Brexit

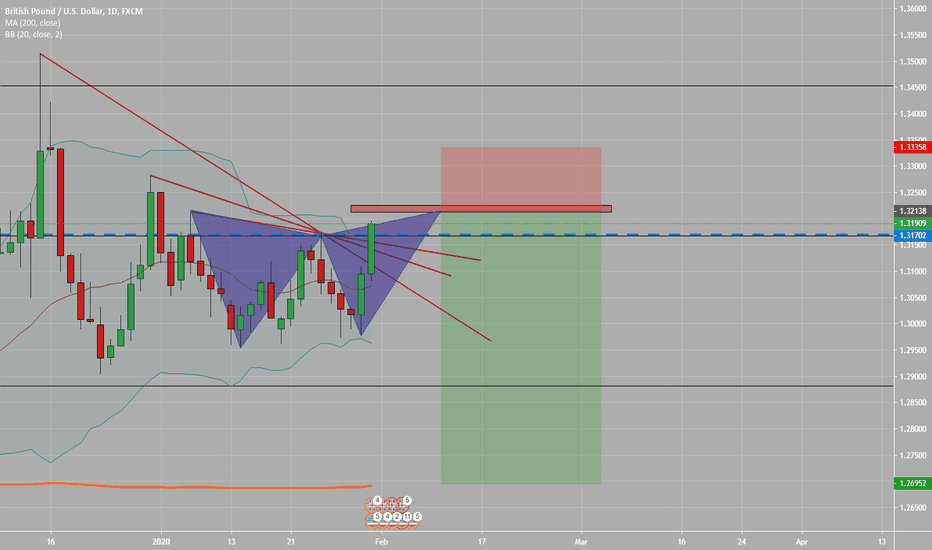

ridethepig | GBP Market Commentary 2020.02.11A timely update to the FX strategy for GBP with particular focus on Cable.

On the UK side, we have loud messages from Europe around the difficulty for both sides to reach an agreement by year-end. Although typical in a game of high-stakes chess, this is a heavy weight on Sterling.

On the US side, a solid round of data prints last week from wages to non-agricultural employment. The FED remains dovish and in cutting mode, in normal circumstances cuts would be difficult to justify but with Trump in full control market expectations do not favour USD walking forward.

