When Intuition Beats the Algorithm█ When Gut Feeling Beats the Bot: How Experience Can Improve Algorithmic Trading

In today’s world of fast, data-driven trading, we often hear that algorithms and rules-based systems are the future. But what happens when you mix that with a trader’s intuition, the kind that only comes from years of watching charts and reading price action?

A recent study has some surprising results: A seasoned discretionary trader (someone who trades based on what they see and feel, not just rules) was given a basic algorithmic strategy. The twist? He could override the signals and use his instincts. The result? He turned a losing system into a winning one, big time.

█ What Was the Experiment?

Researchers Zarattini and Stamatoudis (2024) wanted to test whether a skilled trader’s experience could boost a mechanical system. They took 9,794 stock “gap up” events from 2016 to 2023, where a stock opens much higher than the day before, and let the trader pick which ones looked promising.

⚪ To make it fair:

All charts were anonymized — no names, no news, no distractions.

The trader had only the price action to guide his choices.

He could also manage open trades — adjusting stop-losses, profit targets, and position sizing based on what the price was doing.

⚪ The Trading Setup

█ What Did They Find?

The trader only selected about 18% of all the gap-ups. But those trades performed far better than the full list. Here's what stood out:

Without stop-losses, the basic strategy lost money consistently (down -0.25R after just 8 days).

With the trader involved, profits rose fast, hitting +0.80R just 4 days after entry.

Risk was tightly managed: only 0.25% of capital was risked per trade.

⚪ So what made the difference? The trader could spot things the system missed:

Strong momentum early in a move

Clean breakouts from long sideways ranges

Patterns that had real follow-through, not just random gaps

He avoided weak setups and managed trades like a pro, cutting losers, letting winners run, and trailing positions with smart stop placements.

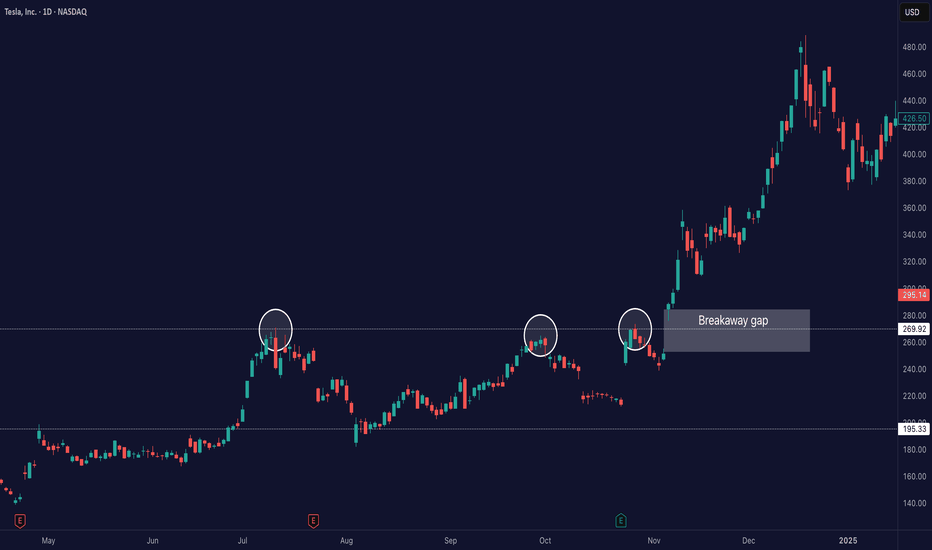

⚪ Example

An experienced trader can quickly identify a breakaway gap, when a stock gaps up above a clear resistance level. Unlike random gaps, this setup often signals the start of a strong move. While a system might treat all gaps the same, a skilled trader knows this one has real potential.

█ What Does This Mean for You?

This research shows that trading experience still matters — a lot.

If you’re a systematic trader, adding a discretionary filter (whether it’s your own review or someone else’s) could drastically improve your results. A clean chart read can help you avoid false signals and focus only on the best setups.

