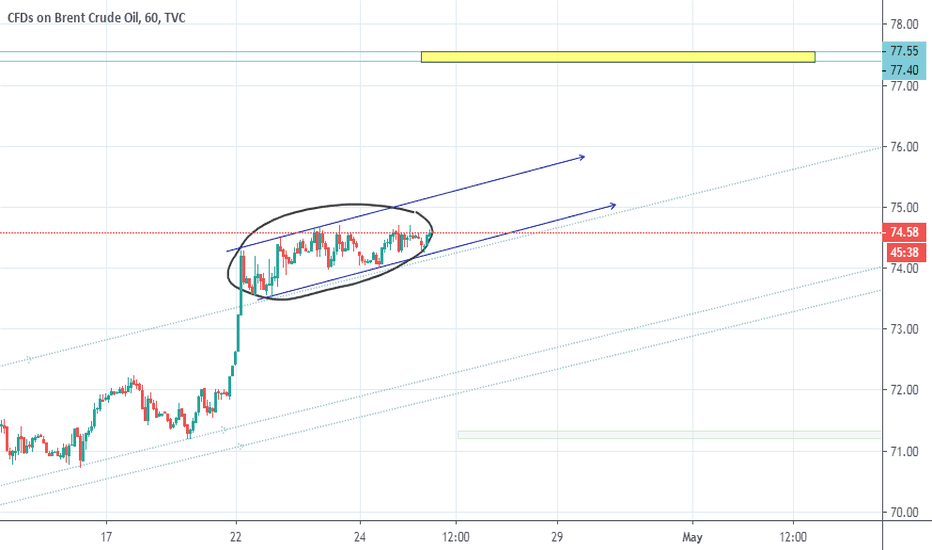

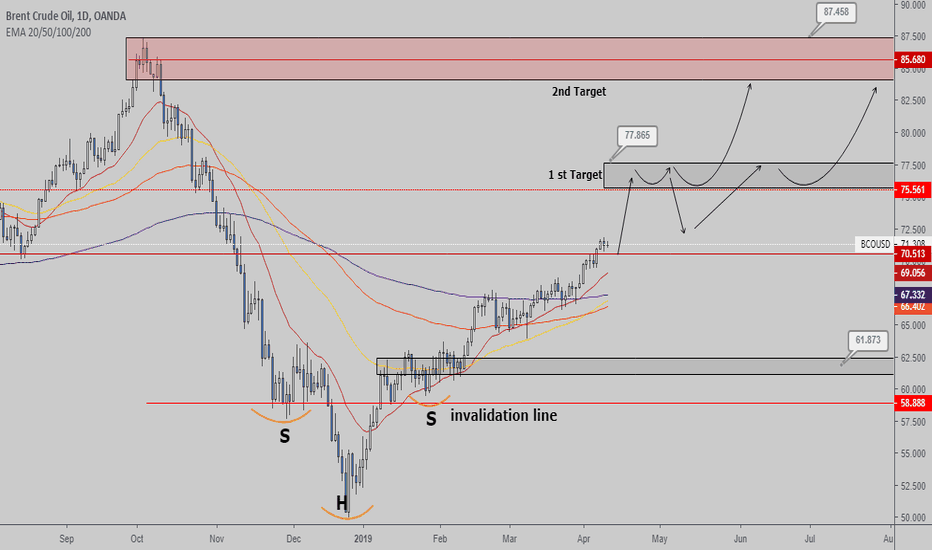

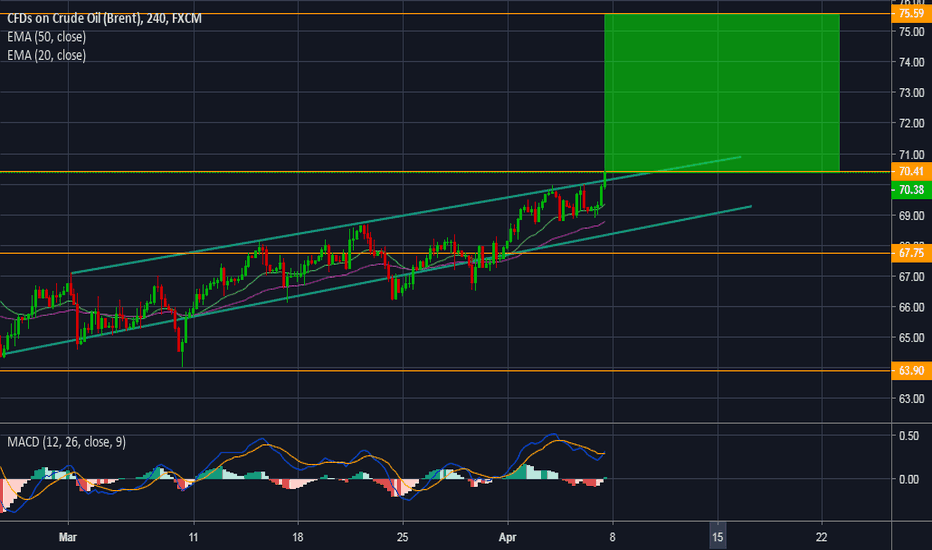

BrentCrude Oil. Turning up now. Note: If you like trends, you'll