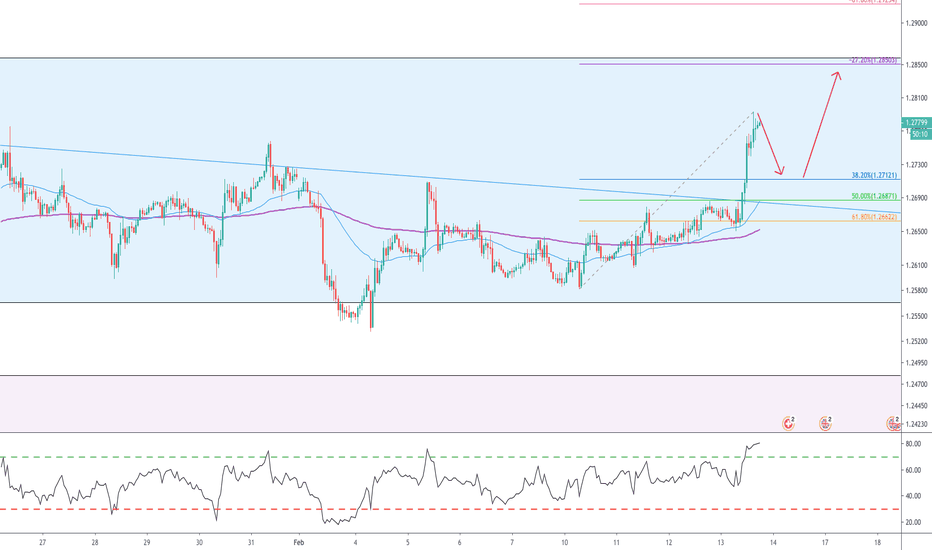

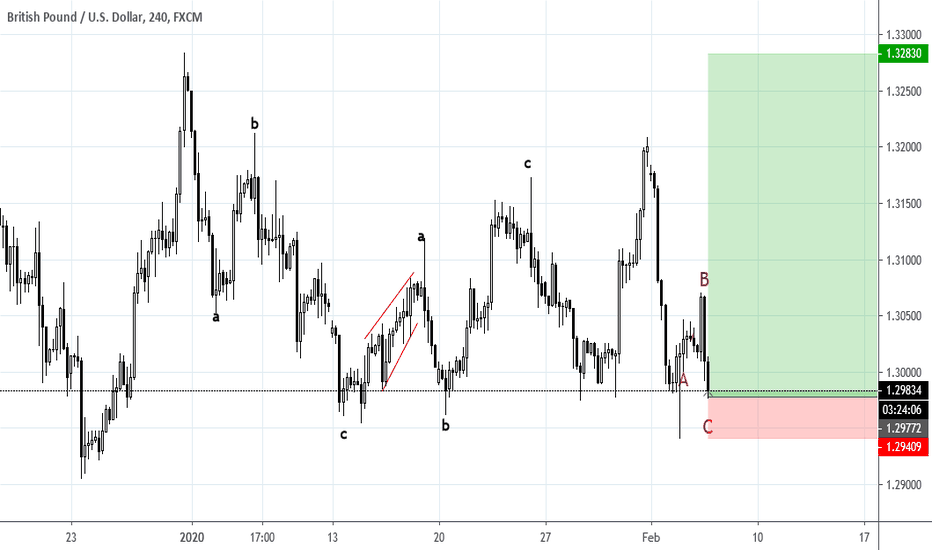

On the technicals the map is crystal clear until we enter into the Brexit impact leg:

Strong Support 1.276x <=> Soft Support 1.290x <=> Mid Point 1.328x <=> Soft Resistance 1.38xx <=> Strong Resistance 1.43xx

On the positioning side, Pound longs were mostly built by speculators in the back-end of 2019 and these began to unwind as we headed into the official finish line in Jan 2020. This is leaving the flows exposed to negative headlines although you can argue the case for further upside as long as strong economic prints continue. The Pound is relatively cheap in this environment, I suspect the main impact leg from Brexit will not kick-in till October 2020 so we have plenty of time to continue working both side in the next 6 months.

Expecting a mild recovery to come in the months ahead which will aid in offshore ownership of UK assets, the desire is there to continue the recovery and as long as this remains the case the breakdown will be difficult. Look to add GBP exposure on dips while we are at the bottom of the short-term and medium term range. A breakdown will be a game changer and will imply BOE are moving in August.

A round of G10 FX charts and strategy updates coming over the sessions today... Don't forget to keep the likes and comments rolling guys!

