Broker

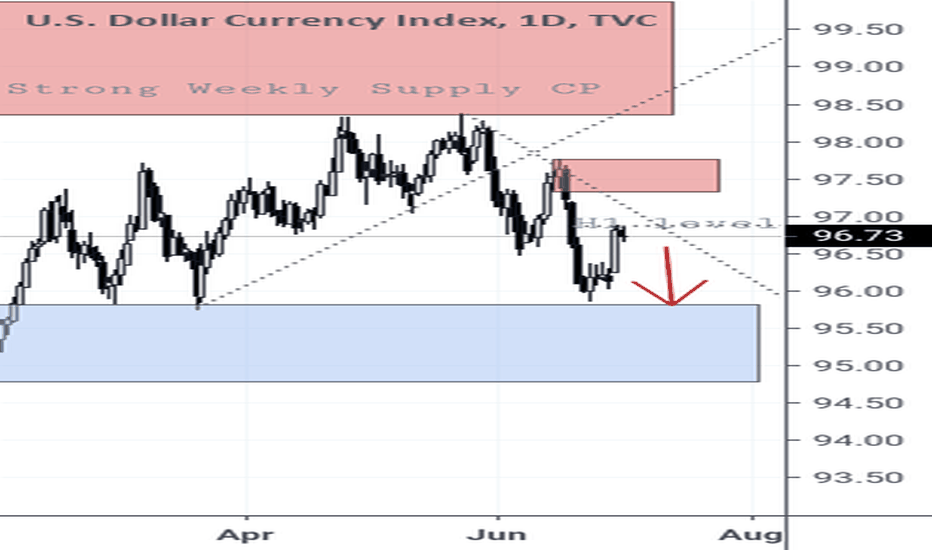

DXY Short Bias Welcome to everyone.

DXY just reacted lower timeframe H1 supply level. If market breaks H1 level then it will go up there to the Daily supply and we will see the strong drop. So we have to wait for that. If market doesn't break H1 level then it will go slightly down as it is happening now. So the Future drops are just there on Dollar yield.

Happy trading

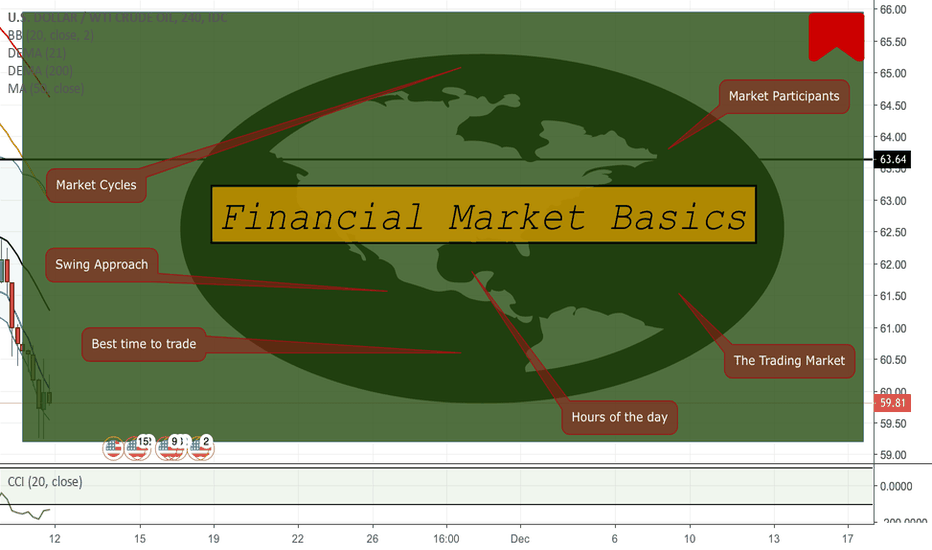

Financial Market Introduction 101SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Financial Market Introduction 101

a) Market participants

Market Participants include those parties that are involved in the operations of investment

companies. Their control in the market is necessary and they should be well aware of the

changes in the market.