like oil. When oil trends, there is no limit. It can trend for a VERY long time.

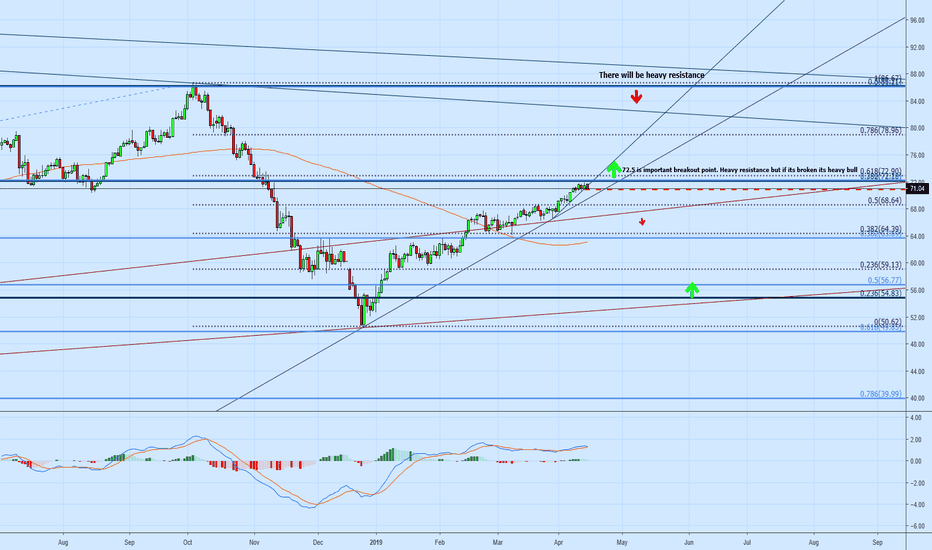

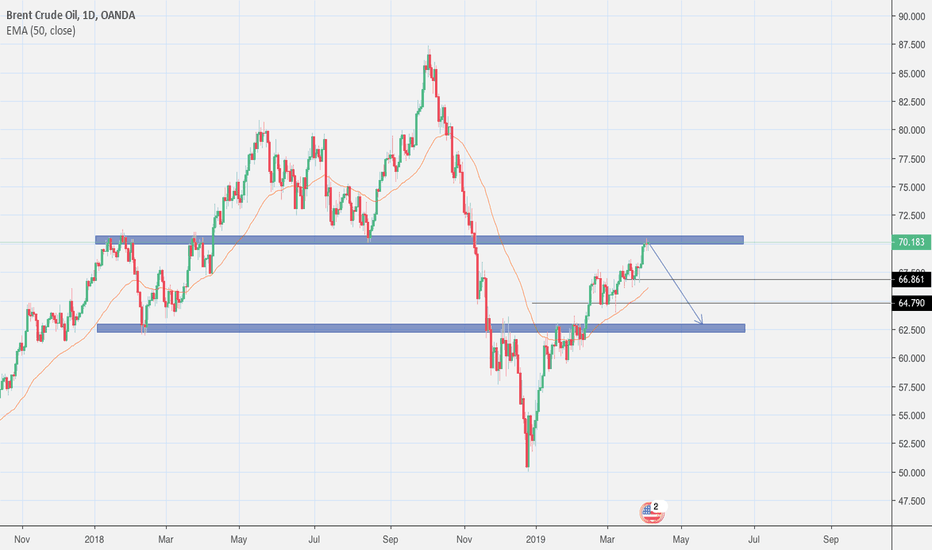

Trading Criteria:

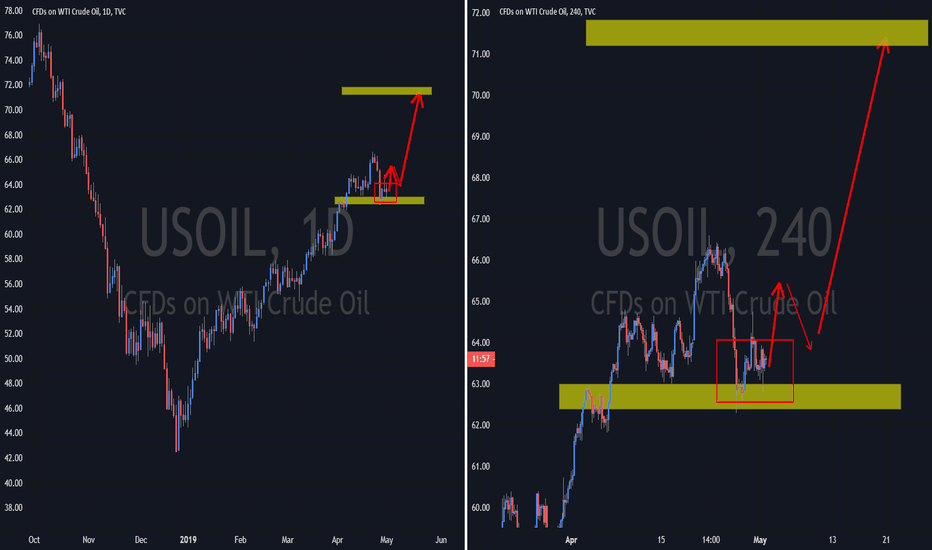

Regardless which way you want to trade, look for minimum five 4hr. candles in consolidation zones (yellow border boxes), or five daily candles for solid yellow boxes. If you're a pattern trader or pinbar trader, this might be useful here.

Wait for a significant breakout of the 4hr. consolidation or daily consolidation from red border boxes to take the trade. Red border boxes are the High/Low of a consolidation period inside the consolidation zone. I usually aim for 80% of the weekly ATR (or monthly ATR for yellow solid boxes) taking profit but not always at the next yellow box. I place my stop loss above/below red border box.

*These zones, with the inclusion of price action described above, have remarkable accuracy.

Yellow border box: weekly consolidation zone

Yellow solid box: monthly consolidation zone

Red border box: High/Low breakout box (5 minimum candles)

