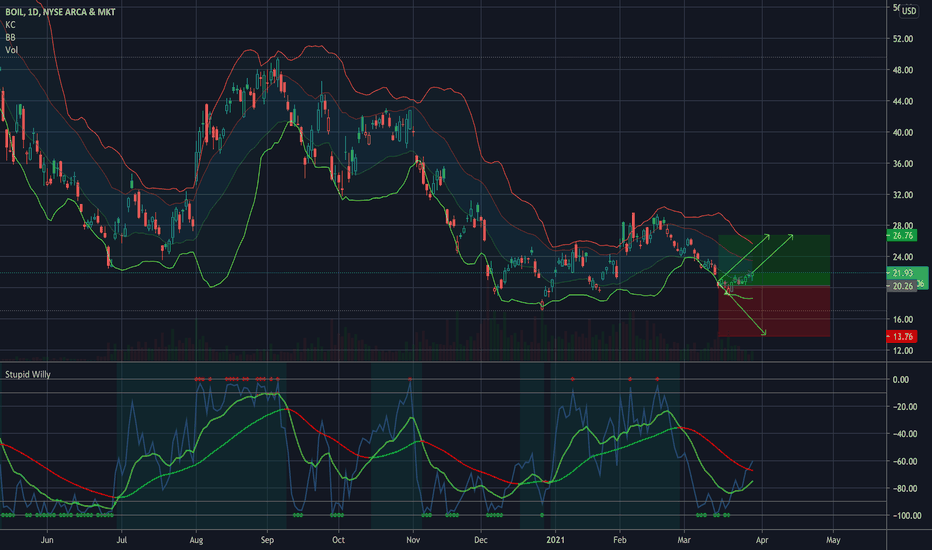

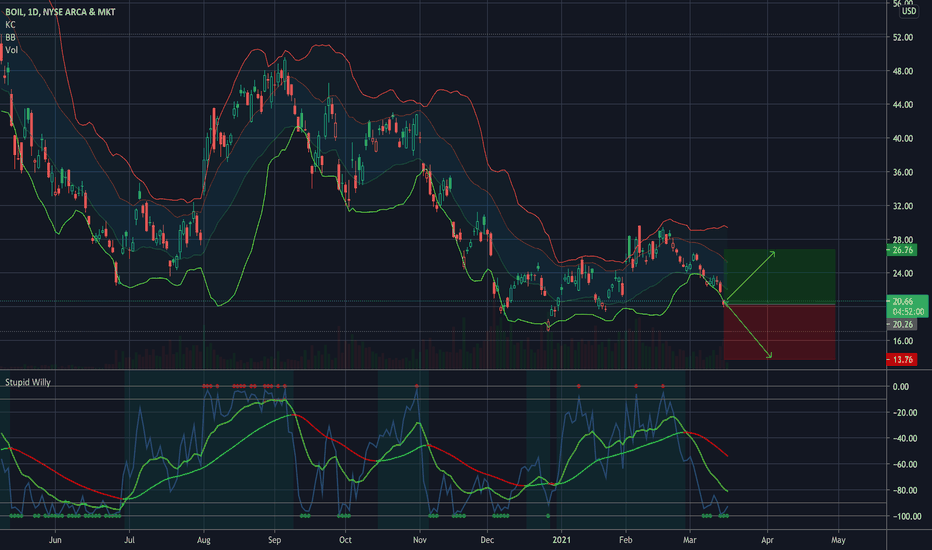

$BOIL Target 26.76 for 32.08% $BOIL Target 26.76 for 32.08%

Or next add level is at 13.76

I meant to publish this last night but fell asleep. Target still holds...

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I start every position with 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

Still on track so far --> $BOIL Target 26.76 for 32.08% $BOIL Target 26.76 for 32.08%

Or next add level is at 13.76

So far so good… I sure do love trading Natty

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

$BOIL Target 26.76 for 32.08% Or next add level at 13.76$BOIL Target 26.76 for 32.08%

Or next add level at 13.76

I started this BOIL position after selling KOLD yesterday. Let’s see what happens. Go Natty.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

TARGET HIT @ 40.96 for 17.43% Profit in 49 days. TARGET HIT @ 40.96 for 17.43% Profit --- Yikes, long hold for 17.43% (49 days) but hey, natty is like that sometimes and other times you can get 17% in two days, so no complaints here.