1. Brokers and dealers handle trade activities between the buyers and sellers of currencies by

charging a fee. They are the crucial part of the FOREX market, which acts as a medium

between buyers and sellers.

2. Investment advisers are individuals who provide investment advice to investors by

issuing reports regarding the analysis of investment securities.

3. The investor is one of the main participants of the financial market as funds are allocated

to them as a capital to gain financial returns in future.

4. A central bank is one of the monetary authority and it regulates the state's currency,

interest rates and money supply. Performance of the commercial banking system is also

overviewed by the Central bank of respective countries.

b) The Trading Market

Trading market is a place where trading of currency and securities are done. The market includes

brokers and investment experts who provide active services as traders on the basis of their

education and knowledge regarding the market. They take investment decisions on the basis of

different trading methodologies and data from past years to determine the most profitable

investment.

c) The Best Time to Trade

Best time during the year

Previous yearly records show that October and September are considered as the best months to

invest in the FOREX. The main reason is due to the price bumps, which usually arises during the

month of November and December, due to the seasonal changes.

Best time during the Month

The best time of the month to invest in the FOREX is during the first five and last five days of

the month. The fact was illustrated in research conducted by Professor Ogden’s, which

determines different types of investment return that are paid in the last first few days of the

month. This "regularity of payments" can enable the investors to generate profit on their

investments.

1. Municipal bonds interest payments are made up to 90%

2. 70% of corporate bonds principal payments

3. Preferred stock dividends are paid up to 65%

4. 45% of all common stock dividends.

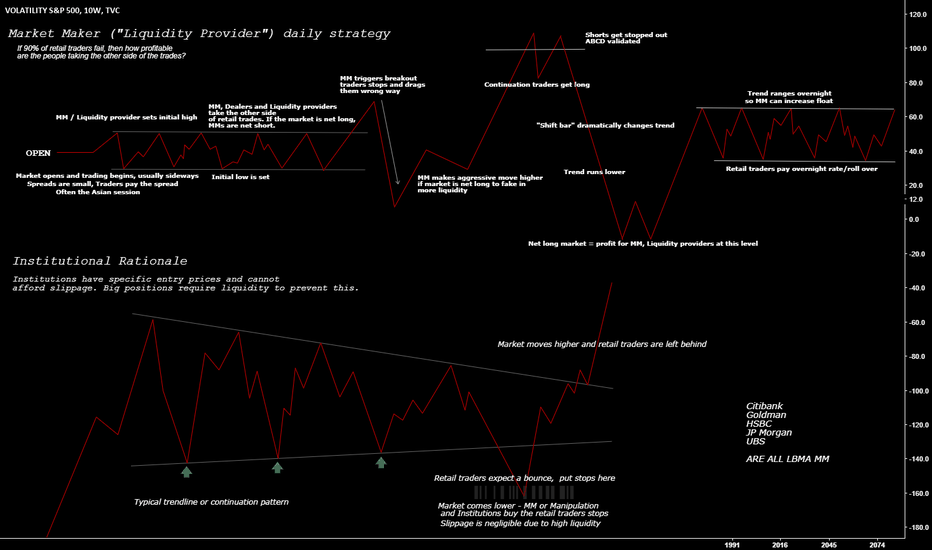

d) Market Cycles

Market cycles are considered as the key to determining the maximum returns. The market cycle

can be divided into 4 phases:

Accumulation Phase

• The accumulation phase arises after the market decline and experienced traders start to buy

after figuring that the worst position of the market is ended.

• At this time period, currency price valuations are pretty enough that they can play an

essential role in profit generation. However, in this stage, prices are flattered and every seller

in the market knows that the buyer will get a healthy discount.

Mark-up Phase

• A Mark-up stage the market stability moves forward towards the higher market moves.

During this time media stories usually determine that the worst period of trading is over,

however, increase in unemployment can arise during this period.