Brentoil

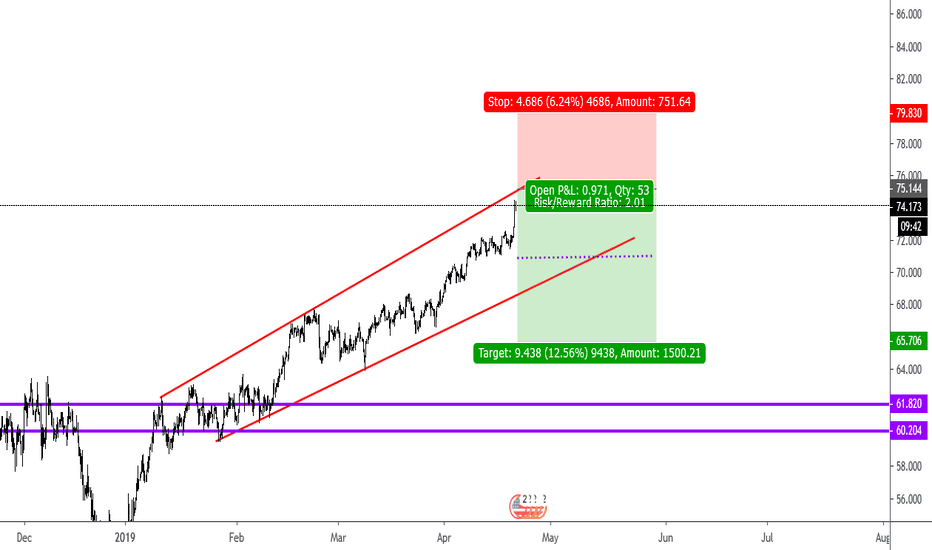

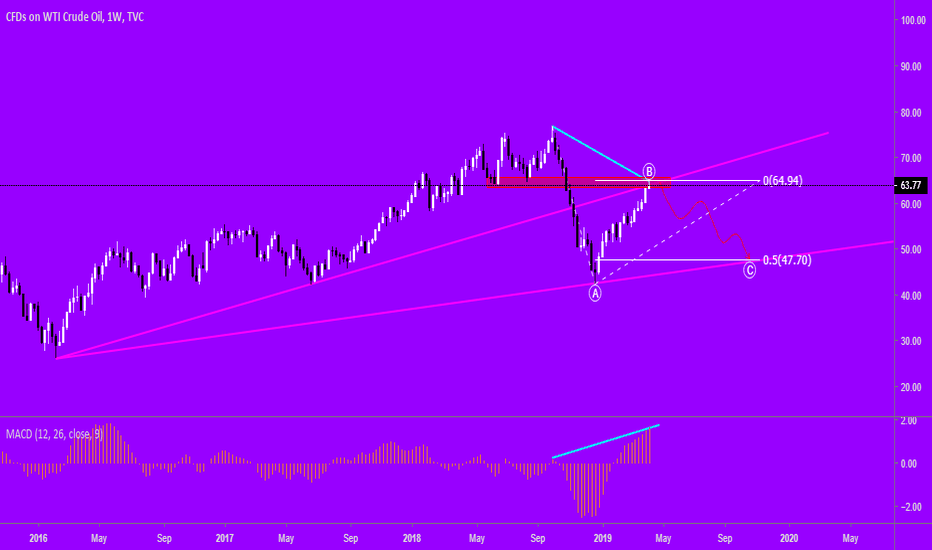

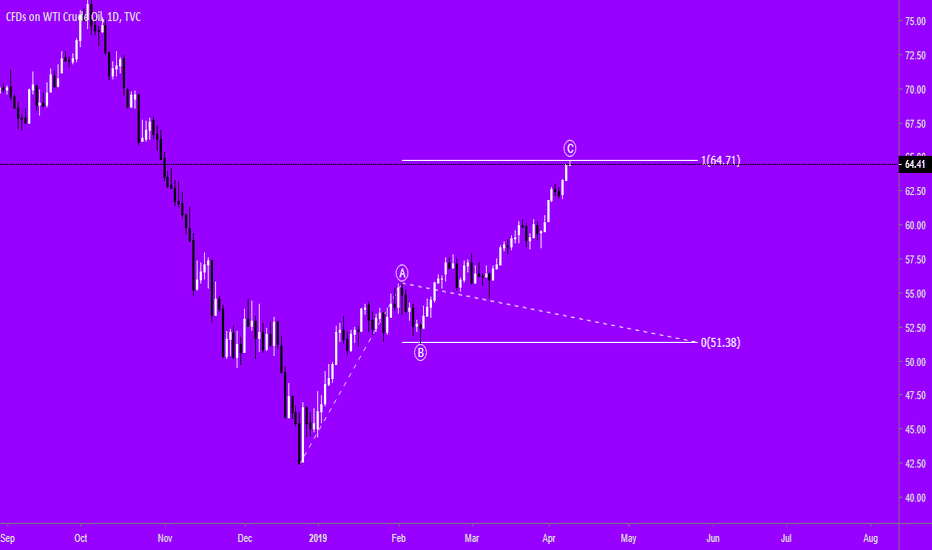

Crude Oil Elliott Wave IdeaUpdate on this idea >

Oil hit 1:1 extension (measured move) and strong resistance, possibly completing a correction to the fall from $76,88 to $42,40. Could now start the post correction impulse waves.