I took profits today. . . The target was set when I bought it 49 days ago.

GL to those who sell higher…

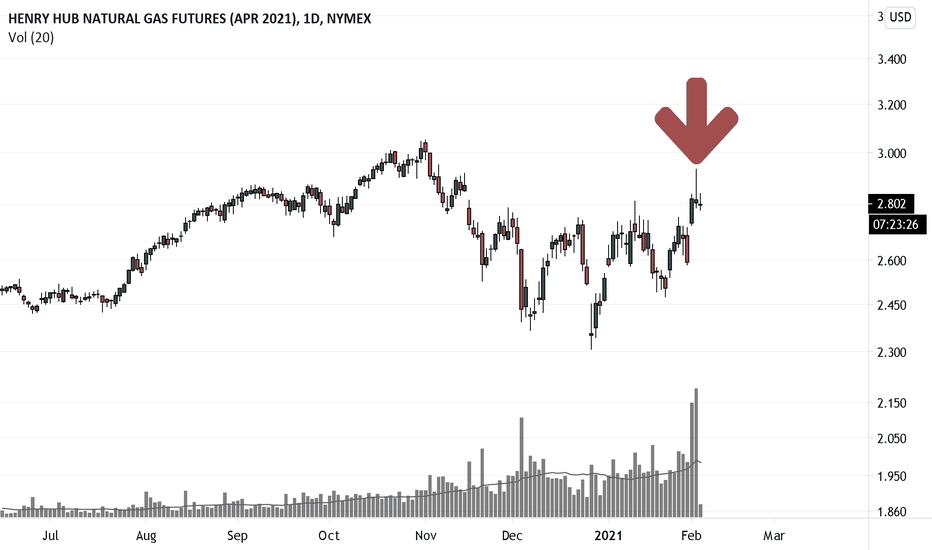

Short-term Spring ShortNatural Gas got a nice boost from colder weather. Looks about ready to crumble in the next month or so.

I am short April(J) @ 2.81

Worst case on this is if weather defies it's tendency to flip bearish and the longer time frame trend line is targeted. But, it will take a lot to push past the highs at $3.00 (April). In which case adding another short there could work.

Bearish inverted hammer on yesterday's move signals selling is strong and this is the top of a channel.

Red box shows that upside risk and below there are a couple gaps that look promising.

Trading is risky, don't do it.

I am still long August(Q), EQT, RRC and would add on significant dips on any of those.