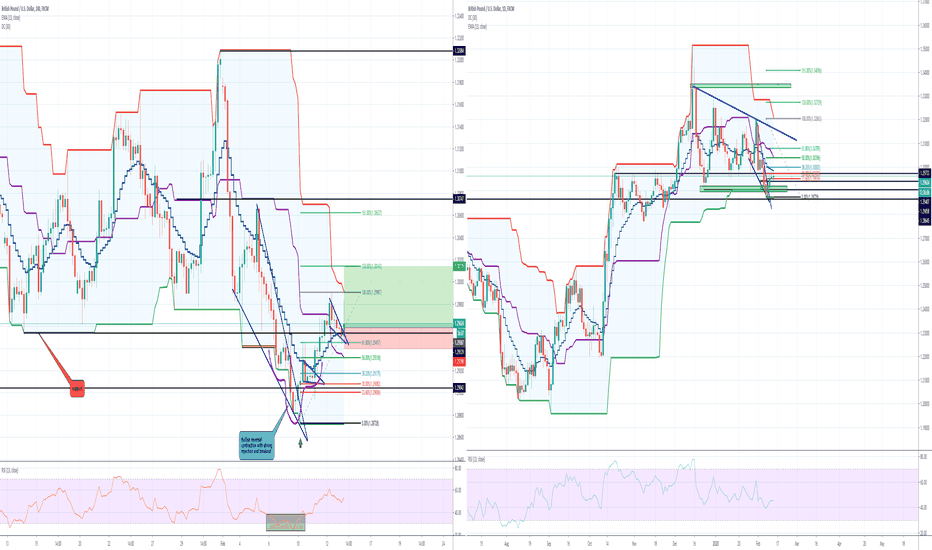

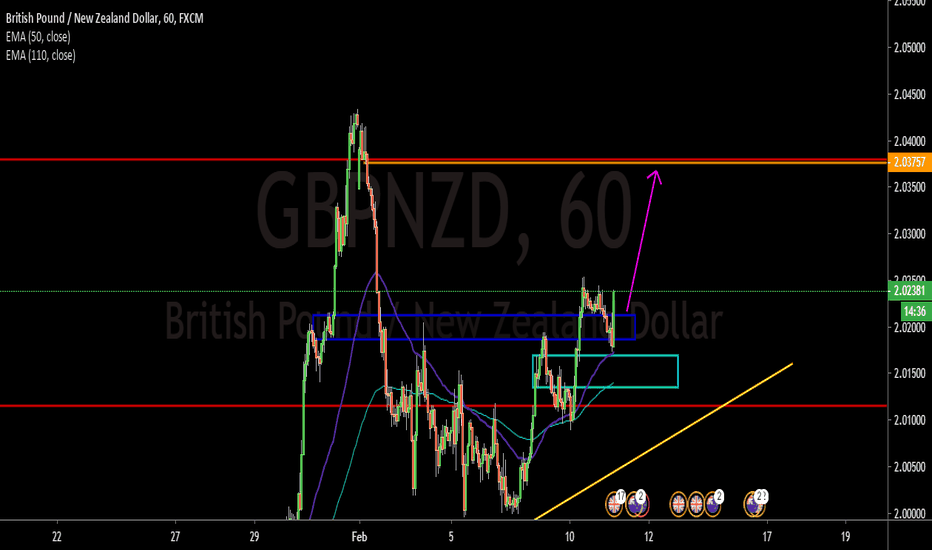

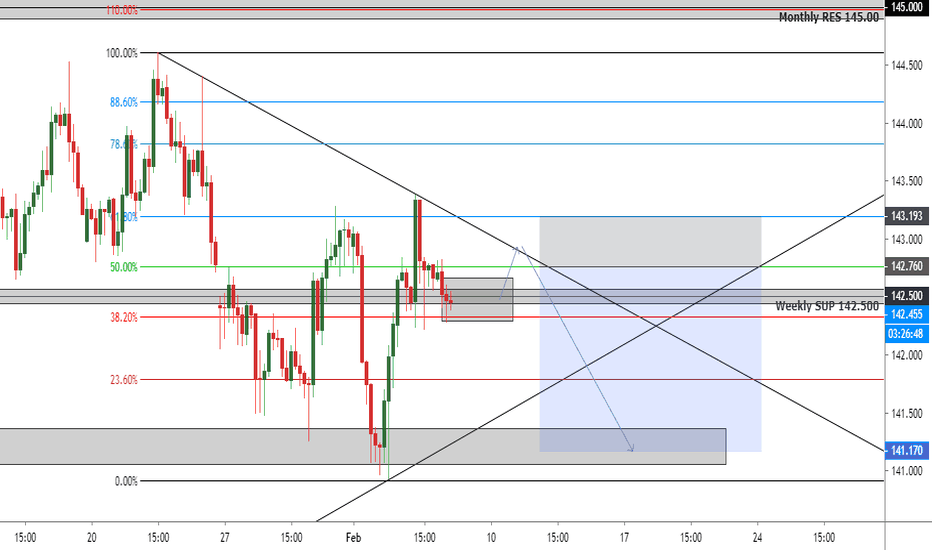

Retracement Determines Next MoveKeeping this short and sweet this week.

All the pairs I'm updating are based on Friday's big move. The focus is to determine price direction and next setups. I don't have enough info yet for the next major moves. So trade zone-to-zone.

BULL TPS:

From the 1.45942 zone…

• 1.46382

• 1.47075

• 1.47542

BEAR TPS:

• 1.45942

• 1.45571

• 1.45161

• 1.46641

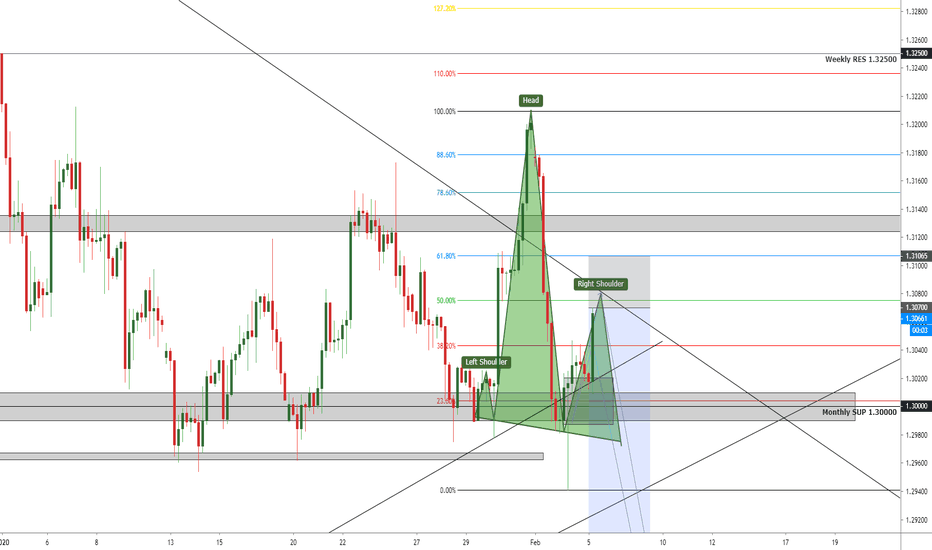

#GBPUSD #Brexit Special Short (Risky Potential Bull Trap)The rise in GBPUSD can very easily be institutions hiding their intention to short GBP and creating a BULL trap. We have several trend lines, patterns and overbought price. There can be huge volatility but GBP is my opinion going down very soon. It will be risky to trade it for retail traders.