If you’re a discretionary trader, this study is proof that your skills can add measurable value. With the right tools and discipline, you don’t need to throw away your instincts, you can combine them with structure and still win.

█ Key Takeaways

⚪ Gut feeling isn’t just noise, trained instincts can spot what rules miss.

⚪ Trade selection matters more than just following every signal.

⚪ Managing risk and exits well is just as important as picking good entries.

⚪ Hybrid trading, rules plus judgment — might be the most powerful combo.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Breakawaygap

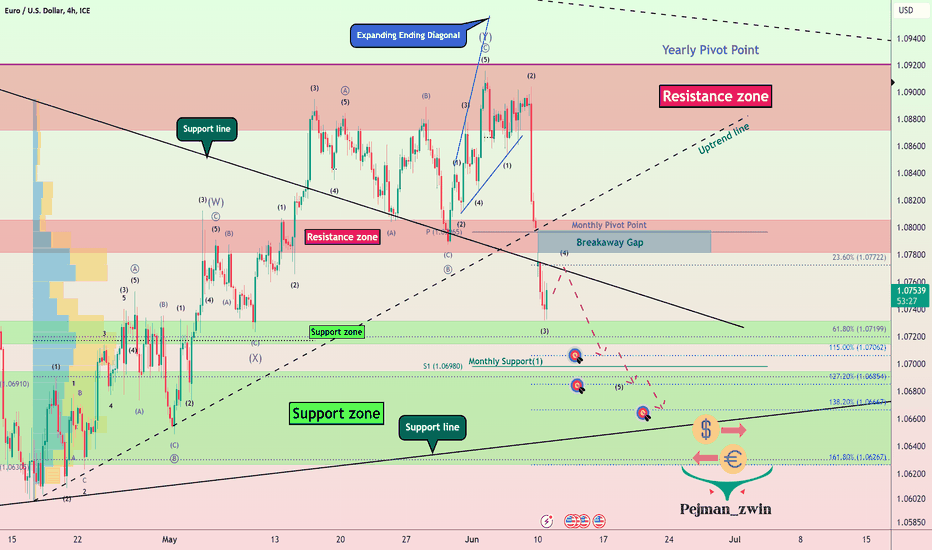

EURUSD Analysis(Continue to Fall)!!!EURUSD managed to break the Support zone($1.080-$1.078) , Monthly Pivot Point , and the Uptrend line . We can also consider this Breakaway Gap a sign of valid failure.

According to the theory of Elliott Waves , EURUSD seems to have successfully completed the Double Three Correction(WXY) .

Currently, EURUSD is completing wave 4 , and we have to wait for wave 5 to start.

After the completion of wave 4, I expect EURUSD to decline at least as far as the targets I have specified on the chart.

Euro/U.S.Dollar Analyze ( EURUSD), 4-hour Time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

