June 29. Today's matrix for intraday trading on m5 timeframe.

Hi everyone. My analysis done for my main timeframe m5. I start from higher timeframes D1, H1 and move down to lowest m5.

Futures contract for Brent crude , London exchange ICE 09-20

My trading is based on market phases by Wyckoff.

For timeframes m5:

Buy on the test of level 41.00, target 41.60

Sell 39.90, target 39.45, target2 38.75

Trading on m5 timeframe.

Brentcrudeoil

June 25. Today's matrix for intraday trading on m5 timeframe.

Hi everyone. My analysis done for my main timeframe m5. I start from higher timeframes D1, H1 and move down to lowest m5.

Futures contract for Brent crude , London exchange ICE 08-20

My trading is based on market phases by Wyckoff.

For timeframes m5:

Buy on the test of level 40.85, target 41.75

Sell 39.65, target 39.05, target2 38.55, target3 38.01

Trading on m5 timeframe.

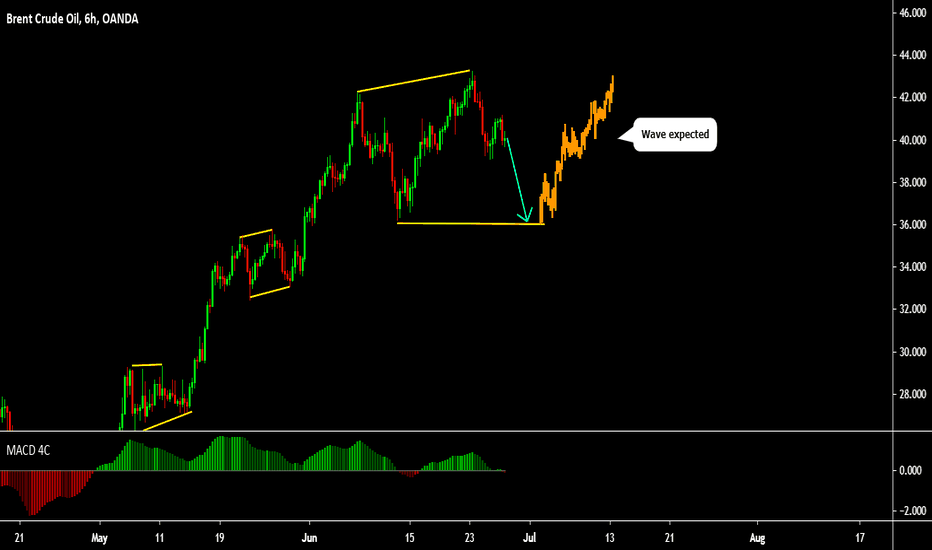