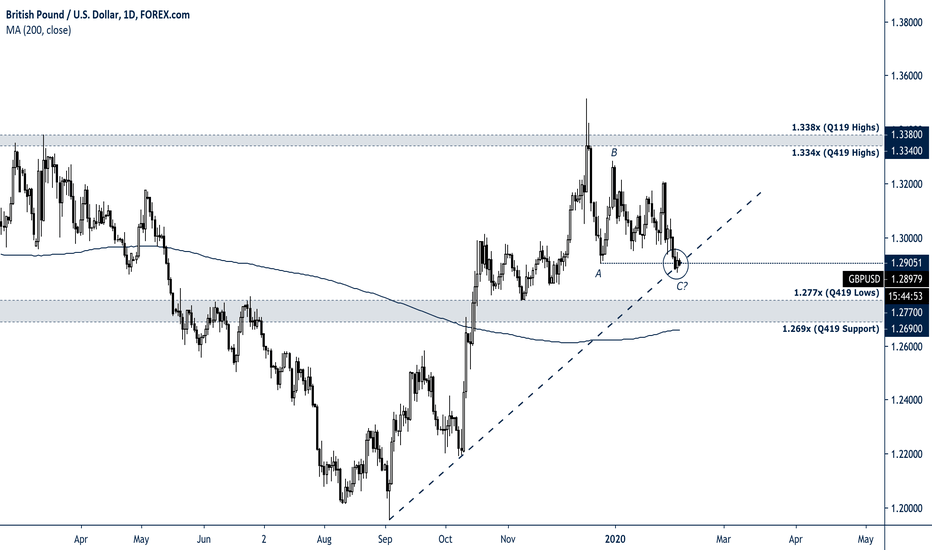

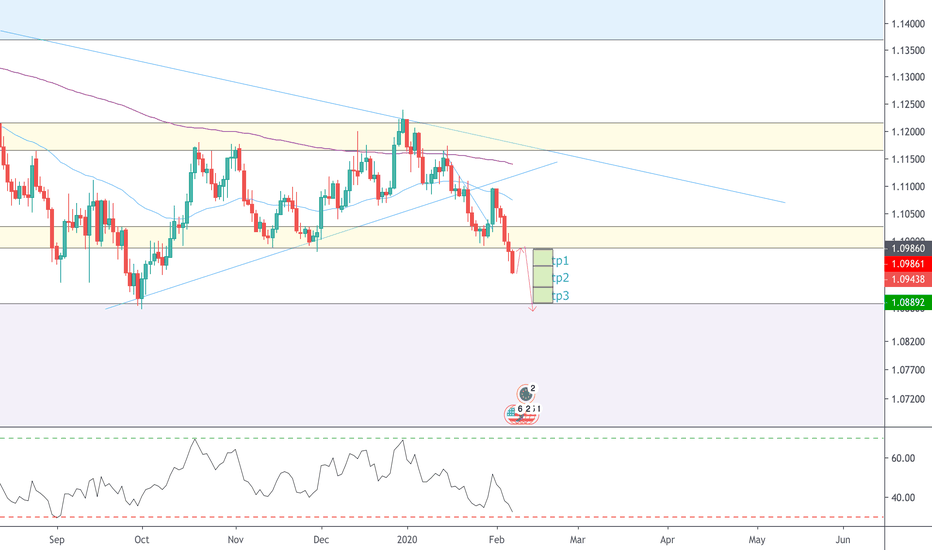

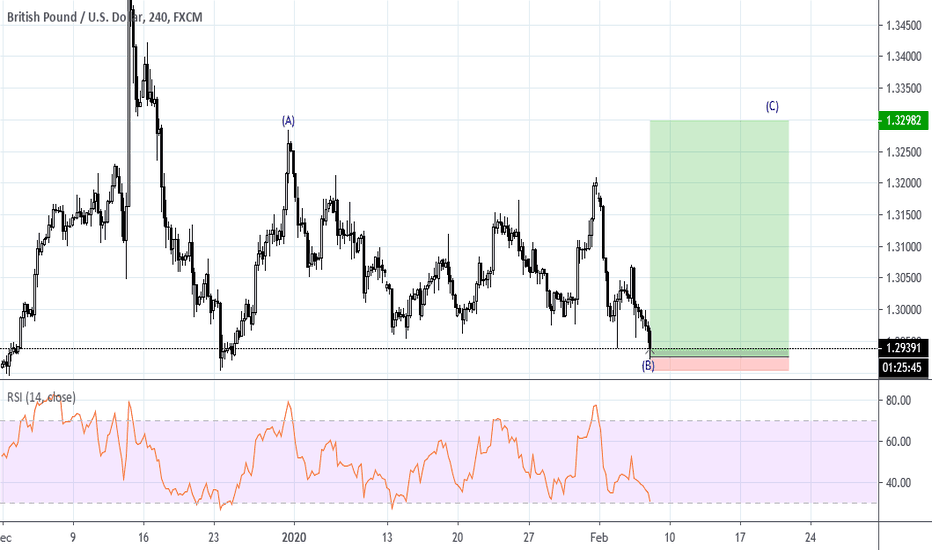

GBPUSD - 2020 - Trend ReversalAfter the October and December bullish impulses, GBP/USD is trading in a rectangle consolidation above the 100/200-day simple moving averages (SMAs). The NFP came in better than expected at 225K vs 160K forecast by analysts; giving an extra boost to USD.

GBP/USD is under bearish pressure as the spot is trying to break the 1.2900 figure for a monthly close below. A break below the above-mentioned level can lead to further weakness towards the 1.2829 figure and the 1.2829 level. Resistances are seen near the 1.2938, 1.2972 level and 1.3000 figure, according to the Technical Confluences Indicator.