Weekly candle looks like a bearish pin bar and possible bearish divergence on MACD:

brent oilwrong past decisions including lack of supply and trade agreements on a line walk i would consider this setup to apply based on market conditions with bad politics to fuel brent more towards an uptrend. global demand will always rise but supply has lowered because the cost of production grows as its harder to get the deeper they try to get it from. this is not financial advice just a mad mans imagination.

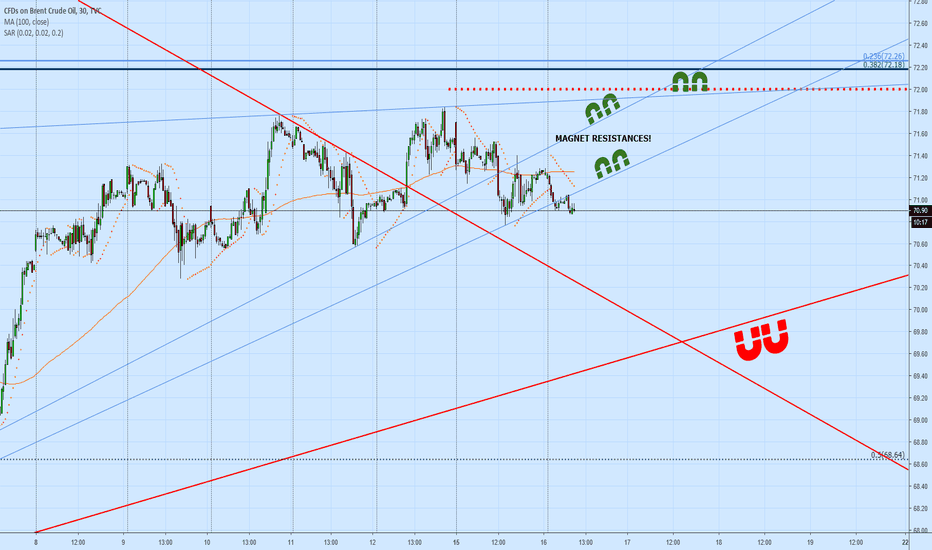

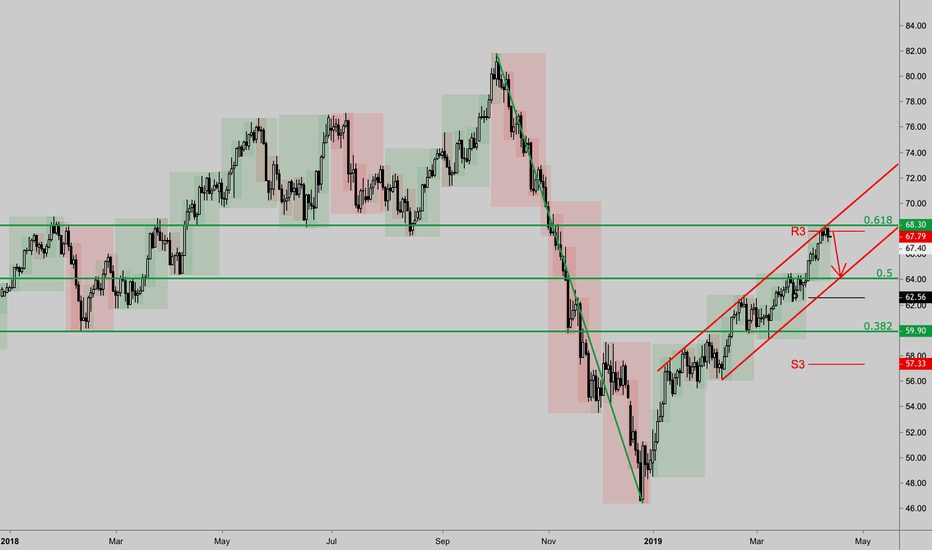

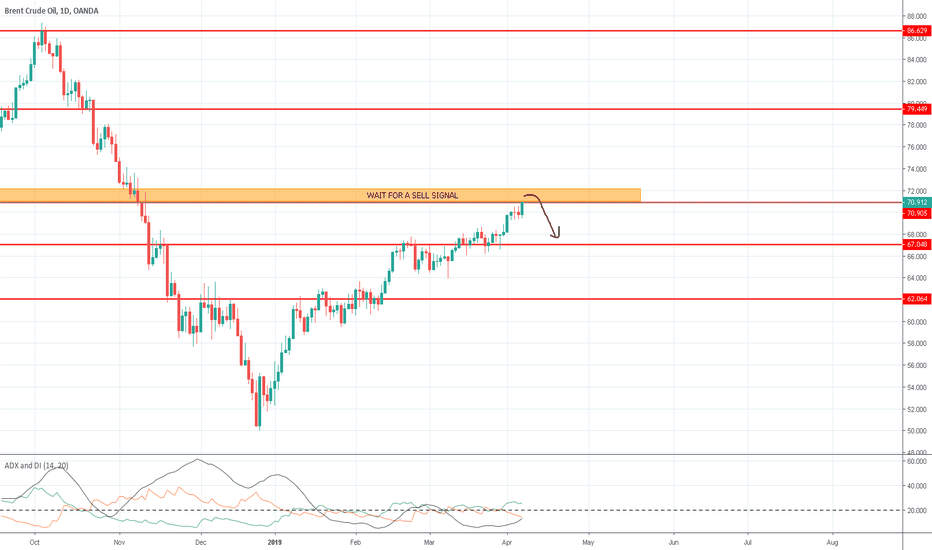

SHORT BRENT OILOIL HAS RECOVERED ABOUT THE HALF OF THE DESCENT STARTED IN OCTOBER AND FINISHED IN JANUARY. WE ARE ON A VERY IMPORTANT STRUCTURE AS YOU SEE THE GRAPHIC. PERSONALLY I ARE LOOKING FOR ENTRIES TO SELL WITH STOP LOSS WITH CLOSING OVER 71 DOLLARS,

