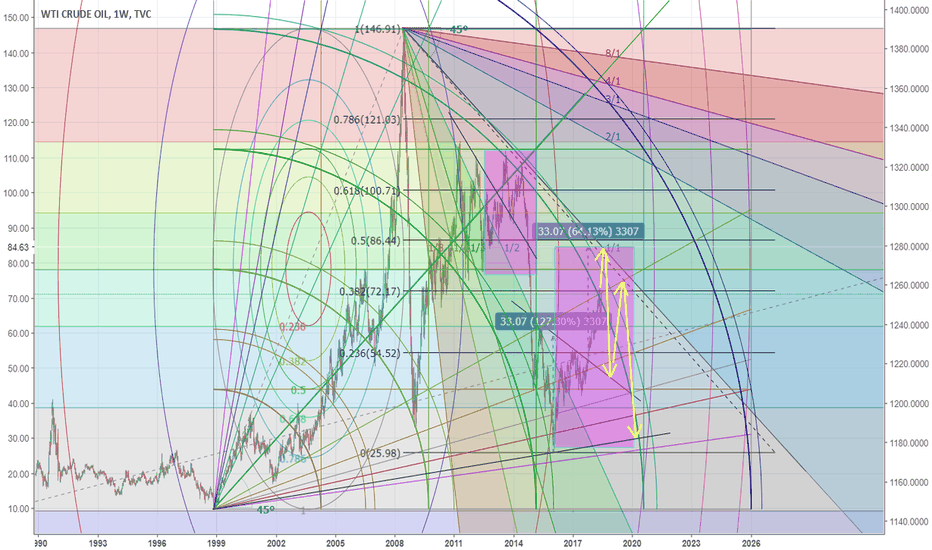

Crude oil projectionIt seems we are going to have some steep runs...I project a steep run to 84 dollars per barrel, then a drop to retest head and shoulders neckline (as it did so in the past pattern), second run up to the fib circle and Gann angle. And then a fast drop to 30 dollars per barrel (trendline) down through the neckline. Many clues have been drawn from the past pattern behaviour. I locked the scale, as its important all the drawing tools and lines stay in the same place. You can move the chart around though.

Brent-wti

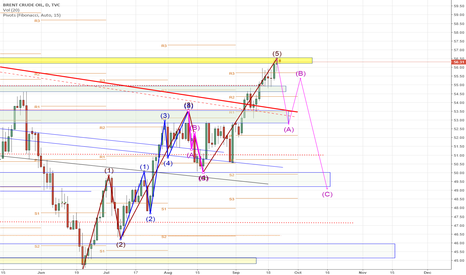

Brent (UKOIL) - Targets For The Next 2 Days: 77.81$ to 78.95$After failing my targets for today, I am pushing them with some slight modifications for the next couple of days. The day covered action between the 0.382 and 0.618 retracement levels of B to C, and finished right above the 0.618 of 5 to C. My target zone is now between the level 1 of B to C, 0.618 & 0.786 of 5 to C, and the 0.236 extension of 1 to 5. A reversed H&S also seems to be forming. Mid-term analysis remains in play, I think we are already the first impulse wave of a new cycle which should take us above 80$ again.

Short at 1.5445 for target 1.5370 =75 pipsShort eurcad due to overbought in many time frame and also EUR Outperform compared tp all the data that he got this mast days especially for Inflation.

And cad i think he little underperform all currencies

so i make this trade in short for a small legit pullback

enter at 1.5445

target a pull back to 1.5370 but can go more deep,but i prefer stay on this cluster target..

gains 75 pips

2 x 1 lot like all time

will cut the first at +35-45 pips and make a SL on the "nd lot at +20 pips for secure all gains

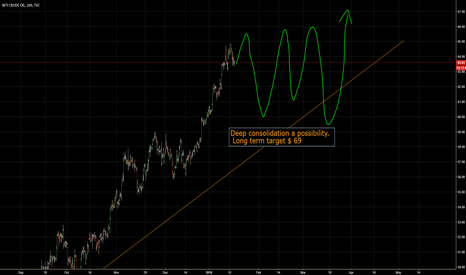

Brent correction and then someSome time ago I had shared with my friends an idea of Brent going to 56.5. it was some late night old mans lonely evenings thoughts on the chart. Brent was at 52+ back then with lots of bearish sentiment built up in the crowds mind. it worked out just great.

s3.amazonaws.com

though I am not an Elliot or other types of wave analyst, I find that some basic ideas are typically the hardest to believe in by more experienced traders and sometime those ideas do work.

There is the one for correction of Brent from current level of 56.6 down.

not sure though what would this do to the idea for WTI, stated below as the linked one.

USDCAD Weekly Head and ShoudlersUCAD is 180pips away from a confirmed Head and Shoulders, weekly study.

Watching price action this week for bear continuation or bull reversal (see my USDCAD Bearish Butterfly study below).

Also keep an eye on EURUSD staying above 114/115 range and of course any Oil fundamental reporting.

OIL - LONG After Bull Blood Bath The market was unloaded today

All bulls on margin call: who buy dip, who buy after OPEC meeting, who sustain the price in march

I think Open Interest sufficiently decreased, and the new bull cycle arisen

Commercials have reduced net short position and new, fresh and brave bulls ready to buy every dip

Open: 45.50

SL: 44.60

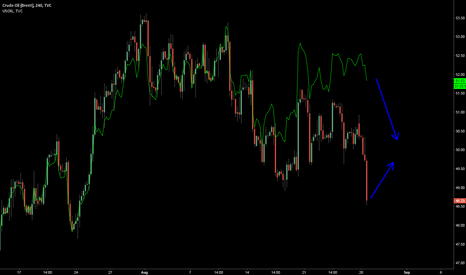

Brent/WTI spread. Brent Oil Could Lose Its Benchmark statusBrent (UKOIL) is on the slippery path as production is falling and this could lead to the drop of it's share and loss of the benchmark status to other crudes, namely WTI or Dubai or Urals.

Triangle is possible model here.

Target minus $10 spread - the WTI (USOIL) becomes more expensive than Brent.