• At the maturity of this phase, investors use bandwagon because of their fear regarding the

decrease in market prices. A bandwagon is a group including technicians who analyses the

market prices to recognise the changes in market direction and sentiment.

The Distribution Phase

• Within this time period, sellers dominate the market. The bullish market sentiments can

turn the market cycle towards the mixed sentiment. Prices in this phase stay locked,

which can last for some weeks and months.

• Even the timing models do not flash any signals to buy the currency. This phase can be

affected due to the bad economic news or adverse geopolitical event.

Mark-Down Phase

• This stage can be most painful for the investors, those who still hold their previous

FOREX reserve can get huge losses, as they would have to sell them even at the lower

prices at which they have bought the currency.

• However, this phase determines the buying signals to the early innovators, which can

enable them to generate returns in future once the prices got higher. This stage also

demonstrates that it is not the good period to sell the FOREX.

e) Days of the Week

1. Throughout the whole week, Monday is considered as most the best day to buy FOREX,

as the prices usually show a decline. A study conducted on "A Survey of the Monday

Effect Literature" reveals that decline in the prices can be the reason of bad news that was

released during the weekend.

2. Conversely, if Monday is considered as the best day to buy FOREX, Friday is determined

as the most feasible day to sell it. As it is better to sell the reserve before the weekend due

to changes of price decreases which can affect the profitability of investment, in case of

selling it at lower prices on Monday.

3. Heading towards Tuesday trading can flourish a little. The reason behind this fact is that

opinions are formed by the traders and they have started taking their positions in the

market. Therefore, this can make a good day for trading in the market.

4. Wednesday shows the same kind of trend in trading followed by Tuesday or usually

depicts bigger price moves and is considered as the second-best day of the week for

trading.

5. Thursday, it quickens. Thursday is considered as the days when huge profits can be made

by the investors. Investing in the right currency can enable the investor to generate huge

profits.

f) Hours of the Day

Trading in the morning time is not a good idea as market prices and volumes can change

roughly. It is assumed by experts that these are considered as volatile hours and several new

releases can affect the investment outcomes adversely.

However, trading in the middle of the day can be favourable for the investor, as prices mainly

remain stable during this time period. Several time frame analysis is utilised by the investor to

select the most appropriate time for trading.

g) Swing Approach

Swing-Traders analyses the swing chart within the day so that they can take advantage of

favourable price changes in the marketplace, and this affords them the benefit of not having to

watch markets continuously while they are trading. Once they find an opportunity in terms of

increase in FOREX prices, they place the currency on sale and then constantly keep a check on

the progress of the pricing.

The approach has different optimal time frames, which include:

• Daily, and Weekly Charts

• 4 Hour, and 1 Hour charts......

Please let me know if you would like to know more

Happy trading :)

"In investing, what is comfortable is rarely profitable" Robert Arnott

USD/JPY SELL - 17/10/2017

The Yen had tested the support level 111.73 - 111.86, but failed to break it down and rebounded up strongly. The growth was sharp, but on average volume, so it does not cancel our previous scenario of opening short positions after a breakdown of the support. The move should be abrupt and supported by large volume. A stop loss should be placed above the breakdown volume bar. A potential of the deal is more than 100-110 pips.

The bottom line: short positions after a sure breakdown of the support.

GBP/USD BUY - 17/10/2017

Yesterday the Pound corrected down and tested the support level of 1.3225 - 1.3254, in which fairly large volume is concentrated. The fall of the price was quite sharp, but on medium volume, so there is simply no way to single out new volume level. Thus, before the breakdown of the support we should give preference to long positions for this currency pair. BUY can be opened after the price rises from the support level. Ideally, it should be a strong bullish impulse. A stop loss should be placed under the support level with a small margin. The growth potential is about 150 points. If the price breaks through this level, then it's worth to be out of the market. Short positions can be considered only after the breakdown of the level of 1.3137.