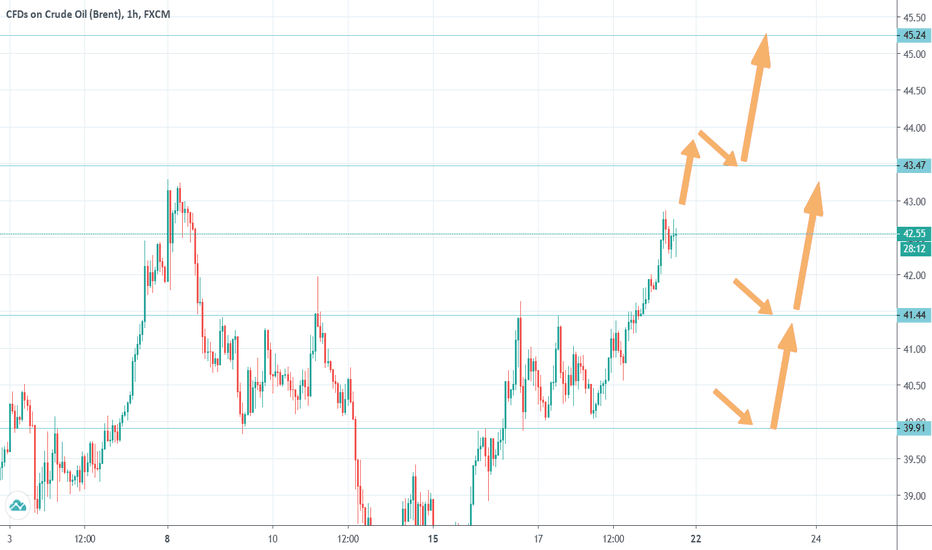

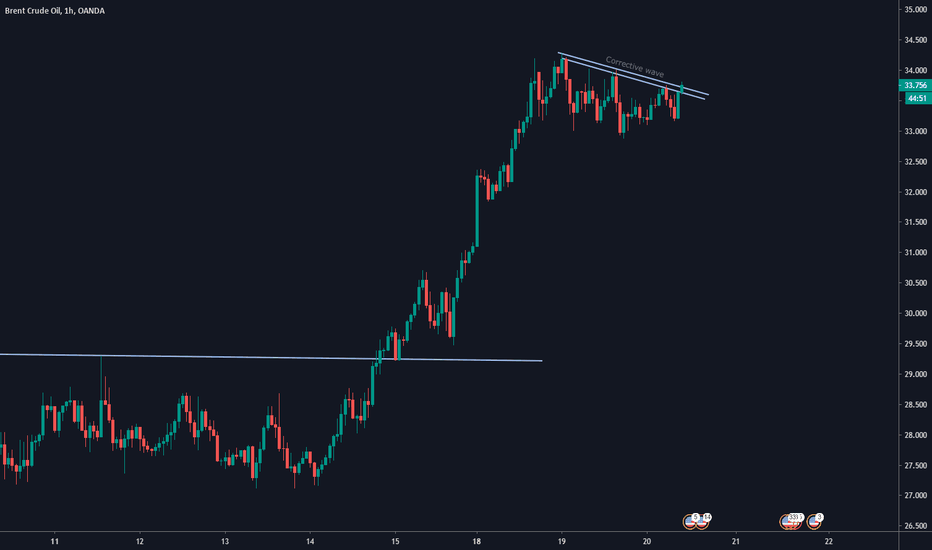

June 19. Today's matrix for mid term trading on m60 timeframe.

Hi everyone. My analysis done for my main timeframe 5m. I start from higher timeframes and move down to lowest m5. As my analysis is already done, I'm publishing matrix levels also for h1 for mid term traders.

If somebody is interested in higher timeframes such as D1, W1 please let me know in comments and I will publish these levels too.

Futures contract for Brent crude , London exchange ICE 08-20

My trading is based on market phases.

For timeframes m60 and h1:

Buy on the test of level 43.46, target 45.24

Buy 41.45, target 43.46

Buy 39.90, target 41.45

Trading on m60 timeframe.

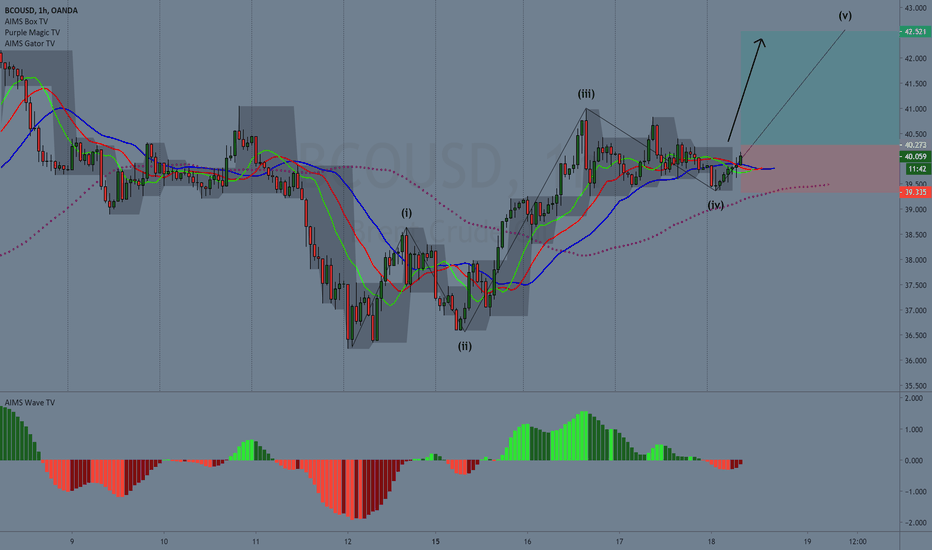

June 17. Today's matrix for intraday trading on m5 timeframe.Hi everyone. My analysis done for my main timeframe 5m. I start from higher timeframes and move down to lowest m5.