Resistance: 1.2938, 1.2972, 1.3000

Support: 1.2900, 1.2829, 1.2750

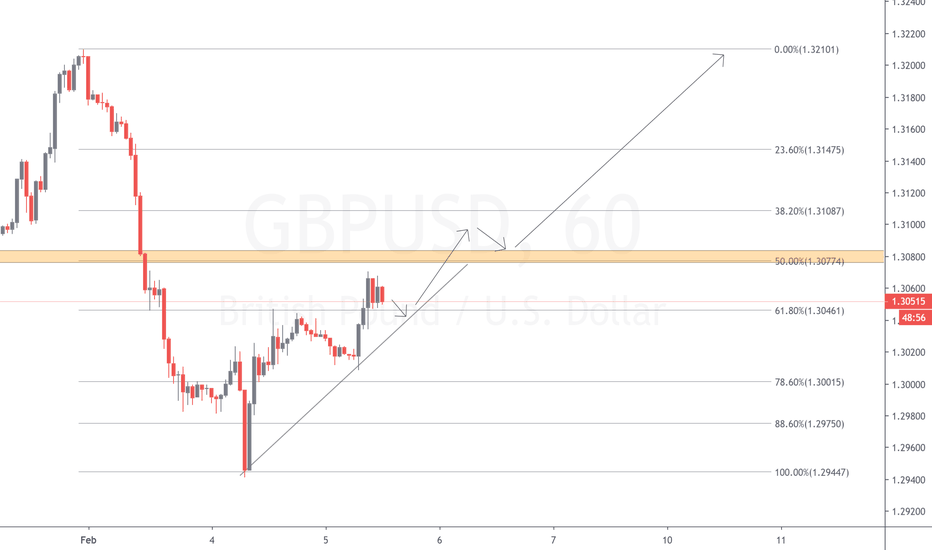

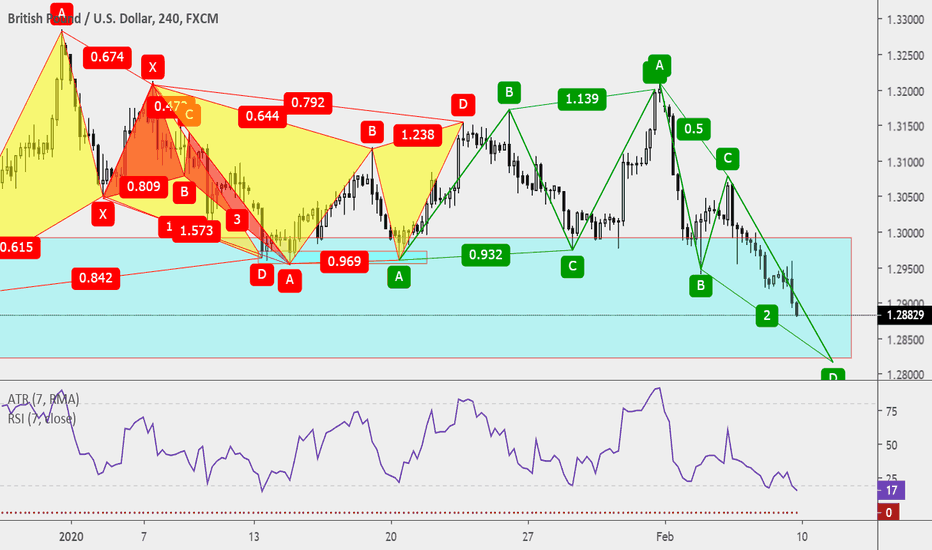

GBPUSD-Weekly Market Analysis-Feb20,Wk2An ABCD pattern setup as a countertrend trade within the buy zone on a sideway setup. Well, simply means, target extension is not highly recommended but if you like to do slight target extension on the second target, it is possible, you just have to watch closely on how it reacts on the original target.

You can also simply look at my trade ideas on signature link(3). Don't miss the next setup like you did when I've shared last week setup, 210pips of total profits gain in a single trading ideas. Wooot

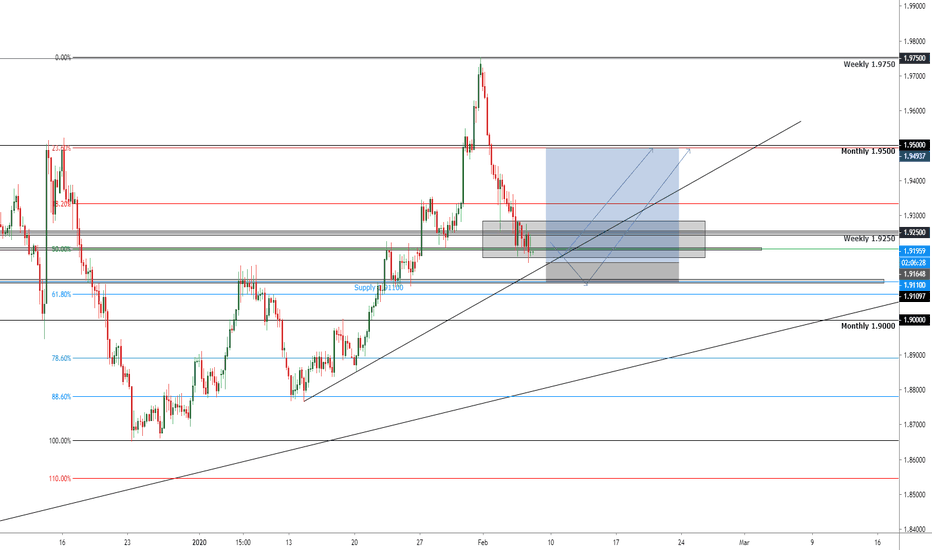

GBPAUD and the long HOME RUN!GBPAUD is in a really important moment, it's being acumulated but we need more acumulation before buy so we will wait a bit and we will also observe if the value can go a bit more down to get a better entry , there are a lot of confluences in our favour for example the the uptrend that needs a P3, fibonacci also could help us because if the value falls to 61% the entry will be excelent and one supply in 1.91100 that has been respected a lot of times.