The bottom line: long positions are still in priority.

EURUSD BUY - 13/10/2017

The Euro showed a smooth downward correction yesterday. The move was also on small volume, so we should consider it as a technical correction, not as a reversal signal. Moreover, the pair is still trading above the previous correction. So that our previous scenario of opening long positions remains the actual. We should enter the market after a resumption of the growth of the price on large volume. A stop loss should be placed below the beginning of the abrupt move. A potential of the deal is 100-110 pips.

The bottom line: long positions are in priority.

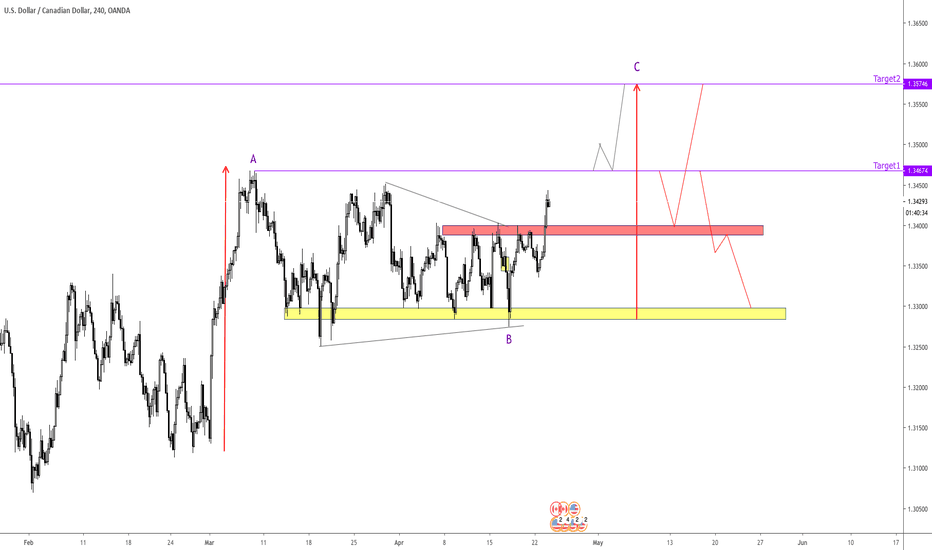

USD/CAD SELL - 12/10/2017

USD/CAD fell down sharply yesterday, but the move was on small volume. Anyway, given that the price is trading near the lower boundary of the range/support 1.2404 - 1.2428, we should consider the scenario of the breakdown of this mark. If the price breaks down the support on large volume, we can open short positions. A stop loss should be placed above the breakdown volume bar. A potential of the deal is more than 120 pips.

The bottom line: short positions after a breakdown of the support.

GBP/USD BUY - 12/10/2017

The price has broken out the previous resistance, but the move was smooth and on small volume, so we can't trade this breakout at the moment. But on the other hand, this movement points us that buyers are dominating the market and we, of course, should give preference to long positions. The scenario is similar to the one for the euro: we need to wait for a continuation of the growth on large volume, so we can consider it as a strong bullish signal and put a stop loss below it. A potential of the deal is up to 140 pips.

The bottom line: long positions are in priority.

EUR/USD BUY LIMIT - 12/10/2017

EUR/USD continued growing and broke out the previous upper limit of the consolidation. Now the price is trading above it. We should note that the breakout move was on increased volume, but it was spread throughout the chart, so we can't point out any specific volume level. Anyway, given all other facts above we should consider opening long positions. Unfortunately, there is no a good entry point at the moment as we don't have a good place for a stop loss. That's why we should wait for a smooth downward correction (optionally) and a resumption of the growth on large volume, so will be able to place a stop loss below the beginning of such move. A potential of the deal is 100 pips.

The bottom line: long positions are in priority.