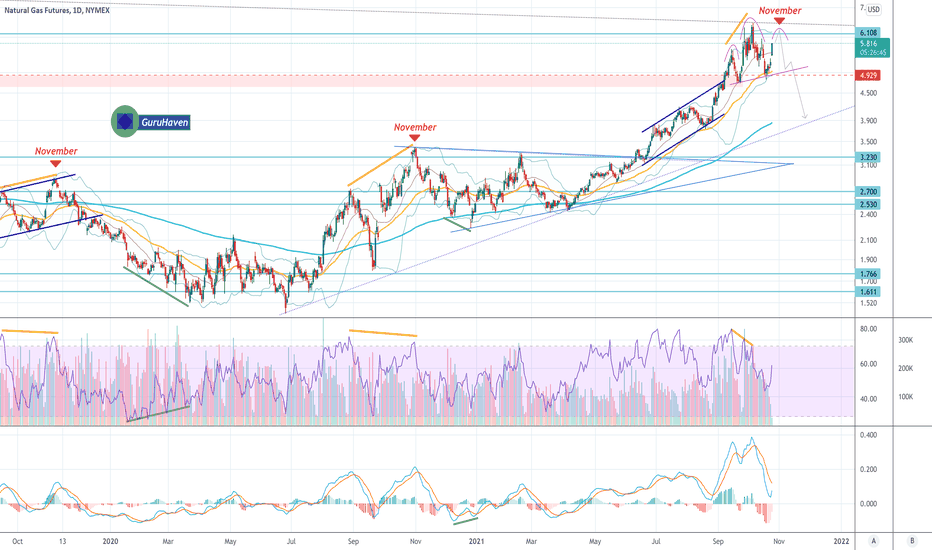

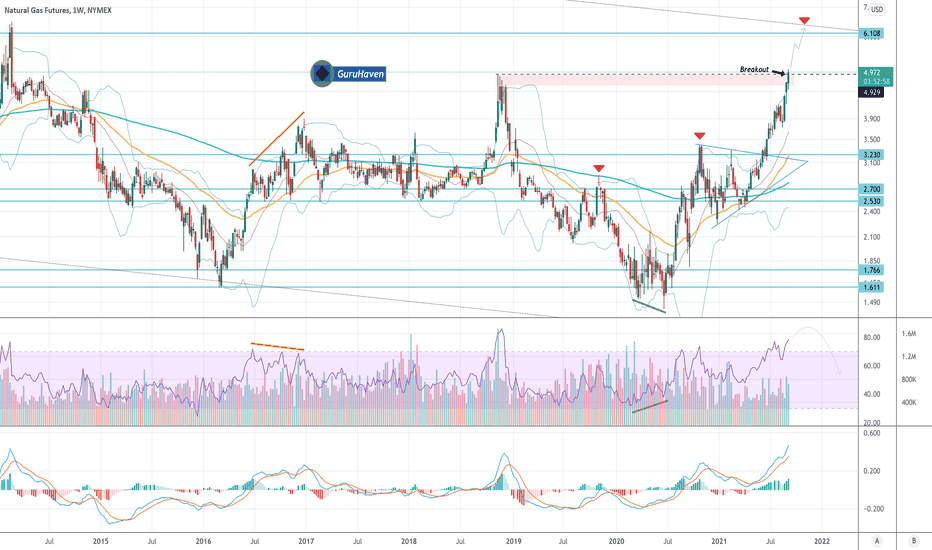

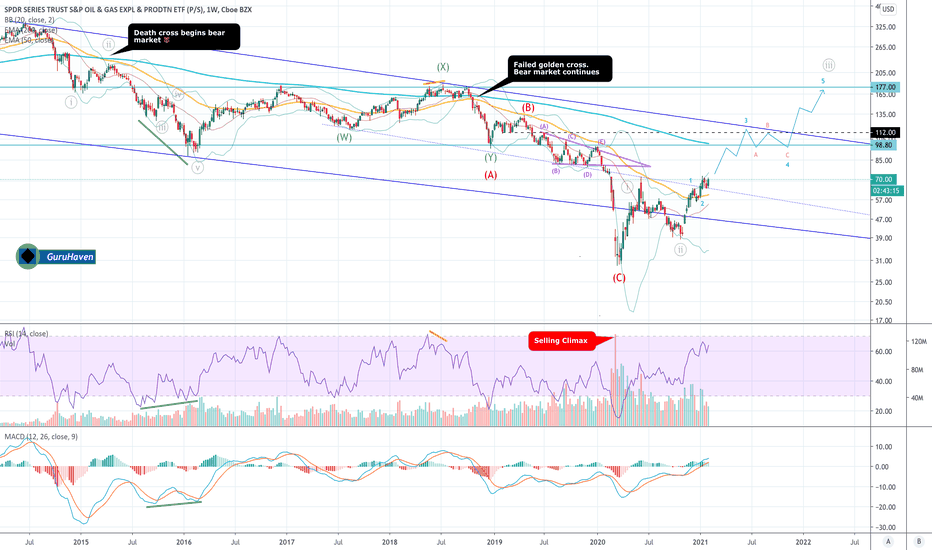

Natural Gas --- ( 2 0 2 1 ) Swing TradeAlas! I am free to post what I want thanks to the help of everyone's contribution thumbs.

------------------------------------------

The Natural Gas setup for 2021 is not only fundamentally bullish, it's a technical trader's gassy dream.

Welcome to the G a s i n o.

Macro View

From a macro view we can see that prices are now at the bottom of a historically supportive range. The previous deviations that dipped below this range were due to the bearish sentiment as production was trending up. This is no longer the case. Sentiment has now flipped cautiously bullish as supply/demand balance is expected to remain tight.

Bullish Indicators

First, we can see the weekly MACD is decisively bullish and above the zero line. This confirms momentum is going to likely remain bullish longer term.