So we will wait a little before the entry and let's catch this pips!!!

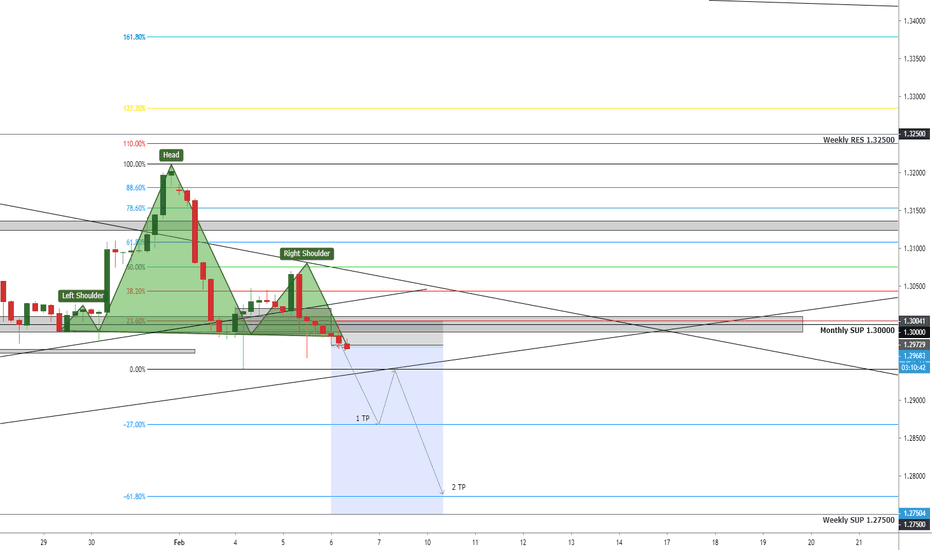

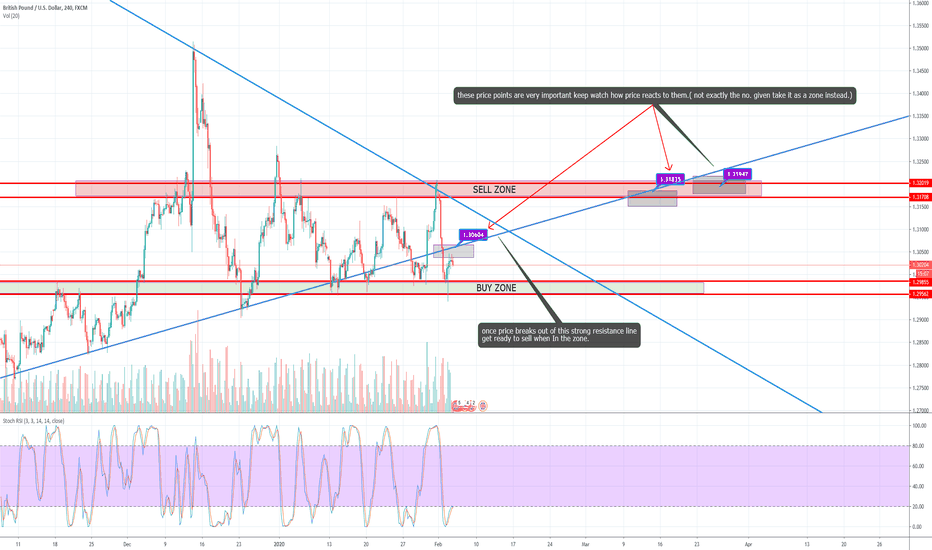

GBPUSDAfter the little acumulation in the KL we have a good entry but we need the confirmation that the vaue will fall, first of all, it's probable that GBPUSD want to return to the KL before the fall, anyway we have a good entry for the retest of the SHS or Hombro Cabeza hombro and Fibo also says that GBP will fall.