Futures contract for Brent crude , London exchange ICE 08-20

My trading is based on market phases by Wyckoff.

For timeframes m5:

Buy on the test of level 41.01, target 41.60, target2 - 42.00

Sell 39.90, target 39.45, target2 - 39.05

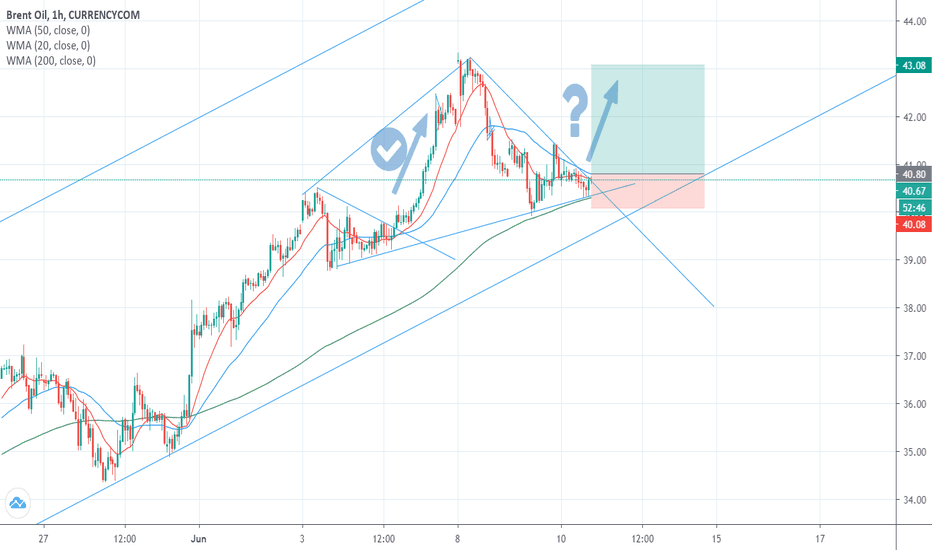

Try again: Brent Oil Entry Level at 40.72; Target 43.00Triangle formation, will TVC:UKOIL CURRENCYCOM:OIL_BRENT break the triangle and move upward.

Stop Loss at 40.00.

Initial trade today at BUY at 40.80 stopped at 40.30.

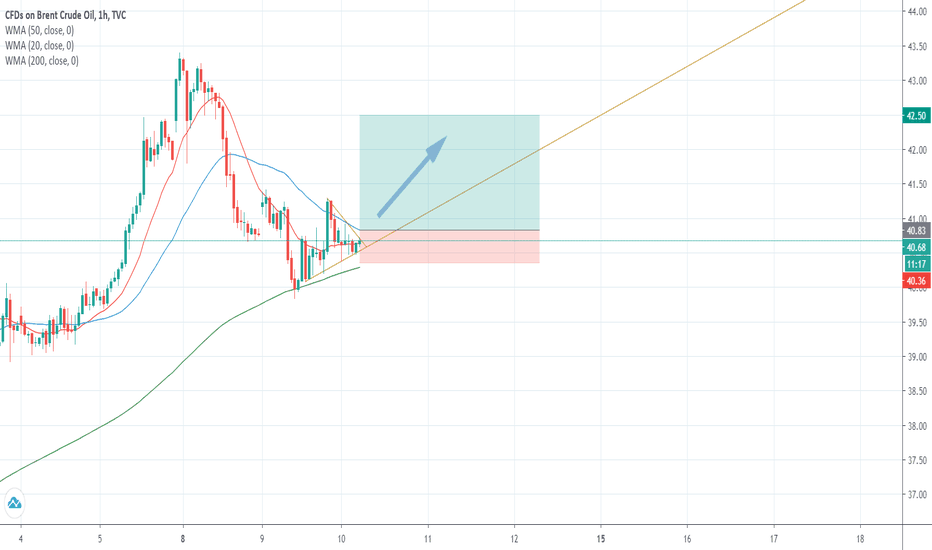

June 9. Today's matrix for intraday trading on m5 timeframe.

ICEEUR:BRN1! TVC:UKOIL

Hi everyone. My analysis done for my main timeframe 5m. I start from higher timeframes and move down to lowest m5.

Futures contract for Brent crude , London exchange ICE 08-20

My trading is based on market phases by Wyckoff.