Secondly, looking at the Commitment of Traders (COT) report on the indicator below the MACD, we see that Asset Managers and Speculators are more interested in long positions than usual. Should be plenty more next year.

Thirdly, prices are maintaining above the 50 week EMA.

Not to mention the inverse head and shoulders that is under construction. You heard it here first.

The Trade Setup

Now, if we overlay two important contracts for Summer(orange) and Winter(blue), we can start extrapolating potential targets. Current prices for either one are at the bottom of the range. This is what large speculators are looking at. This is where I am going to start accumulating starting with Summer. In addition, I am also buying dips of EQT as producers will benefit from stronger prices over the next couple years.

Looking at the August 2021 contract, prices have broken out of the down trend.

Today, in anticipation of a large swing trade next year, I opened a starting long position on the mini contract (QGQ2021) @ $2.78

I welcome dips and estimate a sell target somewhere well north of $3.00

TBD

Trading is risky, don't do it.

Long EQT and

QGQ2021 +1 @ 2.78

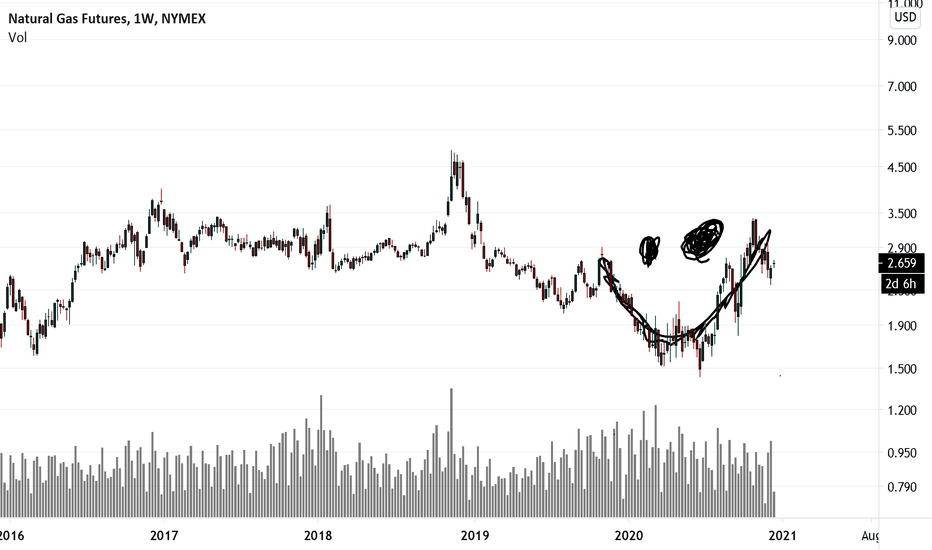

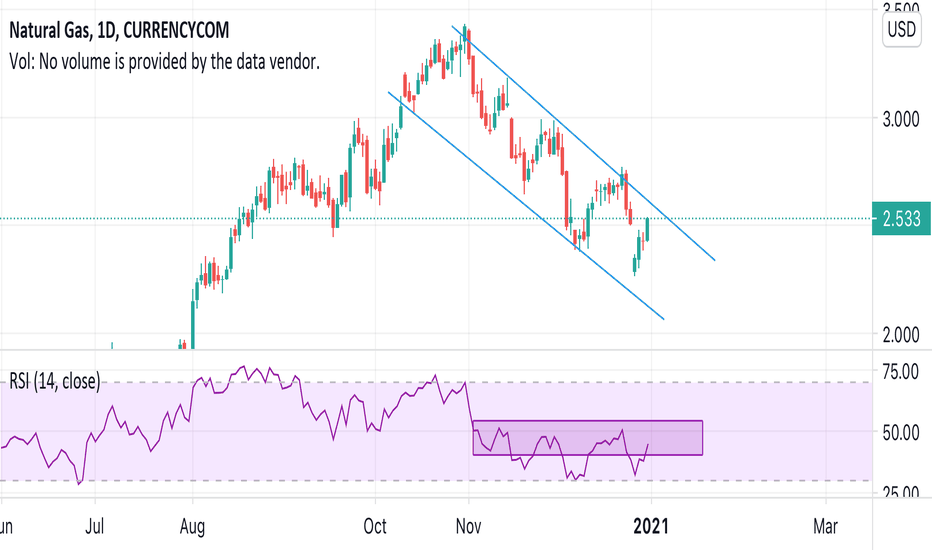

Natural gas down trend continueAs you can see lower highs and lower lows are being made and rsi is being reset every time when at or near oversold condition. I’m calling for continue low... it has a little bit more room to go up before dropping again. Furthermore I believe it’s confirmed with the weekly rsi with plenty of room left before going oversold. Natural gas tends to hit oversold on the weekly which is usually a strong signal for a trend reversal. Conclusion I believed the trend is still trending lower with lower lows and lower high as evidence of rsi reset with weekly rsi still in a dow trend. Breaking above the last lower high would disapprove this.

