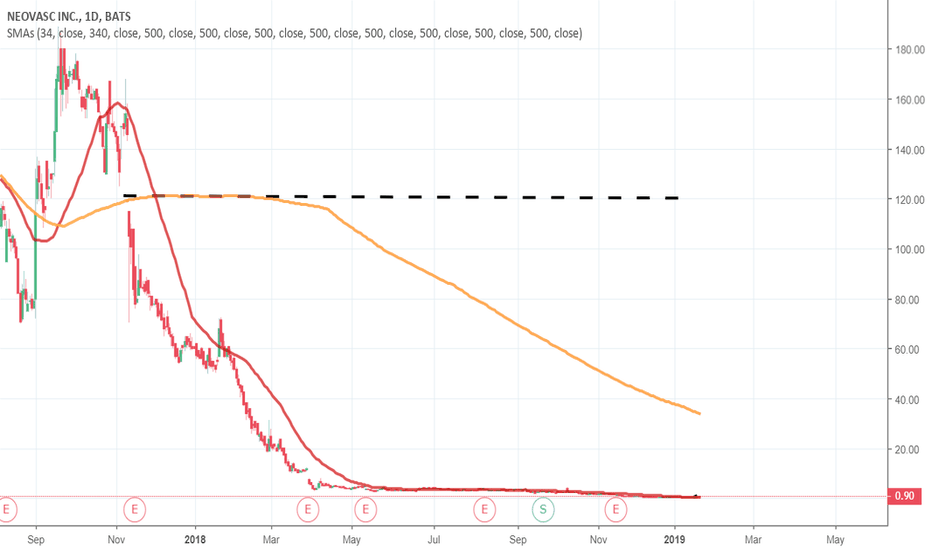

Brschultz

NVCN - I provided Youtube Video on NVCN - brschultz momentumSo i bought NVCN 3 weeks ago based on my momentum model - posted it to youtube brschultz NVCN - and why i bought it. My model suggested a long term momentum trend was bottoming for NVCN - is see it possibly peaking in December 2020.