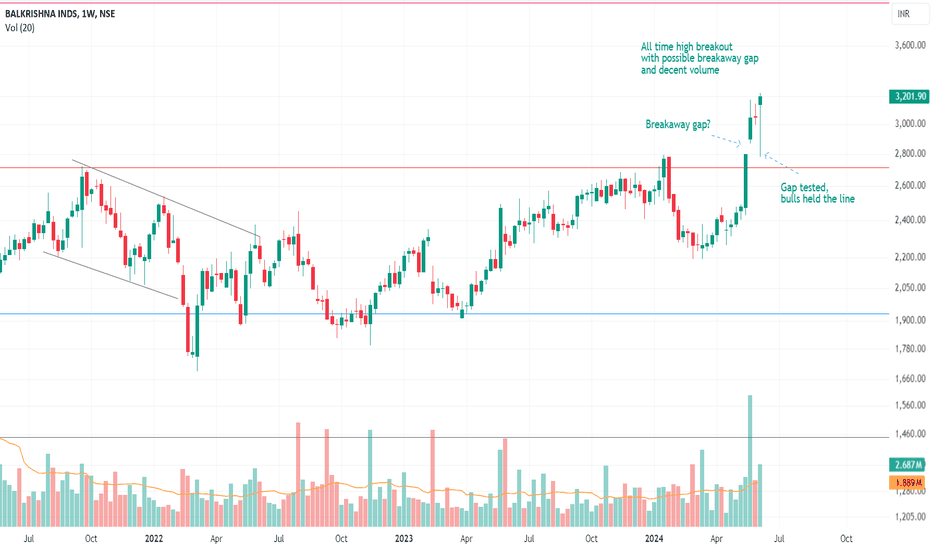

Breakaway gap in Balkrishna Industries?The price of NSE: BALKRISIND did breakout from previous all time high and resistance zone with a gap. This could possibly be a breakaway gap with high volume.

The gap was tested this week and bulls held the breakout.

Looks like decent chances of continuation from here.

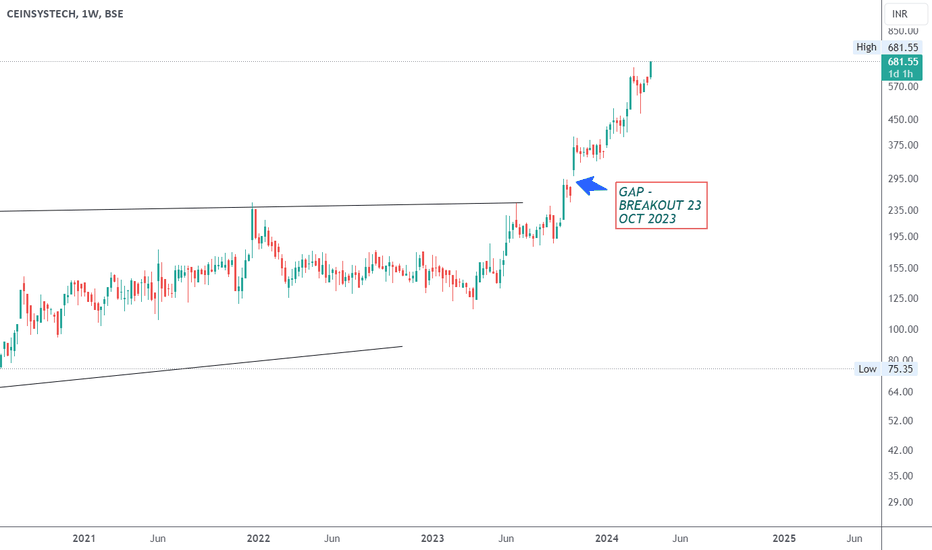

CEINSYSTECH GAP Importance CEINSYSTECH Above image is showing the importance of break away cap gap the consolidation watch almost 2445 days and the structure got 305 to earlier closing 275

if we look the previous consolidation consolidation gives a sense regarding triangle compression that is a technical chart pattern

technical analysis after giving a gap stock has given a good chance of rally why we are discussing this because of educational purpose

Understanding the ICT BREAKAWAY GAPIn this video I go through the ICT Breakaway Gap and how YOU can use it to your advantage. I include some tips and tricks with a real trade setup demonstration.

The Breakaway Gap may have been an elusive concept to understand, but I present a simple way you can spot them on the chart and frame your trades around them. It is a powerful weapon that can be used to snag some awesome trades.

Simple put, the Breakaway Gap is a gap that does not get traded into with the NEXT FEW CANDLES. Emphasis on the last part because price is fractal, and the best way to frame a trade with ICT's Concepts is by taking a few candles on the higher timeframe for your bias, and going to a lower timeframe to form your narrative, and either entering on that timeframe or even going to a lower timeframe for your entry.

Hopefully this gives you some insight into one of the many concepts that ICT has bestowed upon the public.

If you need clarification about the content, or you are still struggling with finding your groove as a trader and need personal guidance or mentorship, feel free to reach out to me via TradingView’s private message or on X.

Happy trading and happy studying!

- R2F