I THINK THE BRENT CAN MISS A 4-5 DOLLARS IN THE NEXT MONTH.

GOOD TRADING AT ALL

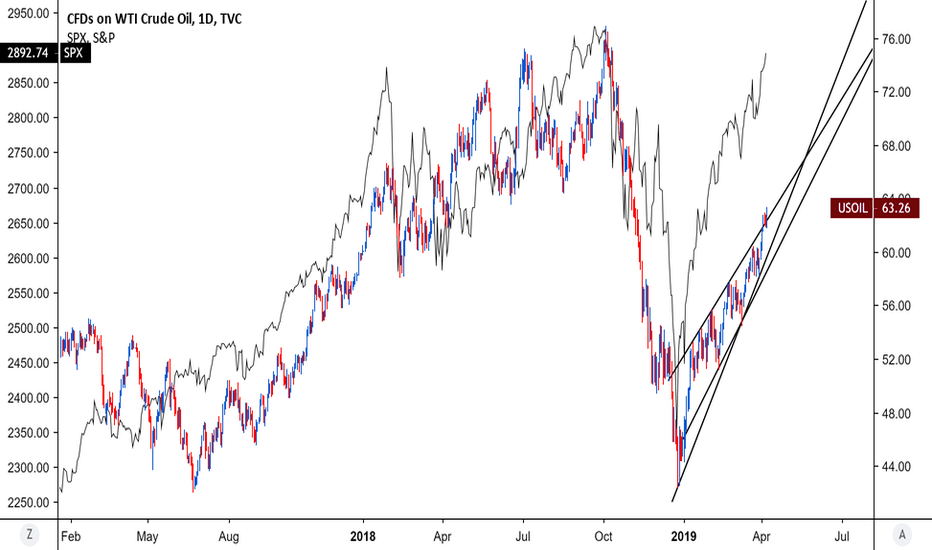

Either Stocks Crash, or Oil RalliesWe are basically exactly where we were at in October 2018. About the same things for US equities. But why the divergence with US equities outperforming oil? Look what happened last time stocks become too zealous in January 2018. Correction downward to a near parity in percentage gains. Either stocks are going to readjust or oil is just going to go crazy in the next few weeks. My question is, where is the conviction, where is the demand (weak EU, weak China, weak EMs) and what are the fundamentals driving markets forward? I'm really opened, but color me skeptical.