GOLD - XAUUSD BUY 11/10/2017

It is necessary to point out the new resistance level 1291.60 - 1294.20, which contains large volume that has stopped the growth of the price. Now gold is trading a little bit below this mark. Given the sure growth we should give preference to long positions, but only after a breakout of this fresh level. The move should be sharp and supported by increased/large volume. A stop loss should be placed below the breakout volume bar. A potential of the deal is around 150 pips.

The bottom line: long positions after a breakout of the resistance.

USD/JPY Waiting - 11/10/2017

The price failed to breakdown the lower limit of the consolidation and returned trading back in it. That's why our previous scenario remains the same: we might consider opening new deals only after a sure exit of the price from the range on large volume, so it will be a more accurate signal for entering the market. While the pair is trading in the consolidation, it is better to stay out of the market.

The bottom line: wait for the price to come out from the range.

EUR/USD BUY - 11/10/2017

The Euro continued its upward movement and now the price is near the upper limit of the consolidation. It is worth noting that the growth was fairly confident and supported by pretty large volume, which is a strong bullish sign. Unfortunately, volume was spread throughout the movement, which makes it impossible to single out a specific new volume level. Thus, the most likely scenario is a breakdown of the upper boundary of the local consolidation, which will be an excellent signal for entry, and further price growth. The breakdown movement must be sharp and on large volume, this is a must condition in order to avoid false breakdown, which will make the entrance more accurate and reliable. A stop loss should be placed below a volume breakdown bar or the beginning of a rapid price growth. The potential of the deal is about 110 points.

T he bottom line: long positions are in priority.

AUD/USD SELL STOP - 10/10/2017

AUD/USD is trading a little bit above the level of support 0.7744 at the moment. The price showed a little growth, but it was on small volume + given the presence of the local downtrend, we should consider short positions for this currency pair. We can enter the market after a breakdown of the support on large volume, so it will be a more accurate signal. A stop loss should be placed above the breakdown volume bar. A potential of the deal is 70 pips. As for long positions, we can consider them only after a breakout of the resistance 0.7868.

The bottom line: short positions after a sharp breakdown of the support.

USD/CAD BUY STOP - 10/10/2017

The pair is trading in the little consolidation below the resistance 1.2566 - 1.2580. The price fell down during the Asian session, but the move was on small volume, so we can’t regard it as a bearish signal. That’s why we still should give preference to long positions, but we can enter the market only after an abrupt breakout of the resistance on large volume. A stop loss should be placed below the breakout volume bar. A potential of the growth is 100 pips. As for short positions, we can deliberate them only after a breakdown of the support 1.2404 - 1.2428.

The bottom line: long positions after a breakout of the resistance.

GBP/USD SELL STOP- 10/10/2017

GBP/USD showed a smooth growth on Monday and broke through one of the resistance levels. It is worth noting that the upward movement was on small volume, so it cannot be regarded as a market reversal. In addition, the second resistance level 1.3184 - 1.3204 is still actual. It contains fairly large volume and was tested yesterday. Given the presence of a strong local downtrend, it is necessary to give preference to short positions. Sales can be opened in case of the test of the resistance 1.3184 - 1.3204 and a sharp rebound of the price down on increased volume. A stop loss should be placed a little above the resistance level. The goal is a local minimum. If the price breaks through the resistance level, then it's worth to be out of the market, since there are several large volumetric accumulations at the top of the chart and we can open long positions only after their breakout. TP 50-60 pips.

The bottom line: short positions after a rebound of the price from the resistance.

EUR/USD Waiting - 10/10/2017

The Euro continued growing up on Monday, but the move was very smooth and wasn’t supported by significant volume, so that we are unable to point out any new volume levels or zones for this currency pair. The only relevant level is the support 1.1680-1.1699. Moreover, the price is locked in the consolidation, where large volume is accumulated. That’s why we need to wait for a sure exit of the price from this range in order to be able to consider new scenarios. While the pair is trading in the consolidation, we should stay out of the market.

The bottom line: waiting for the exit of the price from the range.