Could be THE MOMENT of GBPUSD?We can observe that GBPUSD wants to refuse the Point 4 of our tendence so when the moment arrive, if we have the confirmation, we can sell the value, anyway we need to wait because we need to know what will happens in the Monthly Key Level and if the value wants to retest our Shoulder Head Shoulder so before the entry i prefer to observe what can happens in 50% and if the news do a really alcist movement i will be out of GBPUSD or wait for the entry in 61% havin less risk.

Markets relax again amid concerns over global economyMonday was a very busy day in the financial markets in terms of price dynamics. The tone was set by China, which opened its stock markets after a long vacation. Expectedly, the market collapsed despite unprecedented restrictive measures by the Government and an infusion of nearly two hundred billion dollars from the Bank of China. The Shanghai Composite Base Index lost $420 billion in value over the day.

Experts, meanwhile, note that China is well suited to act as a catalyst for a new global crisis (until recently, the States have done it well). The fact is that in recent years, the role of China in the global economy has grown dramatically. Today, it accounts for about a third of world growth, which is more than the share of the United States, Europe and Japan combined. So if Goldman Sachs analysts are right (they forecast a decline in China in 2020 at 0.4%), then the global economy will face serious problems.

Despite the sales in China and the next anti-record coronavirus epidemic, investors again relaxed and calmed down. This already happened last week and turned out to be nothing more than a pause in the main movement.

So, such gold descents as yesterday, we recommend using the asset for purchases. Moreover, by itself, the gold market could face a shortage. The fact is that the volume of gold mining in the world in 2020 decreased for the first time in 10 years. All easily recoverable metal has already been mined, which only strengthens the current negative trends for the offer of an asset.

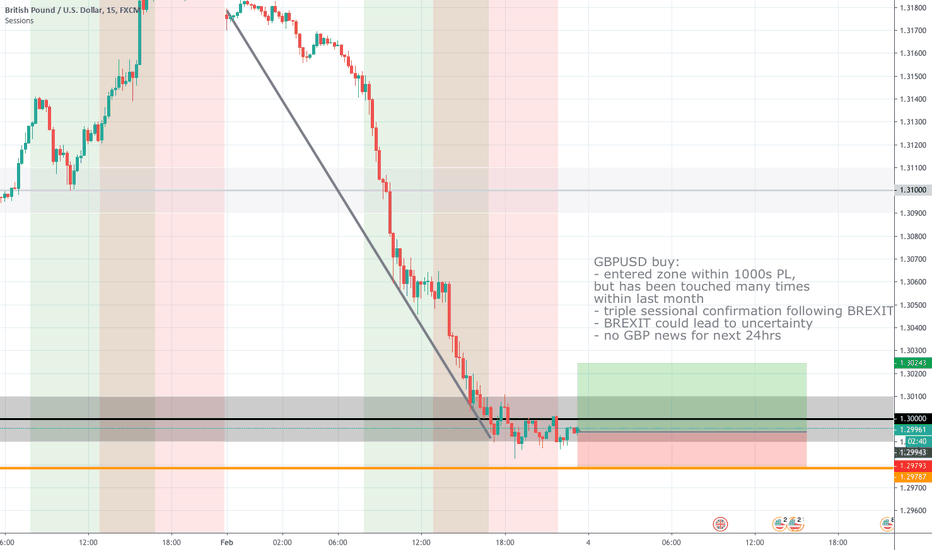

The pound dipped well yesterday. Although not the fact that this is its absolute minimum. The fact is that Great Britain and the EU, after the official withdrawal of the first from the Union, switched to the most important thing - the trade agreement. And then, predictably, the parties faced a problem. However, we have already gone through all this over the past 3 years. The parties will exchange threats, raise rates, put pressure on each other in an attempt to win the most favorable conditions for themselves. Given that the period until the end of the year, the pound is waiting for a difficult 8-9 months. We continue to believe that the parties will agree on how this ultimately happened with Brexit. And so we will use the pound's descents as an excuse for his purchases. At least the point 1.2980-1.3000 looks too attractive not to risk buying from it. But with mandatory stops, because it is likely that the pound can be bought even cheaper.

Oil (WTI benchmark) yesterday fixed below the support of 51.20. In general, the situation looks rather threatening for buyers, especially since the background is generally favorable for further sales (oil demand in China collapsed by 3 million b/d, which is about 20% of its total consumption).