For timeframes m5:

Buy on the test of level 41.45, target 42.50

Sell 40.55, target 40.05

June 5. Today's matrix for intraday trading on m5 timeframe.

ICEEUR:BRN1! TVC:UKOIL

Hi everyone. My analysis done for my main timeframe 5m. I start from higher timeframes and move down to lowest m5.

Futures contract for Brent crude , London exchange ICE 08-20

My trading is based on market phases by Wyckoff.

For timeframes m5:

Buy on the test of level 40.05, target 40.55

Sell 39.71, target 39.24

Brent to Break over $40.00 to $45.00?Lets see if the price squeezed in this triangle breaks and the bulls have the day...

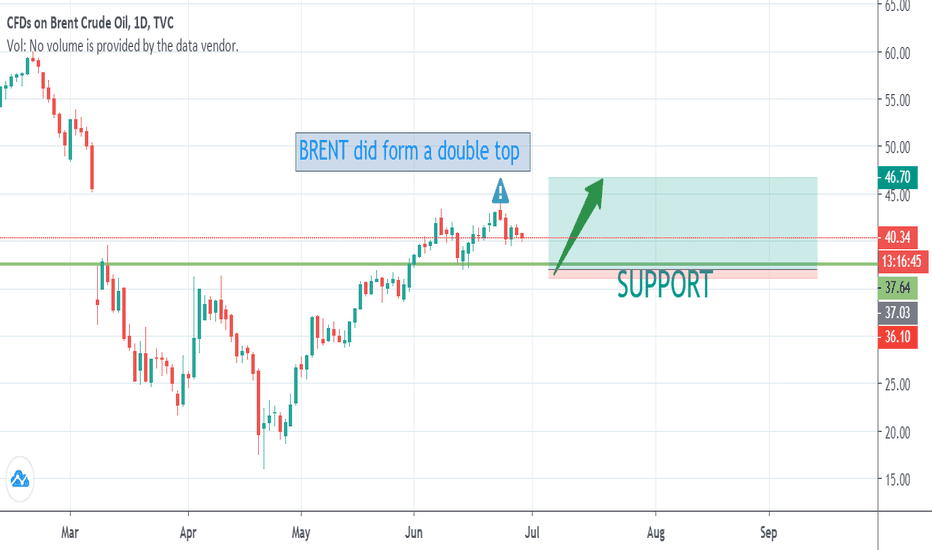

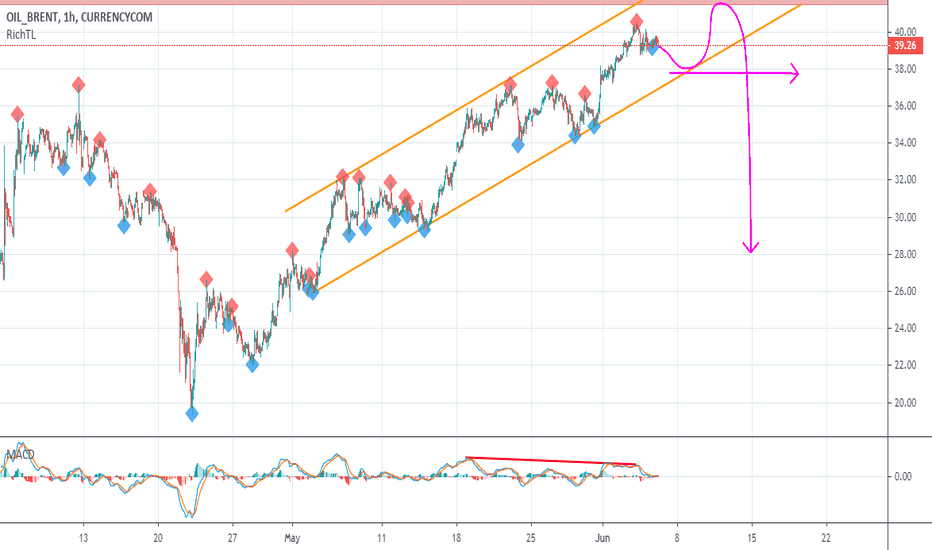

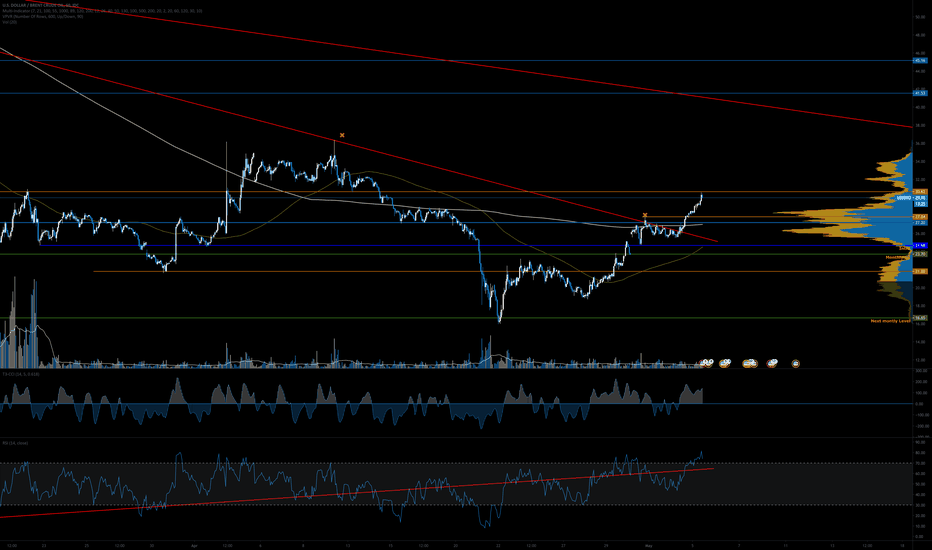

BRENT OIL top-down analysison DAILY: BRENT OIL is approaching a strong resistance and GAP zone so we will be looking for objective sell setups on lower timeframes.

on H1: OIL is currently trading inside our orange channel, so we are waiting for a new swing to form around our lower orange trendline to consider it objective and enter on its break downward.

we also have a regular bearish divergence on MACD.

meanwhile, as usual, BRENT OIL would be overall bullish until an objective sell setup is activated.

June 4. Today's matrix for intraday trading on m5 timeframe.

ICEEUR:BRN1! TVC:UKOIL

Hi everyone. My analysis done for my main timeframe 5m. I start from higher timeframes and move down to lowest m5.

Futures contract for Brent crude , London exchange ICE 08-20

My trading is based on market phases by Wyckoff.

For timeframes m5:

Buy after breakout on the test of level 39.85, target 40.55

Sell 38.80, target 38.25

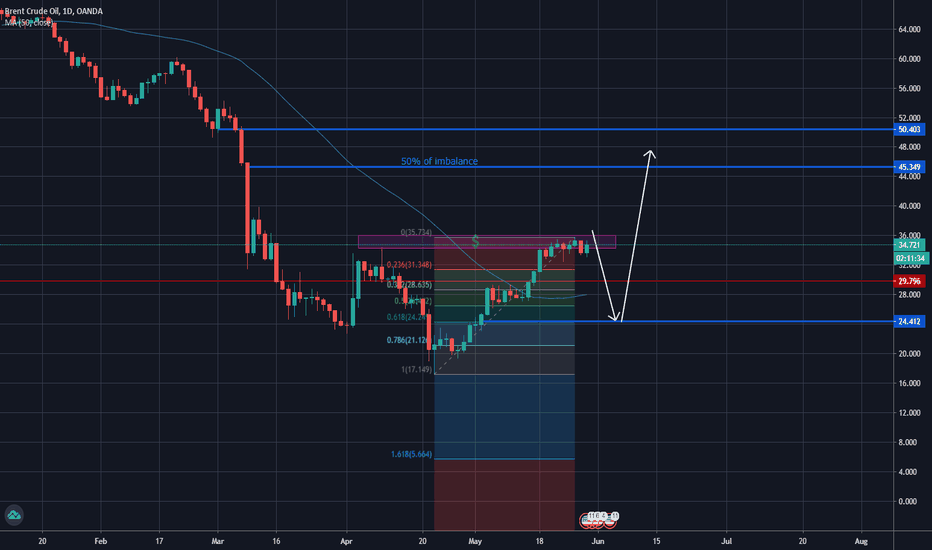

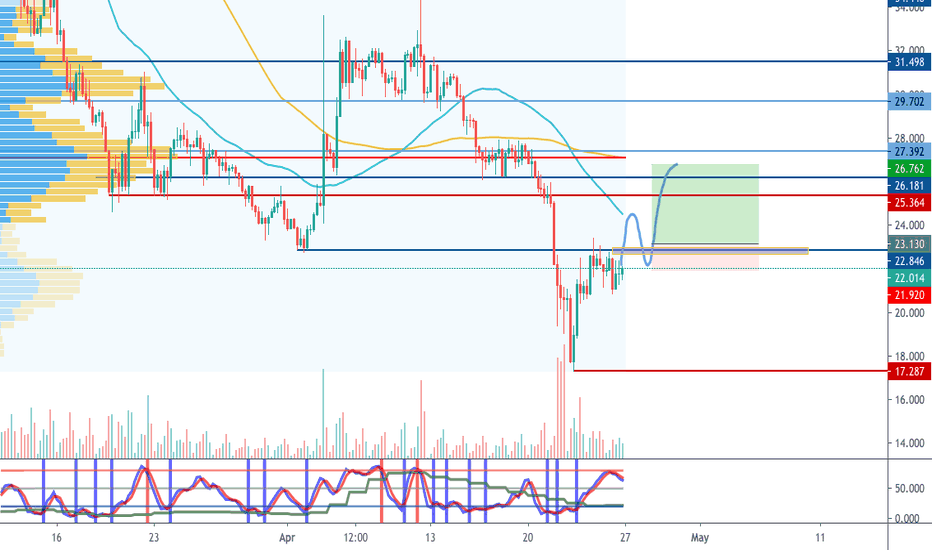

Possible ideas for Brent Crude OilThe price could move up to take out the liquidity formed above $35.8-ish level, before moving down to mitigate. The.618 fib level matched up nicely with the sell before the buy on the 15 min chart.

The price might then move up to fill inefficiencies in the $45-50 region.

I'm pretty new to this so any criticism would be appreciated :)

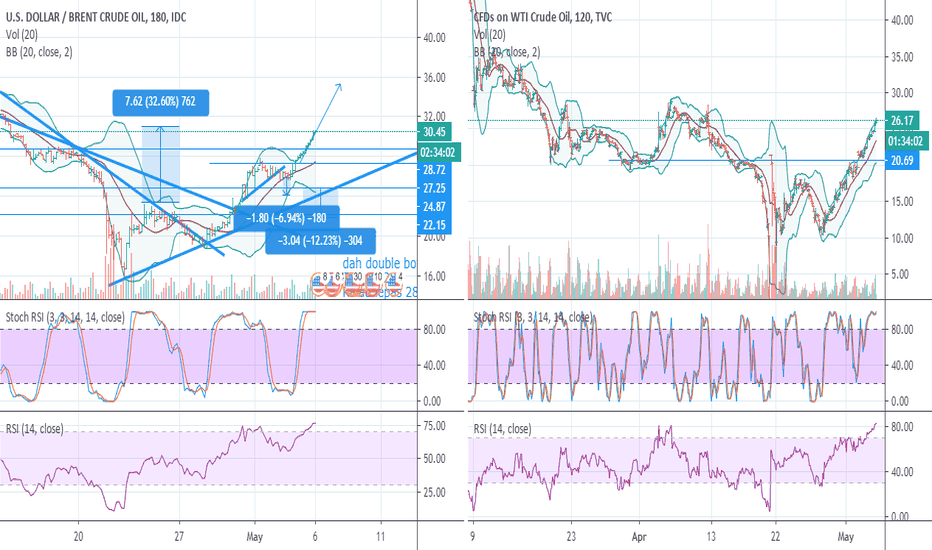

Brent oil (BCOUSD) longI see no reason to short oil.

The decision area for me is about $ 23 per barrel, I focus on my broker quotes.

I believe that a recession awaits the economy, but we are now closer to the moment of exit from the lockdown and the probability of an increase in oil demand is higher.

Asian countries are beginning to come into normal operation, and for them, buying oil at current stock prices is a very interesting idea. Companies engaged in shale oil production are probably close to bankruptcy or a temporary halt in oil production.

In May, the first reductions according to the agreement between OPEC and the Saudi Arabia and Russia. I don’t see an opportunity for short. Therefore, I am considering shopping. Be careful, brokers have very high oil swaps now, so it is better to trade futures but only with stop loss without transfer over the weekend!

Be careful with this tool!