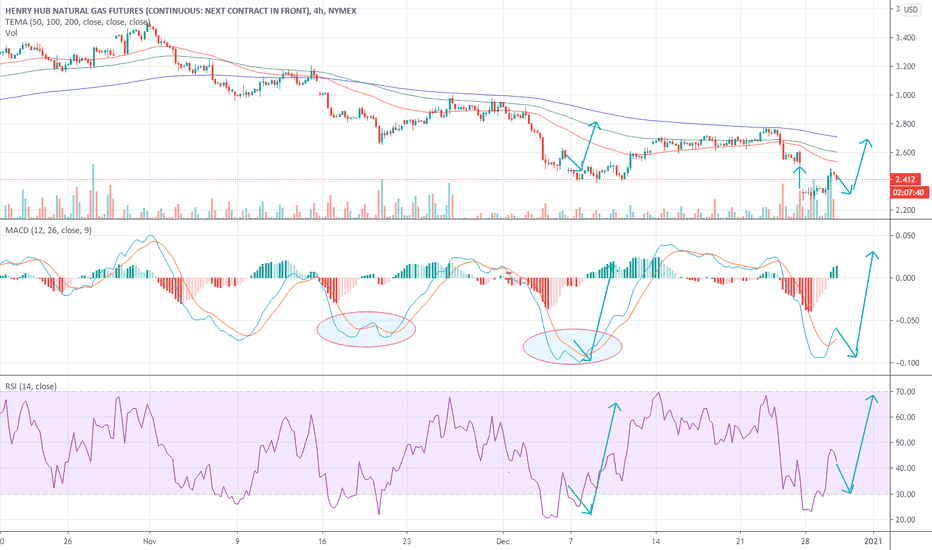

NG: UNG: BOIL: Natural Gas Rebounded on Feb 2021 RollNatural Gas prices rebounded after dropping earlier in the week from $2.5 to $2.25 on warm weather. Prices rebounded on tight balances, oversold technical conditions,

and roll into February 2021 contract. Support is expected to hold, as LNG flows are above 11 Bcf/d and balances are tight, with last draw at -152 Bcf.

Technical Analysis: 4 Hr chart shows oversold condition. Support is seen at $2.25. However, double bottom is still possible, before going higher around January 10.

Potential price target for the next leg up is $2.75 - $2.8. Upside potential for NG and BOIL may be limited due to roll into lower March 2021 contract on January 22 -27.

Fundamental Analysis: Bullish picture with tight balances and potential for a deficit is possible going into 2021. Lower 48 state production lost -4 Bcf/d vs. 2020,

while gas exports increased +4 Bcf/d, resulting in net increase in demand of 8 Bcf/d. Lower 48 production is expected to remain at 91 Bcf/d, while LNG flows and

Mexico exports will total 16 Bcf/d. HFIR energy believes, that forward curve is underpriced at avg. of $2.58/MMBtu. Should weather turn colder after January 11, 2021,

as projected by NatGasWeather, we may see NG prices bounce back to $2.7-$2.8 levels. Cash prices are likely to go much higher during winter. However, NG and BOIL,

will start rolling into lower March contract around January 22 -27, which may bring futures prices back to their current support level at $2.3-$2.5 at that time.

Overall picture for NG in 2021 is bullish, given lower production and higher LNG demand and exports remain in place. Traders are bullish EQT and BOIL (day trade).

Short sellers will still have their opportunities on selling 4 Hr tops. KOLD is an inverse daily ETF, that does well during March - April contract timeframe.